23+ Sample Shareholder Agreements

-

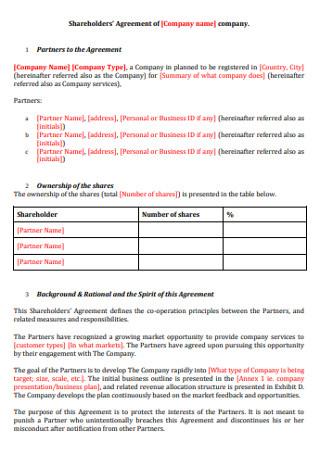

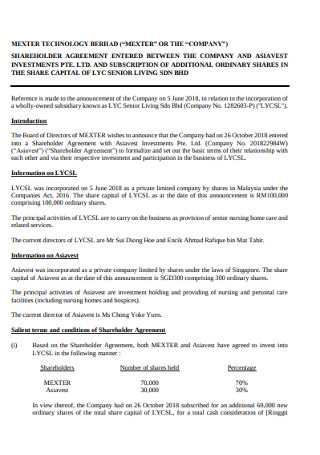

Shareholders’ Agreement of Company

download now -

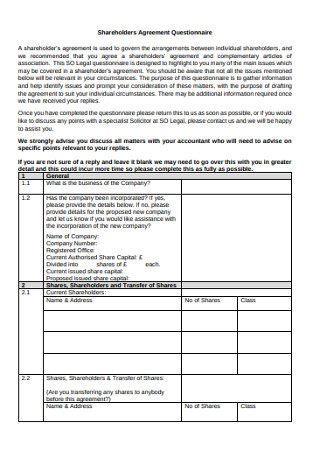

Shareholders Agreement Questionnaire

download now -

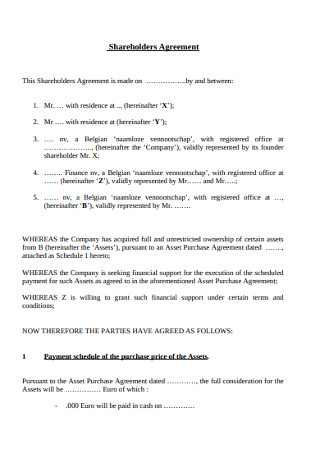

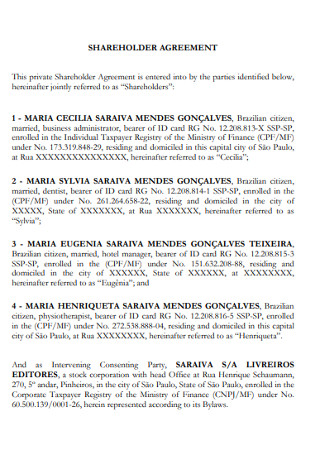

Sample Shareholders Agreement

download now -

Shareholder Agreement Considerations

download now -

Shareholder’s Agreement for Private Companies

download now -

Nonresident Shareholder Agreement

download now -

Shareholders Agreement Short Form

download now -

Shareholders’ Cross Option Agreement

download now -

Nominee Shareholder Agreement

download now -

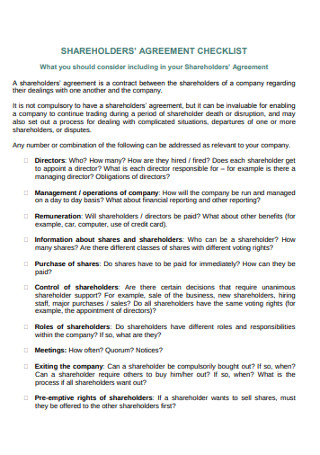

Shareholders Agreement Checklist

download now -

Sining Shareholders Agreement

download now -

Company Shareholders Agreement

download now -

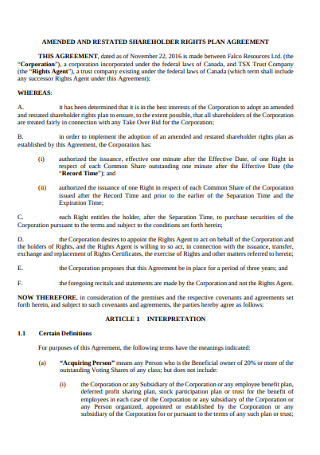

Sharehloders Rights Plan Agreement

download now -

Standard Shareholders Agreement

download now -

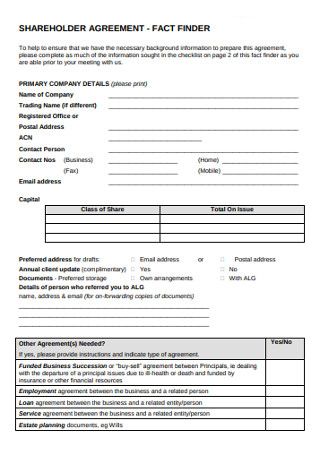

Shareholder Agreement Fact Finder

download now -

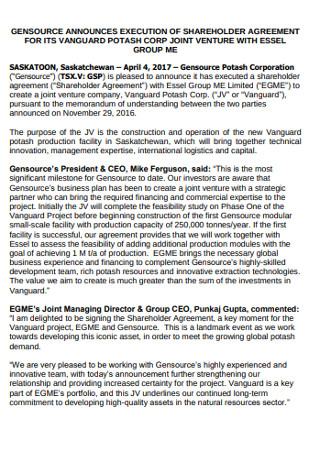

Jiont Venture Shareholder Agreement

download now -

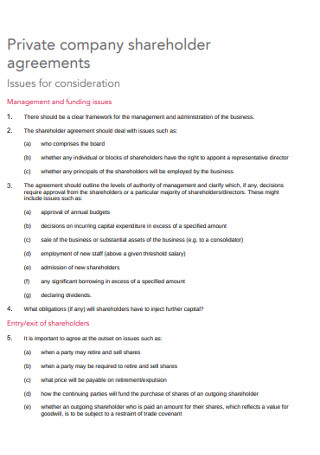

Private Company Shareholder Agreement

download now -

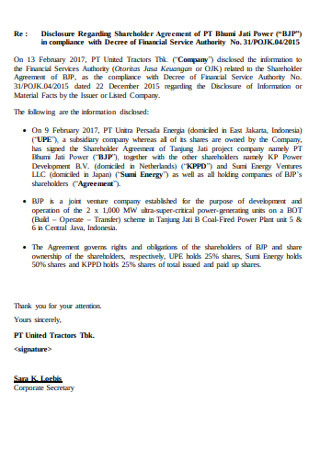

Disclosure Regarding Shareholder Agreement

download now -

Food Industries Signs Shareholder’s Agreement

download now -

Shareholder Agreements for Closely Held Corporations

download now -

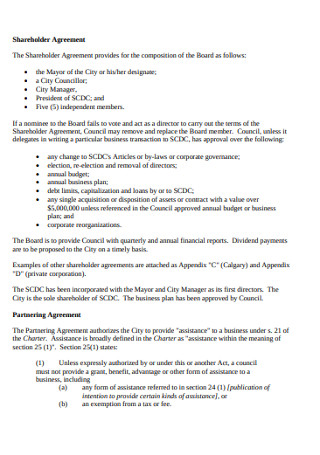

Corporate Shareholder Agreement

download now -

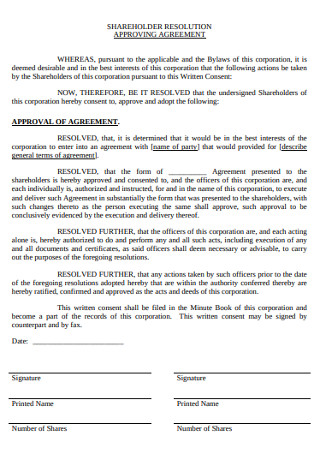

download now Resolution Approving Agreement

Resolution Approving Agreement -

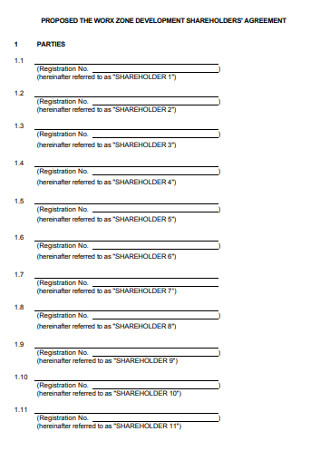

Work Zone Development Shareholder Agreement

download now -

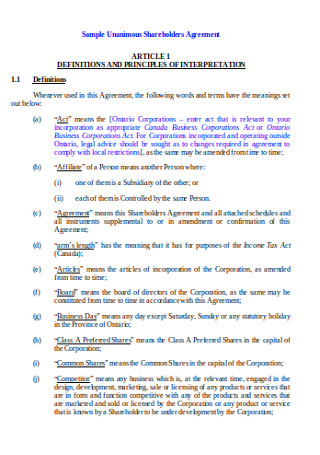

Sample Shareholder Agreement in DOC

download now

Though articles are given—which sets how a business should be run among the people who are managing the company, a shareholders’ agreement controls the actions and relations of shareholders within the corporation. For that reason, a shareholder’s cooperation is essential for the security and protection of the company as a whole. Moreover, having this agreement will minimize disagreements between shareholders in the future.

