20+ Sample Startup Budgets

-

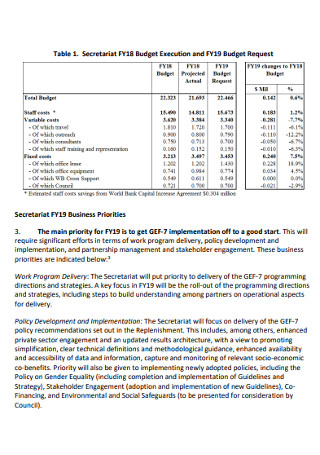

Startup Business Budget

-

Sample Startup Budget

-

Basic Startup Budget

-

Startup Master Budget

-

Standard Startup budget

-

Sample Startup Company Budget

-

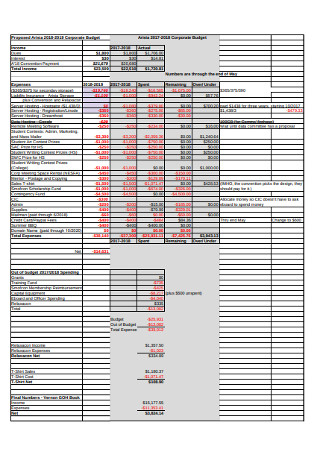

Startup Corporate Budget

-

Small Business Strstup Budget

-

Formal Stratup Budget

-

Printable Startup Budget

-

Corporate Business Plan Budget

-

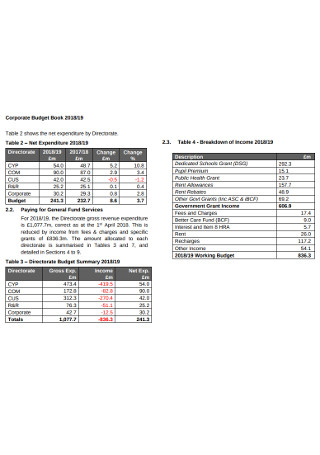

Corporate Budget Monitoring Report

-

Sample Corporate Budget Book

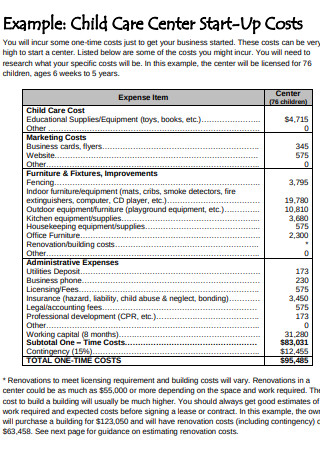

Child Care Center Start-Up Costs

-

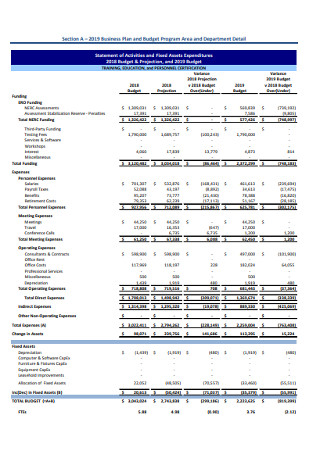

Corporation Business Plan Budget

-

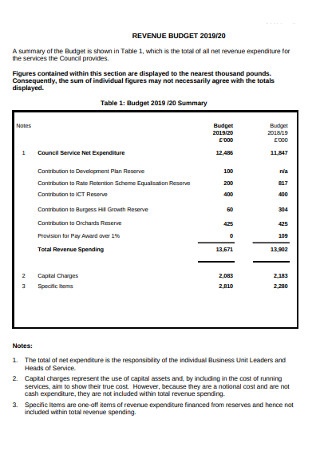

Sample Stratup Revenue Budget

-

Sample Corporate Budget

-

Child Care Center Start-Up Budget

-

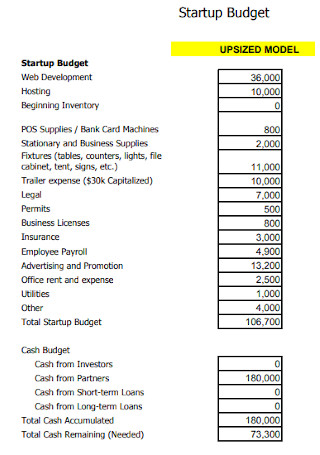

Startup Budget Format

-

Sample Start-up Costs

-

Startup Budget Worksheet

-

Printable Startup Budget

-

Startup Events and Activities Fund Budget

-

Stratup Business budget Plan Template

download now -

Company Startup Budget Template

download now

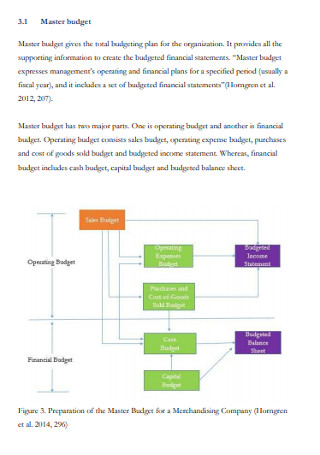

What Is a Startup Budget?

A startup budget contains an itemized projection of sales and expenses for a startup business. Its coverage includes the start of business operations up until a particular time after it starts operating. There are various costs that you need to consider before you launch your startup and these costs should already be projected in a startup business. Appropriate and intensive research must be done when coming up with a startup budget because there is always that possibility that some important items might get left out. A startup budget must be sufficient enough for the needs of a startup. Not all startups need to have a big budget as some can work on a shoestring and still reap profits. But if you run a startup that requires a big budget, then allocate funds appropriately to achieve your business goals.

Importance of Startup Budget

Startup budgets are more than a piece of document that helps you project the possible costs for your startup business. It controls your spending habits, determines your return on investment, helps you make wise financial decisions, keeps you from getting in deep financial problems, and so on. To further convince you to create a realistic startup budget, we list down some of the reasons below.

