14+ Sample Loan Contract Templates

-

Supplementary Loan Contract

download now -

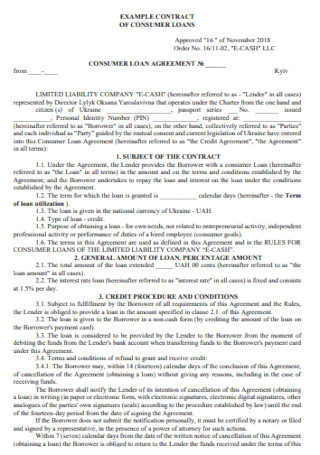

Consumer Loan Contract Template

download now -

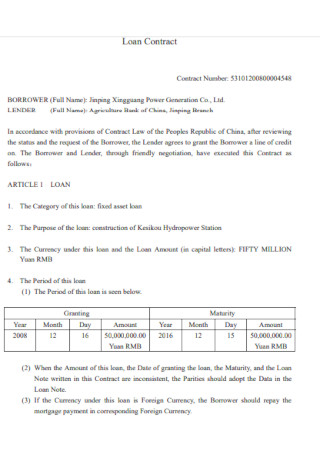

Sample Loan Contract Template

download now -

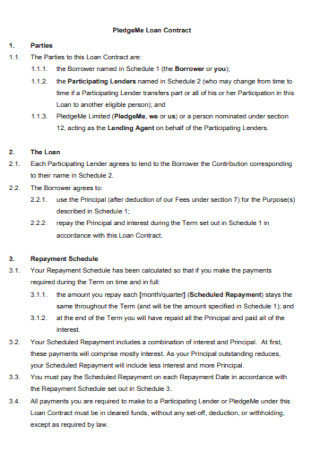

Sample Pledgeme Loan Contract Template

download now -

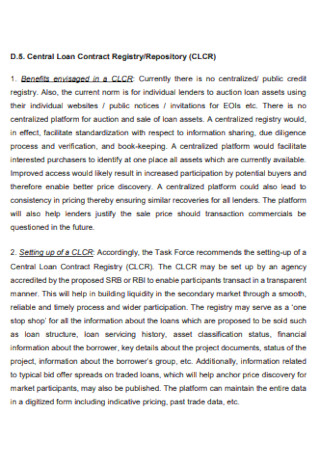

Central Loan Contract Registry Template

download now -

Personal Loan Contract Template

download now -

Basic Loan Contract Template

download now -

Sample Tool Loan Contract Template

download now -

Sample Bank Contract Loan

download now -

Consumer Financial Loan Contract Template

download now -

Standard Personal Loan Contract Template

download now -

Sample Art Loan Contract Template

download now -

Long Term Loan Contract Template

download now -

Non-Exclusivity of Loan Contracts

download now -

Sample Credit Loan Contract Template

download now

FREE Loan Contract s to Download

14+ Sample Loan Contract Templates

What Is a Loan Contract?

The Most Common Types of Loan

How To Create a Standard Loan Contract Template

FAQs

What are the requirements needed when applying for a standard loan?

How do I consolidate my debts with another loan?

What is the difference between an unsecured and secured debt?

Is it wise to make additional payments on a mortgage loan?

What are the types of interest?

What Is a Loan Contract?

Most Americans take loans for different reasons. People usually loan to purchase a vehicle. Others apply for a mortgage to buy a new home. Some use it for personal reasons. Even students apply for loans to pay for their college education. According to Forbes, there are about 45 million students who are in debt in the United States. A loan contract is an agreement between a lender and a borrower concerning the whole process of a loan. Simple loan agreements are documents that spell out the terms of repayment and the interest rate. Other contracts, such as mortgages, are more detailed because it also involves collaterals. Usually, loan contracts are under state and federal laws to prevent lenders from demanding too much interest rate.

The Most Common Types of Loan

There are several types of loans, and each type has a different purpose. They may differ by term, by the amount of interest, and more. The following are the most common types of loans.

