3+ Sample Profit Participation Agreement

FREE Profit Participation Agreement s to Download

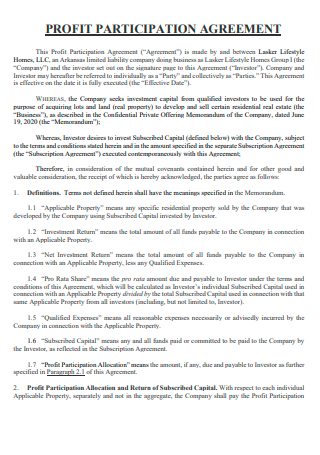

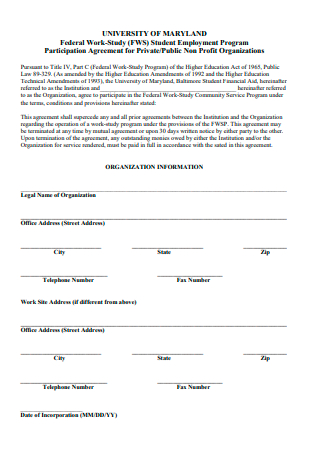

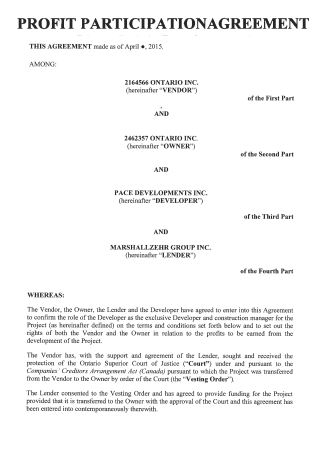

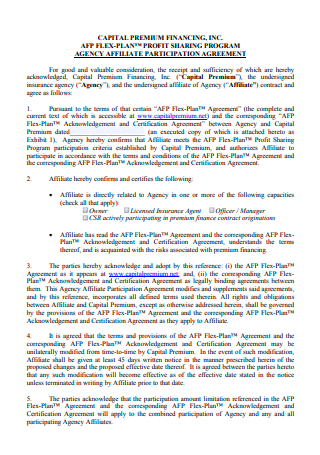

3+ Sample Profit Participation Agreement

What Is a Profit Participation Agreement?

Reasons to Consider Revenue Sharing

Advantages and Disadvantages of Profit Sharing

How to Write a Profit Participation Agreement

FAQs

What are profit participation rights?

What makes profit sharing different from revenue sharing?

When is a profit sharing agreement used?

What Is a Profit Participation Agreement?

The profit participation agreement meaning, also known as an exit fee agreement, is an arrangement in which a lender receives a percentage of an enterprise’s earnings in addition to interest. Under this form of agreement, the borrower will be compelled to provide the lender with a portion of his or her profits. Profit participation agreements may specify each party’s percentage stake, accounting requirements, and dispute resolution methods. Profit participation agreements can also be used to define profit sharing arrangements amongst many parties involved in a joint company endeavor. A sample profit participation agreement would benefit you to have a structured reference as opposed to having no idea how to arrange the contents.

Reasons to Consider Revenue Sharing

A revenue-sharing concept is similar to a royalty agreement. It is a type of investment in which investors put money into a company in exchange for a share of its revenue. As a result, the rate of return on investment is determined by the pace of revenue growth of the firm. Though you might interchange it with profit sharing, you will come to find that these are two similar but different concepts within the business industry. But in order for you to have a better grasp of this aspect, the list has been curated for you if you plan to look into sharing revenues with other stakeholders.

Advantages and Disadvantages of Profit Sharing

A profit sharing plan is one type of employee pay that goes above and beyond wages. In this sort of plan, an organization’s leadership will designate a set proportion of yearly revenues (or all profits) as a cash pool to be split among employees. Profit sharing schemes may alternatively include certain categories of employees, such as managers and above, rather than the whole employee base. The money pool is then split among the employees covered by the plan using a distribution formula that varies per employer. A contemporary profit sharing scheme might include straight cash, stocks, or bonds.

How to Write a Profit Participation Agreement

A profit participation agreement has a significant difference from the profit sharing agreement format and even revenue sharing points. Though the points made in the above lists are still relevant in the creation process of the agreement. You would still need the information on what makes an effective and successful document of profit participation. The guide below helps you in idealizing how your profit participation agreement will be arranged and how each section will be amply filled.

1. Opening Acknowledgement

The first step that you will need to accomplish, is one that will open the document and act as the opening statement. Keep in mind that this is an official business document and for professional purposes only so the tone and words that you will be using have to be formal, with no figures of speech or flowery language. Jargon may be used by the legal team but that depends on who is assigned to be writing the document. Don’t insert unnecessary words if you are not familiar with their use and meaning otherwise, the other party may not think too highly of the composition.

2. Participating Parties

Following the first section of the agreement, what comes next is to detail who is involved in the agreement. Elaborate concisely but also without skipping any important information on who is part of the agreement and what roles they are fulfilling. Designate who the main company is and who the stakeholders are. A few spaces after that would be where you define their respective interest rates. The primary company may have a higher percentage or an equal percentage to that of the stakeholders. The details depend on what you both have come to agree upon.

3. Representations, Warranties, and Conditions

Any legal document would have a section to clarify the involvement of specific parties. In its most basic form, a condition of an agreement is a requirement, so as its agreement terms with which one or both parties must comply. In other situations, a condition refers to an unpredictable future occurrence that, if it occurs, impacts the agreement’s duties and each party’s responsibility.

4. Dispute Resolution

This part will also come in variations as no resolution may be exactly the same as the other. All techniques used to resolve disagreements are referred to as dispute resolution. It encompasses all ways and approaches to conflict settlement, from early resolution to formal tribunal or judicial proceedings.

FAQs

What are profit participation rights?

The profit participation right gives the investor a claim to a proportion of the company’s earnings (annual net profit), determined depending on the amount invested. The subscribed profit participation capital also shares in any loss (net loss for the year) up to the entire amount based on the determined percentage. There are typical processes in obtaining the rights to participate in profits, beginning with the firm seeking to encourage its growth, followed by the desire to profit from the company’s success, and ending with your portion of the earnings being deposited directly to your account. This is all-encompassed within the profit participation rights agreement section.

What makes profit sharing different from revenue sharing?

Profit sharing is a division of profits rather than revenues. This implies that you are only paid if there is a profit, and you are not accountable for helping to pay off any losses. Before you contemplate taking this path, make sure you understand all of the benefits and drawbacks of profit sharing. For example, examine the fine language of a profit sharing agreement carefully; some firms try to charge as many expenditures to the business as possible so that there is little profit left over. Set up a profit sharing scheme for your employees that contributes to their retirement accounts.

When is a profit sharing agreement used?

When two entities collaborate for the same aim, often for a project-based time period, a profit sharing agreement is employed. This is known as an unorganized joint venture since the two entities continue as they are and do not create a new business for the purpose of the project. Typically, the partners will offer distinct talents and abilities to the relationship. As a result, the profit split will often mirror the divide in obligations and risk between the two parties. It is advisable to record this agreement after these two parties have reached an agreement on how profit should be split.

When it comes to drafting an investment contract, it could help to view the samples provided in this article. Although an agreement and contract have their differences, their legal purpose holds a certain degree of similarity. Check out the example of a profit sharing agreement as well so you can get a clearer understanding.