47+ Sample Collection Letters (& Forms)

-

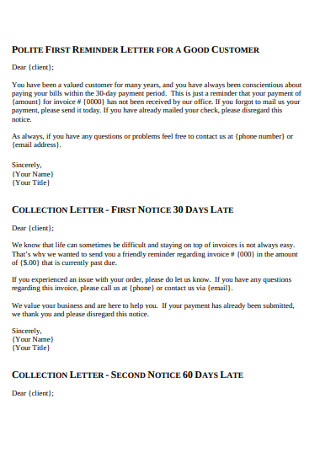

Customer Collection Letter

download now -

Agency Collection Letter

download now -

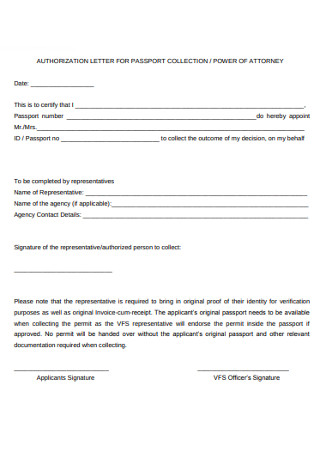

Authorisation Letter for Passport Collection

download now -

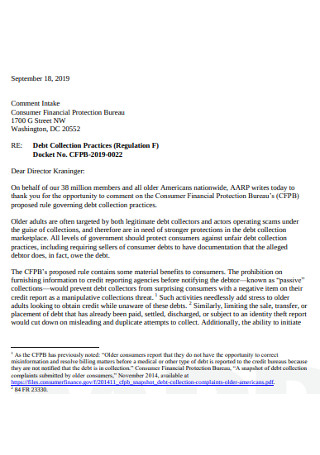

Debt Collection Letter

download now -

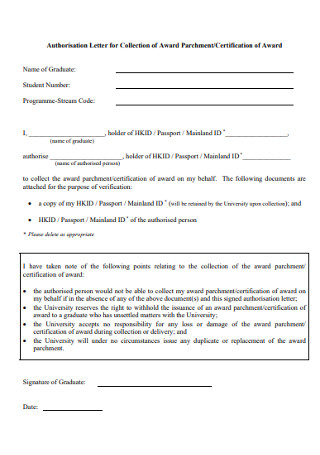

Authorisation Letter for Collection of Award Parchment

download now -

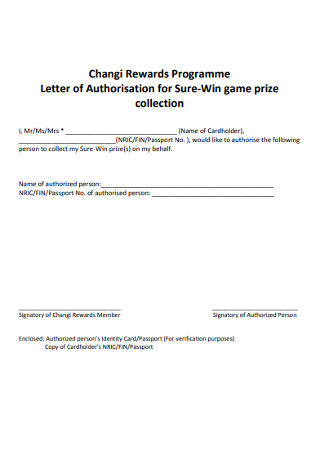

Letter of Authorization for Collection of Prize

download now -

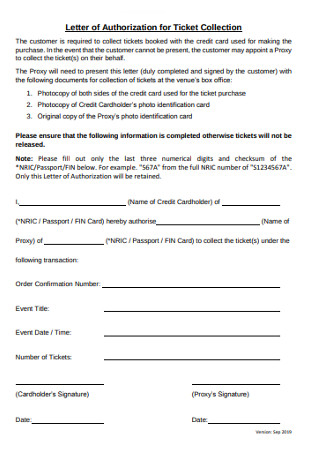

Letter of Authorization for Ticket Collection

download now -

Sample Collection Letter

download now -

