21+ Sample Underwriting Agreement

-

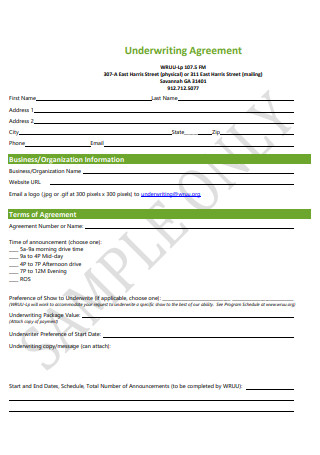

Underwriting Agreement Template

download now -

Underwriting Agreement Form

download now -

Specimen Underwriting Agreement

download now -

Investment Banking Underwriting Agreement

download now -

Underwriting and Sponsorship Agreement

download now -

Delegated Underwriting Agreement

download now -

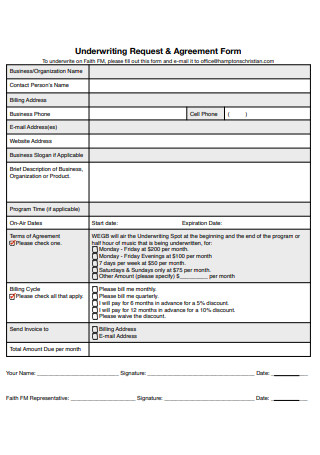

Underwriting Request and Agreement Form

download now -

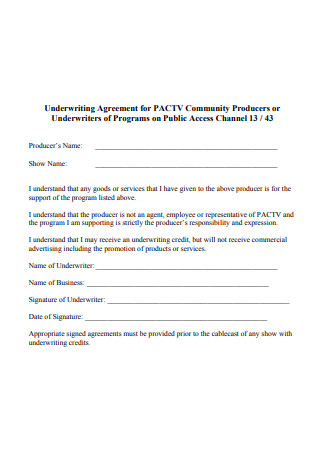

Underwriting Agreement For Community Producers

download now -

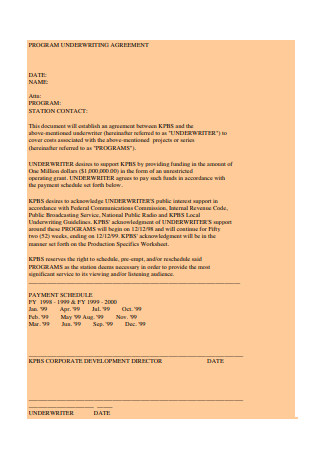

Program Underwriting Agreement

download now -

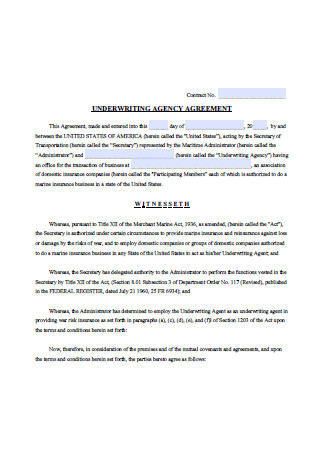

Underwriting Agency Agreement

download now -

Sample Underwriting Agreement

download now -

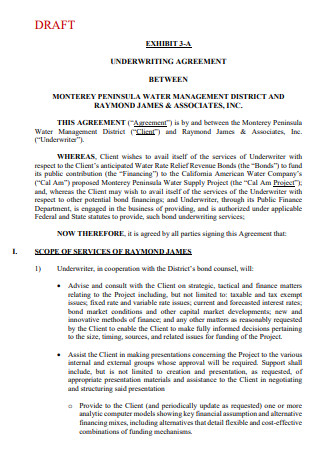

Draft Underwriting Agreement

download now -

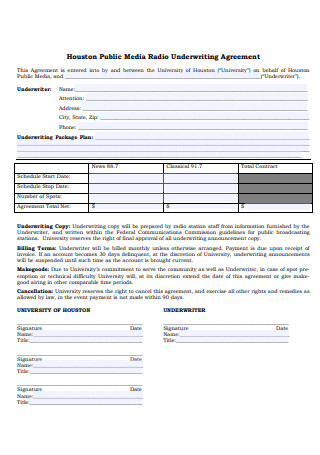

Public Media Radio Underwriting Agreement

download now -

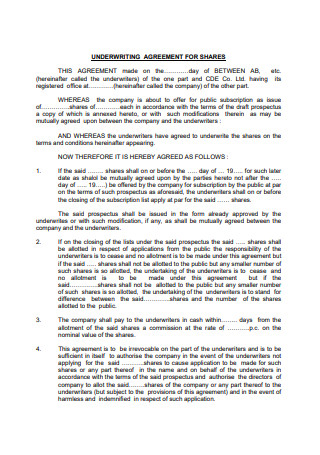

Shares Underwriting Agreement

download now -

Underwriting Services Agreement

download now -

Domestic Underwriting Agreement

download now -

Underwriting Agreement Example

download now -

Execution Underwriting Agreement

download now -

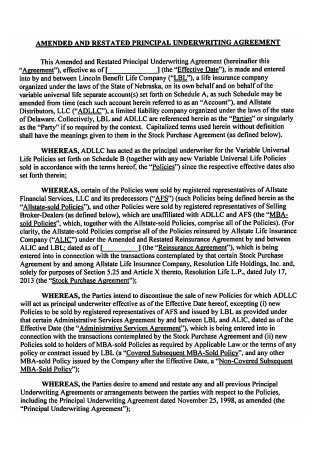

Principal Underwriting Agreement

download now -

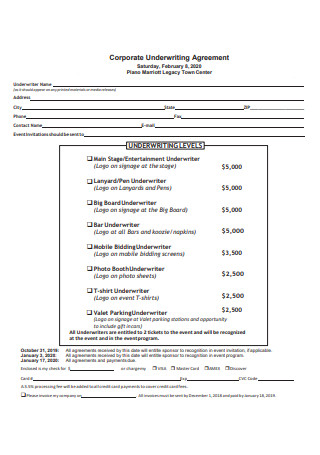

Corporate Underwriting Agreement

download now -

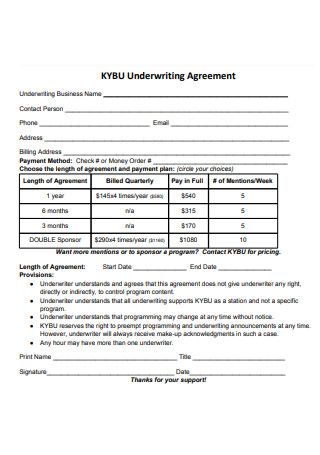

Basic Underwriting Agreement

download now -

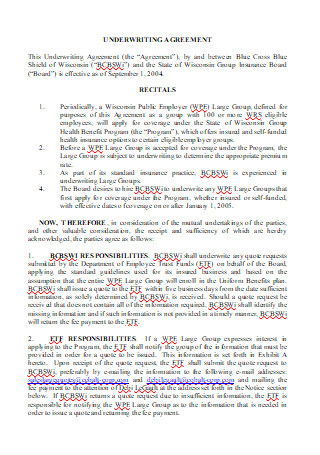

Underwriting Agreement in DOC

download now

FREE Underwriting Agreement s to Download

21+ Sample Underwriting Agreement

What Is an Underwriting Agreement?

Important Elements of an Underwriting Agreement

What Are the Types of Underwriting Agreements?

What Are the Different Types of Underwriting?

Steps of Underwriting

FAQs

What is the Main Purpose of Underwriting?

What is an Underwriting Spread?

Do I Need to Obtain a Certain College Degree to be an Underwriter?

What Is an Underwriting Agreement?

An underwriting agreement is a type of contract document that is used between a group of investment bankers known as an underwriting group and the business that is issuing new securities. The underwriting agreement’s objective is to ensure that all parties understand their roles in the process, which in turn gives a chance to avoid any possible dispute. The underwriting group’s pledge to acquire the new securities issue, the agreed-upon price, the first resale price and the settlement date are all outlined in this agreement.

