Promissory Note Samples

-

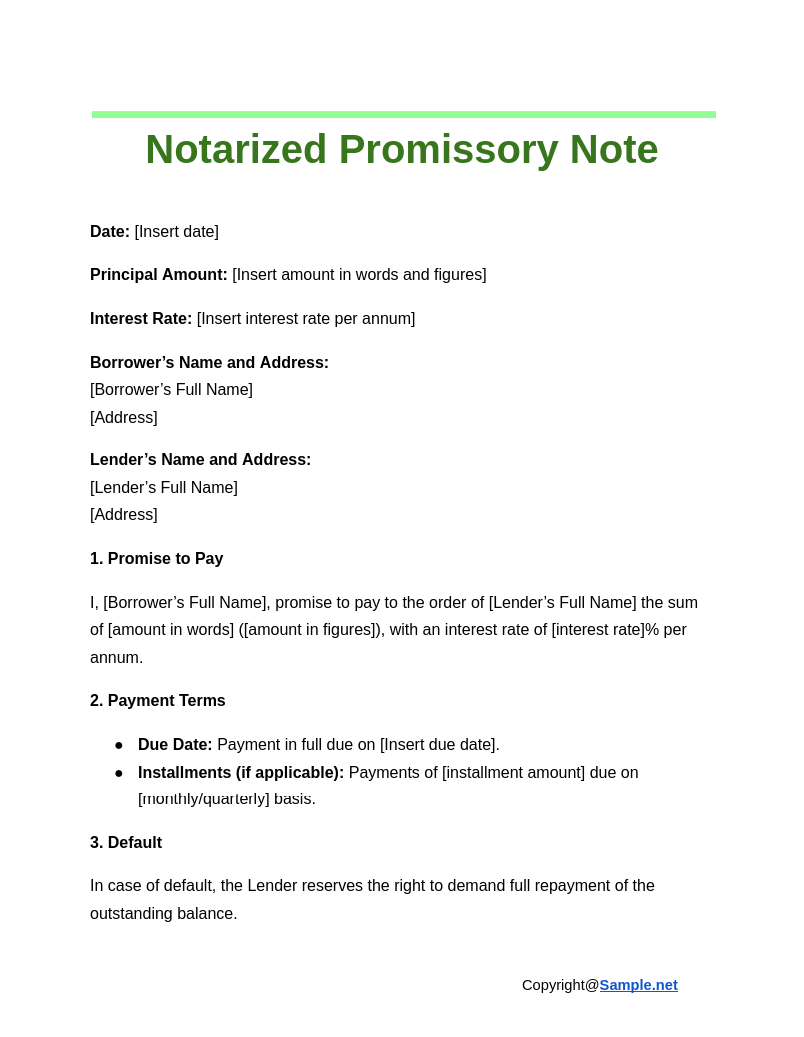

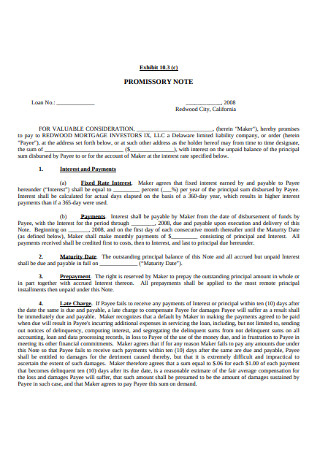

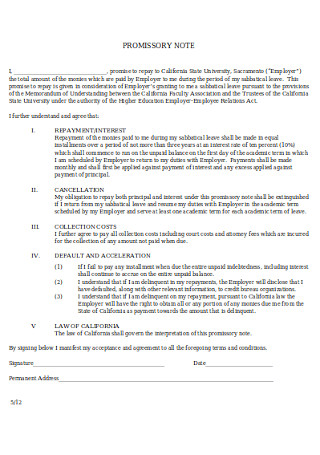

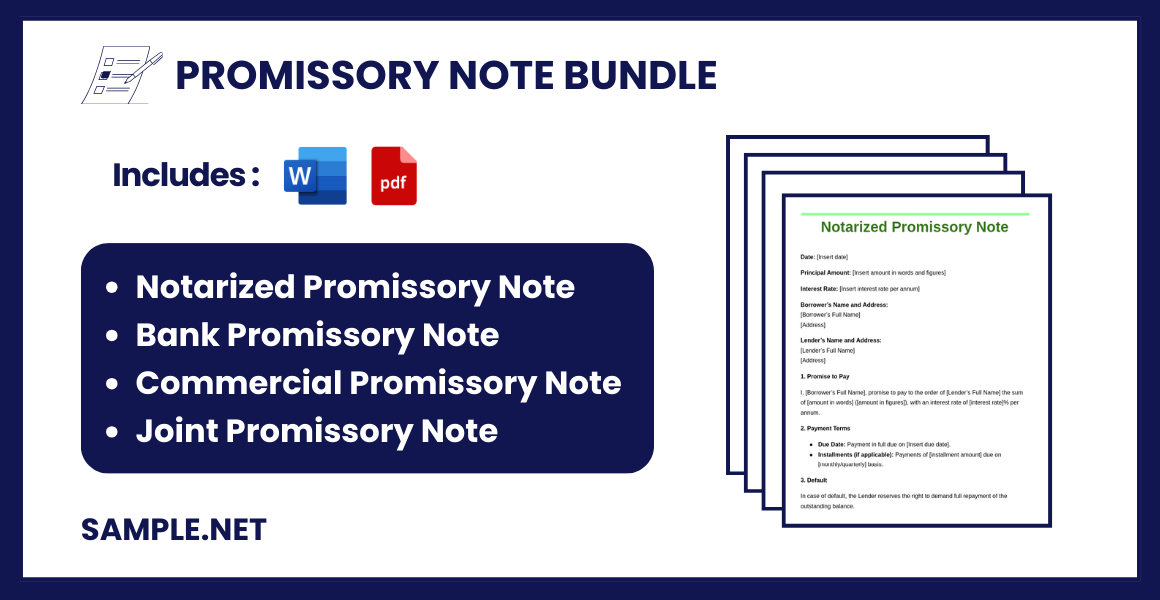

Notarized Promissory Note

download now -

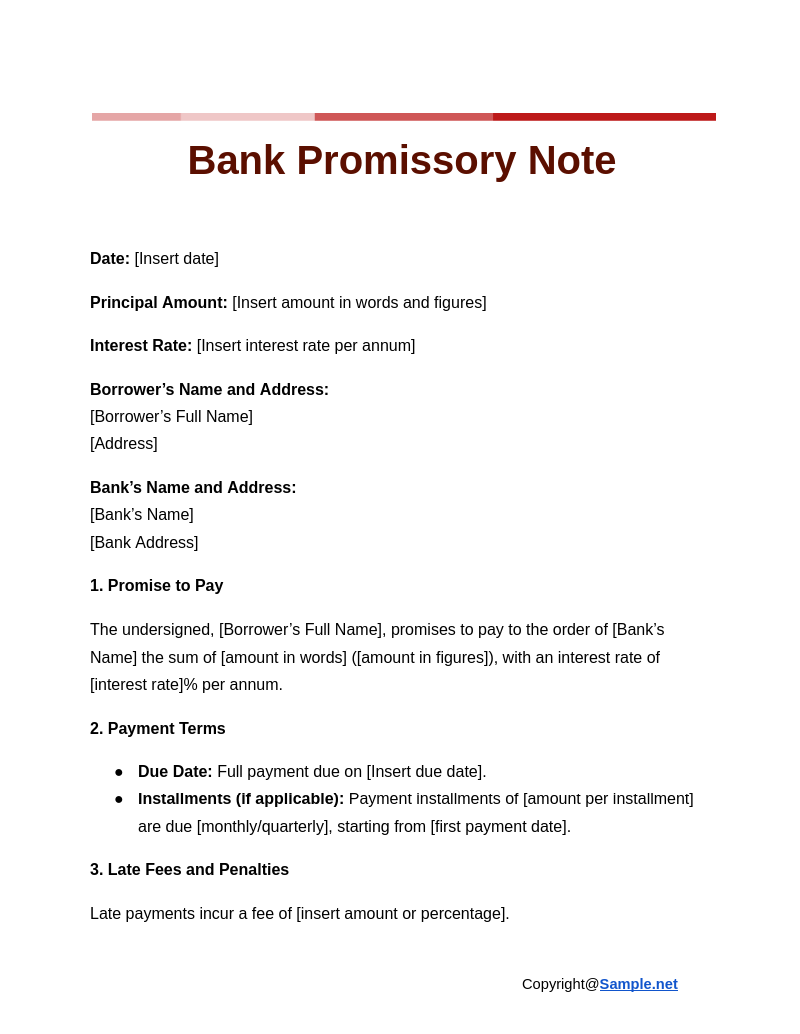

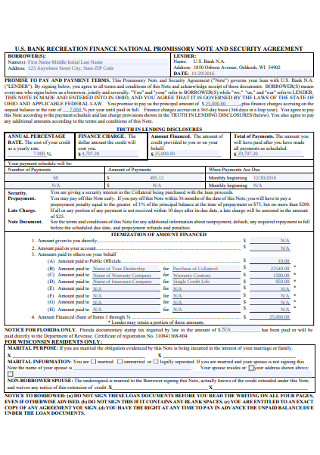

Bank Promissory Note

download now -

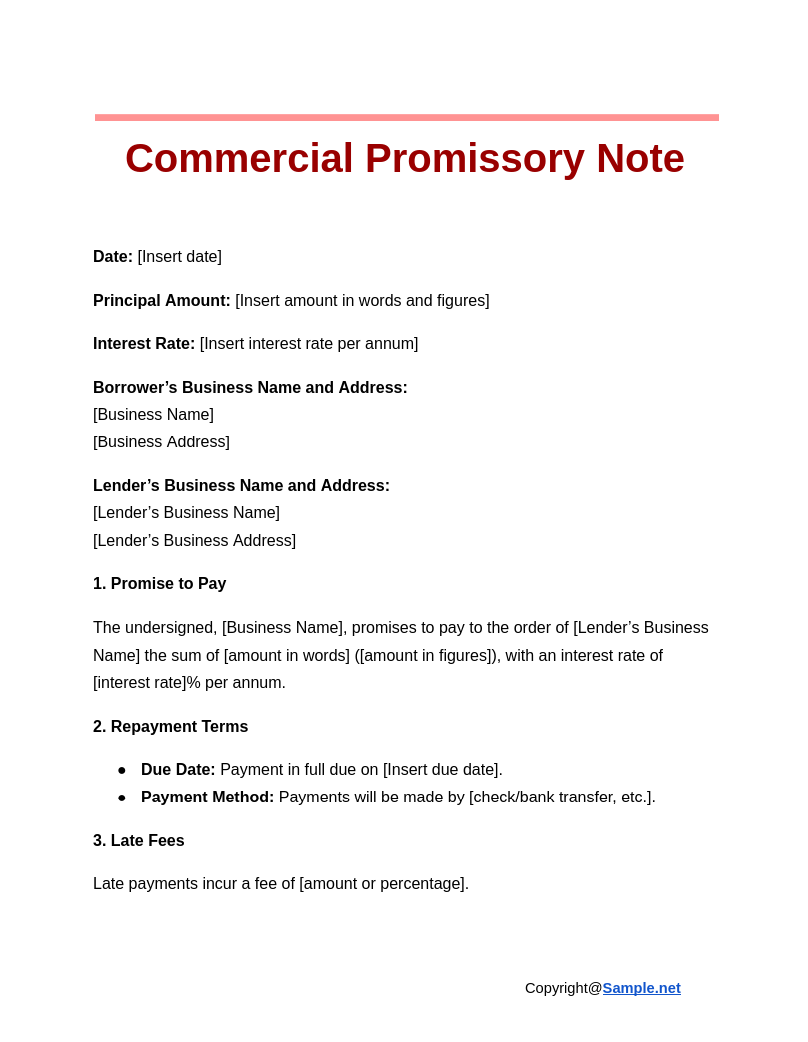

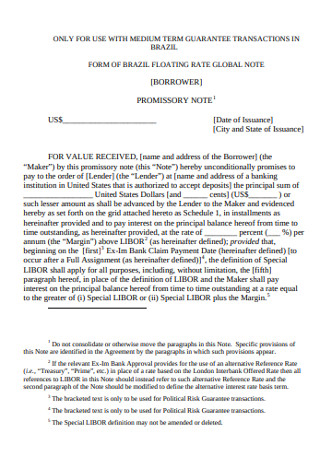

Commercial Promissory Note

download now -

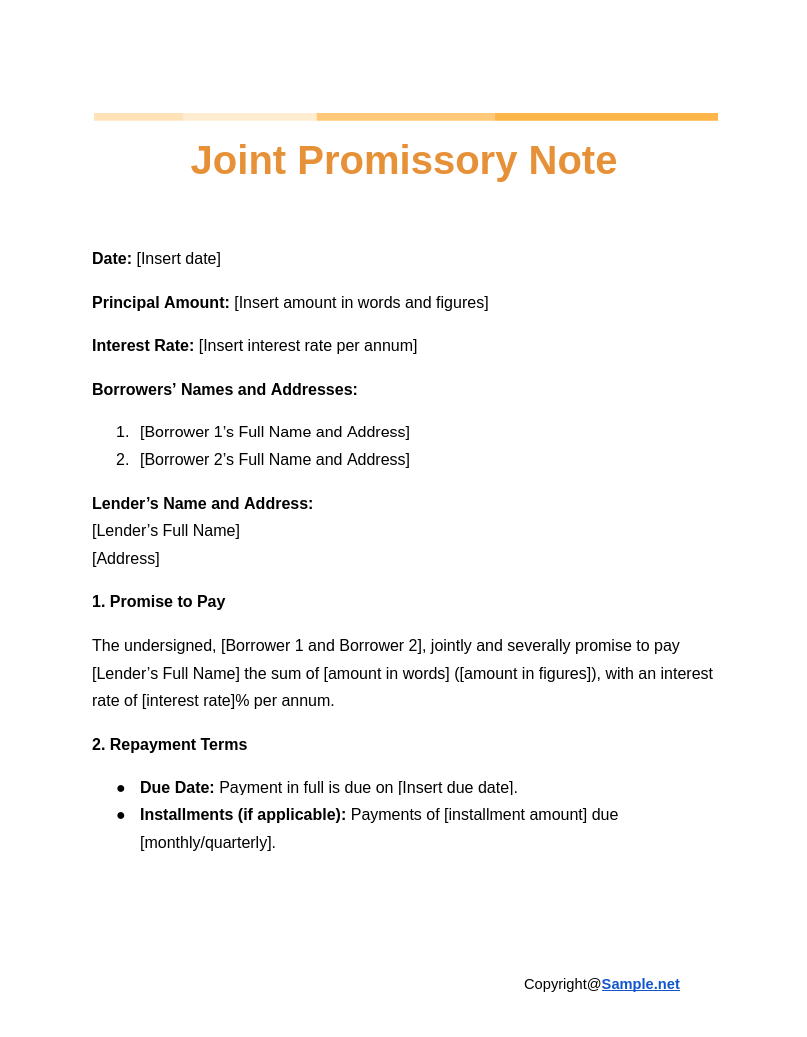

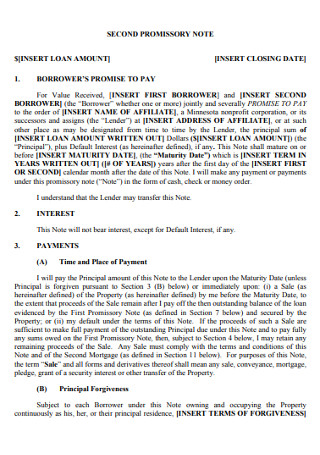

Joint Promissory Note

download now -

General Promissory Note Template

download now -

Promissory Note Line of Credit Template

download now -

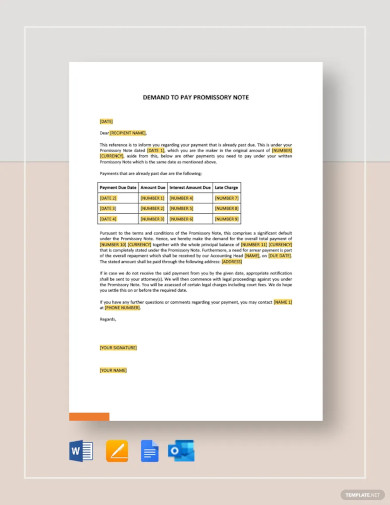

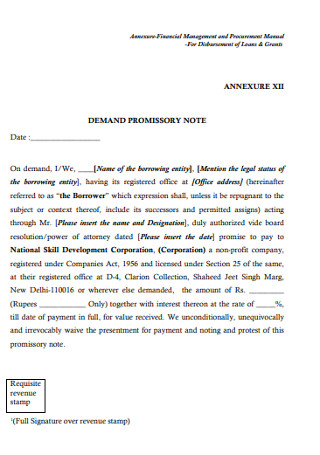

Demand to Pay Promissory Note Template

download now -

Security Agreement and Promissory Note Template

download now -

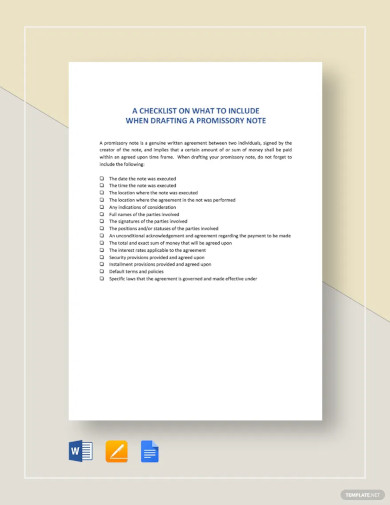

Checklist Items to Consider for Drafting a Promissory Note Template

download now -

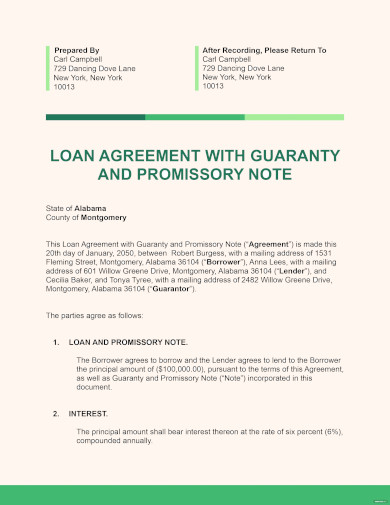

Loan Agreement with Guaranty and Promissory Note Template

download now -

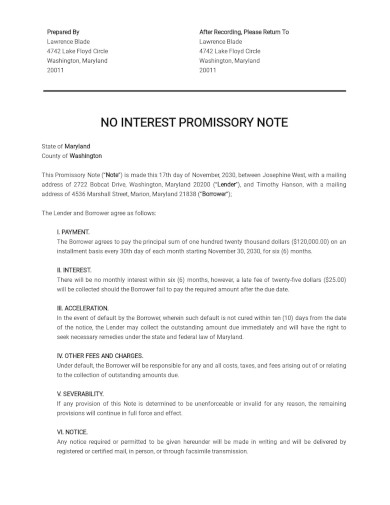

Promissory Note Template No Interest

download now -

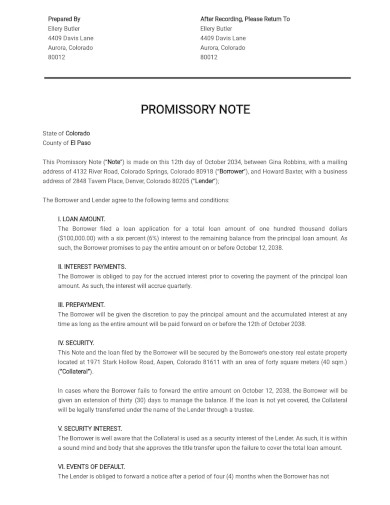

Promissory Note Template

download now -

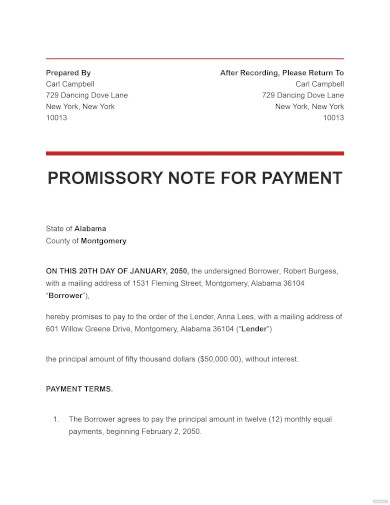

Promissory Note for Payment Template

download now -

Promissory Note With Acknowledgement Template

download now -

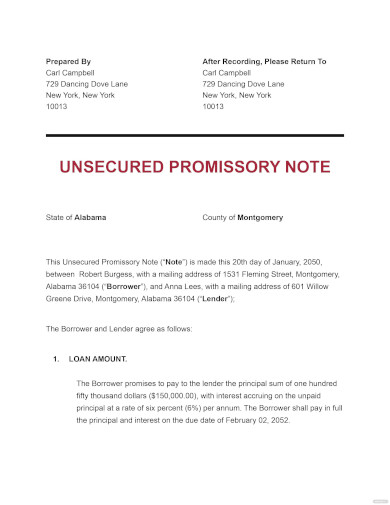

Unsecured Promissory Note Template

download now -

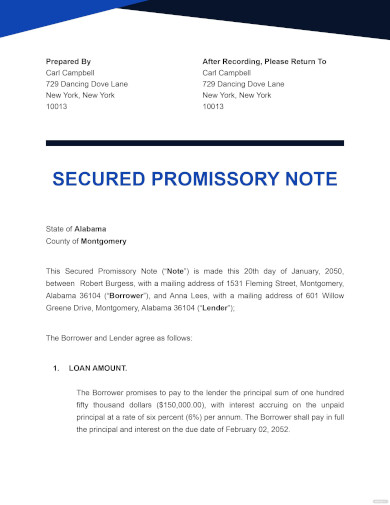

