Letter Of Explanation Samples

-

Letter Of Explanation Template

download now -

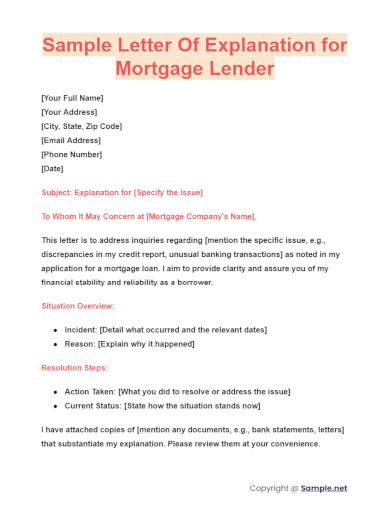

Sample Letter Of Explanation for Mortgage Lender

download now -

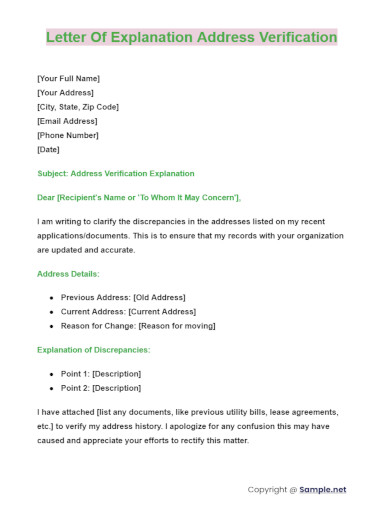

Letter Of Explanation Address Verification

download now -

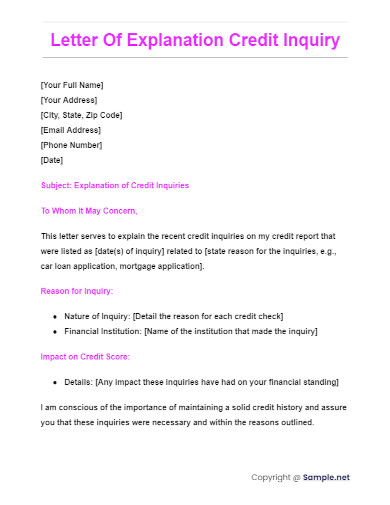

Letter Of Explanation Credit Inquiry

download now -

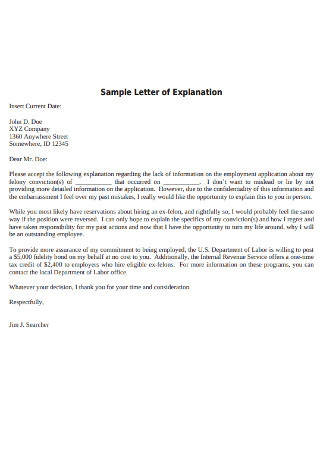

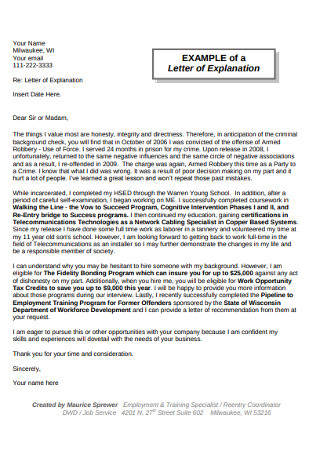

Sample Letter of Explanation

download now -

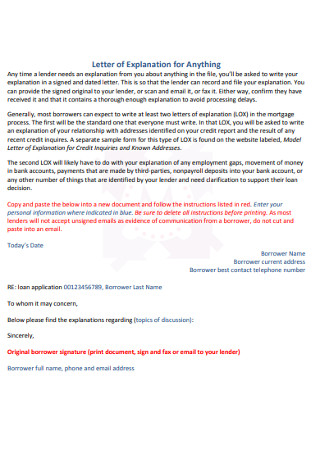

Letter of Explanation for Anything

download now -

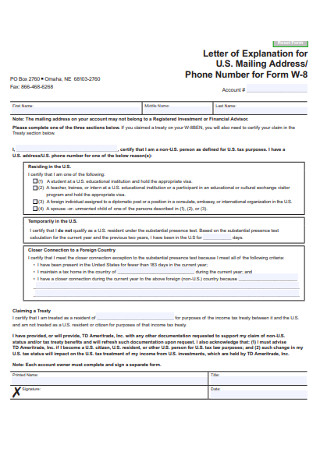

Letter of Explanation mailing Adress

download now -

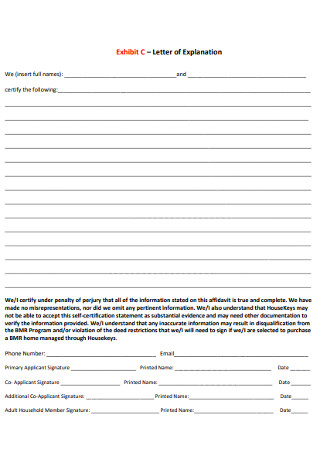

Department of Housing Letter of Explanation

download now -

Simple Letter of Explanation Example

download now -

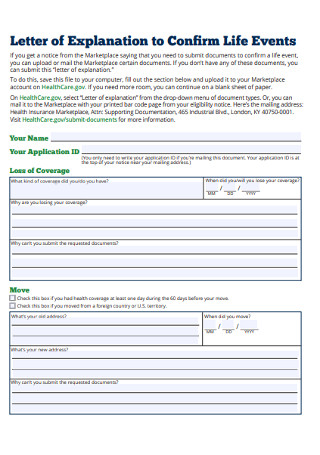

Letter of Explanation to Confirm Life Events

download now -

Community Letter of Explanation

download now -

Derogatory Credit Explanation Letter

download now -

