37+ Sample Owner Agreements

-

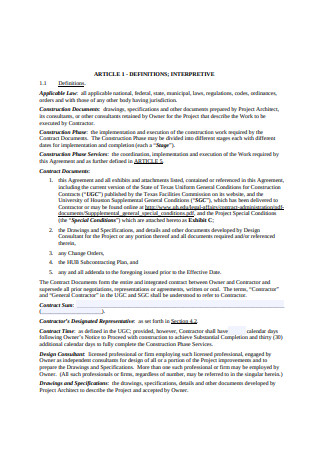

Agreement Between Owner and Contractor

download now -

Owner Architect Agreement

download now -

Owner Tenant Agreement Form

download now -

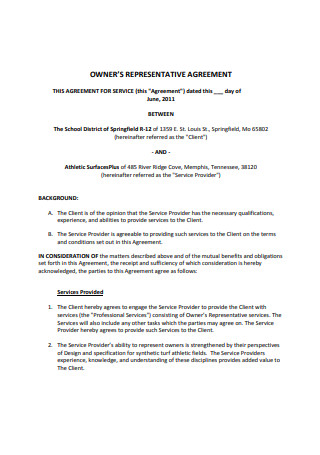

Owner Representative Agreement

download now -

Product Owner Agreement

download now -

Property Owner Agreement Format

download now -

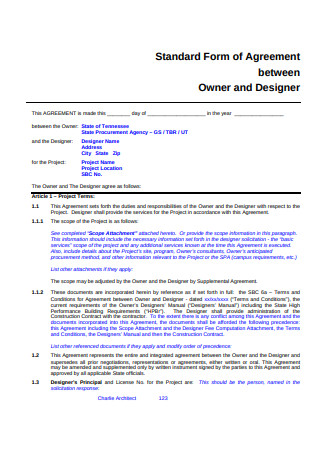

Standard Form of Agreement Between Owner and Designer

download now -

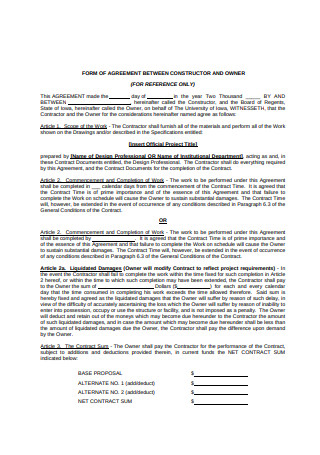

Form of Agreement Between Constructor and Owner

download now -

Agreement Between Owner and Contractor Sample

download now -

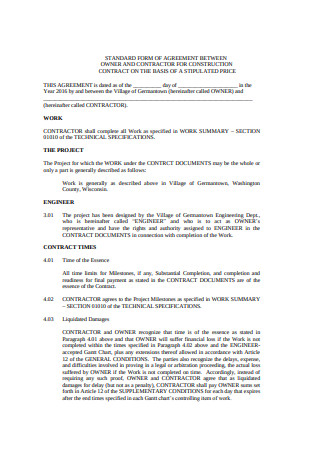

Contractor and Owner Agreement

download now -

Owner Agreement Example

download now -

Owner and Trainer Agreement

download now -

Joint Owner Agreement

download now -

Basic Owner Agreement

download now -

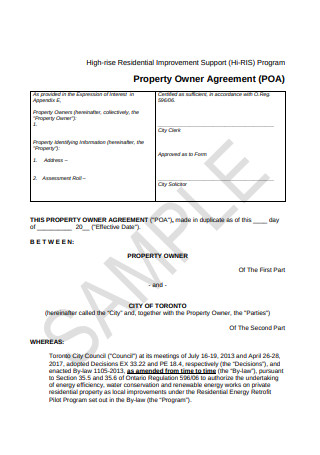

Property Owner Agreement

download now -

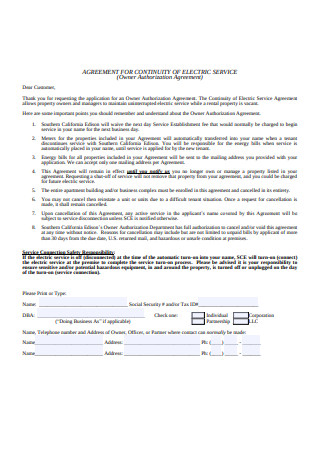

Owner Authorization Agreement

download now -

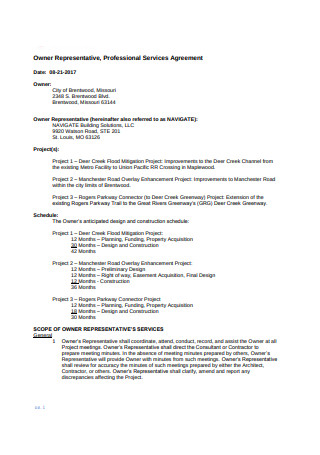

Owner Representative Agreement Format

download now -

Basic Property Owner Agreement

download now -

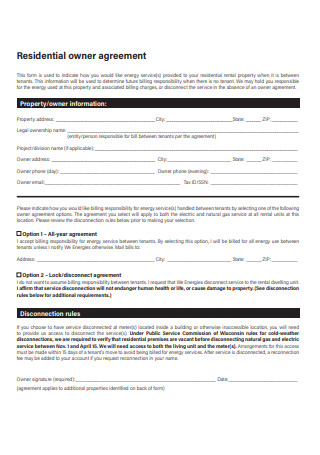

Residential owner agreement

download now -

Owner Agreement Sample

download now -

Owner Contractor Agreement

download now -

Owner Assumption Agreement Form

