50+ Sample Trust AgreementTemplates

-

Agreement of Transfer Trust

download now -

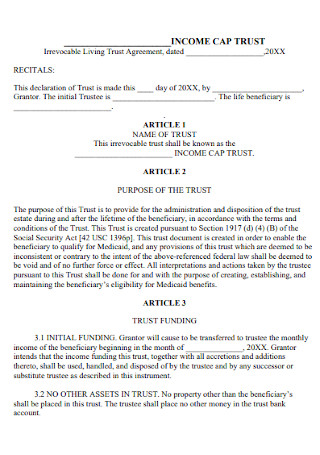

Irrevocable Living Trust Agreement

download now -

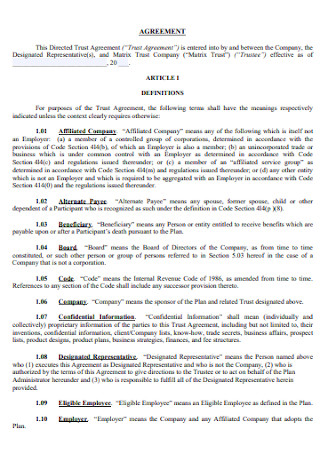

Company Trust Agreement

download now -

Unit Trust Agreement

download now -

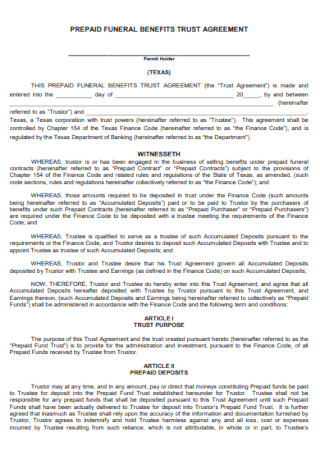

Prepaid Funeral Befits Trust Agreement

download now -

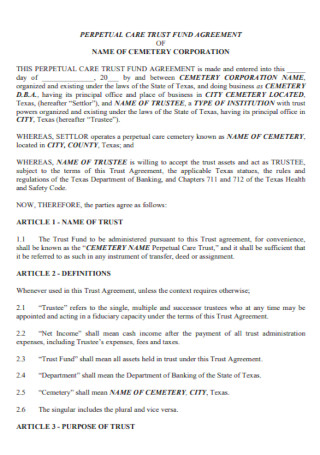

Care Trust Fund Agreement

download now -

Blind Trust Agreement

download now -

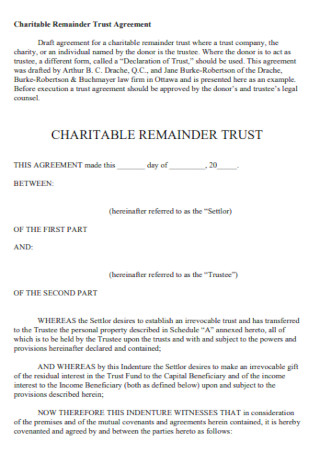

Charitable Remainder Trust Agreement

download now -

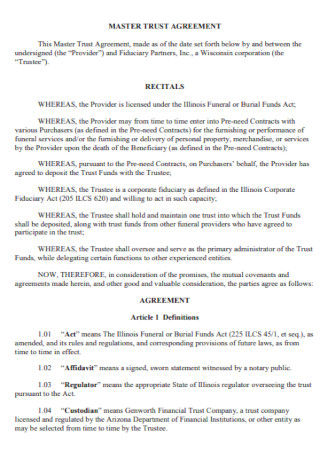

Master Trust Agreement

download now -

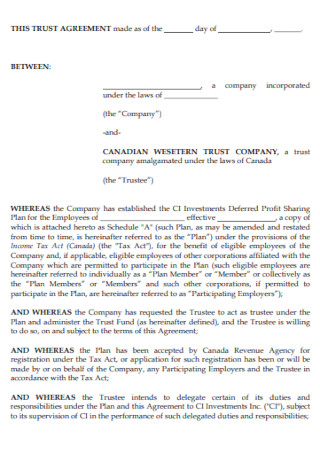

Sample Trust Agreement Template

download now -

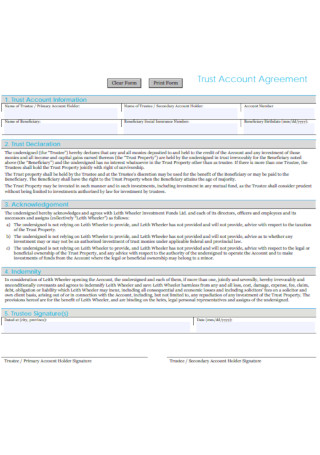

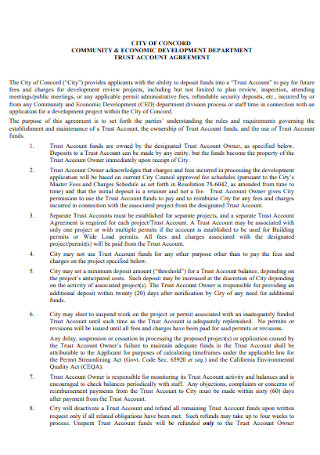

Trust Account Agreement

download now -

Declaration of Trust Agreement

download now -

Trust Management Agreement

download now -

Certification of Trust Agreement

download now -

Environmetal Mitigation Trust Agreement

download now -

Declaration and Trust Agreement

download now -

Standby Trust Agreement

download now -

Basic Trust Agreement Template

download now -

Life Certificate of Trust Agreement

download now -

Union Trust Agreement

download now -

Simple Trust Agreement Template

download now -

Bare Trust and Agency Agreement

download now -

Decommissioning Trust Agreement

download now -

Eight Supplemental Trust Agreement

download now -

Joint Trust Agreement

download now -

Certification of Trust Agreement Template

download now -

Trust Listing Agreement

download now -

Chain of Trust Agreement

download now -

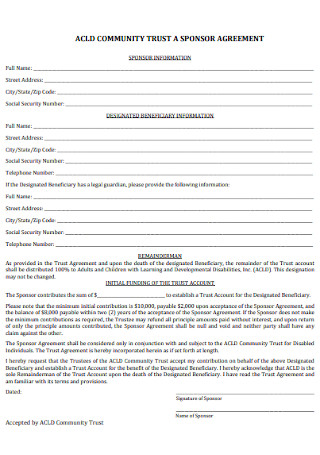

Community Trust Spencer Agreement

download now -

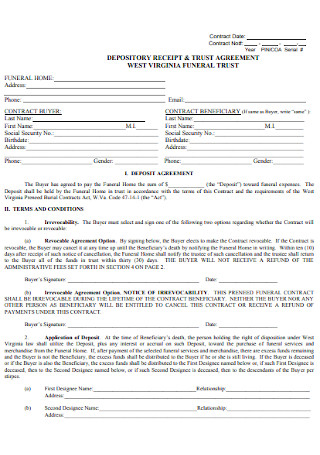

Trust Receipt and Agreement

download now -

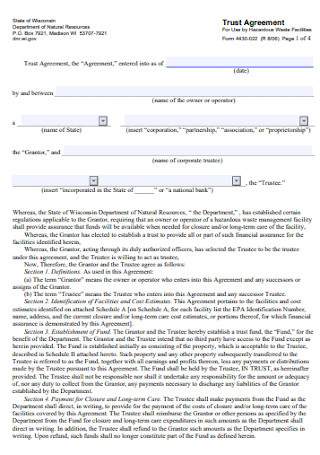

Standard Trust Agreement Template

download now -

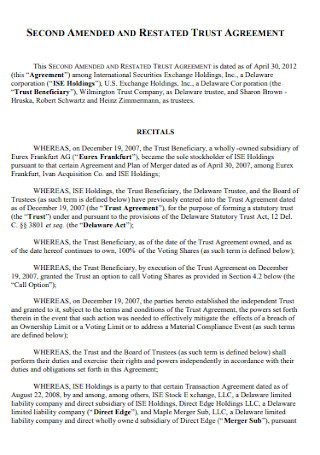

Restated Trust Agreement

download now -

Insurance Trust Agreement

download now -

Irrevocable Burial Trust Agreement

download now -

Sample Blind Trust Agreement Template

