Financial Hardship Letter Samples

-

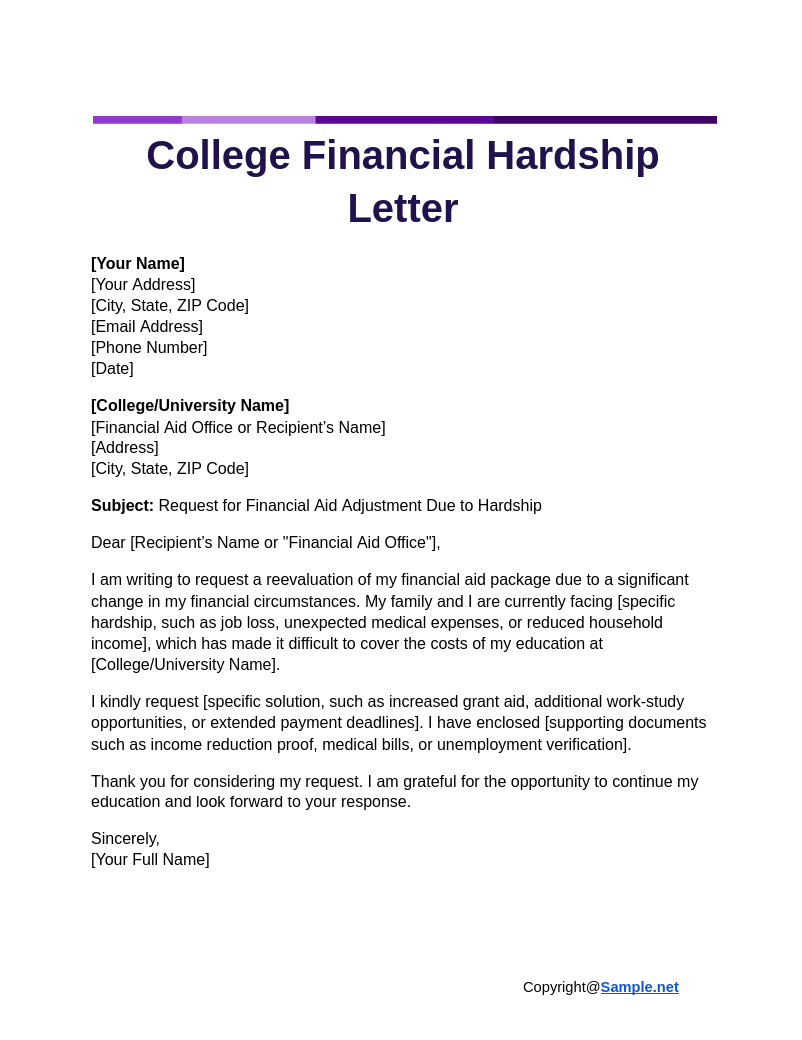

College Financial Hardship Letter

download now -

Financial Hardship Letter for Rent

download now -

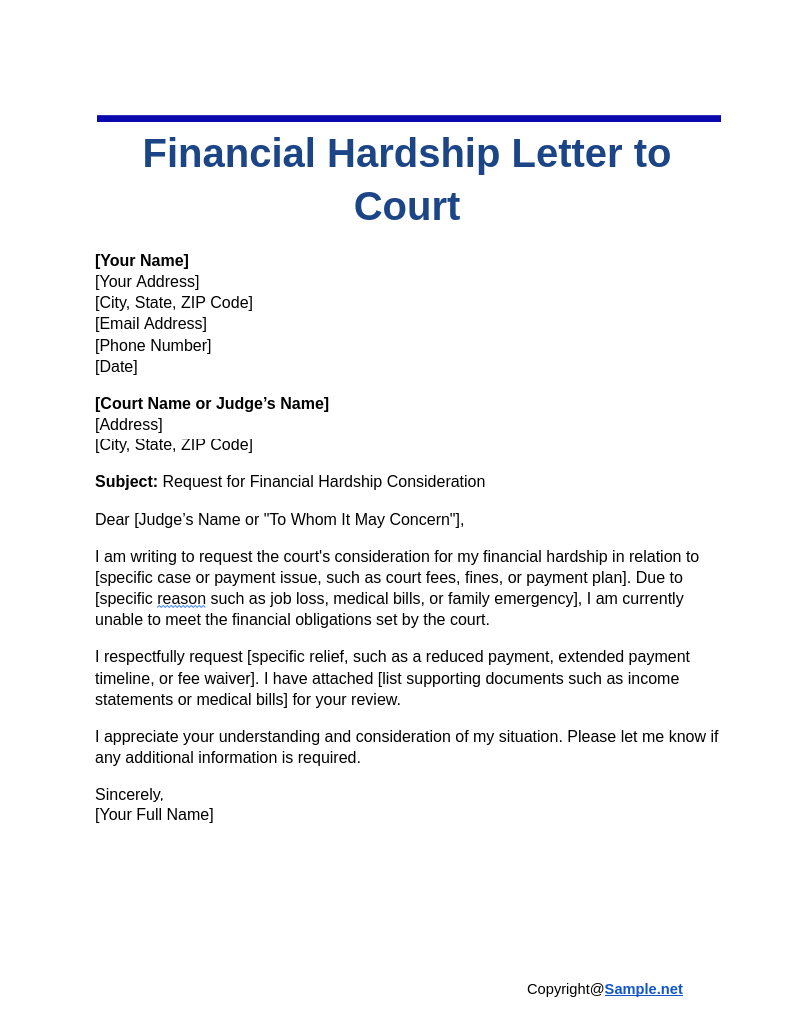

Financial Hardship Letter to Court

download now -

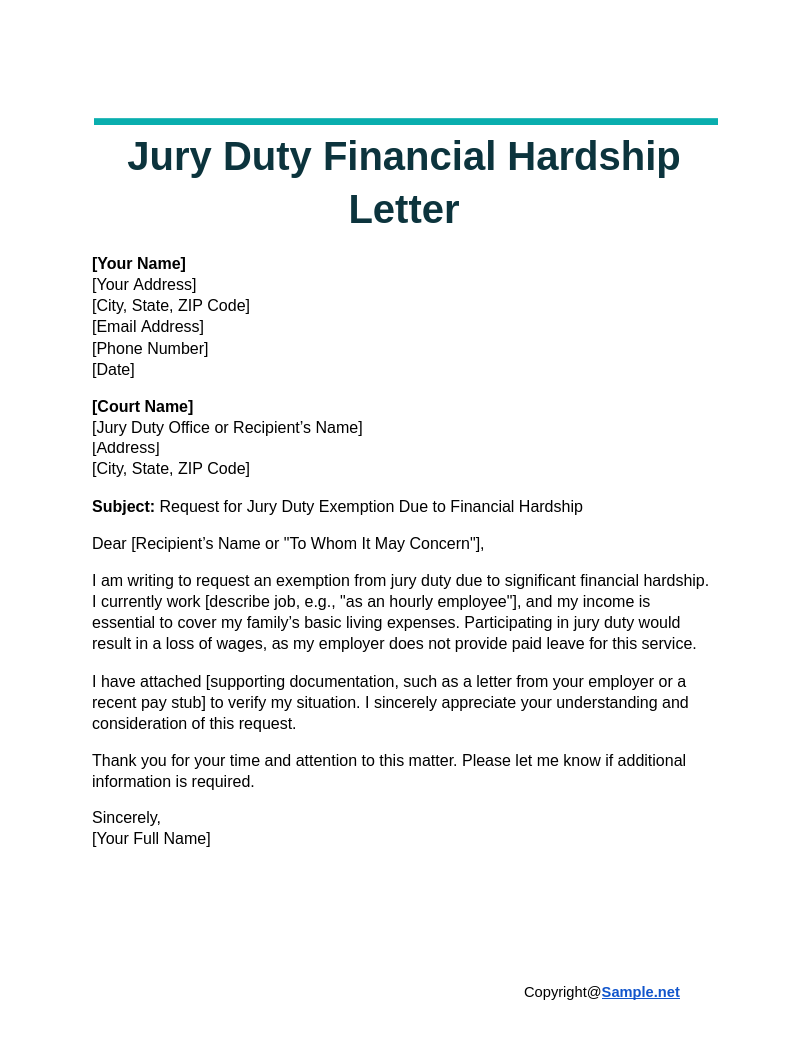

Jury Duty Financial Hardship Letter

download now -

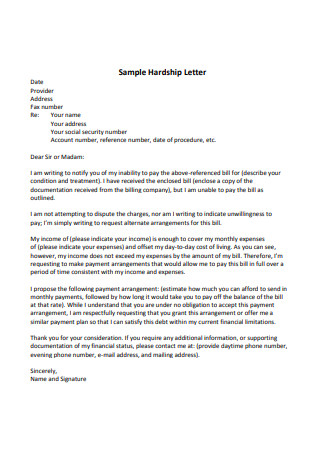

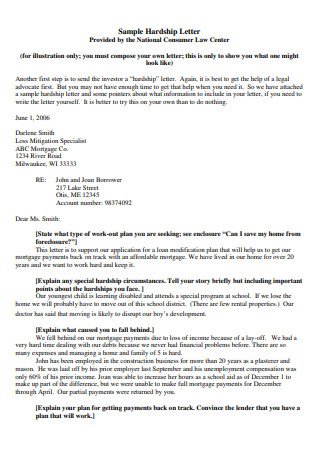

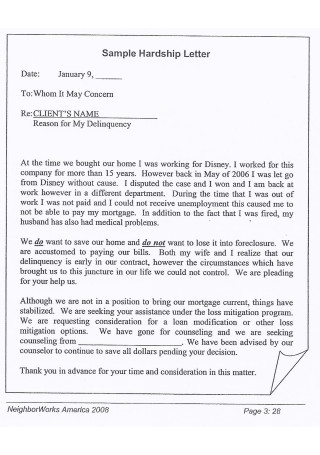

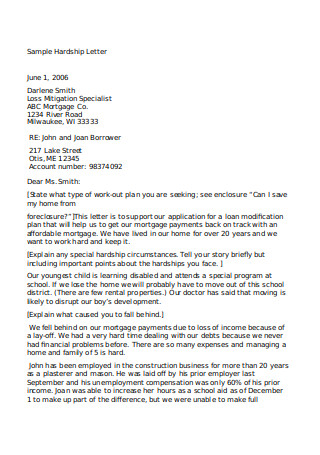

Sample Hardship Letter

download now -

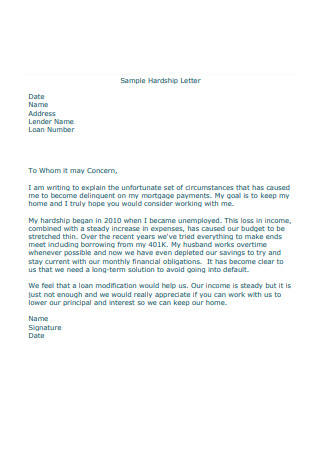

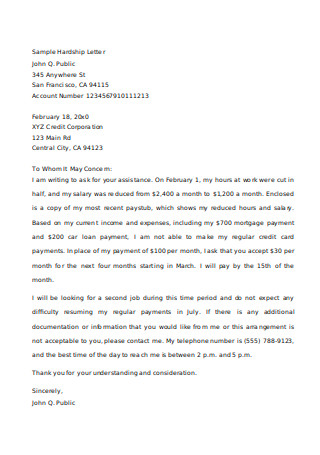

Sample Hardship Letter in PDF

download now -

Hardship Letter Format

download now -

Sample Hardship Letter Guide

download now -

Sample Short Sale Hardship Letter

download now -

Sample Hardship Variation Letter

download now -

