Last Will and Testament Samples

-

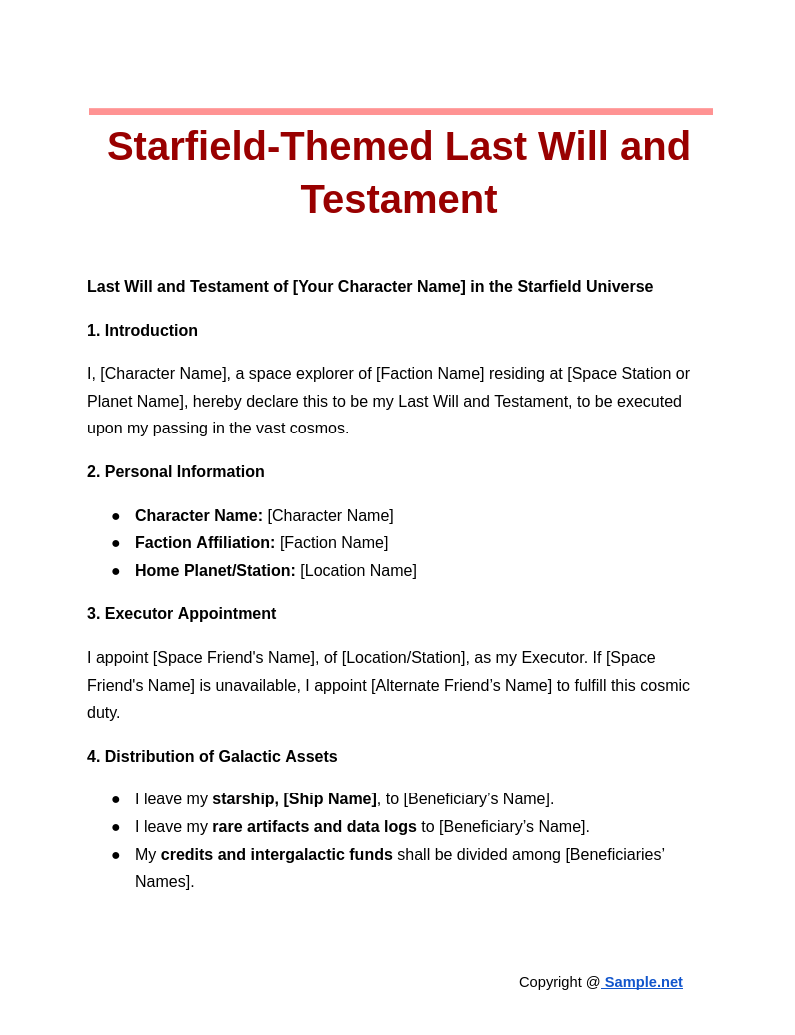

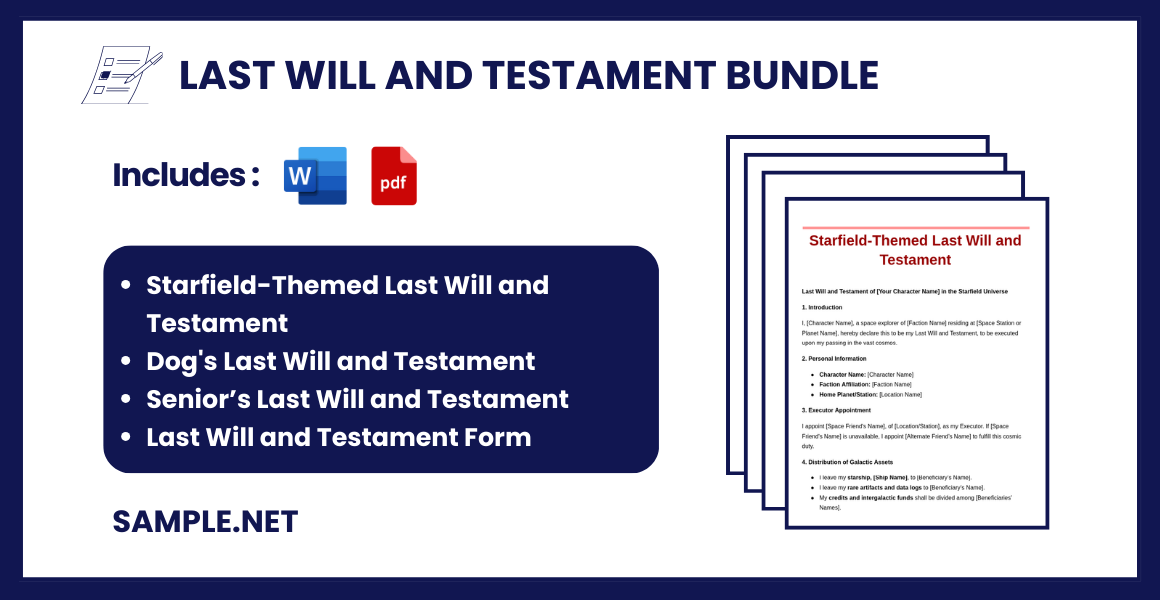

Starfield-Themed Last Will and Testament

download now -

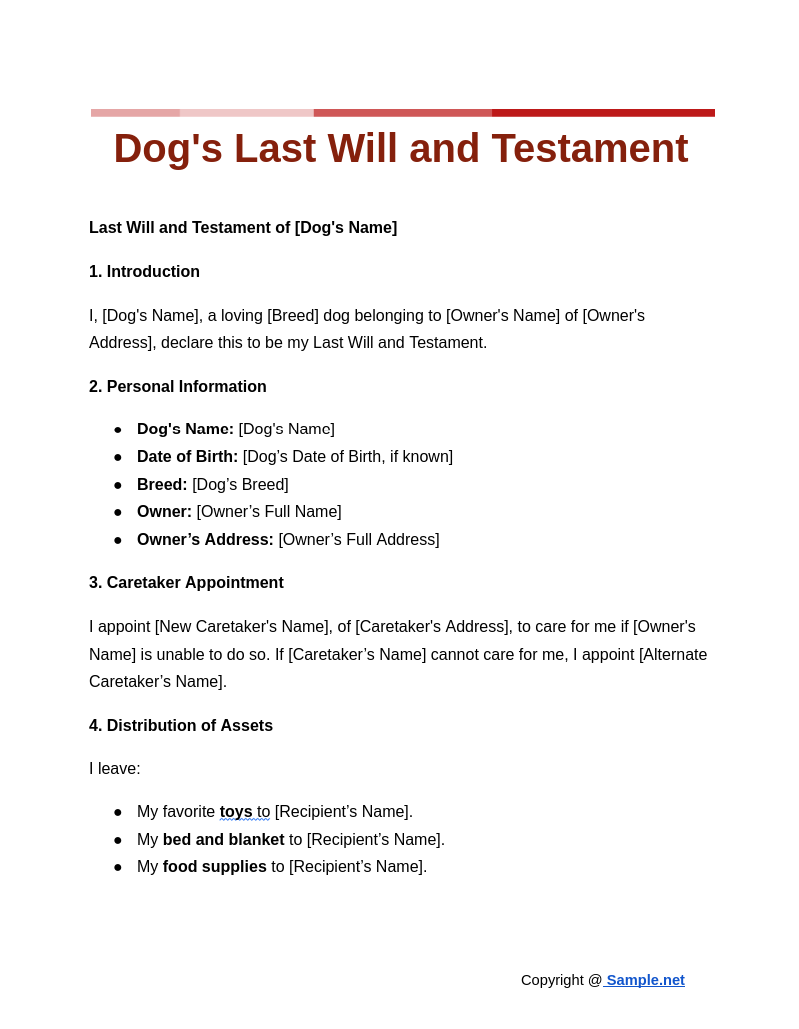

Dog’s Last Will and Testament

download now -

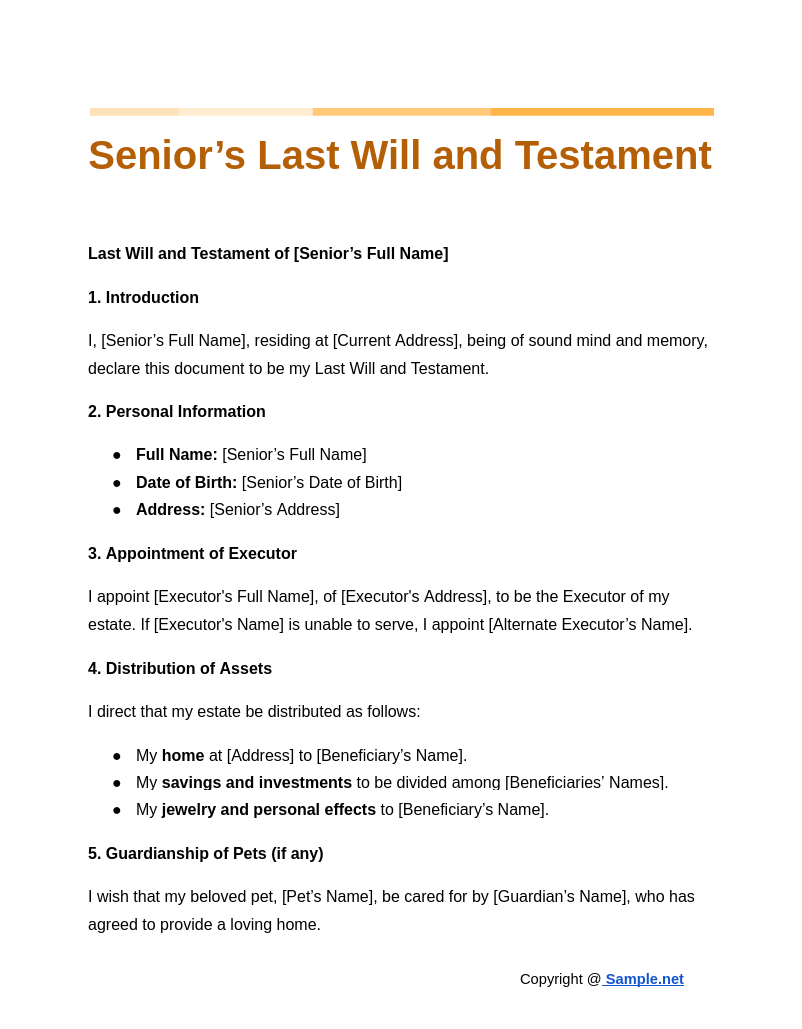

Senior’s Last Will and Testament

download now -

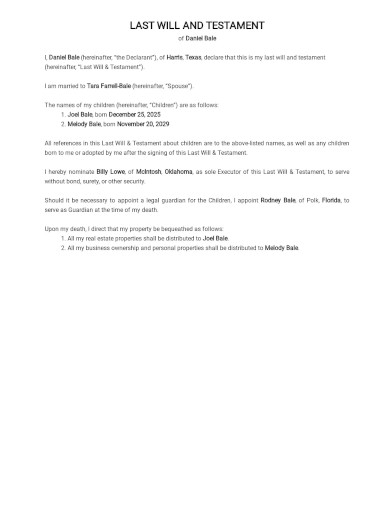

Last Will and Testament with Testamentary Trust Template

download now -

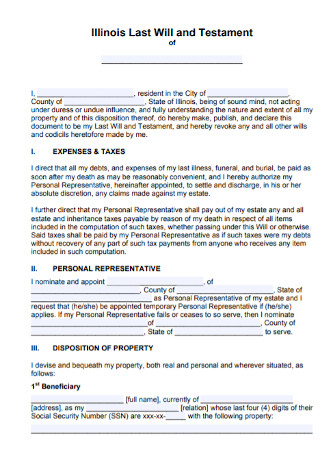

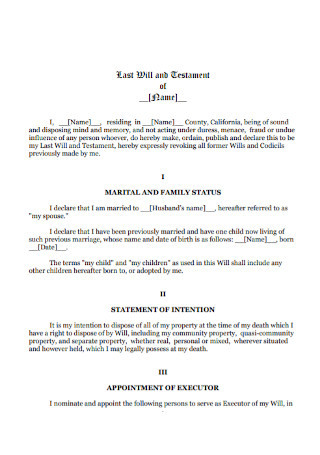

Last Will and Testament Form Template

download now -

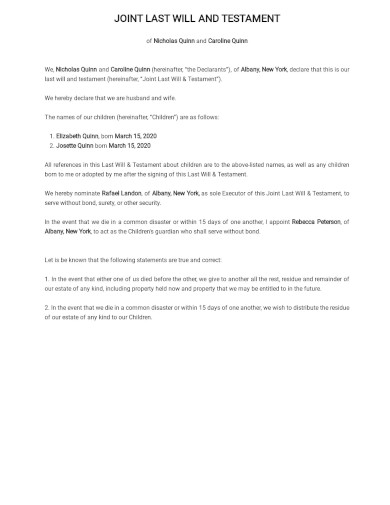

Joint Last Will And Testament Template

download now -