Secured Promissory Note Template

download now -

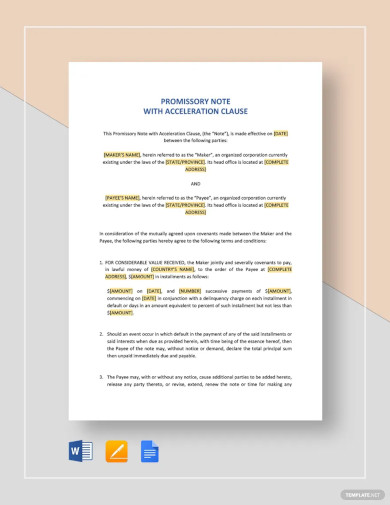

Free Promissory Note With Acceleration Clause Template

download now -

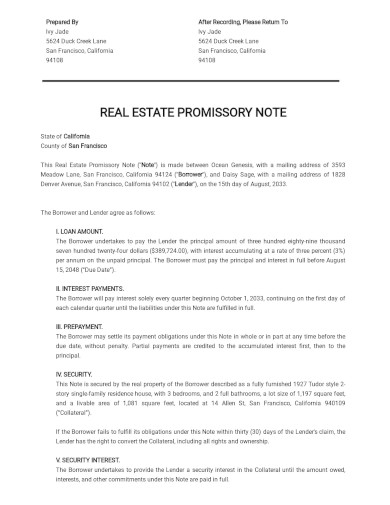

Real Estate Promissory Note Template

download now -

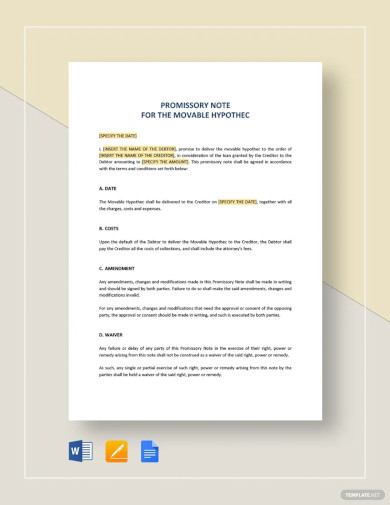

Movable Hypothec Promissory Note Template

download now -

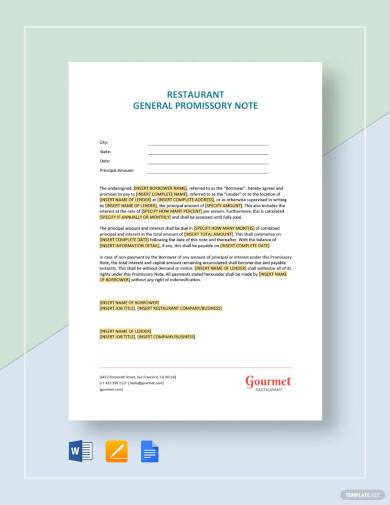

Free Restaurant General Promissory Note Template

download now -

Collection Letter Following Promissory Note Template

download now -

Request for Extension of Time on Promissory Note Template

download now -

General Free Promissory Note Template

download now -

Printable Promissory Note Line of Credit Template

download now -

Professional Checklist Items to Consider for Drafting a Promissory Note Template

download now -

Sample Promissory Note Example

download now -

Real Estate Promissory Note

download now -

School Signed Promissory Note

download now -

Demand Mortgage Promissory Note

download now -

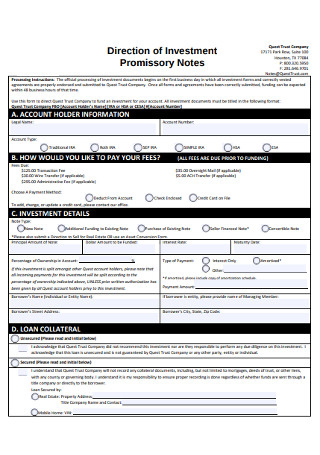

The direction of Investment Letter Promissory Note

download now -

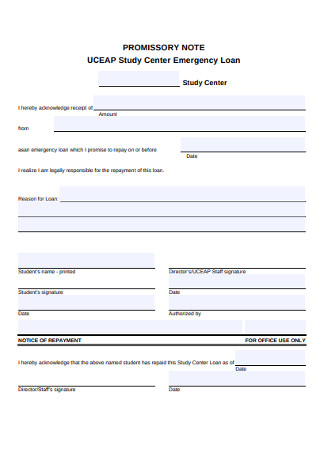

Blank Emergency Loan Money Promissory Note

download now -

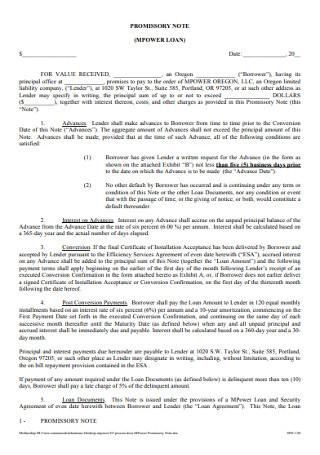

Fees Arrangement Legal Promissory Note

download now -

Sample Family Loan Promissory Note

download now -

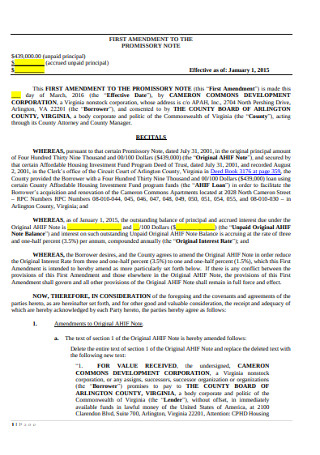

First Amendment Negotiable Promissory Note

download now -

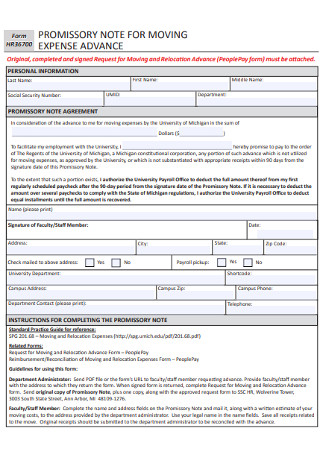

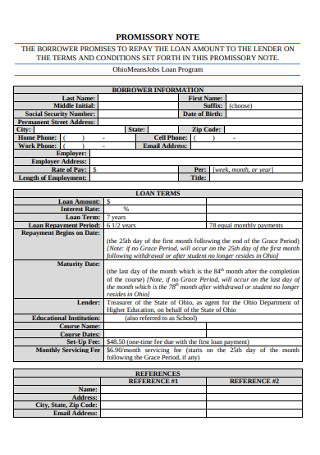

Promissory Note Government Advance

download now -

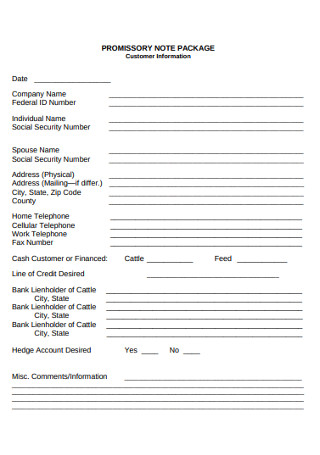

