16+ SAMPLE Audited Financial Statement

-

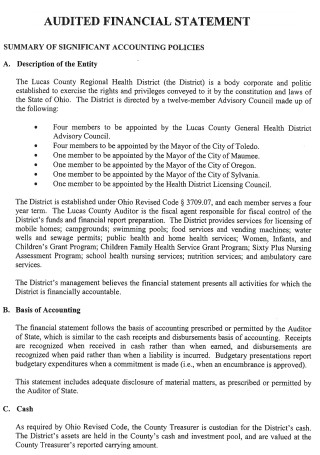

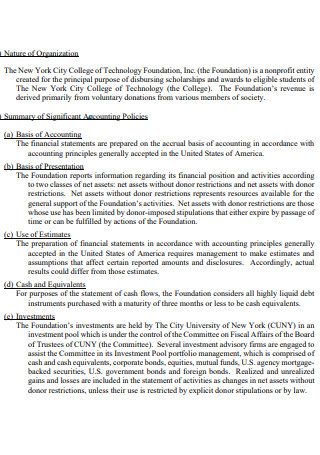

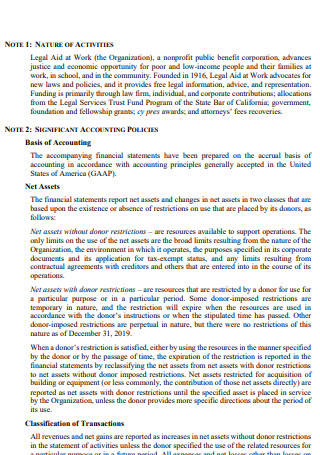

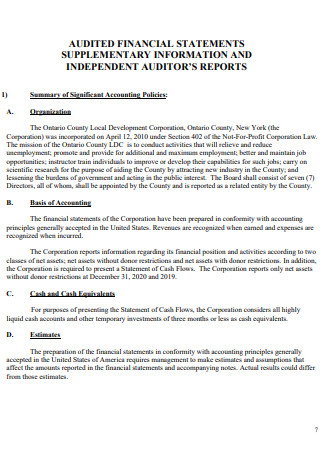

Audited Financial Statement Requirements

download now -

Guidelines for Preparing Audited Financial Statement

download now -

Final Audited Financial Statement

download now -

Sample Audited Financial Statement

download now -

Consolidated Audited Financial Statement

download now -

Audited Financial Statement

download now -

Approved Lender Audited Financial Statement

download now -

Management Responsibility Audited Financial Statement

download now -

Audited Financial Statement And Supplement Information

download now -

Commitee Audited Financial Statement

download now -

Financial Report Audited Financial Statement

download now -

Year Audited Financial Statement

download now -

PAN Audited Financial Statement

download now -

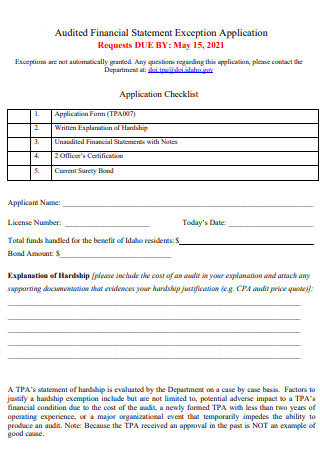

Audited Financial Statement Exception Application

download now -

Audited Consolidated Financial Statement

download now -

Understanding Audited Financial Statements

download now -

Statutory Audited Financial Statements

download now

FREE Audited Financial Statement s to Download

16+ SAMPLE Audited Financial Statement

What Is an Audited Financial Statement?

What Are the Stages of an Auditing Process?

Components of an Audited Financial Statement

Types of Audited Financial Statements

What Are the Different Types of Audits?

Steps in the Audit Process

FAQs

What is an Audit?

What is an Auditor’s Opinion?

Who is qualified/Who should prepare an audited financial statement?

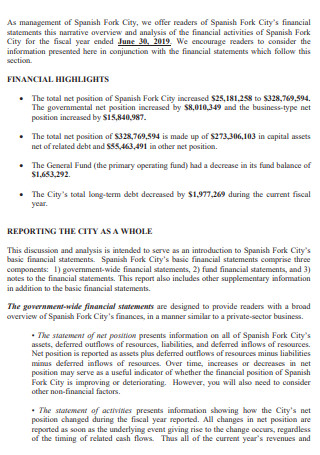

What Is an Audited Financial Statement?