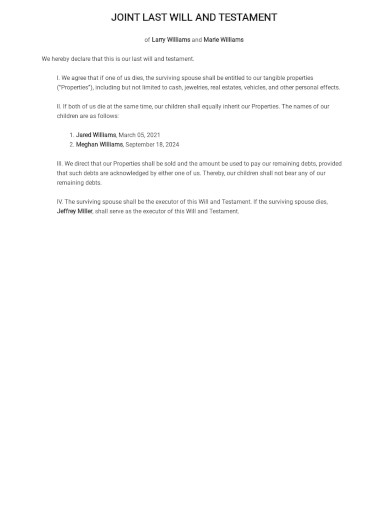

Joint Last Will and Testament Form Template

download now -

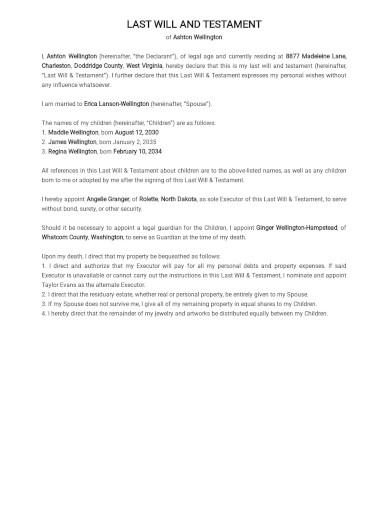

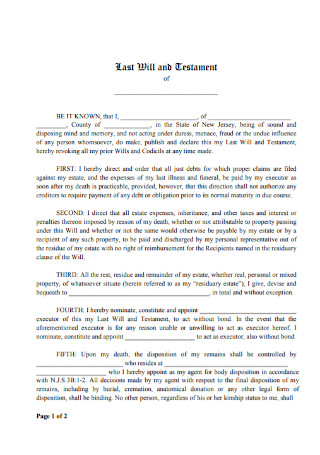

Basic Last Will and Testament Template

download now -

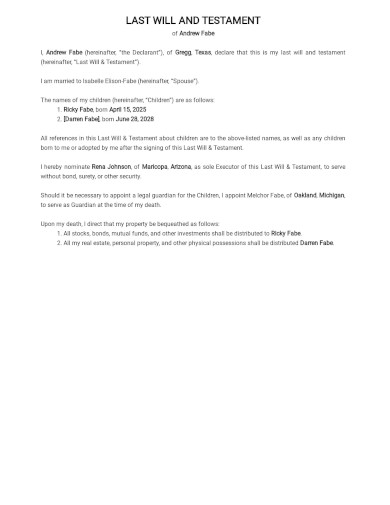

Senior Last Will and Testament Template

download now -

Legal Last Will and Testament Template

download now -

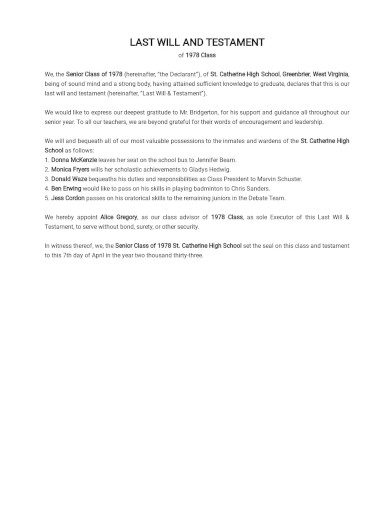

Class Last Will and Testament Template

download now -

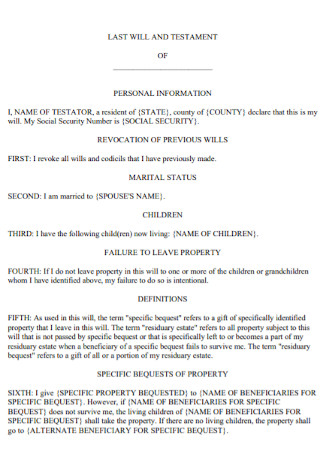

Simple Last Will And Testament Template

download now -

Wyoming Last Will And Testament Template

download now -

Wisconsin Last Will And Testament Template

download now -

