Business Budget Samples

-

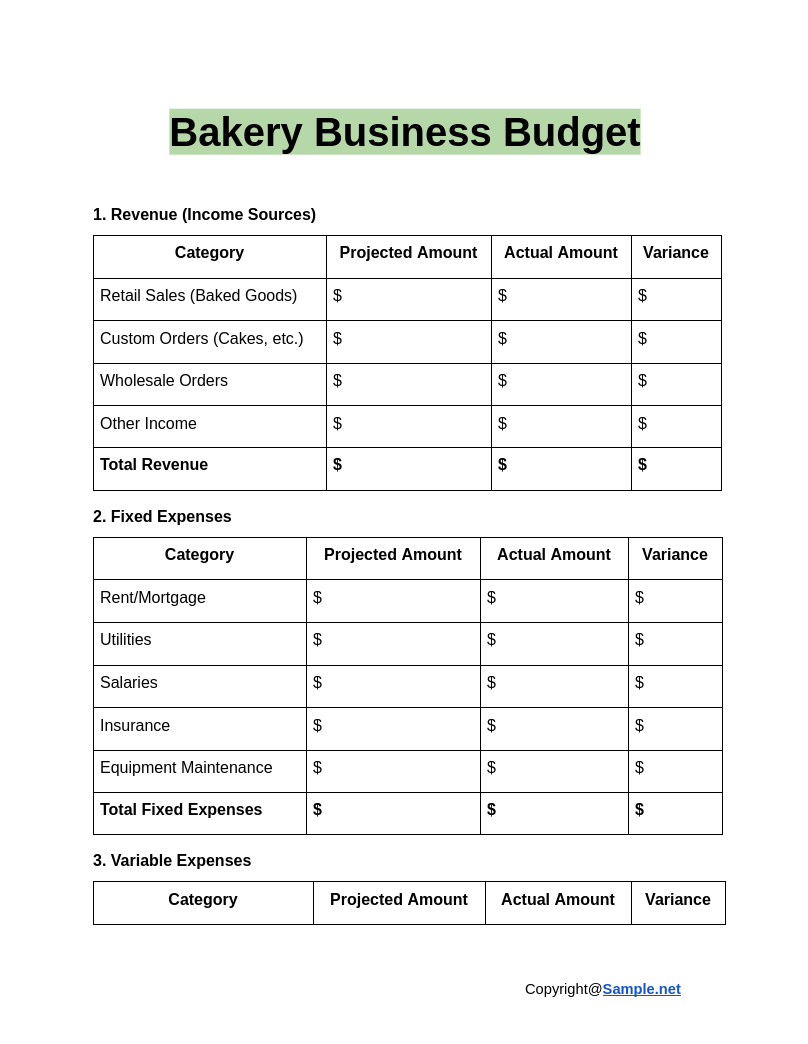

Bakery Business Budget

download now -

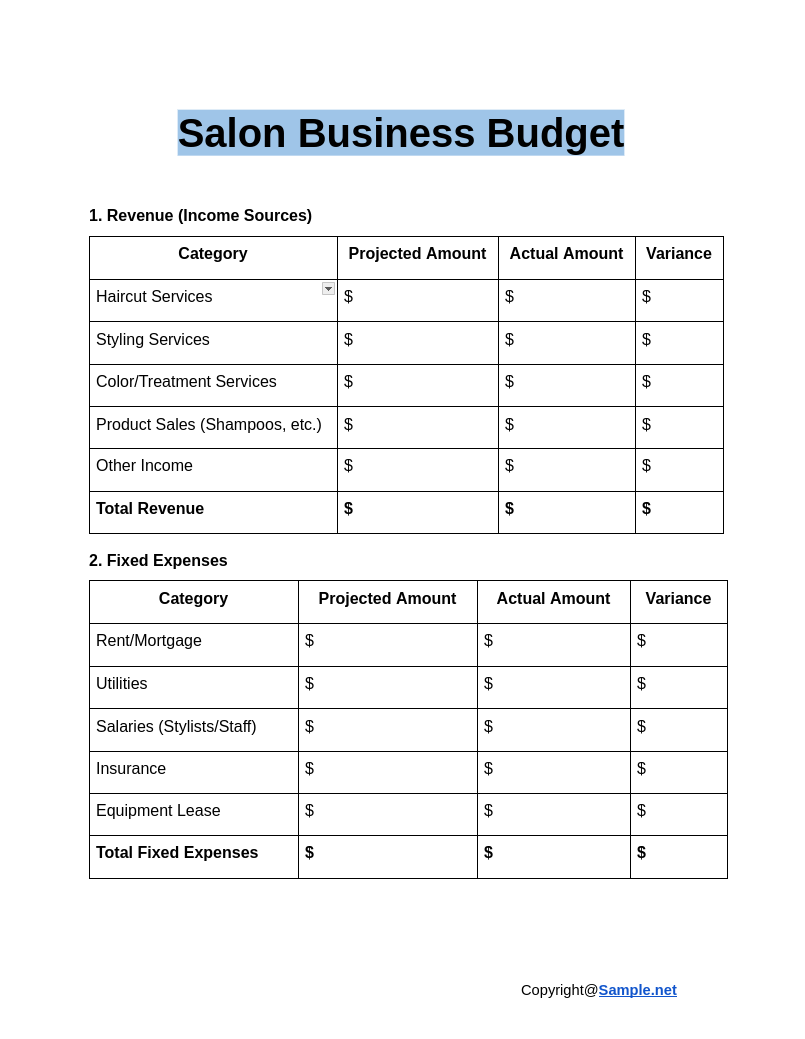

Salon Business Budget

download now -

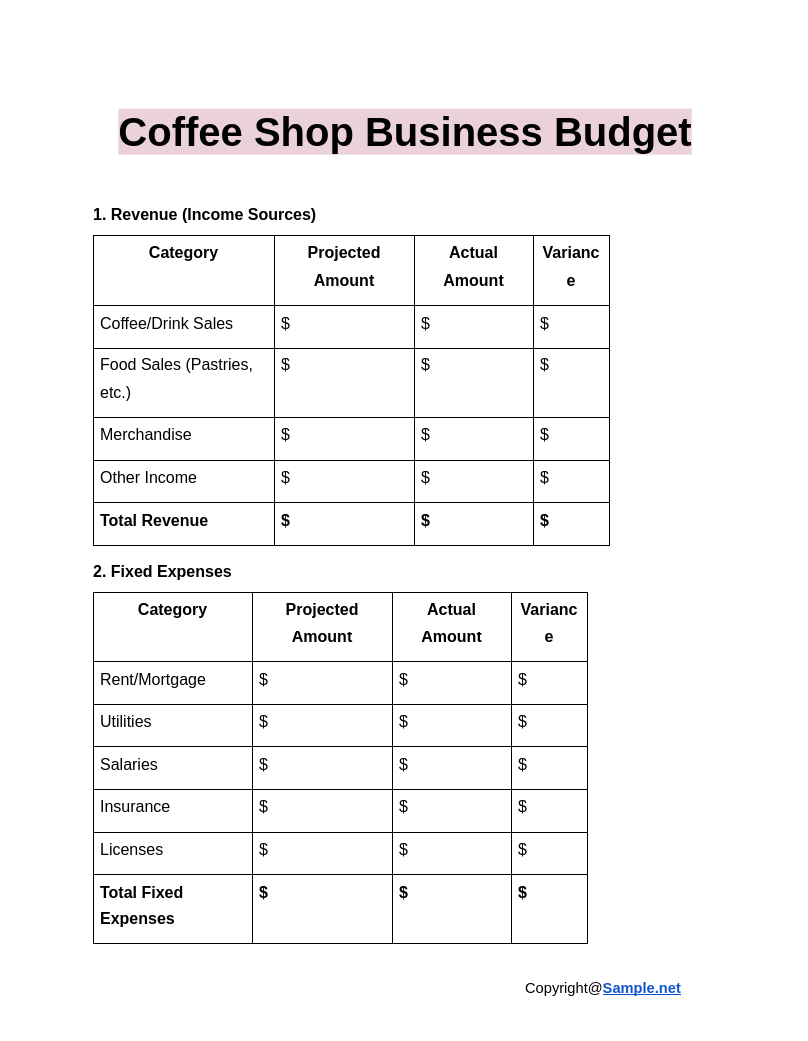

Coffee Shop Business Budget

download now -

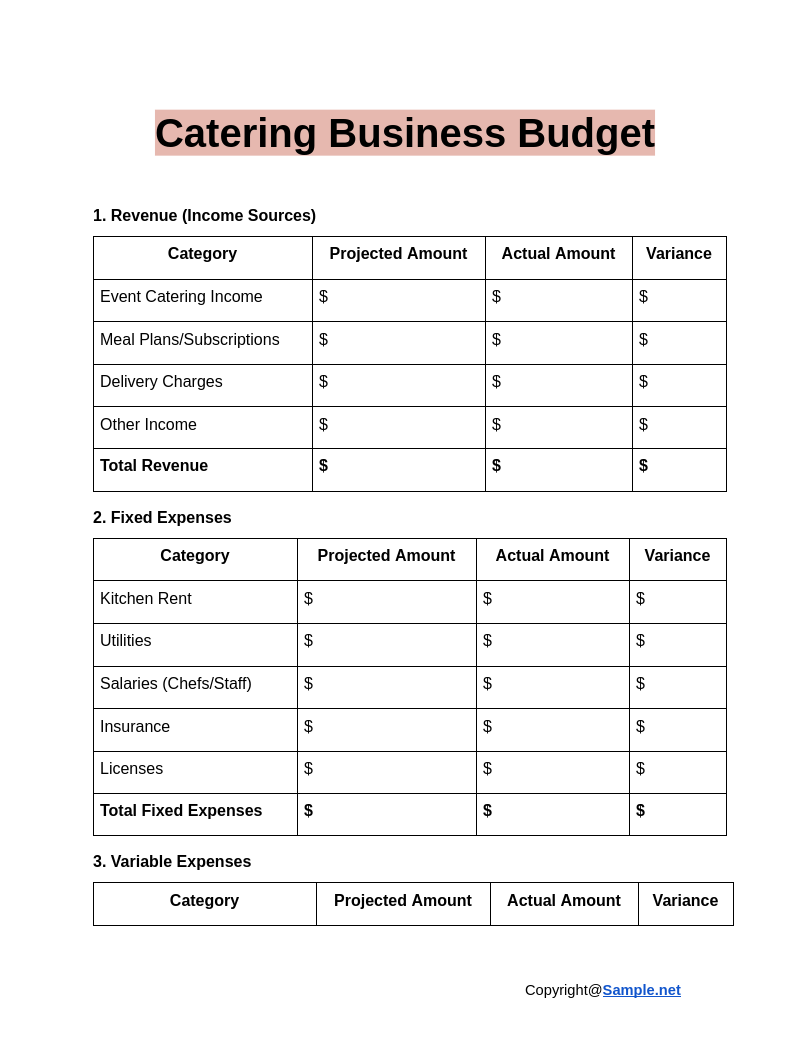

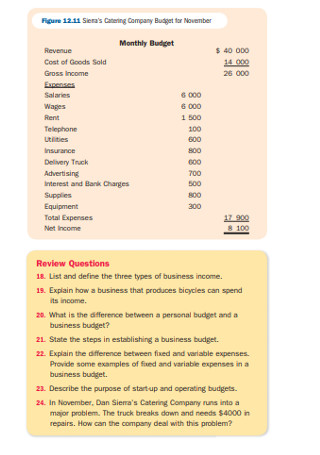

Catering Business Budget

download now -

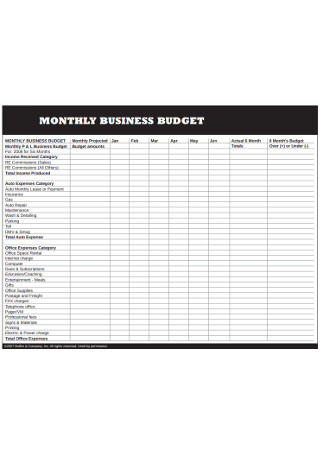

Monthly Business Budget

download now -

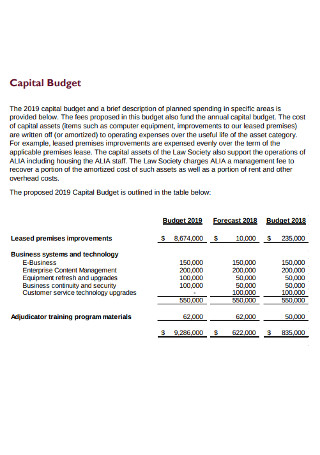

Business Capital Budget Example

