17+ Sample Partnership Contract Templates

-

Partnership Contract Format

-

Partnership Framework Contract

-

Pre Partnership Employment Contract

-

Partnership Contract Checklist

-

Sequential Partnership Contract

-

Funding Partnership Contract

-

Partnership Contract Questionnaire

-

Business Partnership Contract Example

-

Public Private Partnership Contract

-

Indian Partnership Contract Act

-

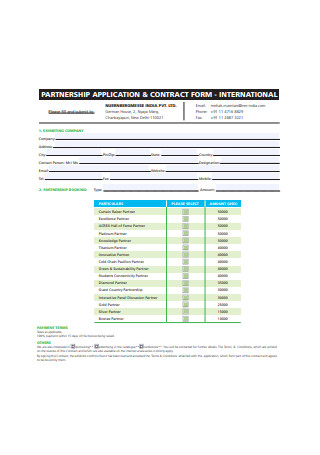

Partnership Application and Contract Form

-

Partnership Services Contract

-

Professional Partnership Contract

-

Subsidy Partnership Contract

-

Public Private Partnership Contract Example

-

Family School Partnership Contract

-

High School Partnership Contract Agreement

-

Bus Safety Partnership Code of Contract

What Is a Partnership Contract?

Personal relationships and business relationships can be similar and different in various ways. While they both center on understanding, trust, reliability, and honesty to thrive, everything about a business relationship is recorded in writing to get everyone on the same page—this is where a partnership contract comes in.

A partnership contract is a legally binding agreement that sets forth the terms and conditions of the relationship for all parties to grasp. It states the nature of the business, the responsibilities of each partner, and other important guidelines to take note of. The document also covers the provisions that affect the financial aspects of the business as well as the authority of each party to control its operations. This is usually written when large sums of money are involved in the exchange, as oral agreements are not as reliable as having it on paper.

Such business contracts are typically used among for-profit businesses as well. It doesn’t always have to be between two or more individuals, as a limited liability company (LLC) may also team up with a corporation to form an LLC partnership agreement. Well-written contracts can sometimes seem complex, but that’s only because they cover many different points and include a chunk of detail to make sure that nothing is left out.

What to Include in a Partnership Contract

Before you and your partner-to-be form a partnership, there are certain items that must be covered by your contract. For instance, the authority of the general partner and the rights of all limited partners in a limited partnership agreement may vary according to their position in the relationship. The former would be responsible for managing the partnership, while the latter will simply supply the funds to run the business. These components will identify the scope of your business operations along with the expectations that each party must meet. To make sure your contract fulfills the desired requirements, here’s a list of the major areas to clarify in the agreement.

1. Partnership Name

While you can always use your last names for easy identification, you can opt to acquire and register a fictitious name that somehow describes the essence of your business together. Make sure that the name you choose isn’t already in use to avoid an unwanted wrangle early on. It’s also best to spell out the complete and correct names of the concerned parties for clarification.

2. Contribution to the Partnership

Apart from the name and purpose of your business partnership, a small business partnership agreement may also include the initial investments of each party. Any cash, property, or services contributed must be recorded in the contract to show the ownership percentage of the said partner. It may also stipulate the procedure for continuous contributions to the business should the partners decide to make future investments together. Any disagreements over these contributions can doom the entire venture, so be wary with who you get into business with.

3. Allocation of Profits, Losses, and Draws

You and your partner may have different ideas about how the money should be allocated. Instead of waiting until your business succeeds or fails, it’s crucial to discuss your financial needs and recommendations for a mutual settlement prior to signing the contract. You must decide whether the profits and losses will be dispensed in proportion to a partner’s ownership interest or if you have an alternative means of addressing the situation. How the money is divided up and distributed to each party would depend on various factors, including each partner’s contribution to the business.

4. Partners’ Authority

Unless the contract states otherwise, any partner can act or bind the partnership without seeking approval from the other party. This can be dangerous in any business venture, as it’s bound to cause arguments and distrust in the relationship. If you and your partner want to obtain the others’ consent before making a crucial decision, you have to clarify this in your partnership agreement.