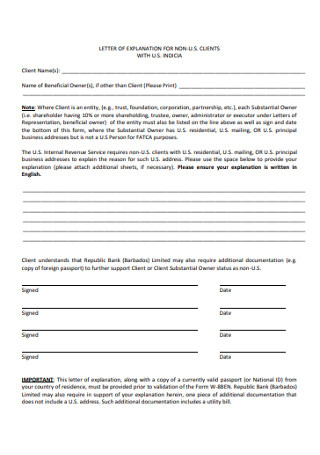

Letter of Explanation for Non Clients

download now -

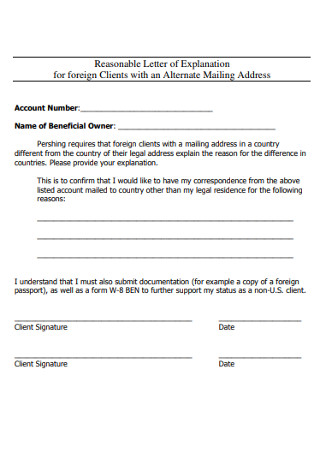

Reasonable Letter of Explanation

download now -

Suggested Letter of Explanation

download now -

Academic Regulation Letter of Explanation

download now -

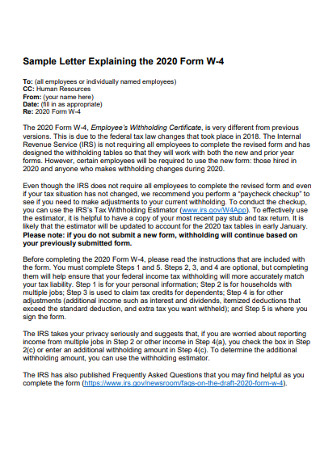

Sample Letter Explaining Template

download now -

Basic Letter of Explanation Template

download now -

Loan Estimate letter of Estimation

download now -

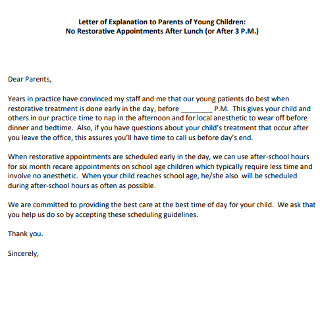

Letter of Explanation to Parents of Young Children

download now -

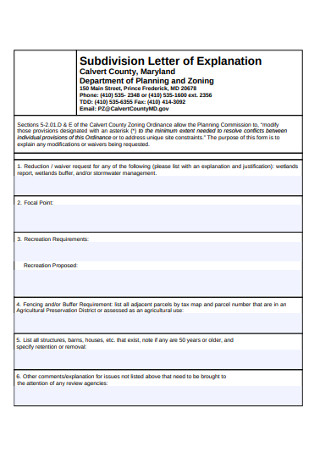

Subdivision Letter of Explanation

download now -

Simple Letter of Explanation Template

download now -

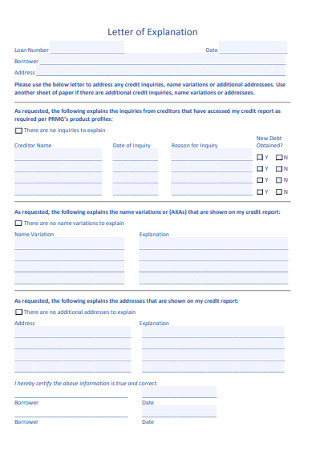

Letter of Explanation for Credit Inquiries

download now -

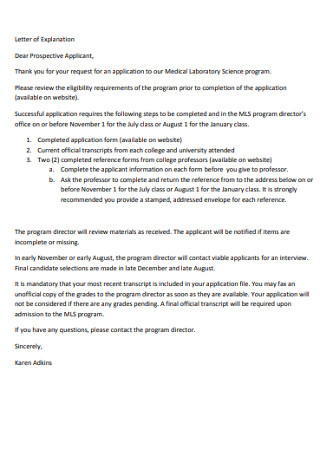

Science Program Letter of Explanation

download now -

Standard Letter of Explanation

download now -

College Letter of Explanation

download now -

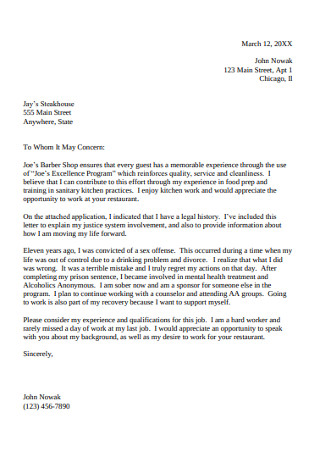