download now -

Litigation Trust Agreement

download now -

Trust Under Agreement

download now -

School Trust Agreement Template

download now -

Creditor Trust Agreement

download now -

Amended Trust Agreement

download now -

Depository Trust Agreement

download now -

Trust Agreement Checklist

download now -

Senior Trust Agreement

download now -

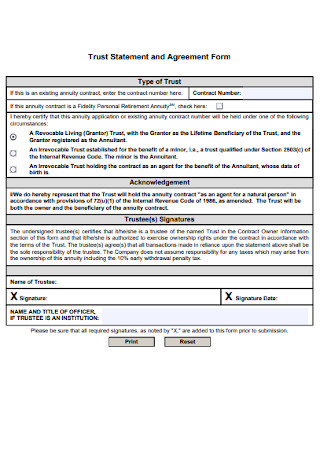

Trust Statement and Agreement Form

download now -

Formal Trust Agreement Template

download now -

Trust Land Agreement

download now -

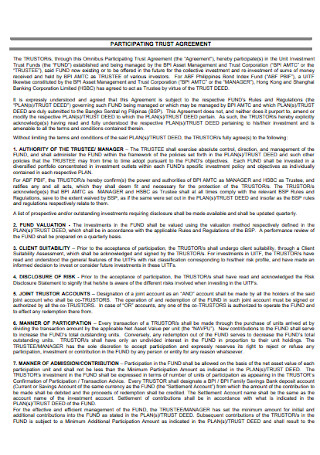

Participating Trust Agreement

download now -

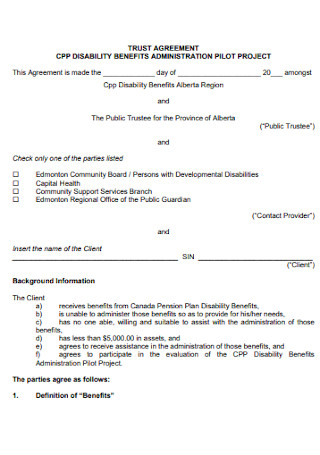

Simple Trust Account Agreement

download now -

Credit Facility Trust Agreement

download now -

Trust Employment Agreement

download now -

Trust Agreement for Third Party Liability

download now

What Is a Trust Agreement?

Are you familiar with the terms trustor, trustee, and beneficiary? As a quick overview, trustors gift funds or properties to beneficiaries. But a trustor cannot give the asset directly to a recipient. First, trustors transfer assets to a third party. This third party is the trustee, who is responsible for maintaining and managing such assets to the beneficiaries. And you commonly see these terms under formal contracts and agreements, specifically a trust agreement. Hence, this agreement is a legal document that grants the title or ownership rights of assets. Moreover, the form contains the trust purpose, asset details, trustee powers and limitations, and compensation.

Did you know that only less than 2% of Americans receive a trust fund?

Moreover, The Cut added that the trust fund median amount reaches up to $265,000, with a $4,062,918 average.

Also, The World Bank mentioned that the hindrance of accomplishing the Sustainable Development Goals (SDGs) for trusts was the worldwide financing gap that reached $3-5 trillion annually.

How Do Trusts Work?

