33+ Sample Deed of Trusts

-

Warranty Deed of Trust

download now -

Mortagage Deed of Trust

download now -

Deed of Trust Rider Template

download now -

Deed of Declaration of Trust

download now -

Release Deed of Trust

download now -

Understanding Deedd of Trust

download now -

Multi Beneficiary Deed of Trust

download now -

Commercial Deed of Trust

download now -

Supplementary Deed of Trust

download now -

Deed of Trust and Security Agreement

download now -

Trust Deed of Married Daughter

download now -

Promissory Note Deed of Trust

download now -

Sample Warranty Deed in Trust

download now -

Education Trust Deed

download now -

Quit Calm Deed in Trust Form

download now -

Environmental Deed of Trust

download now -

Deed of Trust with Assigment of Rents

download now -

Model Trust Deed

download now -

Promissory Note By Deed of Trust

download now -

Model Trust of Deed Specials Disability

download now -

Leasehold Deed of Trust

download now -

Debenture Trust of Deed

download now -

Deed of Trust and Assignment of Rents

download now -

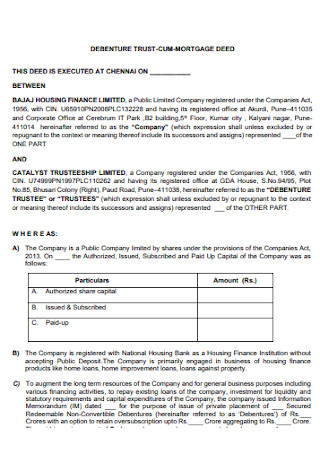

Debenture Trust Cum Mortgage Deed

download now -

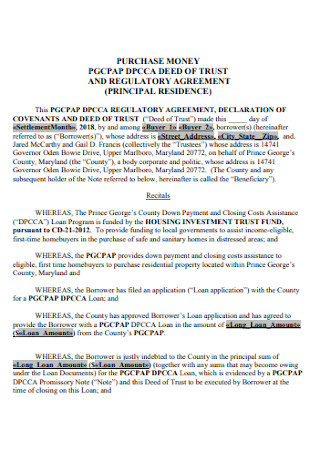

Deed of Trust and Regulatory Agreement

download now -

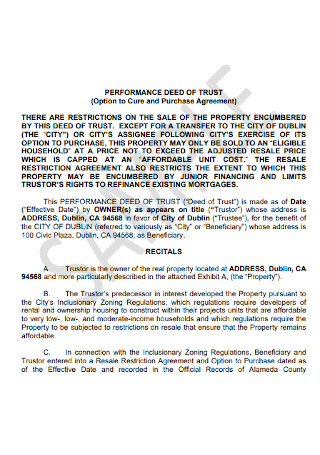

Performance Deed of Trust

download now -

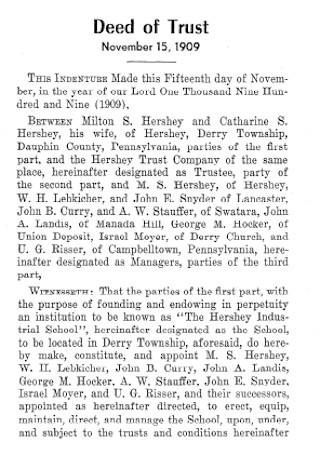

School Deed of Trust

download now -

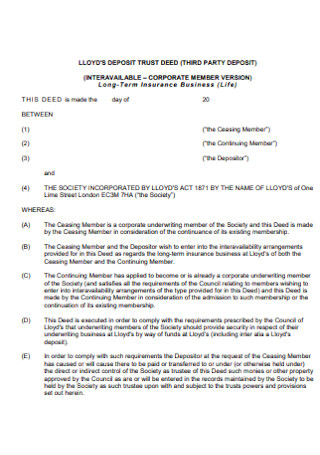

Deposit Deed of Trust

download now -

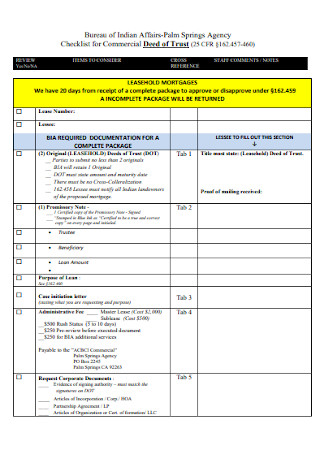

Checklist for Commercial Deed of Trust

download now -

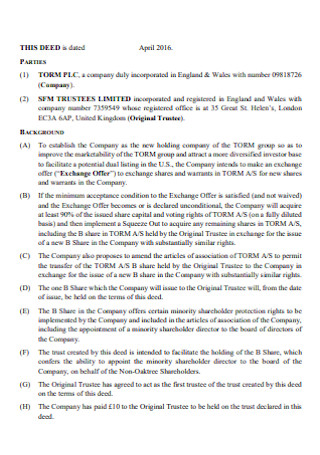

Share Deed of Trust

download now -

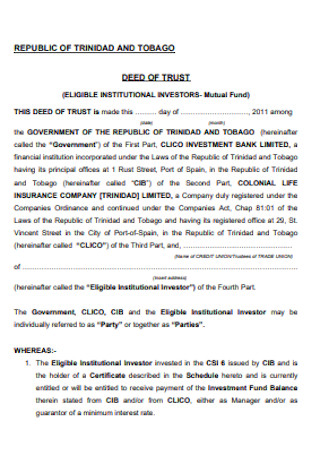

Tobago Deed of Trust

download now -

Amended and Rested Deed of Trust

download now -

Deed of Trust Right of Survivorship

download now -

Deep Education Trust

download now

FREE Deed of Trusts s to Download

33+ Sample Deed of Trusts

What Is a Deed of Trust?

Elements of a Deed of Trust

How To Create a Deed of Trust?

FAQs:

In a Deed of Trust, who may I appoint as a trustee?

When Should I Use a Deed of Trust?

What Happens If I Don’t Fill Out a Deed of Trust?

Is it Possible to Use a Deed of Trust Anywhere?

A deed of trust is a document that secures a loan on real estate. Learn how a lender can use this legal form to easily collateralize a loan. It effectively uses a piece of real estate as security for a loan. Although a deed of trust can be used in place of a mortgage, it has a different function and makes foreclosing on a property easier for the lender.

In states where mortgages are not allowed, a Deed of Trust can be used instead. It can also be utilized in situations where a typical bank or lender is unable to fund the loan. Whether you have a mortgage or a Deed of Trust, both are methods for ensuring that a debt is repaid to the person or lender from whom you borrowed. Trust deeds aren’t as frequent as they used to be. These agreements are not the same as mortgages, despite the fact that they serve the same objective as a land security agreement. Everyone engaged in a typical mortgage has a stake in the outcome. A Deed of Trust, on the other hand, involves an independent trustee.

