Proof of Funds Samples

-

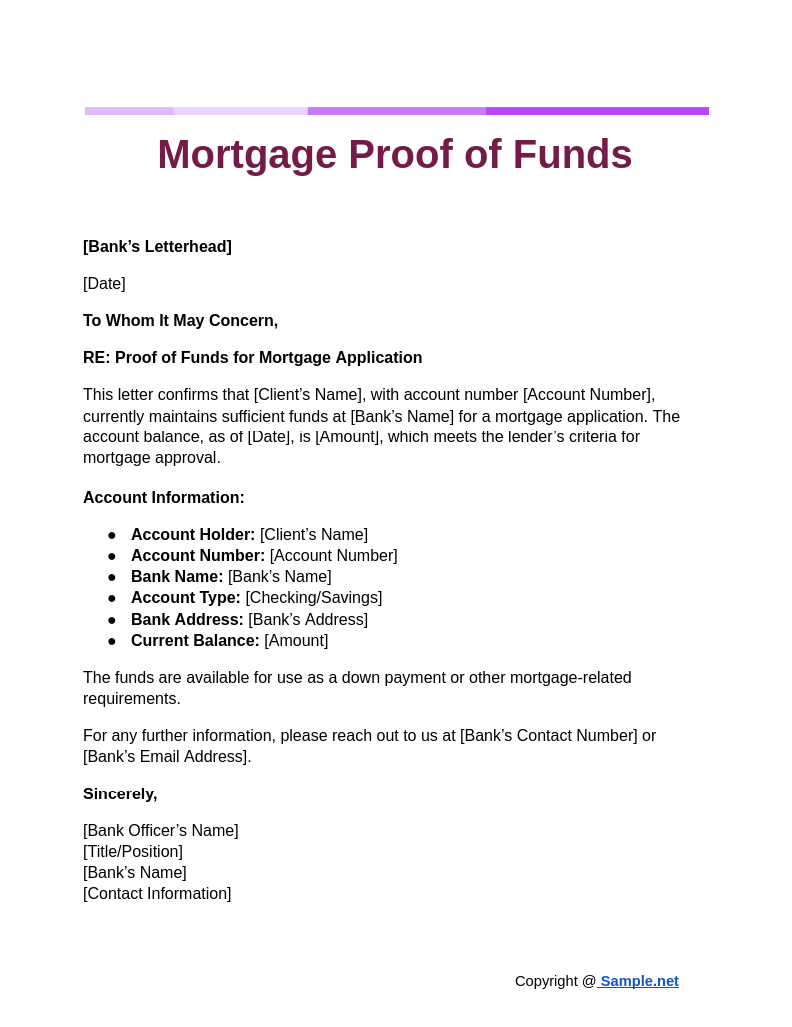

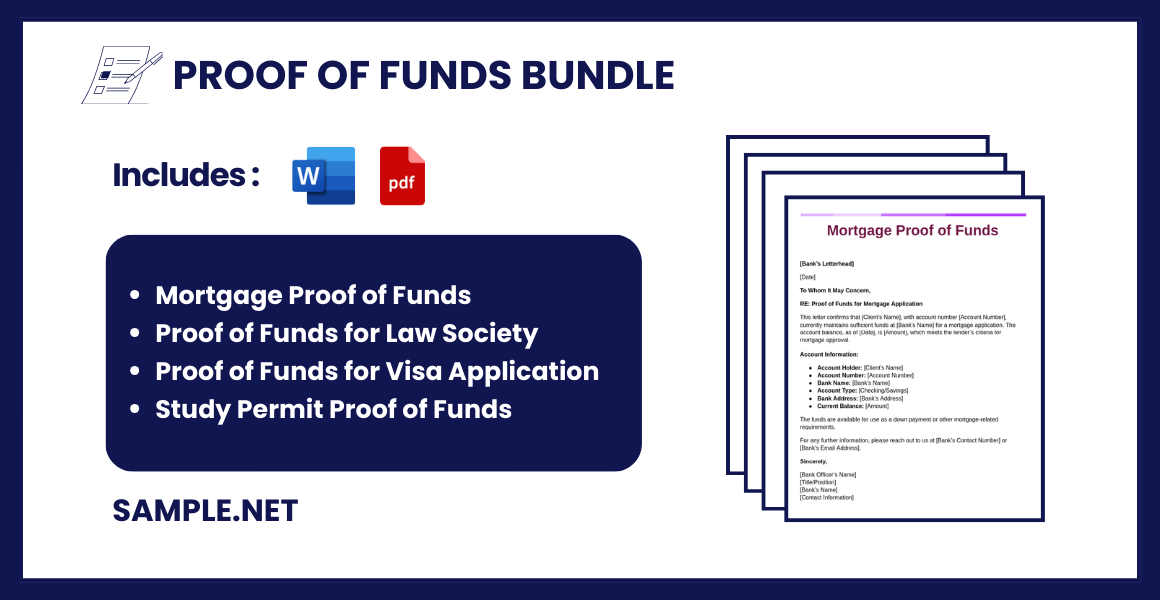

Mortgage Proof of Funds

download now -