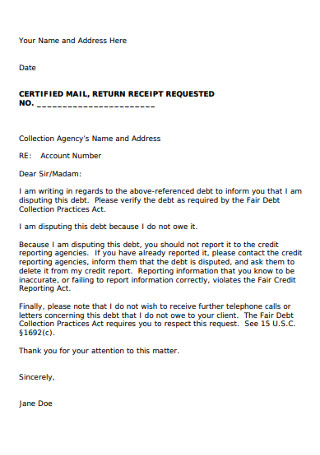

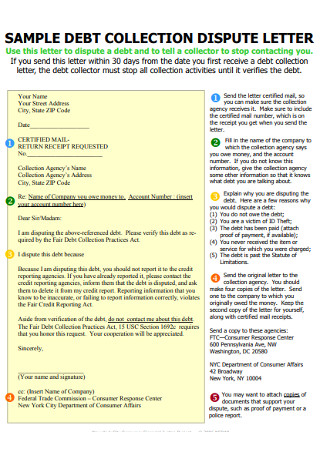

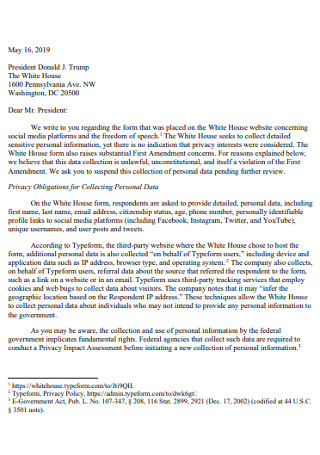

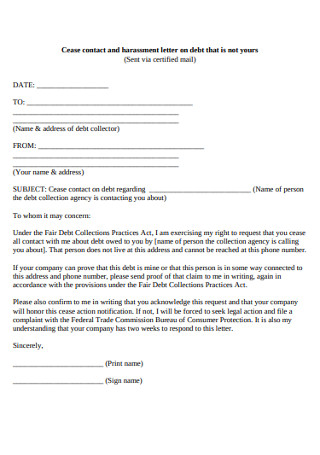

Sample Debt Collection Dispute Letter

download now -

Collection Programme Letter

download now -

Standard Collection Letter

download now -

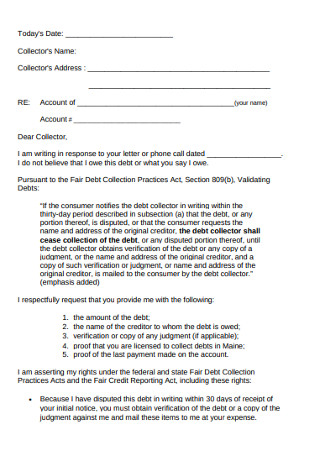

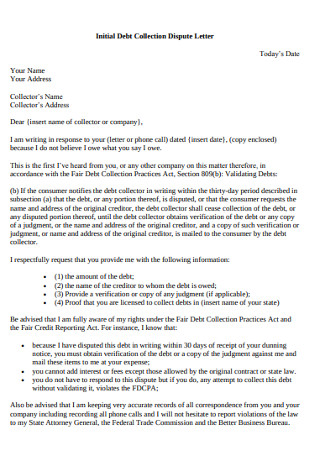

Initial Debt Collection Dispute Letter

download now -

Debt Collection Survey Letter

download now -

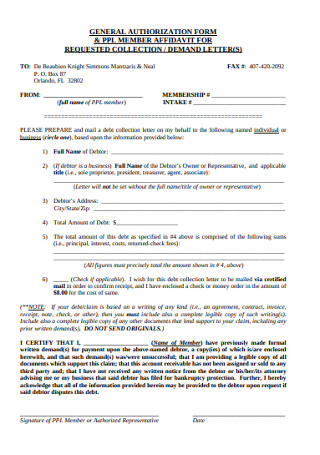

Demand Collection Letter

download now -

Sample Collection Contract Letter

download now -

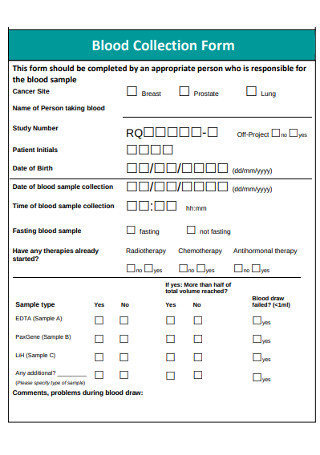

Blood Collection Form

download now -

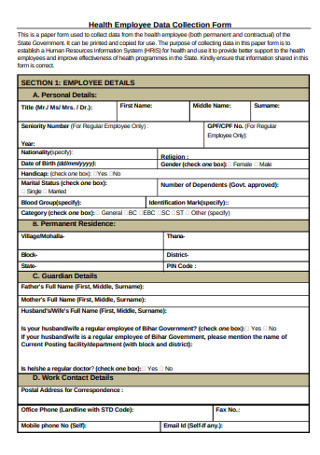