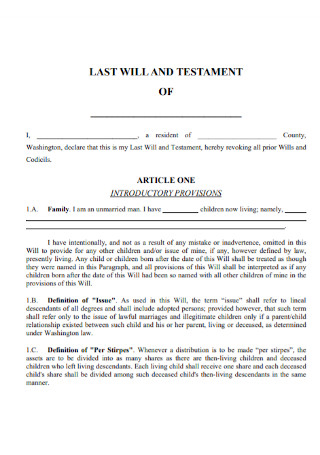

Washington Last Will And Testament Template

download now -

Virginia Last Will And Testament Template

download now -

Vermont Last Will And Testament Template

download now -

Utah Last Will And Testament Template

download now -

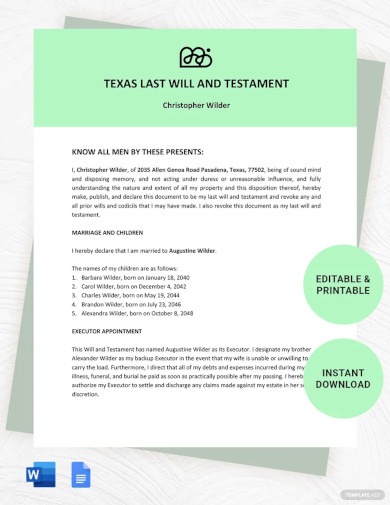

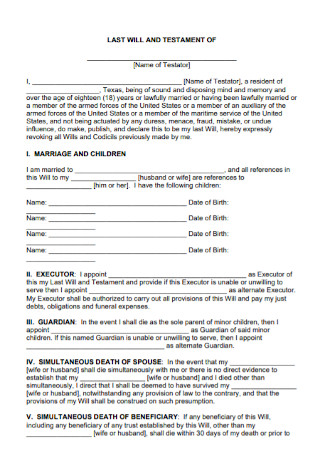

Texas Last Will And Testament Template

download now -

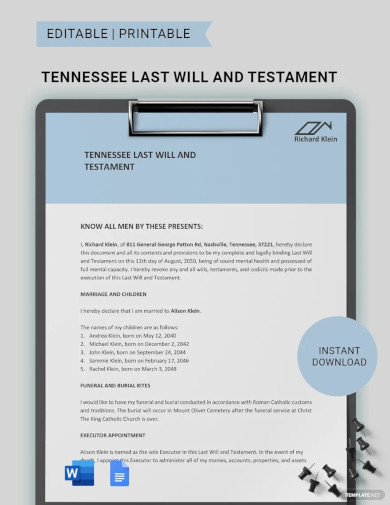

Tennessee Last Will And Testament Template

download now -

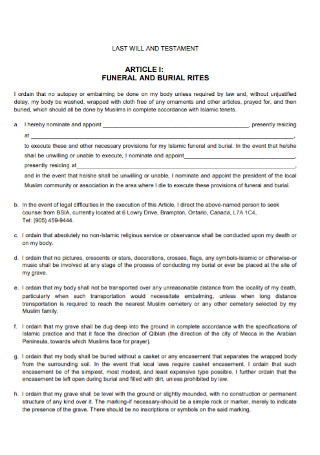

Funeral Last Will and Testament

download now -

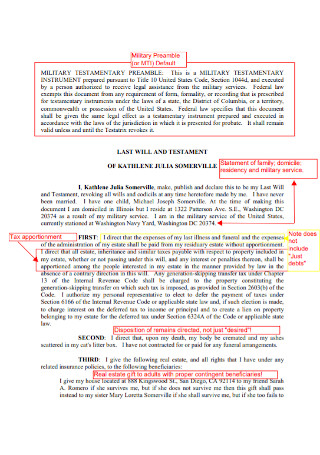

Last will and Military Testament Document

download now -

