24+ Sample Subordination Agreement

-

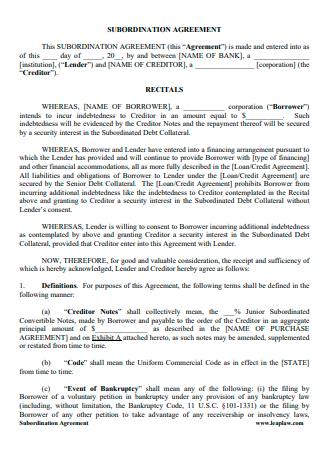

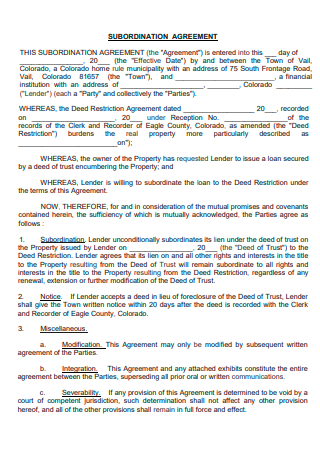

Subordination Agreement Template

download now -

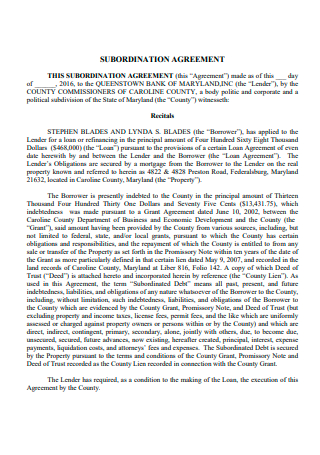

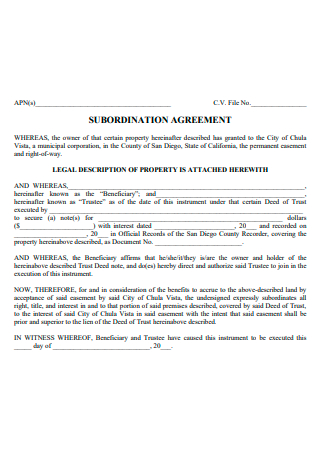

Program Subordination Agreement

download now -

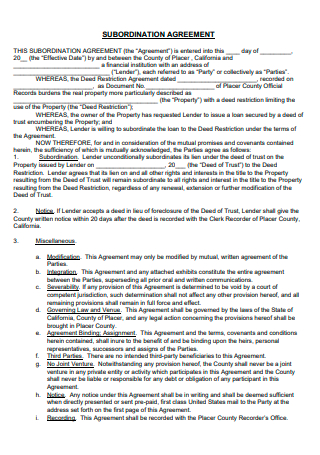

Basic Subordination Agreement

download now -

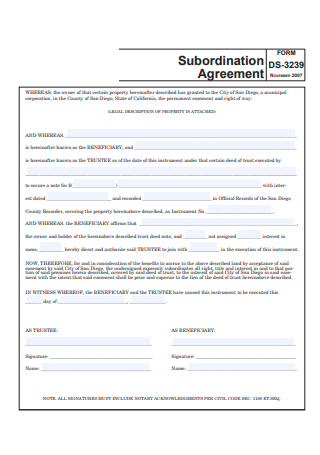

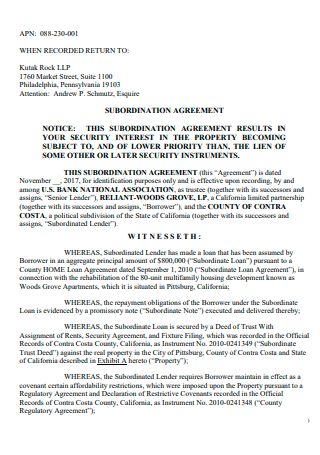

Sample Subordination Agreement

download now -

Subordination Agreement Example

download now -

Standard Subordination Agreement

download now -

Formal Subordination Agreement

download now -

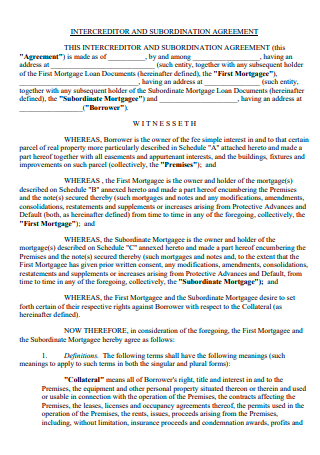

Inter Creditor and Subordination Agreement

download now -

Simple Subordination Agreement

download now -

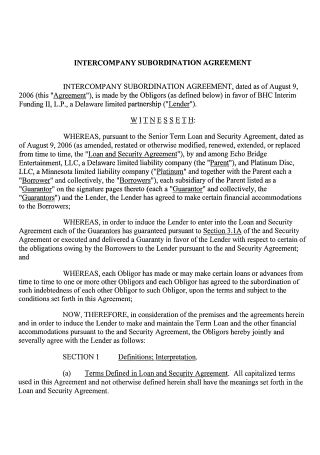

Inter Company Subordination Agreement

download now -

Subordination Agreement in PDF

download now -

Subordination Agreement Format

download now -

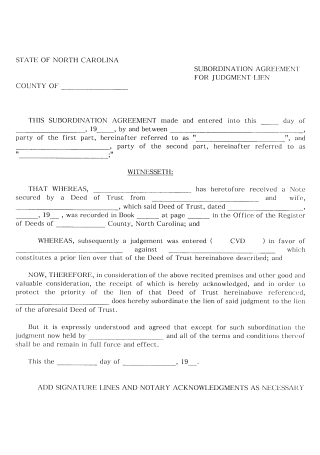

Subordination Agreement For Judgement

download now -

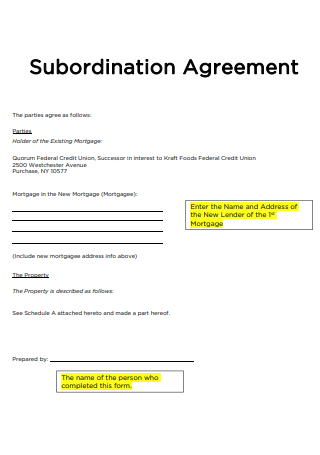

Printable Subordination Agreement

download now -

Subordination Agreement Request Form

download now -

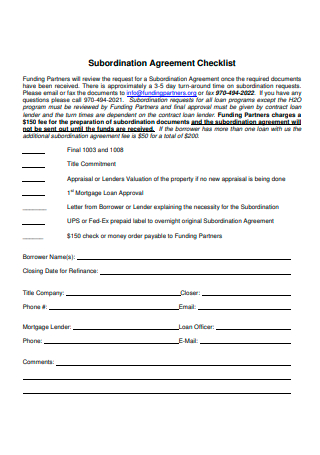

Subordination Agreement Checklist

download now -

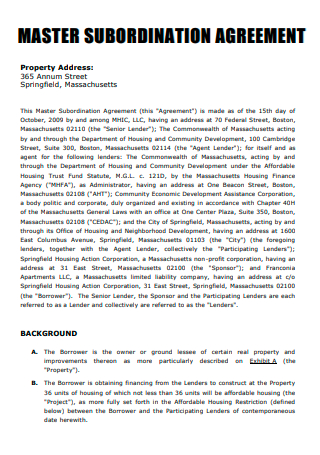

Master Subordination Agreement

download now -

Draft Subordination Agreement

download now -

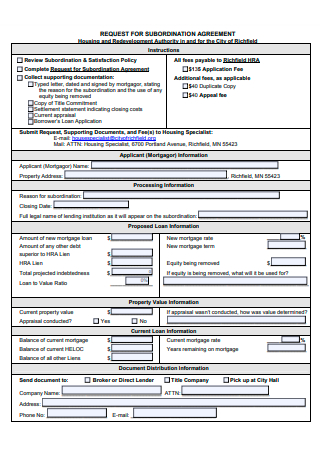

Request For Subordination Agreement

download now -

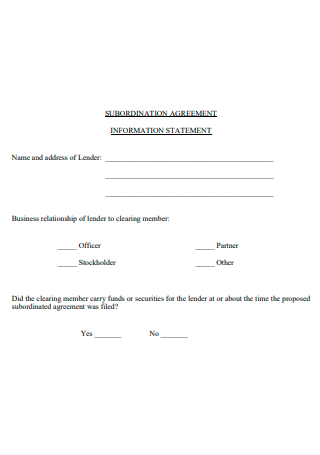

Subordination Agreement Information Statement

