14+ Sample Debt Validation Letters

-

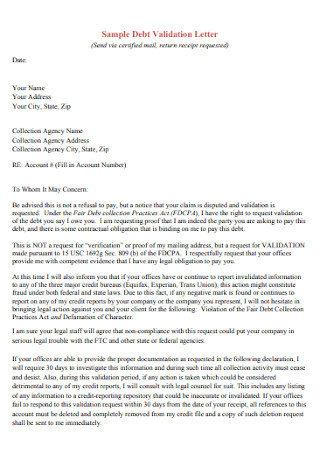

Sample Debt Validation Letter

download now -

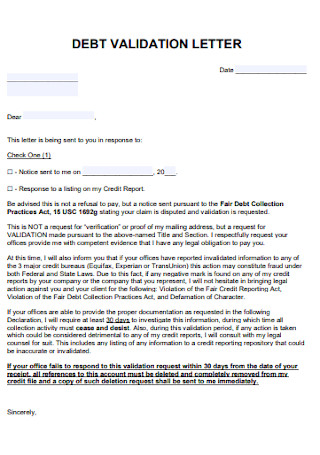

Basic Debt Validation Letter

download now -

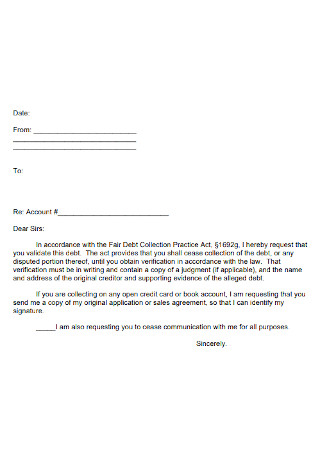

Debt Validation Collection Letter

download now -

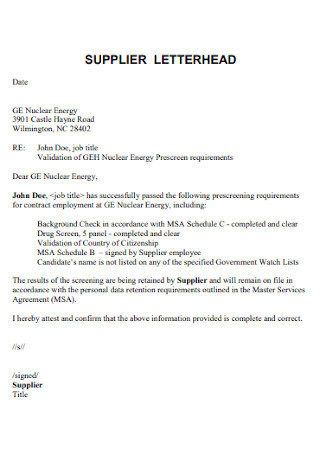

Debt Supplier Validation Letter

download now -

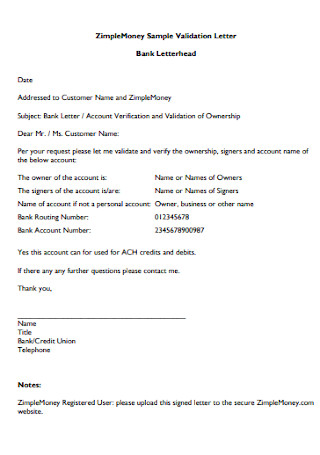

Debt Bank Validation Letter

download now -

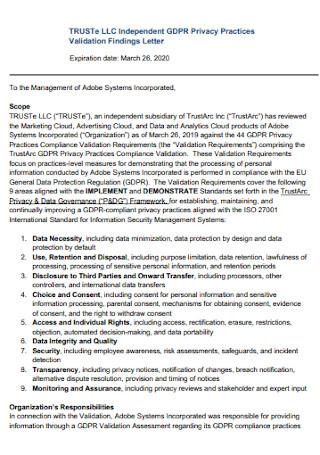

Debt Validation Finding Letter

download now -

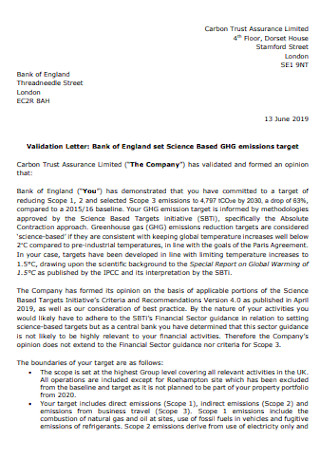

Debt Science Validation Letter

download now -

Debt Validation Follow-up Letters

download now -

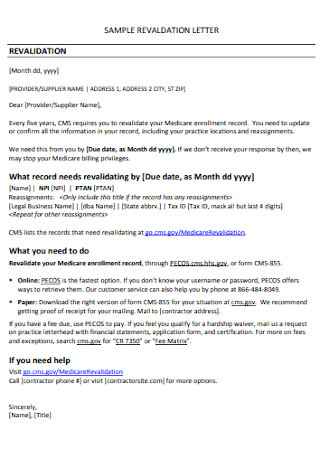

Sample Debt Revalidation Letter

download now -

Debt Business Validation Letter

download now -

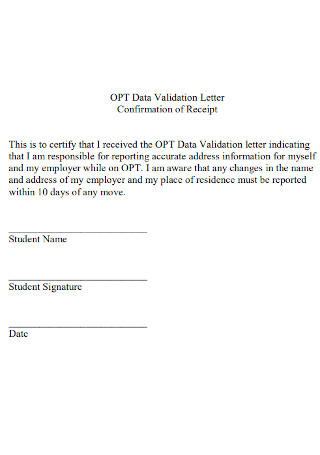

Debt Data Validation Letter

download now -

Simple Debt Validation Letter

download now -

Standard Debt Validation Letter

download now -

Debt Validation Renewal Letter

download now -

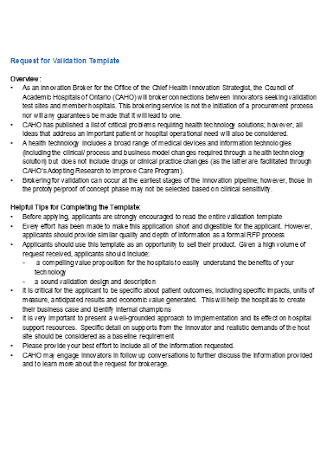

Sample Request for Validation Template

download now

FREE Debt Validation Letter s to Download

14+ Sample Debt Validation Letters

What Is a Debt Validation Letter?

Benefits of Debt Finance

Tips to Get Out of Debt Quickly

How to Stop Borrowing Money

FAQs

Do debt validation letters work?

What happens if the debt is validated?

How do you respond to debt validation?

What Is a Debt Validation Letter?

A debt collector will mail you a debt validation letter to ensure you owe them money. This letter describes the specifics of a debt, including what you owe, to whom you owe it, and when payment is due. A debt collector must send you a debt substantiation letter within five days of their initial contact. If not, you should request one. Why? Because it allows you to decide if the debt is legitimately yours and if anything suspicious is occurring behind the scenes.

