Rent Receipt Samples

-

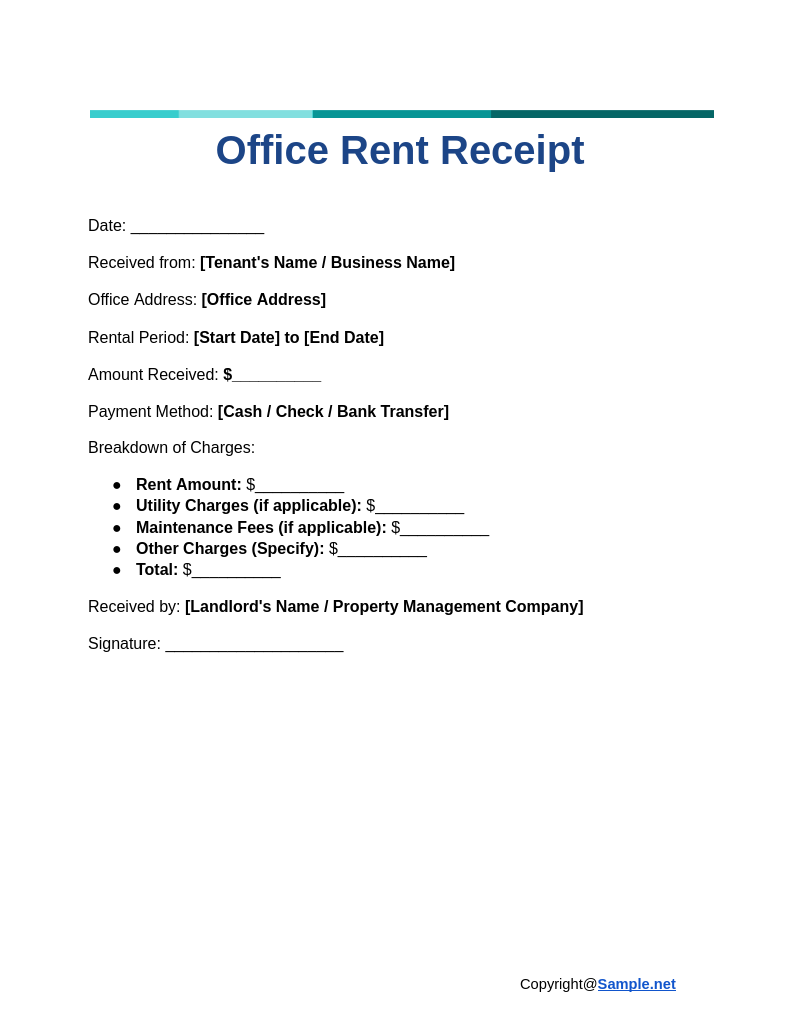

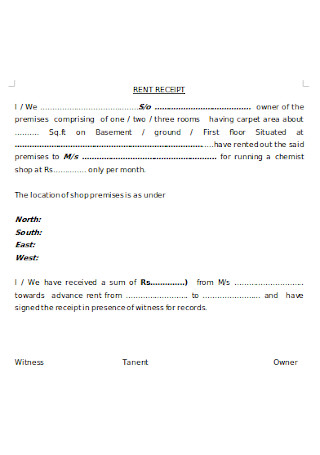

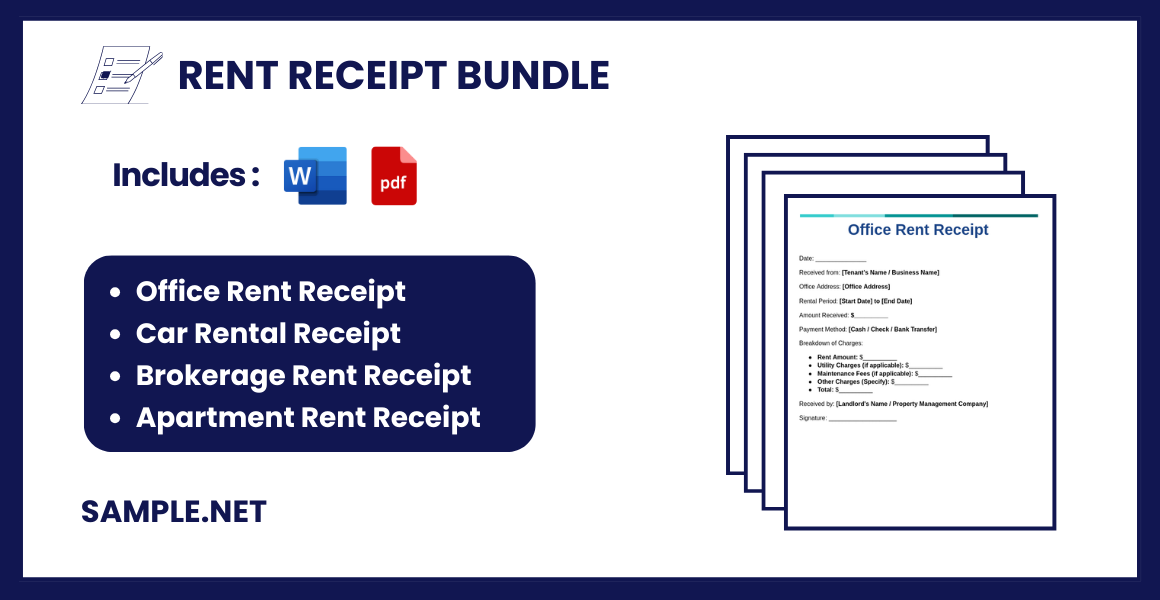

Office Rent Receipt

download now -

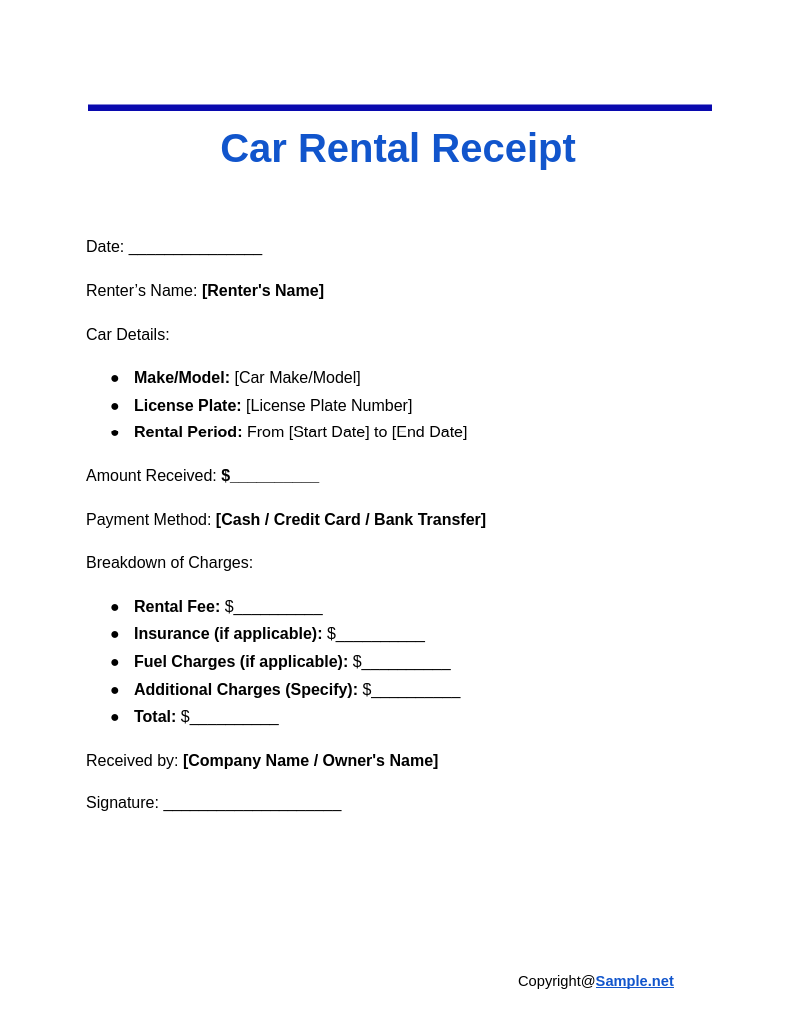

Car Rental Receipt

download now -

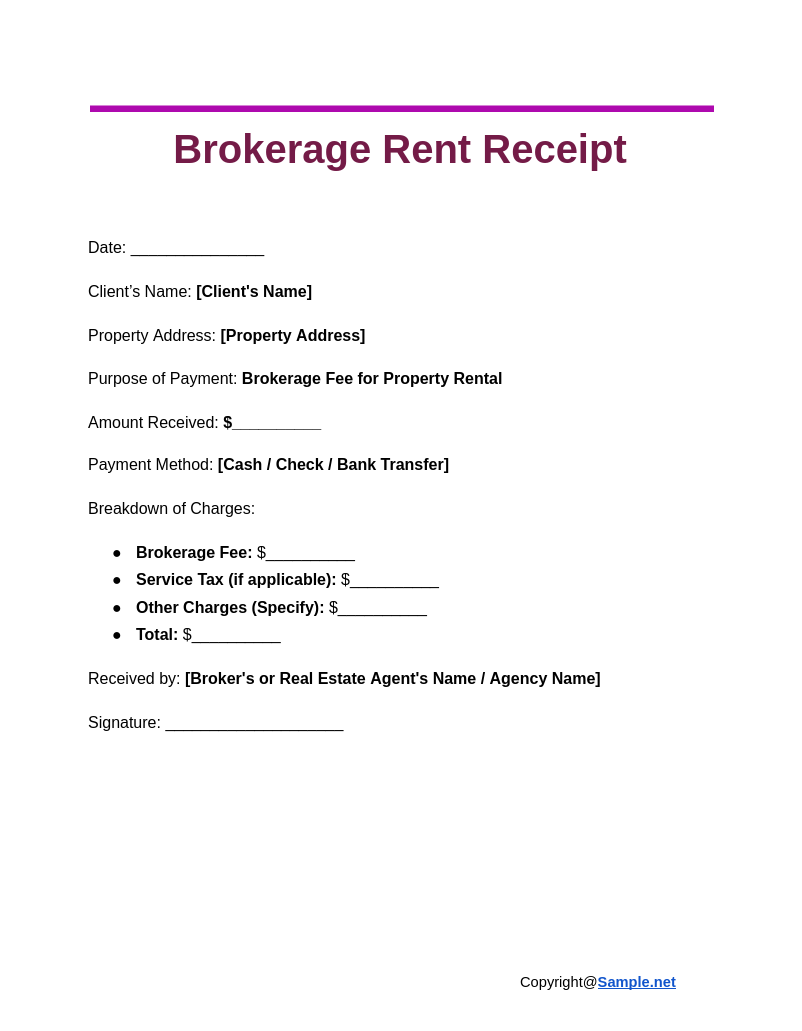

Brokerage Rent Receipt

download now -

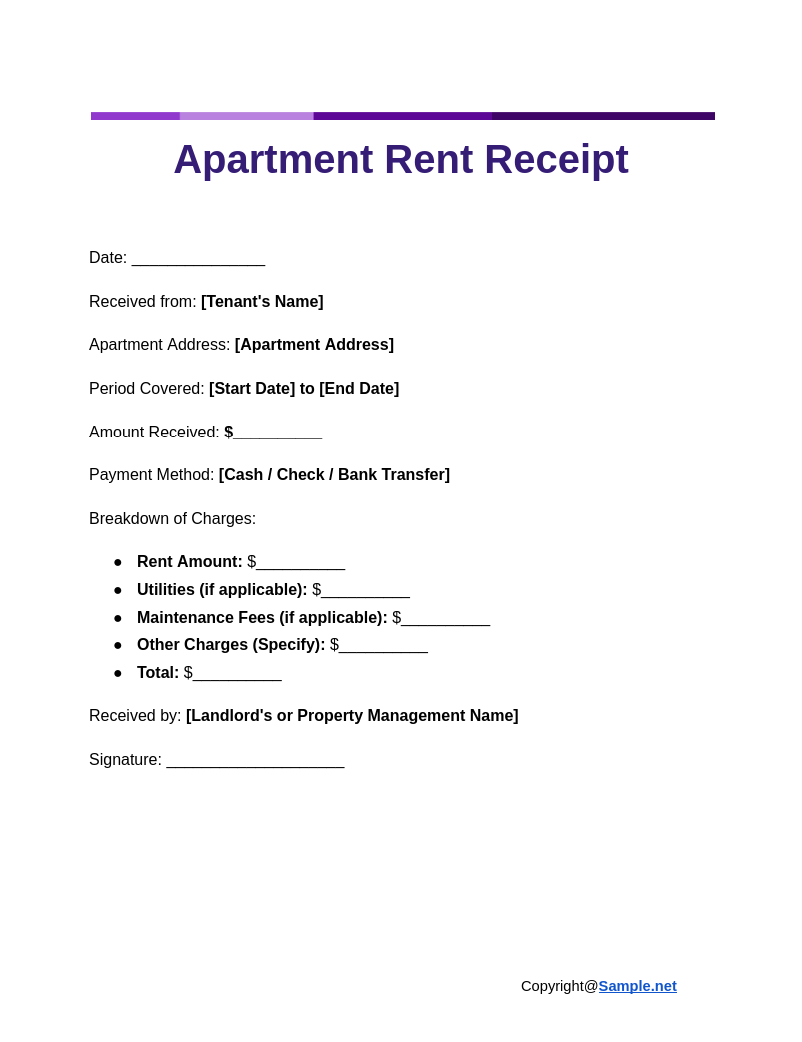

Apartment Rent Receipt

download now -

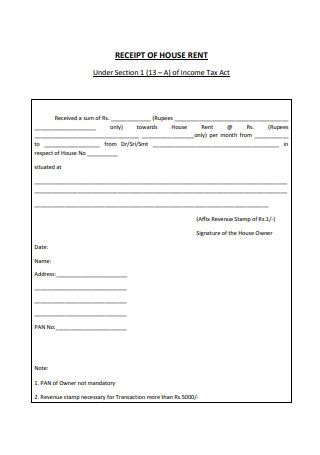

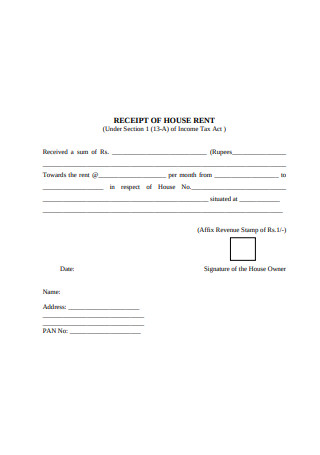

Receipt of House Rent

download now -

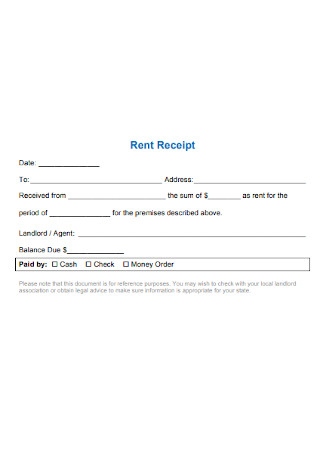

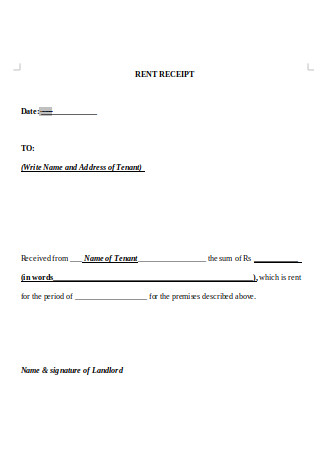

Sample Rent Receipt

download now -

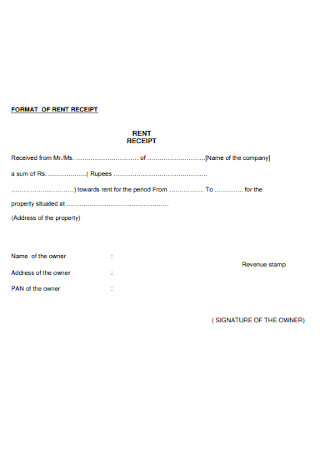

Format of Rent Receipt