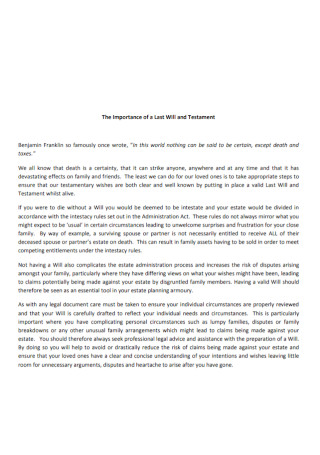

Sample Importance of Last Will and Testament Estate

download now -

Last Will and Testament Death Form

download now -

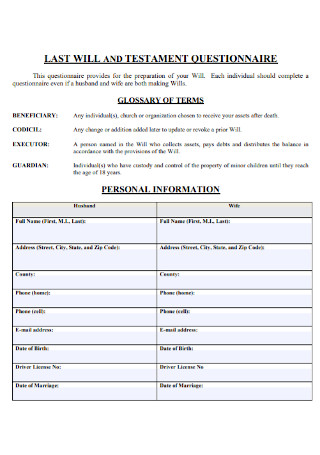

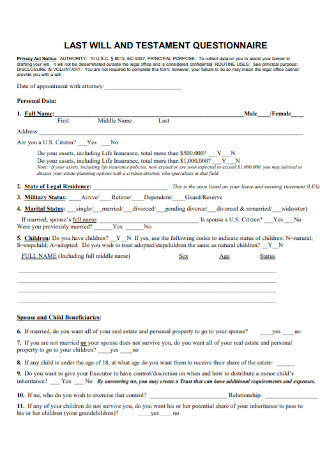

Last Will and Testament Questionnaire Executor

download now -

Attorney of Joint Last Will Testament

download now -

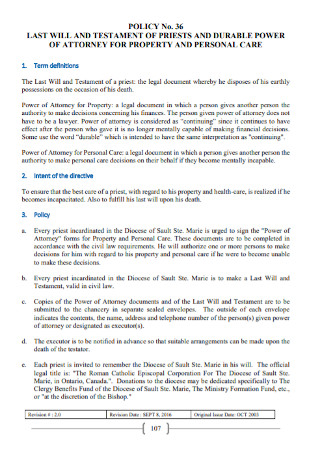

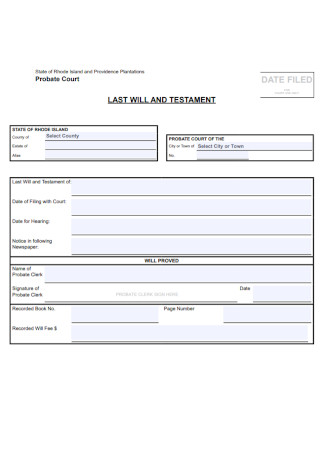

Probate Last Will and Testament Policy

download now -

Make a Personal Last Will and Testament

download now -

Sample Last Will and Testament Testator

download now -

First Last Will and Testament Testor

download now -

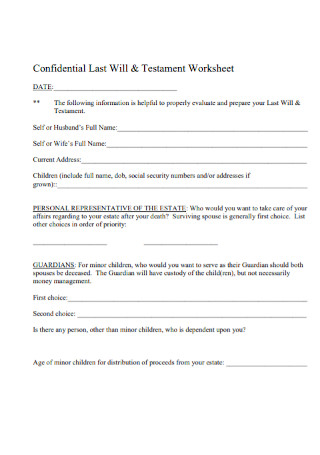