Promissory Debt Note Package

download now -

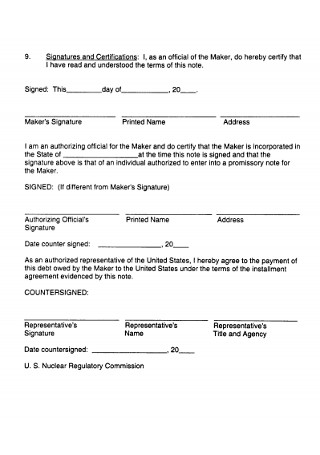

Repayment Specimen Promissory Note

download now -

Loan Repayment Credit Promissory Note

download now -

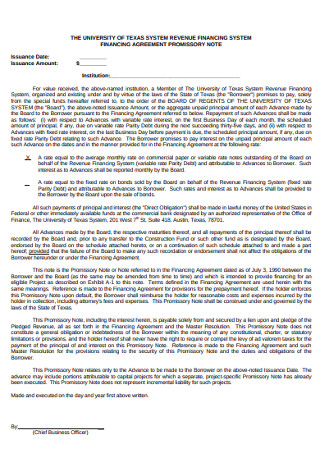

Financing Agreement Promissory Note

download now -

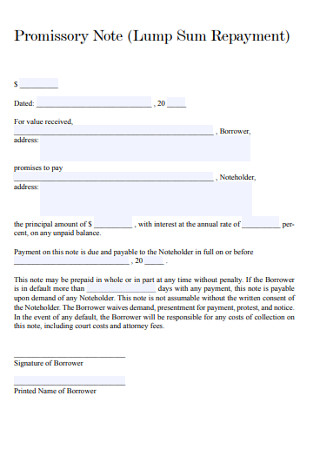

Lump Sum Repayment Promissory Note

download now -

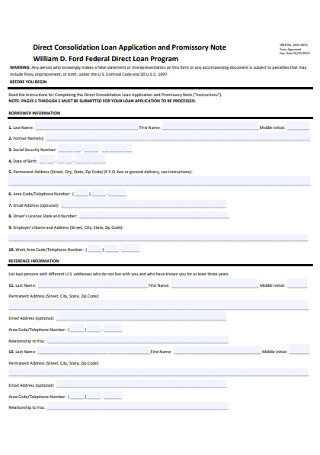

Loan Application and Promissory Note

download now -

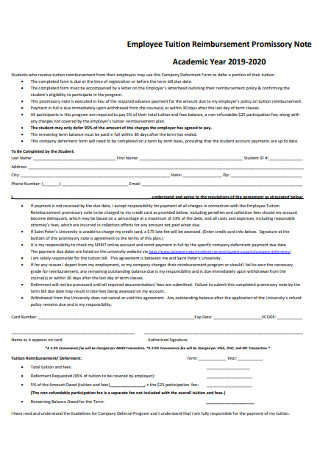

Employee Tuition Reimbursement Promissory Note

download now -

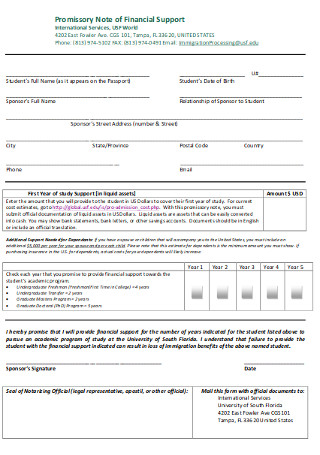

Promissory Note of Financial Support

download now -

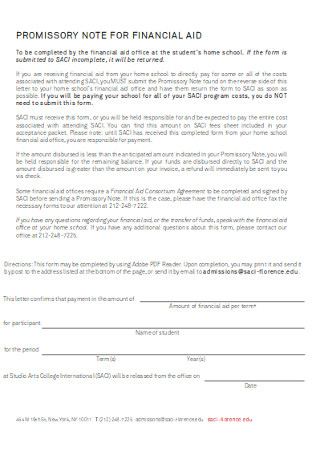

Promissory Note for Financial Aid

download now -

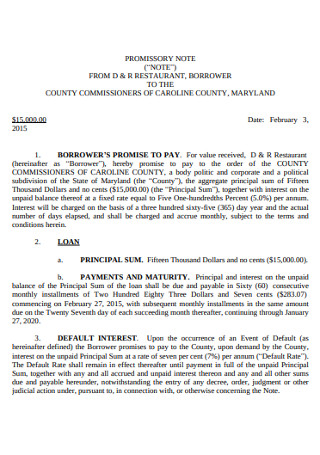

Borrower Promissory Note

download now -

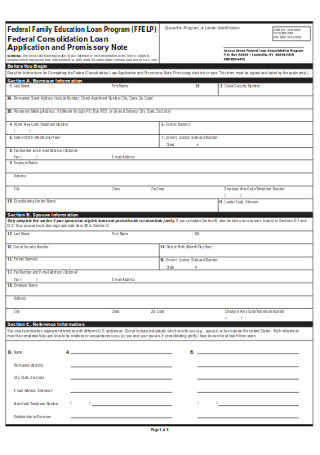

Federal Consolidation Loan Promissory Note

download now -

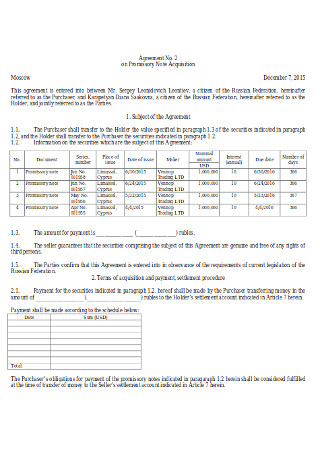

Sample Promissory Note Acquisition

download now -

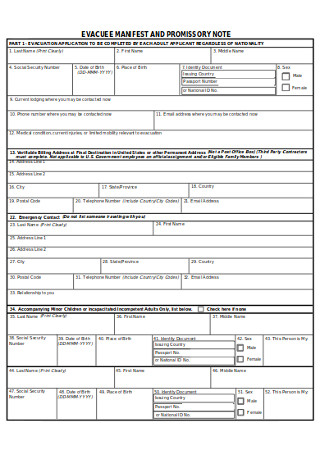

Evacuee Manfest and Promissory Note

download now -

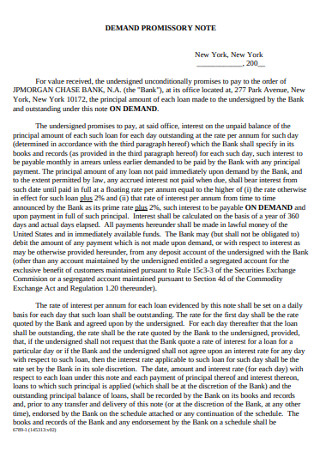

Sample Demand Promissory Note

download now -

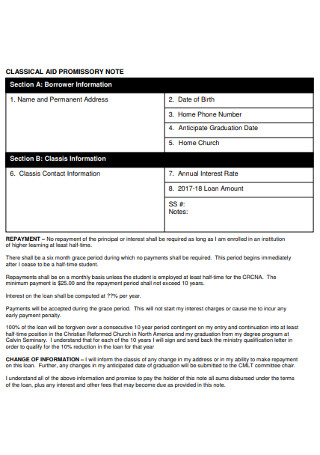

Claassic Aid Promissory Note

download now -

Basic Promissory Note

download now -

Borrower Loan Promissory Note

download now -

Third Party Sponsorship Promissory Note

download now -

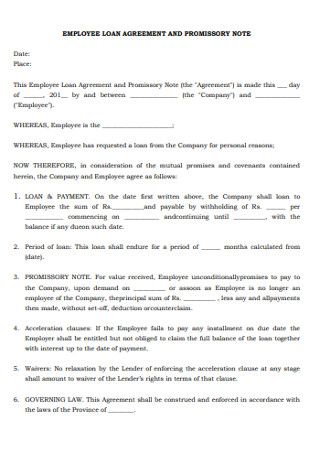

Employee Loan Agreement and Promissory Note

download now -

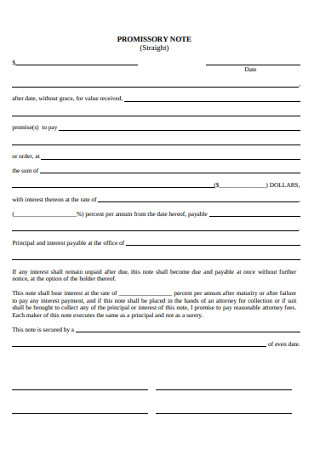

Straight Promissory Note

