47+ SAMPLE Payment Contracts

-

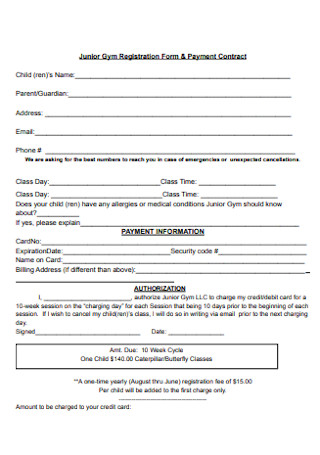

Junior Gym Payment Contract

download now -

Puppy Payment Contract

download now -

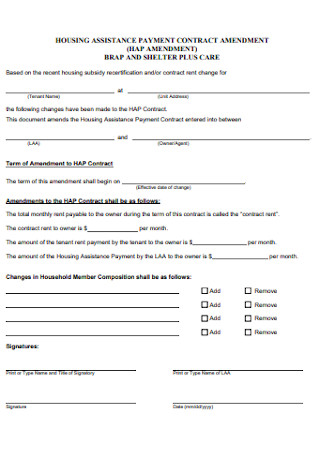

Housing Payment Contract

download now -

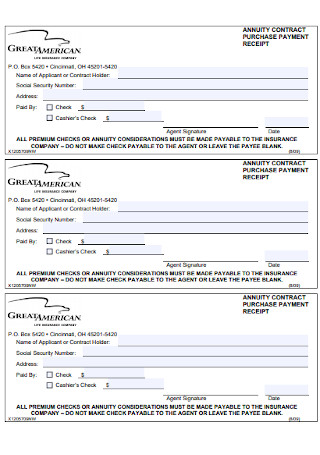

Contract Payment Receipt

download now -

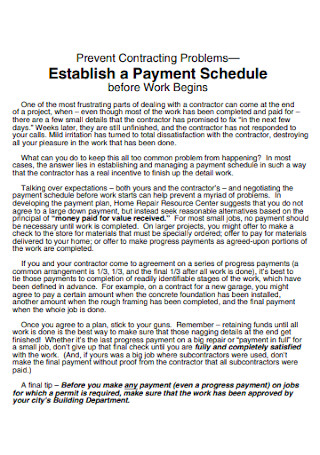

Contract Payment Schedule

download now -

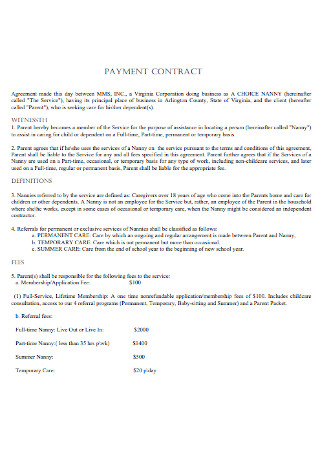

Nanny Payment Contract

download now -

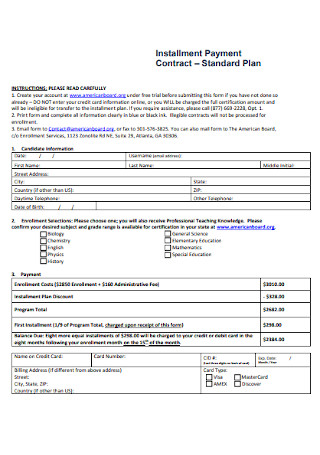

Installment Payment Contract

download now -

Child Care and Payment Contract

download now -

Work Payment Contract

download now -

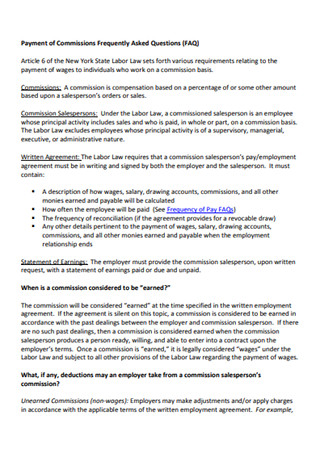

Payment of Commission of Contract

download now -

Payment Service Contract

download now -

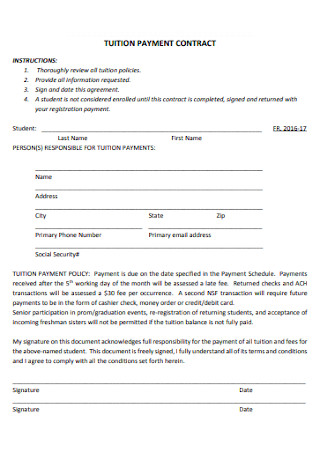

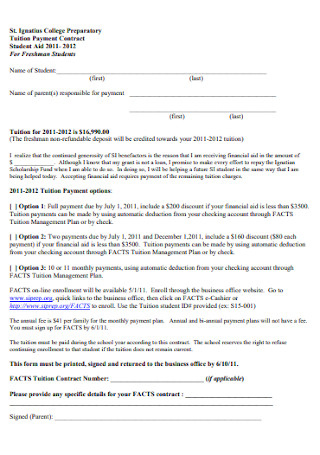

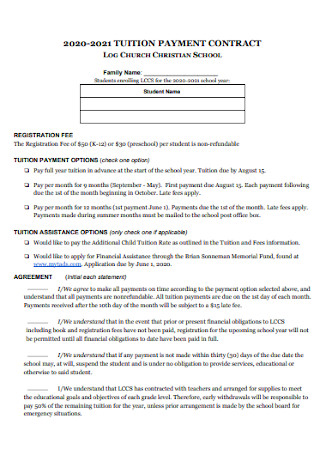

Tution Payment Contract

download now -

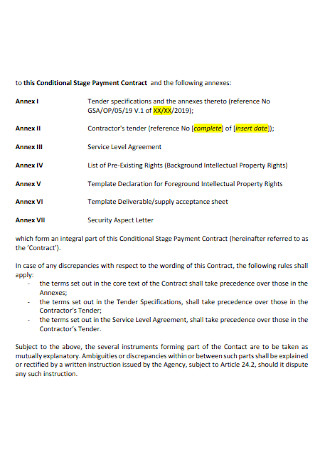

Stage Payment Contract

download now -

Contract Payment Form

download now -

Legal Guardian Payment Contract

download now -

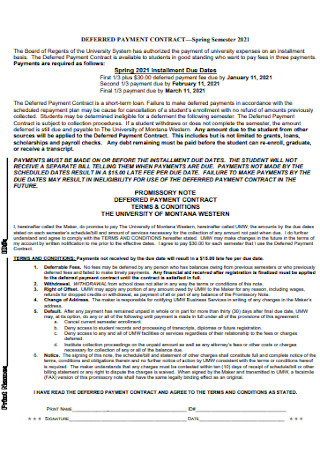

Deferred Payment Contract

download now -

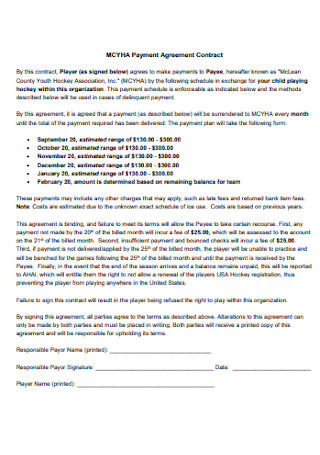

Payment Agreement Contract

download now -

Contract Price and Payment

download now -

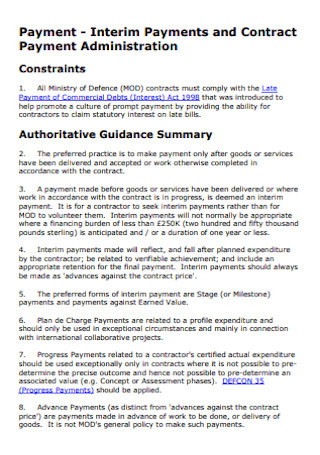

Interim Payments and Contract

download now -

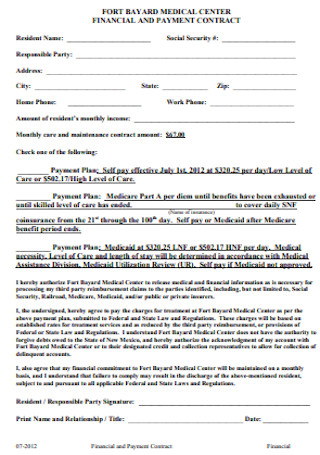

Financial and Payment Contract

download now -

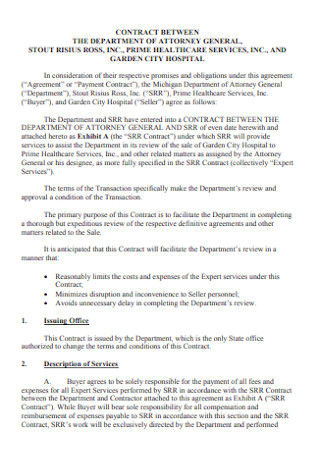

Hospital Payment Contract

download now -

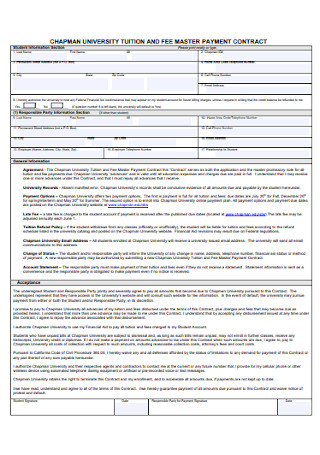

Tution Fee Payment Contract

