Basic Lease Contract

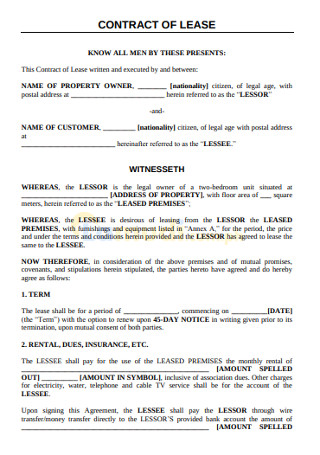

-

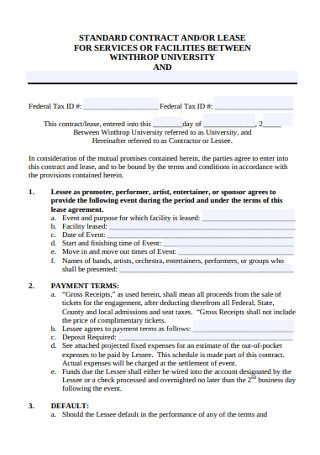

Standard Lease Contract Template

download now -

Land

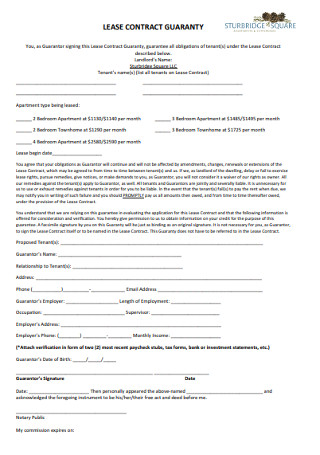

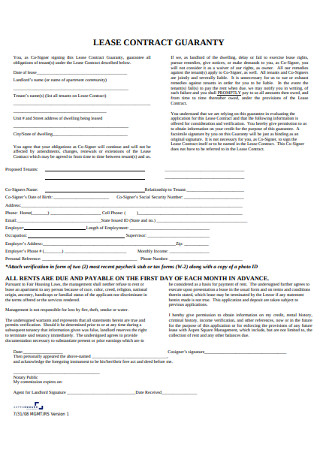

LandLease Contract Guaranty Template

download now -

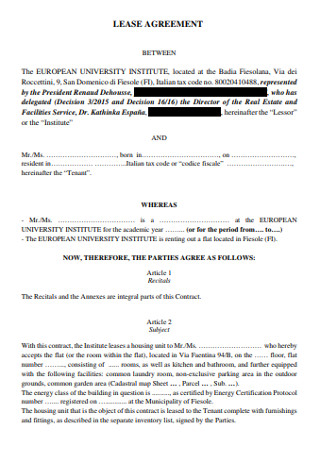

Farm Lease Contract

download now -

Sample Lease Contract Template

download now -

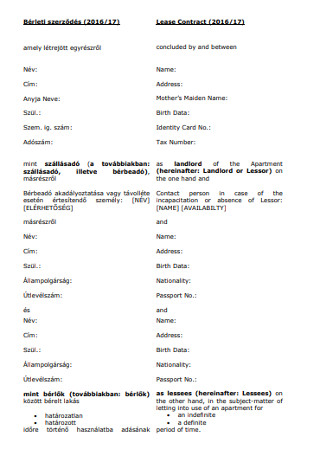

Apartment Lease Contract

download now -

Condominium Unit Lease Contract

download now -

Basic Lease Contract Template

download now -

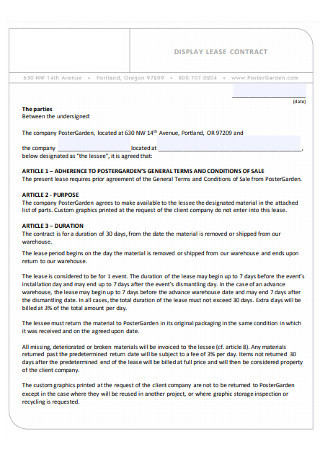

Display Lease Contract

download now -

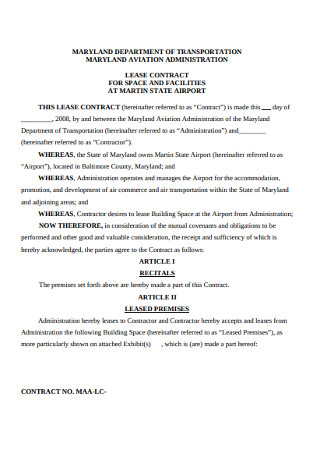

Aviation Administration Lease Contract

download now -

Simple Lease Contract Template

download now -

Sample Lease Contract Guaranty Template

download now -

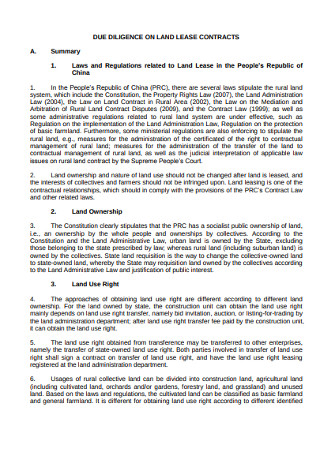

Land Lease Contract Template

download now -

Property Management Case Study Leases and Contracts

download now -

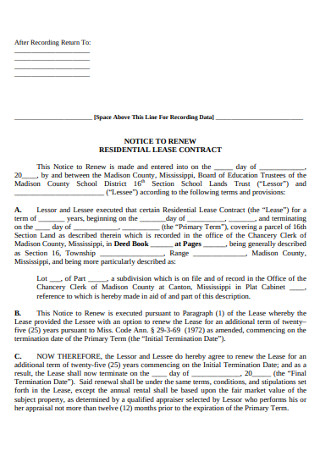

Sample Residential Lease Contract

download now -

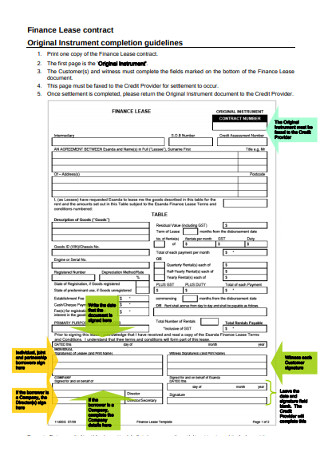

Finance Lease Contract

download now -

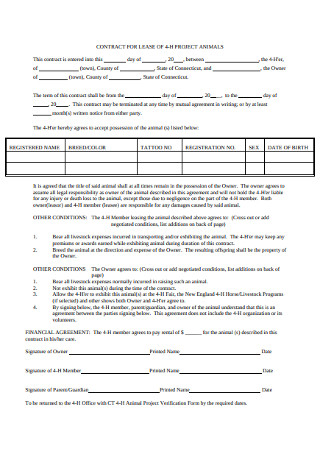

Project Lease Contract Template

download now -

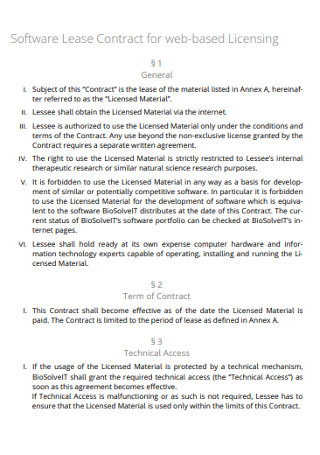

Software Lease Contract for web-based Licensing

download now -

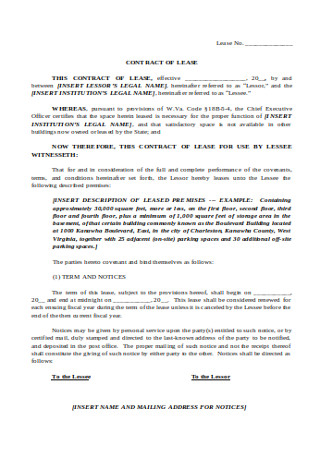

Standard Lease Contract

download now -

Valuation of Lease Contracts Template

download now -

Flat Lease Contract Template

download now -

Formal Lease Contract Template

download now -

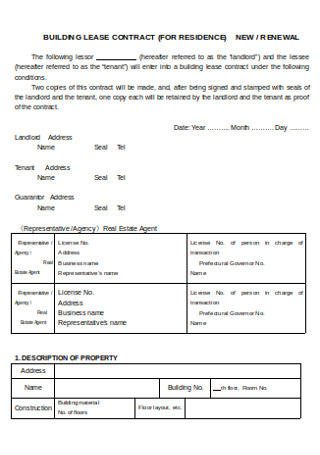

Building Lease Contract Template

download now -

Treatment of Lease Contract

download now

What Is a Basic Lease Contract?