Parent Confidential Last Will & Testament Worksheet

download now -

Invalidity Last Will and Testament Papers

download now -

Simple Last Living Will and Testament

download now -

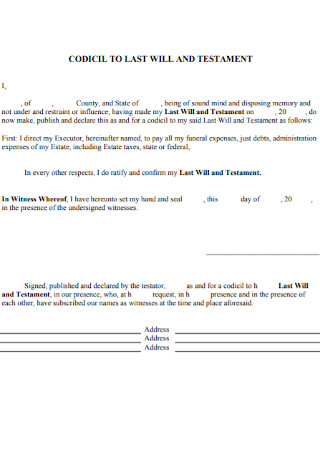

Codicil Last Will and Testament

download now -

Court power Last Will and Testament

download now -

Basic Last Will and Deed Testament

download now -

Spiritual Texas Last Will and Testament

download now -

Last Will and Testament an Extremely Distinguished Dog

download now -

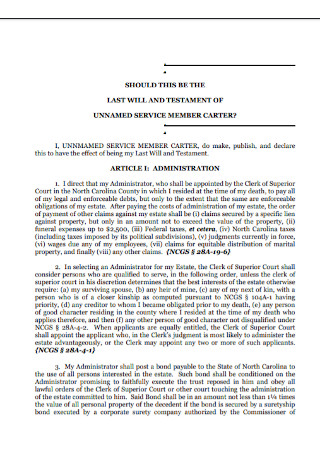

Last Will and Service Member Testament

download now -

Last Will Family Member and Testament

download now -

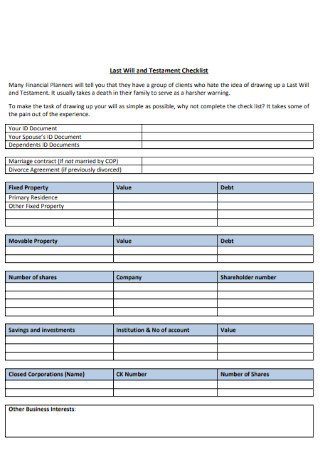

