Guarantee Letter Sample

-

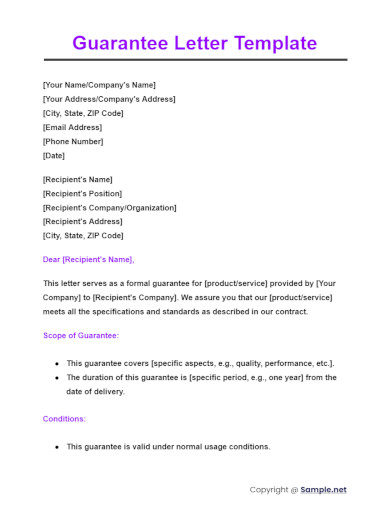

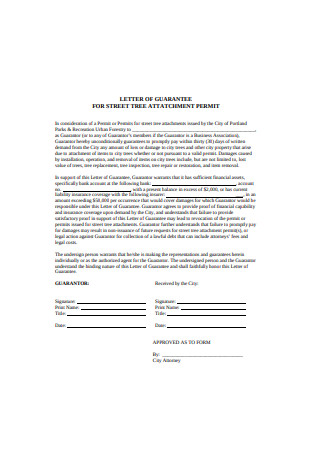

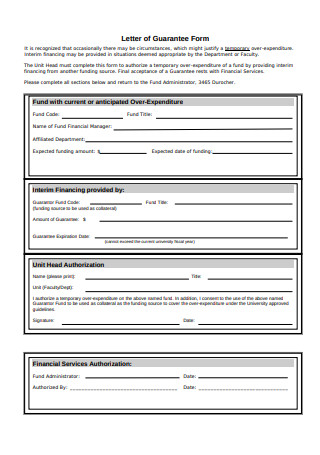

Guarantee Letter Template

download now -

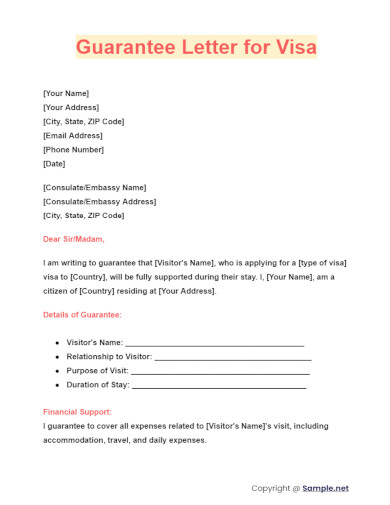

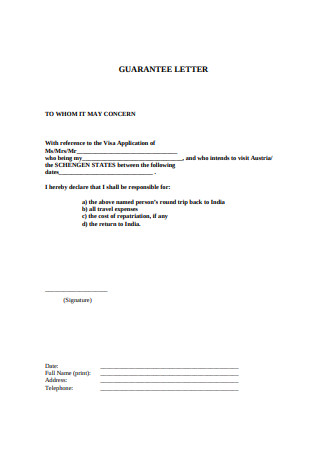

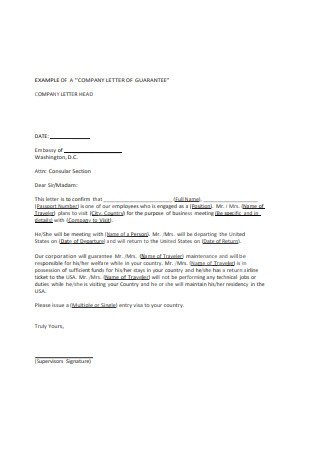

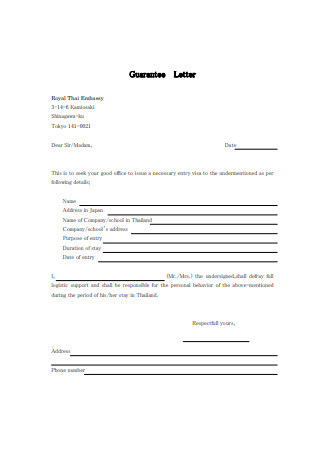

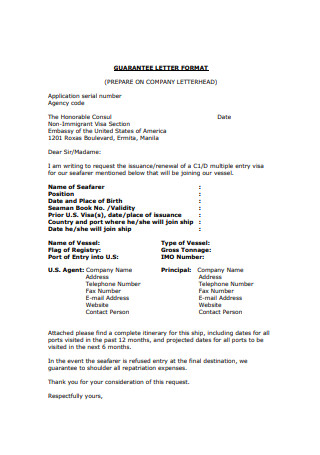

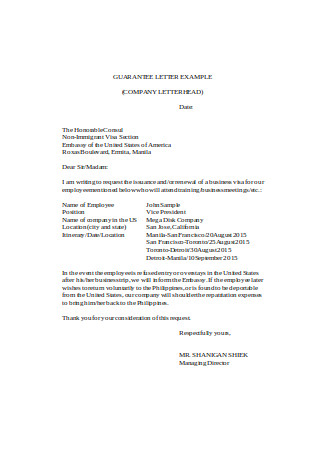

Guarantee Letter for Visa

download now -

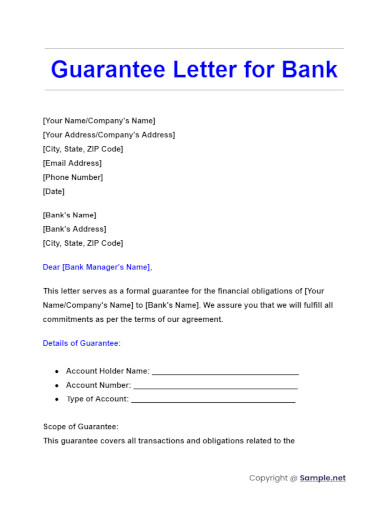

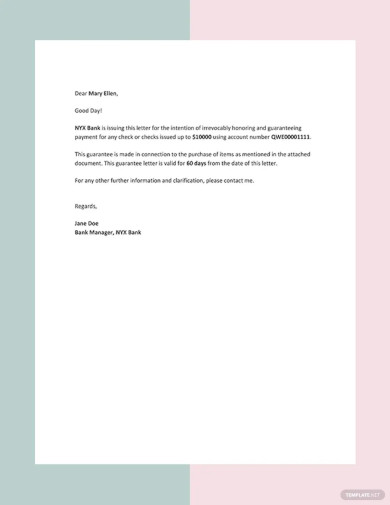

Guarantee Letter for Bank

download now -

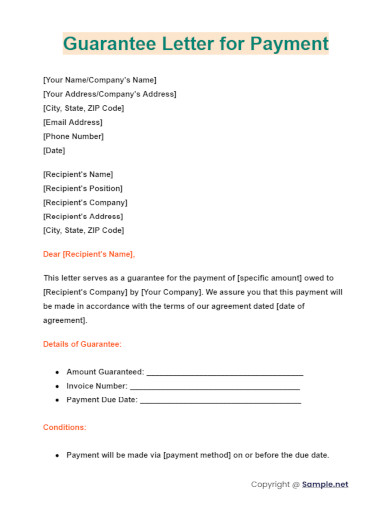

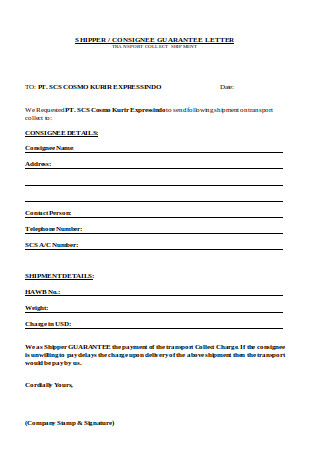

Guarantee Letter for Payment

download now -

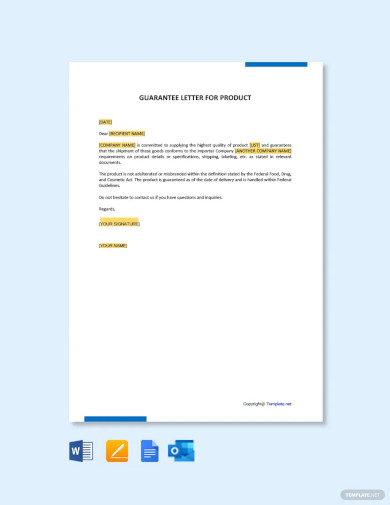