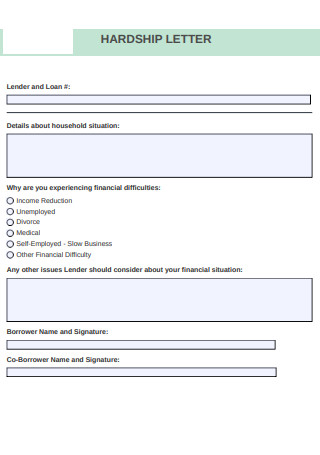

Editable Hardship Letter

download now -

Hardship Letter to Creditors

download now -

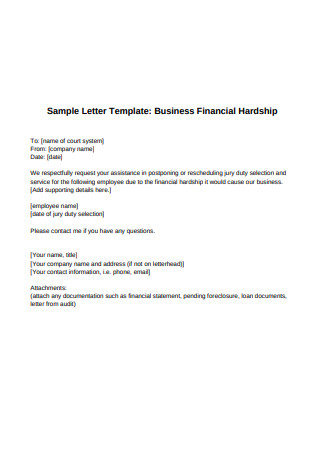

Business Financial Hardship Letter

download now -

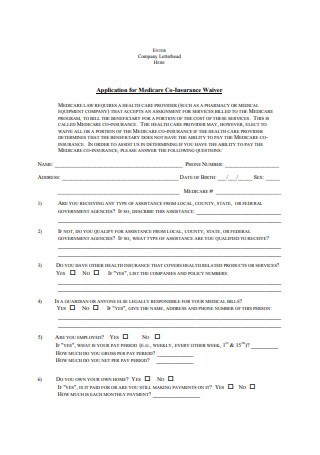

Application for Medicare Co-Insurance Waiver

download now -

Patient Hardship Letter

download now -

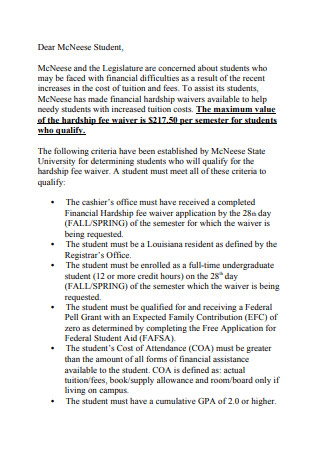

Hardship Waiver Letter

download now -

Financial Hardship Application

download now -

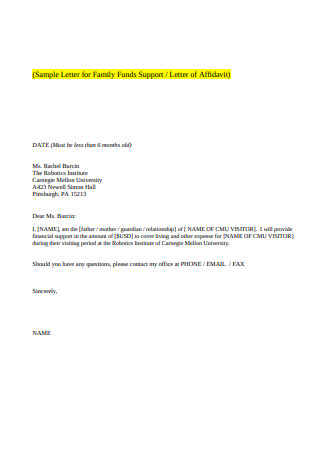

Sample Letter for Funds Support

download now -

Sample Hardship Letter in PDF

download now -

Sample Financial Request Letter

download now -

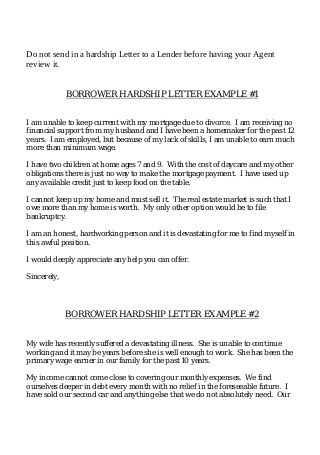

Borrower Hardship Letter

download now -

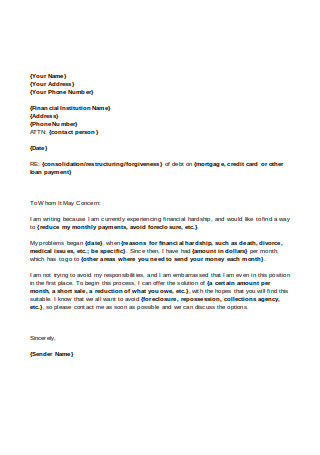

Lender Financial Hardship Letter

download now -

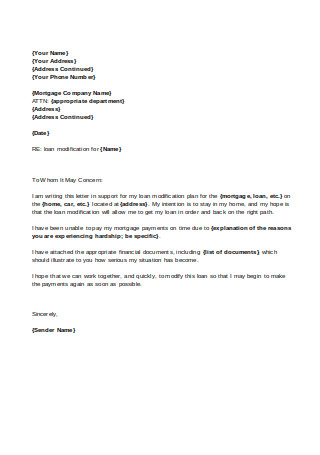

Editable Sample Hardship Letter

