Cashier Check Sample, PDF

-

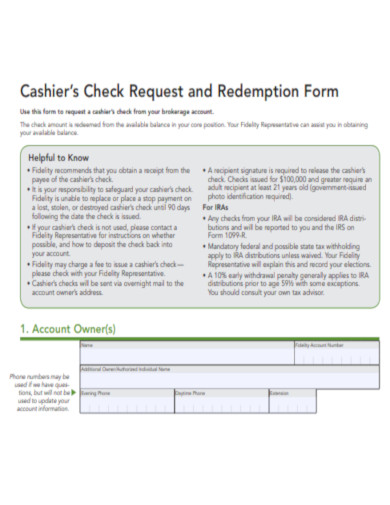

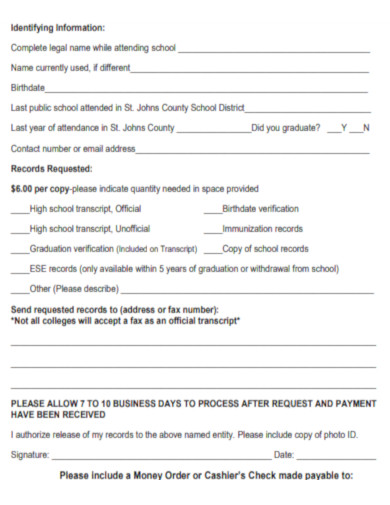

Cashier Check Request and Redemption Form

download now -

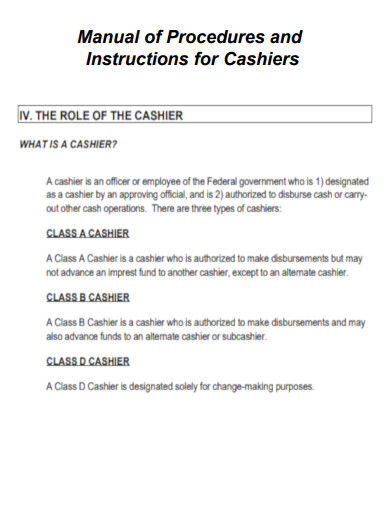

Manual of Procedures Cashier Check

download now -

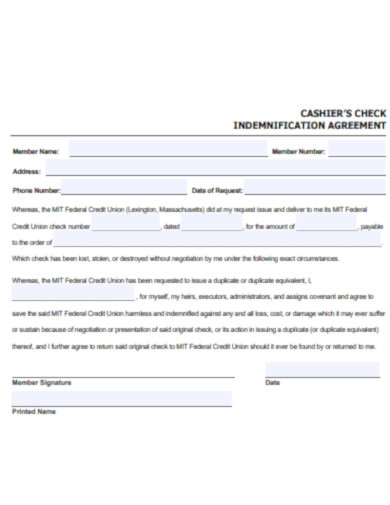

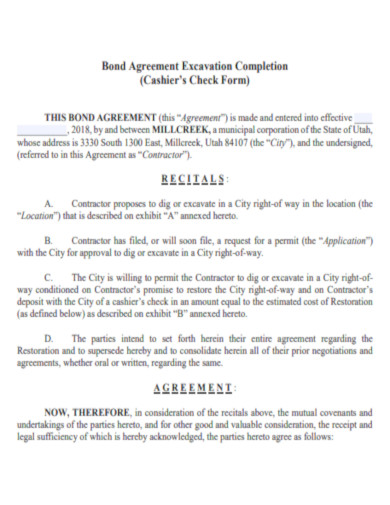

General Cashier Check Agreement

download now -

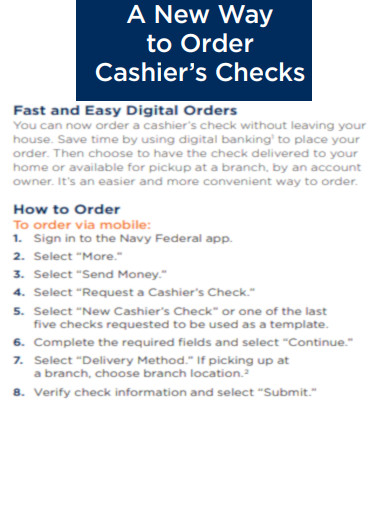

New Way to order Cashier Check

download now -

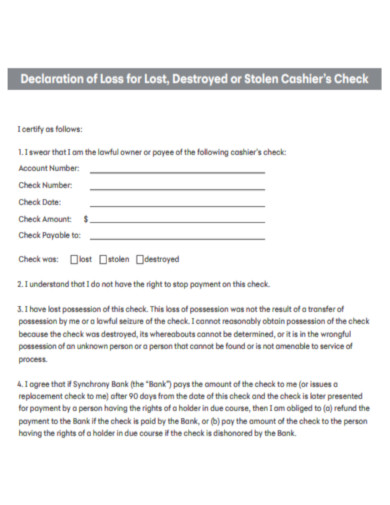

Declaration of Loss or Stolen Cashier Check

download now -

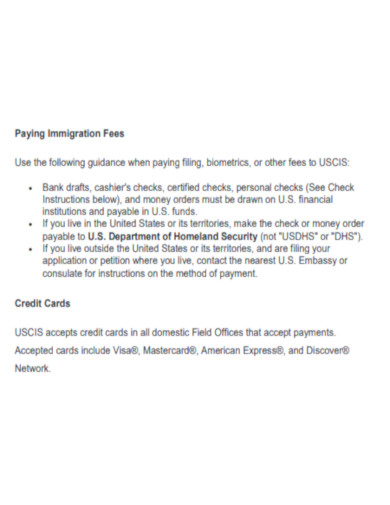

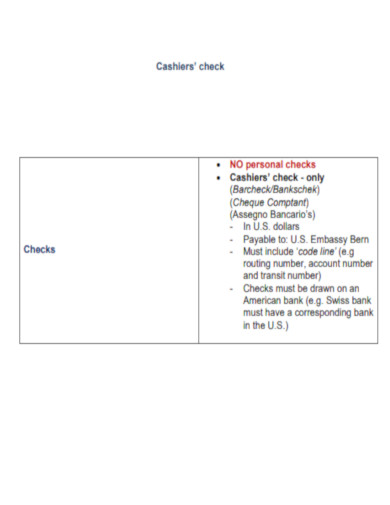

Cashier Check Paying Immigration Fees

download now -

Cashier Check Example

download now -

Bank Cashier Check

download now -

Cashier Check Form

download now -

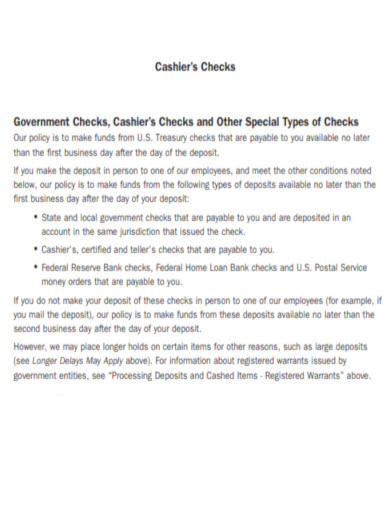

Deposit Agreement Cashier Check

download now -

Cashier Check Sample

download now -

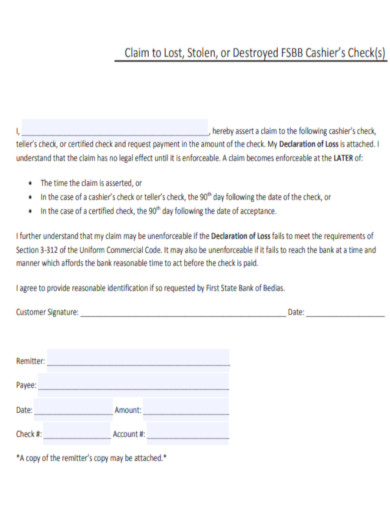

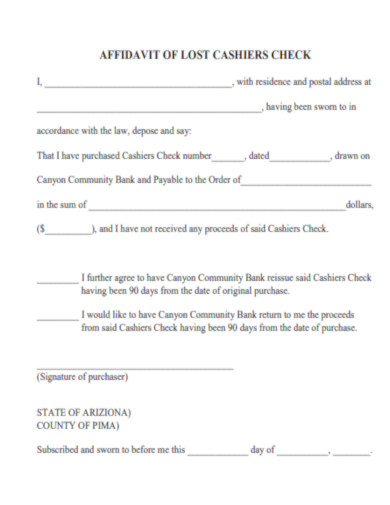

Affidavit of Lost Cashier Check

download now -

Cashier Checks and Other Negotiable Instruments