Last Will and Testament Checklist

download now -

Summers Last Will and Testament

download now -

Basic Last Will and Testament Example

download now -

Standard Last Will and Testament

download now -

Formal Last Will and Testament

download now -

Last Will and Testament Format

download now -

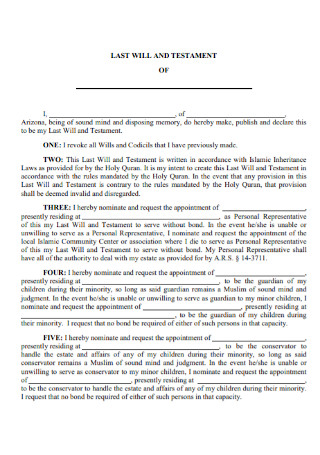

Islamic Last Will and Testament

download now -

Printable Last Will and Testament

download now -

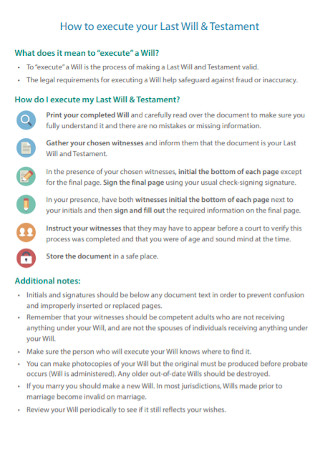

Sample Execute of Last Will and Testament

download now

FREE Last Will and Testament s to Download

Last Will and Testament Format

Last Will and Testament Samples

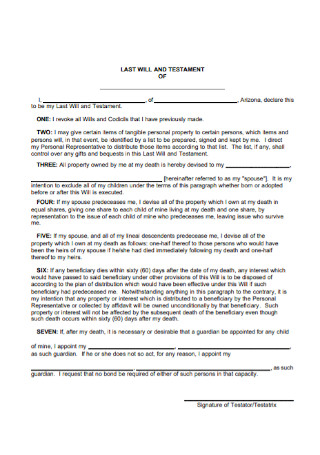

What is a Last Will and Testament?

