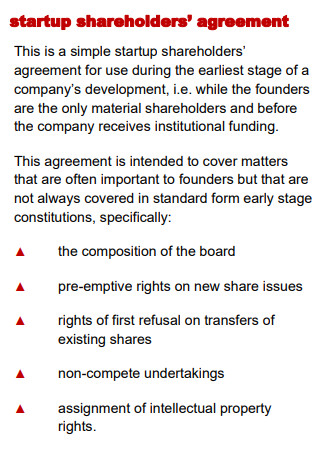

5+ SAMPLE Startup Shareholder Agreement

-

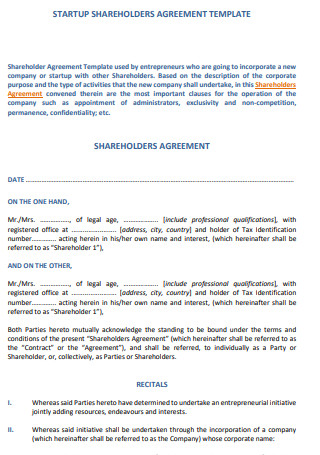

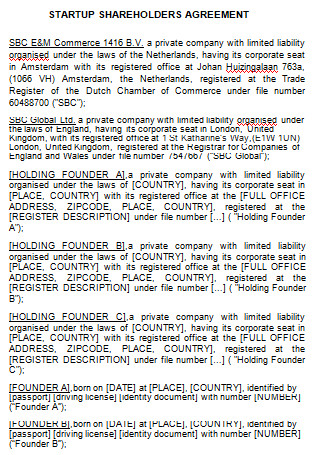

Startup Shareholder Agreement

download now -

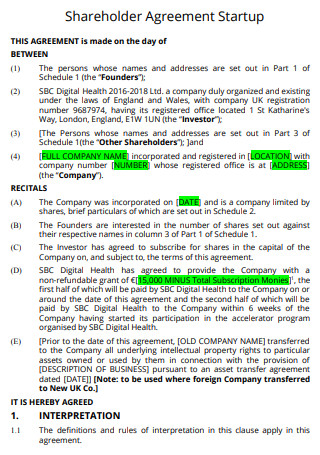

Startup Investor Shareholder Agreement

download now -

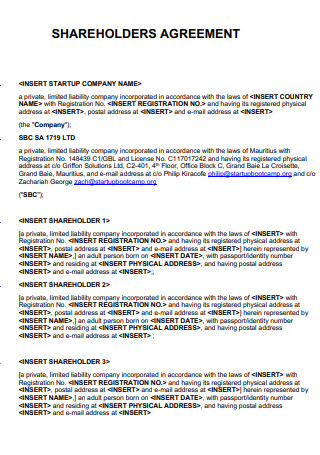

Startup Company Shareholder Agreement

download now -

Foundation Startup Shareholder Agreement

download now -

Sample Startup Shareholder Agreement

download now -

Standard Startup Shareholder Agreement

download now

FREE Startup Shareholder Agreement s to Download

5+ SAMPLE Startup Shareholder Agreement

What Is a Startup Shareholder Agreement?

Benefits of Startup Shareholder

Tips For Shareholders Agreement

How To Find Investors For a Startup

FAQs

What is a shareholder voting agreement?

What should a shareholder agreement include?

Is a shareholder agreement legally binding?

What Is a Startup Shareholder Agreement?

A shareholders’ contract is a private contract that all shareholders of a company sign on their own. Its purpose is to set rules for their relationships, rights, and responsibilities and how the company runs daily. All or some can make a shareholder agreement of the shareholders in a company. It says how shareholders and the company’s management should talk to each other, who can own which shares, and how shareholders should be protected. They are also in charge of how the business is run. Shareholder agreements are legally binding once signed, as long as they meet the standard contract requirements of the offer, acceptance, consideration, and the intention to form legal relations. Investors own 20–30% of a startup’s shares, but the founders should own more than 60% of the company.

Benefits of Startup Shareholder

According to a survey by CB Insights, 13% of early businesses fail due to shareholder discord or strife. Most of these disagreements emerge owing to the absence of a clear protocol or a plan for conflict resolution. The purpose of shareholder agreements is to avoid or resolve these conflicts amicably. A shareholders’ agreement is a contract signed by the company’s investors. This agreement organizes the relationship between the company’s shareholders, even though each contract is created differently for various organizations. Here is a closer examination of the benefits of shareholders’ agreements:

Tips For Shareholders Agreement

A shareholders agreement is an agreement with all the company’s shareholders, or a subset can make it of them. Individuals or corporations can serve as shareholders. A shareholders agreement can be created any time during the company’s existence. Still, it is most typically created when a new company is formed because it provides areas of agreement amongst individuals participating in the company at an early stage. Here are some tips we may provide if you are still interested in this issue!

1. Get It Done At the Outset

The most common error is that the parties fail to draft a shareholders agreement at the commencement of the enterprise. When the necessity for a shareholder’s agreement is recognized, such as during a dispute, it is frequently too late to establish a contract. Attempting to reach a consensus after a risk has materialized can be extremely difficult. In contrast, getting an acceptable agreement before a dispute emerges is far simpler.

2. Business partners aren’t always who you think

This is not only about relationships degrading, although that does occur and is sufficient cause to have a shareholder agreement in and of itself. In reality, you may not even be dealing with the same person. Absent agreed-upon restrictions or procedures; shareholders may sell their investment to a third party who has not been screened. If an investor passes away, you may have to deal with their spouse or executors. You may interact with the bankruptcy trustee if a shareholder becomes insolvent. The shareholders’ agreement may offer some protection against unanticipated third-party meddling.