download now -

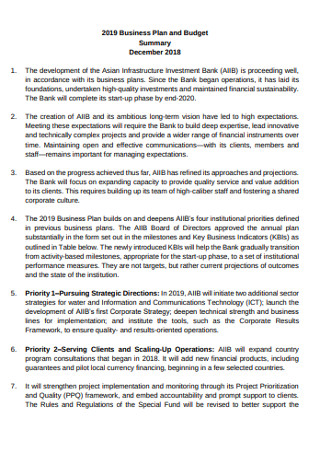

Business Plan and Annual Budget

download now -

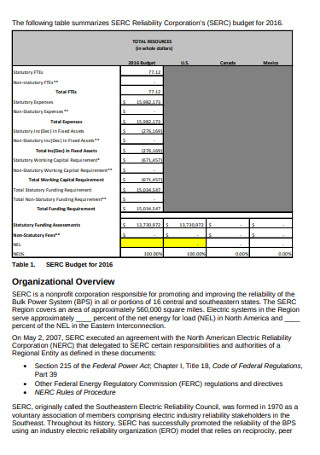

Sample Business Budget

download now -

Business Sales Budget Template

download now -

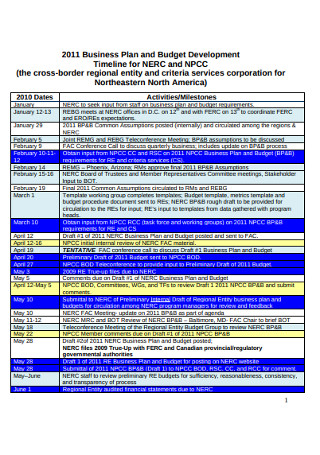

Business Development Plan and Budget

download now -

Annual Business Budget Plan

download now -

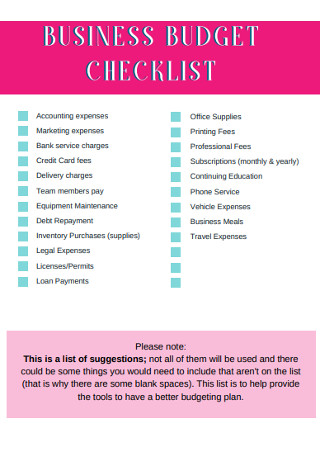

Business Budget Checklist

download now -

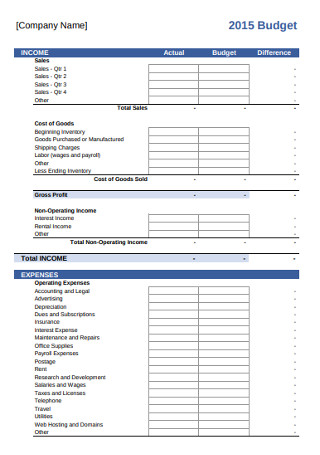

Company Business Budget