download now -

Sample Hardship Letter in DOC

download now -

Hardship Letter in DOC

download now -

Financial Hardship Letter on Loan

download now -

Consolidation Hardship Letter

download now -

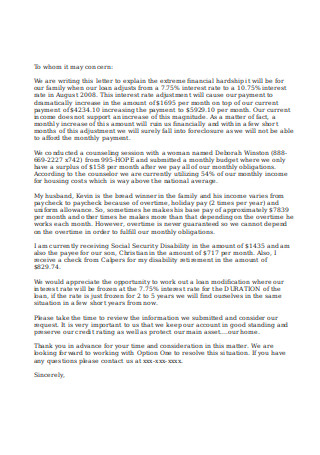

Financial Hardship Letter on Mortgage

download now -

Basic Hardship Letter

download now -

Financial Hardship Letter for Loan Number

download now -

Formal Financial Hardship Letter

download now -

Basic Financial Hardship Letter

download now -

Printable Financial Hardship Letter

download now -

Editable Financial Hardship Letter

download now -

Financial Hardship Letter for Mortgage

download now -

Simple Format of Hardship Letter

download now -

Hardship Letter for Short Sales

download now -

Sample Hardship For Loan Number

download now -

Hardship Letter for Creditors

download now -

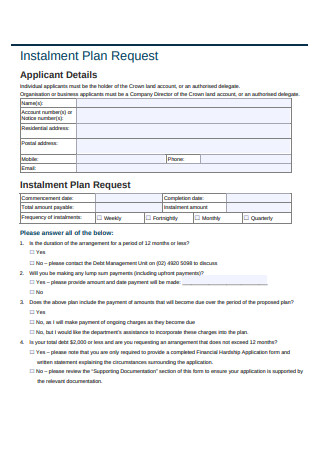

