20+ SAMPLE Debt Letter

-

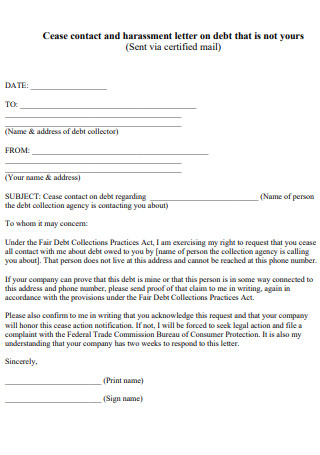

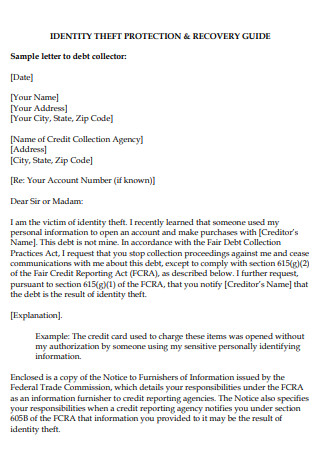

Debt Harassment Letter

download now -

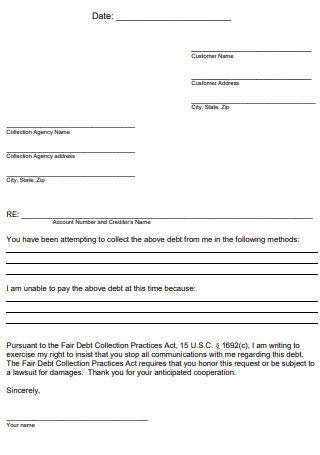

Fair Debt Collection Letter

download now -

Debt Signed Letter

download now -

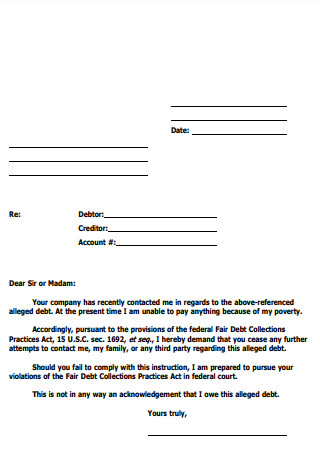

Outstanding Debt Letter

download now -

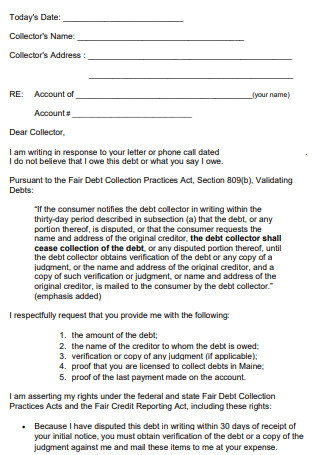

Initial Debt Collection Dispute Letter

download now -

Debt Collector Response Letter

download now -

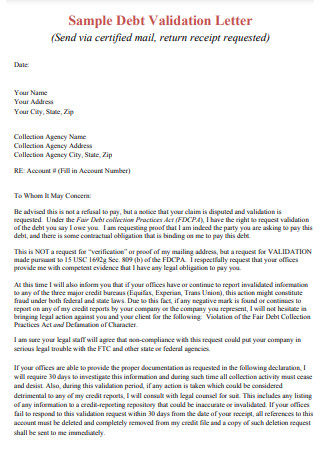

Sample Debt Validation Letter

download now -

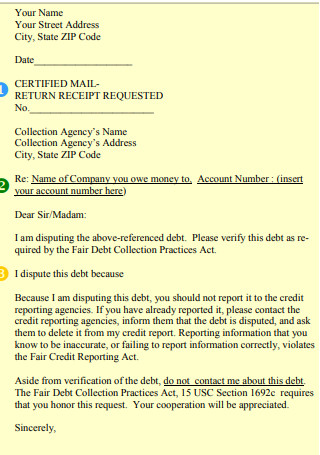

Debt Collection Dispute Letter

download now -

Debt Letter

download now -

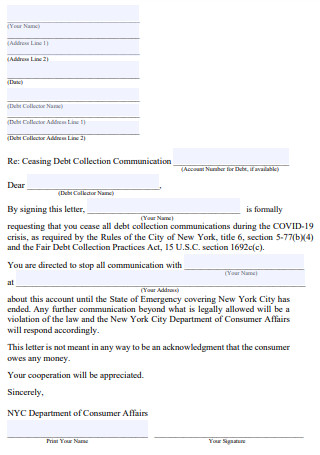

Debt Collection Communication Letter

download now -

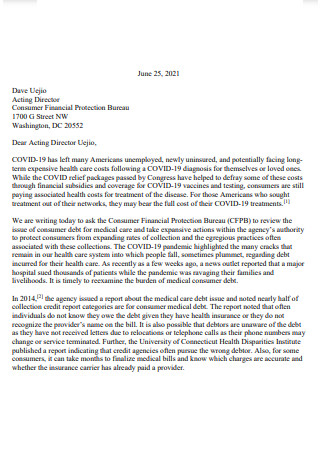

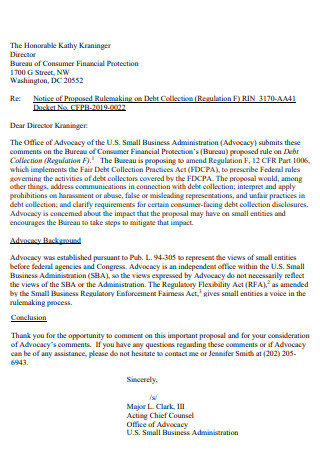