download now -

Owner Management Agreement

download now -

Owner Representative Agreement Example

download now -

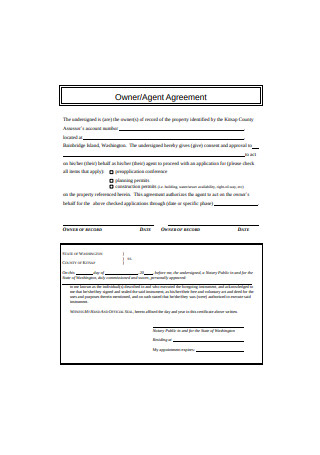

Owner- Agent Agreement

download now -

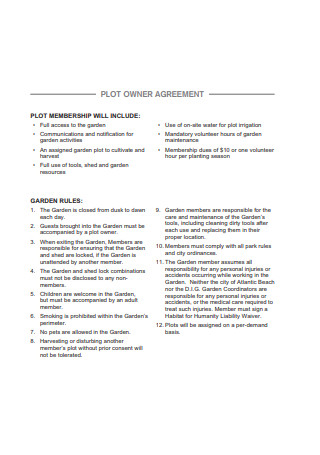

Plot Owner Agreement

download now -

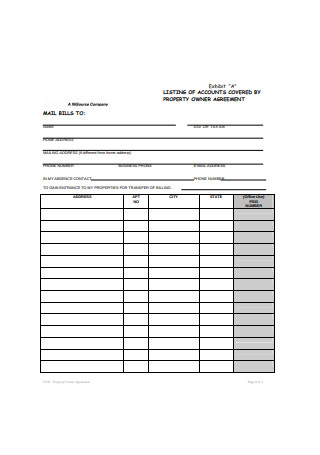

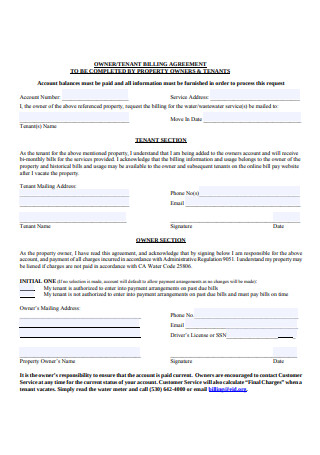

Owner Billing Agreement

download now -

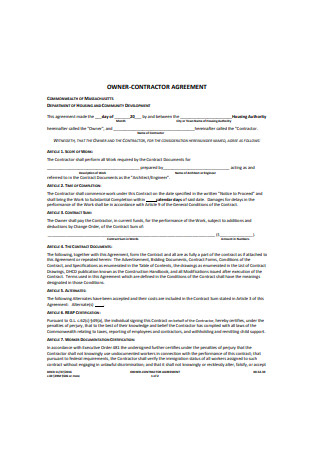

Owner-Contractor Agreement

download now -

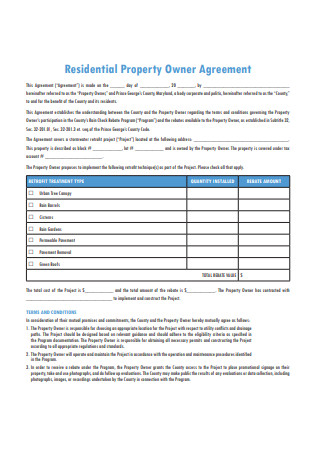

Residential Property Owner Agreement

download now -

Owner and Developer Agreement

download now -

Property Owner Agreement Example

download now -

Owner’s Rental Agreement

download now -

Basic Property Owner Agreement Format

download now -

Vacation Rental Property Owner Agreement

download now -

Owner Agreement Form

download now -

Basic Owner- Contractor Agreement

download now -

Owner Agreement Format

download now -

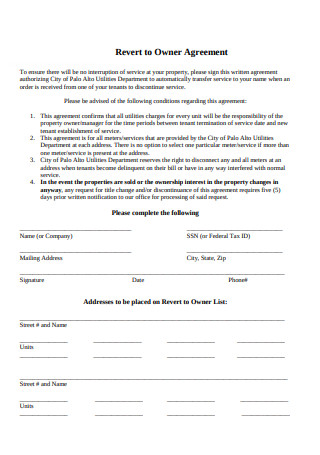

Owner Utility Service Agreement

download now

FREE Owner Agreement s to Download

37+ Sample Owner Agreements

What Is an Owner Agreement?

5 Common Types of Owner Financing

How to Construct a Standard Owner Agreement

FAQs

What are the advantages and disadvantages of seller financing?

What is the difference between seller financing and rent to own?

Will an owner financing contract reflect on my credit history?