Formal Letter of Explanation

download now -

Fire Safety Letter of Explanation

download now -

Information on Submission of a Letter of Explanation

download now -

Printable Letter of Explanation

download now -

Landlord Letter of Explanation

download now -

Move Update Letter of Explanation

download now -

Professional Letter of Explanation

download now -

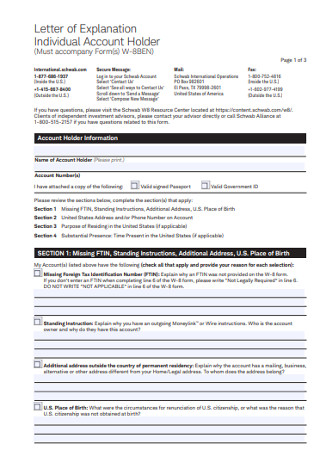

Letter of Explanation Individual Account Holder

download now -

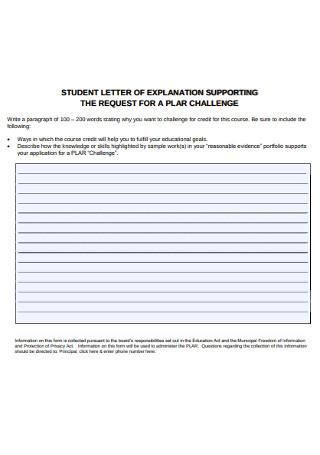

Student Letter of Explanation

download now -

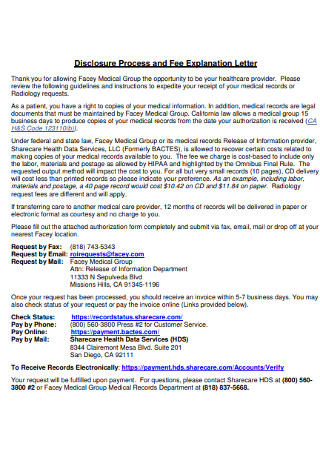

Process and Fee Explanation Letter

download now -

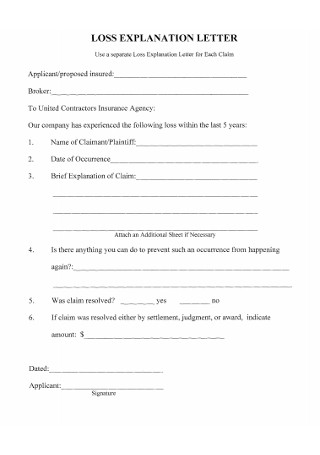

Loss Explanation Letter Template

download now -

Sample Fee Explanation Letter

download now -

Explanations of the Tax Exemption Letter

download now -

Explanation Policy Letter

download now -

Direct Tax Letter Of Explanation

download now

FREE Letter of Explanation s to Download

Letter Of Explanation Format

Letter Of Explanation Samples

What is a Letter of Explanation?

