Invoice Samples

-

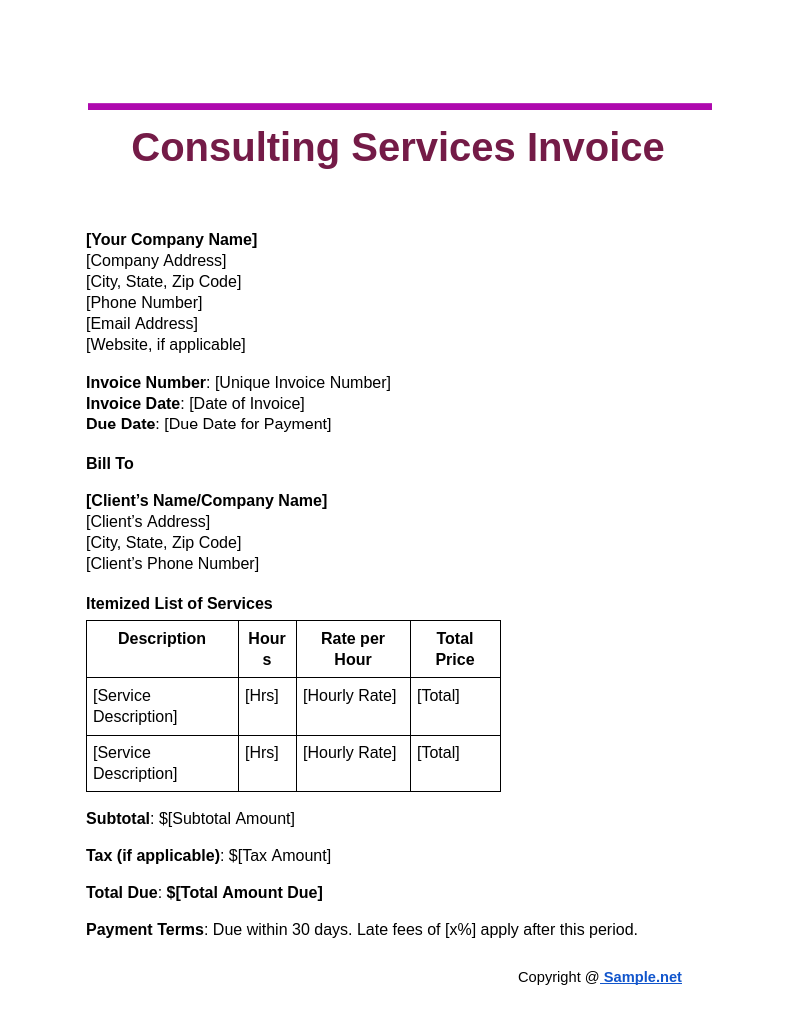

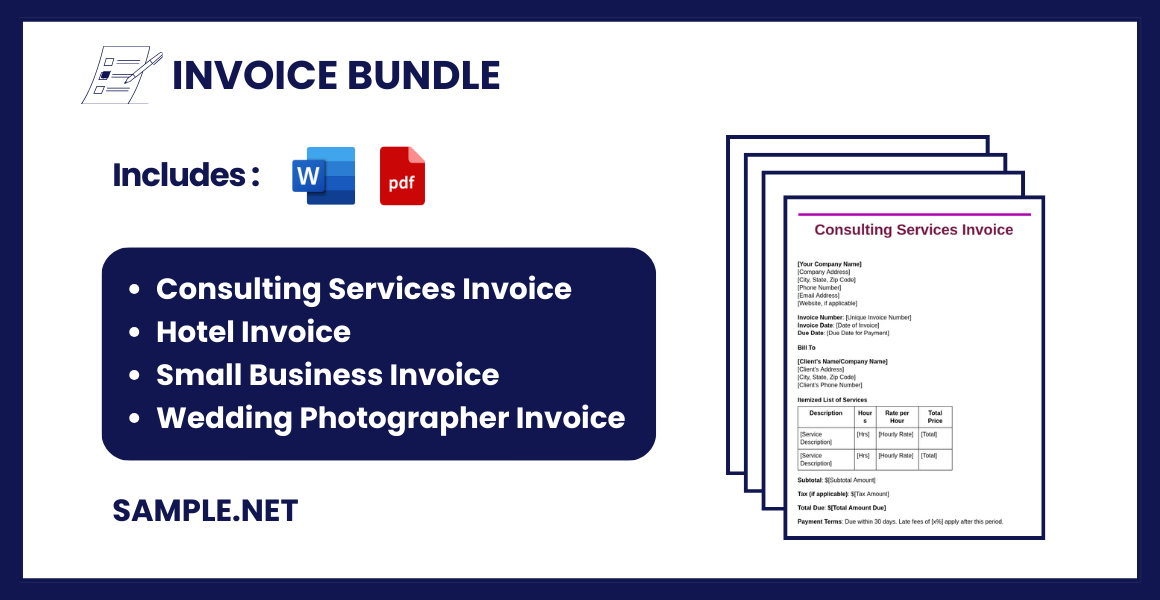

Consulting Services Invoice

download now -

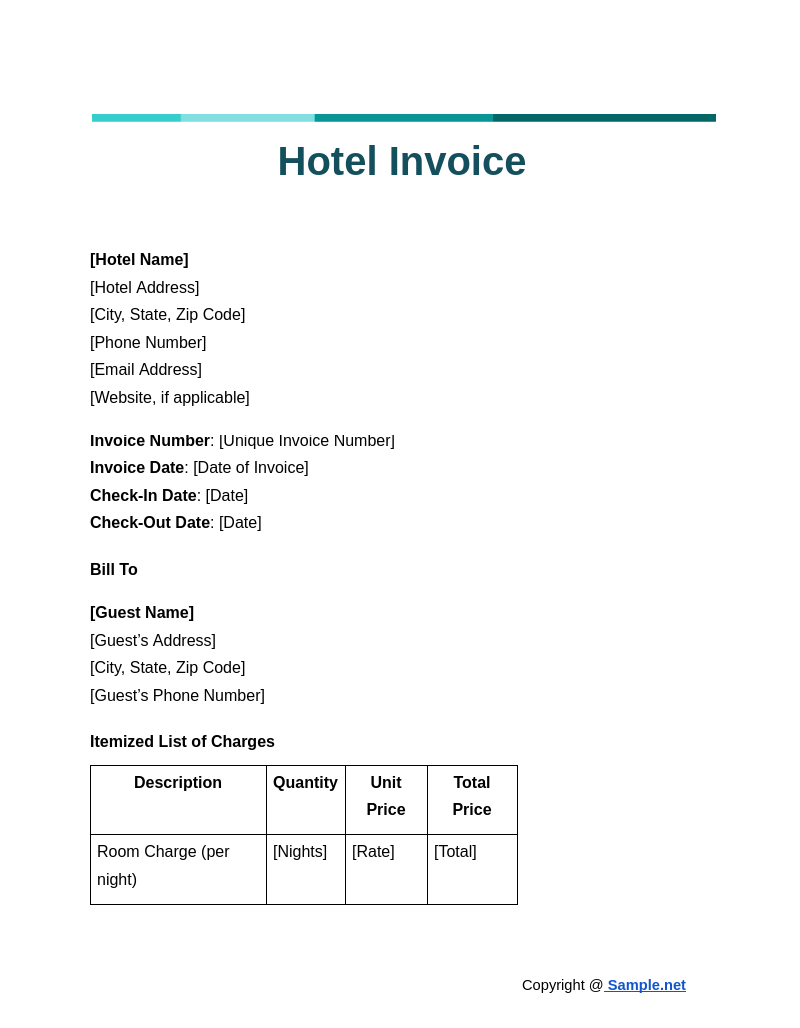

Hotel Invoice

download now -

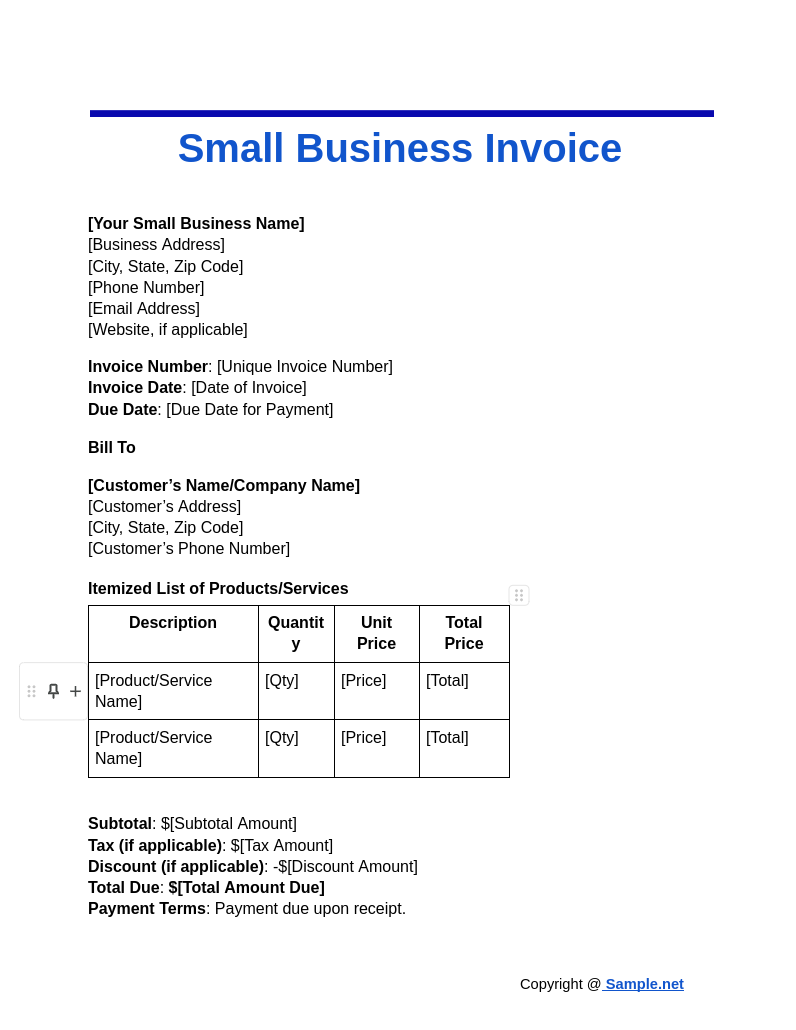

Small Business Invoice

download now -

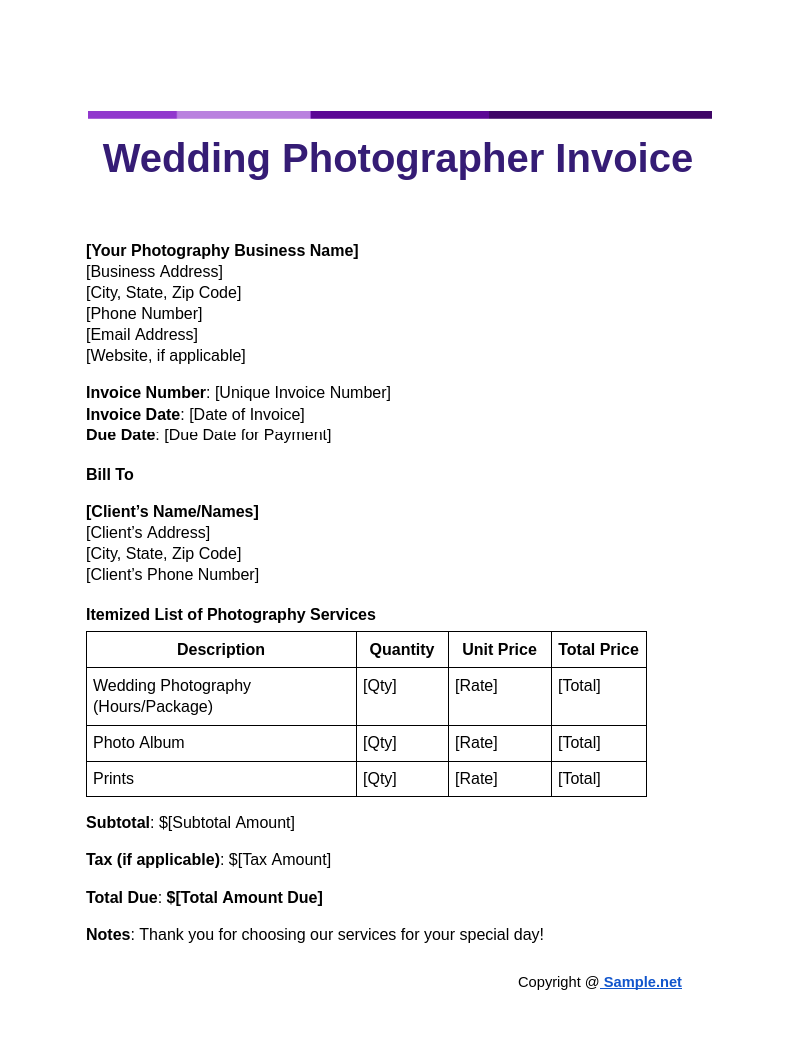

Wedding Photographer Invoice

download now -

Free Invoice Template

-

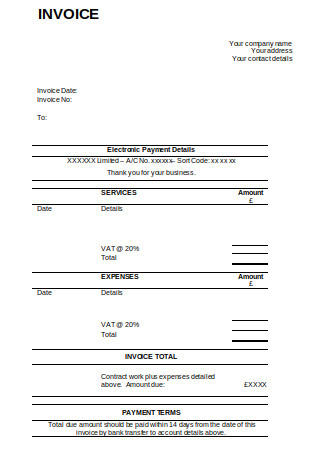

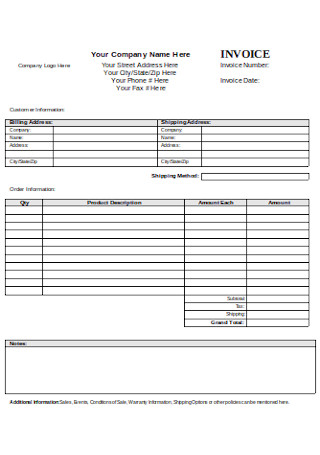

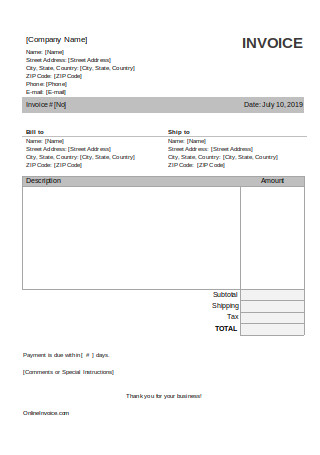

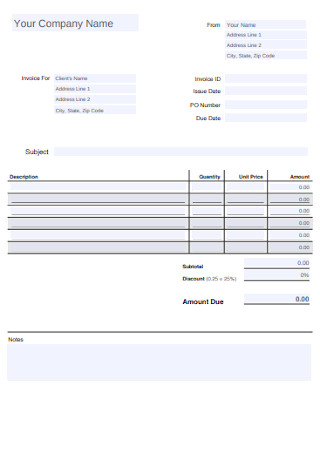

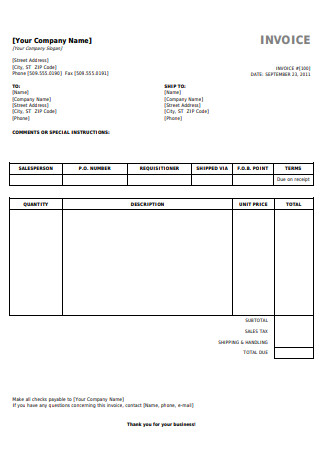

Invoice Template

-

Commercial Invoice Template

-

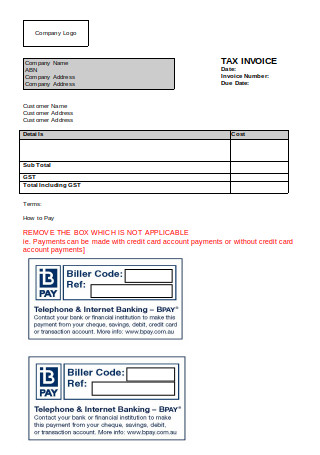