According to a research by Erin Duffin, the profit of U.S. corporations in 2018 was about 2.07 trillion dollars. This only proves that a majority of people in the U.S. do invest in stocks and become shareholders.

What is a Shareholders’ Agreement?

In simple terms, a shareholders’ agreement is a written contract between investors of a corporation. The deal is expected to have similarities with the “articles of association” but the difference is that in an agreement, shareholders’ have the power to add whatever they desire as long as it is within the bounds of the law. To give you an overview, a shareholders’ agreement basically deals with the following matters:

- Voting process

- Responsibilities

- Dividends

- Policies

- Rights

- Termination

What are Important Terms you Need to Know as a Shareholder?

1. Articles

“Articles” as termed in Canada and the U.S are also referred to as “articles of association”. These are important business documents that contain company regulations regarding system operations and company plans. Specifically, the articles talk about duties that need to be fulfilled by the corporation. Additionally, the articles of association can be likened to a manual that guides each shareholder to what needs to be done. This includes how shares are issued, how dividends are paid, how financial records are audited, and how voting rights are going to be applied.

2. Minority Shareholders vs. a Majority Shareholder

A company or person who has at least a share in the business is a shareholder. They are company owners who are not held in debt if the corporation experiences bankruptcy, unlike other business organizations which are bonded through partnership contracts. Shareholders who possess stock percentage below 50% are called minority shareholders. Usually, they don’t have substantial voting rights within the organization or even have the authority to nominate any director for the company.