download now -

Small Business Budget Template

download now -

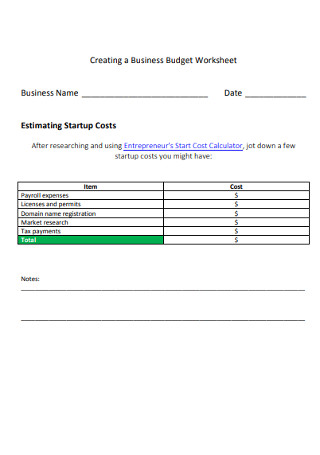

Business Budget Worksheet

download now -

Business Budget Analyst Template

download now -

Company Business Monthly Budget Template

download now -

Basic Business Plan and Budget

download now -

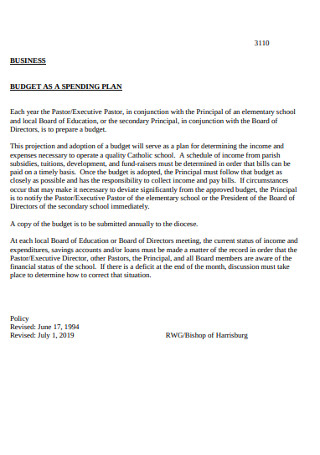

Business Budget Spending Plan

download now -

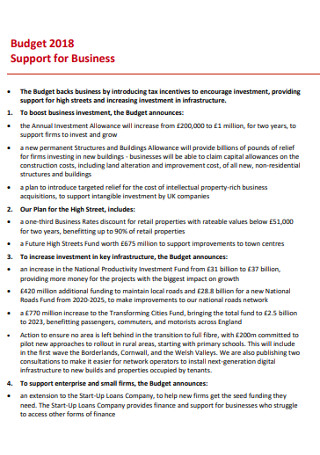

Business Support Budget

download now -

Simple Business Budget Template

download now -

Business Budget Statement Template