Health Employee Data Collection Form

download now -

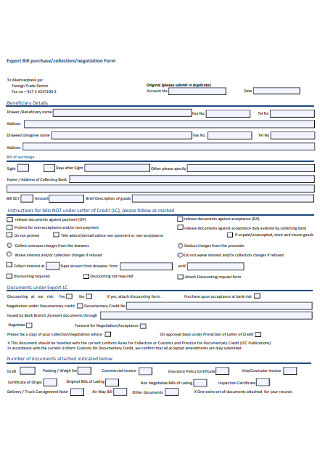

Export Bill Purchase Collection Form

download now -

Standard Data Collection Form

download now -

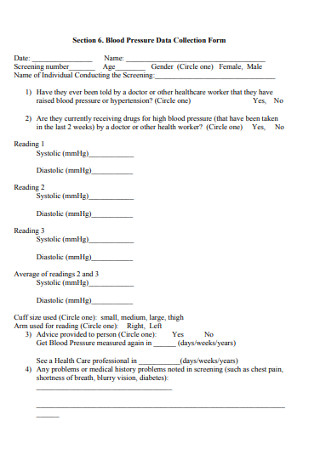

Blood Pressure Data Collection Form

download now -

Laboratory Data Collection Form

download now -

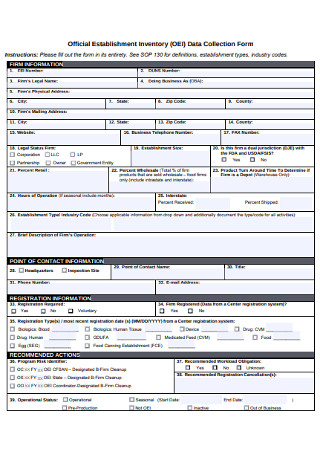

Official Establishment Inventory Data Collection Form

download now -

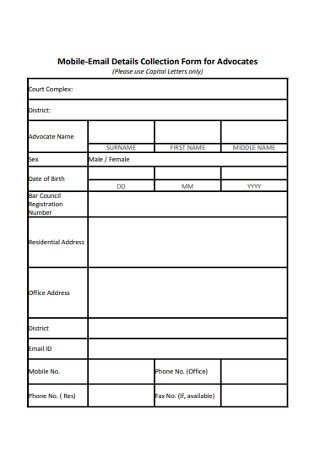

Mobile-Email Details Collection Form

download now -

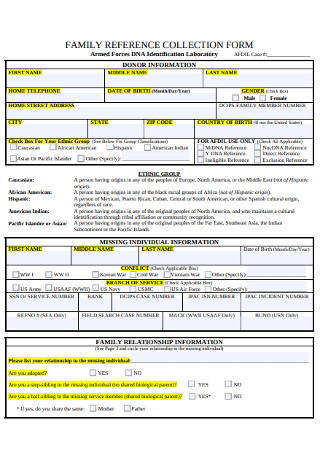

Family Reference Collection Form

download now -

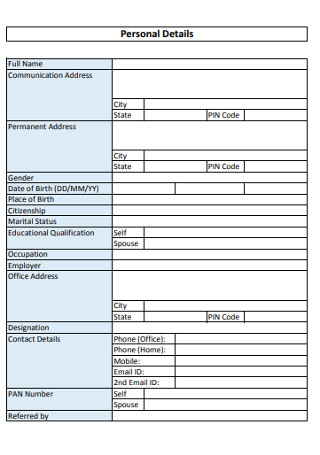

Financial Planning Data Collection Form

download now -