5. Management duties

Working as partners can be both a good thing and a bad thing, simply because neither of you has full control over what happens. This also means that management duties are divided between partners to ensure that the responsibilities are assigned accordingly. You could use your knowledge and skills in sales and marketing to spearhead those departments, while your partner can handle human resources and accounting duties as planned. Working this out in advance is a great way to ensure a fair workload in the partnership.

6. Withdrawal or Death of a Partner

When you make a contract, you need to consider every possible circumstance in the book. This includes one’s departure from the business due to death or withdrawal. A buy-sell agreement, also known as a buyout agreement, is often used to govern these situations. Most financial planners and business specialists recommend securing a buyout scheme to ensure that the arrangement is well-funded for when things take a turn for the worse. Think of it as a life insurance policy that delegates one party as the main beneficiary after an unexpected passing or a voluntary withdrawal.

7. Making Decisions and Resolving Disputes

Making mutual decisions is always the biggest challenge among partners. Your inability to think critically and negotiate on certain conditions will likely result in business failure, which is why it’s a good idea to set out the terms for every major and minor business decision in order to satisfy the best interests of all partners. The document may stipulate how decisions must be made to bind the relationship. These decision-making procedures will help you resolve disputes as fairly as possible as you thread through issues that could potentially affect the course of your partnership.

The Role of Attorneys in Preparing a Partnership Contract

Constructing a DIY partnership agreement might seem like a money-saving idea, but it poses several risks that could destroy your business relationship or bring your partnership to a rocky start. Oftentimes, relying on a poorly worded contract is just as bad as having none at all. This is why it’s important to get an attorney to help you with the process of drafting the contract and ensuring that it meets the legal requirements. You don’t need to have a contract lawyer present every step of the way, but it is advisable to consult with your attorney before having the contract signed. By doing so, you can prevent expensive lawsuits and ill feelings between partners.

Why Your Partnership Needs a Formal Agreement

There are a ton of reasons to have a written agreement for every partnership you form. Even if you are doing business with someone close to you, like a friend or a family member, signing a partnership contract will help you avoid miscommunications and legal issues that may emerge along the way.

For one, the partnership contract outlines the specific details of the collaboration, including the names of the individual partners, the purpose for which the partnership is established, and the directives for profit distribution, among many others. This allows the partners to set forth their expectations and manage their business according to their desires and objectives. This will also protect your interests should the business be sold or abandoned due to bankruptcy or similar misfortunes. You can also use the agreement to avoid tax problems that require you to prove that the partnership is distributing profits based on the standard tax and accounting practices.

But contrary to what many believe, partners in the agreement don’t necessarily own an equal share and/or involvement in the business. Some partners can own more than 50% of the business based on initial investments, while others can function as silent partners with limited control over certain business decisions. A majority partner can also choose to take on heavier responsibilities in exchange for a higher percentage of the profits. Limiting the decisions that either party can make will make it easy for partners to steer the business in the right direction and prevent disagreements down the road.

How to Write a Partnership Contract

There’s nothing easy about writing a contract. You don’t want to create something that is either too broad or overly complex for readers to comprehend. The whole idea of drafting a document that could impact your business in a certain way can seem overwhelming, but if it means protecting your business from conflict, writing a solid contract should be considered when entering into an agreement.

If you’re new to the game, we’ve listed a few tips to help get you started with your business partnership agreement.

Step 1: Get It in Writing

Anytime you enter into a deal with a business partner, documenting your agreement on paper is a must. It’s probably the first lesson in the rulebook of contract writing. While oral agreements are acceptable in smaller business contexts, they aren’t always enforceable nor reliable in the event of a dispute. Most contracts and agreements in the business world are put into writing even if the law does not require it. That’s because it’s less risky and more effective in administering all kinds of business relationships. Our memories as human beings can be faulty at times, which can often modify the exact terms of an agreement into something significantly different.