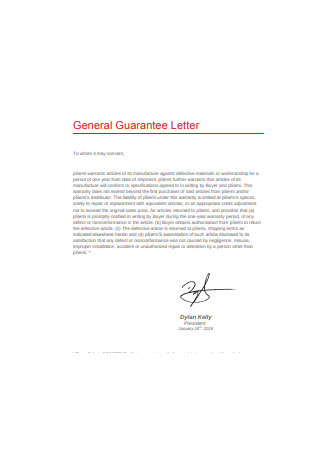

Guarantee Letter for Product Template

download now -

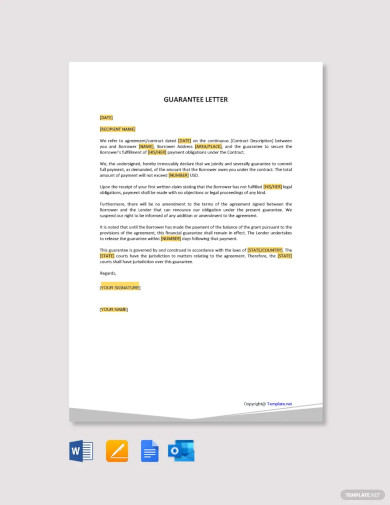

Guarantee Letter Template

download now -

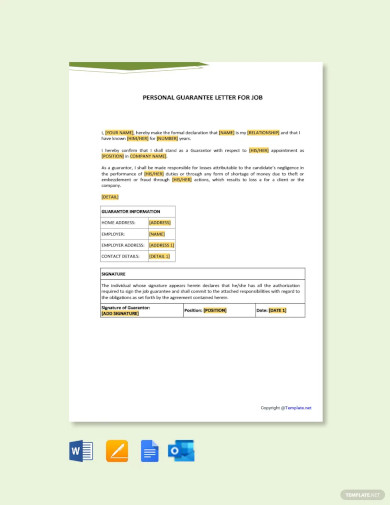

Personal Guarantee Letter for Job Template

download now -

Guarantee Letter Sample Template

download now -

Free Loan Guarantee Letter Template

download now -

Free Employment Guarantee Letter Template

download now -

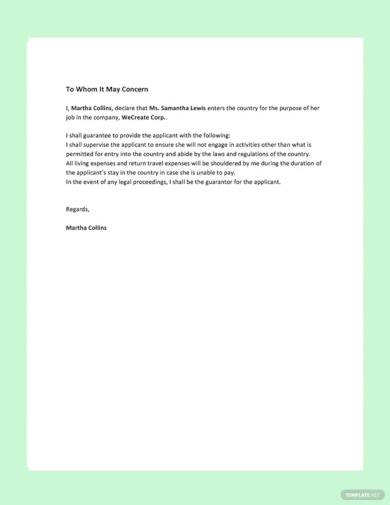

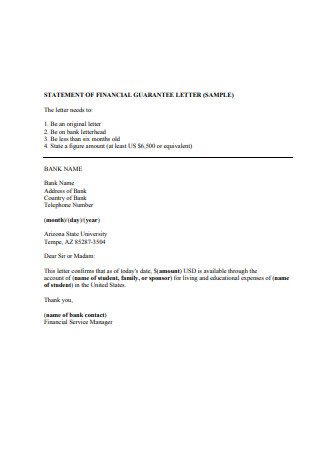

Free Financial Letter Guarantee Sample Template

download now -

Sample Guarantor Letter for Job Template

download now -

Customer Guarantee Letter

download now -

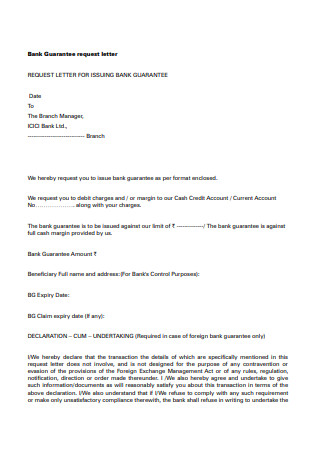

Bank Guarantee Request Letter

download now -

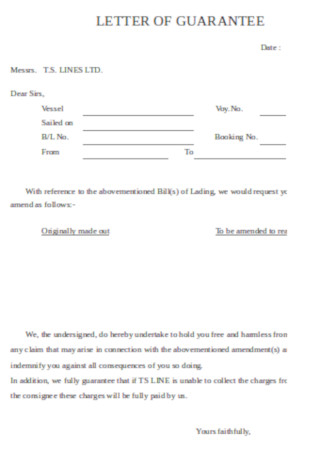