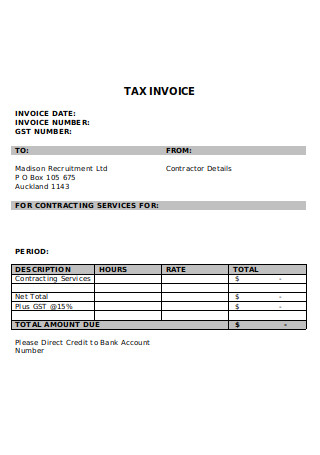

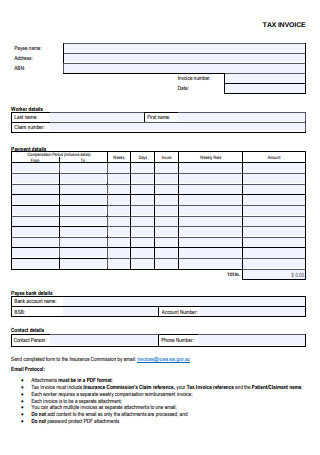

Tax Invoice

-

Blank Invoice

-

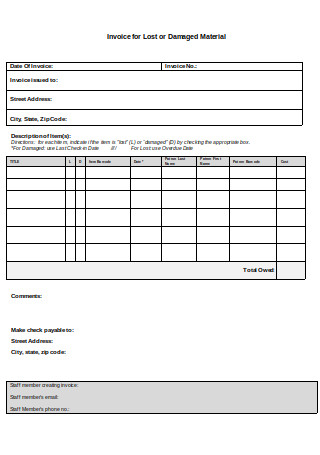

Library Billing Invoice Template

-

Sales Invoice

-

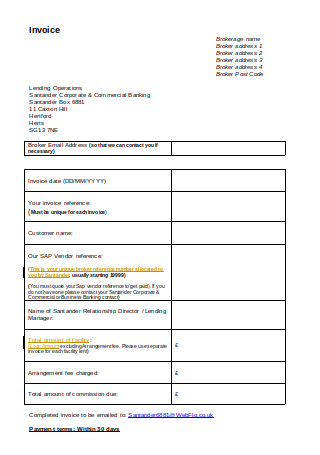

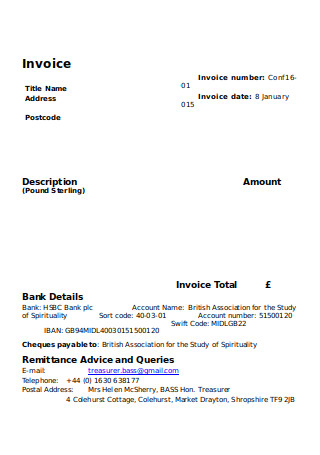

Bank Invoice

-

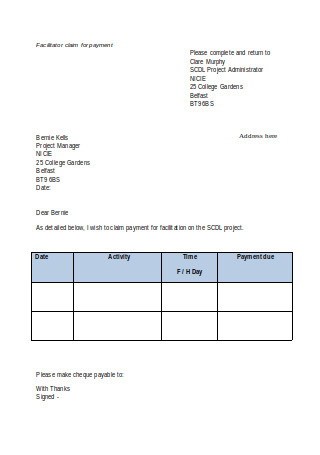

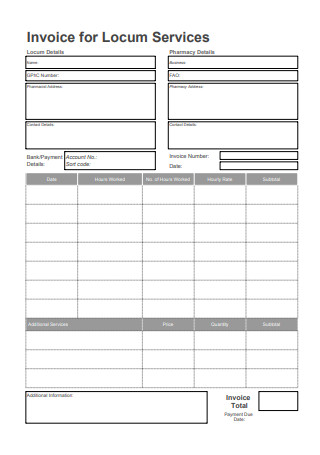

Facilitator Invoice Template

-

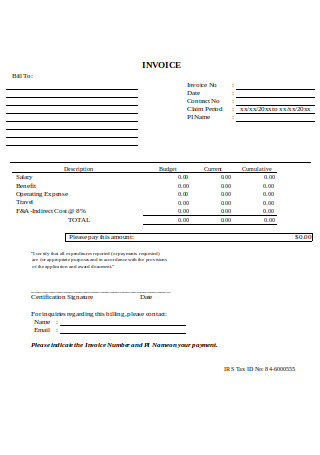

Billing Invoice Template

-

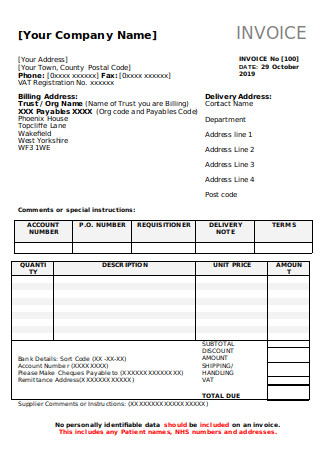

Printable Invoice Template

-

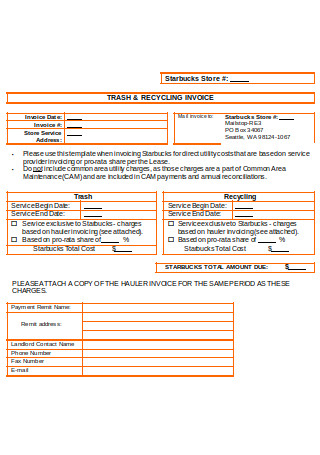

Sample Utility Invoice

-

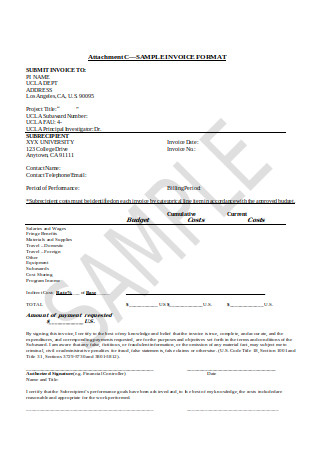

Sample Invoice Format

-