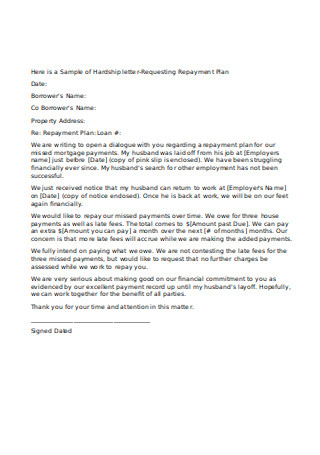

Sample of Hardship Letter-Requesting Repayment Plan

download now -

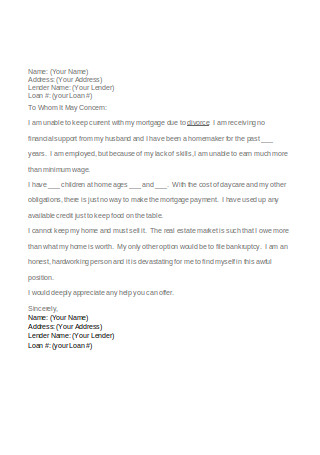

Sample of Hardship Letter for Mortgage Finance

download now -

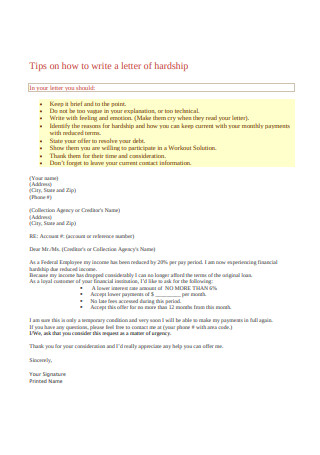

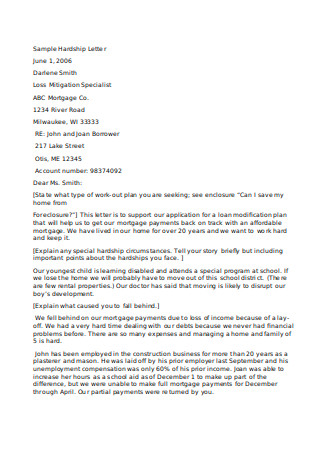

Sample Hardship Letter Format

download now -

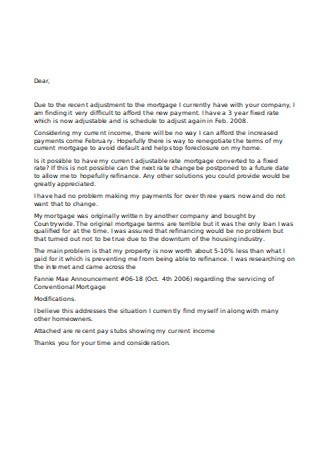

Standard Hardship Letter

download now -

Hardship Letter of Example

download now

FREE Financial Hardship Letter s to Download

Financial Hardship Letter Format

Financial Hardship Letter Samples

What is a Financial Hardship Letter?

Purpose of a Financial Hardship Letter

How to Create a Financial Hardship Letter

FAQS

Can a financial hardship letter help me avoid foreclosure?

Who can I send a financial hardship letter to?

What documentation should accompany a financial hardship letter?

How long should my financial hardship letter be?

