14+ SAMPLE Voting Trust Agreement

-

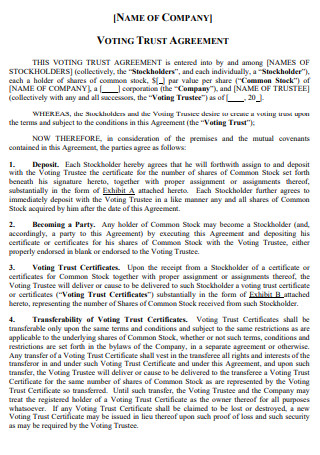

Company Voting Trust Agreement

download now -

Voting Trust Listing Agreement

download now -

Voting Trust Agreement

download now -

Voting Trust Shareholders Agreement

download now -

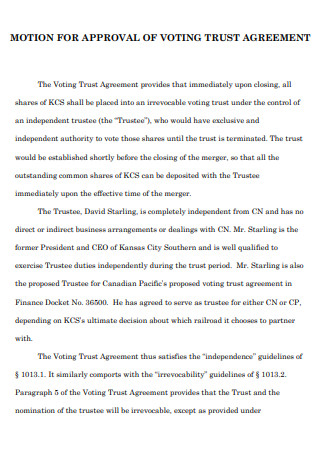

Voting Trust Approval Agreement

download now -

Voting Trust Agreement Example

download now -

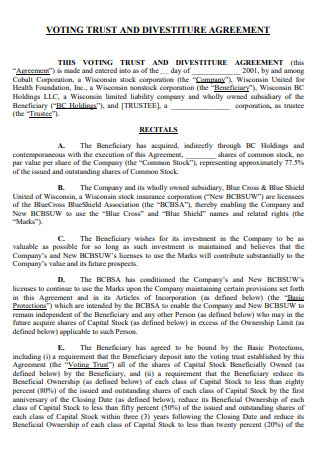

Voting Trust Divestiture Agreement

download now -

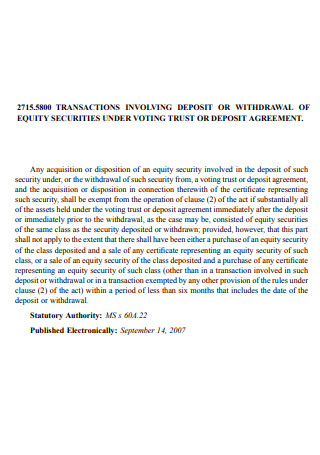

Voting Trust Deposit Agreement

download now -

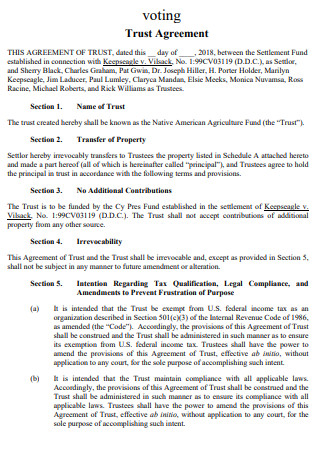

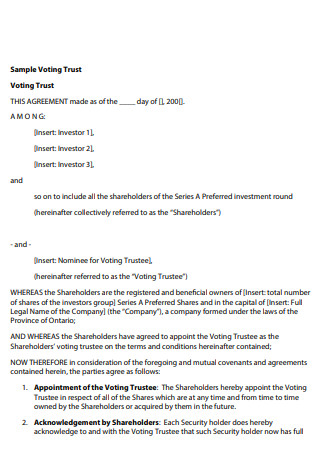

Sample Voting Trust Agreement

download now -

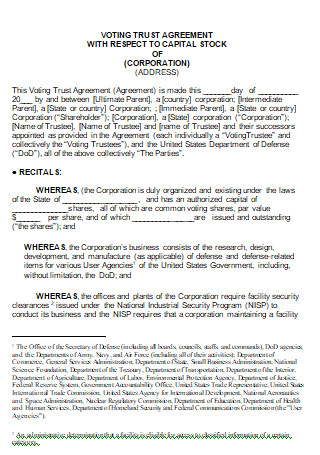

Capital Stock Voting Trust Agreement

download now -

Voting Trust Agreement Template

download now -

Business Corporation Voting Trust Agreement

download now -

Simple Voting Trust Agreement

download now -

Formal Voting Trust Agreement

download now -

Voting Trust Agreement Format

download now

FREE Voting Trust Agreement s to Download

14+ SAMPLE Voting Trust Agreement

What Is a Voting Trust Agreement?

Different Parts of a Voting Trust Agreement

Different Purposes of a Voting Trust

Steps/Process in a Company Takeover

FAQs

What is a hostile takeover?

What is a voting trust certificate?

How do you defend against a hostile takeover?