download now -

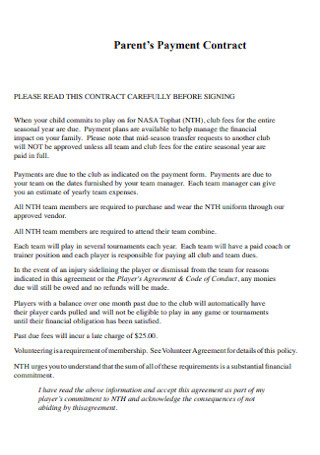

Parents Payment Contract

download now -

Payment Contract and Card Pre-Authorization

download now -

College Tuition Payment Contract

download now -

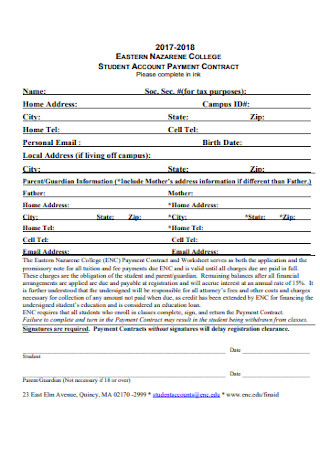

Student Account Payment Contract

download now -

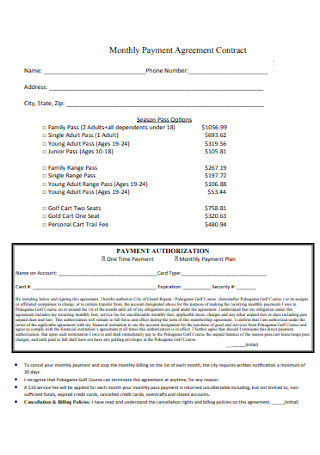

Monthly Payment Agreement Contract

download now -

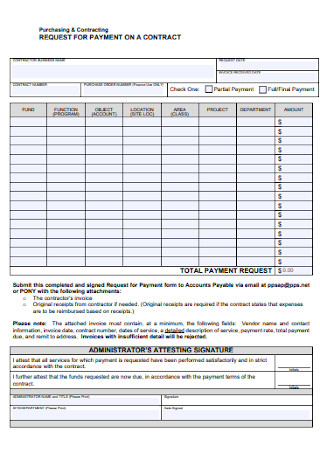

Request for Payment Contract

download now -

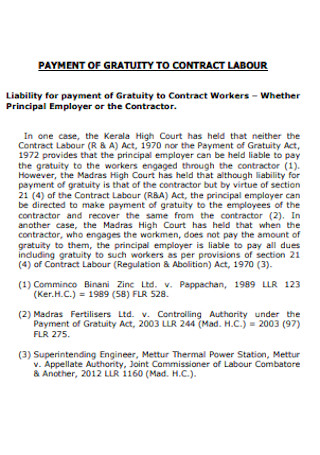

Payment of Gratuity to Contract

download now -

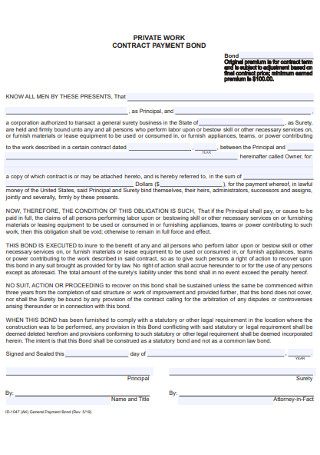

Bond Payment Contract

download now -

Program Contract Payment Checklist

download now -

Design Analysis of Contract Payment

download now -

School Tution Payment Contract

download now -

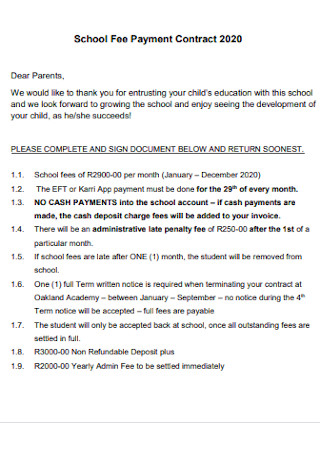

School Fee Payment Contract

download now -

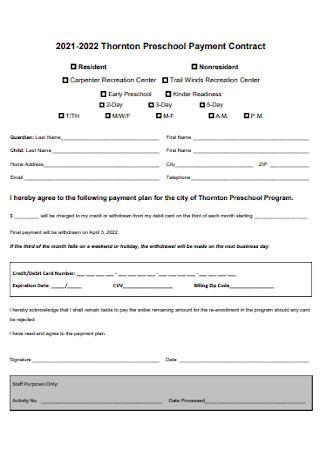

Preschool Payment Contract

download now -

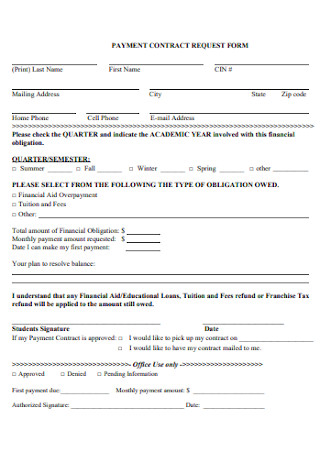

Payment Contract Request Form

download now -

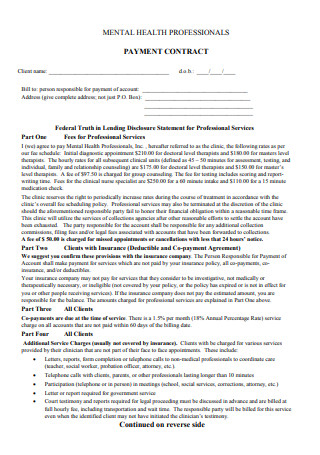

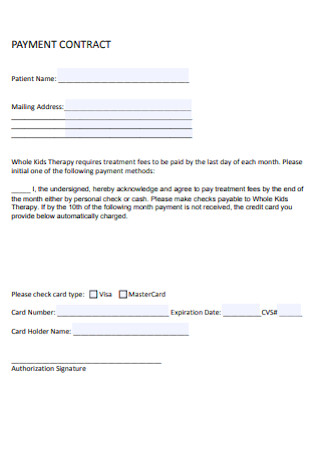

Mental Health Payment Contract

download now -

Payment Fixed-Price Contract

download now -

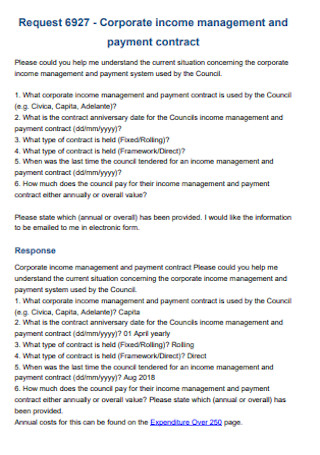

Corporate Payment Contract

download now -

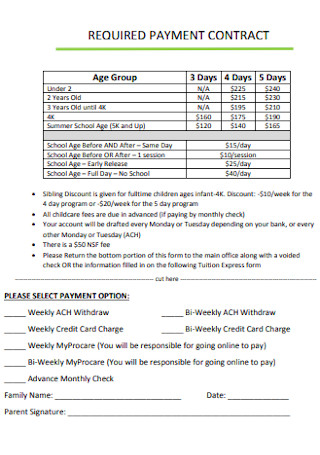

Simple Required Payment Contract

download now -

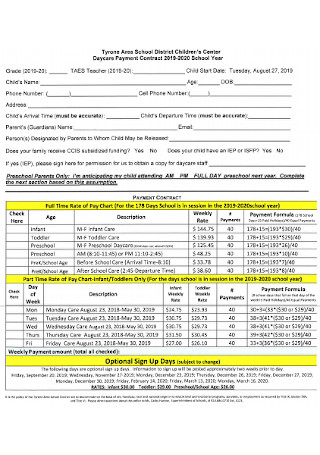

Daycare Payment Contract

download now -

Payment Contract Format

download now -

Bus Payment Contract

download now -

Advance Payment Contract

download now -

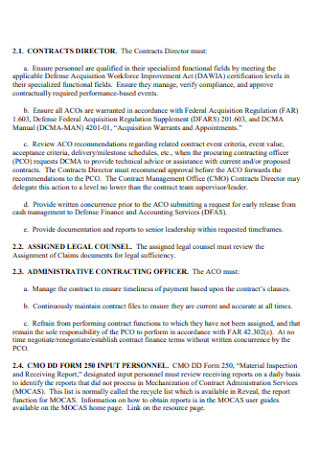

Director Payment Contract