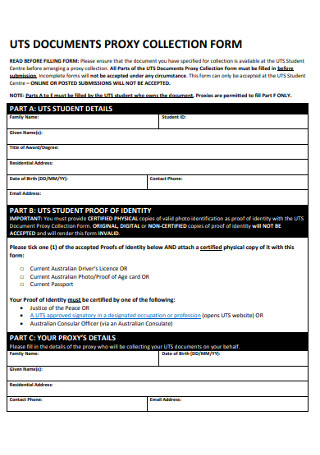

Documents Proxy Collection Form

download now -

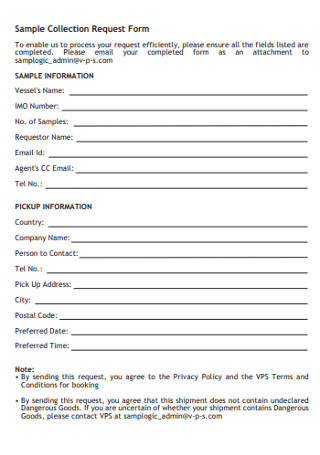

Sample Collection Request Form

download now -

Forest Service Seed Collection Form

download now -

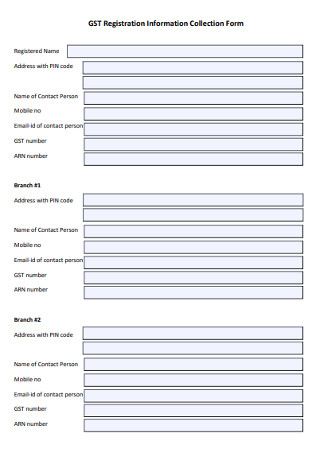

Registration Information Collection Form

download now -

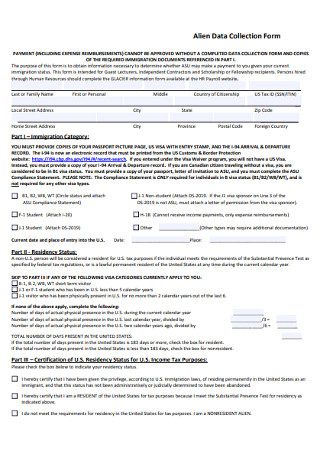

Alien Data Collection Form

download now -

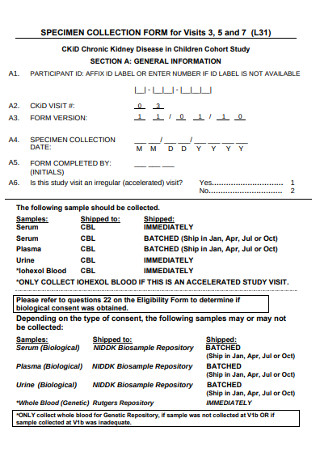

Speciment Collection Form

download now -

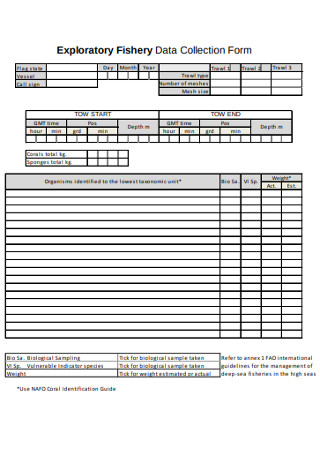

Exploratory Fishery Data Collection Form

download now -

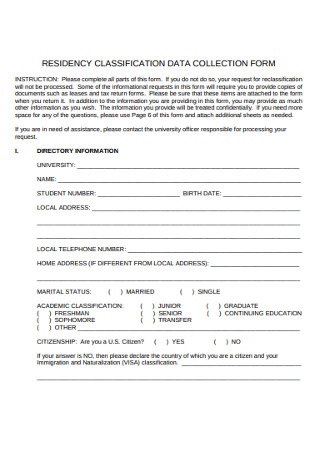

Residency Classification Data Collection Form

download now -

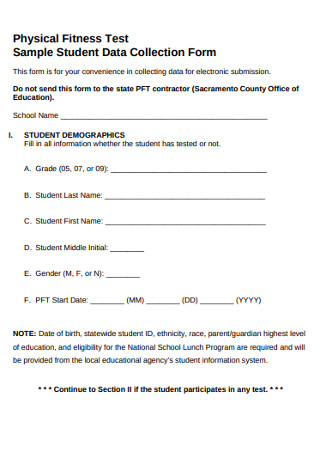

