4+ Sample Profit Sharing Agreement

FREE Profit Sharing Agreement s to Download

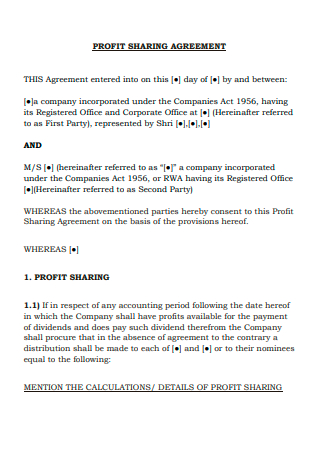

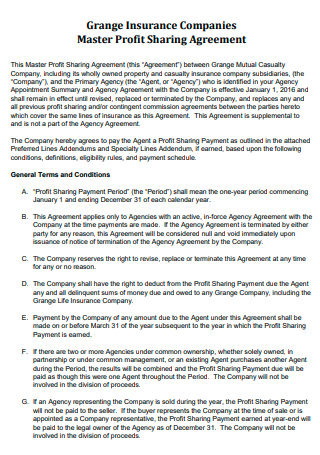

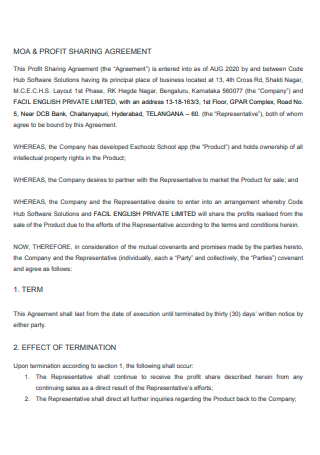

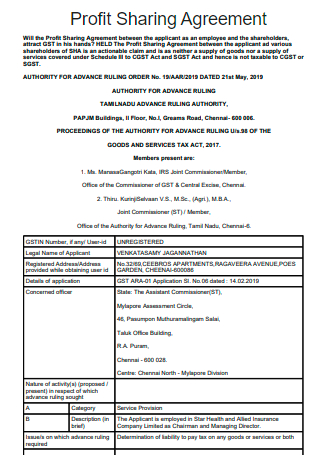

4+ Sample Profit Sharing Agreement

What Is a Profit Sharing Agreement?

Components of a Profit Sharing Agreement

Types of Profit-Sharing Plans

How To Implement a Profit Sharing Agreement

FAQs

What is profit and loss agreement?

How does a 50/50 partnership happen?

How do partners share profits?

What Is a Profit Sharing Agreement?

A profit-sharing agreement is a legally binding contract that regulates and outlines the terms and conditions of a profit-sharing process. It is a document that two parties use in working together for a similar purpose, typically within a project-based timeframe. A profit-sharing agreement is also known as an incorporated joint venture agreement. In this scenario, two entities remain independent without forming a new and singular company or corporation for a single project. Each party offers a different set of skills and competencies to the business relationship. As such, the division of revenue reflects the division of responsibilities and possible risks between the two entities. Once the two parties have arranged the process of profit sharing, they must provide clear and comprehensive documentation of it. In providing the profit-sharing agreement, the entities will have a lesser occurrence of misunderstandings and confusion. A company can also use the document for employment purposes and dealing with independent contractors. The profit-sharing agreement applies to arrangements that deal with splitting revenue with an entity they work with for a specific period.

According to the Organization for Economic Cooperation and Development or OECD in their published article entitled Profit-sharing in practice in selected OECD countries, about three percent of firms with greater than a hundred employees engage in cashed based schemes of CPS, a subcategory of profit sharing.

Components of a Profit Sharing Agreement

There is no one format for writing a profit-sharing agreement. Since the document handles different industries and businesses, most profit-sharing agreements are tailor-made to fit the entities that engage in a profit-sharing arrangement. As a profit-sharing agreement can be for employment purposes or handling independent contractors, several elements may be present in one document that are not present in another. The person responsible for drafting the agreement must determine the necessary elements that must be in the document. This section of the article identifies the essential components of a profit-sharing agreement with helpful descriptions to provide a better understanding.