Debt Collection Comment Letter

download now -

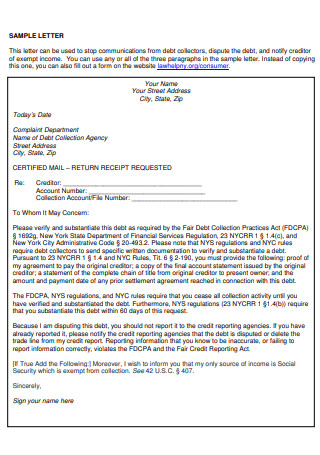

Debt Letter to Stop Collection Calls

download now -

Student Loan Debt Relief Letter

download now -

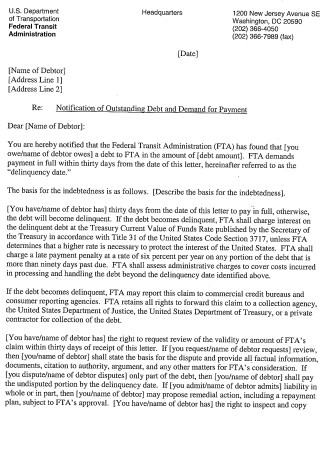

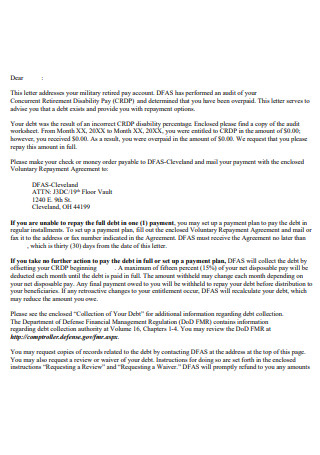

Debt Notification Letter

download now -

Disputing a Debt with a Collection Agency Letter

download now -

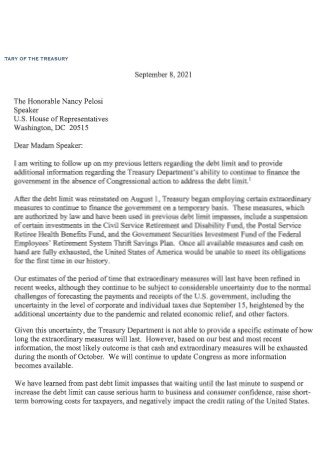

Debt Limit Letter

download now -

Debt Collectors from Bothering Letter

download now -

Debt Letter Format

download now -

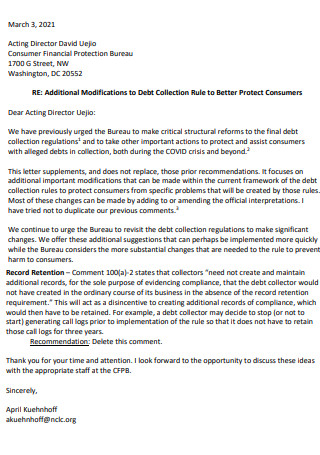

Additional Modification to Debt Collections Letter

download now -

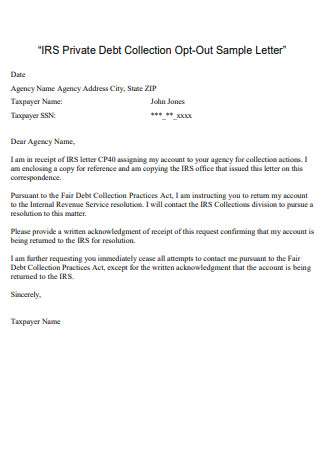

Private Debt Collections Letter

download now -

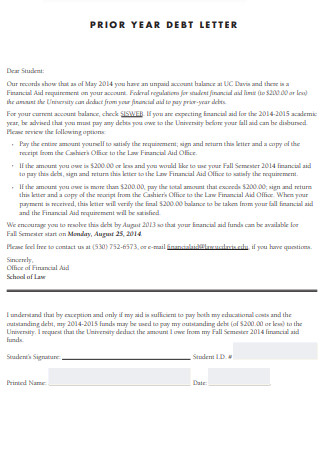

Prior Year Debt Letter

download now

What Is a Debt Letter?