download now -

Business Committee Budget

download now -

Standard Business Budget

download now -

Formal Business Plan Template

download now -

Event Business Budget Template

download now -

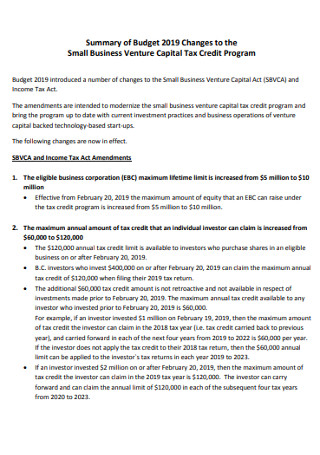

Small Business Venture Budget

download now -

Company Annual Business plan Template

download now -

Formal Business Budget Template

download now -

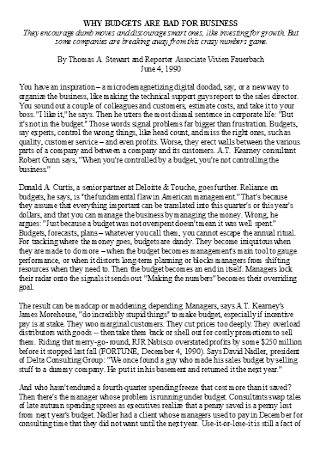

budget for Bad Business Template

download now -

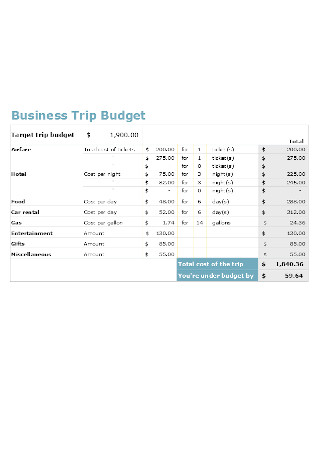

Business Trip Budget Template

download now

FREE Business Budget s to Download

Business Budget Format

Business Budget Samples

What is a Business Budget?

What are the Consequences of Poor Budgeting in Business?

Getting Started: How to Improve Your Business Budgeting Habits

FAQS

How often should a business budget be reviewed?

How do operational budgets differ from capital budgets?

What challenges might businesses face when creating a budget?

How does a budget influence strategic decision-making?

What is the role of cash flow in budgeting?

