46+ Sample Industry Analysis

-

Determinants Industry Analysis

download now -

Industry Analysis and Forecast

download now -

Informal Investment Industry Analysis

download now -

Industry Analysis Matrix

download now -

Target Industry Analysis

download now -

Industry Analysis Importance

download now -

Industry Analysis Typical steps

download now -

Industry Analysis Report

download now -

Industry Analysis Forces

download now -

Industry Analysis Recommendation and Comparison

download now -

Environmental Analysis to Industry Analysis

download now -

Cloud Computing Industry Analysis

download now -

Agro-Based Industry Swot Analysis

download now -

Automobile Industry Analysis

download now -

Industry Based Analysis

download now -

Industry Analysis and Market Trends

download now -

Industry and Trade Analysis

download now -

Hospital Industry Analysis

download now -

Eco Industry Analysis

download now -

Industry Analysis Worksheet

download now -

Industry Steel Analysis

download now -

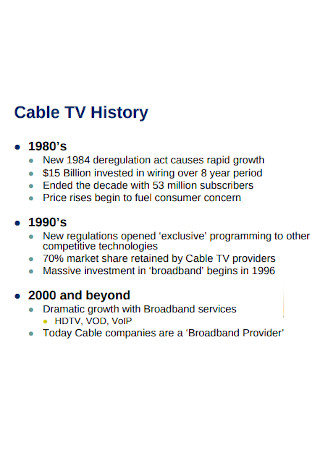

Cable Industry Analysis

download now -

Fashion Industry Analysis

download now -

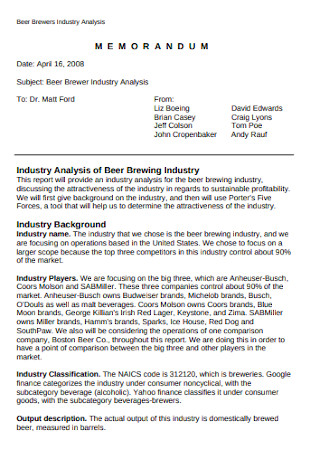

Industry Analysis Memorandum

download now -

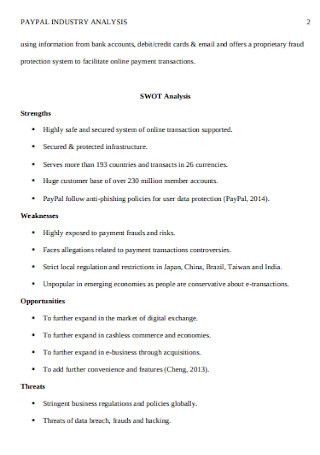

Sample Industry Analysis

download now -

Cross Industry Analysis

download now -

Passenger Car Industry Analysis

download now -

Industry Strategic Analysis

download now -

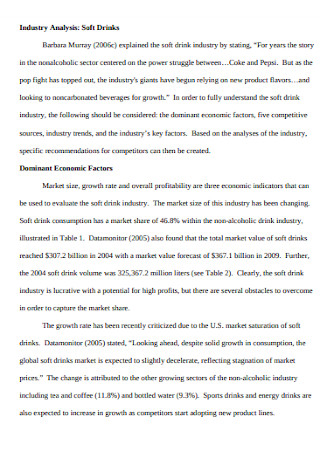

Soft Drinks Industry Analysis

download now -

Return Preparer Industry Analysis

download now -

Basic Industry Analysis Report

download now -

Industry Analysis and Competitive Strategy

download now -

Industry Economic Analysis

download now -

Industry Analysis and Outlook

download now -

Telecommunication Industry Analysis

download now -

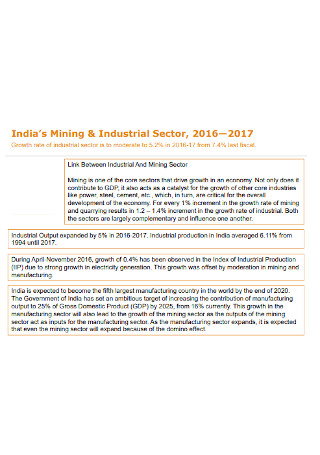

Mining Industry Analysis

download now -

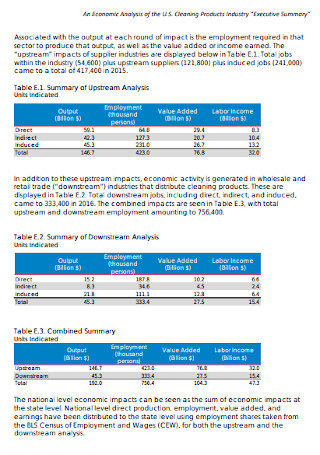

Cleaning Products Industry Analysis

download now -

Target Industry Analysis Report

download now -

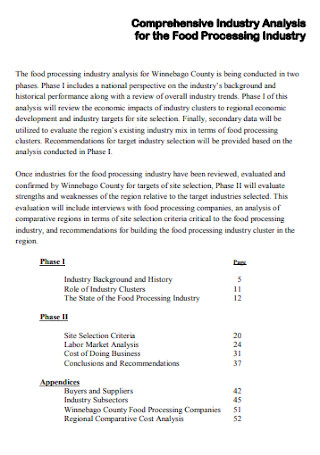

Comprehensive Industry Analysis

download now -

Standard Industry Analysis

download now -

Paperboard Industry Analysis

download now -

Industry Analysis Example

download now -

Industry structural Analysis

download now -

Cell Phone Industry Analysis

download now -

Industry Analysis Project Worksheet

download now -

Industry Situation Analysis

download now -

Tobacco Industry Analysis

download now

This time, what sparked the change was the development of public transportation. The mass availability of steel since the first revolution enabled faster means of construction of both infrastructures and modes of transportation. It was the onset of today’s goal which is globalization. Because of these technological and mechanical advancements, industries emerged left and right. Companies began to best one another and became hyperaware of the capabilities of their competitors. At this point, thorough industry analyses were conducted to maintain their edge in their industry.

What is an Industry Analysis

Industry analysis is vital in a company’s strategic planning. It provides in-depth information about the nature of the industry, how each factor in the industry and how it affects others. It also supplies information regarding the company’s position in the market with respect to other similar companies under the same industry. Apart from providing an idea of the market standing of the company, an industry analysis also provides information on what the company can work and focus on to gain an advantage. Furthermore, it can also provide a forecast on the state of the industry after several technological advancements and on how it can catalyst changes in the market.