Goods Letter of Guarantee

download now -

Company Loan Letter of Guarantee

download now -

Request Letter for Guarantee Attorney

download now -

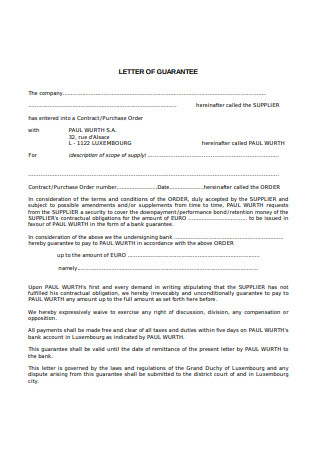

Company Contract Letter of Guarantee Sample

download now -

Guarantee Personal Letter Format

download now -

Sample Money Letter of Guarantee

download now -

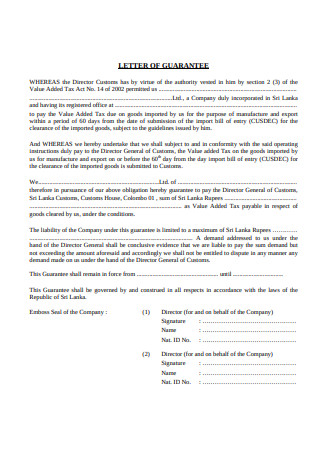

Letter of Guarantee Sample

download now -

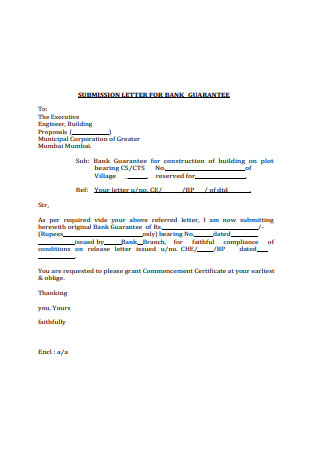

Performance Submission Letter for Guarantee

download now -

Basic Government Guarantee Letter

download now -

Equipment Letter of Guarantee Format

download now -

Certificate Guarantee Letter

download now -

Court Guarantee Letter Form

download now -

General Official Guarantee Letter

download now -

Financial Rent Guarantee Letter