Common Expenses in a Startup Budget

No startups are alike. Each requires a unique set of startup expenses. However, some expenses are common to almost all types of business. These include:

How to Set a Startup Budget

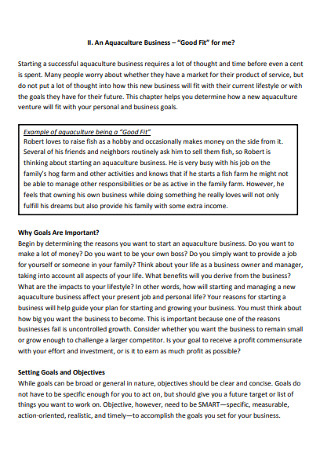

Startup funding increased by 50% between 2012 and 2017. These numbers are significant enough especially that funding plays a vital role in the success of startups. For you to make the most out of the funds you acquire, it’s only imperative to come up with a budget. If acquiring the funds to run a startup is already tricky, it’s even more challenging to set up a budget. Making use of the easy-to-follow steps below should help you build a realistic startup budget.

Step 1: Know the Industry

As the first step in creating your startup budget, you need to know and analyze first the industry you are entering. You can start by analyzing the general practices of the industry so you can get the idea of the possible expenses needed for your business to operate. This step does not only help you in coming up with your startup budget but it also gives you an idea of the norms and values of the industry.

Step 2: Come up with Cost Estimates

Now that you have an idea of the possible costs that might incur during your business operations, what you can achieve now is a realistic estimate for the potential costs required so you can set up and launch your startup. Once you can estimate the costs, you can quickly determine the capital you need to bring in for your business. If you are planning to loan money, estimating costs beforehand should enable you to determine not only the amount that you need to borrow from the banks but you can also take the interest costs of the loan into account

Step 3: Create a Sales Forecast

Since you have not started operating your startup yet, you might find it tricky to determine your sales once your business launches. However, it is still necessary that you understand your market and derive a sales forecast out of it. A sales forecast is essential for every startup business as it helps in projecting its sales revenue within a particular period such as on a monthly, quarterly, or yearly basis. With a sales forecast, you can now comprehend how to understand and manage your cash flow, plan procurement and production schedule, and avoid any supply-chain shortages.