By simple definition, an audited financial statement is a business document that is audited by a certified public accountant. When a financial statement is being audited by a certified public accountant, the financial statement is being checked to make sure that it conforms to the accounting principles and the standards that are set by auditing. An audited financial statement also guarantees the lenders and/or investors that everything presented in the statement is accurate.

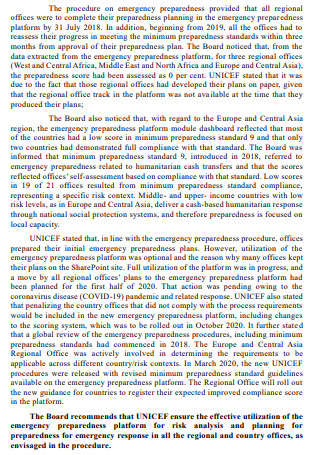

What Are the Stages of an Auditing Process?

There are three stages of an auditing process, all of which are discussed down below:

- Planning Stage – This is also known as the planning and risk evaluation stage. Prior to entering this stage, the auditor involved must possess a great understanding of the business he/she is auditing and the environment in which the business operates, competitive or not. The knowledge and understanding are then used by the auditor to identify and assess any risks that can have an impact on how valid the financial statement is.

- Testing Stage – In this stage, the internal controls of the company are tested. In other words, the auditor then performs an analysis of the effectiveness of the company’s internal control procedures. The analysis focuses on the limits of employee authorizations, asset protection and preservation, and duty separation. A strength test of the control procedures is also performed. If the auditor finds it to be effective, more intense auditing procedures will follow. If not, other types of financial examinations are going to be conducted to determine how accurate the financial statements are.

- Substantive Procedures – This is the stage wherein the auditors make use of a substantial amount of investigative procedures to begin verifying the validity and the accuracy of the company’s financial data. The fully audited statements of the company are usually the ones that are subjected to the most intense scrutiny in order to verify if it’s valid and accurate.

Components of an Audited Financial Statement

Expanding on the third stage of the auditing process, here are the processes that can be found in a fully audited financial statement:

Types of Audited Financial Statements

Listed below are the different types of audited financial statements:

What Are the Different Types of Audits?

Here are the different types of audits which may vary depending on the type of business:

- Internal Audit – Internal audits are performed within your company. Internal audits can be used by businesses with shareholders or board members to keep them up to speed on the financial status of their company. Internal audits are also a useful approach to keep track of financial goals. Internal audits are commonly performed for a variety of purposes, including suggesting changes, assessing operational procedures, checking and confirming financial information, and so on.

- External Audit – An external audit is a type of audit that is conducted by an external party, such as an accountant, a government agency (such as the IRS), or a tax agency. The external auditor has no ties to your company, and they must adhere to generally accepted auditing standards. The primary goal of an external audit, like that of internal audits, is to determine the correctness of accounting records. External audits are often required by investors and lenders to confirm that the business’s financial information and data are accurate and fair.

- Financial Audit – One of the most prevalent forms of audit is a financial audit. The majority of financial audits are performed by third parties. The auditor examines the fairness and correctness of a company’s financial accounts during a financial audit. To conduct a financial audit, auditors examine transactions, procedures, and balances. Following the audit, the third party often issues an audit opinion regarding your company to lenders, creditors, and investors.

- Compliance Audit – A compliance audit evaluates your company’s policies and processes to see if they meet internal or external requirements. Compliance audits can assist in determining if your company is in compliance with paying workers’ compensation or shareholder payouts. This type of audit can also assist you in determining if your company is in compliance with current legislation.

- Operational Audit – An operational audit examines your company’s objectives, planning processes, procedures, and operational outcomes. The purpose of an operational audit is to thoroughly assess your company’s operations and identify areas for improvement. In most cases, operational audits are carried out internally. however, operational audits can also be performed by a third party.

- Payroll Audit – A payroll audit verifies the accuracy of your company’s payroll systems. Payroll audits should look at several payroll aspects such as pay rates, salaries, tax withholdings, and employee records. Businesses should undertake internal payroll audits on a yearly basis to ensure that their payroll systems are error-free and that they are in compliance with existing regulations.

