14+ Sample Debt Hardship Letters

-

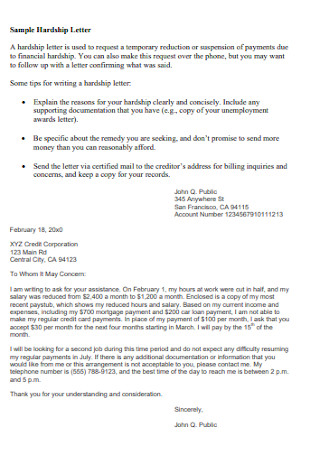

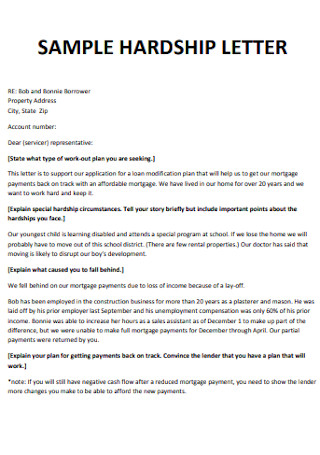

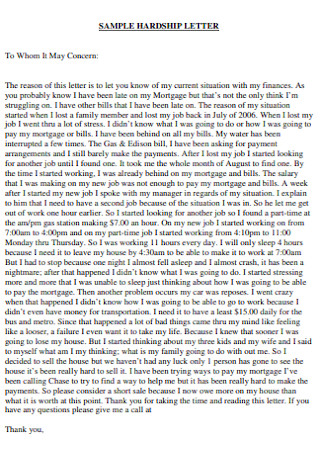

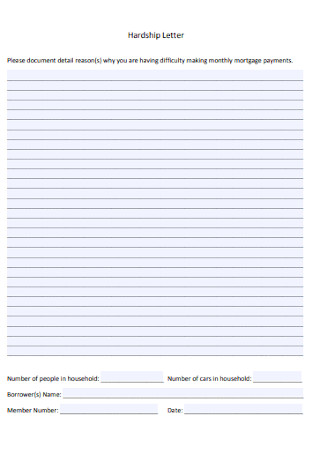

Sample Debt Hardship Letter

download now -

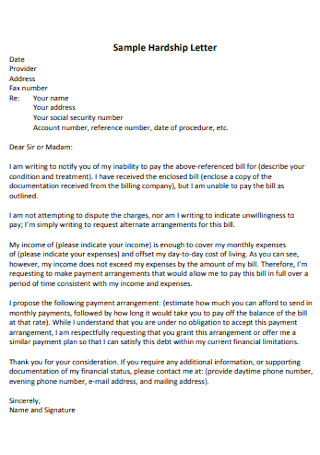

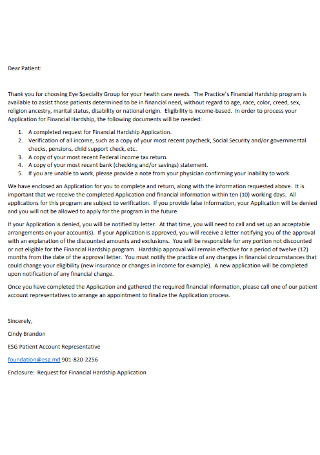

Debt Financial Hardship Letter

download now -

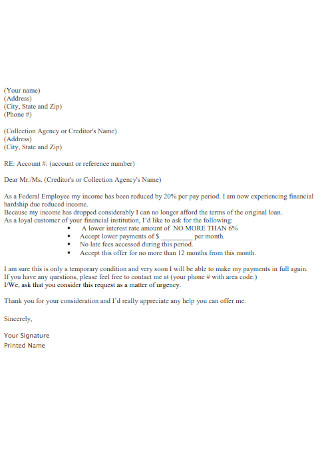

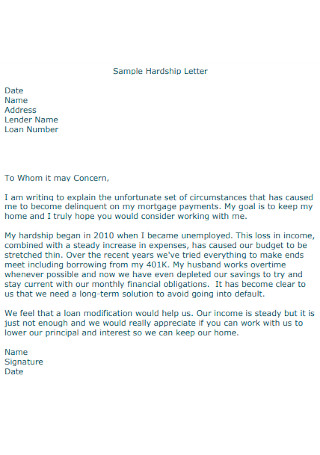

Basic Debt Hardship Letter

download now -

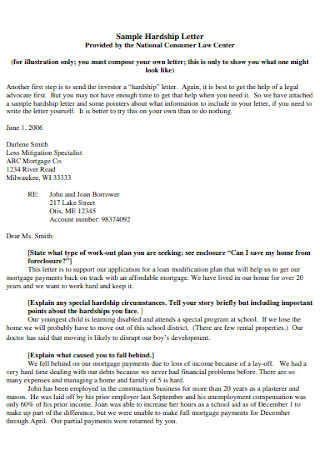

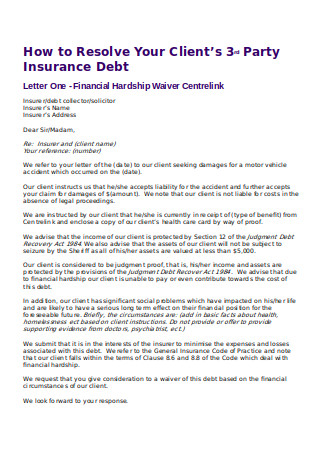

Debt Customer Hardship Letter

download now -

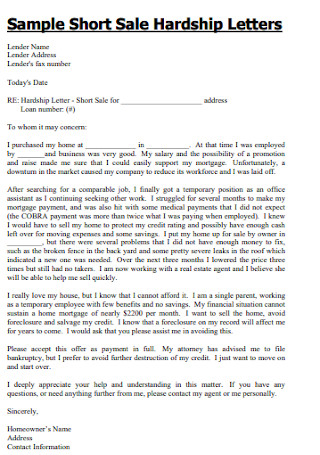

Debt Short Sale Hardship Letters

download now -

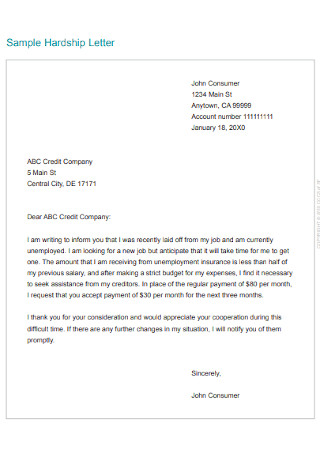

Simple Debt Hardship Letter

download now -

Company Debt Hardship Letter

download now -

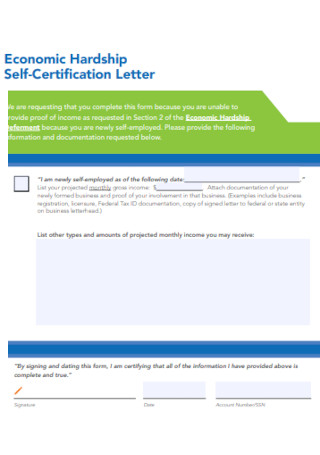

Debt Hardship Self-Certification Letter

download now -

Standard Debt Hardship Letter

download now -

Debt Sellers Hardship Letter Template

download now -

Debt Partner Hardship Letter

download now -

Debt Hardship Variation Letter

download now -

Debt Hardship Letter Format

download now -

Sample Debt Financial Hardship Letter

download now -

Printable Debt Hardship Letter

download now

What is a Debt Hardship Letter?

You might find yourself in a situation where you are having difficulties paying off debt. It might be due to personal circumstances such as losing your job, family hardships (divorce or child custody battle), addiction, etc. For example, you have an ongoing mortgage or loan contract. With money problems, you won’t be able to pay your mortgage on time and this might cause its foreclosure. To save yourself, you might have to consider a short sale, and you will need to write your creditor a debt hardship letter. The letter will explain to the bank the reason why you are defaulting on your mortgage and why you have to sell your home for a lesser price just to cover the mortgage cost. Basically, a debt hardship letter is a letter you will have to send a current creditor explaining your financial situation. In the letter, you can politely request an alternative way of settling the debt. You can appeal for a loan modification or request an alternative payment arrangement subject to the creditor’s approval. The creditor can either provide you a relief by reducing, deferring or temporarily suspending your payments.