download now -

Standard Payment Contract

download now -

Payment Renewal Contract

download now

FREE Payment Contract s to Download

47+ SAMPLE Payment Contracts

What is a payment contract?

Types of Payment Contracts

Elements of a Payment Contract

How to Make a Payment Contract

FAQs

How much do you pay when you breach a payment contract?

What happens when there is an error in a payment contract?

What happens when one party in a contract dies?

What is a payment contract?

A payment contract, also known as payment agreement contract, is a written agreement of payment between parties that promised to pay a specified amount of money to those being transacted. An example would be selling a car with a payment’s contract. Other businesses that do installment may use an agreement for installment payment. However, this doesn’t only apply to businesses, this could also be an agreement to pay back the money owed by a friend.

Check out the templates above for reference.

Types of Payment Contracts

Each of the structure of payment contracts may vary. Below are its types:

1. Personal Payment Contract:

This type of payment contract can be used personally, may it be for a person who owes a specific amount. This may be used between normal people and is excellent for short transactions that do not need a large number of requirements. It also places a greater emphasis on direct payments.

2. Business Payment Contract:

This type of payment contract is excellent for businesses and is used by entrepreneurs’ transaction with customers and shareholders. This usually involves really big amount of money transactions and is used to protect both buyer and sellers equally.

3. Installment Payment Contract:

In this type of payment contract, payments of money, items delivered, or services performed are to be made in a succession of payments, performances, or deliveries, frequently on certain dates or events. This does not require immediately the entire amount to be paid.

Elements of a Payment Contract

The payment contract does not have to be fancy. It could be a very simple payment contract as long as it is able to protect you against breach and is directed towards a goal.

How to Make a Payment Contract

These are the steps in making a detailed payment contract. However, you can download the sample templates provided above to make things easier for you.

Step 1: Creditor & Debtor’s Info

The payment contract should include the information about the creditor and the debtor. This may include their numbers and emails. This is crucial to determine the parties involved and how to contact them in times of need.

Step 2: Amount

The exact amount of the payment should be provided together with the breakdowns to make it clear why the amount has gone into a certain point. This is the very point of the contract and this should not be subject to any errors.

Step 3: Mode of Payment

Since there are a lot of modes of payment, the payment contract should specify how the money will be transacted with respect to the agreed decision of both parties. May it be in checks, cards, wire transfers, cash or goods.

Step 4: Actions In Case of Dispute

There should be a provided remedies if breach occurs stating issues that should be addressed through either equitable or legal methods. This could in the form of monetary compensation for the complainant’s loss, taken by the parties to resolve a disagreement.

Step 5: Signatures

A contract is usually invalid without the signatures of the parties involved. There are certain factors you should keep in mind before signing. Make sure that you agree to the conditions and promise to keep your part of the agreement when you sign on the dotted line.

FAQs

How much do you pay when you breach a payment contract?

The procedure for dealing with a breach of contract can sometimes be stated out in the original contract. A contract, for example, may say that in the case of late payment, the offender shall pay a certain amount to charge in addition to the missed payment.

What happens when there is an error in a payment contract?

If you spot a mistake within a contract, one of the consequences might be that the payment contract becomes worthless from the start. Based on this error, the court rules that the contract does not exist. Furthermore, this might decide that the parties never entered into the contract legitimately.

What happens when one party in a contract dies?

If a party dies after signing the contract but before settlement, the contract is immediately cancelled, or discharged. In other words, this indicates that the contract is no longer in effect, and the other party left alive has no future rights and claims under it.

Overall, a good payment contract will be beneficial to your business, whereas a bad payment contract may be harmful to your business and its demands. A contract that covers all aspects of your business’ terms and conditions can put you in a stronger position if a disagreement arises. You may ask a payment contract analyst to help you sort things out.