Step 4: Write the Fixed and Variable Expenses

While creating a startup budget, you must estimate and write down the fixed and variable expenses. In doing so, it best if you overestimate it rather than think of it lightly and cause problems later on. Segregate the fixed and variable expenses. Fixed expenses are the costs that won’t change and won’t depend on your consumers. Some of your fixed expenses include office rent, utilities, business phone fees, office supplies, insurance, employee pay and benefits, loan payments, and so on. Variable expenses are dependent on the number of customers you have. Some of these expenses include production costs, raw materials, packaging, and shipping costs. If your startup solely provides services, your variable expenses may not be as many as those startups who both sell products and provide services.

Step 5: Make Your Startup Budget

Once you have successfully set the basics, you can now start tallying your startup budget. Allocate it properly so you will have enough cash to survive in the cutthroat business world. In your first few weeks or even months, you might find it challenging to keep up with your budget especially that there will always be some unexpected circumstances along the way. That is why you must create a startup budget that is flexible enough that you can easily adjust it when the need arises. Other than consistently sticking to your startup budget, it is also essential that you have an emergency fund ready on the side.

The Dos and Don’ts of a Startup Budget

Startup budgets, when set and done right, are game-changers for most startups. To further guide you in the process, we provide some dos and don’ts that you can follow.

Dos

1. Do involve and consider your employees.

Your startup budget does not only involve you as the business owner but it also includes everyone who works in the company. Don’t take up all the pressure by yourself and delegate some things with your employees. Consider coming up with a team of employees that can help you scrutinize the startup budget you came up with and check whether it covers everything the startup needs. Trust that the capabilities and skills of your employees can help you make the most out of your startup budget. Other than that, consider updating and informing your employees with the short- and long-term financial goals you have planned for the company so that they may be able to understand and prepare for whatever lies ahead.

2. Do know and understand the risks that lie ahead.

As mentioned, running a start-up is risky. Like any other business venture, the element of risk is never absent. There are various risks you might deal with and it is of utmost importance that you have defined and understood all the possible risks you might face along the way as it can have a financial impact on your business endeavors. It’s ideal to look at the bright side and focus on your short- and long-term goals, but you should not forget to be realistic and also consider the short- and long-term risks to have a clear road map for your financial future.

3. Do stick to your startup budget.

Setting your startup budget is not enough. To make any budget work, you need to stick to it and act it out. There will be unexpected instances where you will encounter unexpected time expenses. But there will also be days when you will be given with unforeseen opportunities. If the startup budget you set works, then keep using it, but if there are things that require you to change whatever was set beforehand, don’t hesitate to modify the contents of your startup budget. Don’t be surprised if you think your startup budget.

Don’ts

1. Don’t forget to pay yourself.

No matter how much you want to keep your finances tight, don’t forget to pay yourself. Don’t feel guilty paying yourself for all your hard work, thinking that your pay should go elsewhere relevant for the business. Do not forget that you are also relevant to the business. Having backup finances is great but know that you deserve to be compensated. Create a startup budget that allows every single employee to receive the pay they deserve and that includes you.

2. Don’t forget that time is more important than money.

When it comes to business, time should be treated as something more valuable than money. If you waste your money, you can still earn it back but if you spend your time carelessly, you can no longer bring it back. Time is your startup’s nonrenewable resource; that is why it is essential always to consider it as you create your startup budget. For example, your stall at the mall ran out of products to sell and the delivery came in to restock only four hours after the mall opened. You might not physically see it but the four hours that gone by were already detrimental to the business’ sales for that day.

3. Don’t forget to update your budget regularly.

As your business continues to evolve, your startup budget grows along with it. That is why you must also continuously update your budget based on how your business’ growth and profit. Stay on top of your budget by revising it regularly so you can get a bird’s eye view of the state of your business finances. In doing so, you can also create rational business financial decisions because you can base it on your financial reality rather than on your projections. If you are planning to prepare a budget for the next year ahead, you can refer to the past market trends to quickly determine how much you should allocate for emergency funds and other contingency expenses.

Startups are fragile?one move can make or break it. Never underestimate the importance of managing your finances through effective budgeting. If you intend on making your startup business sustainable right from the start, then start making a startup budget today. To help you in getting started, we provide startup budget templates that you can download and customize according to your business needs.