Reasons Why You Need to Create a Letter of Explanation

How to Write a Convincing Letter of Explanation for a Mortgage

What are the main things that a lender looks for before approving a loan?

Will I get my deposit back after my request is rejected?

How much mortgage loan can I be entitled to?

Will a fixed mortgage change throughout the loan process?

What is an escrow account?

Why Letter Of Explanation is Important And How To Write One With Your Mortgage Application

How To Write an Explanation Letter With Templates?

What is an Explanation Letter at Work?

Why do Underwriters Ask for Letters of Explanation?

How Do You Write a Letter of Explanation After Refusal?

How Do I Write a Letter of Explanation for a Mistake?

What is Personal Letter Explanation?

Why Would a Mortgage Lender Ask for a Letter of Explanation?

How Long Should a Letter of Explanation Be?

What is a Letter of Explanation for a Loan?

What is Letter of Explanation Documents?

Is Letter of Explanation Necessary?

How Do You Start a Letter of Explanation?

How Do You Write a Strong Letter of Explanation?

Download Letter Of Explanation Bundles

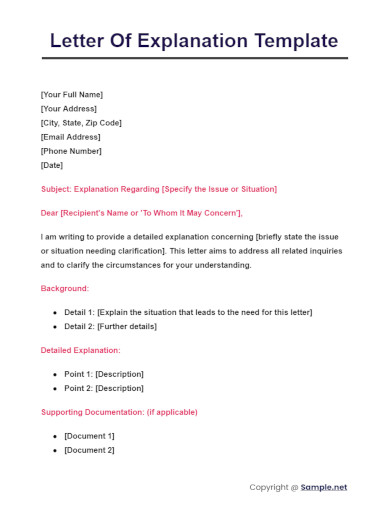

Letter Of Explanation Format

[Your Full Name]

[Your Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

[Date]

To Whom It May Concern,

I am writing this letter to explain [Mention the Situation or Decision you are explaining]. The purpose of this explanation is to provide insight and context to [Explain the circumstances].

Details of the Situation:

- Key Fact 1: [Detail]

- Key Fact 2: [Detail]

- Key Fact 3: [Detail]

Conclusion:

I hope this letter serves to clarify any questions or concerns regarding [Mention the topic or issue]. I am willing to provide further information if required.

Sincerely,

[Your Signature (if sending via mail)]

[Your Printed Name]

What is a Letter of Explanation?

When you are having trouble applying for a loan, a letter of explanation might help you, especially during the process of underwriting. Underwriting involves evaluating the risks a lender has to take for every loan applicant. Usually, mortgage companies let professional underwriters do the job for them. If an underwriter is not satisfied with the information a borrower provides, he may ask for a letter of explanation. A letter of explanation, from the word “explanation” itself, is a document that answers and explains the questions that are in the mind of an underwriter concerning your finances. Letters of explanation are a lender’s way of saying that they are willing to let you borrow money. According to Statista, the total mortgage debt of Americans from 1950 to 2019 increased from $0.05 trillion to $10.61 trillion. That is one of the reasons why lenders must first assess the risk before placing their money on the line.

Reasons Why You Need to Create a Letter of Explanation

The following are reasons why a borrower must provide an explanation letter to his lender:

How to Write a Convincing Letter of Explanation for a Mortgage

A letter of explanation depends on what reason you are writing it for. When you’re drafting your letter, keep it connected with your present situation. The following are steps in writing a persuasive letter of explanation.

Step 1: Know the Content of Your Letter

An explanation letter is just a short letter that comprises of the following information: (1) the date you write the letter, (2) the lender’s name, address, and contact information, (3) your name and loan number, (4) a paragraph explaining your current situation, (5) a conclusion that indicates you’re open to answer any additional questions, (6) your legal name and signature, (7) your co-borrowers’ legal names if there are any, and (8) your contact information and mailing address.

Step 2: Keep Your Letter Short and Straight to the Point

The purpose of making a letter of explanation is to let an underwriter understand your circumstance. So, be straightforward with your answers. Don’t open up an issue that is not related to the main issue unless it’s necessary. Remember that the goal is to persuade the underwriter of your capability to take responsibility for a loan agreement regardless of your mistakes in the past. Don’t add up to his hesitations.