download now -

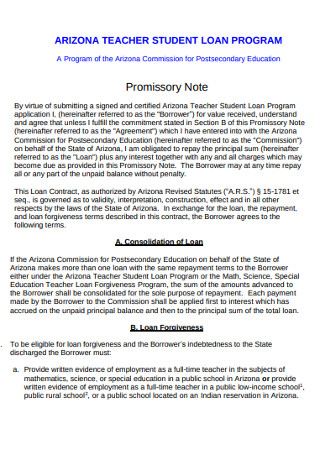

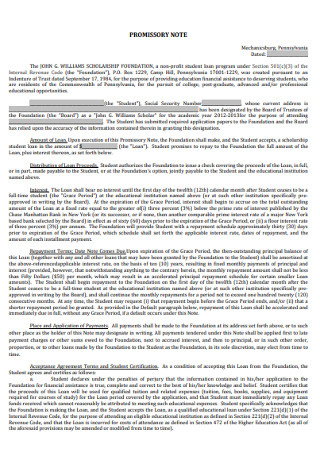

Student Loan Program Promissory Note

download now -

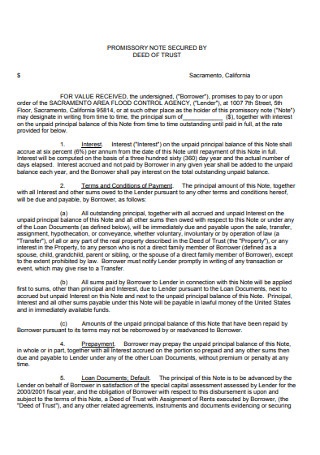

Trust Secured Promissory Note

download now -

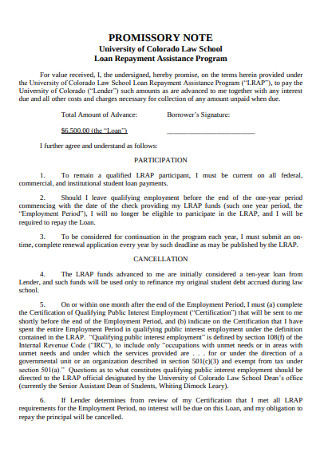

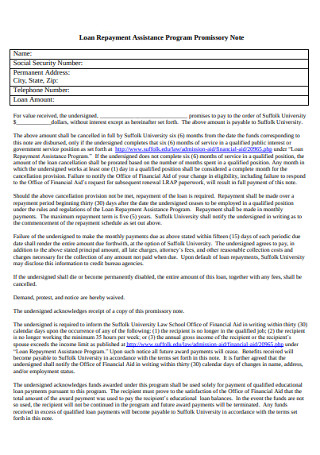

Loan Repayment Assistance Program Promissory Note

download now -

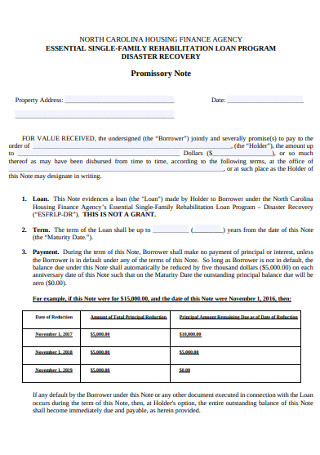

Housing Finance Agency Promissory Note

download now -

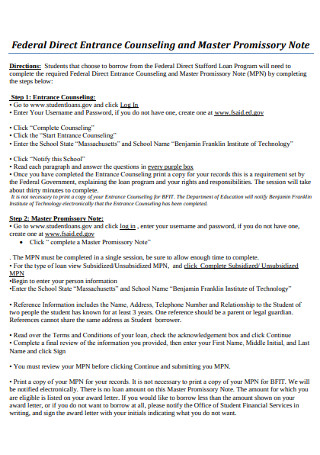

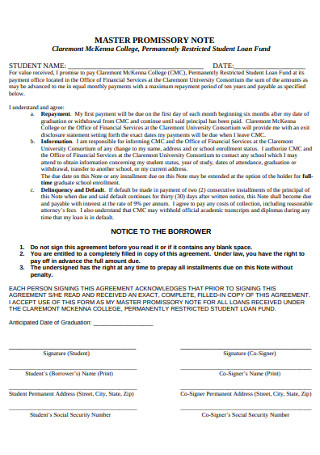

Counseling and Master Promissory Note

download now -

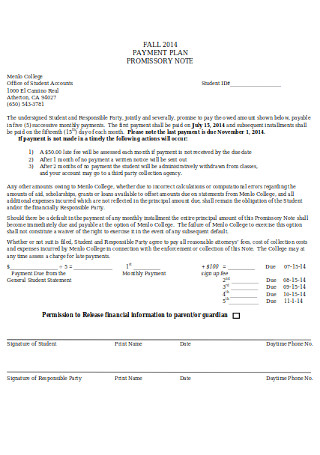

Payment Plan Promissory Note

download now -

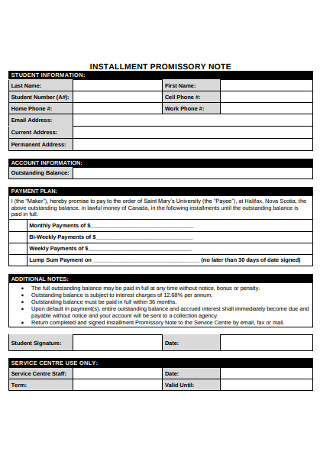

Instalment Promissory Note

download now -

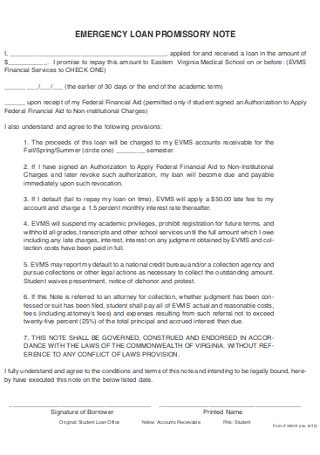

Emergency Loan Promissory Note

download now -

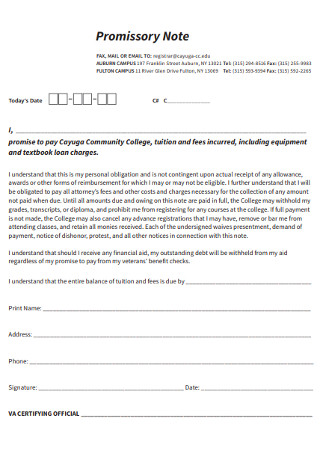

College Promissory Note

download now -

Promissory Note Form

download now -

Sample Finance Promissory Note

download now -

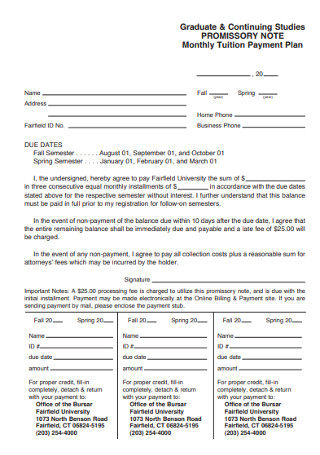

Graduate and Continuing Studies Promissory Note

download now -

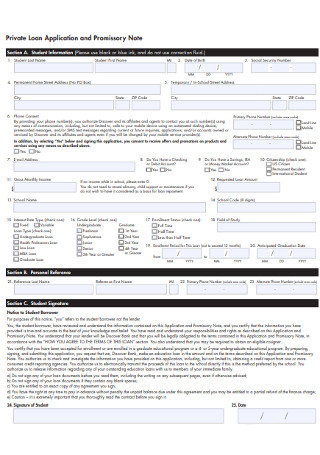

Private Loan Application and Promissory Note

download now -

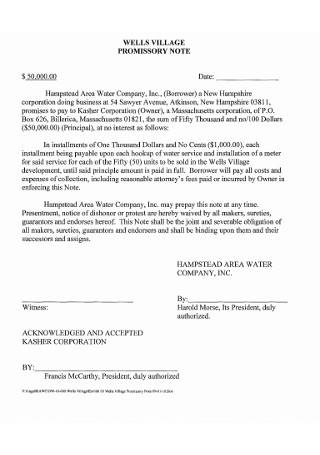

Wells Village Promissory Note

download now -

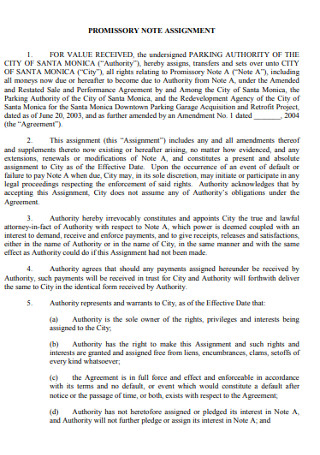

Sample Promissory Assignment

download now -

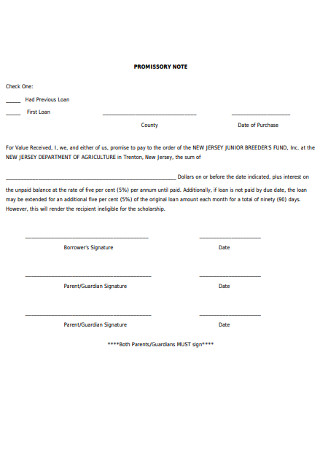

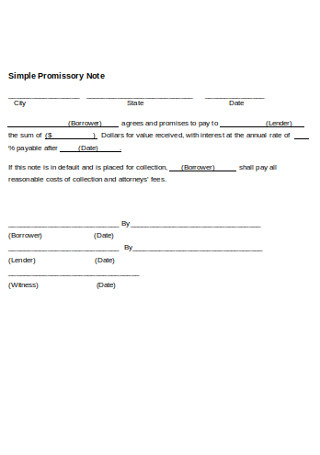

Simple Promissory Note

download now -

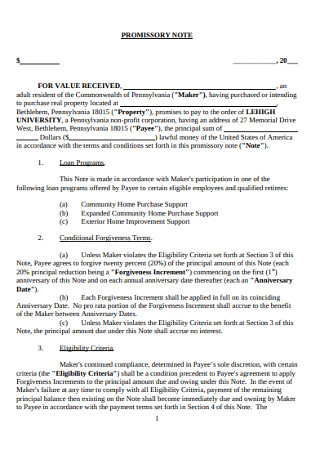

Standard Promissory Note

download now -