Some Examples of Financial Hardships

No one really plans to go through financial troubles. Not getting to pay your bill on time can cause tremendous amounts of stress and anxiety. But life happens. Things spiral out of our control and we lose financial stability. You cannot avoid it when it comes. The best you can do is to brace yourself. There are a handful of circumstances that can cause financial difficulties for a person. Some examples can be found below.

1. State of Unemployment or Income loss

One day you have work with great pay that’s able to pay the bills and more. The next thing you know, the place you work at is downsizing, your employment contract is being terminated and you are out of work. In today’s economy, it is a struggle to get a job. If you are one of those people fortunate enough to have savings put away in case of financial setbacks, you will survive without work for the next few weeks or months. If you are not, then your bills will start to pile up and you are drowned in debt. Contact your creditor and let them know your situation.

2. Unexpected Medical Illness or Injury

Getting in an accident where your injuries will not permit you to work for a long period of time can really cause financial setbacks. Medical bills will pile up but your savings remain stagnant since you haven’t been working your regular shifts. Stress and anxiety might consume you, but you need to focus on your health and in getting better soon. Once you regain your strength, it is back to hustling and getting on your feet again.

3. Undergoing Divorce or Family Problems

Divorce rates are quite high in the United States. In 2018, there were more than 700, 000 divorces and annulments in the US. Going through legal separation proceedings can really affect a person’s financial stability. You will have to pay for legal fees, a divorce attorney, and all other expenses related to a divorce settlement. A person going through a divorce will have a hard time bouncing back. Until the proceeding is over and he has moved on, he then can start rebuilding his life once again.