Are there closing payments at the end of an owner agreement?

What does mortgage mean?

What Is an Owner Agreement?

An owner agreement is a contract between a buyer and a property holder. The homeowner agrees to assist the buyer in purchasing the property financially. The buyer, on his/her part, agrees to pay back the owner on the set schedule. This type of lending is also known as owner financing. For example, a client is interested in buying a lot, and the price of the lot is $500,000. The client is ready to pay a 20% down payment, which is $100,000. The buyer may apply for a mortgage, but only $300,000 was approved. The seller might offer the buyer a loan amount of $100,000 to cover for what is lacking, or he/she might agree to pay for the entire $400,000 at the moment. In this case, the client will have to pay the seller every month with interest.

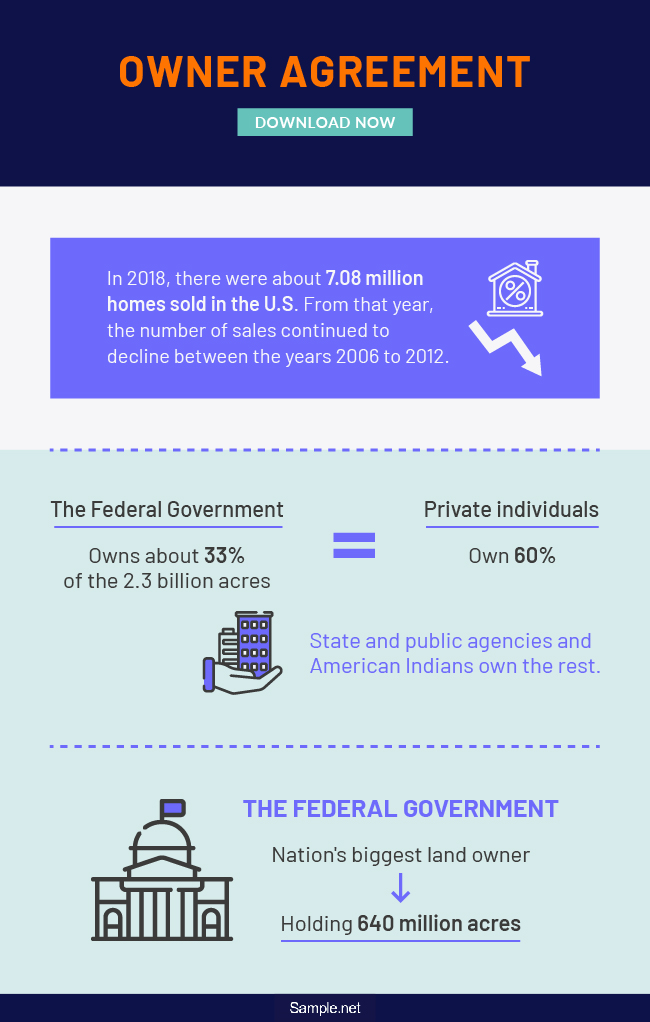

According to Statista, in 2018, there were about 7.08 million homes sold in the U.S. From that year, the number of sales continued to decline between the years 2006 to 2012.

Based on a report from the United States Department of Agriculture, The Federal Government owns about 33 percent of the 2.3 billion acres while private individuals own 60 percent. State and public agencies and American Indians own the rest.

In an article published by the Washington Post, it says that The federal government is by far the nation’s biggest landowner, holding 640 million acres in total.