download now -

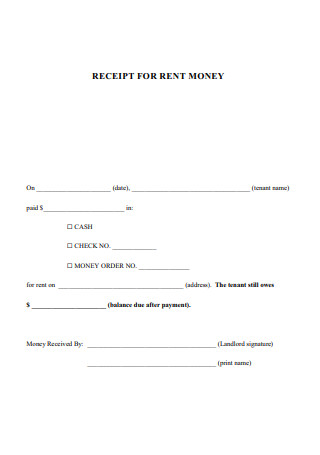

Receipt for Rent Money

download now -

Online Rent Receipt

download now -

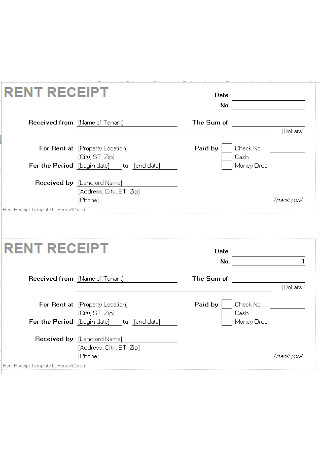

Monthly Rent Receipt

download now -

Rent Pay Receipt

download now -

Sample Rent Receipt

download now -

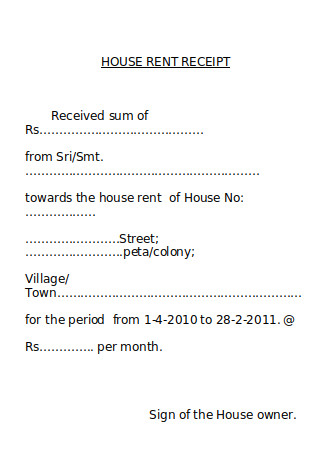

House Rent Receipt

download now -

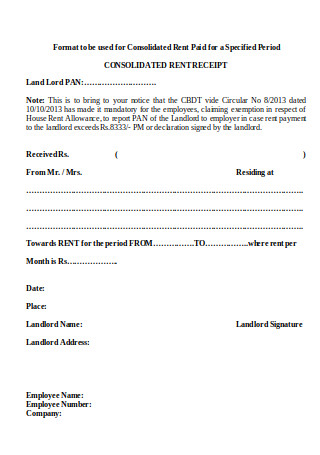

Consolidated Rent Receipt

download now -

Editable Rent Receipt

download now -

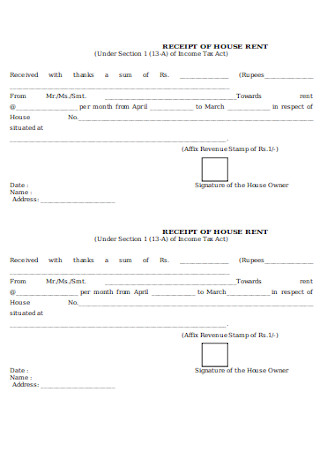

Printable Receipt of House Rent

download now -

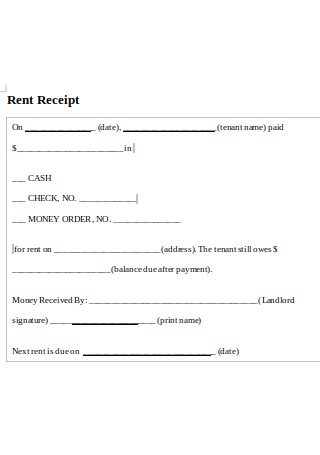

Rent Received Receipt Form

download now -

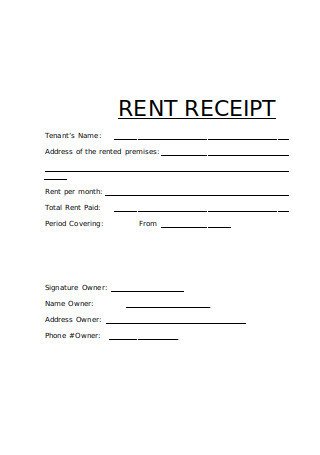

Rent Payment Receipt

download now -