download now -

Standard Cashier Check

download now -

What is a Cashier Check

download now -

Important Information for Cashier Check

download now -

Cashier Check Fraud Depository Liability

download now -

Stolen Cashier Check

download now -

Making Cashier Check

download now -

Cashier Check PDF

download now -

Cashier Check Facts

download now -

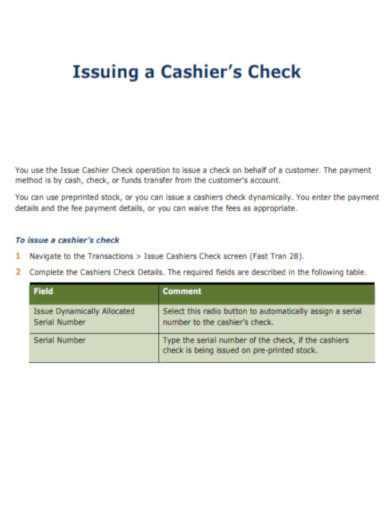

Issuing a Cashier Check

download now -

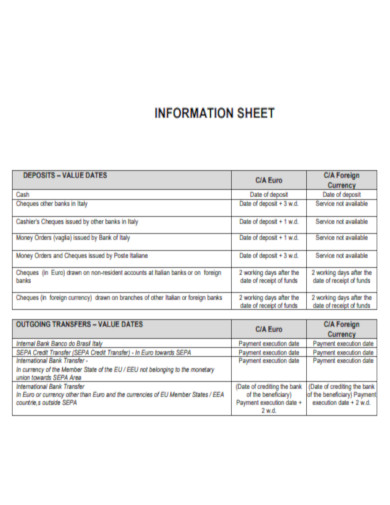

Cashier Check Information Sheet

download now -

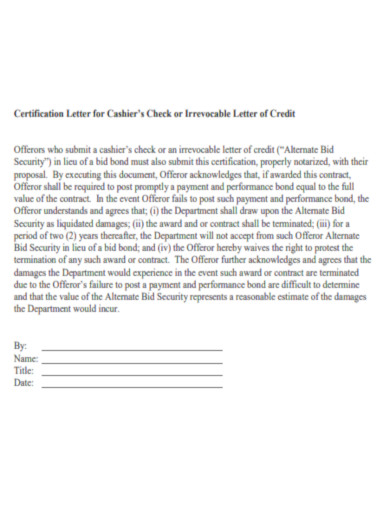

Certification Letter for Cashier Check

download now -

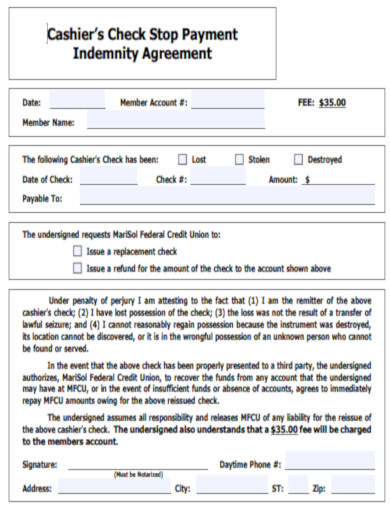

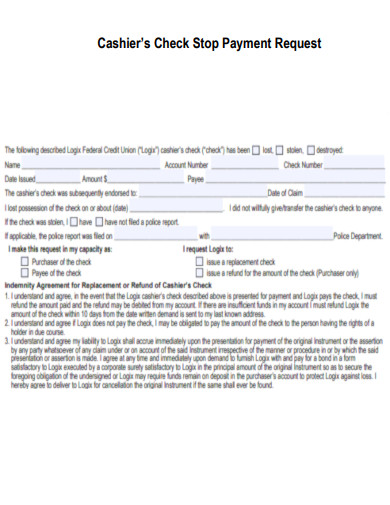

Cashier Check Stop Payment Indemnity Agreement

download now -

Cashier Check Stop Payment Request

download now -

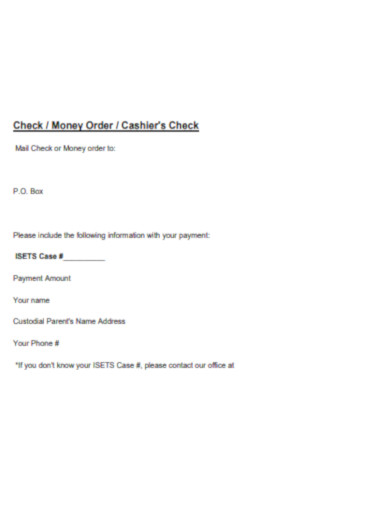

Cashier Check Instructions

download now -

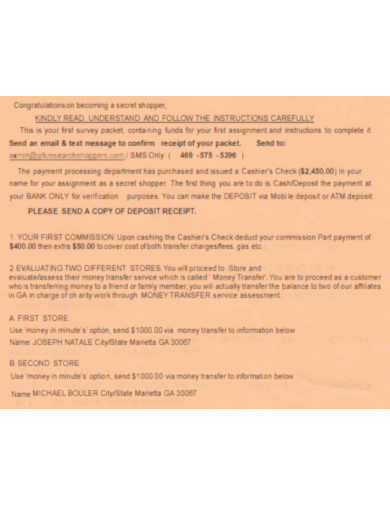

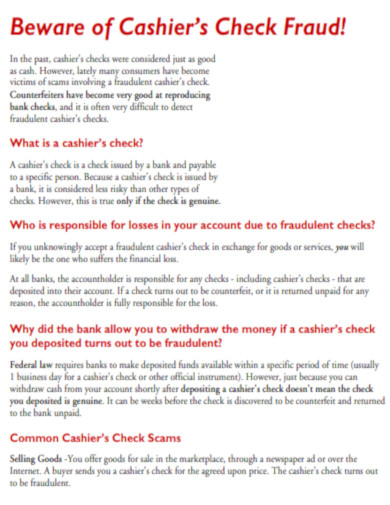

Beware of Cashier Check Fraud

download now -

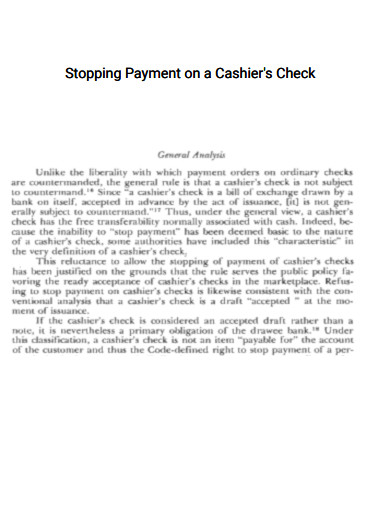

Stopping Payment on a Cashier Check

download now -