Download Business Budget Bundle

Business Budget Format

1. Header Information

- Business Name

- Budget Period: (e.g., January 2024 – December 2024)

- Prepared By: (Name/Role)

- Date Prepared

2. Summary

- Total Revenue: (Sum of all income sources)

- Total Expenses: (Sum of all expenses)

- Net Profit/Loss: (Revenue – Expenses)

3. Revenue (Income Sources)

| Category | Projected Amount | Actual Amount | Variance |

|---|---|---|---|

| Product Sales | $ | $ | $ |

| Service Revenue | $ | $ | $ |

| Other Income | $ | $ | $ |

| Total Revenue | $ | $ | $ |

4. Fixed Expenses (Monthly/Annual)

| Category | Projected Amount | Actual Amount | Variance |

|---|---|---|---|

| Rent/Mortgage | $ | $ | $ |

| Salaries/Wages | $ | $ | $ |

| Utilities | $ | $ | $ |

| Insurance | $ | $ | $ |

| Depreciation | $ | $ | $ |

| Total Fixed Expenses | $ | $ | $ |

5. Variable Expenses

| Category | Projected Amount | Actual Amount | Variance |

|---|---|---|---|

| Marketing/Advertising | $ | $ | $ |

| Raw Materials | $ | $ | $ |

| Shipping/Delivery | $ | $ | $ |

| Miscellaneous | $ | $ | $ |

| Total Variable Expenses | $ | $ | $ |

6. Capital Expenditures (Investments in Assets)

| Item | Projected Amount | Actual Amount | Variance |

|---|---|---|---|

| Equipment Purchase | $ | $ | $ |

| Technology Upgrade | $ | $ | $ |

| Vehicles | $ | $ | $ |

| Total CapEx | $ | $ | $ |

7. Contingency Fund

| Category | Projected Amount | Actual Amount | Variance |

|---|---|---|---|

| Emergency Savings | $ | $ | $ |

| Unforeseen Expenses | $ | $ | $ |

| Total Contingency | $ | $ | $ |

8. Profit and Loss Summary

- Total Revenue: $

- Total Expenses: $

- Net Profit/Loss: $

9. Notes/Comments

- Key considerations, observations, or assumptions used in preparing the budget.

What is a Business Budget?

A business budget outlines an organization’s goals by estimating and forecasting its revenue and expenses over a specified period. It’s an internal instrument that managers use to ensure that the company’s financial status meets its obligations and goals to continue operations. A budget is something that startups and small businesses must have as an essential part of their business plan. By practicing strict budget habits early on, budget planning becomes a regular task that you do on a quarterly and yearly basis. This microeconomic concept helps owners and managers understand the most fundamental aspects of their organization’s financial responsibilities to improve cash flow and satisfy corporate demands.

What are the Consequences of Poor Budgeting in Business?

In the business world, no one is safe from financial burden.

For decades, General Motors (GM) was the largest American automobile manufacturer and one of the largest in the world, rising to fame with its popular brands such as Chevrolet and Cadillac. So it came to everyone’s surprise when the multinational company filed for Chapter 11 bankruptcy in 2009.

The cause? On top of high labor costs and mounting debt, thousands of businesses around the world, including GM, took a hard hit from the global recession that began in 2008. Although GM had the privilege to rise from the tragedy thanks to a government bailout, not many businesses at the time were as lucky. You can also see more on Department Budget.

So if high-profile companies—which the world never thought would fail—reach a financial crisis, there’s always the possibility of your company meeting the same fate if you don’t start thinking critically. Other possible effects of poor budgeting include the following:

Getting Started: How to Improve Your Business Budgeting Habits

Think of your company’s budget as a battle plan. A well-thought-out business budget goes a long way toward ensuring that your organization survives the toughest financial obstacles that come your way. But if it’s plagued with loopholes, miscalculations, and lack of factual evidence, your business may end up losing more than it thought it could.

But there’s more to budgeting than minimizing expenses and changing your spending habits, as it requires extensive research of various internal and external factors to determine what’s best for your company’s financial health. You can also see more on Sales Budget. That said, let’s take a look at some of the easiest ways to approach business budget planning like a pro:

1. Stick to a Plan

Doing business without a plan in place is like entering a war zone with your hands tied and eyes closed. Many companies make the mistake of setting budgets that do not align with their corporate objectives, forcing them to spend their funds on matters that may not yield progressive outcomes. So instead of ignoring these plans, strategizing drives you to handle any threats and opportunities that may affect your financial standing. It also helps you deal with the impact that these expenditures may have on your business, as you work toward addressing concerns that were not a part of the original budget. You can also see more on Startup Budgets.