Benefits of an Industry Analysis

Analysis, reports, and plans are staples for a business. All of these are tools in making the organization perform better and achieve more. An industry analysis, in particular, helps an organization and an industry be better in several ways apart from the obvious one of having a clear view and picture of the environment.

How to Conduct an Industry Analysis

In 1979, Michael Porter, an economist and business strategist, developed the five-factor model which is crucial in modern business strategy development. This model essentially tells the competitiveness of the environment of a certain industry and its attractiveness. The evaluation of these five factors helps create an analysis for a particular industry. So, for this part, we will bank on Porter’s framework in creating an analysis for small-time and medium businesses.

Step 1: Find Out the Availability of Substitutes

An industry, based on its fundamental definition, is a sector that provides goods and services in an economy. With this, an industry is not a monopoly—it is not made up of a single corporation. Several companies thrive and compete with each other under a single industry. Based on the recent statistic, one of the main economic drivers of the United States is the healthcare industry. The growth of job opportunities from this industry since the 2008 recession has grown exponentially and is forecasted to continue until the late 2020s. The emergence of healthcare companies are also rapid, from hospitals to home health clinics, the masses are provided with more substitute methods on getting the best healthcare. It is quite impossible for a company under this industry to establish its competitive advantage mainly on this factor because of the wide array of available substitutes.

Step 2: Identify the Buyer’s Bargaining Powers

Bargaining power is the extent of how far one party influences the other. In the market, the buyers have great bargaining power in industries where they are the sole or main source of the income of the industry. This power alone can help control the price that is placed on the product. Say, for example, a thriving artist who aims to sell their art has a handful of patrons. That artist cannot dare to mark up the price because their patrons can easily go to another artist who prices their work at a lower rate. And because of this threat of having no patrons at all, the artist keeps their price range at an acceptable level for the customers. This situation demonstrates that the customers have excellent and compelling bargaining power over the creator.

The common question now is how to determine the bargaining power of the customers. It is quite easy. If many substitutes are available at more affordable prices, the buyer’s bargaining power is high. And given that there are available substitutes, the consumers become sensitive to the prices. Once they notice the subtle price changes easily, the extent of their influence in the industry’s market is great. Lastly, and the most obvious one, when a customer places in bulk orders. The business wants to maintain a partnership with these customers and in order to do so, they agree to the customer’s demands.