Schedule of Fees and Charges Cashier Check

download now -

Counterfeit Cashier Check

download now -

Cashier Check Collection

download now -

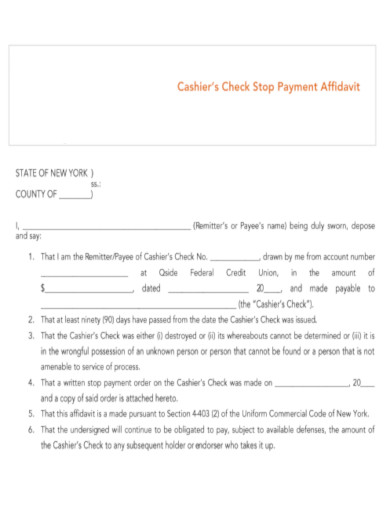

Cashier Check Stop Payment Affidavit

download now -

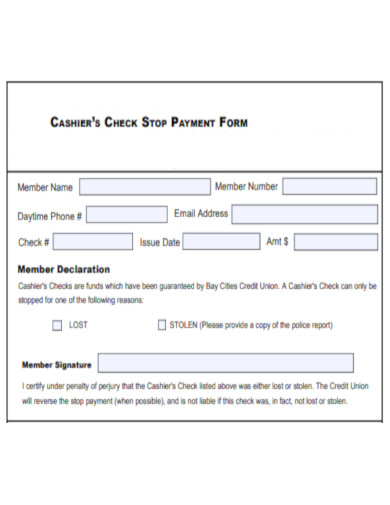

Cashier Check Stop Payment Form

download now -

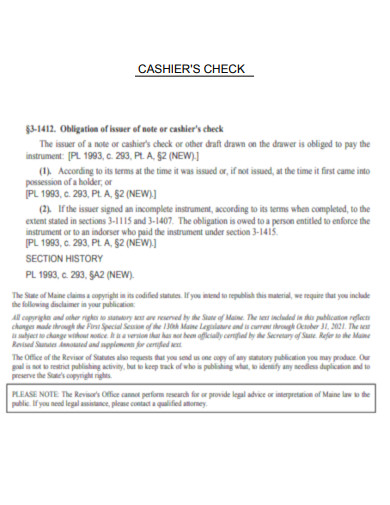

Action on a Cashier Check

download now -

Printable Cashier Check

download now -

Editable Cashier Check

download now -

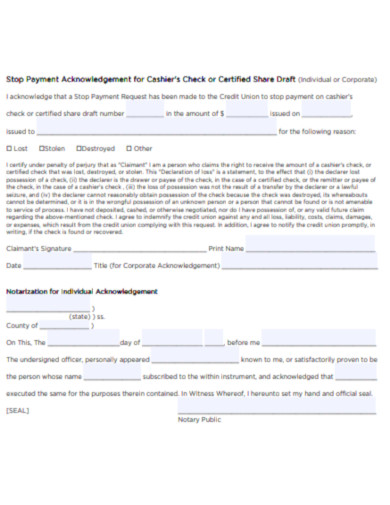

Stop Payment Acknowledgement for Cashier Check

download now -

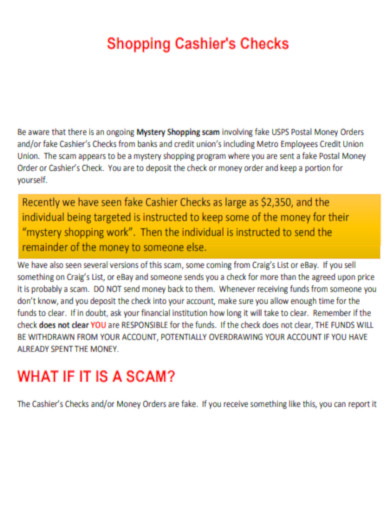

Shopping Cashier Checks

download now -

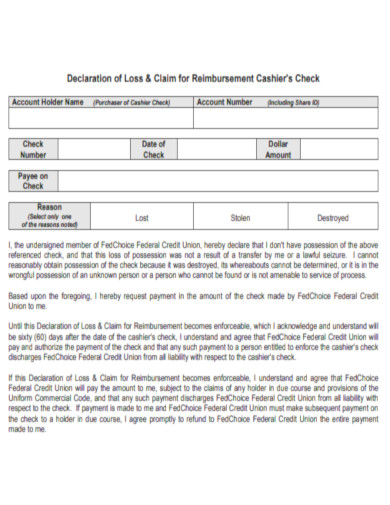

Declaration of Loss & Claim for Reimbursement Cashier Check

download now -

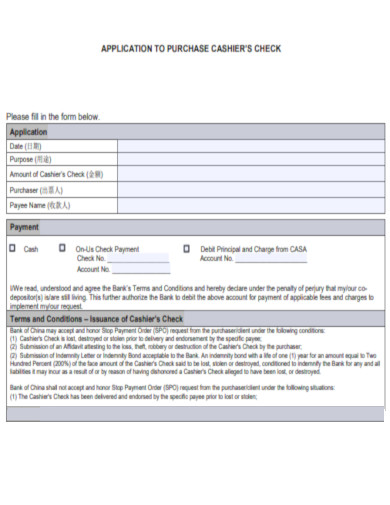

Application to Purchase Cashier Check

download now -

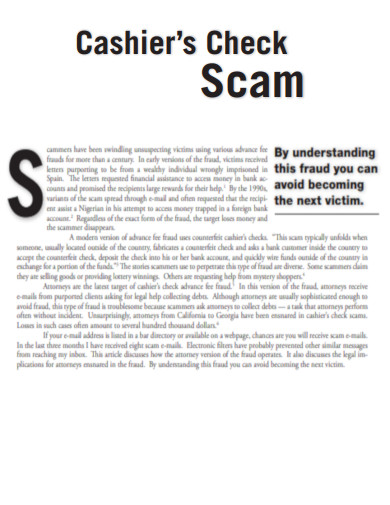

Cashier Check Spam

download now -

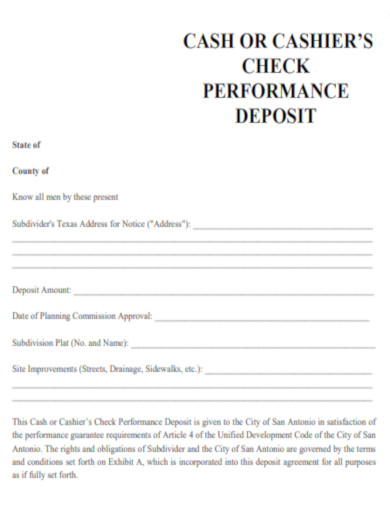

Cashier Check Performance Deposit

download now -

Tips to Avoid Cashier Check Fraud

download now -

Cashier Check Alert

download now -