download now -

Sample Signature Letter of Guarantee

download now -

Release Letter of Guarantee Example

download now -

Return Letter of Guarantee Form

download now -

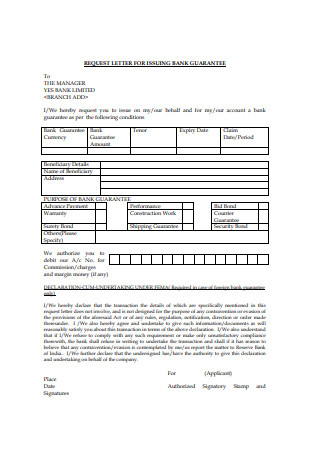

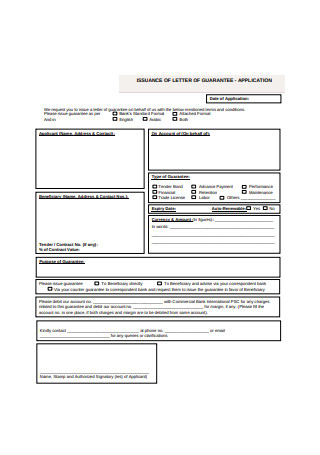

Request Letter for Issuance of Guarantee

download now -

Letter of Guarantee Title

download now -

Sample Guarantor Letter of Guarantee

download now -

Continuing Guarantee Letter

download now -

Supplier Financial Guarantee Letter

download now -

Food Guarantee Letter Sample

download now -

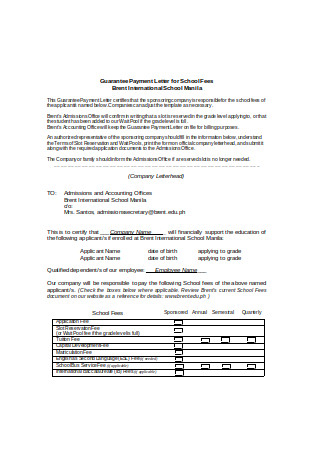

Guarantee Payment Letter

download now -

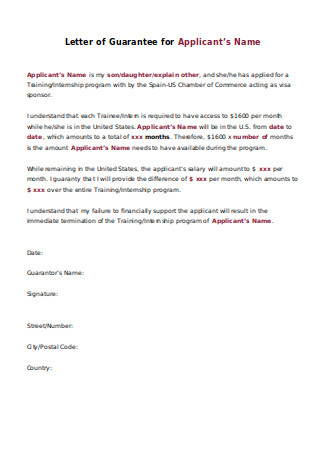

Letter of Guarantee for Applicant

download now -

Sample Guarantee Letter Example

download now