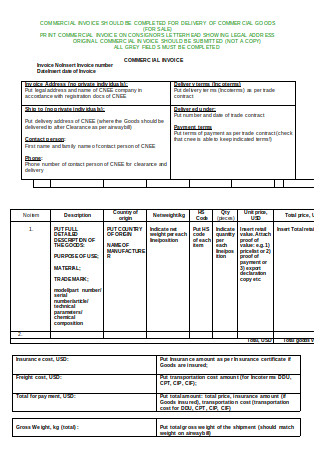

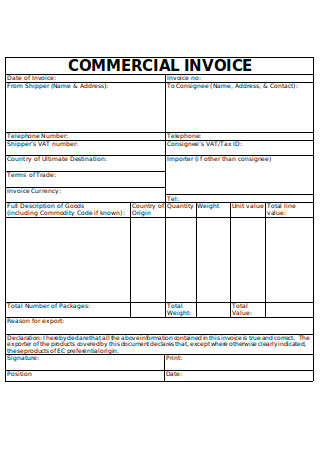

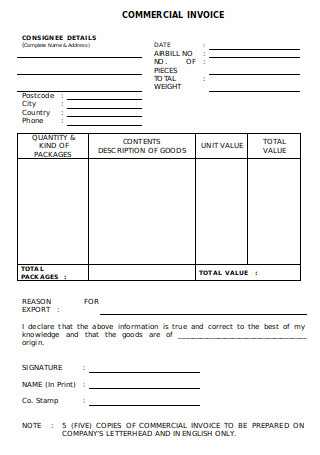

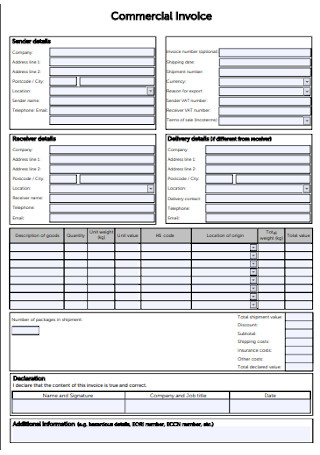

Commercial Invoice

-

Simple Invoice Template

-

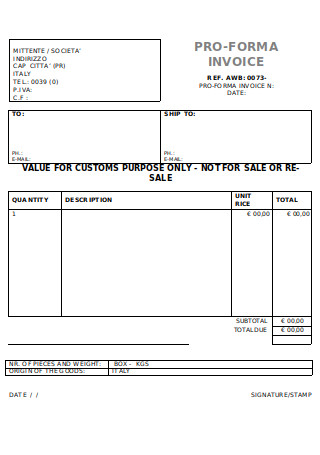

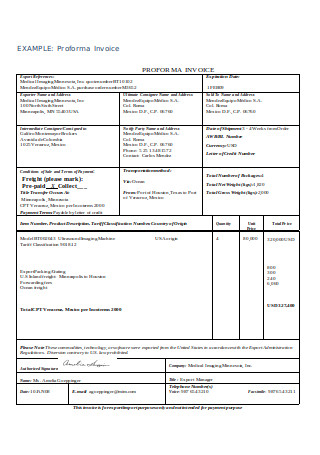

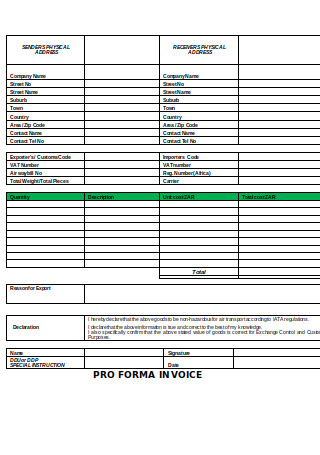

Proforma Invoice

-

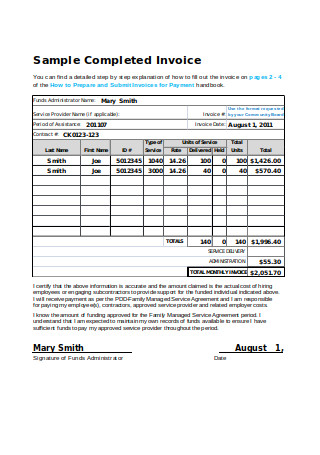

Sample Completed Invoice

-

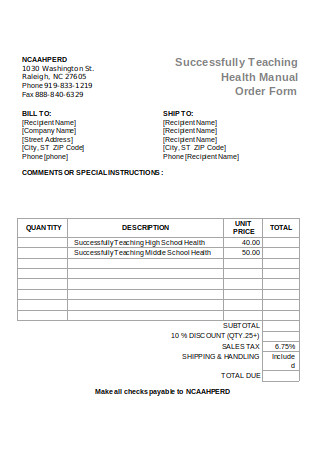

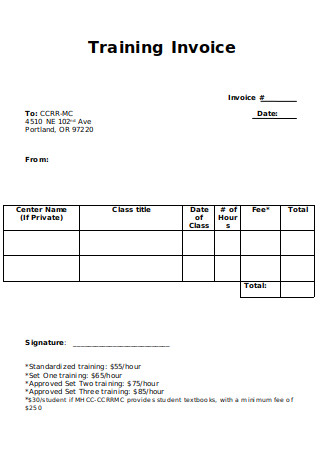

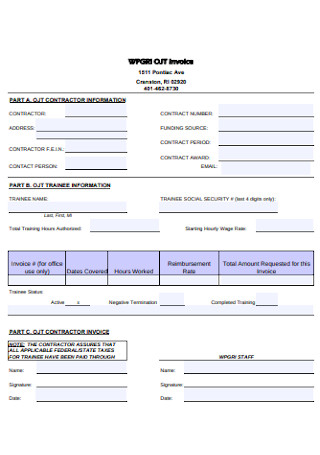

Training Invoice

-

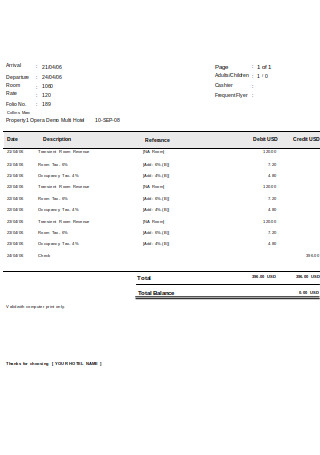

Hotel Bill Format

-

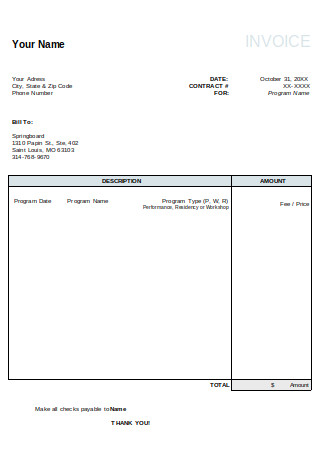

Formal Invoice

-

Conference Invoice Template

