20+ Sample Payroll Templates & Calculators

-

Payroll Payment Templates

download now -

Payroll Services Template

download now -

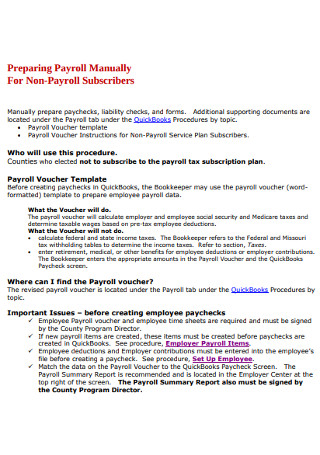

Payroll Manually For Non-Payroll Subscribers

download now -

Summer Payroll Procedures

download now -

Payroll File Template

download now -

Software Payroll Template

download now -

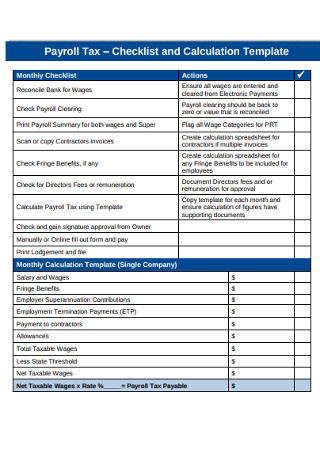

Payroll Tax Calculation Template

download now -

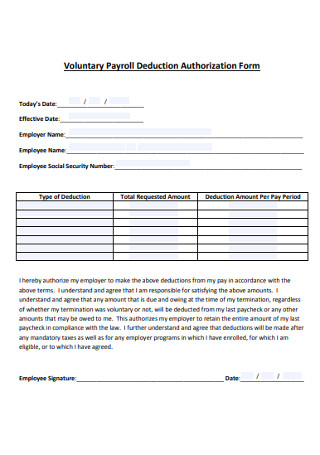

Voluntary Payroll Deduction Authorization Form

download now -

Day-force Payroll Template

download now -

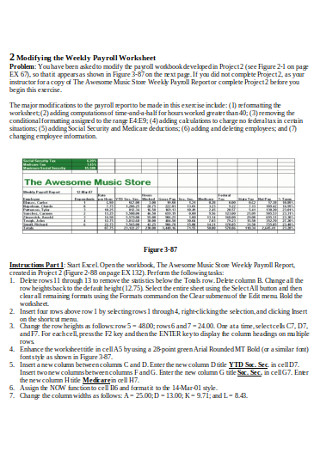

Weekly Payroll Workseet

download now -

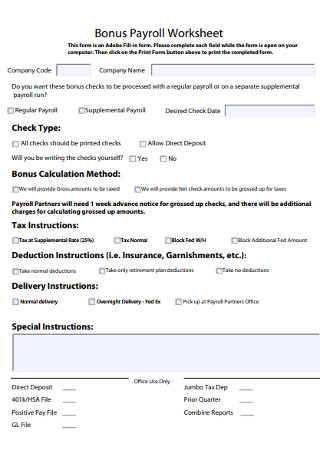

Bonus Payroll Worksheet

download now -