Rent Receipt in DOC

download now -

Basic Receipt of House Rent

download now -

Rent Receipt for Income Tax

download now -

Standard Rent Receipt Template

download now

FREE Rent Receipt s to Download

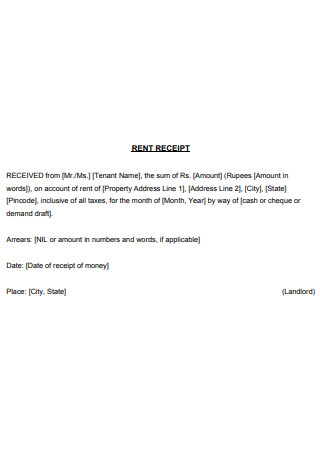

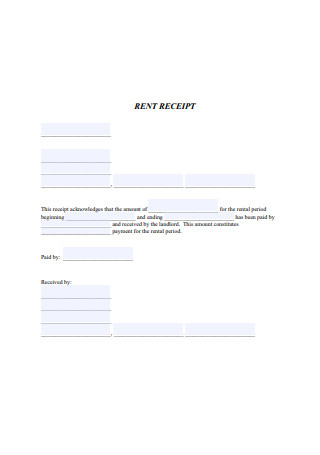

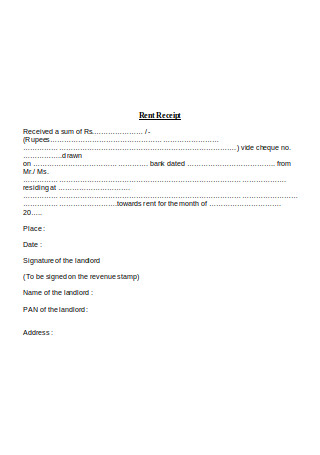

Rent Receipt Format

Rent Receipt Samples

What is a Rent Receipt?

Kinds of Rent Receipts

Elements of an Outstanding Rent Receipt

8 Steps for Creating a Complete Rent Receipt

FAQS

What details should be included in a rent receipt?

Are rent receipts legally binding documents?

Why are rent receipts necessary for landlords and tenants?

What happens if a tenant loses their rent receipt?