Formal Promissory Note

download now -

Sample Master Promissory Note

download now -

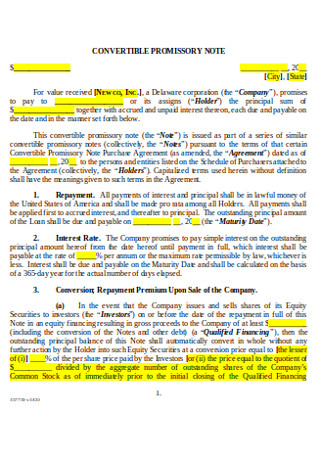

Convertible Promissory Note

download now -

Simple Promissory Note in DOC

download now

FREE Promissory Note s to Download

Promissory Note Format

Promissory Note Samples

What is a Promissory Note?

The Advantages of a Promissory Note

Types of Promissory Notes

How to Make a Promissory Note

FAQS

What details are included in a promissory note?

Can a promissory note be transferred to someone else?

How does a promissory note differ from an IOU?

What are the consequences of not honoring a promissory note?

How does interest calculation work on a promissory note?

Are promissory notes suitable for all types of loans?

Download Promissory Note Bundle

Promissory Note Format

Promissory Note

Date: [Insert date]

Principal Amount: [Insert amount in words and figures]

Interest Rate: [Insert interest rate per annum, if applicable]

Borrower’s Name and Address:

[Insert Borrower’s Full Name]

[Insert Address]

Lender’s Name and Address:

[Insert Lender’s Full Name]

[Insert Address]

1. Promise to Pay

I, [Borrower’s Full Name], the undersigned, promise to pay to the order of [Lender’s Full Name], the sum of [amount in words] ([amount in figures]), with an interest rate of [interest rate] per annum, if applicable.

2. Payment Terms

- Due Date: The full amount of this promissory note is due on [Insert due date].

- Payment Method: Payments will be made via [insert payment method, e.g., bank transfer, cash].