FREE Guarantee Letter s to Download

Guarantee Letter Format

Guarantee Letter Sample

What Is a Guarantee Letter?

Where Do You Use a Guarantee Letter?

How to Write a Guarantee Letter

Is a guarantee letter the same as a letter of credit?

How do I obtain a guarantee letter from my bank?

Can a bank guarantee be canceled?

Can I get out of a personal guaranty?

How to write a guarantor letter for visa application?

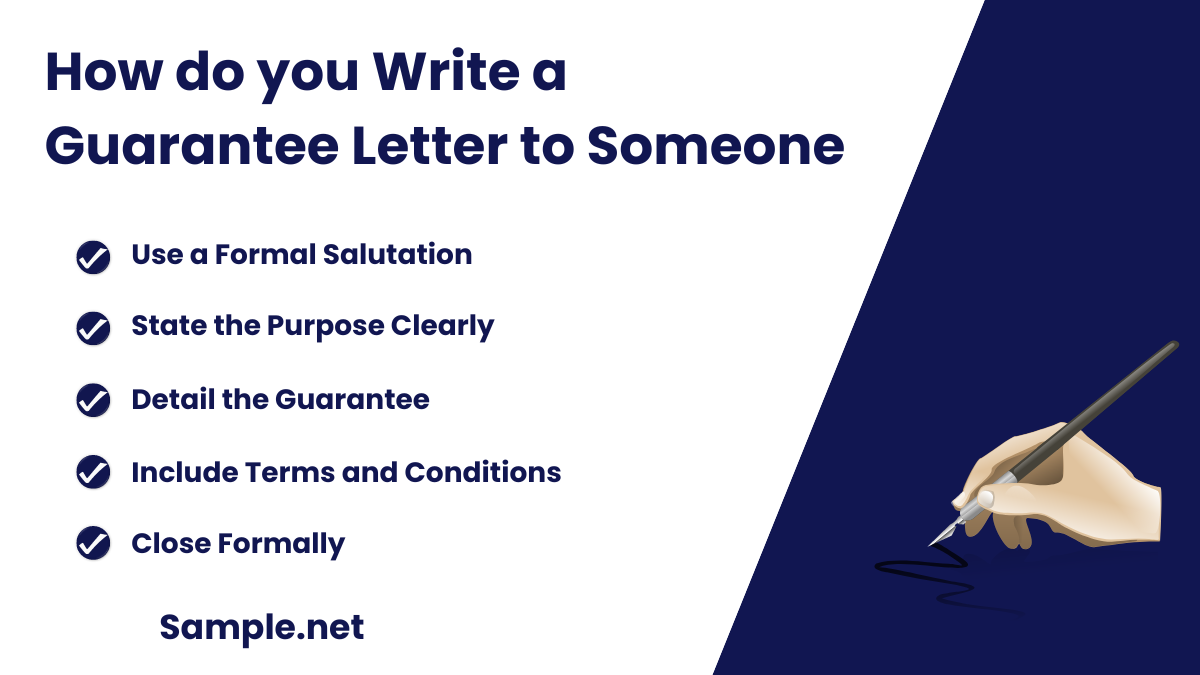

How do you write a guarantee letter to someone?

What is the purpose of a guarantee?

What are the three types of guarantees?

What are the requirements for a guarantee?

What is the purpose of the insurance guarantee?

What is a letter of guarantee for a carrier?

What is a letter of guarantee to make payment?

What is another name for letter of guarantee?