Sample Student Data Collection Form

download now -

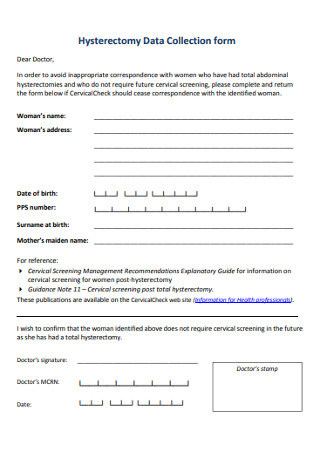

Hysterectomy Data Collection form

download now -

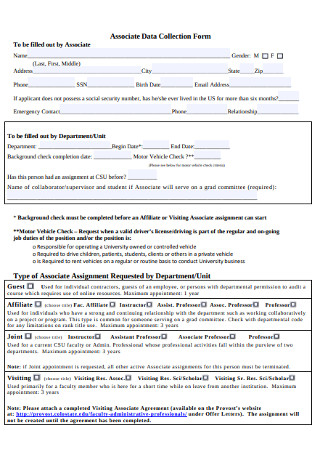

Associate Data Collection Form

download now -

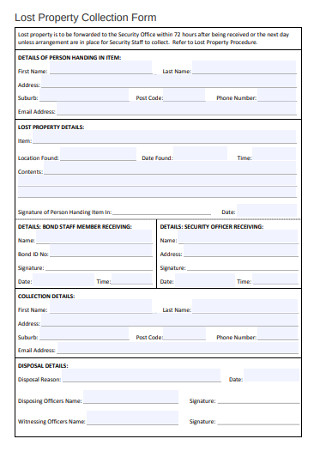

Lost Property Collection Form

download now -

Export Collection Form

download now -

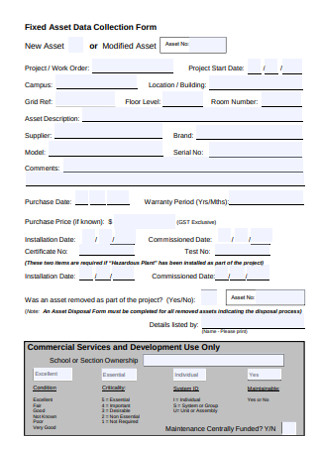

Fixed Asset Data Collection Form

download now -

Customer Details Collection Form

download now -

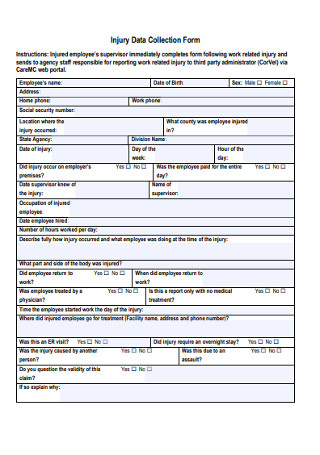

Injury Data Collection Form

download now -

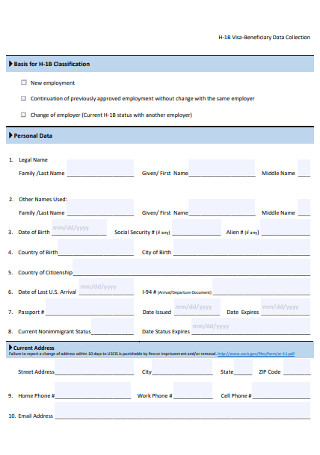

Visa-Beneficiary Data Collection Form

download now -

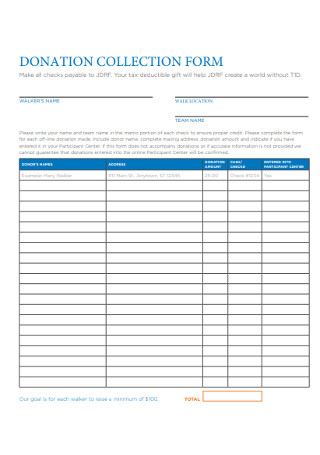