Since the trustee must be willing to sell the property to satisfy the loan if the borrower defaults, he must be unbiased in this arrangement. To ensure that the trustee does not try to influence the price in favor of either the borrower or the lender, all jurisdictions require the trustee to remain impartial. A Deed of Trust foreclosure sale does not have to follow the same procedures as a judicial foreclosure, which has stricter restrictions and a higher level of accountability; in most jurisdictions, a Deed of Trust foreclosure sale does not require court supervision. Are you looking for a sample, printable templates that you can use? You came to the right website! Scroll down to know more about a Deed of Trust and to download our templates for free.

What Is a Deed of Trust?

When real property is used as collateral for a loan, a deed of trust is used. If the loan is not paid, the lender has the right to obtain the proceeds of the property’s auction sale. Unlike a warranty deed, which conveys the owner’s rights in the property to the buyer immediately, a deed of trust does not transfer title to a property until the loan is paid off. A deed of trust is a legal document used to transfer property in real estate. Three persons, including the borrower, the lender, and the trustee for the property, may collaborate on the deed. The form will also include personal information about these individuals.

To transfer property and begin financing, this sort of deed might be used instead of a mortgage. It can also be used to finish loans for purposes other than real estate. Because a deed of trust deals with money, it’s critical to include as much information about payments and due dates as feasible. Because a deed of trust can be a legally binding contract, it must be precise and professional. An expert legal firm can assist you in drafting a deed of trust for your personal transaction, ensuring that all parties are protected in the event of a disagreement.

Elements of a Deed of Trust

If you’re going to write or encounter a deed of trust template, there are elements that you should always consider and understand. In this way, you get to know what they are, what they consist of and what information should be included in those elements. Learn more about them below:

How To Create a Deed of Trust?

A trust deed, also known as a deed of trust, is a deed in which legal title to real property is transferred to a trustee, who retains it as security for a loan (debt) between a borrower and a lender in the United States. The lender is referred to as the beneficiary of the trust deed, while the borrower is referred to as the trustor. In comparison to a mortgage, a trust deed provides a significant advantage. The trustee has the authority to foreclose on the property on behalf of the beneficiary if the borrower fails on the loan. A trust deed (but not a mortgage) can contain a particular “power of sale” clause that allows the trustee to utilize these powers in most U.S. states. Scroll down below to know how to create a deed of trust

1. Identify the features that a deed of trust includes

A trust deed is made up of several components. In some ways, it resembles a mortgage in terms of features. Other components of the deed of trust are similar to those of a typical property deed. Let’s go through what the deed of trust entails in detail:

- Amount of the Initial Loan

The original loan amount is the sum given to you by the lender or another trust beneficiary in order for you to purchase the home. This is usually the home’s agreed-upon purchase price minus the down payment. This is significant because it informs you of the exact amount that must be paid off by the end of the loan term to meet the loan’s terms and dissolve the trust.