4. Getting Hit by a Natural Disaster

With the recent hit of the deadly global pandemic known as Coronavirus or COVID-19, small businesses have to close their shops to follow stay at home orders issued by the state. This can cause significant business setbacks. People are going jobless and have no source of income. Relying heavily on the government for succeeding orders. The economy is struggling and so are the people. While other creditors are giving their debtors some slack by allowing late payments or offering alternative payment agreements, some will still insist on following the original agreement prompting debtors to worry about how they are going to pay their debts. One way of letting your creditor know your situation is by writing them a debt hardship letter, explaining how this pandemic is affecting your financial stability.

How To Write a Debt Hardship Letter

Contrary to popular belief, but most Americans struggle financially despite the US having a strong economy. As reported by Forbes, around 135 million Americans are going through some type of financial difficulty. Approximately, 29% of the population are spending, saving, and borrowing money from financial institutions. In a 2019 Consumer Debt Study conducted by Experian, total consumer debt in the United States is at a whopping $14.1 trillion, with each American having an average personal debt of $90, 460. However, not everyone is capable to pay their debts. If you are one of these people with existing debt and are experiencing financial troubles, you should consider writing your creditor a debt hardship letter. Below are some steps to help you write the letter.

Step 1: Identify What’s Causing the Hardship

Before you can start writing the letter, you need to have a clear picture of your situation, specifically your financial stance. Gather yourself and think things through. Once you are emotionally stable, then you can begin writing the letter. Having a hard time paying a debt can mean that you are going through financial setbacks. It can be due to loss of work, an unexpected accident causing personal injury, family problems like going through a divorce or losing a loved one, or any other circumstance causing you to lose a huge amount of cash from your savings. Whatever your personal reason is, it must be real and valid. Put yourself in your creditor’s shoes. Will he accept my excuse?

Step 2: Provide a Description of the Hardship

There is always a backstory to everything. You can try and narrate in the letter the chain of events causing you to lose financial stability. You do not have to write a three-page essay that could bore the reader. Try to be short and concise. Not too short that the letter will lack emotions. Just enough to appeal to the reader’s heart. After all, you are requesting sympathy from your creditor to loosen the payment of your debt. Lay down the facts. If possible, do it in a poetic manner. Write something that genuinely comes from within that can cause an eruption of emotions from the person reading.

Step 3: Be Open and Honest

Although you need to write with emotions in mind, remember to be honest. Do not overexaggerate your circumstance to your creditor. Keep your emotions and soppy stories at a minimum. Consider attaching documents to boost the authenticity of your claims. For example, you are going through a nasty divorce. You can attach the contact information of your attorney and the case reference number of the divorce proceeding. You can also include a statement that if the creditor has further questions from you, he can directly contact you through the number you have included in the letter.

Step 4: Suggest an Action Plan

Think of something you can do to remedy your situation. If you lost your job due to retrenchment in your company, you can tell your creditor that you are in the process of looking for a new job. In the meantime, ask him to consider giving you some time for late payments until you get employed again. You can propose an interest payment so he can approve your request. For example, propose to reconcile your debt after 3 months. Three months is enough time to look for a new job. For those months, you will offer to pay interest on top of the base monthly payment. Prove a specific target day for payment to boost your credibility.

Step 5: Write a Strong and Sincerely Enclosure

End the letter with a sincere apology and thank you. Not getting to pay your debt in time can be a hassle to a creditor, it may mean loss of income in his perspective so give the proper apologies for the inconvenience. At the same time, signify your sincerest gratitude to him for simply taking the time to read your letter. In addition, say that you are willing to discuss this with him in person. Hence, be sure to enclose your phone number so he can contact you. If you do not receive a reply from your creditor within a week or so, try and make a follow-up call and ask if he has read your debt hardship letter.

FAQs

How do you show financial hardship?

If you want to defer paying an existing loan you have since you are going through financial hardships, you need to write your creditor a debt hardship letter. You can show him some documentation to boost your claim that you are undergoing financial difficulties. Some types of documentation you can show your creditor is proof income which can be verified through a copy of your pay stub or income statement. You can also include the receipts of monthly utilities you pay on a regular basis such as rent or mortgage receipts, electricity bills, grocery receipts, transportation, and medical receipts. You can talk to your employer in providing your creditor a certified income verification statement on how you actually make in month’s worth of work.

What should I do if I cannot pay my credit card bills?

The first thing you should do is call your credit card company. Inform them about your situation and why you are unable to pay your bill. They will negotiate a payment plan for you. Most of the time you will have to write a debt hardship letter addressed to the credit card company for them to keep on file. Do not be alarmed, it is usually part of the process. You will need to provide a description of your current financial situation and the reason why you are unable to pay the credit card bill at the due date. Once you send the letter, you will need to wait for a few days until the credit card company gets back to you and gives you their response. They can either approve, reject, or consider the request.

It is not easy going through financial distress. It can cause worries and anxiety. If you are having trouble paying your bills, buying essential necessities, or even paying an existing debt, you might be going through financial hardships. That’s okay. A lot of people go through and deal with unexpected money problems and survive. With respect to the people you owe money, be polite, and make sure to let them know. They might understand your situation and provide you an alternative payment plan. To do this, you can use our sample debt hardship letter templates above. All you need to do is find a template that works for you, download the file, make adjustments, and print.