Donation Collection Form

download now -

Portfolio Collection Form

download now -

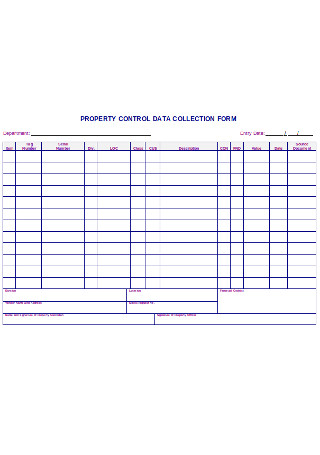

Property Control Data Collection Form

download now -

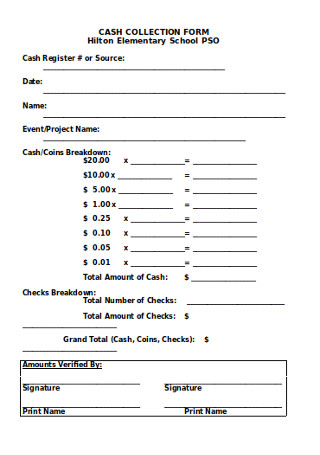

Cash Collection Form

download now -

Web Link Collection Form

download now -

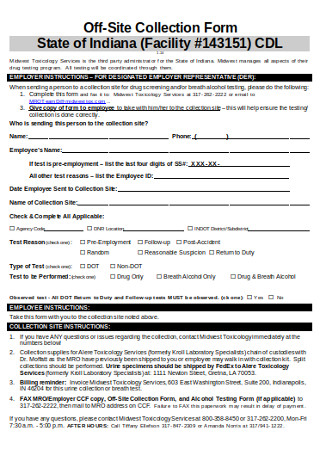

Off-Site Collection Form

download now

One of the biggest challenges of writing collection letters is your ability to maintain good customer relations in spite of one’s passive behavior. Getting paid the full amount can take forever to happen when faced with troublesome customers. Thus, knowing how to write friendly, yet firm collection letters are vital to retaining positive customer engagement.