Benefits of Debt Finance

Debt financing raises capital by selling debt instruments to institutional and private investors. The investors become the company’s creditors and are compensated with principal and interest payments on the borrowed amount. Debt financing is attractive because it enables a business to rapidly acquire working capital without ceding control to investors. If a company cannot raise funds by selling debt instruments, it may issue shares of its stock in a public offering or use equity financing. Here are a few benefits of debt financing:

Tips to Get Out of Debt Quickly

Creating your plan to eliminate debt is feasible. Even with low revenue, you can get out of debt quickly by making fundamental lifestyle adjustments. However, turning your financial situation around only occurs sometimes. It requires dedication, organization, and self-discipline. Fortunately, it becomes easier as you develop improved spending habits. Take back control of your existence immediately. There are numerous methods to escape debt quickly. Check out these debt repayment suggestions:

1. Stop Borrowing Money

The first and most essential measure to getting out of debt is to stop making new loans: no more credit card use, no more loans, and no more debt. The most fundamental change that must occur is a shift in one’s perspective on finances and debt. To avoid accumulating more debt, you must comprehend the cost of using credit cards and obtaining new loans. Resolve to survive on cash while implementing your changes. You’re still in the beginning phases, so you shouldn’t worry about debt consolidation or balance transfers. You should only exchange one type of debt for another once you comprehend your financial situation and have an action plan. When we counsel individuals entering a debt management program, they cut their credit cards. It is essential to begin a new phase of life without incurring additional debt.