What is a letter of personal guarantee?

Who sends a letter of guarantee?

What are the advantages of letter of guarantee?

How do you personally guarantee a loan?

Who can issue a guarantee?

What is the letter of guarantee system?

Download Guarantee Letter Bundle

Guarantee Letter Format

[Your Name/Company’s Name]

[Your Address/Company’s Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient’s Name]

[Recipient’s Position]

[Recipient’s Company]

[Recipient’s Address]

[City, State, ZIP Code]

Dear [Recipient’s Name],

1. Introduction

This letter serves as a guarantee for [product/service] provided by [Your Company] to [Recipient’s Company].

2. Details of Guarantee

- Scope of Guarantee: Describe what is covered by the guarantee.

- Duration: Specify the period during which the guarantee is valid.

- Conditions: Outline any conditions or limitations of the guarantee.

3. Claim Process

Explain the process for making a claim under the guarantee, including contact details and required documentation.

4. Closing Paragraph

We stand behind our [product/service] and are committed to ensuring your satisfaction.

Sincerely,

[Your Name/Position]

[Company’s Name]

What Is a Guarantee Letter?

A guarantee letter is a formal document where one party assures another of fulfilling a commitment, such as paying a debt or performing a service. This letter legally binds the guarantor to uphold the specified terms. It is often used in business and financial contexts to provide security and build trust between parties. The guarantee letter typically includes details about the obligation, the parties involved, and the terms of the guarantee. It is similar to a contract but specifically focuses on guaranteeing the fulfillment of certain conditions or actions.

Where Do You Use a Guarantee Letter?

When we make life decisions, big or small, we’d want to ensure our safety. That’s why we purchase insurance to have protection in case something unexpected occurs. Having that sense of security will ease us to venture into transactions. That’s what guarantee letters are used for: to serve as security. A guarantee letter is commonly used to secure the following:

How to Write a Guarantee Letter

Writing a guarantee letter is the same as making a promise. Promises carry with it a great responsibility. When you make a promise to someone, you need to be sure that you can follow through or else you’ll lose your credibility. That’s why we should only commit ourselves to things or persons we are confident in; just like being in a relationship. We need to be positive that we can take on the responsibilities attached to it before entering into one. To help you be sure that you’re serious enough to furnish a letter of guarantee for someone, here’s something that can help you:

Step 1: Know what you’re getting into

When you fall in love with someone, you don’t fall in love instantaneously. You need to go through the process of getting to know each other. Just like agreeing to be a guarantor. You need to read the entirety of the guarantee arrangement. Get to know the principal agreement. Is it for a loan? If so, what kind of loan? How much is the guarantee covering? If you feel like the terms are agreeable, and you have the means to cover the amount, then go for it. You should also take a look at our Referral Letter

Step 2: Meet with the person you’re guaranteeing

Have you ever heard of the expression “if it looks good paper, it might be too good to be true?” Solely reading a piece of paper containing a proposal should not be enough to convince you to sign a guarantee letter. By agreeing to meet in person, you can see the sincerity in a person through his facial expressions and tone. You’ll be able to tell if he’s serious about entering into the business transaction and how it will mean to him if you’ll be his guarantor. You should also take a look at our Donation Letter

Step 3: Negotiate on the terms

When enough is enough. You need to set your limits on how much guarantee coverage you’ll agree to and for how long it’s valid. You might care for the person too much, and your emotions will cloud your judgment; which will lead to you agreeing to cover more than you’re capable of. You should take caution and set up preventive measures from giving too much. That’s why you need to set a definitive figure. Only agree to a reasonable amount of guarantee coverage. Guaranteeing is a financial risk, and you would want to minimize that risk. You should also take a look at our Termination Letter

Step 4: Write your letter

You’ve finally decided to take that risk. First, you should cover the basics. What are the essentials that go into a guarantee letter? Who is it addressed to, how much is the guarantee covering, and how long will the guarantee last for?—Address your guarantee letter to the creditor of the person you’re guaranteeing. The amount and duration will depend on your financial capacity and what you’ve agreed on during the negotiation phase. Lastly, a guarantee letter is a formal document, so be sure to write it with a firm and convincing tone. You should also take a look at our Letter of Interest

Step 5: Have it checked by professionals

When you write and sign a guarantee letter, it’s the same as entering in a valid and binding contract. You’re making a legal promise. Breaking that promise would have legal repercussions. Have professionals with an elaborate understanding of the law review your document. You can hire the services of a lawyer for guarantees that cover a considerable amount of money or your local accountant or bank. This way, you will be able to know the extent of the severity of the contract you’ll be agreeing to. You should also take a look at our Personal Reference Letter

Is a guarantee letter the same as a letter of credit?