General Cashier Check

download now -

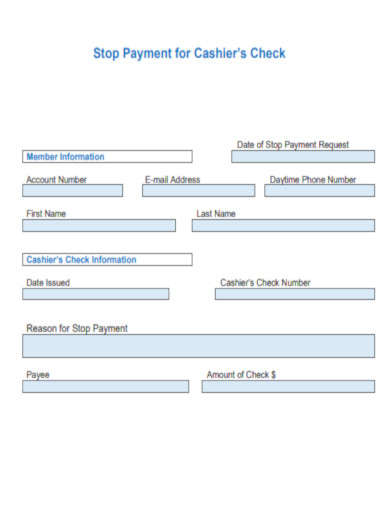

Stop Payment for Cashier Check

download now -

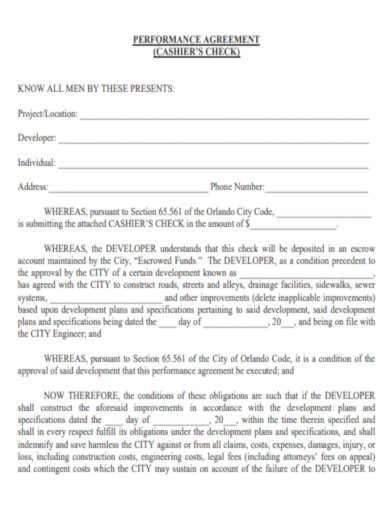

Performance Agreement Cashier Check

download now -

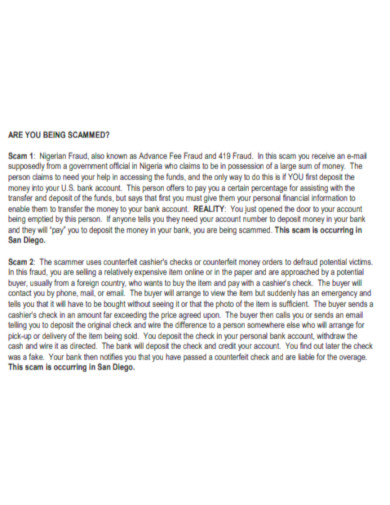

Cashier Check Scam

download now -

Blocking Payment on a Cashier Check

download now -

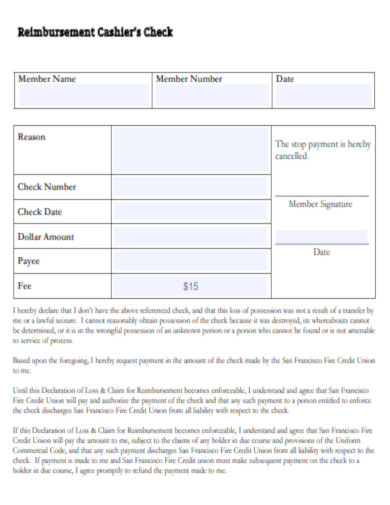

Reimbursement Cashier Check

download now -

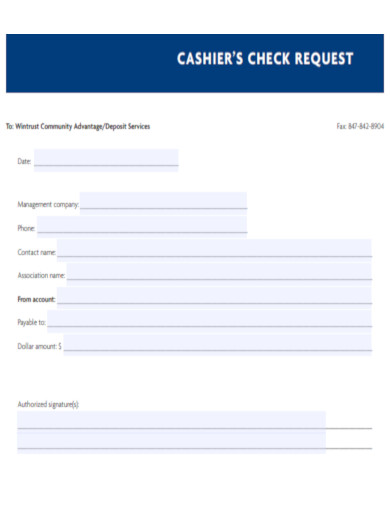

Cashier Check Request

download now -

Cashier and Certified Check Difference

download now

What is a Cashier Check?

A cashier check is a type of check that is backed up by your bank. This is a check that is supported by the bank’s own funds. Because of this, it is a more secure way of payment because the bank can surely pay the amount that you owe. Your personal bank account or business bank account may not have sufficient funds sometimes, but if you will be backed up by your bank, you can be sure that the check will not bounce. This is a very good way of payment, especially if you are going to pay large amounts. Nowadays, you can even have a cashier’s check online. Just beware of cashier check scams.