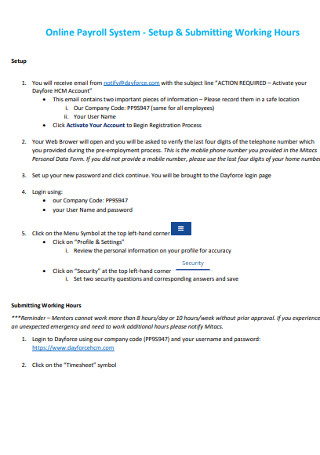

Working Hours Payroll System

download now -

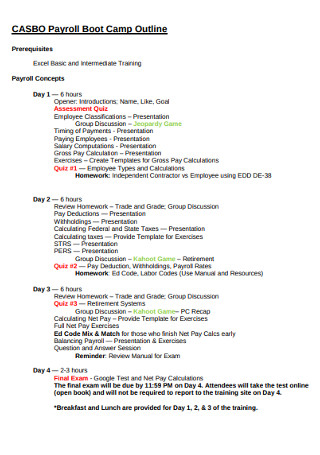

CASBO Payroll Boot Camp Outline

download now -

Payroll Travel Report

download now -

Payroll Data Entry Template

download now -

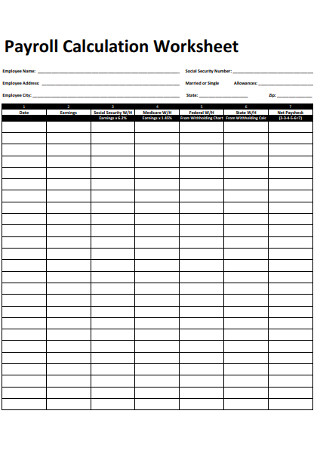

Payroll Calculation Sheet

download now -

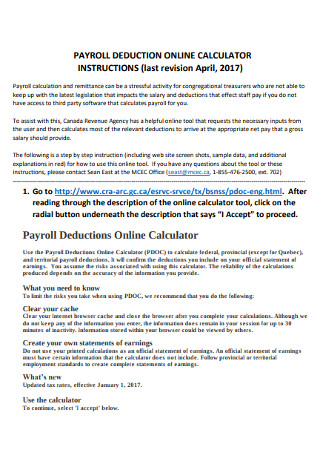

Payroll Deduction Online Calculator

download now -

Sample Payroll Calculation

download now -

Payroll Tax Calculation

download now -

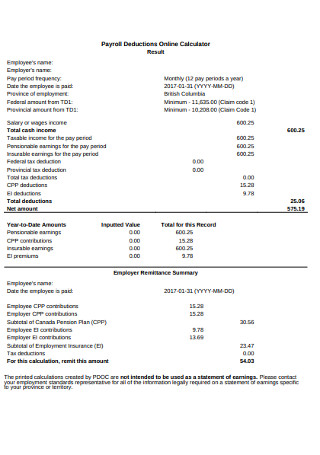

Payroll Deductions Online Calculator

download now -

Payroll Deduction Form

download now -

Sample Monthly Calendar Template

download now

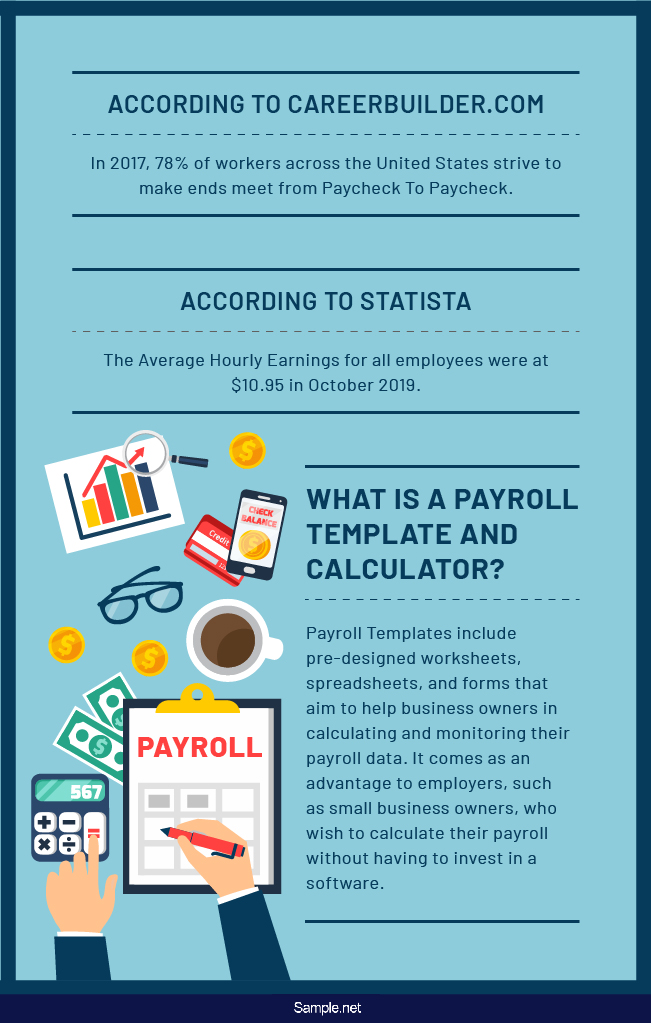

What Is a Payroll Template & Calculator?