Although minority shareholders own most of the shares, most of the time, their total votes won’t have enough strength to overpower the vote of a majority shareholder. On the other hand, a shareholder who holds a stock percentage above 50% is called a majority shareholder. In contrast to the minorities, a majority shareholder is given the right to decide on who should be part of the board of directors. Most often, a majority shareholder is the founder of the business or maybe a close relative of the founder him/herself.

3. Stakeholders

Stakeholders are those people who are directly or indirectly linked to the operations of the company. They can come from within or without. Stakeholders from within are employees, investors, and owners, while stakeholders from without are suppliers, customers, creditors, and etc. What differentiates a stakeholder from a shareholder? Stakeholders, as mentioned earlier, are more interested in the company’s analytics. Even though shareholders are owners, they can still sell their share and purchase another—which means they are not bound to the company for a long period of time when compared to stakeholders.

4. Rights Issue

A rights issue is a call to existing shareholders of the company to buy more shares. With a rights issue, the shares that they are appealed to purchase are at a discounted price for only a period of time. This is one of the company’s ways to compensate for their debts and increase capital. There are two types of rights issues: renounceable and non-renounceable rights. Basically, renounceable rights are tradeable, while non-renounceable rights are non-transferable. A rights issue is not only real for companies who are trying to survive. This strategy is also used by other growing companies who have goals to earn more money for business improvements.

5. Share Transfers

From the word “share transfers” itself, you will know that it is a process where shares are being transferred to another shareholder. Before a share is transferred, the existing shareholder should know what is in the shareholders’ agreement and articles. When it is permitted in both legal documents, the transfer shall be under the approval of the board of directors. New share certificates are then given to the new shareholder. A share certificate is a confirmation of a person’s title as a shareholder.