The demand of the current market pushes working-class people to work with a tight budget. Individuals want to start their lives in states that offer higher salary rates. These areas have a, likewise, more expensive standard of living. It became the ultimate irony of life; people need to pay to live a comfortable life. From the dreams of owning homes with white picket fences and spacious lawns, some settle to live in them temporarily. Through basic lease agreements, fleeting moments with a person’s dream house are possible.

When properties are up for lease, the owner or lessor agrees to lend the property for definite periods. It can be as short as five months, or it can be as long as five years. The contract protects both parties by informing both of their obligations and responsibilities to the partnership. Once both parties affix their signatures on the document, they agree to adhere to all the arrangements.

How Do you Apply for a Lease?

Whether you are a young adult in a new city or a newlywed couple who is expecting a baby along the way, you may be browsing at several websites and housing applications looking for your new home for the next few months. You might be new to the whole adulting thing and is confused with all the paperwork that comes with settling in a new home. Here are some of the necessary documents and requirements that you need to prepare beforehand to make your transition hassle-free.

Do you Know your Lease?

Most people confuse lease for rent and the other way around. The definite difference between the two is the length of occupancy. Rents are short term, usually runs for a single month. When rent contracts end, it automatically rolls over and continues for the next month until either party terminates it. In most states, notifying for the rent’s termination is necessary thirty days before the expected date. Lease contracts, on the other hand, are for more extended stays. It goes for months to several years. It is suitable for people who want to establish a life in the place.