download now -

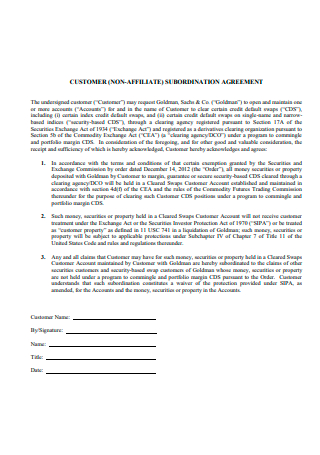

Customer Subordination Agreement

download now -

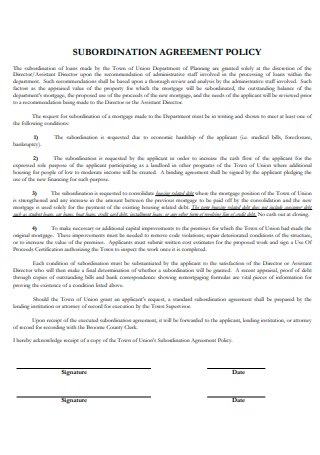

Subordination Agreement Policy

download now -

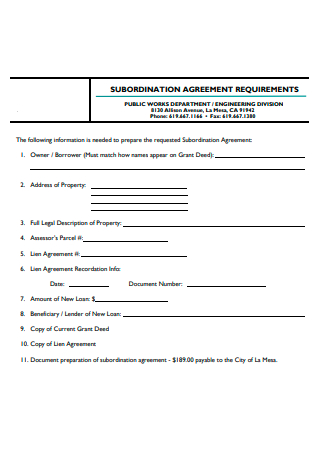

Subordination Agreement Requirements

download now -

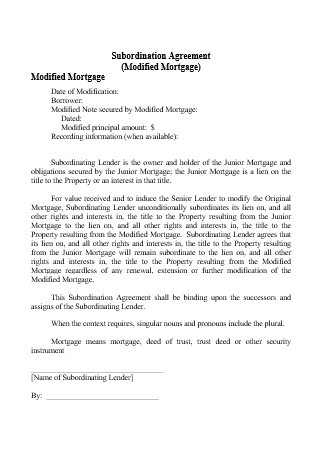

Modified Mortgage Subordination Agreement

download now -

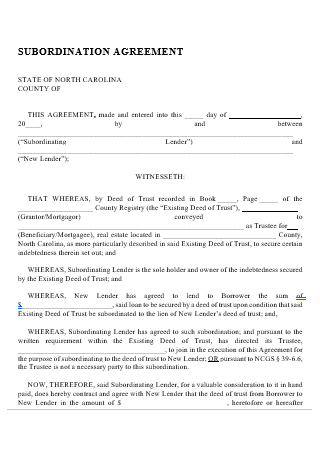

Subordination Agreement in DOC

download now

FREE Subordination Agreement s to Download

24+ Sample Subordination Agreement

What Is a Subordination Agreement?

How Does a Subordination Agreement Work?

Categories of Subordination Agreements

What Are the Risks That Come With Multiple Loans at a Time?

Situations That a Loan Can be Used

Steps in Writing a Subordination Agreement

FAQs

What is Junior Debt?

What is a Subordination Clause in an agreement?

Why do other lenders usually agree to subordinate?

What Is a Subordination Agreement?

First of all, what is the process of subordination? It is the act of classifying multiple loans in order of priority. As stated earlier, this process is done in case the borrower defaults on his/her payment or the company that the borrower took the loan from ends up being bankrupt.

What is a subordination agreement, then? It refers to a legal document/legal agreement that places one obligation as second in precedence for obtaining repayment from a debtor. It is a deal that changes the lien status. In the occasion that the borrower’s properties need to be liquidated to satisfy the obligations, a subordination agreement admits that one party’s claim or interest is greater than that of another. The lender of the first loan will now demand the second loan officer to execute a subordination agreement in order to relocate it as a priority for debt repayment.

How Does a Subordination Agreement Work?

When the situation arrives wherein borrowers require additional funds on top of their existing loans, a subordination agreement has to be carried out. In the case of two loans being taken by the borrower, the second loan becomes the junior debt while the first loan becomes the senior debt.

As the case usually is, the senior debt will always take precedence over the junior debt. As a result, the original loan lenders will wish to retain first priority in receiving loan repayments and will not sanction the second mortgage unless a subordination agreement is executed. If the debtor intends to take out a second mortgage in the future, the creditor may want a subordination agreement to secure his/her payments. A subordination agreement guarantees that the creditors’ payments take precedence and are paid prior to the second mortgage.

Categories of Subordination Agreements

Listed below are the different categories/types of subordination agreements:

- Executory Subordination Agreement – In an executory subordination agreement, the subordinating party will agree to have his/her interests ranked below the security interests of another party. Because it is merely a promise to agree on in the future, an executory subordination agreement may be difficult to enforce later on. A contract claim breach might occur if the party does not sign the executory subordination agreement.