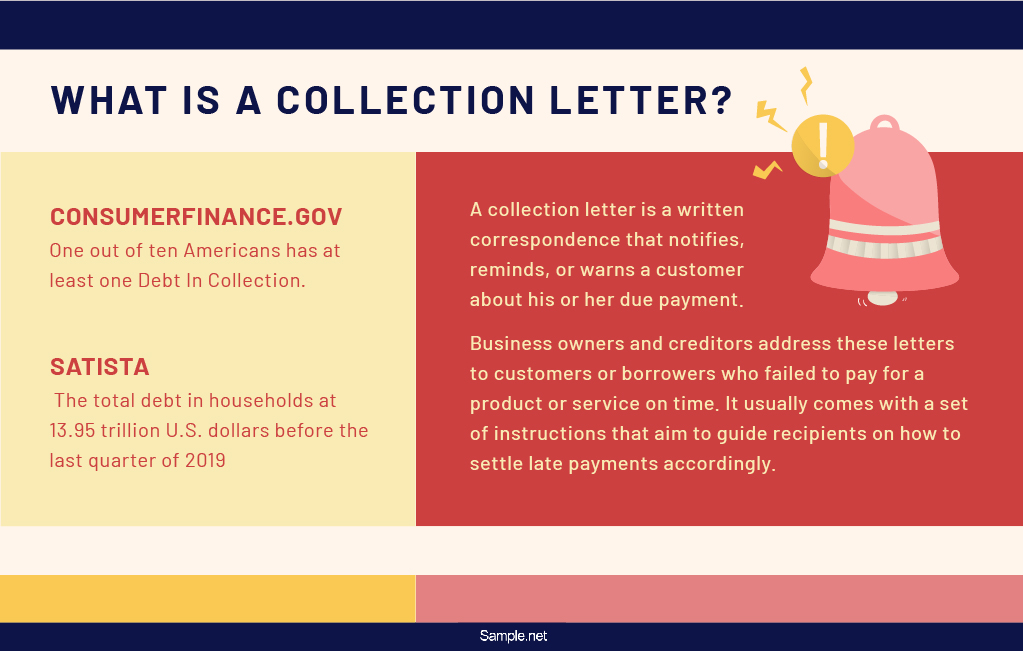

What Is a Collection Letter?

A collection letter is a written correspondence that notifies, reminds, or warns a customer about his or her due payment. Business owners and creditors address these letters to customers or borrowers who failed to pay for a product or service on time. It usually comes with a set of instructions that aim to guide recipients on how to settle late payments accordingly. Since it’s always possible that the customer might have missed the payment after losing the invoice request, it’s important to demonstrate professionalism when approaching the matter at hand.

Types of Collection Letters

Many companies worry about sending a collection letter in fear of damaging their relationship with customers. Fortunately, that won’t be the case if you know what letter to send and when. We classify collection letters into four different types:

How to Write a Collection Letter

People write collection letters with the intent of receiving payment from an overdue account. To remain professional throughout the correspondence, you need to communicate appropriately with customers regardless of the amount of work they put you through just to have them settle the payment. Preserving the relationship you share with each customer is crucial to open more doors to business deals in the future.

With that said, you’ll want to keep this step-by-step guide to letter writing in mind.

Step 1: Prepare a Letter Template

It’s a good idea for a business to have a letter template ready that they could use to make follow-ups with customers who past their payment deadlines. The collection letter template should consist of your company letterhead as well as supporting details that are unique to the transactions made by your business. You can save a copy of the template in your computer or a printed one in your files for future use.

Securing a template for the correspondence will save you the time and effort it takes to write the letter from scratch, especially when handling multiple client accounts simultaneously.

Step 2: Collect the Customer’s Account Details

Gather all the necessary information regarding the transaction. Every case is different, so your collection letters will likely vary in terms of the items availed and the total amount due. The debt collection letter must indicate the exact amount that the recipient owes (including any additional costs and fees) and when it was expected. Clarifying this part in the body of your letter will keep you away from unwanted disputes down the road.

Step 3: Insert a Copy of the Invoice

Including a copy of the invoice or a summary statement comes more as an advantage to you than it does for a customer. It makes communicating all the more convenient by supplying both parties with context and reference that point to the transaction. When you have a lot on your hands, you’ll need any distinctive details that will help you identify the transaction and avoid confusion. It’s one of the reasons why every business must issue a sales invoice as a personal record to keep.

Step 4: Make a Call-to-Action

CTAs are a critical element of any business instrument because they appeal to customers and encourage them to make the payment immediately. It also helps remind a customer of the acceptable payment methods that your business processes to avoid problems. You can word this section of the letter in any way that you prefer, as long as it drives a reader to respond accordingly.

Step 5: Provide Your Contact Information

Customers should be able to reach you for questions or concerns that only you can address. You can make yourself accessible by providing your company’s contact information, such as your mailing address, phone number, email address, and website. Not everyone will put in the extra effort to find this out themselves, so you might as well take matters to your own hands.

The Dos and Don’ts of a Collection Letter

It can be tricky to write a collection letter to a customer who has yet to settle a business invoice given to him or her. As much as you want to get paid for the product or service rendered, you don’t want to jeopardize your business relationship with someone that offers value to your company. You can use a collection letter to let your customers know about a payment that is past its due. It’s a crucial part of the customer engagement process that you must carry out carefully to maintain a positive status with your consumer market.

Listed below are a few tips to help you pen a professional and effective collection letter.

Dos

1. Do keep it typewritten.

Avoid sending handwritten collection letters. You want to establish credibility and authority by taking a professional approach when corresponding with customers. Typing your message also spares you from making spelling errors and grammar mistakes that could easily be corrected by a built-in system in your computer. It’s one way to maintain a clean and organized content for the sake of readability.