Step 2: Use Simple Language

Don’t be intimidated by the false notion that all contracts need to be written in legalese. Legal English can be difficult to understand, especially to those who have no prior experience or background in the field. Hence, the best contracts are often written in plain English to ensure that both parties understand the meaning of each provision and that they know exactly what they’re getting themselves into. This is one way to avoid confusion or misunderstanding between parties. And because certain terms have a specific meaning in the law, it’s important to be mindful of your word choice.

Step 3: Spell out Each Clause

You’d be surprised by how often people tend to misinterpret the terms of a contract. This occurs when authors fail to lay out the rights and obligations of the agreement in full detail. It must be written as clearly and coherently as possible. If you and the other party agree to revise or add a new term to the contract, a written amendment must be attached to the document so as not to leave anything out. As long as the parties concerned initiate the change, it immediately becomes a part of the agreement.

Step 4: Specify Payment Details

How will payments be made? Partnership contracts are written to foster different types of business relationships, whether it’s an employer-employee alliance, customer-seller arrangement, or a joint venture. This means that payments will vary depending on the nature and duration (if applicable) of your partnership. Some payments are settled through installments, while others are paid only when work is completed. Make sure to list the dates, requirements, and payment methods that are accepted. Contract disputes are sometimes caused by compensation issues, so you’ll want to be firm and specific with your payment obligations.

Step 5: Identify the Circumstances that Terminate the Contract

All contracts are meant to end at some point. However, it is possible for a contract to be terminated even before it has served its main purpose. If one party fails to perform its part in the agreement, you want to have a procedure in place that allows you to terminate the contract without committing a breach. It could be a partnership termination agreement that either side has the authority to terminate if the opposing side violates a major term included in the contract. A proper notice signifying a party’s intent to terminate the agreement must also be specified to prevent further conflict.

Step 6: Decide on a Way to Resolve Disputes

You can never take back the time, effort, and resources that were wasted in a failed venture. Taking your issues to court is likely to cause even more trouble to both teams, not to mention the amount of time and money it requires to arrive at a settlement. One way to address these problems is to write into the agreement the actions that will be taken if something goes wrong. You can consider adding a mediation or arbitration clause that the parties can enter if the worse comes to worst.

Mediation is a voluntary process where both parties try to negotiate on a settlement with the assistance of a third-party mediator. A resolution is only reached once both parties agree on it. Arbitration, on the other hand, is similar to a court process where the arbitrator should first hear the arguments from both sides before making a decision that both parties must adhere to. The arbitrator is usually someone who is knowledgeable of legal agreements, such as a retired judge, a senior lawyer, or even a licensed professional.

Step 7: Consider the Laws that Govern the Contract

If you and your partner operate in different states, it’s important to choose only one of your state laws to regulate the contract. Failure to indicate this arrangement will likely fuel another argument about which state’s laws should be applied to the contract. You must also determine where the mediation or arbitration will occur under the contract when the circumstance calls for it. This will simplify the entire process and spare you the hassle.

Step 8: Make it Confidential

Working on a partnership deal usually obligates you to provide the other party with access to your business practices and possible trade secrets. Given how you are already vulnerable to various security concerns, the last thing you would want is for the other party to share this information with competitors or other individuals and entities that may threaten your business operations. Thus, it’s best to include a clause that prohibits either party from disclosing any sensitive information shared during the partnership. A clause stating the actions to be taken to address the leak must also be included.

There are many things to consider before you and your partner begin your journey together. We understand that writing a contract is not an easy task, which is why you shouldn’t hesitate to use a partnership agreement template when you feel the need to do so. You can find many contract templates that may be downloaded and customized to meet your business standards. Though this shouldn’t give you a reason to write your agreement without professional assistance, it can help you get started with your partnership contract for a better understanding of how it all works. By following the tips provided, you can create an enforceable partnership contract in a swift!