How can tenants benefit from requesting a rent receipt?

Do landlords need to keep copies of rent receipts?

Rent Receipt Format

Rent Receipt

Date: _______________

Received from: [Tenant’s Name]

Property Address: [Property Address]

Period Covered: [Start Date] to [End Date]

Amount Received: $__________

Payment Method: [Cash / Check / Bank Transfer]

Breakdown of Charges:

- Rent Amount: $__________

- Utilities (if applicable): $__________

- Other Charges (Specify): $__________

- Total: $__________

Received by: [Landlord’s Name]

Signature: ____________________

Additional Notes

- Receipt Number: Add a unique receipt number for tracking purposes.

- Payment Confirmation: Indicate if the payment was made in full or partially, if applicable.

- Contact Details: Optionally, add landlord contact information for tenant reference.

What is a Rent Receipt?

A rent receipt is a simple document that presents all the details about rental payment. Rent receipts are commonly used in room rental transactions especially on those where monthly payments are given by tenants to their landlords. However, the usage of a rent receipt is not limited to this activity. There are still other kinds of rental agreements and processes where a rent receipt can be utilized. You can also see more on Rental Receipts.

Kinds of Rent Receipts

Do not overlook or underestimate the benefits of having a rent receipt. It may seem as something that is unnecessary for some, but it can actually help you a lot whenever you are faced with certain instances like rent payment disputes and record loss. If you want to make your rent receipt from scratch, you have to ensure that you are aware of the particulars or the basics of the specific rent receipt that your business needs. You can also see more on Landlord Receipts. A few kinds of rent receipts are as follows:

1. Commercial Space and Booth Rent Receipts

Use a commercial space rent receipt if you want to record the payment made by a lessee for his or her business location rental for a month or any time period depending on your rental agreement. Also, you can use a booth rent receipt if you are an owner of a spa or a salon and you received payment from one of your booth renters.