Steps in the Audit Process

The auditing process can help uncover many inconsistencies in your financial reports and iron them out, identify weaknesses in your controls, and help increase confidence during your financial reporting process. With that being said, here are the steps of an auditing process:

-

1. Engagement Process

This is usually what happens first in the audit process. In this step, an engagement letter is signed by the company once an auditing firm has been selected. The auditor will next put together your audit team, create a timetable, and describe the extent of the audit queries and onsite fieldwork. Following that, the auditor will normally request documents from a preliminary audit checklist. A copy of the prior audit report, as well as actual bank statements, receipts, and ledgers, may be included in these papers. Furthermore, the auditor may obtain organizational charts, as well as files of the board and committee minutes, bylaws, and standing rules.

-

2. Risk Assessment

After signing an engagement letter and preparing the necessary documents, the risk assessment then follows. The main goal of conducting an audit is to determine whether the financial statements of a company are free from any substantial misrepresentations. The management, as well as third-party stakeholders that rely on your financial statements, will certainly want the statements to be accurate and in accordance with established accounting standards. Auditing standards require auditors to evaluate both general business risks and industry- and company-specific hazards. The evaluation assists auditors in determining which accounts to focus audit processes on, as well as developing audit methods to reduce potential risks.

-

3. Planning Phase

After conducting a risk assessment, the planning phase of the audit process then follows suit. In this step, The audit firm produces a comprehensive audit plan based on the risk assessment to evaluate the internal control environment and probe the correctness of individual line items in the financial statements. The auditors then assign members of the audit team to concentrate on each component of the plan.

-

4. Fieldwork/Gathering of Evidence

After the planning phase of the audit process, this step then follows. What happens in this step? Well, the auditors examine and assess internal controls while on the job. The auditor then uses the information acquired during the risk assessment to finalize the audit plan. Following that, fieldwork is carried out by chatting with staff members and evaluating procedures and processes. The auditor verifies that policies and procedures are followed. Internal controls are audited to ensure that they are adequate. The auditor may raise issues as they occur in order to provide the organization with a chance to respond. Auditors may also call third parties, such as your company’s suppliers or customers, during this phase to check transaction data or account balances.

-

5. End of the Process

This is the last step of the auditing process. In this step, the auditors will set up a meeting and communicate their findings. The auditor creates some sort of opinion about the accuracy and integrity of the company’s financial statements at the end of the audit procedure. To do so, they depend on quantitative data, such as testing results, as well as qualitative data, such as remarks supplied by the company’s workers and management. Afterwards, the auditors then make a report on the financial statements, judging them if they present an accurate representation of the performance of the company and if they conform to the applicable standards.

FAQs

What is an Audit?

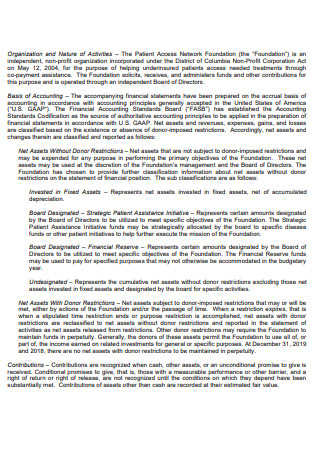

An audit is defined as the process of a thorough study of the financial records of a particular company along with their subsequent internal control systems by an independent auditor who attests to the fairness and correctness of the financial statements’ content. This process may be performed internally by the employees of the particular company or they can use the services of a certified public accountant to conduct this process externally. A complete audit is the most thorough and reliable review that an accountant can provide.

What is an Auditor’s Opinion?

An auditor’s opinion refers to a type of certificate that is issued in conjunction with financial statements. An auditor’s opinion is based on an audit of the methods and records used to prepare the financial statements and provides an opinion on whether there are any serious misstatements in the financial statements. It is usually known as an accountant’s opinion. It is typically presented in an auditor’s report, which includes multiple sections, such as an introductory section, a section identifying the financial statements in question, another section outlining the auditor’s opinion on those financial statements, and an optional fourth section that may supplement additional relevant information.

Who is qualified/Who should prepare an audited financial statement?

Any type of business, whether big or small, that intends to submit its financial records to investors or lenders should prepare audited financial statements. The great majority of potential financiers for your business will require audited financial statements rather than unaudited financial accounts since the latter offers significantly less space for error. Furthermore, if your firm is publicly listed, you must provide yearly copies of your audited financial statements.

An audit should be frequently conducted inside your business so that a proper understanding of its different aspects is reached. It is also important that an audit process should happen because it lets you detect mistakes as they happen before they get even worse. Without this process being done, who knows how accurate the financial statements of your company are?