- Installment Payments (if applicable): Payments will be made in installments of [amount per installment] on a [weekly/monthly/quarterly] basis, starting from [first payment date].

3. Late Fees

If any payment is not made within [number of days] days after the due date, the Borrower agrees to pay a late fee of [insert late fee amount or percentage].

4. Prepayment

The Borrower has the right to prepay this promissory note, in full or in part, without penalty.

5. Default

If the Borrower fails to pay the principal or interest when due, the Lender has the right to declare the entire unpaid balance immediately due and payable.

6. Waiver of Demand

The Borrower and any guarantors, if any, waive any requirement of demand or notice for payment from the Lender.

7. Governing Law

This Promissory Note will be governed by and construed in accordance with the laws of the [Insert State/Country].

Borrower’s Signature:

[Borrower’s Full Name]

Date: [Insert date]

Lender’s Signature:

[Lender’s Full Name]

Date: [Insert date]

What is a Promissory Note?

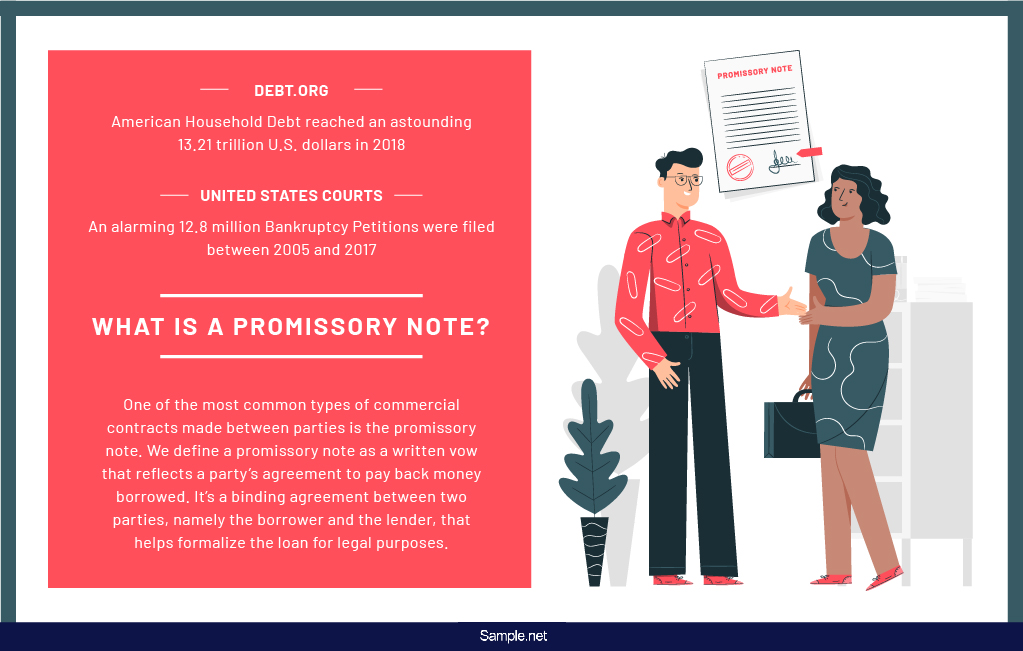

Records by Debt.org shows how American household debt reached an astounding 13.21 trillion U.S. dollars in 2018. It’s an alarming number that reflects the cause and effects of loans in today’s world. But considering the benefits offered by these loans, it only makes sense to make sure that these financial agreements legally seal the deal.

One of the most common types of commercial contracts made between parties is the promissory note. We define a promissory note as a written vow that reflects a party’s agreement to pay back money borrowed. It’s a binding agreement between two parties, namely the borrower and the lender, that helps formalize the loan for legal purposes.

If you want to lend a large sum of money to a person, putting it into writing gives the other the obligation to repay the loan within a specified period. Also known as a note payable, an adequately written promissory note may be enforced in the court of law to ensure that the parties involved reach a fair settlement by the end of the professional relationship. As long as those involved in the arrangement sign the note, you are each expected to uphold your end of the agreement to avoid legal problems down the road. You can also see more on File Notes.

The Advantages of a Promissory Note

Promissory notes can come in handy in numerous settings. A promissory note for personal loans, student loans, business loans, vehicle loans, and mortgages are quite common in today’s world, as it allows borrowers and lenders to set the terms and details of the arrangement coherently on print. Given how an alarming 12.8 million bankruptcy petitions were filed between 2005 and 2017, as reported by the United States Courts, it’s safe to say people tend to hold onto loans to keep themselves afloat during trying times.

For lenders and borrowers, the promissory note guarantees that both parties follow a fair process in providing and acquiring these loans. Think of it like a legal contract that ensures that both parties stay true to their word. You can also see more on School Notes. Other reasons why promissory notes to secure a promissory note include the following:

Types of Promissory Notes

There are two specific types of promissory notes: a secured promissory note and an unsecured promissory note.