- Description of the property

A deed of trust, like a standard deed, offers a full description of the property being purchased. It specifies in detail what the trustor is entitled to, providing that they fulfill all of the trust’s requirements for debt repayment.

- The Loan’s Duration

The loan period, often known as the loan term, indicates the time frame in which the loan must be paid off. If you’re negotiating with a single individual, this phrase can be whatever you both agree on. If you work with a traditional lender, your loan duration could range from 8 to 30 years, depending on the sort of loan you want and your financial goals, as well as what you can afford. The loan terms do not always imply that you must just make planned payments and wait 30 years to pay it off. You can pay off the loan sooner and save money if you follow the terms of the loan.

- Conditions for obtaining a loan

In order to provide you the loan, a lender may set certain conditions, just as they would with a regular mortgage. You may, for example, be required to live in the property as your principal residence for a particular period of time. Depending on the type of loan you have, you may also be required to pay mortgage insurance for a set amount of time or for the life of the loan. One of the most important things to know is whether or not there is a prepayment penalty and, if so, for how long. If you pay off your mortgage within the first three years after purchasing a home, for example, you may face a penalty. Prepayment penalties are not charged by Quicken Loans®.

- Clause of Sale Power

A power of sale clause specifies the circumstances in which a trustee may sell a beneficiary’s property. This usually only applies if you default on your mortgage. Because it is a nonjudicial foreclosure, a deed of trust has a substantially faster foreclosure process. There is no need for the courts to get involved if the terms of the deed of trust governing power of sale are followed, which speeds up the process. Because a court foreclosure with all of its protections isn’t what happens when you do a deed of trust, it’s critical to understand your rights and obligations under this power of sale clause.

2. Acquire a deed of trust form

Before you can continue, you now have to acquire your own deed of trust form, you can download a printable and editable template that can be found here in the website or you can also ask from your lawyer.

3. Fill out the form

In the first section of our deed of trust form, you’ll put in the relevant parties’ names, addresses, and other pertinent information. This section normally takes the longest to finish, but it’s really simply a matter of gathering and entering the necessary data. You’ll add one or more legal descriptions of the property in the next section. If you don’t already have the legal property description, you can get it by calling or going online to your county register or recorder of deeds and supplying the property address or tax parcel number.

4. Include the terms of repayment

After that, you’ll enter the main repayment conditions. These can be found on the promissory note and will be agreed in advance by the parties. This information is provided solely for the purpose of reference. Outline the principle amount owed, the interest rate, how interest is computed (annually, semi-annually, or monthly), the address where payments are to be sent, and when the interest adjustment date is, if any, from the promissory note.

5. Execute the agreement

The parties merely sign and date the agreement in the presence of a notary or witnesses to put it into effect. In most states, only one notary is required to act as a witness. In Arkansas and Georgia, however, two witnesses are necessary to sign deeds of trust. A notary can sign in place of one of the witnesses in these states.

FAQs:

In a Deed of Trust, who may I appoint as a trustee?

The trustee is a neutral third-party who keeps the legal title to the property as collateral for the loan until the lender’s money is repaid or the borrower defaults in a Deed of Trust. Escrow agents are a term used to describe trustees. The procedure of a third-party securing a transaction is known as escrow (in the case of the sale of real estate, they are holding the title of the property until the loan agreement is satisfied or dissolved). An attorney or a title business is usually the escrow agent (trustee). A title business verifies the legitimacy of real estate titles and insures the property. Title insurance protects both the lender and the borrower from any litigation arising from title issues.

When Should I Use a Deed of Trust?

In real estate transactions, a Deed of Trust is an important security mechanism. Lenders will want additional assurance that the money they lend to Borrowers will be repaid, especially in light of the 2008 housing crisis and today’s unpredictable economy. If a Borrower stops paying, this agreement allows a Lender to swiftly sell and recoup some of their money at a cheap cost and with little fuss. Many states are shifting away from Mortgage Agreements and allowing lenders to use Deeds of Trust as a result of this ease.

What Happens If I Don’t Fill Out a Deed of Trust?

Borrowers may default on their debts for a variety of reasons, including job loss, bankruptcy, unforeseen medical costs, a big weekend in Las Vegas, or simply making a calculated decision, to mention a few. If the Borrower stops making payments without this agreement, the Lender is in a lot of trouble. The Lender would have no remedy against the Borrower and would be forced to go to court and queue alongside other creditors in order to get any money.

Is it Possible to Use a Deed of Trust Anywhere?

Both deeds of trust and mortgages are governed by state law. Some states only allow mortgages, while others only allow deeds of trust to be used by lenders. Only a few states accept both types of contracts. In these states, the lender has complete control over the type of loan agreement that a borrower receives. Some states do not employ mortgages or deeds of trust for loan transactions, instead relying on other instruments such as security deeds to give lenders a security interest in the property.