-

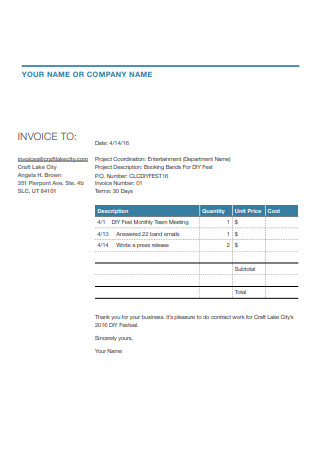

Sample Invoice Template

-

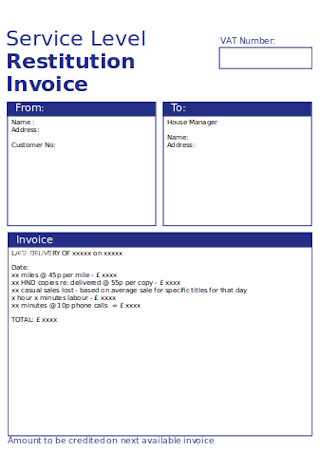

Restitution Invoice Template

-

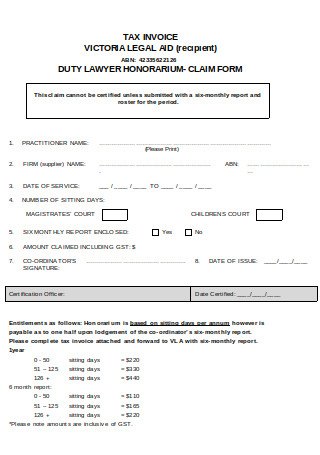

Sample Tax Invoice

-

Sample Commercial Invoice

-

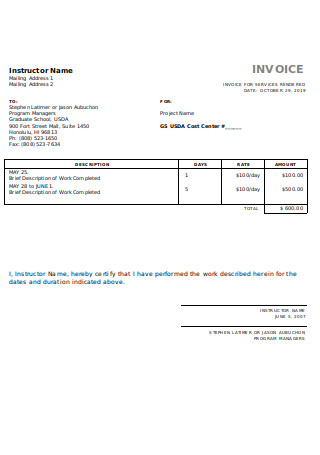

Instructor Invoice Template

-

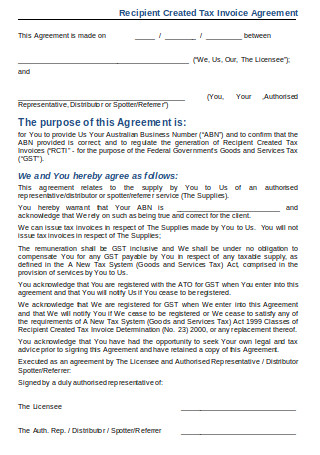

Recipient Created Tax Invoice

-

Sample Proforma Invoice Template

-

Commercial Invoice in PDF

-

Formal Tax Invoice

-

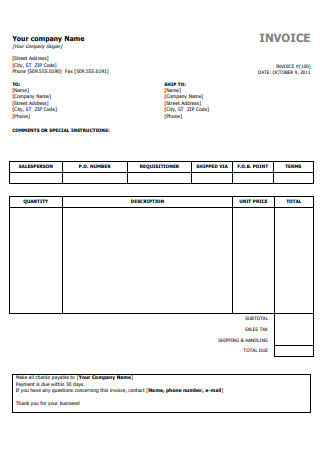

Standard Invoice

-

Simple Invoice in PDF Template

-

Invoice Format

-

Standard Format of Invoice

-

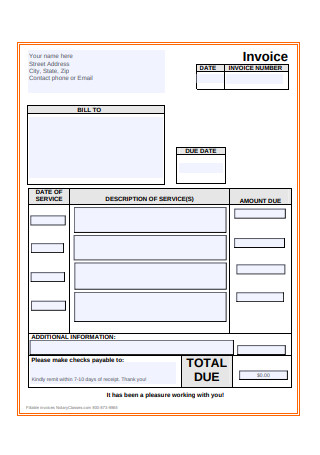

Basic Invoice

-

Contractor Invoice

-

Letter Head Invoice