How To Create a Standard Loan Contract Template

Normally, loan contracts contain arrangements, collaterals, guarantees, interest rates, and a repayment agreement. Its primary purpose is to spell out the obligations of the parties involved towards each other and the term of the deal. Most contracts clearly define how the borrower is going to use the funds, whether it be for a car, a new house, or an existing debt. To create a standard loan contract template, follow the steps below.

Step 1: Provide the Necessary Background Information

The earlier part of the agreement normally contains the legal names of both parties and the contract’s date of effectivity. Writing the correct name of both parties is important for identification purposes. When we talk about the date of effectivity, it is the day both parties sign the contract and is the day the borrower gets financial aid.

Step 2: Set the Contract Arrangement

A basic loan contract usually details the loan amount, the interest rate, the payment schedules, and penalties for delayed payments. Depending on the type of loan, the interest rate may be fixed or fluctuating. Also, the payment schedules may differ, it can be monthly, quarterly, or annually, depending on what both parties agree on. Moreover, penalties for late payments should be part of the contract to protect the lender. In case of non-payment, an acceleration clause may come in handy. It is a provision where a lender has the power to let the borrower pay all his remaining debts when there is a breach of contract.

Step 3: Identify the Collateral

Don’t forget to indicate the collateral. As we’ve mentioned earlier, collateral can be a car, a property, or any asset that has equal or more value than the loan amount. Collateral protects a lender in case a borrower defaults or cannot fulfill his payments.

Step 4: Don’t Forget to Include the Governing Law

The governing law depends on which state you belong to. The law makes a loan contract enforceable. In case disputes and disagreements arise, later on, the governing law has the power to decide on the case. Its purpose is to announce what rules both parties should follow and what actions are to be taken if they violate those rules.

FAQs

What are the requirements needed when applying for a standard loan?

Expect your lender to ask for the following requirements: (1) Income tax return documents for the previous years as well as present pay stubs, (2) bank details that relate to your debts, (3) financial statements if you are self-employed, (4) information concerning where your down payment comes from. Be sure to provide the latest information to your lender if there are any changes. Note that mortgage loans have their requirement list.

How do I consolidate my debts with another loan?

One way to consolidate your remaining debts is to apply for a personal loan. The goal is to combine all your debts and pay them all at once. The first thing you need to do is to list the debts you want to consolidate. Next is to apply for a personal loan that is equivalent to the sum of all your debts. When a lender approves your application, you can now use the funds to pay off debts with high interest and pay them all at once at a lower interest rate.

What is the difference between an unsecured and secured debt?

An unsecured debt doesn’t demand collateral. From the word “unsecured”, it means that it has no security. If a borrower fails to fully repay the debt, the lender must first file a lawsuit against the borrower for him to get his money back. On the other hand, a secured debt requires collateral to secure the loan. So, in case of default, the lender gets to own the collateral or asset that is tied to the loan.

Is it wise to make additional payments on a mortgage loan?

Paying more also means paying less. When you prepay a mortgage loan, the term of the loan shortens, which means you get to save from paying interest. If you find it difficult to make additional payments, you can try rounding off your payment. For example, if your monthly payment is equal to $80, you can make it $100. However, if you also have other debts (e.g., credit cards), you have to weigh between both. If the interest rate of your credit card is higher than the rate of your mortgage, then you must pay your credit card first.

What are the types of interest?

There are two types of interest, the simple interest, and the compound interest. Simple interest is the principal loan alone. Compound interest is more interest on top of the principal interest and the interest of the previous periods. To get the simple interest, you multiply three givens: the principal amount, the annual interest rate, and the loan term (in years). To compute for the compound interest, you have to multiply the principal amount to the result when you add the annual interest rate to one and raise it to the number of years the interest rate applies. Then, subtract the principal amount to the result.

Though it seems that loan contracts favor a lender more than a borrower, it actually favors both. As a borrower, you need to know how much interest you have to pay, or else a lender might take the opportunity to increase it from time to time. A contract lays out all the details of a loan process to make both parties meet halfway. Without one, a lender might decide to send the borrower a contract demand letter, or both parties might find themselves in court.