Step 3: Assess the Bargaining Powers of the Supplier

Establishing bargaining power is a two-way relationship. If you have determined the bargaining power of your buyers, the next thing to assess is the power of your suppliers. Similar to what the demands of the buyers can do if the supplier has high bargaining power, they can easily surge the prices of their products or services. They can also adjust the quality of their offerings. On the other hand, a supplier has low bargaining power when there are a number of other suppliers, this means that the industry can easily switch from one supplier to another. Another note of low bargaining power is if the buyers do not rely heavily on the suppliers to make a sale.

Determining the bargaining power of the supplier is essential in an industry analysis because it is one of the factors that identify the attractiveness of the industry to new entrants. It is also a crucial factor in estimating the profitability of a business within the industry. Businesses can be more profitable when the bargaining power of the suppliers are relatively low because they are free, to a certain extent, in making decisions regarding the prices of the goods, with all the other things considered.

Step 4: Determine the Openness for Entry

After figuring out the dynamics of the bargaining powers between opposite parties, the next thing to place a finger on is the ease of entry into the industry. The relationship of influence between the buyers and suppliers starts to create and build up the attractiveness of a certain industry. And similar to what we label as a law of nature, people are interested in things that are beautiful, beneficial, and advantageous. In a business context, profitable industries rake in most people who want to try and succeed in their business ventures. Industries with low entry barriers are densely populated with competitors which limits the profit of each business. Moreover, established and leading brands in densely populated industries have more or less established their dominance and are more knowledgeable in the nitty-gritty details of the economies of scale.

It is important to note if the industry you are in is easy to enter or not. The desirability of your company increases when you are in an industry with low openness to new entrants. Being in such an environment means that there are fewer competitors but these other companies are also as established and well-managed.

Step 5: Evaluate the Performance of Competitors

The rivalry among the existing competitors is at the core of Porter’s framework. Understandably so because the aim of an industry analysis is to realize the competitive advantage of each company over the others. Understanding how the competition works is beneficial because you can see where one company lacks and, in turn, you can make up for it in yours. A company strives to produce products and services that have a cutting edge over the others. Similar products from different companies decrease the attractivity of the particular business sector. Make sure that your industry analysis has sufficient information regarding your competitors in terms of their market standing, marketing advertising practices, and nature of their products and services, among all other things.

Dos and Dont’s of Creating an Industry Analysis

The industries on the frontline right now may change in the succeeding years. This uncertainty demands more frequent use of industry analysis to make sure that they retain their standing. These leading industries need to check their performance every so often to keep their excellent performance over the years. In order to do so, here are some guidelines to come up with the best industry analysis.

Dos

1. Do take into account other analysis methods

Aside from the established analysis framework by Porter, there are other methods that are applicable for industry analysis. The SWOT analysis is effective in smaller scales. It points out the strengths, weaknesses, opportunities, and threats that the industry may face. Another method that can also be used is the Broad Factors Analysis, which is more known as the PEST Analysis. Each letter represents a factor: political, economic, social, and technological. Similar to the importance of Porter’s model, the Broad Factors Analysis rakes in information and provides a summary of the overall impact of the factors on the performance of the business and industry. It is important to look into these other options to make sure that the method you utilize in your company is the most beneficial.

2. Do use it to your advantage

In the same way that war strategists prefer to camp in highlands to have a better view of the battlefield, an industry analysis creates a clear picture of your market considering a handful of factors. Industry analysis is more than just a report on the industry’s current status, it is also an evaluation and a measure of how you can improve your business. Make sure to use the material to your advantage, improve on the things that your goods and services lack and maintain the best practices. Additionally, the analysis provides details on the edge of your company over others within the industry.

3. Do provide ample time for the analysis

The analysis has simple methods. It makes use of matrices and flowcharts that show the relationship of each factor to another. What the analysis demands is time. Enough time is needed to produce a thorough and well-thought report. Regardless of the number of factors to consider, on average there are four to five overarching factors, but each one is broad and encompasses several elements that make it up.

Dont’s

1. Do not miss out on recent developments

Technology and innovation are one of the major catalysts of change in the economy. In conducting your analysis, make sure to take note of the recent technological developments that are available in the market that you can use for your production. Also, do not forget to check if there are upcoming innovations that can boost the quality of your products and production. These changes can alter the needs and demands of the market from the industries.

The hypercompetitive environment molded the same kind of people. In turn, these like-minded people built empires and industries who strive to best and topple each other to reach the top spot and be the main driver of a country’s economy. Industry analysis keeps them at bay and checks their performance. These researches are essential to the success, growth, and continued development of the industries.