6. Primary Rights

Corporation shareholders should know what their rights are as a part of the company. The following are the primary rights of all shareholders:

7. Preemptive Rights

Preemptive rights grant the shareholder a right to finance more shares before the company opens it up to the public. Sometimes referred to as a provision to prevent dilution. This allows an investor to maintain his/her ownership at a specific percentage while the corporation expands. How do preemptive rights benefit both the company and the shareholders?

- It maintains the power of a shareholder to vote.

- Shareholders can profit because newly issued shares are sold at a lower price.

- The company will also profit when selling newly issued shares to existing shareholders because initial banking services are no longer needed.

- It lessens the corporation’s equity and capital cost.

8. Dispute Resolution

As stated by the American Bar Association, a dispute resolution uses different ways to settle disputes, claims, and issues with the help of a judge from the government. The process for a dispute resolution requires less time and money compared to the traditional way of dealing with legal cases. The process is more casual and flexible compared to the rules imposed by trial courts. In most procedures, both parties involved in the dispute do not need lawyers. In several cases, lawyers attend to counsel their clients. In corporations, the shareholders’ agreement is used as a basis to know the process of negotiation.

How to Outline a Shareholders’ Agreement for your Corporation

Whether you are opening up a small business or continuing on with your long-existing company, you still need support for your corporation—a shareholders’ agreement. This agreement has a huge impact on the decisions made in a corporation. As we have seen the importance of a shareholders’ agreement, let us familiarize the basic format of this agreement.

1. A Lists of all Shareholders’ Names and their Responsibilities

In this part of the agreement, all correct names of the first shareholders should be listed. The legal name, exact address, and contact number of every shareholder who is a part of the agreement should be identified. Also, the board of directors is listed. Remember that a shareholders’ agreement is made to minimize disputes that may arise among shareholders. Having a description of responsibilities will inform every shareholder of what is expected of them, and this is most especially applicable to the board of directors or managers. If a problem arises, shareholders can go back to the description of their responsibilities and solve the matter.

2. The Right to Vote

Every shareholder, minority, or majority, should be given the right to vote for decisions that will affect the business as a whole. Even if a majority shareholder has more influence in the system for voting, a more significant number of minorities voting for the same terms may still be able to win the vote. Growing corporations do change some things in the system for their businesses to develop. That is why a shareholders’ agreement is used to protect shareholders who may not agree to some decisions being made by the board of directors. The more specific an agreement is, the better.

3. The Process of Stock Transfer

A well-established business will, in time, have to sell or transfer their stocks to other shareholders as part of their marketing strategy. A company should provide a detailed explanation of how shares should be sold or transferred. In the agreement, restrictions on how the process should be done and who is fit to be shareholders are determined by the corporation. For that reason, every shareholder can control and protect their investments. Moreover, a corporation should include a provision concerning a shareholder who dies or is divorced. Either the company will buy back the shareholder’s stock or transfer the ownership to a family member.

4. Legal and Monetary Obligations

A new shareholder should be informed of his/her legal and monetary obligations towards the corporation. Including legal responsibilities in the contract will help the company deal with future disagreements justly. Every shareholder who signs the agreement should be completely aware of this provision. A fair amount of share should be determined at the beginning of the agreement, and it is essential that every shareholders’ percentage of contribution should be specified.

5. Issuance of Dividends

It is expected for a company to share its sales profit to shareholders through dividends. A corporation is obligated to pay its shareholders once they declare a dividend. Normally, the shares are given through checks. On the date of declaration, the amount of the dividend, the date of record, and the date for payment is made public by the board of directors. The funds are then deposited and recorded under the DTC or Depository Trust Company. According to Investopedia, DTC had above 1.3 million securities with a $54.2 value, which was issued in 131 countries and the United States.

6. An Exit Plan

Advance thinking is essential when creating a secure document. Every agreement should have a termination plan in case the business dissolves. How the shareholders will get back the money they have invested should be determined. If the shareholder plans to leave his/her position, they should be permitted by the board of directors before they do.

A well-functioning business should have a system that guides and supports it. It doesn’t matter if you are setting up the market with your family members or close relatives. A company should have the right documents to keep the shareholders guided with the operations, relations, and circumstances happening within the corporation. What kind of company would want to have many issues coming up in the future? As much as possible and as early as possible, companies should find ways to run their businesses smoothly.