Types of Last Will and Testaments

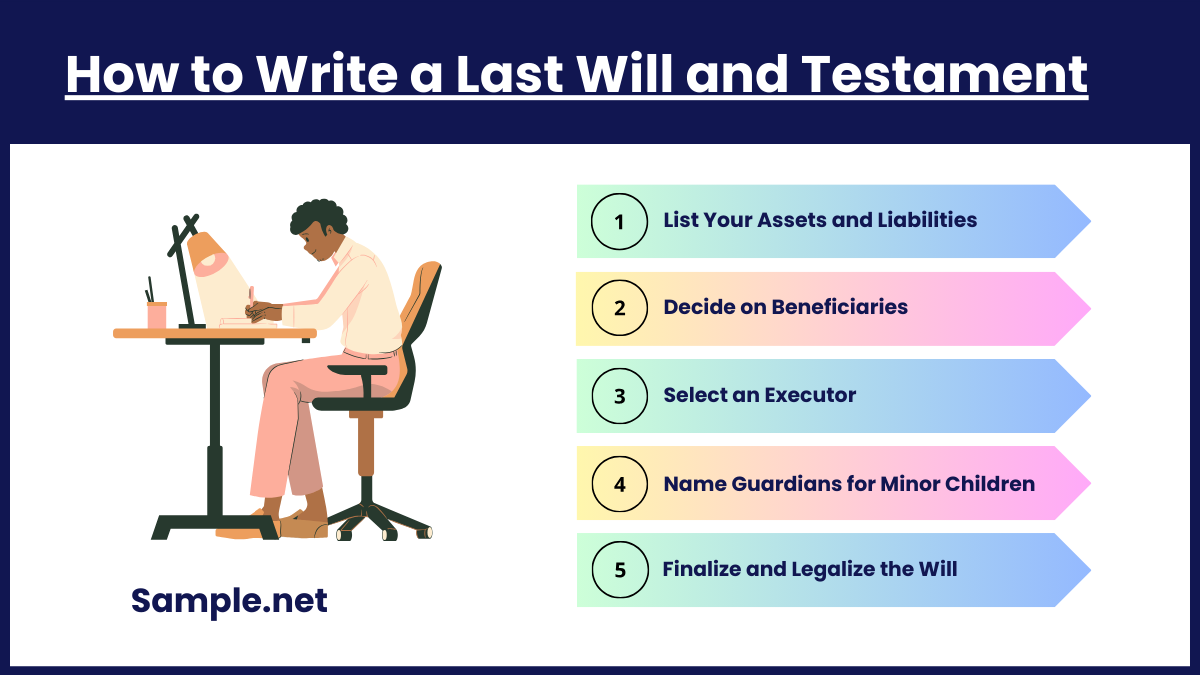

How to Write a Last Will and Testament

FAQS

What happens if I die without a will?

How often should I update my will?

Can I change my will after it’s written?

What’s the difference between a will and a living will?

How can a testamentary trust benefit my heirs?

How does a will affect taxes on my estate?

Download Last Will and Testament Bundle

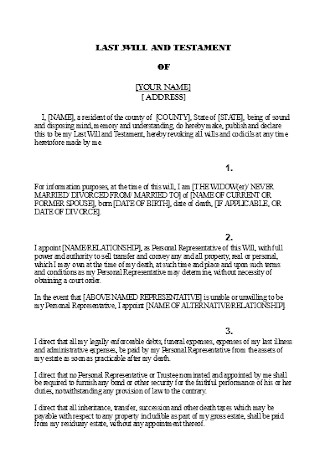

Last Will and Testament Format

Last Will and Testament of [Your Full Name]

1. Introduction

I, [Your Full Name], of [Your Full Address], being of sound mind and memory, do hereby declare this document to be my Last Will and Testament, revoking any and all prior wills and codicils made by me.

2. Declaration

This is my final will, and I make this declaration willingly and without any duress.

3. Personal Information

- Full Name: [Your Full Name]

- Date of Birth: [Your Date of Birth]

- Address: [Your Full Address]

4. Appointment of Executor

I appoint [Executor’s Full Name], of [Executor’s Full Address], to be the Executor of my estate. If [Executor’s Name] is unable or unwilling to serve, I appoint [Alternate Executor’s Name], of [Alternate Executor’s Address], as the alternate Executor.

5. Distribution of Assets

I direct that my property, both real and personal, be distributed as follows:

A. Real Estate

- I leave [Property Description or Address] to [Beneficiary’s Full Name], of [Beneficiary’s Full Address].

B. Personal Property

- I leave [Description of Personal Property, such as jewelry, furniture, etc.] to [Beneficiary’s Full Name], of [Beneficiary’s Full Address].

C. Financial Assets

- I leave [Description of Financial Assets, such as bank accounts, stocks, etc.] to [Beneficiary’s Full Name], of [Beneficiary’s Full Address].

D. Residue of Estate

I leave the residue of my estate (whatever is left after all specific bequests have been distributed) to [Beneficiary’s Full Name], of [Beneficiary’s Full Address]. If [Beneficiary’s Name] does not survive me, then I leave the residue to [Alternate Beneficiary’s Full Name], of [Alternate Beneficiary’s Address].

6. Guardianship

If I have minor children at the time of my death, I appoint [Guardian’s Full Name] as the legal guardian of my children. If [Guardian’s Name] is unable or unwilling to serve, I appoint [Alternate Guardian’s Name] as the alternate guardian.

7. Debts and Expenses

I direct that all my debts, taxes, and final expenses be paid as soon as possible by my Executor.

8. Funeral Arrangements

I wish [specific funeral arrangements, if any].

9. Signatures

Testator:

I, [Your Full Name], the Testator, sign my name to this Will on this [Day] of [Month], [Year].