Secured promissory notes are loans backed by collateral in the form of a house, a car, or any asset of significant value. If the borrower fails to pay the loan amount as promised, the lender has the right to take away the property as agreed in the promissory note. A lot of thought and planning goes into making these kinds of decisions, which is why it’s crucial to think twice before agreeing to the arrangement. You can also see more on Research Note.

Unsecured promissory notes, on the other hand, do not involve a mortgage or deed of trust for security. Even then, lenders still have the authority to pursue legal action if the borrower fails to pay the loan amount on the expected due date. You can also opt to undergo a debt collection process to settle the case by filing a claim in the court of law. You can also see more on Meeting Note.

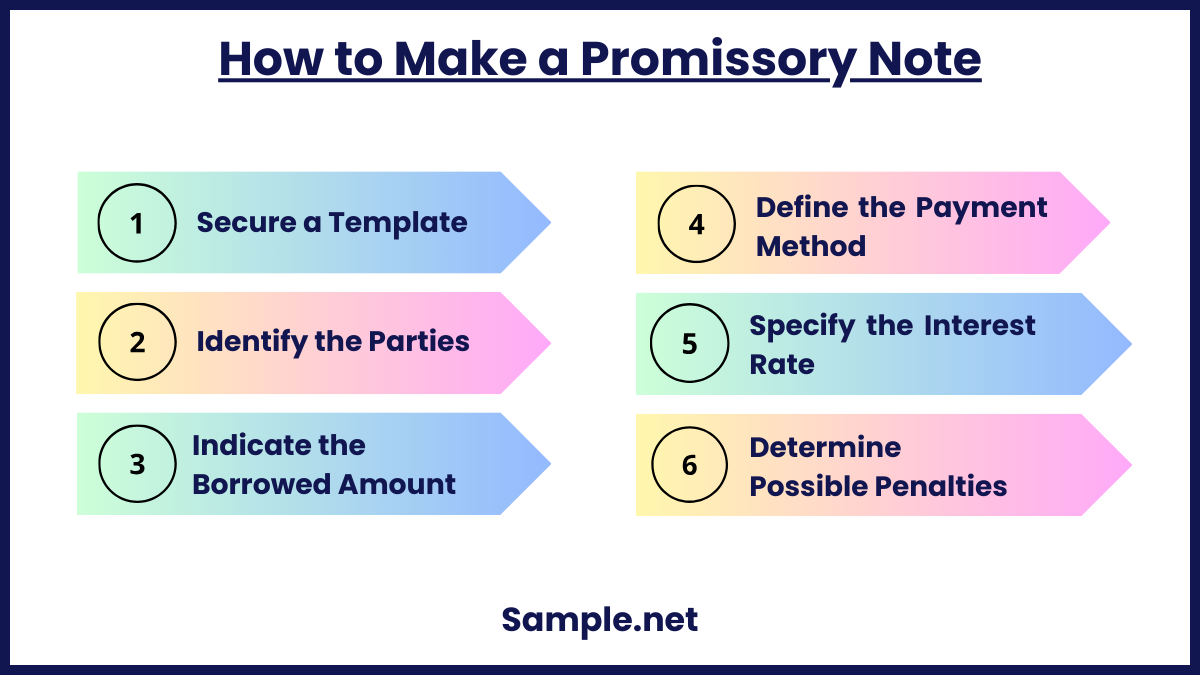

How to Make a Promissory Note

Taking out a loan can be a scary thing, especially when you’re unfamiliar with the process. As a lender or a borrower, it is your responsibility to be aware of how these arrangements work to secure yourself from legal conflicts. Promissory notes spell out the details of the loan, particularly its legally binding components. Thus, a promissory note is only useful when it is written thoroughly. You can also see more on Return Delivery Note.

If you’re new to this, understanding how promissory notes function and what it should cover is crucial to a safe and lawful arrangement. With that said, here’s a step-by-step guide for you to follow.

Step 1: Secure a Template

Promissory notes generally contain the same elements, all of which you will likely find in a ready-made template. But because every case is unique, you will have to customize the template to meet your exact requirements. Some promissory notes even come in the structure of a form that you could fill out with your personal information. You can also see more on Thank You Notes. Just be sure to find a note template that’s closely similar to your ideal content. Once you find one, you can make the necessary adjustments in the succeeding steps.

Step 2: Identify the Parties

Name the parties involved in the arrangement, namely the party that lends the money and the party that receives it. You’ll also want to make sure that each party’s names and addresses remain clear and correct for proper identification. As for co-signers to the contract, be sure to indicate them as well. Don’t forget to write the date of the note in the upper part of the front page.

Step 3: Indicate the Borrowed Amount

Money—the most vital element of any loan agreement. Without any indications of the exact borrowed amount, creating a promissory note would be pointless.

Think about how someone would issue a check. The amount borrowed must be written in numbers and spelled out in specific detail, along with its currency. That way, there’s no way for a reader to misinterpret the promissory note. It’s also a smart way to prevent unauthorized alterations by either party. If you make even the slightest mistake, it would be much better to rewrite the note than to make messy changes to the document. You can also see more on Nursing Notes.

Step 4: Define the Payment Method

How and when the borrower should settle the payment is something to be negotiated before signing. Both parties must agree on the due date, the means of payment, and other alternatives should the first two be impossible to carry out. If you want the other party to make the payment in cash on a month-end basis, clarify this arrangement in the promissory note. This part of the agreement should explain how settlements will take place from when the first payment is due to when the final payment will be made. It’s always a better idea to provide specific dates as opposed to obscure timelines that may confuse those concerned.

Step 5: Specify the Interest Rate

Similar to the amount to be paid, you must write the interest rate in a numerical percentage and words. It is the amount charged on top of the money borrowed based on the lender’s conditions and the laws of the state. Keep in mind that most states provide an interest rate that banks and other financial firms must conform to in order to legalize the transaction. If applicable to your case, you must also state how you plan to integrate the interest rate into the final balance. You can also see more on SOAP Notes.

Step 6: Determine Possible Penalties for Late Payments

Although this is not something you’d find in most promissory notes, many lenders feel the need to define how late payments and penalties will be handled. For instance, if a borrower settles the payment only a few days after the specified deadline, will the borrower be charged extra as a penalty? Or will you provide a grace period as a chance for borrowers to settle their dues? Make sure to offer considerations for instances that go beyond either party’s control, as you wouldn’t want to make it hard for people to decide whether to accept the loan or not.

A promissory note is a straightforward yet essential document in finance, providing security and clear expectations for both parties. With its defined terms, it protects lenders and borrowers, establishing trust and accountability in loan agreements. This document helps prevent misunderstandings, making it invaluable in various financial transactions. You can also see more on Intake Progress Note.

FAQS

What details are included in a promissory note?

A promissory note includes essential details such as the loan amount, repayment schedule, interest rate, borrower and lender information, and penalties for non-payment.

Can a promissory note be transferred to someone else?

Yes, promissory notes can be transferred or assigned to a third party, depending on the note’s terms, allowing the lender to sell the debt or change the noteholder. You can also see more on Business Loan Agreement.

How does a promissory note differ from an IOU?

Unlike an IOU, which is informal, a promissory note is a formal, legally enforceable document with detailed repayment terms, including interest and conditions.

What are the consequences of not honoring a promissory note?

If a borrower defaults on a promissory note, the lender can take legal action to recover the funds. For secured sample notes, the lender may also claim any collateral listed, adding extra protection against non-payment.

How does interest calculation work on a promissory note?

Interest on a promissory note is calculated based on the interest rate and loan term specified in the note. It may be calculated as simple or compound interest, impacting the total repayment amount. You can also see more on Security Agreement.

Are promissory notes suitable for all types of loans?

Promissory notes are versatile and can be used for various loan types, from small personal loans to large real estate transactions. However, the complexity of terms and legal implications should be considered for larger loans.