32+ SAMPLE Vehicle Lease Agreement

-

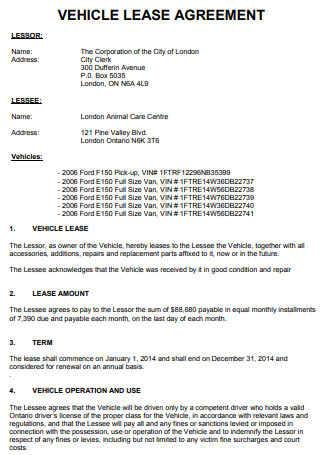

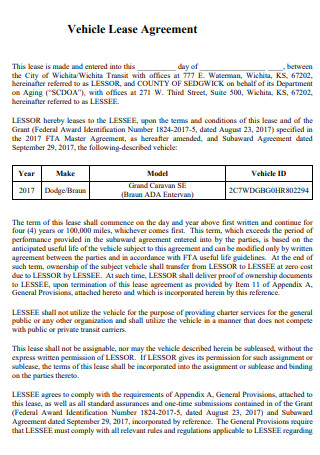

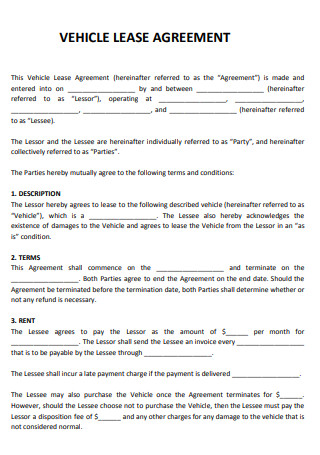

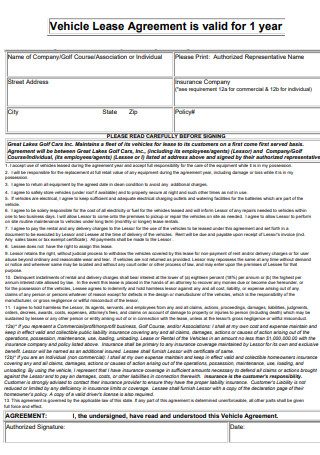

Vehicle Lease Agreement

download now -

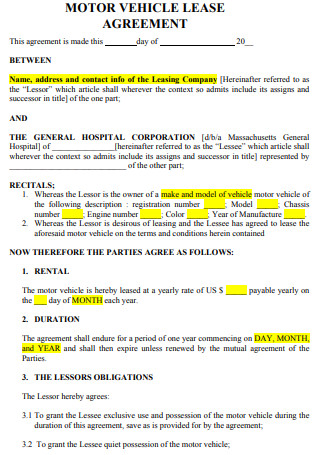

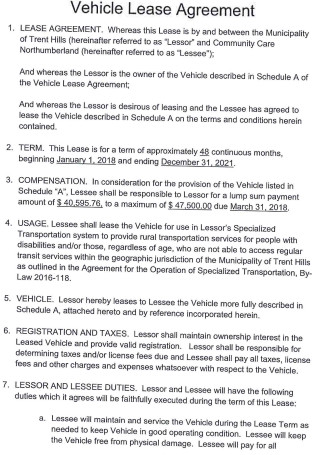

Motor Vehicle Lease Agreement

download now -

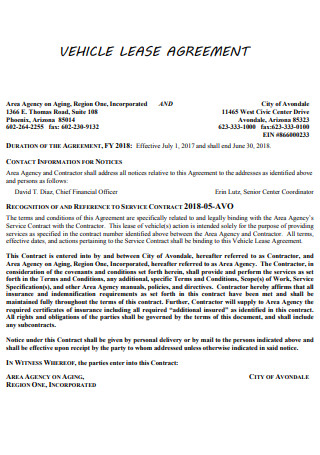

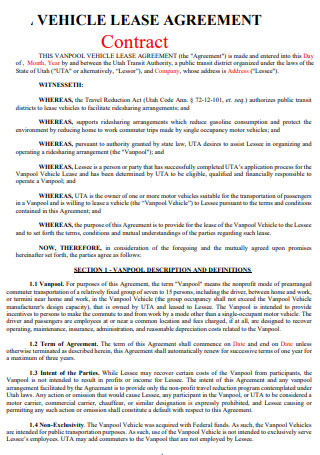

Sample Vehicle Lease Agreement

download now -

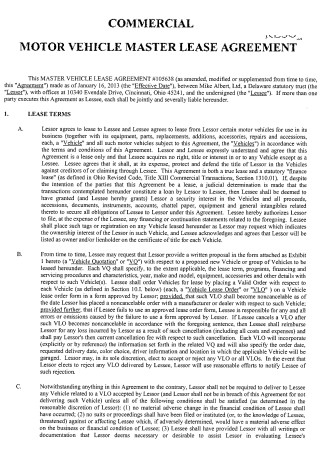

Commercial Vehicle Lease Agreement

download now -

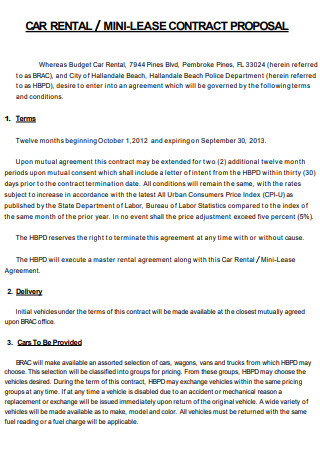

Car Mini Lease Agreement

download now -

vehicle Lease Agreement with Fiduciary Warranty

download now -

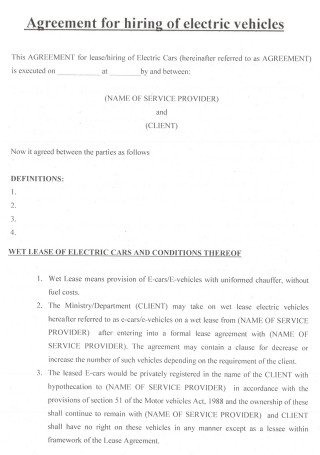

Electric Vehicle Lease Agreement

download now -

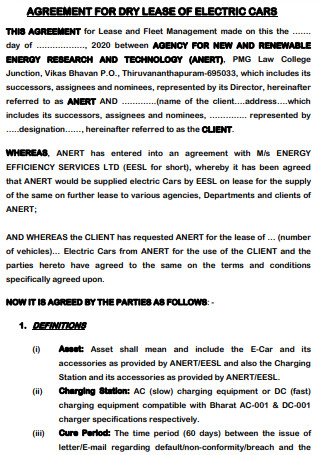

Electric Car Dry Lease Agreement

download now -

Simple Vehicle Lease Agreement

download now -

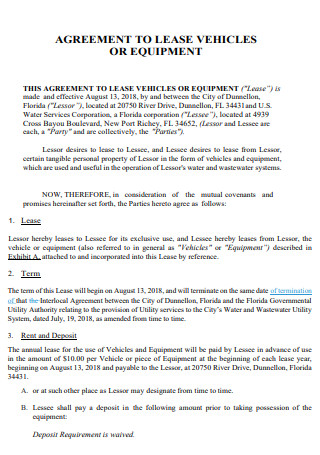

Vehicle Lease or Equipment Agreement

download now -

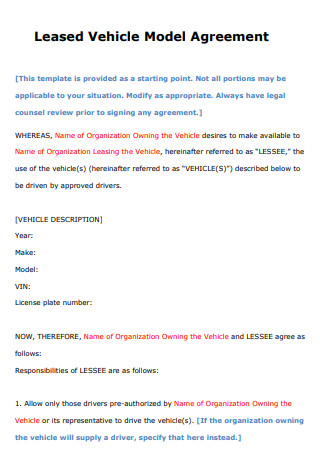

Leased Vehicle Model Agreement

download now -

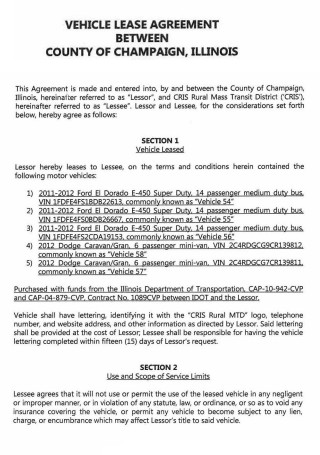

Basic Vehicle Lease Agreement

download now -

Master Vehicle Lease & Assignment Agreement