A 2017 survey by Career Builder found that approximately 78% of workers across the United States strive to make ends meet from paycheck to paycheck. The average hourly earnings for all employees were even reported at $10.95 in October 2019 by Statista. While setting up and running payroll is a lot to do, you need to understand how one mistake may significantly affect an employee’s daily living, along with how they view the company. Most people already struggle to get by with what they have, what more if your company fails to calculate their wages correctly?

The good news is, payroll management doesn’t have to be as dreadful as it sounds with the help of the right templates.

Payroll templates include pre-designed worksheets, spreadsheets, and forms that aim to help business owners in calculating and monitoring their payroll data. It comes as an advantage to employers, such as small business owners, who wish to calculate their payroll without having to invest in a software. Some payroll templates even come in automated forms to serve as calculators for easy computation. These documents are the perfect instruments to use to help you better manage your company payroll system.

Types of Payroll Templates

Calculating an entire workforce’s salary is a tedious and often stressful task for anyone, which is why an organized payroll system is crucial to keep you on top of things. Fortunately, there are various types of payroll templates that your company can utilize to carry out its operations. Listed below are some of the common types of payroll templates that you’ll find useful.

How to Do Payroll Effectively

It’s not unusual for a small business to do its own payroll without the assistance of an accountant or a bookkeeper. Thanks to easy-to-use templates, you can get started with the payroll process immediately. Manual calculations is the least expensive option for businesses of any size, which makes it a good alternative for startups and SMEs. It’s an endless cycle of calculating records, distributing wages, and filing taxes until the next pay period. There’s a ton to get done in so little time, so we’ve summarized the entire process to a few steps to keep you guided.

Step 1: Gather the Necessary Information

Start by rounding up any payroll-related business data, including your identification number and tax rates. Employee information must also be collected based on individual accounts. Make sure to have these files on standby for every time you need to process your company’s payroll. The last thing you want to do is to dig up these folders for the first part of every pay period.

Step 2: Refer to Timekeeping Data

There’s a good reason why companies keep an attendance record for clocking in and out of the office. It may come in the form of a time sheet or a time card, depending on whether your company follows a manual or electronic system of capturing data. It’s best to start collecting this information a reasonable number of days before employees receive their paycheck, as it does require much of your time and effort to complete. If you have a handful of people employed in the organization, you may want to consider using an automated scheduling system for accuracy.

Step 3: Calculate Wages

In this stage, it’s time for you to determine the total wages of your employees, including any compensation they’re set to acquire. You must also account for the deductions from an employee’s gross pay for taxes, tardiness, absences, insurance, and other benefits. Be sure to check if these deductions are correct by reviewing the employee’s account. You also need to note those who worked over 40 hours in a week during the said period to make them eligible for overtime pay. Variable pay for employees with bonuses and commissions from exceptional work performance should also reflect in the total.

Step 4: Release the Payroll

You may pay your employees through cash, check, direct deposit, or other payment methods available. The distribution will likely vary between exempt and nonexempt employees, so be sure to clarify this with your HR manager upon employment. If your state laws require you to provide pay stubs (or payslips) to your employees, be sure to have them printed before or on the day of your payroll release.

The Dos and Don’ts of Using Payroll Templates

Payroll is an essential part of running a business, but it can also be time-consuming to conduct. It’s confusing, to say the least, not to mention daunting to the inexperienced. However, executing your payroll process shouldn’t be something to run from. Instead, you could always maximize the efficiency of your payroll templates to ensure successful payroll management.

With that said, you might want to keep the following dos and don’ts in mind.

Dos

1. Do familiarize payroll rules and regulations.

We all know how the laws keep changing. But as frustrating as it can be, acting under government regulations is essential to avoid disputes with your employees and the local authorities. In the U.S., you can find these policies in the Fair Labor Standards Act (FLSA). Understanding the policies that revolve around payroll compliance in the state or country you are in is crucial for your business to operate under legal circumstances. It also ensures that you don’t get audited as soon as tax season comes around.

2. Do ensure that information remains accurate.

Federal and state agencies continue to impose penalties against employers that fail to adhere to the rules of payroll. These organizations have the right to intervene if workers set forth complaints regarding employers that fail to do their payroll the right way. Records with discrepancies in working hours, off days, and overtimes of an employee are sure to put you in hot water, mainly if they occur consistently. Thus, it’s vital to secure accurate time records of all your staff members for easy tracking.