5 Common Types of Owner Financing

Owner financing allows a property seller to sell a home while getting an investment return. An owner is in a favorable position to sign a finance agreement with the buyer, especially when the property is free from mortgage. Here are the five common types of owner financing.

How to Construct a Standard Owner Agreement

The arrangement of an owner agreement ultimately depends on the buyer and the property owner. Some owners may have different terms than others. Some may be stricter than others, or some may be more flexible. Nevertheless, it is important to know this document. So, here are the steps in creating a standard owner agreement.

Step 1: Specify the Loan Term

The buyer can repay a loan in five, ten, or thirty years. Commonly, a 30-year mortgage or a 10-year mortgage with a balloon fee after the contract is used. An owner can choose between the two. If he/she chooses a 30-year mortgage, the buyer’s monthly payment will be lower, but the total interest rate the owner collects will be higher.

Step 2: Set the Down Payment Amount

A down payment shows the interest of a buyer to purchase a property or home. The payment is deducted from the total price, and the seller will finance the remaining amount. Zero down payment is possible but is not common in the real estate contracts. Usually, sellers demand a 10% to 20% down payment before they close the deal with a buyer.

Step 3: Write Down the Interest Rate

In owner financing, interest rates ultimately depend on the property seller. It may be higher or lower than what conventional lenders offer. Some sellers may charge an interest rate that is higher because they are taking a risk by offering to finance. In this case, interest rates may range from 10% and up. It is important to know that state laws have regulations concerning the maximum interest a lender can charge. Furthermore, there are different ways to repay a debt with interest. It can be a fixed interest rate, an adjustable interest rate, or an interest-only loan. Among the three, fixed-rate is commonly used for easy record keeping. An adjustable-rate may change in time. Therefore, it should be closely monitored to avoid miscalculations and mispayments. Investors often use Interest-only mortgages (e.g., fix and flip loans). Fix, and flip loans are for purchasing and renovating a house before investors market it for gain.

Step 4: Incorporate the Balloon Payment

A balloon fee is a payment usually given after a debt term. The whole process of the loan agreement includes monthly payments for a specific timeline and, in the end, a balloon payment, which is the remaining principal balance. Often, lenders do not want to wait for 30 years to get an investment return. That is why balloon payments come in handy. Moreover, a buyer can pay this enormous amount of money from his/her savings, by selling a property, or through refinancing.

FAQs

What are the advantages and disadvantages of seller financing?

Seller financing is another term for owner financing. It allows an owner to sell his/her property more quickly by offering financial assistance to a buyer, but it poses a risk if the buyer doesn’t continue with the agreement. For that reason, a seller might demand a higher down payment to cover up for the risk. Down payments may range from 10% to 20% compared to traditional lenders who offer a down payment starting at 3%. On the good side, seller financing offers the owner cash flow monthly. Moreover, buyers also benefit from this type of transaction since the terms and conditions are negotiable.

What is the difference between seller financing and rent to own?

Rent to own is another term for a lease option. In a lease option, a buyer is given an option to buy the rented house at the end of the agreement. The landlord remains to be the legal property owner until a renter decides to buy the property. In seller financing, the deed of the property is immediately transferred to the client when both parties sign the contract. Therefore, the client becomes responsible for repaying the remaining debt.

Will an owner financing contract reflect on my credit history?

There are many requirements a lender must meet for a seller financing contract to reflect on your credit. These requirements may include proof that a lender or seller is doing it as a business and proof of the seller financing contract. If the seller meets the requirements of the bureau, your contract might reflect on your credit score.

Are there closing payments at the end of an owner agreement?

Yes, there may be closing payments such as transfer taxes, title fees, and lawyer fees. However, buyers will still save more with seller financing since owners don’t demand origination fees. Moreover, even if appraisals are not common in owner financing, it is still wise to have one if you are serious about purchasing a property. You can contact or ask help from a real estate agent and inquire about a comparative property analysis to be sure.

What does mortgage mean?

A mortgage is an official paper a buyer signs giving a lender the right to own a property in case the buyer doesn’t pay the loan. Companies and individuals utilize mortgages to purchase real estate properties without having to pay it all at once. For specific periods, a buyer repays his/her debts with interest. Note that mortgages are also referred to as “claims on property” or “liens against the property.”

Using an owner agreement will benefit both the buyer and the seller of a home or property. The buyer on his/her part benefits from this contract because owner financing usually doesn’t require origination fees. Also, interest rates are negotiable. On the other hand, the seller benefits from this agreement because it increases the number of buyers. Moreover, the seller will receive a steady cash flow. Note that there are other types of owner agreements, and you can check them on the templates provided above.