20+ Sample Stock Purchase Agreement

-

Stock Purchase Agreement Template

download now -

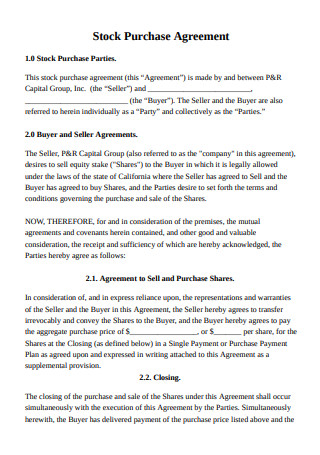

Sample Stock Purchase Agreement

download now -

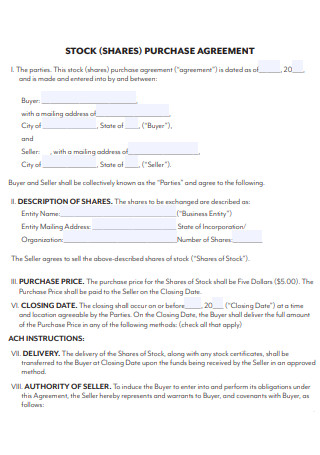

Basic Stock Purchase Agreement

download now -

Stock Sale and Purchase Agreement

download now -

Stock Purchase Agreement Example

download now -

Preferred Stock Purchase Agreement

download now -

Formal Stock Purchase Agreement

download now -

Common Stock Purchase Agreement

download now -

Stock Purchase Agreement in PDF

download now -

Stock Shares Purchase Agreement

download now -

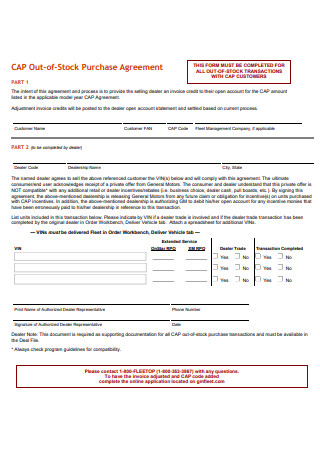

Out of Stock Purchase Agreement

download now -

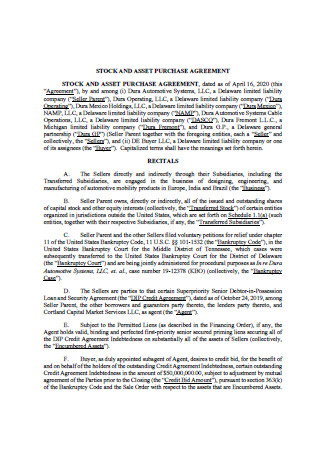

Stock and Asset Purchase Agreement

download now -

Model Stock Purchase Agreement

download now -

Restricted Stock Purchase Agreement

download now -

Printable Stock Purchase Agreement

download now -

Amended and Restated Stock Purchase Agreement

download now -

Standard Stock Purchase Agreement

download now -

Simple Stock Purchase Agreement

download now -

Stock Purchase Agreement Format

download now -

Stock Purchase Agreement in DOC

download now -

Series Preferred Stock Purchase Agreement

download now

FREE Stock Purchase Agreement s to Download

20+ Sample Stock Purchase Agreement

What Is a Stock Purchase Agreement?

What Are The Types of Stock?

What Are The Classes of Stock?

Elements of a Stock Purchase Agreement

How to Create a Stock Purchase Agreement

FAQs

Can Company Sell Shares Without a Stock Purchase Agreement?

Who Is Not a Party to The Stock Purchase Agreement?

Can I Create My Own Stock Purchase Agreement?

What Is a Stock Purchase Agreement?

A stock purchase agreement is a precise and definitive agreement that finalizes all terms and conditions that are related to the purchase and sale of the seller or the target. In a simpler definition, it is a contract to transfer ownership of stocks from the seller to the purchases. Mainly, its provisions focus more on the transaction itself than includes the date of transaction, the number of stock certificates as well as the price per share. There is a lot of simple stock purchase agreement that has been used by companies or even private sellers. This type of business contract agreement also contains certain terms and conditions that outline the nature of the agreement. In addition to that, we have an agreement called the stock buyout agreement in which is quite similar to the stock purchase agreement. In this business contract, the agreement stipulates what happens with the shares of a business if something unforeseen occurs. Furthermore, it provides limitations as to how owners can sell or transfer shares of the company. This agreement is written to provide better control and management of a company. At the end of the transaction, the seller or the target will transfer and deliver all certificates representative of the stocks sold and the purchaser or the acquirer will pay the specific price in the agreement as a consideration that the stocks are being bought.

What Are The Types of Stock?

1. Corporations

A stock corporation is a for-profit corporation that has shareholders, each of whom receives a portion of the ownership of the corporation through shares of stock. In simpler terms, the shares may receive a return on their investment in the form of dividends.

2. Limited Liability Companies

A limited liability company is a business entity structured to have either single or multiple owners. Members can be added and subtracted over the life of the limited liability company, and profits can be distributed in varying amounts to each of the members.