2. Keep It Flexible

There’s a chance your budget plan won’t work once you set it in stone. Unforeseen events and market fluctuations occur when you least expect them to, and you need to prepare for the effects they will leave on your business before it puts you at a counterproductive state. Adjusting to these circumstances might not be easy, but that doesn’t make it impossible. Being dynamic is also a trait you’ll need when planning for the next quarter or year. It gives you enough space in your budget for equipment or technology that will improve your company’s workflow for faster results. It even offers you the opportunity to invest in alternative strategies to replace old, inefficient ones. You have to make room for these changes if you wish to eliminate the need to let go of resources just to stay on target.

Thus, consider building flexibility into your budget plans to help generate accurate and sustainable outcomes for your business.

3. Openly Communicate with Departments

Effective budgeting demands the joint effort of company leaders, as the funds and expenditures of every department can potentially affect other aspects of the business. Speak with the managers and supervisors of each sector to gather data that may be useful to the budgeting and forecasting process. You can deliver and receive information through emails, letters, and memos, or you can call formal meetings with the team to answer questions and concerns. By keeping an open line of communication with all departments, you can reduce conflicts and remain committed to your company’s operational strategies. You can also see more on Manufacturing Budget.

4. Have the Entire Team Involved

Note that different budget plans are necessary for every sector of the organization, which you’ll find in reports, request letters, and other corporate documents. Because of this, you’ll want to keep everyone involved in your plans before you implement them. Doing so offers you a clearer understanding of their needs to make it possible for your team to set realistic budgets that will address their concerns. Your team, along with representatives from other departments and units, can work together on the different budget plans as you view each case from different perspectives.

5. Prepare for the Unexpected

While it’s ambitious for you to have a plan for everything, that doesn’t mean you can’t take the possibility of these obstacles into account. Taking the time to review market conditions and economic trends will help you learn more about the impacts that they will have on your company, which also gives you enough ideas to formulate a response. This approach will help you stay on top of these turning points if they do happen at the most inconvenient times. You also need to acknowledge that any changes, whether positive or negative, could have a severe impact on your operations, so proper budgeting and forecasting is essential to help streamline this transition.

6. Track Everything

Pay attention to details. You can never go wrong by tracking every trend, behavior, or market competition that may affect your company’s financial strength. Monitoring your budgetary progress is especially crucial for businesses that exist in a volatile environment. External changes can take a massive toll on your current and future budget, which is why you shouldn’t wait until the last minute to take action. It won’t hurt to look into the many possible scenarios that may occur at any given time. By carefully monitoring these details, you’ll have a clear idea of what to expect in the months leading up to the next budget planning session. You can also see more on Annual Budgets.

Ultimately, poor budgeting practices will leave you in a financial crisis. There are no shortcuts to prosperity; it’s a road with numerous potholes and unstable conditions. And even the slightest errors in cost projections or earnings can have disastrous effects on your operations. That is why examining records, and forecasting finances are vital in keeping your business afloat. And if done right, you can establish a budget that will influence all your financial decisions to help meet your long-term goals.

FAQS

How often should a business budget be reviewed?

It is recommended to review a business budget monthly or quarterly to ensure it aligns with actual performance and adjusts for changes.

How do operational budgets differ from capital budgets?

An operational budget focuses on day-to-day expenses like salaries and utilities. In contrast, a capital budget addresses long-term investments, such as purchasing equipment or developing infrastructure. Both are vital for balanced financial planning. You can also see more on Small Business Budget.

What challenges might businesses face when creating a budget?

Challenges include inaccurate forecasting, unexpected expenses, and fluctuating market conditions. Businesses can overcome these by using historical data, maintaining a contingency fund, and conducting regular reviews to adapt to changes.

How does a budget influence strategic decision-making?

A budget provides a financial framework that helps prioritize goals and allocate resources efficiently. By understanding financial constraints and opportunities, businesses can make informed decisions to achieve long-term success.

What is the role of cash flow in budgeting?

Cash flow plays a critical role in budgeting by ensuring that a business has sufficient funds to cover its operating expenses and investments. A cash flow budget helps track liquidity and prevents financial shortfalls. You can also see more on Capital Budgets.