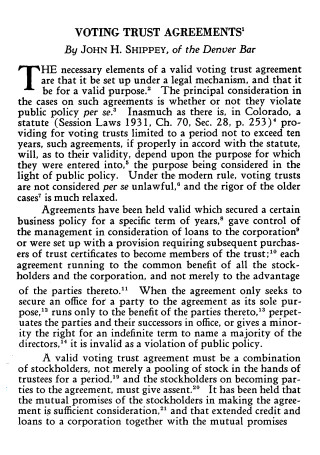

What Is a Voting Trust Agreement?

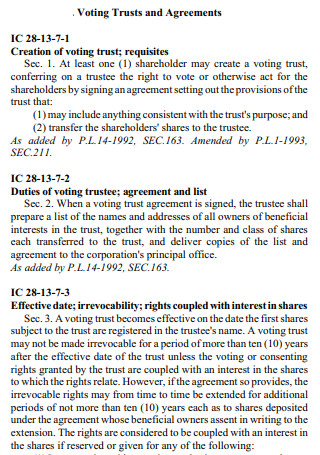

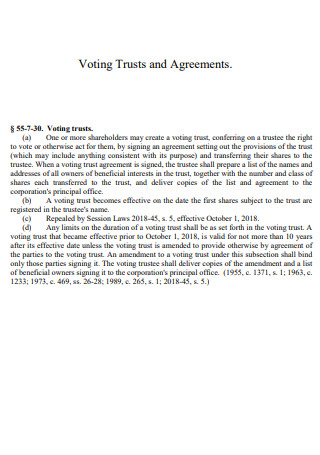

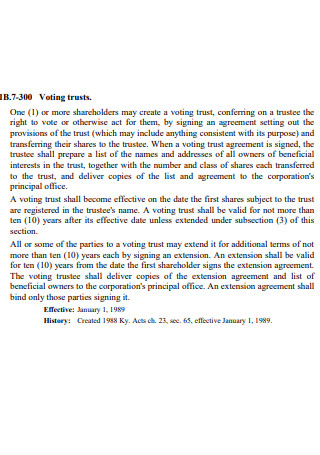

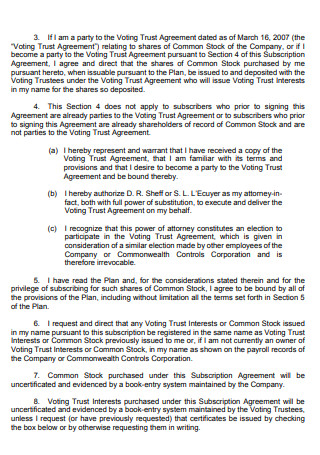

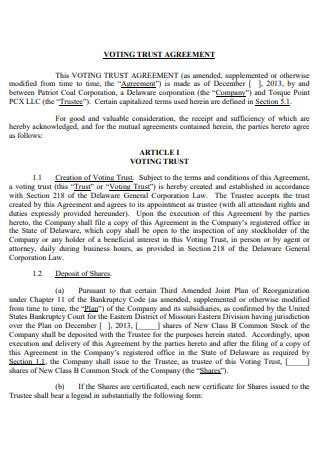

First of all, what does voting trust mean? By definition, this is created to combine the power of voting of the shareholders by temporarily giving their shares to an established trustee. By creating a voting trust, the company shareholders then acquire certificates that state that they are beneficiaries of the said trust being created, with a condition that their shares must be given to the trustee. They are usually the same as proxy voting in the sense that the shareholders assign voting duties to another party. During a voting trust, the trustee is then required to vote in favor of the wishes of the participating shareholders.

A voting trust agreement is a business document that also serves as a legally binding contract that documents the transfer of shares from a shareholder to a trustee. The arrangement grants the trustee temporary authority over the shareholders’ voting rights. Voting trusts are then managed by the company’s present directors to prevent other parties from taking control over the company without any of the directors’ knowledge. Shareholders most typically employ a voting trust agreement to establish uniform voting blocks.

Different Parts of a Voting Trust Agreement

Listed and discussed below are the different parts that need to be present when a voting trust agreement is drafted:

Different Purposes of a Voting Trust

Here are some of the reasons why a voting trust exists:

- Prevention of hostile takeover – The target company’s board of directors does not authorize the takeover transaction in a hostile takeover. Whenever a corporation is threatened with a hostile takeover, the shareholders have the option to place their shares in a trust. Since a substantial amount of shares are locked up in a trust for a defined period of time, the practice discourages the firm from pursuing the takeover and attempting to purchase a significant chunk of the target company’s shares.

- Resolution of conflicts of interest – Shareholders can utilize voting trusts to effectively address conflicts of interest in certain firm responsibilities. To avoid conflicts of interest, such shareholders would often pass their shares to a trustee, who would then vote on their part at arms’ length. The common practice here is to hand over the shares to a blind trust, which has no knowledge of the trust’s holdings and no right to vote. As a result, there is little conflict of interest among shareholders and investments.