3. Confirm Each Party’s Expectations

Clarify what each partner will donate to the firm and how they will be reimbursed. Consider if a participant’s cash contribution is a loan to be repaid or initial share capital. Consider whether they should be employed or otherwise compensated for their time and how, if they are adding labor to business operations management. However, this is not only about the startup period but also the business’s long-term needs. Consider whether a supply or service contract should be in place from the start if, for example, one of the participants will be a supplier to the firm. Consider whether disparate contributions justify differing ownership or control interests.

4. Have A Clear Procedure For Impasses

Companies that are owned and run 50/50 can be bad for business. If there is no trust between the people involved, it may not be possible to run the business. Directors cannot make decisions, documents cannot be signed, and there is no majority shareholder. Even though it happens less often, deadlocks can still occur with three or more participants if there aren’t enough directors or if the way the company is owned makes it possible. For company structures that are “at risk,” there should be a detailed plan for getting out of a stalemate. When there is no way to make a decision, the only thing left to do may be to ask a court to order the company to be shut down. When a company goes out of business, the goodwill and sale price often decrease.

5. Have An Exit Strategy

It is improbable that all stockholders will wish to depart the company simultaneously. There are frequently many personal considerations involved with leaving a firm. Consider how your stake will be valued and who will acquire your shares if you decide to sell. Assess whether you have a pre-emptive right to purchase the shares of a departing shareholder, as well as the possible price and payment terms.

How To Find Investors For a Startup

Identifying and gaining potential investors for your firm can be essential to its success. Learning a few tried-and-true tactics can help you achieve this objective. In this section, we examine the advantages of acquiring investors for a startup, outline the methods for locating investors, and provide networking advice for possible investors. Consider the following stages when you pursue investors for your startup:

1. Ask family and friends

When examining for investors, friends and family are frequently the first individuals that startup founders consider. Additionally, it is typically more cost-effective, as family and friends are more likely to loan you money on more favorable terms than a professional investor or a bank. You must determine if you wish to request a loan or a genuine investment, which typically entails a share of future profits. Although persuading relatives and friends to participate in your business may seem like a simple and uncomplicated approach to getting funds, treating them like regular investors is typically a good idea, explaining your intentions and the associated dangers. Having business relationships with personal acquaintances can have unintended implications if good communication is not always maintained.

2. Consider equity-based funding

Equity finance is acquiring funding for an ownership stake in your company. During the early phase of a business, selling a portion of the company may not be appealing, but doing so allows you to raise capital quickly and get your items on the market. You can obtain equity financing from various sources, including investment firms, online crowd-funding sites, incubators, accelerator programs, and online organizations.

3. Apply for a small business administration loan

The Small business administration is a state agency with the mission of assisting small enterprises. Although they do not offer loans directly, they can connect you with approved lenders and may even guarantee the loan, allowing the lending institution to provide you with far more favorable repayment terms and interest rates. Small business administration can assist you in learning information on how to design, launch, and expand your new business, in addition to gaining access to capital.

4. Contact nearby business owners.

Local business owners are an excellent resource for finding startup or small firm investors. They have likely needed funds in the past and can help you connect with individuals and organizations willing to invest. If your product or service improves their current firm, local business owners may wish to support themselves. Start by requesting the names of other investors, but if the business owner expresses interest, don’t hesitate to pitch your startup’s potential.

5. Consult Established Business Owners

Established business owners can also be a treasure of information regarding how to get investors for a startup or small firm. Utilize your local chamber of commerce or Better Business Bureau to network. Attend local events, join tech, startup, and business social media groups, and try to meet as many people as possible. As you perform these actions, avoid constantly pounding the pitch. Meet your peers and bond over the triumphs and tribulations of starting your own business. As a result, you will develop strong ties that will be beneficial when it comes time to obtain finance.

6. Share Information With Industry Colleagues

Many investors specialize in specialized areas; therefore, if you have contacts within your business, you should seek their advice. And do not restrict your efforts to business owners. Even if your sector acquaintances are not business owners themselves, they may be able to provide you with vital information regarding investors. Don’t be disheartened if you don’t find any results when you first inquire. You have sown the seed. Eventually, this seed may blossom into a full-fledged opportunity.

7. Contact Local Business Universities

Local business schools are an additional resource for locating potential investors. They frequently have a network of instructors, alumni, and guest speakers who may know investors seeking the next great thing or are investors themselves. Furthermore, do not restrict yourself to business colleges. Contact them about financing opportunities if you have a bachelor’s or master’s degree from a college or university. They are typically willing to assist a former student.

FAQs

What is a shareholder voting agreement?

A shareholder commits to voting their shares generally or in favor of a particular proposition and against any other. Voting agreements are frequently used in business combination transactions to guarantee to the buyer that significant shareholders would vote in favor of the relevant transaction.

What should a shareholder agreement include?

Typically, a shareholders’ agreement will contain rules requiring directors and shareholders to keep all company-related matters secret. In addition, it may prohibit stockholders from forming competitor firms or negotiating with the company’s consumers.

Is a shareholder agreement legally binding?

A shareholders’ agreement is a lawfully binding contract between the shareholders of a company that outlines their rights and responsibilities, outlines how the company should be managed, and establishes share ownership and share transfer rules – all to provide precise solutions to future contentious situations.

In conclusion, a shareholder contract spells out the rights and responsibilities of shareholders, the rules for how the start-up company is run, and who has power over it. The goal of the agreement is to protect the rights of shareholders. Download one of our short and easy-to-change Start-up Shareholder Agreement samples today to help you get started.