download now -

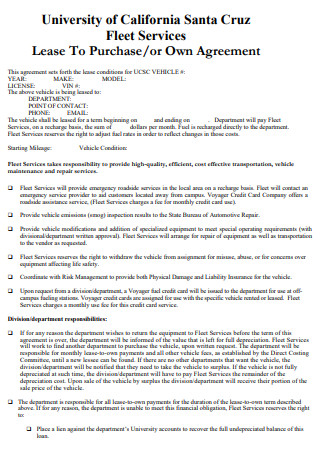

Vehicle Lease to Purchase Agreement

download now -

General Vehicle Lease Agreement

download now -

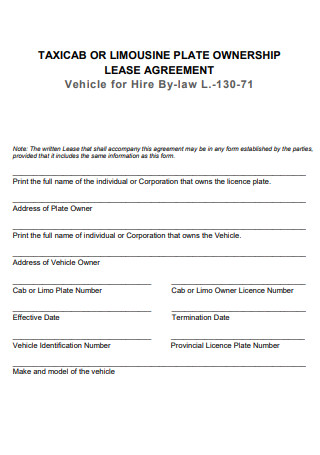

Vehicle for Hire Plate Lease Agreement

download now -

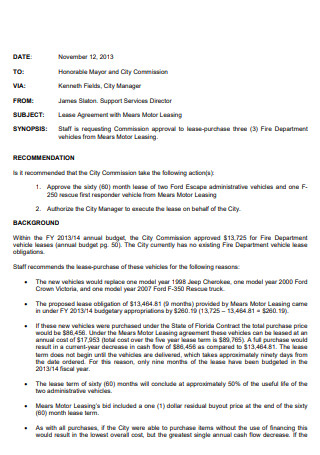

Fire Department Vehicle Lease Agreement

download now -

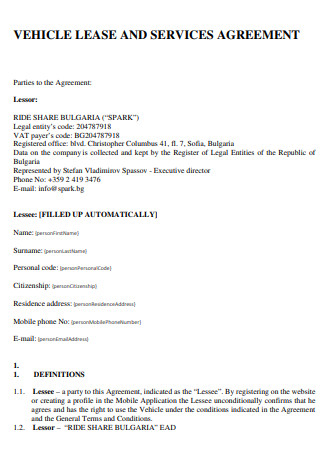

Vehicle Lease And Service Agreement

download now -

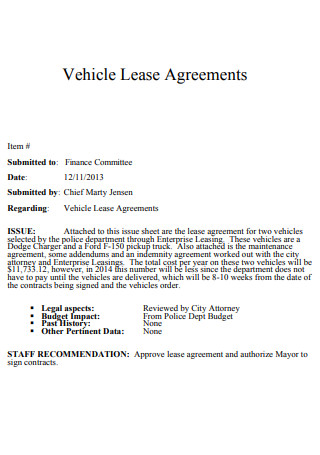

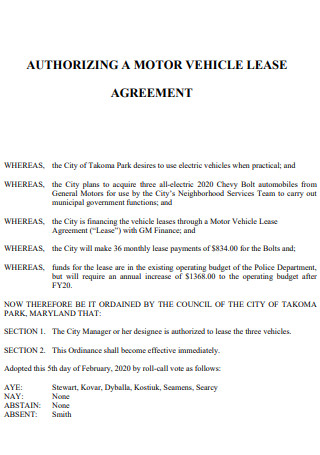

Authorizing Motor Vehicle Lease Agreement

download now -

Month Vehicle Lease Agreement

download now -

Blank Vehicle Lease Agreement

download now -

Standard Vehicle Lease Agreement

download now -

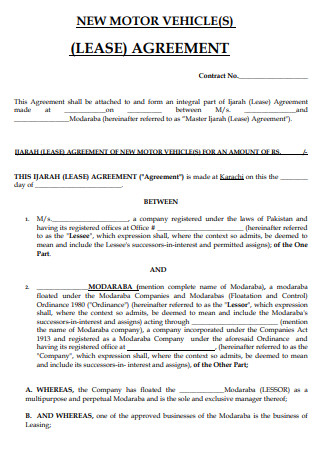

New Vehicle Lease Agreement

download now -

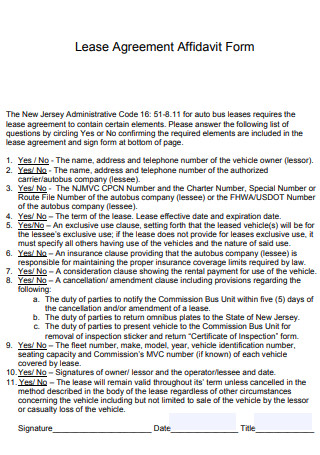

Vehicle Lease Agreement Affidavit Form

download now -

Vehicle Lease Agreement Form

download now -

Vehicle Lease Service Agreement

download now -

Vehicle Lease Agreement Example

download now -

Closed-End Vehicle Lease Agreement

download now -

Vehicle Lease Agreement Template

download now -

Vehicle Lease Contract Agreement

download now -

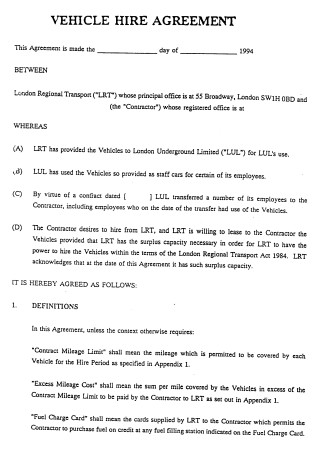