The individuals who assume another individual’s risk for a certain amount of payment and who determine the amount of risk that is present for the lenders are called underwriters. Because of their capacity to assess risk, underwriters have become essential individuals in the mortgage sector, insurance industry, equities markets, and typical kinds of debt security trading. A lead underwriter is also called a book runner.

Important Elements of an Underwriting Agreement

In order to be effective, there are some key elements or provisions that need to be included whenever you draft an underwriting agreement. Here are those elements discussed below:

What Are the Types of Underwriting Agreements?

Discussed below are the different types of underwriting agreements that exist:

What Are the Different Types of Underwriting?

Discussed below are the different types of underwriting that exist:

- Underwriting for Loans – This sort of underwriting is automated and entails evaluating the credit history of the applicant, their financial records, and the value of any collateral given, as well as any other forms of considerations based on the loan’s size and purpose. Mortgages are the most prevalent kind of loan underwriting that includes a human underwriter. This is also the form of loan underwriting that the majority of individuals deal with. The evaluation of loan underwriting can span anything from a few minutes to a few weeks, relying on whether the evaluation involves the involvement of a human individual.

- Underwriting for Insurances – In this type of underwriting, the prospective policyholder is given focus. A prospective policyholder is also referred to as the person who is looking for or applying for health insurance. It wasn’t always like this in the past, since underwriting for health insurance was previously used to assess how much to charge an applicant depending on their health and even whether to give coverage at all, frequently based on the applicant’s pre-existing diseases. In life insurance underwriting, the underwriter attempts to identify the risk of insuring a prospective policyholder based on their age, health, lifestyle, employment, and other characteristics. Underwriting for life insurance can result in acceptance (along with a variety of coverage quantities, costs, exclusions, and restrictions) or outright rejection.