3. Partnerships

Partnerships can make an income that distributes to their partners. Distributions resemble dividends in several ways in which they normally cash payments and may be issued periodically throughout the year.

5. Limited Partnership and Trusts

Trusts and Limited Partnerships Combining trusts with limited partnerships makes for a powerful family asset protection device. However, combining trust with a limited partnership is a more complicated structure than using either alone. Combining the family limited partnership with the living trust can provide a superior estate plan.

What Are The Classes of Stock?

For the seller or the company not to be confused or have a mix-up of knowledge with regards to the stock that is written in the agreement, classes of stock commonly have different voting rights allowing a group of individuals makes the primary decisions of the company. Stated below are the classes of stock:

1.Class A Stock

Since we are talking about the voting rights of a group of individuals, Class A Stock allows 3 votes per share.

2. Class B Stock

Following the Class A Stock is Class B Stock. In this class of stock, it is stated that it allows 2 votes per share.

3. Class C Stock

The final class stock is the Class C stock where it only allows 1 vote per share compared to the first 2 classes of stock that have 3 and 2 votes per share, respectively.

Elements of a Stock Purchase Agreement

In order to fully grasp the precise definition of a stock purchase agreement, there are certain elements that will explain how the transaction process works and certain concepts that are broken down into parts. Listed below are the elements found in a stock purchase agreement:

How to Create a Stock Purchase Agreement

Creating a stock purchase agreement allows the seller and the purchaser to agree to both perspectives in terms and conditions. However, in making this agreement there are certain steps that should be included in order to have a comprehensive business contract agreement.

1. Set Agreement to a Specific Date, Produce The Purchaser’s Identity, and The Seller’s Information

The agreement’s introduction should seek the date that the purchaser wishes to be applied. Furthermore, the identity of the purchaser must also be identified to affirm the concerned shares of stock and to input in the agreement that he/she is the buyer. In addition to that, the seller’s identity and information must also be attached with the authority to sell the concerned shares to the purchaser.

2. Define The Entity Behind The Shares The Purchaser Shall Buy

The next step in creating a stock purchase agreement is to define the entity behind the shares the purchaser shall buy. Bearing the title “Description of Shares”, this seeks several details for its completion. The first of which is the full name of the “Business Entity” whose stock is being sold. After filling out the required and necessary entities, you may now proceed in doing and creating the next step.

3. Provide a Discussion On The Concerned Shares

The Description of Shares continues with some requests that shall define the concerned stock. The first thing to note is to record exactly how much money is required to purchase one share of this stock. Afterward, name the “Class” the shares being bought are classified under by the Stock Company on the last section.

4. Attach The Formal Asking Price for The Shares of Stock

The next step in creating the agreement is the purchase prices in which the amount of money is expected to be noted for all the shares being sold. It should definitely be mentioned the amount that is expected from the purchaser on the closing date of this agreement.

5. Solidify The Closing Date Through This Agreement

The date that defines the last day when the purchaser can buy the stock under the terms must be discussed. The month and two-digit calendar day in the first section should be noted upon making the agreement.

6. Report The Manner of Payment Expected For The Shares and Affix Signature of The Seller

The mode of payment expected from the purchaser must be pinned after solidifying the closing date. This information can be easily conveyed through a series of checkboxes. You may check one or more of the lists provided in this section so long as it defines how payment for the stock will be received. Thus, if the money will arrive in the form of a “Bank Wire” then check the first box. In case that the preferred mode of payment of the purchaser is not on the list stated in the agreement, the purchaser may choose or mark the “other” box. This will expect a direct report to define how the Purchaser will submit the payment for the concerned stock. after reviewing the completed document above and any formally added or attached material, the Seller must sign his or her name as a promise to comply with its contents.

Keeping all of these elements in mind can create a precise and comprehensive stock purchase agreement. Before purchasing a product, you must be aware of all the terms and conditions as well as the requirements needed for it to be accomplished. All these are contained in the agreement document. Before signing the contract, make sure that all documents are factual and real.

FAQs

Can Company Sell Shares Without a Stock Purchase Agreement?

The stock purchase agreement is used so that companies can sell to outsiders without asking other shareholders. With an agreement, a “right of first refusal” clause can be created. This means other shareholders will have the option to purchase the shares before they are sold to someone else.

Who Is Not a Party to The Stock Purchase Agreement?

The Seller is not a party to any contract that remains in effect with respect to the Shares and there are no restrictions on the offer, sale, or transfer of the Shares other than applicable securities laws.

Can I Create My Own Stock Purchase Agreement?

This depends on what you prefer. You can find a lot of templates online to download but it is not really the best decision. It is always safe to have a legal professional draft of the agreement.

Understanding the stock purchase agreement is vital in the business sector. This agreement is important because they put the terms of a sale into writing. This can prevent misunderstandings that may end up in the courtroom. The agreement also allows the seller to show and explain that they are the owner of the stock being sold. This gives the purchaser more faith in the transaction. This also provides specific information on the transfer of stock.