Vehicle Hire Lease Agreement

download now -

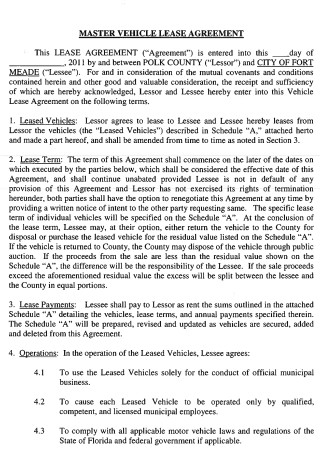

Master Vehicle Lease Agreement

download now -

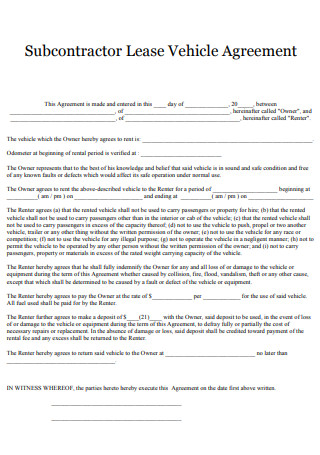

Subcontractor Vehicle Lease Agreement

download now

FREE Vehicle Lease Agreement s to Download

32+ SAMPLE Vehicle Lease Agreement

What Is a Vehicle Lease Agreement?

Terms associated with Vehicle Lease Agreements

Mistakes To Avoid When Engaging in Vehicle Lease Agreements

FAQs

Can I cancel a car lease agreement?

Is leasing a car a good idea?

What are the disadvantages of choosing a car lease?

What Is a Vehicle Lease Agreement?

A vehicle lease agreement or a vehicle leasing agreement is a document between a vehicle owner, known as the lessor, and the individual that pays the owner to possess the vehicle for a specific amount of time, known as the lessee. It is a legally binding document between the two parties. In most cases, the vehicle lease agreement shares similarities with other lease or rental agreements. The document is also common to new or pre-owned cars, trucks, motorcycles, and other vehicles that have a vehicle identification number (VIN) and a license plate number. Other vehicles include scooters, recreational vehicles, and powerboats with a Hull Identification Number (HIN). The vehicle lease agreement aims to protect both parties from any confusion and miscommunication that leads to misunderstandings that can arise during the duration of the leasing agreement through the presence of comprehensive and well-written documentation of the lease terms and conditions.

According to the statistical data presented by the Statista Research Department in their article published in Feb 2022 entitled monthly car loan rates in the United States from 2014 to 2021, the car loan interest rates in the US are just below four percent by the end of January 2022. The average amount spent towards new car financing in the United States reaches 35,200 US dollars at the end of 2020.

Terms associated with Vehicle Lease Agreements

The first part of a vehicle lease agreement focuses on the expected payments of the lessee, including associated calculations of the monthly payments. It also provides additional information regarding concerns of early termination, mileage limits, end-of-lease options, among others. Some vehicle lease agreements also explain and interpret certain restrictions that define the vehicle use of the lessee. The section below provides necessary information about the terms that are present in vehicle lease agreements with their respective descriptions.