First things first, do you know what assets are? Trust funds hold assets that refer to money, stocks, bonds, real estate, businesses, insurance policies, a hybrid of assets, or any related property. And to implement the trusts, the trustor or grantor creates a formal written agreement. Often managed with an attorney’s help, grantors use the binding contract to specify anything about the trust. If the trustor dies or goes mentally ill, for example, then assets are no longer his or hers. That is, due to how trusts are a separate entity.

Meanwhile, trustees have another responsibility, which is to take care of the trusts so those will benefit the beneficiaries in the end. A trustee does not need to gain any advantage from the trust, though. However, trustees need to have thorough knowledge about managing trusts wisely. Also, trustees handle bookkeeping and tax payments. And with the right partnership and terms between parties, rest assured that each beneficiary receives and owns their assets in the future.

What Are the Elements of a Trust Agreement?

Since you already know what the trust agreement means, how about what is included in its document? Do you know about the particular elements to discuss inside the form? Just like a cooking recipe, there is a set of ingredients to produce the best product. And like trust agreements, it contains important ingredients to keep those forms valid and legally binding. Without further ado, these are the elements to expect:

The Benefits of a Trust

According to The Cut, via the Survey of Consumer Finances, the median amount for trust funds is around $265,000. And it had a $4,062,918 average to boot. With those numbers alone, you can tell that its impact on society is quite high. However, only 2% of people in the US receive a trust fund. It is wise to change the statistics as a lot of opportunities would be missed in not considering a trust. In fact, it had plenty of advantages to offer. The benefits of a trust are as follows:

Control

In the risk of a disability or death, who knows what could happen to your assets, right? Some people might take advantage of your land or property that your appointed beneficiaries would not receive a single asset. To prevent poor management and fraud, you are given control of the trust agreement or contract. Whether you plan on adding collateral, special request, timeline—name it, the decision is yours.