-

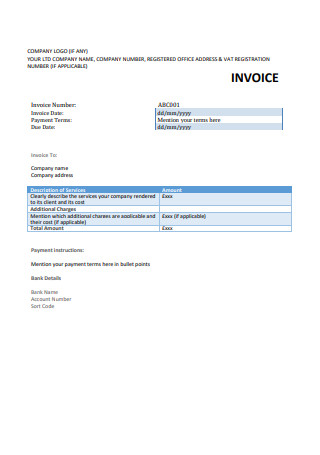

Limited Company Invoice

-

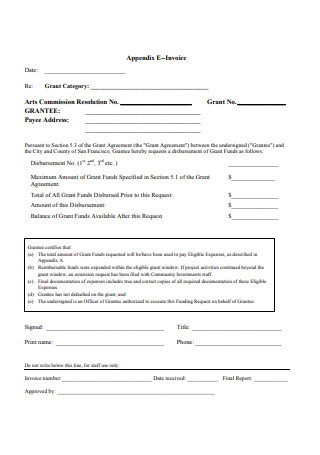

E-Invoice

-

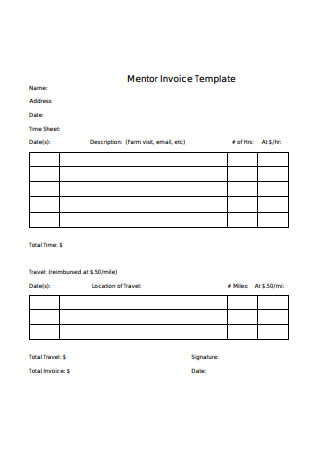

Mentor Invoice

-

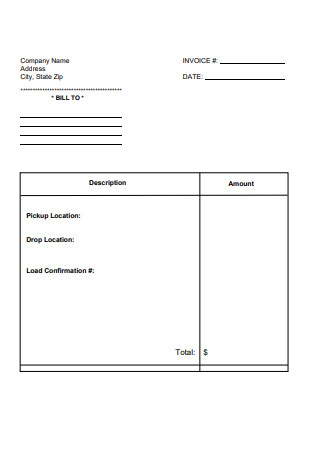

New Invoice Template

-

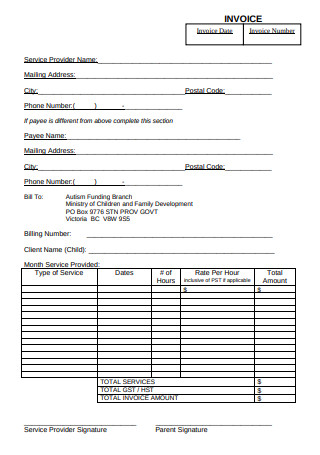

Invoice

-

Printable Invoice

-

Reimbursement Tax Invoice

-

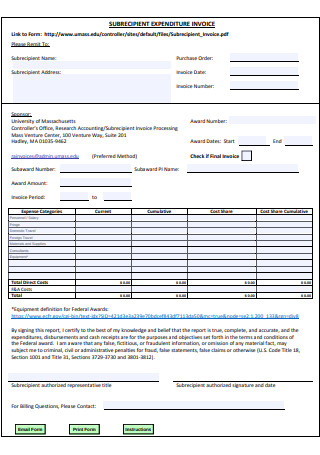

Sub Recipient Invoice

-

Service Invoice

-

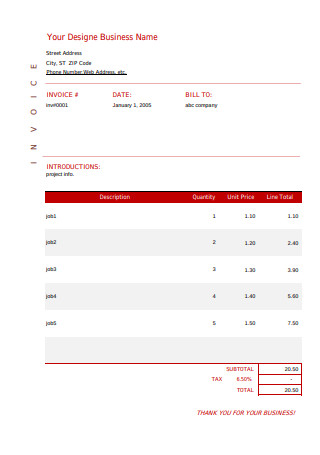

Designer Invoice

-

Billing Invoice Form Template

download now

FREE Invoice s to Download

Invoice Format

Invoice Samples

What is an Invoice?

Reasons to Issue an Invoice

How to Make an Invoice

FAQS