So, you can use the bank’s account for payment. But what is the maximum amount for a cashier’s check? Generally, there is no upper limit. So, you can pay a very large amount of money. The next question can be, “Can I get a cashier’s check from any bank?”. Yes, you can, but you have to know that most banks give a cashier’s check to customers only. If you compare the certified check vs cashier check, you will know that you can have a better benefit with the cashier check because you can use the funds of your bank. Some examples of a cashier check are Wells Fargo cashier check sample, USCIS cashier check sample, Chase cashier check sample, M & T cashier check sample, PNC cashier check sample, HSBC cashier check sample, and Citizens Bank cashier check sample.

Benefits of a Cashier Check

You can opt to use the traditional check, but if you do not have enough funds, the check will bounce. If you are going to use a cashier check, you can use the funds of your bank to help you with anything that you have to pay. This does not mean that you will get a credit from your bank. Of course, you have to pay the amount for the cashier check. Cashier checks have been used by many people because they can give them a lot of conveniences. The following are the benefits that you can get from having a cashier check:

How to Get a Cashier Check

Banks and credit unions offer cashier checks to customers. Though, this may not always be the case. Some may offer cashier checks to non-customers. But how can you get a cashier check? Have the following steps:

1. Prepare the Requirement

The first thing that you should do is prepare the requirements. You need to be sure about the amount of the cashier check. Be also definite in stating the name of the payee. This is the only information that you need when you are having a sales agreement and you want to pay in a cashier check. And of course, you have to prepare your ID. This is needed to process a cashier check.

2. Request a Check

When you have all the requirements for the cashier check, you can visit a branch of your bank or credit union. Some may allow you to have a cashier check online or through your phone, but usually, you have to visit personally. After that, you have to request a check from the teller.

3. Pay the Check

Then, you should pay for the amount of the check. Make a deposit. If you have insufficient funds, you have to pay for charges. Then, you will be issued a cashier check that will be signed by the teller.

4. Get a Receipt

After you have paid the amount in the cashier check, you should not forget to get your receipt. This is a true record of your transaction. Get the payment receipt so you will have a record of everything.

FAQs

On what transactions is a cashier check usually used?

Cashier checks are common for transactions in making a down payment for a house, paying closing costs for a mortgage, and buying a property.

When is a cashier check needed?

A cashier check is needed when you are going to pay something with a large amount of money. This is because by using a cashier check, everything will be more secure.

Paying a large sum of money always has many risks. There is the risk of theft that you should avoid at all costs. By using a cashier check, you can have a secure payment where you do not have to worry about anything. You can be sure you can fulfill your obligation without having any risk at all.