Types of Profit-Sharing Plans

Profit-sharing plans are mostly company-based plans between an employer and employee where employers provide a part of the company’s earned profit to its employees. Profit-sharing plans build a strong relationship between an organization and its employees, instilling a sense of ownership and responsibility in employees. There are different types of profit-sharing in a business and the section below talks about each one.

How To Implement a Profit Sharing Agreement

At the beginning of negotiations of a profit-sharing agreement, each party raises their concerns and expectations from the collaboration. There must be a clear vision and project goal of what the parties want to achieve at the end. Whichever profit-sharing plan the company chooses for their employees, the section below contains a helpful guide that will help implement the profit-sharing agreement for employees.

-

1. Make Sure To Record All Essential Information in the Agreement

The profit-sharing agreement must have all the necessary information from both parties. The document must indicate the details of the partners in the agreement, including personal accounts, identification cards, proof of mailing address, income tax statements, and asset list.

-

2. Indicate the Investment Amount and Define Revenue Sharing Methods

Each party is responsible for paying a specific amount of money at the beginning or an initial investment payment. The profit-sharing agreement details the specific amount that each party must contribute during the implementation of the project. It is also advisable to clarify the amount of money that each partner will receive. Revenue sharing can be in different types of profit-sharing plans. One of which is each party receives profit according to their contributions.

-

3. Set the Terms and Conditions, Payments, and Distributions of the Agreement

The terms and conditions of the profit-sharing agreement include information about invested ratios, vital information concerning the parties, and all other information that serves relevance in the document. Ensure that both parties understand and approve the terms and conditions of the agreement before finalizing it on the document. When it comes to profit shares, the distribution can either be immediate or at a later date. A company can distribute the profits to its employees in either lump-sum payments or business equities. Meanwhile, the transfer of profit shares is much later in deferred payment methods, the company storing the shares in a trust fund.

-

4. Discuss Binding Effects, Waivers, Modifications, and Further Assurances

The profit-sharing agreement between the parties is legally binding. The document becomes legally binding when both parties understand and agree on the terms surrounding the arrangement. Modifications to the agreement are possible according to the needs of the party. Either entity can make changes to the agreement so long as the other party has knowledge of the change and agrees. Assurance clauses can also be incorporated in the agreement, dealing with mortgages, but is not necessary.

-

5. Define the Relationship and Execution Processes of the Parties

In a profit-sharing agreement, there are no third parties that exist. If one of the parties brings in a third-party entity to participate in the agreement, the party responsible has a high possibility of losing the partnership or collaboration opportunity. Roles and responsibilities must be clear in the agreement since both parties have different perspectives on implementing the activity or project. The agreement must set explicit boundaries and limitations regarding various aspects of the business.

-

6. Review the Entire Agreement and Details of Jurisdiction

Finally, before both parties sign the profit-sharing agreement, there must be a comprehensive review of the document. Both parties are accountable for checking and making sure that both parties are in agreement before finalizing the document. It is also necessary to discuss the lawful jurisdiction surrounding the terms of the agreement.

FAQs

What is profit and loss agreement?

A profit and loss transfer agreement is a document that details the transfer of a company’s entire profits to another company, intending to share both profits and losses at a certain rate or percentage.

How does a 50/50 partnership happen?

In a 50/50 partnership, the engaged parties each have a 50 percent share of a business. It means that neither can act without getting the other’s approval unless there is a clear distinction of responsibilities and that the party responsible for that aspect makes the decision.

How do partners share profits?

When it comes to profit sharing with other entities through collaborations, the parties can share profits by dividing the roles and responsibilities, setting capital contributions, and establishing a profit-sharing ratio.

Profit-sharing agreements exist internally and externally in an organization. External profit-sharing deals with collaborations and partnerships with a different company or organization for a particular project. Meanwhile, an internal profit-sharing agreement exists between an employer and employees. Make sure that the profit-sharing agreement covers the necessary provisions and terms catering to the relationship. Familiarize yourself with the document and draft your profit-sharing agreement by downloading the 4+ SAMPLE Profit Sharing Agreement in PDF from the article above. Get yours from Sample.net today!