What should I do if my hardship request is denied?

Download Financial Hardship Letter Bundle

Financial Hardship Letter Format

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient’s Name]

[Recipient’s Title/Department]

[Company/Organization Name]

[Address]

[City, State, ZIP Code]

Subject: Request for Financial Assistance/Hardship Adjustment

Dear [Recipient’s Name or “To Whom It May Concern”],

I am writing to formally request financial assistance/adjustment due to significant financial hardship. [Briefly explain the purpose of your letter, such as requesting a payment plan, deferment, or waiver.]

Background and Current Situation:

[Explain your current financial situation in detail. Include specific events or reasons for the hardship, such as job loss, medical expenses, or unforeseen emergencies. Be factual and concise.]

Impact on Obligations:

[Describe how the hardship has affected your ability to meet your financial obligations. Clearly state the challenges you’re facing and how they relate to the specific issue you’re addressing.]

Proposed Solution:

[Provide a proposed solution or request, such as a reduced payment plan, temporary deferment, or fee waiver. Be specific and realistic about what you are asking for.]

Supporting Documentation:

To support my request, I have attached [list relevant documents such as proof of income, medical bills, unemployment verification, or bank statements].

Closing Statement:

I deeply appreciate your time and understanding in reviewing my situation. I am committed to resolving this matter and hope to find a mutually agreeable solution. Please let me know if any additional information is needed to process my request.

Thank you for your consideration. I look forward to your response.

Sincerely,

[Your Full Name]