2. Track Your Expenditures

Finding where your money is going is the next step in getting out of debt. With a complete understanding of what you pay for and how you spend, deciding where to make a budget plan can be more accessible. It’s advisable to keep track of everyday expenses budget and all your monthly expenditures for at least a month. When tracking, remember to include your debt payment commitments. Whatever approach you go with, make sure it’s one you’ll use consistently and will provide you with a complete picture of how much money you spend.

3. Set a Budget

After keeping note of your expenditures, you should create a budget. The monitoring will also reveal areas where you can reduce spending. You’ll be able to determine areas where you’re spending too much and where you can make cutbacks without sacrificing your quality of life. You may also discover places requiring modifications you wish to avoid making. Balancing livability and a strict budget is essential to get out of debt.

4. Create a Plan for Debt Repayment

After tracking your expenditures and creating a budget, it is time to implement a payoff strategy. If you need to clear debt quickly, you’ll need to know how to spend it using a system that optimizes your repayment schedule. When a debt is paid off, it is replaced with a new debt that receives all the additional funds. Repeat this process until all debts have been repaid in full. Over time, the additional funds grow while the quantity dedicated to debt repayment remains constant.

How to Stop Borrowing Money

When strapped for cash, it can be challenging to cease borrowing money. Everyone has been there. A glare at the back of the tunnel is a cover loan that will get us out of the red and bolster our stocks. Most of us live above our means, which is a primary reason for our ever-growing borrowing habit. Simply, outgoings have surpassed incomings. And it’s getting worse. Here are some stages to assist you in getting off the gerbil wheel and becoming debt-free.

1. Keep Your Spending Under Control

Be strict regarding your credit card spending. Examine your bank statements; did you need everything you purchased? Even if you are spending on luxuries such as a vacation, it may be prudent to forego this year’s vacation and clothing purchases until your spending and debts are under control. It is a sacrifice, but to be debt-free, you must reduce your expenditures somehow. Being debt-free is one of the most incredible emotions or experiences you will ever encounter. Trust me. It is well worth the cost.

2. Establish a Spending Plan

An expenditure plan is your financial strategy. A spending plan or budget worksheet is an essential element of financial security. By comparing your expenses to your income, you can live within your means and refrain from borrowing money. Using a budget spreadsheet, create a comprehensive inventory of your expenditures, debts, and revenue. But be truthful. Once you have a precise sense of how much cash you have, you can forego that new credit card. You will also be able to identify cost-cutting opportunities.

3. Work Towards a Clean Slate

Set an objective to be permanently free of debt and the temptation to borrow. How do you envision your finances a year from now? Or five years from now? If you know your desire to be debt-free, you can take measures toward achieving this objective. If you are experiencing a debt crisis, you should seek assistance.

4. Enter the Savings Mindset

What do you accomplish when you have your mind on something but lack the funds to purchase it? Place it on plastic. Why not attempt going traditional and saving instead? It will take you longer to obtain your heart’s desire, but the wait will be well worth it. Putting it on credit will only increase the price in the long run; nobody needs it that badly. Consider establishing an emergency fund if you’re borrowing money to repair a leaking roof, a malfunctioning vehicle, or any other annoyance life throws at us.

FAQs

Do debt validation letters work?

Indeed, they do. When debt collectors receive a Debt Validation Letter, they must legally confirm the debt. The most effective Debt Validation Letters include a cease clause that compels a lawsuit.

What happens if the debt is validated?

If you do not discuss the debt within 30 days of accepting a debt validation letter, the debt collection agency will presume the debt is accurate, whether or not it is. Even if the debt is legitimate, sending a letter confirming the debt may be beneficial.

How do you respond to debt validation?

A debt substantiation letter need not contain flowery language. State that you’re responding to a collection effort, you don’t recognize the debt, you’re demanding that they provide proof that you owe it, and if they can’t, you’re requesting that they cease contacting you.

The debt validation approach can be an effective weapon. But for optimal outcomes, it must be applied in the appropriate situation as outlined above. Debt collectors know that most consumers must know their legal rights regarding debt collection. You have the right to demand verification from the debt collector verifying the accuracy of their claim if you are contesting a debt’s legitimacy, in whole or in part.