Privacy

There are essential private topics to decide and talk about, and entrusting assets to any beneficiary is included. However, it can be risky just to keep confidential records or your will and testament public. There are a lot of issues about recipients fighting on who gets to keep particular properties, and it can be a nightmare in court. Thus, write your trust plan in the document where your privacy is respected.

Continuity

Life is unpredictable, don’t you think? Thus, it is imperative to prepare for any life-changing event or the worst circumstances in life. At least, while you are still alive and in the right mind, asset management runs continuously. You no longer worry if your business, house, or insurance policy ceases in the long run.

Tax Benefits

Another vital detail to recognize in from the trust is the tax advantage. Are you aware that distributing assets helps lessen the burden of tax? The best part is how your beneficiaries experience it as well. Calculate the tax benefits and you eventually see a difference.

How to Make a Trust Agreement

It is normal to find the trust process a bit complicated. There are even plenty of challenges seen in trusts, particularly the global financing gap of $3-5 trillion annually. However, understanding how the agreement works and how to get started gives you the edge in forming an excellent output for sure. And now that we know how the trust agreements spell out the regulations and details to observe for any asset held in trust, let us proceed to the real deal of making the agreement itself. To do that, just follow these easy steps:

Step 1: Declare a Trust Agreement

Right when people look at the form, can people identify right away that it is specifically the trust agreement? Maybe others mistook it for hold off, employment, or grant agreement. Indeed, labeling the document is a quick fix. However, it the formal declaration of trust. Write the preamble or introduction that proves the form’s purpose. At least this part already confirms that there is a mutual decision between parties, once signed, about managing trusts.

Step 2: Identify the Parties

Are you finished with your introductory statement? Good, recognize the trustor, trustee, beneficiary, and the rest next. Remember that the party details are part of the trust agreement elements; thus, it is essential. Be sure you have talked with these people ahead, so they are aware of their roles and responsibilities afterward. Next, check the spelling of their identification details to correct everything. And most importantly, review if they are eligible. Maybe some people do not qualify as the grantor or trustee.

Step 3: Input the Trust Details

Now insert the other two elements, which are the type and purpose of the trust. Everything about trusts should be clear until the whole plan is accepted. Is the trust living or testamentary? Revocable or not? Also, is it funded or unfunded? Write it down. You may seek advice from an attorney or a legal expert for this segment too. That way, they can answer your concerns about trusts further.

Step 4: Explain the General Terms and Rules

Of course, the rules are a no-brainer?—important. Otherwise, lacking standards would end in disagreement since no basis of law is followed between the parties. Albeit you determine the terms, be sure to expound to keep it more understandable. For example, what will be the termination grounds? Will disputes be forgiven? Also, keep the regulations reasonable and under the state or local law. And if everything is set, ask for everyone’s signature to validate the document.

FAQs

Should I prepare a trust or a will?

The trust and will are both essential tools, but they have different purposes. With a will, the stipulations inside only take effect after death. Meanwhile, trust can work the moment it is created. Despite their differences, having them both still observes an effective plan.

When should I set up a trust?

Set up trusts while you are still capable of decision making and alive. The advantage of being early is how you prevent probate time and expense. And at least everyone involved in asset management will be fully aware of their roles.

What is the trust’s average cost?

Trusts are generally priced from $1,500 to $3,000. And the costs cover a lot from the required documents to handle trust, power of attorney, and related services. However, a very simple will is only $400 to $700 in California.

According to Investopedia, most people think that trust funds are for the rich only. While it may be true that many wealthy individuals plan to protect their money or properties to the right beneficiaries, you do not agree that they are meant for that status only. Everyone deserves the protection of their assets. Passing away at some point is inevitable, whether you are rich or poor. So, do not be intimidated in starting a trust agreement, especially when anyone who is financially responsible can handle this.