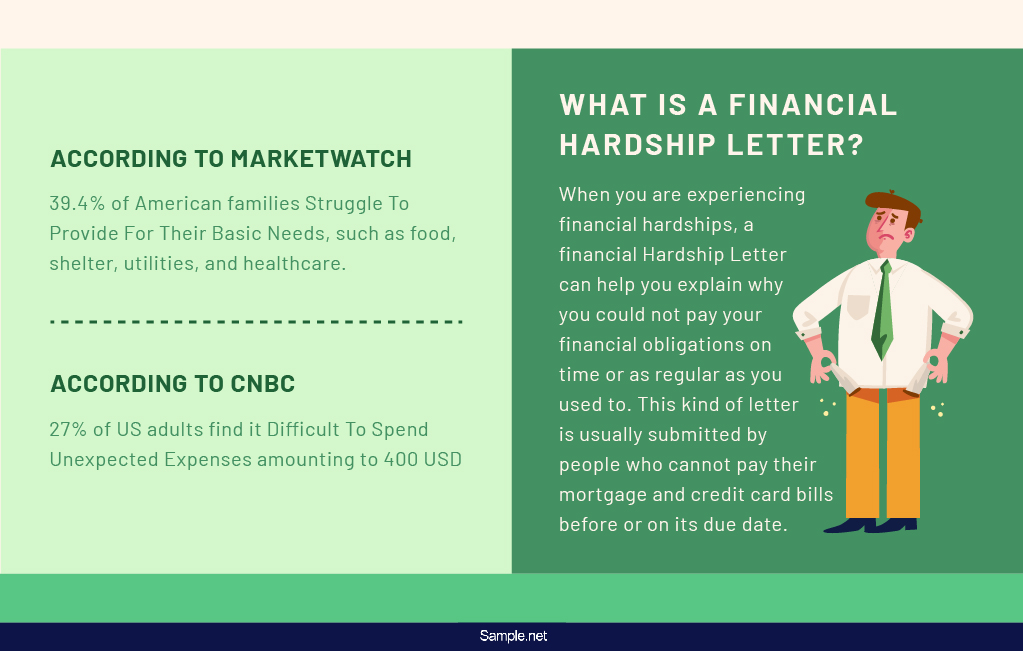

What is a Financial Hardship Letter?

When you are experiencing financial hardships, a financial hardship letter can help you explain why you could not pay your financial obligations on time or as regular as you used to. This kind of letter is usually submitted by people who cannot pay their mortgage and credit card bills before or on its due date. With this letter, they can request leniency and can prevent the possibility of any foreclosure. The use of this letter can also help people deal with medical bills, child support for single mothers, and student loans. Other circumstances that put an individual in a financial hardship include the sudden death of a loved one, unexpected job loss, pay reduction, and so on.

While it is not a guarantee that your lenders will give you special consideration, they will surely acknowledge sending one as an act of courtesy. But in the event that it is considered, adjustments such as reducing your payments, allowing debt settlement, or modifying your loan will be granted. Apart from explaining why you are struggling financially, this kind of letter can help you in proving yourself that you have the ability to sort things out which can also help you to convince your lenders to agree upon your request. You can also see more on Financial Aid Appeal Letter.

Purpose of a Financial Hardship Letter

To write an effective financial hardship letter, it is crucial that you know your purpose for writing one in the first place. With purpose in mind, you can easily determine the appropriate terms and content that you need to use in your hardship letter. You can make various appeals, such as the temporary suspension of your previous amount dues, interest rate adjustments, loan modification, debt settlement, or the short sale your house. There are more options to explore so consider seeing advice from a finance expert to help you in determining the best one that fits your situation. You can also see more on Letter Of Explanation.