Mistakes To Avoid When Engaging in Vehicle Lease Agreements

Many people choose to lease vehicles since it is much cheaper than purchasing brand new cars. However, the most common mistake that individuals make when entering vehicle lease agreements is that they do not pay attention to the content of the document. Later on, these lessees will pay hefty fines or fees for it. To help you deal with vehicle lease agreements, the section below details the mistakes you can avoid when you decide to lease your next vehicle.

-

1. Paying Too Much Money on Initial Payments

Many car dealerships utilize different marketing strategies, including advertising low monthly lease payments on newer vehicles with the underlying condition of paying over thousands of dollars for the upfront payment to avail of the promotion. On the occasion of car wrecks or stolen cars, insurance companies can reimburse the dealership for the value of the car. However, it is more likely that the initial payment will be non-refundable. As a recommendation, do not spend more than two thousand dollars for upfront payment when leasing a vehicle. If the dealership permits the option of incorporating all fees into monthly payments, take advantage of it.

-

2. Not Investing in a Gap Insurance

When driving a leased vehicle, always remember to get gap insurance. The gap refers to the difference in price between what you owe the leasing company and the vehicle value. For example, the lease agreement states that the value of the car at the end of the lease amounts to 17,000 dollars. If an accident occurs that renders the vehicle unusable, the insurance agency calculates its current market value and pays the dealership that has ownership of the vehicle. If the current market value is 13,000, you must shoulder the four thousand dollars as residual value. If you have gap insurance, it will cover the difference. Regardless of whether you buy from the dealership or third-party insurance, it is well worth the investment.

-

3. Underestimating the Mileage Use of the Vehicle

For you to avoid any additional costs and fees, it is advantageous to identify driving habits before leasing. Consider different scenarios, including daily commute, long trips, and unplanned vacations. If you already know that you are prone to driving long distances and will exceed the mileage limit on the agreement, negotiate a higher mileage limit. Keep in mind that in doing so, monthly payments increase as greater miles result in higher depreciation.

-

4. Refusing To Get or Pay For Car Maintenance

If the leased vehicle has more than necessary wear and tear damage, there is a bigger chance that you incur additional fees when returning the vehicle to the dealership. The definition for normal usage varies from one dealer to another. Lessors will most likely complete car inspections before turning in the vehicle, looking for specifics, including scratches, dents, damages, wears, and tears, in all aspects of the vehicle, from the windshield to the tires and interiors to the exteriors. Before proceeding with car leases, make sure to ask about the necessary guidelines about the lease-end conditions. It specifies the types of damages that require payment upon surrendering the vehicle.

-

5. Leasing Cars For Too Long

When you are leasing a car, guarantee that the lease period matches or is shorter than the vehicle warranty. These warranties vary depending on the manufacturer, but the typical warranty period is three years or 36 thousand miles. If you intend to get a car for longer periods, consider acquiring an extended warranty. Otherwise, you are paying for maintenance and repairs for a vehicle without possession while making monthly payments. To determine whether leasing or buying a car is the best option for you, you can use an auto lease calculator to weigh costs and save more money.

FAQs

Can I cancel a car lease agreement?

An individual can terminate a car leasing agreement any time they like. However, there are penalties that the lessee needs to pay for, depending on the made payments and payment structures.

Is leasing a car a good idea?

There are various benefits when it comes to leasing a car. For one, it brings lower monthly payments in comparison to loaning. There are also smaller down payments, provide a new car experience, reduce hassle with selling or trading, and cover warranties and other costs.

What are the disadvantages of choosing a car lease?

As there are advantages to leasing a car, it also comes with some downsides that make you think twice. It does not give the ownership of the vehicle. There are also restrictions that a lessee must adhere to while in the agreement. There are also considerations for additional costs, one of them revolving around constant car switches.

Before planning to engage in a vehicle leasing agreement, it is best to consider all the conditions associated with leasing a car. For starters, a person must consider the miles they travel every year. It greatly impacts the negotiations and the prices that come with vehicle leases. After considering the yearly mileage count and converting it to possible mileage limits, an individual can consider leasing or purchasing a car. It is also advantageous to know about the various terms that are present in the vehicle lease agreement. Once a person makes up their mind on pursuing a car lease, the next step is to familiarize themselves with the document. The article contains 32+ SAMPLE Vehicle Lease Agreement in PDF downloadable only at Sample.net.