2. Residential Rent Receipts

Create a residential rent receipt so you can compile all the payment records of your tenants. Landlords of townhouses, apartments, and bed spaces can benefit a lot from having a residential rent receipt. More so, the specific document can also be used by owners of residences, condominiums, and other personal properties that are up for rent.

3. Equipment Rent Receipts

Make an equipment rent receipt if you think that it is necessary or if you are required by law to make one. Rent receipts are not only used for home rentals. If your business provides lights and sound equipment rental services, you can also use a rent receipt to make sure that the payment of your clients is accurately recorded in a timely manner. You can also see more on Security Deposit Receipts.

4. Vehicle Rent Receipts

Develop a vehicle rent receipt if you are putting your vehicle up for rent for purposes of vacation tours, goods transport, and servicing. Aside from these, vehicle rent receipts can be used by your business as long as you are providing or offering a type of vehicle rental to your customers.

Elements of an Outstanding Rent Receipt

A rent receipt can keep necessary financial or rental payment details systematic. For you to be assured of the completion of your rent receipt content, it is imperative for you to understand all the elements and variables that you have to consider and work with. You can also see more on Payment Receipt. Here are the basic elements that you have to look into so you can create an outstanding rent receipt:

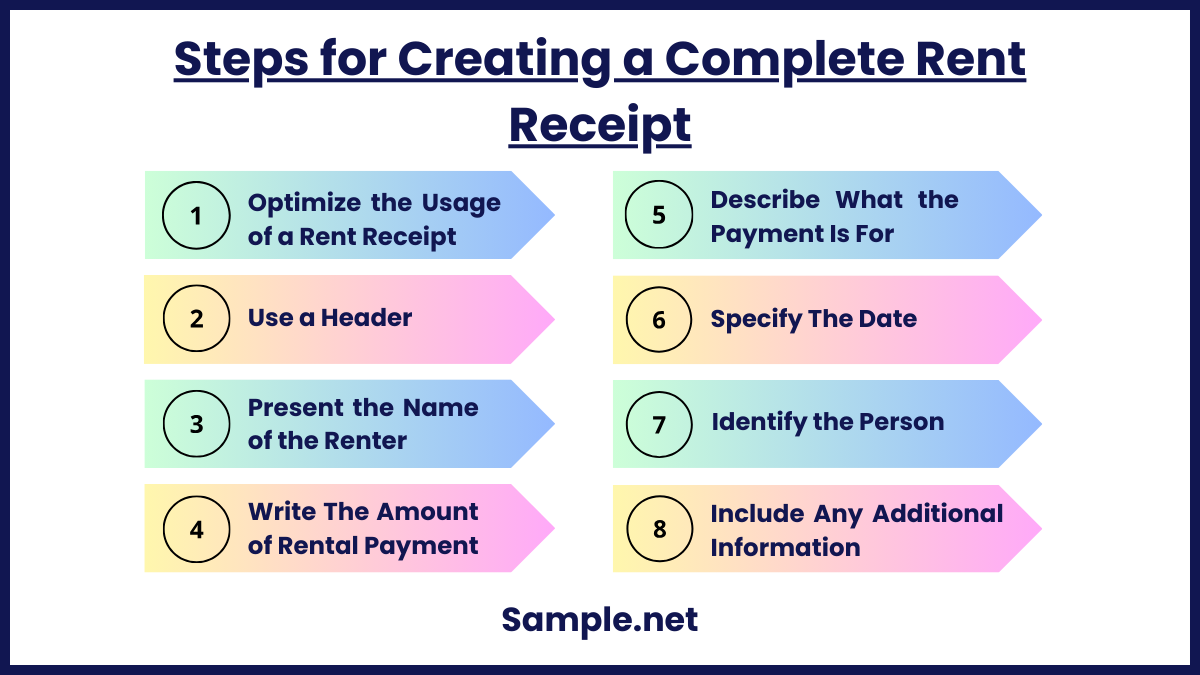

8 Steps for Creating a Complete Rent Receipt

Are you confused or unaware of how you can start creating your rent receipt? There are actually many ways on how you can come up with the rent receipt that you would like to develop. For you to not be overwhelmed, try to make the process of making your business’ own rent receipt as simple as possible. You can also see more on Real Estate Receipts. Below is a step-by-step guide that you can refer to once you decide to create a rent receipt:

Step 1: Optimize the Usage of a Rent Receipt Template

Just like when developing other kinds of documents for your business, you can also optimize a template if you plan to create your own rent receipt. There are different kinds of rent receipt templates which is why you have to be mindful when selecting the particular template that you will use as a formatting guide.