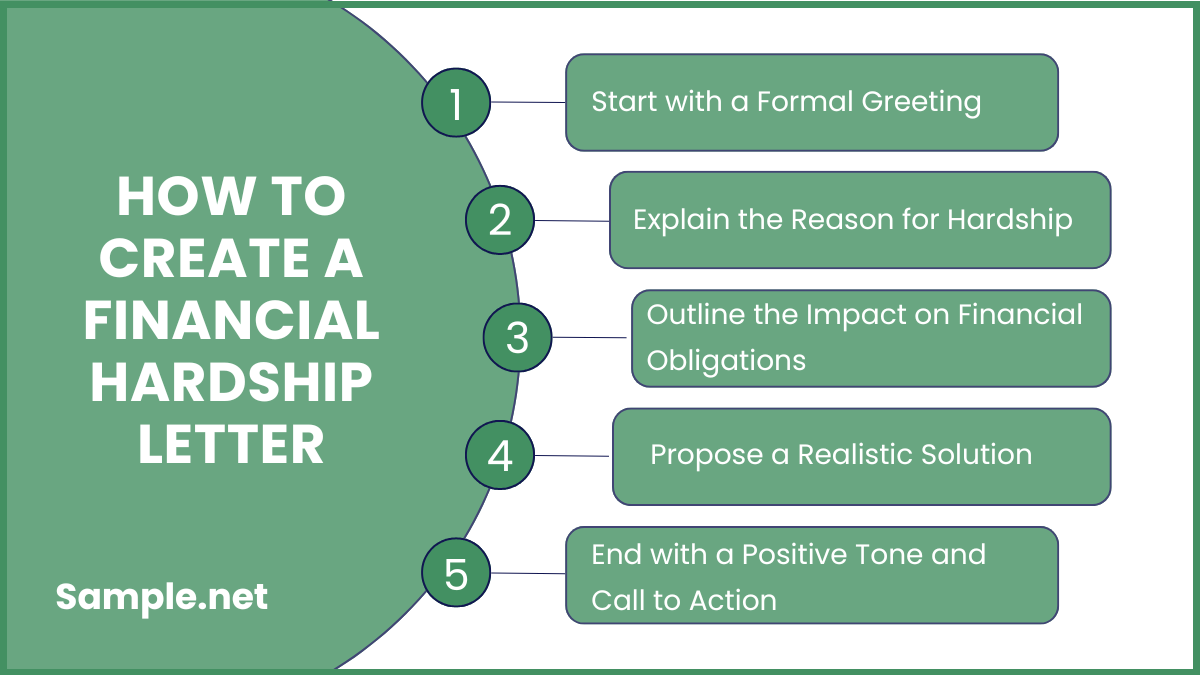

How to Create a Financial Hardship Letter

Step 1: Start with a Formal Greeting

Begin your letter with a respectful salutation, addressing the creditor or organization’s representative by name if possible. A polite opening sets a professional tone for your request. You can also see more on Authorization Letter.

Example:

“Dear [Creditor’s Name], I hope this message finds you well. I am writing to discuss my financial situation and request assistance with [specific obligation].”

Step 2: Explain the Reason for Hardship

Provide a concise and honest explanation of your financial difficulty. Include specific details such as job loss, medical issues, or other unavoidable circumstances that caused the hardship.

Example:

“Due to an unexpected medical emergency, I incurred significant expenses that have severely impacted my ability to meet my financial obligations. I lost a significant portion of my income due to this situation.” You can also see more on Appeal Letter.

Step 3: Outline the Impact on Financial Obligations

Describe how the hardship affects your ability to meet specific financial commitments. Be clear and direct without overstating your situation.

Example:

“This financial strain has made it challenging to manage my monthly mortgage payments, utilities, and other essential expenses, leaving me in a vulnerable position.”

Step 4: Propose a Realistic Solution

Clearly state your proposed solution, such as adjusted payment plans, temporary deferment, or waived fees. Demonstrate that you are willing to meet your obligations responsibly.You can also see more on Explanatory Letter.

Example:

“I kindly request a temporary reduction in monthly payments or a deferred payment plan for three months to help me regain financial stability.”

Step 5: End with a Positive Tone and Call to Action

Conclude the letter by expressing gratitude and requesting a response or meeting. Include your contact information to encourage further discussion.

Example:

“Thank you for considering my request. I am confident we can work together to find a solution that benefits both parties. Please feel free to contact me at [your contact information] to discuss this further.”

A financial hardship letter can be an effective way to seek leniency during tough financial times. When crafted properly, it conveys transparency, responsibility, and a commitment to finding solutions. Always be honest, concise, and respectful in your tone. Tailor your message to the recipient and include relevant documentation to strengthen your case. A well-drafted hardship letter can foster understanding and cooperation between you and the creditor. You can also see more on Proven Letter of Support.

FAQS

Can a financial hardship letter help me avoid foreclosure?

Yes, it can. A mortgage hardship letter may help you negotiate payment plans or forbearance with your lender, potentially avoiding foreclosure.

Who can I send a financial hardship letter to?

You can send it to creditors, lenders, utility companies, landlords, or any entity you owe payments to during financial hardship. You can also see more on Recommendation Letter.

What documentation should accompany a financial hardship letter?

Include medical bills, bank statements, income loss evidence, or any relevant proof of your financial hardship. Tailor the documents to the specific request.

How long should my financial hardship letter be?

Keep it concise, ideally within one page. Include all necessary information while maintaining a professional tone and avoiding unnecessary details. You can also see more on Detailed Letter.

What should I do if my hardship request is denied?

If denied, inquire about alternative options, such as reduced terms or other relief programs. Persistence and clear communication can lead to eventual solutions.