- Automatic Subordination Agreement – Automatic subordination agreements work very differently compared to executory subordination agreements. In this type of subordination agreement, the recording and the execution of the main and subordination agreements take place at the same time. For example, if a deed has an automatic subordination clause, it will often specify that after the lien of the deed is recorded, it will be immediately secondary to another deed.

What Are the Risks That Come With Multiple Loans at a Time?

Listed below are the ways that availing multiple loans at a given time can become a risk:

Situations That a Loan Can be Used

Here are some of the different situations in which a loan can be used:

Steps in Writing a Subordination Agreement

A subordination agreement must be understandable and clearly made so that no confusion happens over what mortgage takes priority over another one. With that being said, here are the necessary steps to follow in creating this type of document.

-

1. Create the Basic Information

This is the first step to do when creating this type of agreement. In this step, what you need to do is write down the basic information that’s needed in the document such as the title of the document and the date when it is created. A definition of terms section may also be included in writing this section as there may be some legalese terms that are too difficult or too confusing for any of the parties to comprehend. This is done to avoid any unnecessary confusion regarding the terms that are written in the agreement.

-

2. Identifying the Parties Involved

After writing down the basic information of the agreement such as the title, date of the agreement, and the definition of terms section, this step then follows. This is crucial as this step is when the parties of the subordination agreement are going to be clearly identified. In this section, clearly identify who is the lien holder (someone who legally has an interest in your property until you pay it off in full) and the borrower of the loan. In writing this section, it is important to place their full legal names and their identified roles in the agreement so that it can easily be understood by anyone who goes through it.

-

3. Identifying the Senior and Junior Debt

After identifying the parties involved in the agreement, this is the step that will proceed, which is identifying the senior and junior debt in the agreement. Since a subordination agreement is all about identifying which debt takes precedence over another, this step is crucial. Senior debt is the type of debt that holds a higher claim to all the borrower’s assets while junior debt is the type of debt that has been issued with lower priority in the debt repayment hierarchy compared to the senior debt. After that, in the case of an executory subordinating agreement, the subordinate party will then have to agree that his/her interests will fall below the senior party.

-

4. Setting the Terms and Conditions of the Agreement

After classifying the junior and senior debts in the agreement, this step will then follow, which is to lay out the terms and conditions of the agreement. It is important that the terms and conditions must be set since a debt simply cannot take precedence over another one without explicitly saying the terms that allow doing so. This section makes the parties involved clearly understand everything they should and shouldn’t do. It’s also necessary that this section should be written as detailed as possible.

-

5. Signatures

This serves as the last step in creating the subordination agreement. Having the signatures of all the parties involved in the creation of this agreement is crucial since it signifies that they have agreed to every term and condition that were stated and have committed to the enforcement of this agreement. This section also makes the subordination agreement legally enforceable. Also, it is important to have the date that the parties signed the agreement be stated in this document.

FAQs

What is Junior Debt?

In the event of a default, junior debt pertains to bonds or other kinds of debt that have lesser precedence for reimbursement over other, more senior debt claims. As a result, junior debt is riskier for investors and, as a result, has a higher rate of interest than the more senior debt from the same company. Junior debt, often known as subordinated debt, is only reimbursed in the case of default or bankruptcy after further senior loans have been fully repaid. In addition, contrary to senior debt, junior debt is often not secured by any form of asset.

What is a Subordination Clause in an agreement?

The act of surrendering priority is known as subordination. A subordination clause refers to a provision in an agreement that indicates that the present claim on any debts takes precedence over any additional claims generated in future agreements. A subordination provision essentially makes the present claim in the agreement superior to any subsequent agreements. These provisions are most frequently seen in loan agreements and bond issue contracts.

Why do other lenders usually agree to subordinate?

Since conventional first-mortgage lenders will not agree to refinance a debt unless they are assured the first position, the only way refinancing transactions may take place is if the second-mortgage holder chooses to subordinate. A subordination arrangement permits the new lender to take the lead. Junior lienholders will often accept to be subordinate to a new first loan if the equity is sufficient to service both debts. As a result, subordination agreements are a very typical occurrence in the loan sector.

Debt priority can prove to be extremely crucial when a debtor declares bankruptcy, hence why an effective subordination agreement must be put in place when the debtor decides to acquire multiple loans. Inside this article, you can find example templates of subordination agreements in case you are required to draft one in the future.