Signature: ________________________

Date: ___________________________

Witnesses:

We, the undersigned, do hereby certify that [Your Full Name], known to us, declared this document to be [his/her/their] Last Will and Testament and signed it in our presence. We, at [his/her/their] request and in [his/her/their] presence, sign our names as witnesses on this [Day] of [Month], [Year].

- Witness 1:

Name: ____________________

Address: ___________________

Signature: __________________ - Witness 2:

Name: ____________________

Address: ___________________

Signature: __________________

What is a Last Will and Testament?

A Last Will and Testament is a legal document that contains instructions and details on how a person wants their estates, belongings, and wealth to be distributed among the living members of their family. The recipients, however, are not limited to the family of the person. It can also be given to private organizations that were supported by the deceased. It can also contain details regarding the guardianship of the dependents. There are also last wills that contain stipulations about conditional gifts to some benefactors, a simple example for this is when the partition is awarded only when the beneficiary accomplishes a certain goal. Special instructions regarding the burial are also commonly included in a last will. The last will and testament covers all the possible living situations in cases of unforeseen and immediate death. You can also see more on Codicil to Will.

Types of Last Will and Testaments

As popularized by the media, last will and testaments are usually hidden in vaults and waxed envelopes to avoid unwanted changes from some people who want to own more for themselves by taking advantage of others. What we usually see on television is only one type of will. It comes in different forms depending on its form and general purpose. You can also see more on Living Will.

How to Write a Last Will and Testament

Writing a last will and testament is not as simple as directly assigning something to a chosen benefactor. It needs a proper and thorough introduction, which encompasses several elements that make it legal and authoritative. It also needs to be specific; every detail needs to be stated clearly and directly. Ultimately, a last will and testament includes the declaration of the executor, beneficiaries, and the partitions of the testator’s properties. You can also see more on Affidavit of Death.

Step 1: List Your Assets and Liabilities

Start by making a detailed list of all your assets, such as real estate, personal property, investments, and bank accounts. Include any liabilities, like outstanding debts or loans. This comprehensive list will serve as the foundation for your will, ensuring all your possessions are accounted for and can be distributed according to your wishes.

Step 2: Decide on Beneficiaries

Choose who will inherit your assets. Beneficiaries can be family members, friends, or charitable organizations. Specify what each beneficiary will receive, ensuring a clear distribution plan. This step is crucial to prevent any misunderstandings or disputes among heirs and to ensure that your wishes are honored after your passing. You can also see more on Affidavit for Proof of Identity.

Step 3: Select an Executor

Appoint a trusted person as your executor. This individual will be responsible for managing your estate, settling debts, distributing assets, and handling any legal matters after your death. Make sure the person you choose is willing and capable of fulfilling this role, as it carries significant responsibility.

Step 4: Name Guardians for Minor Children (if applicable)

If you have minor children, it’s essential to appoint a guardian in your will. This person will take care of your children if both parents pass away. Discuss this with the potential guardian to confirm their willingness to take on the responsibility, ensuring your children’s well-being is secured. You can also see more on Minor Child Power of Attorney.

Step 5: Finalize and Legalize the Will

Once your will is complete, sign it in the presence of witnesses and have it notarized to make it legally binding. Review it with a lawyer to ensure it complies with state laws and covers all necessary details. Store the original copy in a secure place, like a safe deposit box, and inform your executor of its location.

Creating a Last Will and Testament is a crucial step in ensuring your assets are distributed according to your wishes. It helps avoid legal issues, protects loved ones, and secures your legacy. Preparing one offers peace of mind and a sense of security for your family’s future. You can also see more on Real Estate Marketing.

FAQS

What happens if I die without a will?

If you die without a will, your estate will be distributed according to your state’s intestacy laws. This could result in assets going to unintended heirs, and the process may be lengthy and costly for your family.

How often should I update my will?

You should review and potentially update your will every 3-5 years or after major life events such as marriage, divorce, birth of a child, or a significant change in financial status. You can also see more on Small Estate Affidavit.

Can I change my will after it’s written?

Yes, you can change your will by adding a codicil or creating a new will. The changes must be signed, witnessed, and notarized to be legally effective.

What’s the difference between a will and a living will?

A Last Will and Testament deals with the distribution of assets after death, while a living will outlines medical treatment preferences if you become incapacitated. Both documents serve different purposes in estate planning. You can also see more on Affidavit of Personal.

How can a testamentary trust benefit my heirs?

A testamentary trust helps manage assets for beneficiaries, especially minors, ensuring they are financially secure. It distributes assets over time rather than as a lump sum, providing more control over the inheritance.

How does a will affect taxes on my estate?

A will itself doesn’t determine estate taxes, but it directs how assets are distributed. Depending on the estate’s value, taxes may apply, and the executor is responsible for managing and paying these taxes before distributing assets. You can also see more on Affidavit of Domicile.