When should an invoice be issued?

How long should an invoice be kept?

What is a recurring invoice?

How does an invoice differ from a bill?

What are the benefits of digital invoicing?

What should be included in invoice payment terms?

Invoice Format

[Your Company Name]

[Company Address]

[City, State, Zip Code]

[Phone Number]

[Email Address]

[Website, if applicable]

Invoice Number: [Unique Invoice Number]

Invoice Date: [Date of Invoice]

Due Date: [Due Date for Payment]

Bill To

[Client’s Name/Company Name]

[Client’s Address]

[City, State, Zip Code]

[Client’s Phone Number]

Itemized List of Services/Products

| Description | Quantity | Unit Price | Total Price |

|---|---|---|---|

| [Product/Service Name] | [Qty] | [Price] | [Total] |

| [Product/Service Name] | [Qty] | [Price] | [Total] |

Subtotal: $[Subtotal Amount]

Tax (if applicable): $[Tax Amount]

Shipping (if applicable): $[Shipping Amount]

Discount (if applicable): -$[Discount Amount]

Total Due: $[Total Amount Due]

Payment Terms

- Payment Method: [Bank Transfer, Credit Card, etc.]

- Bank Account Details (if applicable):

- Bank Name: [Bank Name]

- Account Number: [Account Number]

- SWIFT Code: [SWIFT Code]

Notes/Terms & Conditions:

[Optional section for payment terms, late fees, or other relevant details.]

Thank You

Thank you for your business! Please feel free to contact us with any questions.

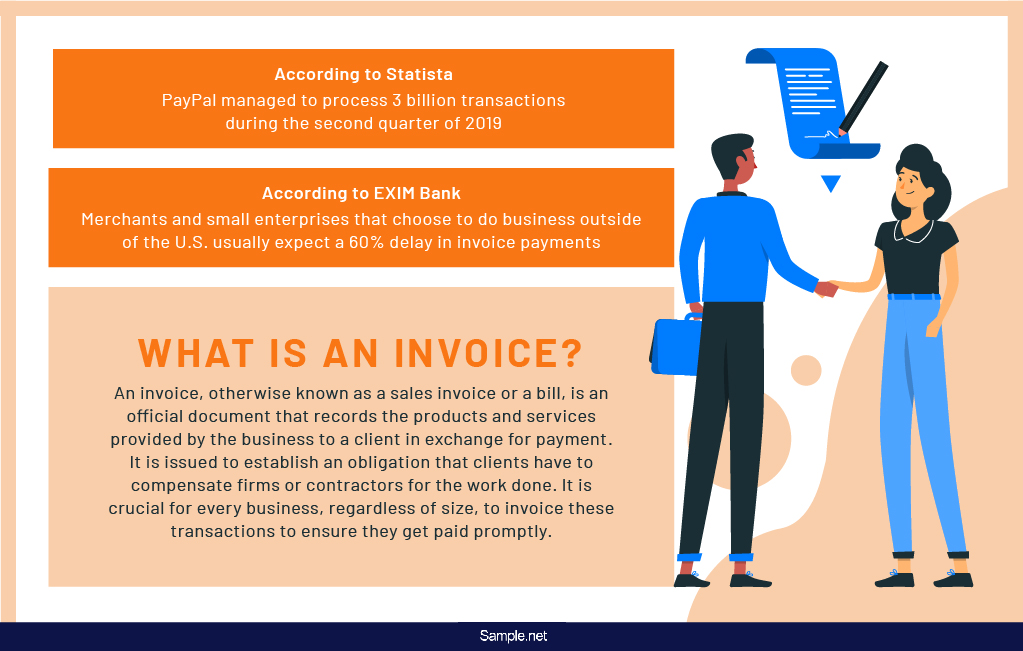

What is an Invoice?