- Increase voting power of shareholders – Individual shareholders have less authority and may not be able to perform some responsibilities that large shareholders can. For example, in order to have the authority to summon meetings, shareholders must own a large percentage of the company’s shares. When shareholders entrust their voting rights to a trust, they get more voting power compared to them voting separately. A united voting power may allow shareholders to take actions that they would not be able to conduct if they voted separately.

- Safeguard control of a company – Whenever the founders of a company believe that their ownership of the company is in jeopardy, they might pool their shares in a trust. By transferring the promoters’ shares to a voting trust, a powerful voting block is formed that may outnumber any one shareholder’s voting power. The promoters pool their shares in order to retain decision-making authority and prevent powerful shareholders from seizing control of the company.

Steps/Process in a Company Takeover

A voting trust agreement is a document that is usually needed to prevent a hostile takeover of a company and to safeguard its control. But what is usually the process involved in normally taking over a company (also known as a friendly takeover)? Here are those listed below:

-

1. Determining the Market

This is the first step to be followed when a company takeover is to be planned. In this step, the leaders usually begin the process of acquisition by establishing and analyzing the appropriate market for purchase. The suitable market in terms of growth potential in the market serviced, company, or service given is analyzed and graded based on available opportunities. This stage often collects data about the client’s origin, population, market employment rate, alternative sources for the product, competitive pricing, and customer preferences.

-

2. Candidate Identification

After determining the target market and subsequently analyzing it, this step will then follow in a company takeover. In this step, the appropriate candidates for the company takeover are then selected. This step entails a comprehensive review of possible candidates who might fulfill an acquirer’s appropriate strategic and financial growth objectives. This entails identifying potential possibilities and prospects that exist both within and outside of the sector. This procedure is focused on management research, experiences, consultation, and other similar approaches.

-

3. Evaluating the Financial Position

After identifying the suitable candidates for the company takeover and selecting the best possible one, this step will then follow. The third step that occurs during the company takeover process is a thorough examination of the target company’s volume, revenue, cost, and balance sheet. The target company’s financial and credit condition is also reviewed at this stage based on the financial projection.

-

4. Decision Making

Once the evaluation process of the target company’s financial position has been completed, this step will then follow. In this step, the purchaser who plans to take over the company must weigh the benefits and drawbacks of the company acquisition. Depending on the evaluation report, checklist of questions, or questionnaires, they must assess the anticipated advantages and cons of the proposed purchase. A thorough examination is used to make a high-quality judgment. Leaders examine the strategic value addition for a merged firm following the acquisition.

-

5. Value Assessment

After weighing the advantages and disadvantages of the company takeover and subsequently deciding whether to proceed to not, then this step then happens. In this phase, it is critical to assess the target company’s financial worth. Concurrently, the options for arranging and funding the takeover are explored. In this step, the framework that best meets the financial and development objectives of obtaining a company is chosen. Valuation is the most essential step of the company takeover process because if it goes wrong, it may derail the entire acquisition decision. This may be accomplished using the discounted cash flow approach or the comparable transaction method.

-

6. Due-Diligence Process and Takeover

After the value assessment is completed, this step then happens. In this stage, the executives of the acquirer firm begin the comprehensive due-diligence process of the target company in order to gain a clear image of the target company. In this manner, they may be confident in their decision to invest in the company. Following that, the takeover procedure is carried out. A successful acquisition is uniting two businesses in order to maximize strategic and financial benefits while avoiding disruptions and restrictions in both entities’ current operations.

FAQs

What is a hostile takeover?

A hostile takeover is referred to as the takeover of a target firm by another corporation, which is also known as the acquirer company, by a direct approach to the target company’s shareholders, either through a tender offer or a proxy vote. The key distinction between a hostile and a friendly takeover would be that the target company’s board of directors does not approve of the transaction in a hostile takeover.

What is a voting trust certificate?

A voting trust certificate is a business document that is granted to a shareholder in return for the shareholder transferring shares to one or more trustees. By receiving this certificate, the shareholder agrees to delegate provisional control of their rights and powers to a voting trustee in order for the company to make decisions without interference. The voting trust certificate is valid for the duration of the voting trust term, after which the assets are restored to the equitable owners.

How do you defend against a hostile takeover?

Aside from using a voting trust agreement as a deterrent against a hostile takeover, one way of defending against is by using a poison pill. The process of using a poison pill is by making the target company’s stock less appealing by permitting current shareholders to acquire additional shares at a lower cost. This will diminish the equity interest that is indicated by each share and, as a result, raise the number of shares required by the acquiring business to gain a controlling position. The goal is that by making the purchase more difficult and costly, the would-be acquirer will quit their bid.

As stated earlier, voting trust agreements are documents that are used to allow the shareholders to transfer their voting rights to a trustee, which in turn effectively gives the trustees temporary control of the beneficiary corporation. Writing this document may be a daunting task since this is a legal business document and many things can go wrong if done poorly. In this article, there are plenty of sample templates of this type of document that are readily available for you to have a look at in order for you to get familiarized with what this document really is.