- Underwriting for Securities – This type of underwriting is undertaken on behalf of a potential investor, typically an investment bank, to assess risk and the proper price of certain securities. Individual stocks and debt instruments, such as governmental, corporate, or municipal bonds, might be included in this sort of underwriting. Underwriters or their employers acquire these securities with the intent of reselling them for a profit to investors or distributors, who in turn redistribute them or resell them to other buyers.

- Underwriting for Real Estate – In this type of underwriting, a borrower’s past, as well as the real estate property for which they wish to obtain a loan, are both considered. The underwriting procedure will assess if the property’s value can be recovered if the borrower is unable to repay the loan.

Steps of Underwriting

For an underwriting process to be effective, it needs to follow a number of steps. In this particular section of the article, we will discuss mortgage underwriting.

-

1. Start Your Mortgage Application

In this step, choose the type of mortgage loan that you want to apply for. It can be a conventional mortgage, jumbo mortgage, fixed-rate mortgage, adjustable-rate mortgage. or government mortgage. After you’ve decided on the mortgage of your choice, proceed on filling out a mortgage application form, which can be done online, or in-person with the presence of the lender. Additional information may be required, depending on the type of mortgage loan that you are applying for.

-

2. Obtain a Loan Estimate

This step happens after filling out a mortgage application. In this step, your lender will immediately give you a loan estimate for you to review. The amount in the loan estimate may also depend on the type of mortgage that you applied. The loan estimate document also explains how much you’ll pay in monthly mortgage payments, total cost, and principle in the first five years—as well as the percentage you’ll pay in interest throughout the life of the loan.

-

3. Processing of the Loan Application

Once you’ve received your loan estimate and done a thorough review of the document, and you still want to proceed with the loan application, then this step will follow suit. What happens in this part of the application process? The lender or loan processor will seek proof for the personal and financial information from your mortgage application at this step. When all of the required material is obtained, the underwriter then begins to scrutinize it for any inconsistencies, potential gaps, or potential risks.

-

4. Wait for the Application Results

After submitting all the other necessary requirements or documents, this is now the step in the mortgage underwriting process in which you wait. In this step, the mortgage loan application might be approved, suspended, or denied by the underwriter. The underwriter usually accepts the mortgage loan application, but with terms or contingencies. That indicates you still have work to complete or information to supply, such as further documents or an appraisal.

-

5. Sort Out Any Contingencies

Once the application gets approved by your lender, this step will follow suit. This is the stage at which you’ll collaborate with your lender to ensure that any contingencies discovered in the previous phase have been resolved. In addition, your lender will lock in your interest rate. Once all of the requirements have been completed, you will get a “clear to close” letter from your lender. That implies your mortgage loan is complete and ready for closing on the scheduled day.

-

6. Closing Process

This serves as the final part of the process. In this stage, you will usually receive a closing disclosure document at least three days prior to your closing out date. It is sent in advance to give you enough time to go through the basics of your loan, such as your monthly mortgage payment and the money you’ll need to bring to closing. To summarize, the most essential thing you can do to keep the underwriting process flowing as smoothly as possible is to answer your lender’s requests for information as quickly as possible, especially if you hit some snags along the road.

FAQs

What is the Main Purpose of Underwriting?

The main purpose of underwriting is to reassess the risk level of a proposed transaction or agreement. The underwriter must assess the risk of a client filing a claim that needs to be paid out before the said policy becomes profitable for an insurer. The risk for a lender in the underwriting process is default or nonpayment. Similarly, investment banks use securities underwriting to calculate the risk-adjusted value of freshly issued shares and bonds.

What is an Underwriting Spread?

An underwriting spread refers to a difference between the price per share paid by an underwriter or underwriting group to an issuing corporation and the public offering price offered by the underwriter to the public. In general, the underwriting spread should indicate the net proceeds that the underwriter will be able to acquire from the investment. The underwriting spread might be large depending on the size of the securities issuance and the price that the shares can demand on the open market.

Do I Need to Obtain a Certain College Degree to be an Underwriter?

No, it typically is not required. To get started in the underwriting business as an underwriter, you typically do not need a specialized bachelor’s degree, although having a degree in courses that involve mathematics, business, economics, and finance is helpful. If a certain college degree is not needed, what makes a good underwriter? Well, a good underwriter should be detail-oriented and has strong math, communication, problem-solving, and decision-making abilities. Once employed, you will normally get on-the-job training while being overseen by experienced underwriters. As a trainee, you will learn about typical risk variables and fundamental underwriting applications. As you gain experience, you will be able to work independently and take on greater responsibility.

As stated earlier, underwriting has a critical role in the world of finance as it serves to establish fair rates on loans, helps investors arrive at proper decisions concerning their various investments, ensures accurate assessment and coverage, and so on. With recent developments in today’s technology, the process of writing an underwriting agreement, and underwriting as a whole has been cut by a significant amount of time. What usually takes a number of weeks or months will now require a number of days or hours, hereby making the entire process easier. In this article, you can acquire examples of underwriting agreements for personal use.