Let’s say you want to purchase high-end computer parts from Japan in bulk for your computer shop here in the US. You negotiate with the seller and agree that you will only pay a portion of the purchase price as down payment and pay the balance once the parts are delivered. The seller agrees, provided you furnish him with a guarantee letter or letter of credit from a trusted bank. Both options are beneficial to him; however, as a buyer, you should choose a letter of credit. In a letter of credit, payment of the balance is paid by the bank once items are delivered. On the other hand, for guarantee letters, there is a guarantee that the seller will receive full payment from the bank despite non-delivery or non-payment of the buyer. You should also take a look at our Warning Letter

How do I obtain a guarantee letter from my bank?

First, you need to assess whether you have a good relationship with your bank. Ask yourself if you have a good credit history. If you do, then you’re great. You can call your bank and set an appointment. Most banks will require you to fill out a guarantee application form where you need to provide the reason, the amount, and duration of the guarantee. Once you’ve filled out the form, you will be interviewed by a bank personnel to further elaborate on the guarantee request. In the interview process, the bank personnel usually asks if you have assets such as money in another bank, shares of stock, and a property budget. Some banks may require your assets as a pledge in turn for the guarantee. If everything goes smoothly, they’ll furnish your guarantee letter.

Can a bank guarantee be canceled?

Yes. All you have to do is simply return the guarantee letter to the person or banking institution issuing it. However, some banks might require you to furnish a discharge letter from the beneficiary before it can cancel a bank guarantee. A bank may also cancel it’s guarantee automatically in the case of its non-use. In this instance, the banks will ask your beneficiary to return the original guarantee letter. After the lapse of a reasonable time from receipt, the bank will automatically cancel the guarantee. You should also take a look at our Landlord Reference Letter

Can I get out of a personal guaranty?

Legally, you cannot. However, there are options to protect yourself and your business. You can try to renegotiate the terms. For example, negotiate a shorter period for the personal guarantee or provide an alternative paying scheme. If you cannot reach an agreement with your creditor, you may want to opt for bankruptcy. It’s not preferred, but companies declare bankruptcy as one way to discharge its owners from a personal guarantee. You should also take a look at our Parent Permission Letter

How to write a guarantor letter for visa application?

First, begin by indicating the name of your addressee, which is the name of the embassy, you’ll be applying for a visa. Write the date. Start the letter with a formal greeting. Introduce yourself—provide personal information like your full name and passport number. State the name of the person whom the guarantee letter is made for and provide his personal information. Signify your intention to guarantee the travel and living expenses of the person applying for the visa in case he is unable to pay himself. And lastly, sign the letter with your full name and signature. Concerning formatting, some countries might require a specific format. You should check on the country’s embassy website or call their office to ask for the specifics. You should also take a look at our Contract Letter

How do you write a guarantee letter to someone?

Writing a guarantee letter involves providing a clear and legally binding commitment. Here are the steps:

1. Use a Formal Salutation

Start with a respectful greeting, such as “Dear [Recipient’s Name],”

2. State the Purpose Clearly

Clearly state that you are providing a guarantee for a specific obligation or performance.

3. Detail the Guarantee

Include specific details about what is being guaranteed, such as the nature of the service or payment.

4. Include Terms and Conditions

Outline the terms and conditions of the guarantee, similar to an Apology Letter where clarity is key.

5. Close Formally

End with a formal closing statement and your signature.

What is the purpose of a guarantee?

The purpose of a guarantee is to provide assurance that an obligation will be fulfilled. Here’s how it works:

1. Builds Trust

Guarantees help build trust between parties by ensuring commitments are met.

2. Provides Security

They offer security for the party receiving the guarantee, much like an Confirmation Letter provides clarity.

3. Reduces Risk

Guarantees reduce the risk of non-performance or non-payment.