Step 2: Use a Header Containing the Details of Your Business

Choosing a pre-formatted rent receipt template is only the beginning of this process. You have to modify or alter the information that is listed in the reference. Place your business header on top of the rent receipt template. Your header should include the name of your business, its location, and your contact information.

Step 3: Present the Name of the Renter Who Paid the Rent

Ensure that you will accurately write the name of the person who paid for his or her rent. It will be best if you will write his or her complete name as this can make your documentation efforts more accurate. Allow the person to check the spelling of his or her name so you can correct any errors right away. You can also see more on Official Receipt.

Step 4: Write The Amount of Rental Payment

Be particular when listing down the amount of money that the renter has given as rental payment. You have to make sure that the paid rental price for a given period which you have specified in the rent receipt is truly what the renter has provided you with. You can also include the mode of payment being made for purposes of referencing.

Step 5: Describe What the Payment Is For

Your rent receipt should specify the reason why the payment has been made. What is being rented? What is the duration of the rental that is actually covered by the payment? Being able to answer these questions by writing a brief description of the payment’s purpose can make your rent receipt more relevant, useful, and informative. You can also see more on Honorarium Receipt.

Step 6: Specify The Date When The Payment Has Been Given

Do not forget the write the date when the rental payment has been handed by the renter to the owner of the business or any of its official representatives. This is important information that can be used as evidence whenever discussions about late payments and other related concerns need to be settled.

Step 7: Identify the Person Who Received the Payment

Lastly, the rent receipt should include the name of the person who received the rental payment. Through this, involved entities can be identified appropriately especially if there are discrepancies in the records maintained by the business. You can also see more on Travel Receipts.

Step 8: Include Any Additional Rent Receipt Information

If you would like to, you can still include other details that can make your rent receipt filled with further information. You can place a receipt or control number in any area of your rent receipt. You can also write brief notes and terms based on your own liking. Once all of these details are already in the rent receipt, try to browse through the document draft again so you can finalize your output before using it.

Rent receipts are vital documents for tracking rental payments, protecting both landlords and tenants. They streamline record-keeping and provide crucial proof of payment in case of disputes or tax claims. Whether digital or physical, a well-structured rent receipt can prevent misunderstandings and promote clear communication. Creating rent receipts consistently is an essential practice for managing rental properties efficiently and ensuring both legal and financial security. You can also see more on Temporary Receipts.

FAQS

What details should be included in a rent receipt?

A complete rent receipt should include tenant and landlord names, property address, payment amount, payment period, payment method, date, and, if applicable, the landlord’s signature. These details ensure clear documentation.

Are rent receipts legally binding documents?

Rent receipts are not contracts, but they serve as legal evidence of payment. They can be used in disputes to prove that a tenant paid rent for a specific period, making them valuable in court. You can also see more on Salary Receipts.

Why are rent receipts necessary for landlords and tenants?

Rent receipts protect both parties by maintaining transparent records. For landlords, they simplify accounting, while for tenants, they ensure documented proof of payment, useful for tax deductions and dispute resolution.

What happens if a tenant loses their rent receipt?

If a rent receipt is lost, the tenant should request a copy from the landlord. For digital receipts, tenants can save and back up files, reducing the chance of losing this important document. You can also see more on Equipment Receipts.

How can tenants benefit from requesting a rent receipt?

Tenants benefit from rent receipts by having documented proof of each payment, which is helpful for budgeting, tracking rental history, and claiming tax deductions on rent if eligible.

Do landlords need to keep copies of rent receipts?

Yes, landlords should keep copies of all rent receipts as part of their financial records. This helps with annual tax filing and financial audits. You can also see more on Hospital Bill Receipt.