An invoice, otherwise known as a sales invoice or a bill, is an official document that records the products and services provided by the business to a client in exchange for payment. It is issued to establish an obligation that clients have to compensate firms or contractors for the work done. It is crucial for every business, regardless of size, to invoice these transactions to ensure they get paid promptly. The invoice can also remind clients how much they owe a business and why. This will further verify the agreement between a buyer and a seller as part of your company’s bookkeeping and accounting responsibilities. You can also see more on Consultant Invoices.

Although printed documents were mailed to buyers back in the day, technology has now made it possible for sellers to request payments online through various electronic systems in the market. You can also see more on Electrical Invoice.

Reasons to Issue an Invoice

Running a business can get overwhelming at times. One of the responsibilities that come with the job is the process of sending invoices and receiving payments. Unfortunately, not many SMEs seem to recognize the importance of invoicing to their daily operations. So to understand the role that these documents play in the world of business, let’s discuss the key purposes of invoicing for efficient sales and accounting. You can also see more on Delivery Invoice.

How to Make an Invoice

Nearly every type of business you can think of may benefit from the use of an invoice. Like any other accounting invoices and documents, billing statements like these enable you to inform clients of the expenses they are obliged to settle within a particular period. It’s a time-consuming task that often adds a bit of weight to your already hectic workload. Still, this shouldn’t stop you from making an invoice that works. Even if you decide to use an invoice template to speed up the process, you’ll still need to fill the document with the required details. Hence, you may want to consider taking a more efficient approach with the help of the steps below.

Step 1: Start with Your Business Information

Your company information is a vital element of the invoice that you must never overlook. This includes your logo, legal company name, office address, phone number, and email. While branding might be a common reason to have it in your invoice, keep in mind that the invoice may also inform clients of ways to contact you in case they have any questions to raise. They could also refer to the invoice if they wish to get in touch with you for future projects. Be sure to put and organize this information in the most visible area of your invoice for recipients to locate.

Step 2: Address the Recipient

Think of it as a formal business letter. Aside from identifying the business sending the invoice, you also need to direct it to the right person or entity. If you’re billing it to a company, the invoice must clearly specify who the payer is in this arrangement. Proper spelling must be observed to prevent legal issues along the way. The same applies for addresses, emails, and other unique indicators that may be pertinent to the case. The last thing you want is to misspell the name of the person you are expecting payment from.

Step 3: Record Key Components of the Billing Statement

No two invoices are the same. In addition to payer and payee details, invoices vary in terms of the payment date, the amount due, and the billing number. The presence of a unique identifier makes it easier to track the billing statement among a thousand other records. Rather than informing clients and colleagues about the invoice you sent a week ago, you can refer to the billing number for quick identification. It also makes tracking more convenient during tax season, especially when the business has been booming over the past couple of months. Most electronic systems issue these invoices based on unique and sequential invoice numbers as a more practical approach to accounting.

Step 4: List Down the Products or Services Sold

Make a detailed list of the products or services being invoiced, along with any additional expenses that came with it. If you’re hired to play a few songs for an event, for example, your contract may indicate other fees apart from your standard service rate. This may involve food, travel, and lodging for events held outside of town. Make sure to list each item separately for a comprehensive and accurate breakdown of the costs. You can also see more on Sports Invoice.

Step 5: Indicate the Total

The amount that clients are expected to pay should be inclusive of taxes, discounts, and other additional fees. Since these components are not a part of the invoiced items, they are usually listed separately on the bill. Always remember to review the total amount before sending it to its respective recipient. Any discrepancies or miscalculations in the invoice may cause problems, putting you and your team at a disadvantage.

Step 6: Provide Your Terms of Payment

What modes of payment do you accept? How may business days are involved in processing the payment? What other terms do clients have to take note of? All these must be stated clearly in the invoice for a smooth transaction. You can also provide a few instructions if necessary. You can also see more on Proforma Invoices.

Invoices are more than just payment requests; they’re key to financial management and transparency in business. They ensure precise transaction records, help monitor cash flow, and aid in financial audits. A well-documented invoice process strengthens professional relationships and ensures efficient, clear payment procedures in all business dealings. You can also see more on Bakery Invoice.

FAQS

When should an invoice be issued?

Invoices are usually issued immediately after goods are delivered or services are provided. This promptness helps establish timely payment cycles, keeping cash flow steady and transactions transparent.

How long should an invoice be kept?

Invoices should be retained for at least six years for tax and accounting purposes. This retention supports financial audits and compliance with regulatory requirements. You can also see more on Event Planner Invoice.

What is a recurring invoice?

A recurring invoice is sent at regular intervals, often for ongoing services or subscriptions. It helps streamline invoicing for repeated services, making billing predictable and easy to manage.

How does an invoice differ from a bill?

While invoices and bills serve similar purposes, an invoice is sent by the seller to request payment, whereas a bill is typically received by the buyer. Invoices detail transaction specifics, while bills are often simpler, listing the amount due without itemization. You can also see more on Cake Invoice.

What are the benefits of digital invoicing?

Digital invoicing offers advantages like faster delivery, tracking options, and secure payment links, reducing the time for payment processing and lowering the risk of lost paperwork. It also helps in automating follow-ups for overdue invoices.

What should be included in invoice payment terms?

Payment terms outline the due date, accepted payment methods, early payment incentives, or late fees. These terms establish clear expectations, motivating timely payments and fostering healthy business relations. You can also see more on Commercial Invoice.