Step 3: Explain the Reason for Your Past Failures

This is the most crucial part of your letter. Be careful not add up doubts in the mind of an underwriter, especially when he has seen a pattern of non-payment in the past. Explain your reasons clearly and convincingly that those past failures happened because of an unexpected event resulting in your financial hardship. Also, try to make it up by saying that you are more stable now and are more confident to pay for a mortgage. You may also see Job Letter of Recommendation

Step 4: Be Professional and Polite in Your Approach

Even if the thought of writing an LOE bothers you, you must keep your tone formal and polite at the same time. Don’t get too irritated because the underwriter is just doing his job. An approach that is polite shows that you have respect for both the lender and the underwriter. Who knows that this might be a reason for them to approve the sample agreement.

Step 5: Review Your Letter

A letter that has many spelling and grammatical errors will give a bad impression. Also, you must ensure that all the information you’ve written is correct. Moreover, an incorrect name and loan number may delay your application. Therefore, proofreading your letter is essential.

What are the main things that a lender looks for before approving a loan?

There are four main things that a lender looks for before approving a loan: (1) Capability. Are you capable of paying your loan? The lender will ask for your employment history and will also assess your current employment status as well as your income. (2) Credit history. Are you really willing to pay your debt? The lender will keep an eye on your credit history and see whether you have remaining debts, or how frequently you borrow, or whether you delay paying your bills. (3) Capital. Is your money enough to afford the down payment and all other mortgage expenses? Do you need help from a relative? Will you still have money after paying the initial costs for mortgage? (4) Collateral. Do you have an asset that is equal to the value of your loan in case you default? The lenders must make sure that the house you are purchasing is enough to back that up. You may also see Apology Letter

Will I get my deposit back after my request is rejected?

The purpose of the deposit when applying for a loan is to assess your property or credit-worthiness before a lender decides to approve your application. Therefore, you will not get a refund once the process has begun. You can only get a refund before any procedure begins. You may also see

How much mortgage loan can I be entitled to?

Before purchasing a property, you must first determine your budget. There is a standard rule that says a home you can possibly afford is equal to two and a half times your yearly gross income. The maximum loan you can apply for depends on your income, remaining debts, the price of the home, the down payment amount, the loan interest, and the cost of insurance and taxes. You may also see Board Resolution Letter

Will a fixed mortgage change throughout the loan process?

Your monthly payment may change or fluctuate during the loan process. However, a fixed loan rate doesn’t change throughout the loan process. Only your insurance fees or taxes may fluctuate over time. The principal amount and the interest rate will not change throughout the mortgage term. You may also see Letter of Employment

What is an escrow account?

Escrow is a term used to describe a process where an asset or money is kept safe by another party on behalf of a lender and a borrower. An escrow account is under the control of an escrow agent who keeps the assets or funds until there are further instructions given or until the contract has been fulfilled. You may also see Parent Permission Letter

Why Letter Of Explanation is Important And How To Write One With Your Mortgage Application

A well-crafted Letter of Explanation can clarify any uncertainties in your mortgage application, enhancing your approval chances.

- Identify the Issue: Start by clearly identifying what you need to explain (e.g., gaps in employment, credit inquiries).

- Be Concise: Keep the explanation concise and to the point.

- Provide Documentation: Attach any relevant documentation that supports your explanation, such as bank statements or pay stubs.

- Use a Formal Format: Structure your letter as a formal letter, using a professional tone and format.

- Proofread: Ensure accuracy with no grammatical errors to maintain credibility. You may also see Contract Letter

How To Write an Explanation Letter With Templates?

Crafting an explanation letter can be streamlined using templates to ensure all necessary information is communicated effectively.

- Choose the Right Template: Select a template that best matches the context of your explanation.

- Customize Your Information: Fill in your specific details, making sure to tailor the content to address the particular issue.

- Include Essential Details: Clearly state your name, the date, and the purpose of your letter.

- Attach Supporting Evidence: Include or reference any consent letter or documents that support your explanation.

- Conclude Appropriately: End with a polite conclusion and your contact information for any follow-up. You may also see Condolence & Sympathy Letter

What is an Explanation Letter at Work?

An explanation letter at work is used to address and clarify any misunderstandings or issues regarding workplace situations.

- State the Purpose: Begin with a clear statement of why you are writing the letter.