By definition, a debt letter is a business document that is used by various creditors (any person who offers or extends credit creating a debt) and debtors (an individual or an institution that owes a specific sum of money) for the purpose of collecting, verifying, settling, and disputing debts in accordance with the Fair Debt Collection Practices Act. Whenever a debt letter is used, the parties involved should be aware that they need to use a verified and secure means of communication in order to protect their interests and also to have a valid receipt for such transactions.

What Are the Parts of a Debt Letter?

Here are some of the key pieces of information that should be included whenever you start to write a debt letter; any other information will vary on the type of debt letter that is being written.

- Header – this part of the debt letter should include the sender or the debtor’s full legal name and their present mailing address.

- Body – this part of the debt letter should contain the facts regarding the debt. It should include the payment amount that is being sent along with the request. This part should also contain the account details provided by the debt collector such as a reference number.

- Closing – this ends the debt letter with the signature of the debtor.

What Are the Various Types of Debt Letters?

Here are the different types of debt letters, sorted according to their purpose:

Negative Outcomes Of Being in Debt

A little debt won’t hurt, but if it starts to accumulate, you can be stunned to learn how much in debt you really are if you frequently enter it even if in small amounts. Here are some reasons why being in debt can be a problem in your life.

How To Send a Debt Letter

When you want to collect, settle, dispute, or forgive a debt, you will need to undergo the process of sending a letter. Described here is the step by step process of sending a debt letter:

1. Describe the Parties Involved in the Deal

In this step, write who the letter is from and who it is addressed to in the upper-left corner of the letter. Also, if this is an offer, entering the effective date is useful because if it is only valid for a certain number of days, it will become useful.

2. Know and State Your Respective Rights

The Fair Debt Collection Practices Act outlines the rights of the consumer and any creditor, requiring debtors to state any specific items when administering a debt such as the amount, original creditor, and that the debtor has thirty (30) days to dispute any collection. After you have ascertained your rights, you should clearly state them in the debt letter so that all parties are aware of them.

3. Negotiate For a Valid Settlement

Unless the creditor believes the debtor is very creditworthy, most debts are discounted by up to 70% if the debtor decides to offer the creditor a lump-sum payment. Because so many debts go uncollected, it is usually difficult for any type of business or collection agency to give up on this final payment. And if the creditor believes the debtor is unconcerned about what is presented on their credit report, obtaining payment from an individual becomes even more difficult. As a result, asking for something slightly less than the original amount always results in a better response.

4. Respond or Accept the Terms

No matter what happens, responding to the letter will always prove to be the best available option. If the letter is an offer, respond with a counter-offer; if the letter is a claim, it is best practice to request validation. Furthermore, if any other contacts are listed in the letter, it is far preferable to communicate via phone or e-mail. Traditional mail (also known as “snail mail”) is usually not recommended since this method of communication takes far too long, especially since most businesses have limited support through their inbound mailing process.

FAQs

What does debt mean?

By definition, the term debt basically refers to any type of obligation or alleged obligation of a consumer to pay money arising out of a transaction in which the money, property, insurance, or services which are the subject of the transaction are primarily for personal, family, or household purposes, whether or not such obligation of the consumer has been reduced to judgement.

What is a promissory note?

A promissory note is a legal document that states the borrower’s promise to repay money owed within a certain timeframe. The borrower receives the funds after signing the note and agrees to make payments in accordance with the terms and conditions of the note. The lender will charge interest as a fee for lending the money.

What does a loan agreement mean?

A loan agreement refers to a written agreement between a lender that lends money to the borrower in exchange for repayment plus additional interest. In this agreement, the borrower will be required to pay back the loan in accordance with a payment schedule, unless a balloon payment is required. A loan agreement can be used by an individual or a business to specify terms such as an amortization table detailing interest (if any) or the monthly payment on a loan. The most appealing aspect of a loan is that it can be as detailed or as simple as you want it to be. Any loan agreement, in any case, must be signed in writing by both parties.

Getting into debt may not be a preferable option for some people. They usually just sacrifice and save up for a given number of days, weeks. or months in order to acquire the service or the item that they desire. As stated earlier, for these people, they see being in debt as a double-edged sword, with the second edge striking them much later in their lives. Care and discipline must be exercised if getting into debt is absolutely necessary, to avoid your credit score, your finances, and possibly, your life from spiraling downhill and going out of control.

With that being said, this article provides ready-made and effective samples of a debt letter for download and personal use in case you need to write and send one to an individual.