Residential Lease

There is this old saying that you will never know a person once you decide to live with them. Indeed, this adage aged like fine wine. A current trend among the Millennial generation prioritizes living together and homeownership, therefore delaying marriage. Most couples and individuals in this generation are looking up residential spaces that are up for lease. These individuals are also at the prime of their youth. Understandably, they prefer living in areas that fit their preference for that particular moment. Residential leases also work best for individuals who want to immerse and experience different cultures. To fully experience a new culture, one must live there for several months or a few years. In this situation, leases are more favorable than short-time rents.

Commercial Lease

The propagation of start-up businesses, both through online and offline mediums, increased the necessity for commercial spaces. More often than not, these businesses funnel all their finances to stabilize the operations of the company. Leasing a commercial space for an office is the most feasible option for them. Commercial leases concern arrangements between landlords and tenants who agree to lease the area for business uses only. The usual properties under this category are office spaces and warehouses. Commercial leases also come in several specific types. Each one comes with a distinction on who pays for a particular operational expense.

Fixed-term Lease

Whether the commercial or residential nature of the area, a lease is also classified according to its duration. One type is a fixed-term lease. Based on the name, it follows a specific start and end date. The landlord and tenant agree on an arrangement that will run for a particular time frame. Most lease situations follow a fixed-term agreement because it provides a sense of security and organization for both parties. It assures the tenant that they will have a place to live in for the next months until the arrangement ends. On the other hand, it will help the landlord keep track of which of their properties under an ongoing lease and until when.

Periodic Lease

After a fixed-term lease ends, it automatically shifts to another type of lease. It follows the arrangements of a periodic lease. The main difference between these two types is that a periodic lease can go for as long as possible unless one party decides to terminate the deal. After the expiration of the fixed termination, renewing the accord can be in weekly, monthly, or yearly periods. A scenario that often follows a periodic lease is when a tenant was not able to look for another place to stay before the original terminates. In this scenario, the tenant and homeowner can agree on an extension by signing a periodic lease so that both parties can continue to enjoy the security of having a signed agreement.

How to Write a Comprehensive Basic Lease Agreement

As of 2017, New York, Los Angeles, and Chicago had significant renter populations. In all these areas, more than 50% of its people are transient. Office spaces and apartment leases are for educational and commercial reasons. If you are currently leasing in any of these densely populated areas or planning to move in one, it is best to educate yourself on how to draft a lease agreement. It is also best to familiarize yourself with the document to have a grasp of its general idea, as seen in two viewpoints.

Step 1: Indicate the Specifics of the Rental

The first step in drafting a lease agreement is to establish the parties that are involved in the deal. It is best to list down all the adult occupants. In cases where they were not able to pay, the landowner knows who to ask legally. All adult occupants are liable to pay the rent and other dues. Also, labeling an individual as a tenant makes them responsible for following the policies of the landlord in protecting the property. Aside from mentioning the parties involved, the first part of the lease must specify the description of the property. It must determine if it is for residential or commercial use. The complete address of the property must also appear and its inclusions, such as the shared spaces and assigned parking slot.

Step 2: Specify the Lease Arrangement

The next part of the agreement should document the specifics of the lease arrangement. Generally, it includes both the start and end date of the stay, and the length of the tenancy. Additional details, such as the nature of the lease, should also be in this part of the document. If there are nuances in your arrangement, those that are not in standard transactions, you must indicate those at this part of the contract. Say, for example, that your fixed-term lease does not immediately turn into a periodic lease after it expires. Then, it would help if you made it clear in this section to avoid confusion in the future.

Step 3: Discuss Payment Settlement and Additional Fees

After making sure that the details regarding the property and parties involved are accurate, it is time to discuss the necessary payments and methods of settlement. This part of the document includes the details on the lease unit price and the total rent for the place. Do not forget to mention the dates for collecting the payment. Aside from that, discussions regarding the settlement and use of security deposits are at this point in this document. The talks about the additional fees are often regarding the maintenance of the place. The stipulations bearing the arrangements of who will pay for repairs and for putting in other fixtures are at this point in the lease.

Step 4: Impose the Policies of the Proprietor

Reasons for possible early termination of the lease must also be in the contract. It often involves the tenants’ non-compliance to policies set by the landlord. On the other hand, the reason for imposing rules is to ensure safety and security in the neighborhood. It also avoids causing inconvenience to other tenants in the area. In standard arrangement, there are stipulations concerning noise control, subletting space to another renter, and engaging in criminal activities. Some cities also have strict policies about living together with pets. Some buildings allow pets but indicate specifications regarding its size and breed. These circumstances, along with others not mentioned, are aimed to achieve and maintain a pleasant stay in the residential or commercial space.

The population who are on the lookout for spaces for lease in prime locations is becoming more diverse. Young adults explore more opportunities in different cities and states. Older couples are comforted by the noise of the city and prefer its demand. The increased demand for these spaces calls for a deeper understanding of how lease contracts work. Understanding a lease contract has different implications for a lessee and a landowner.