3. Do make it easy to use.

Payroll records get passed around often by people from your HR department and accounting services. These documents usually go back and forth between the two parties, as they each cater to a specific business function. Although you may have someone assigned for the job, it’s still possible for someone else to take on the role of a temporary or permanent replacement for the last appointee. With this in perspective, it’s clear why your payroll templates need to be flexible and understandable for long-time usage. You could always customize the model as the company grows to complement your current needs and avoid confusion.

4. Do compensate your employees on time.

Now that you have a payroll schedule in place, late salary releases shouldn’t be an issue anymore. There’s nothing worse than getting paid late, especially with the amount of effort that employees put into their work to meet deadlines and client demands as timely as possible. You don’t want your employees to resent you for a mistake that could have easily been avoided if you only tried to steer clear of the loopholes from the very beginning. If cases like this become prevalent in your company, it could drive employees to resign from their positions and get you in trouble with the law.

5. Do consider outsourcing.

Managing a company’s payroll can be taxing for someone who has other responsibilities to take care of. While many organizations still handle these tasks through an in-house department, it wouldn’t hurt to outsource payroll services for your convenience. Working with a bookkeeper or a certified public accountant can spare you from making costly mistakes that may threaten your company’s financial resources. But because you’ll be working with a third-party entity, you’ll still be responsible for collecting and sharing attendance records and other related documents with the service agency. It’s a smart way of simplifying the entire payroll process for timely salary distribution.

Don’ts

1. Don’t include overtime productivity.

Heavy workloads and urgent deadlines often force employees to work off the clock. While it’s good to know that there are people who would go above and beyond to finish their tasks before the day ends, overtime benefits can sometimes lead to an abusive workforce. There’s a reason why employers do not encourage their employees to work overtime, especially if they have an entire shift to get it done. There are cases when employees choose to go overtime for the extra cash, even if they had every opportunity to finish an assignment within their working hours.

To avoid instances like this, refrain from including these entries in your payroll template. While you should still pay employees for the time rendered, you can note these details down in a separate sheet.

2. Don’t miscategorize workers.

When it comes to payroll concerns, large corporations classify their employees according to their status in the organization. Salaried employees, hourly employees, and independent contractors each have different pay grades, depending on how they are bound to the company. Getting this part of recordkeeping wrong may cause some employees to receive a miscalculated wage at the wrong pay date. Misclassification can also lead to serious legal trouble with the IRS, so be mindful of how you manage each group’s payroll.

3. Don’t neglect your payroll policy on overtime pay.

Apart from the 15-minute breaks and 1-hour lunchtime perks given to employees, your policy manual or employee handbook must also take overtime work into account. There are laws that cover the terms of employee overtimes, which may vary from state to state. These laws, along with your company policies, need to be considered. Even if you choose not to emphasize overtime situations in your templates, the least you can do is acknowledge these cases so you’ll know how to manage them when they happen.

4. Don’t establish changes without informing your staff.

Whenever you decide to make some changes to your payroll policies, make sure that every person in your workforce is aware of them. Refrain from implementing procedures, no matter how minor, to your company policies without giving the rest of your team notice. Transparency is a crucial trait that an organization must have to develop trust with its employees. Regardless of why these revisions were decided upon by the management, everyone deserves to know how these changes may affect them directly or indirectly. Let them know by communicating your policy changes through a formal letter, business memo, or company-wide announcement.

5. Don’t forget to double-check your time cards.

If you have hourly workers employed, you might want to verify the data inputted in one’s time card before entering it into your payroll system. It comes as no surprise that employees commit mistakes out of mere carelessness. In a week, you’ll likely find at least one employee who might have forgotten to clock in or clock out during their shift. Although employees are usually held accountable for their faults, it is still the employer’s responsibility to try and correct these mistakes to avoid underpayment. You can even provide your employees with a record of your company’s timekeeping sheet for verification before finalizing the payroll.

There are plenty of things you should do and shouldn’t do when managing your company’s finances. With all the rules there are to follow, staying organized is crucial to minimize risks and mistakes in the payroll process. So if you’re looking for a convenient solution to general payroll problems, feel free to find a payroll template that suits your business needs from the collection above. That way, you can develop a better payroll system to streamline business processes for the benefit of all.