2. Do reference purchased items.

Mention all products and services in the transaction. It’s important to clarify what you did for a customer and how much they owe you for such. You can opt to attach a copy of the billing statement or invoice issued as proof of the amount due. This financial document will also provide customers with a breakdown of the total costs (inclusive of tax) for the purchased items. List them down accordingly so that the recipient could quickly review each item for verification.

3. Do consider discounting early payments.

If it means securing early payments, you can always consider giving customers a discount for payments made on or before a particular date. Nothing excites consumers more than the thought of saving a few bucks on a purchase. It’s a win-win situation for both parties, as early-bird payments could keep you from chasing customers around for the money they owe you. Be sure to make the terms and conditions of the discount apparent in your collection letter so as not to mislead readers.

4. Do offer to help customers having problems with an overdue bill.

The only way to collect late payments without taking matters to court is to offer your assistance to troublesome customers. Using a sincere and persuasive tone should help you convince the customer to come clean with the problems they are experiencing. You don’t have to believe their reasons for the delay, as no matter what excuse they give you, what matters is that you get paid by the end of it. You can choose to propose new terms, extend the payment deadline, or make other adjustments that will allow you and the customer to meet halfway.

5. Do inform customers of potential penalties.

Setting deadlines is always a good idea, as it creates a sense of urgency that will drive a person to act immediately. But if a customer fails to cooperate with you and continues to exhibit undesirable behavior, your final letter can serve as a written warning of what the penalties will be if they refuse to meet your terms. You can also remind customers about what they agreed to do from the very beginning as a heads-up, as it’s normal for some customers to forget some essential details in your business deal after some time.

Don’ts

1. Don’t make it sound too friendly.

There’s nothing worse than people who abuse your kindness. Being “too friendly” can be a bad thing when the receiving end of your service begins to take it for granted. It’s bad for business, and it’s bound to put you at a disadvantage in most circumstances.

However, you don’t want to seem angry, rude, or impatient in your letter. Understand that some customers have a valid reason for not paying on time, and the last thing you want to do is to shame them for the delay. The best approach is to remain calm yet insistent that they stay committed to the business agreement.

2. Don’t hesitate to demand payment.

You have every right to push customers to settle their dues. While collecting payments is often easier said than done, you don’t want to do anything that could make you appear too demanding. Avoid, under any circumstance, making any threats that involve taking legal action against the individual. Discriminative language is also forbidden when making a formal correspondence. Showing any signs of aggression can often put the image of your business under a bad light. Using harsh words will only offend the reader and further delay the payment.

3. Don’t post it in public.

There are guidelines that you need to follow when it comes to writing to customers about an unpaid invoice. In no way do you have the authority to expose a customer’s information to the public without acquiring permission to do so. Even when someone gets on your nerves, learn to handle conflict privately to maintain a professional front for your business. Stating any distinct details about the debt in a public platform may get you in serious trouble with the customer and his or her legal team.

4. Don’t invade a person’s privacy.

You’ll likely encounter several customers who can be a pain to deal with, despite your efforts to remain calm and collected. But even if you have access to someone’s data, you should fight the urge to use this information against them. Never address the collection letter to a customer’s place of employment. Also, it’s never okay for your message to include threats to contact one’s family member, friend, colleague, landlord, or employer.

5. Don’t forget to send an acknowledgment letter.

Though this isn’t always necessary, it’s common courtesy to let someone know that you’ve received something that they sent. Some customers might need reassurance as well. It doesn’t have to be anything too serious, as a few words of acknowledgment will be enough to put someone’s mind at ease. Regardless of how much trouble a customer puts you through, converting prospects to buyers takes time and money, so you as well be thankful for the opportunity in front of you.

Effective collection letter are both professional and straightforward. Getting customers to settle their dues will take up much of your time and energy, so make sure each letter expresses how serious you are about handling the case and what measures you are willing to take to ensure that everything gets settled. Feel free to download and refer to the collection letter samples provided in this article to help you get started.