- Describe the Situation: Provide a factual description of what occurred. You may also see Misconduct Warning Letter

- Take Responsibility: If applicable, acknowledge any mistakes or misunderstandings on your part.

- Explain the Resolution: Discuss what steps you have taken or will take to resolve the issue.

- Close Formally: Use a To Whom It May Concern letter & email closing to maintain professionalism.

Why do Underwriters Ask for Letters of Explanation?

Underwriters request letters of explanation to understand complex or unusual items in your financial history more clearly.

- Clarify Financial Issues: They help clarify any discrepancies or unusual activities in your financial records.

- Assess Risk: By understanding the context, underwriters can better assess the risk associated with lending.

- Verify Information: These letters also serve to verify the information provided in your application. You may also see Confirmation Letter

- Support Application Decisions: Provide essential insights that support the decision-making process.

- Document Compliance: Serve as an authorization letter for proceeding with financial agreements.

How Do You Write a Letter of Explanation After Refusal?

Writing a letter after a refusal involves addressing the reasons for refusal and providing additional information or corrections.

- Acknowledge the Refusal: Start by acknowledging the initial refusal and express your intent to clarify.

- Address Each Point of Concern: Specifically address each issue that was raised in the refusal.

- Provide Additional Information: Include new or corrected information to support your case.

- Request Reconsideration: Politely request reconsideration of your application or decision.

- Attach Documentation: Include any relevant permission request letter or documents that support your new submission. You may also see Referral Letter

How Do I Write a Letter of Explanation for a Mistake?

Addressing a mistake through an explanation letter requires honesty and a commitment to resolving the issue.

- Admit the Mistake: Clearly state the mistake and take full responsibility.

- Explain How It Happened: Briefly describe the circumstances that led to the mistake.

- Detail the Remedial Steps: Explain how you have corrected or plan to correct the mistake.

- Assure Future Compliance: Reassure the recipient that such mistakes will not happen in the future.

- Sign Off Respectfully: End with a respectful closing and your signature, using an excuse letter tone if appropriate. You may also see Donation Letter

What is Personal Letter Explanation?

A personal letter of explanation addresses personal issues or situations that may impact professional or legal standings.

- Personal Context: Provide a background of the personal circumstances or issues. You may also see Personal Reference Letter

- Link to Professional Impact: Explain how these personal details may affect your professional life or obligations.

- Supporting Personal Documentation: Attach any relevant personal documents that can help clarify your situation.

- Express Willingness to Discuss Further: Offer to discuss the matter in more detail if necessary.

- Maintain Privacy: Keep the tone respectful and ensure privacy is maintained, similar to an event invitation letter.

Why Would a Mortgage Lender Ask for a Letter of Explanation?

Mortgage lenders request a Letter of Explanation to clarify discrepancies in your application, ensuring financial stability and reducing risk. You may also see Landlord Reference Letter

How Long Should a Letter of Explanation Be?

A Letter of Explanation should be concise, ideally one page on company letterhead, clearly addressing the issue without unnecessary detail.

What is a Letter of Explanation for a Loan?

This is a document that clarifies or provides more information about specific aspects of your loan application, like sudden income changes or guarantee letter discrepancies.

What is Letter of Explanation Documents?

Letter of Explanation documents are written submissions provided by a borrower to explain or clarify any uncertainties in their financial or personal information. You may also see Warning Letter

Is Letter of Explanation Necessary?

Yes, a Letter of Explanation is often necessary to move forward with financial applications, providing crucial context for decisions. You may also see HR Letter

How Do You Start a Letter of Explanation?

Begin with a polite introduction, state the purpose of your letter, and reference the relevant transaction or issue clearly and directly. You may also see Congratulation Letter

How Do You Write a Strong Letter of Explanation?

To write a strong Letter of Explanation, use clear, straightforward language, be honest, provide factual information, and reference any relevant acceptance letter or documents.

Crafting an effective Letter of Explanation is crucial when you need to clarify details in professional or personal scenarios. These letters should be concise, straightforward, and factual, ideally complementing a cover letter or application. They serve as an opportunity to present yourself in a responsible manner, addressing any concerns with transparency and integrity. Our guide provides you with the necessary tools and samples to create impactful explanation letters, helping you communicate more effectively and improve the outcomes of your applications or queries. Use this knowledge to approach your next explanation with confidence and precision.