4. Legal Binding

They create a legally binding commitment, ensuring accountability.

5. Facilitates Agreements

Guarantees facilitate smoother agreements and transactions by offering clear assurances.

What are the three types of guarantees?

There are three main types of guarantees, each serving a different purpose. Here they are:

1. Financial Guarantees

Ensure that financial obligations, such as loans, will be paid.

2. Performance Guarantees

Assure that services or projects will be completed as agreed.

3. Bid Guarantees

Ensure that a bidder will undertake a project if selected, similar to a Character Reference Letter which formalizes decisions.

What are the requirements for a guarantee?

To create a valid guarantee, several requirements must be met. Here they are:

1. Clear Terms

The terms of the guarantee must be clear and unambiguous.

2. Written Agreement

The guarantee must be documented in writing, like a Relieving Letter.

3. Legal Capacity

Both parties must have the legal capacity to enter into the guarantee.

4. Specific Obligations

The specific obligations being guaranteed must be detailed.

5. Signatures

The guarantee must be signed by both parties to be legally binding.

What is the purpose of the insurance guarantee?

An insurance guarantee provides financial assurance for the performance of a contract or agreement. Here’s its purpose:

1. Risk Mitigation

Reduces the financial risk for the parties involved.

2. Ensures Performance

Guarantees that the terms of the contract will be fulfilled.

3. Financial Security

Provides financial security in case of non-performance or default.

4. Trust Building

Helps build trust between parties, like a Acceptance Letter adds clarity to a situation.

5. Legal Compliance

Ensures compliance with legal and contractual obligations.

What is a letter of guarantee for a carrier?

A letter of guarantee for a carrier assures that the carrier’s responsibilities will be met. Here’s how to create one:

1. Formal Introduction

Start with a formal salutation and introduce the purpose of the letter.

2. Detail the Guarantee

Specify the obligations being guaranteed, such as safe delivery of goods.

3. Terms and Conditions

Outline the terms and conditions, ensuring they are clear and comprehensive.

4. Legal Framework

Mention the legal framework governing the guarantee, similar to a Letter of Appreciation.

5. Signature

End with a formal closing and include signatures from authorized parties.

What is a letter of guarantee to make payment?

A letter of guarantee to make payment assures that a payment will be made as promised. Follow these steps:

1. Begin Formally

Start with a respectful greeting, such as “Dear [Recipient’s Name],”

2. State the Guarantee

Clearly state that you are guaranteeing a specific payment.

3. Provide Details

Include details about the amount, due date, and conditions of the payment.

4. Outline Obligations

Detail the obligations of both parties, like an Explanation Letter clarifies responsibilities.

5. Close and Sign

End with a formal closing and signatures from both parties.

What is another name for letter of guarantee?

Another name for a letter of guarantee is a Petition Letter of assurance, often used in business and financial contexts to provide security.

What is a letter of personal guarantee?

A letter of personal guarantee is a commitment by an individual to cover a debt or obligation, similar to an Appeal Letter.

Who sends a letter of guarantee?

A letter of guarantee is typically sent by a guarantor, such as a bank or financial institution, akin to a Sponsorship Letter from a sponsor.

What are the advantages of letter of guarantee?

A letter of guarantee provides security, builds trust, reduces risk, ensures performance, and facilitates agreements, similar to the benefits of a Job Reference Letter.

How do you personally guarantee a loan?

To personally guarantee a loan, sign a legal document committing to repay the loan if the borrower defaults, akin to signing an Authority Letter.

Who can issue a guarantee?

A guarantee can be issued by banks, financial institutions, or individuals with sufficient credibility and authority, similar to issuing a Vacation Request Letter.

What is the letter of guarantee system?

The letter of guarantee system ensures obligations are met, providing security and trust in transactions, much like the Nomination Letter process ensures fairness and recognition.

In conclusion, a well-crafted guarantee letter is essential for ensuring that commitments are clearly defined and legally binding. This article provided a comprehensive overview of various Proxy Letter formats, including sample letters, forms, and practical tips for writing effective guarantee letters. By following the guidelines and examples provided, you can create guarantee letters that protect your interests and build trust with your partners. Whether for business agreements or personal commitments, a detailed and clear guarantee letter is crucial for successful and secure transactions. Use this guide to ensure your guarantee letters are professional and reliable.