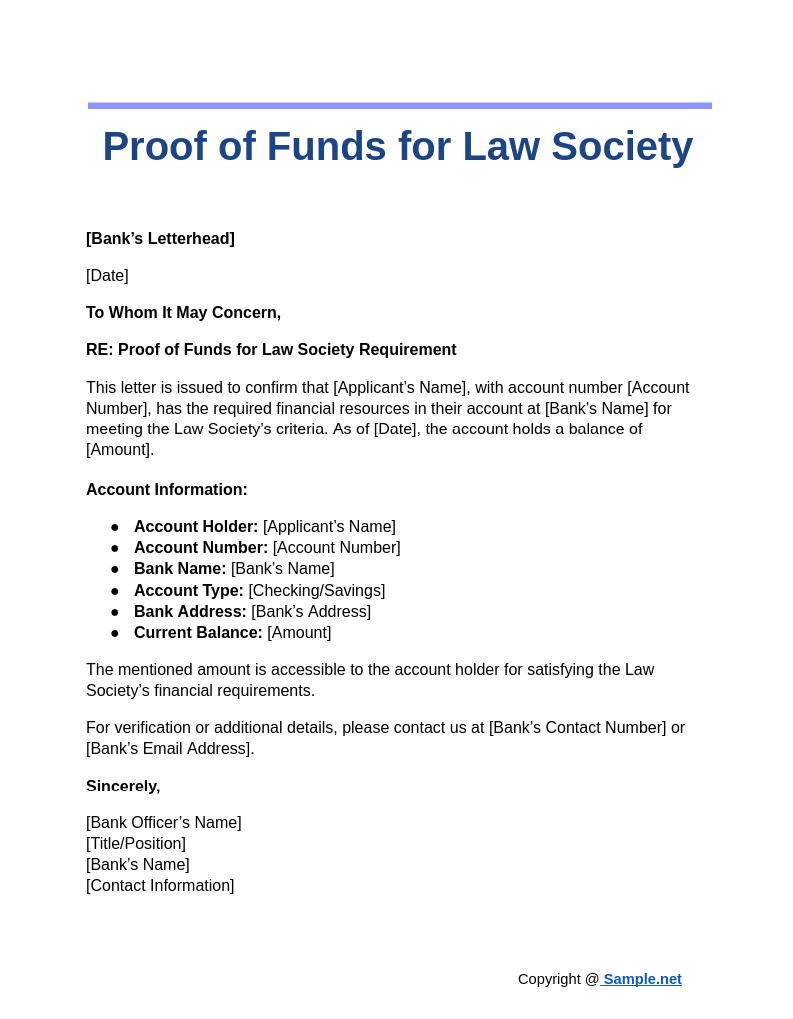

Proof of Funds for Law Society

download now -

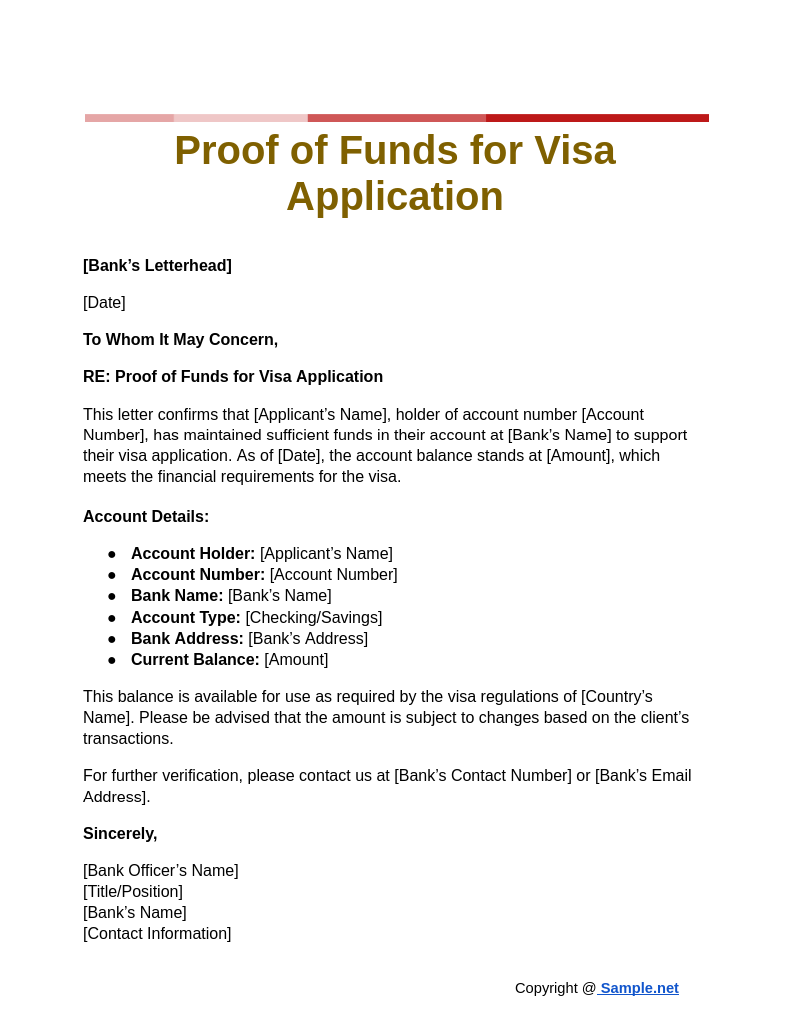

Proof of Funds for Visa Application

download now -

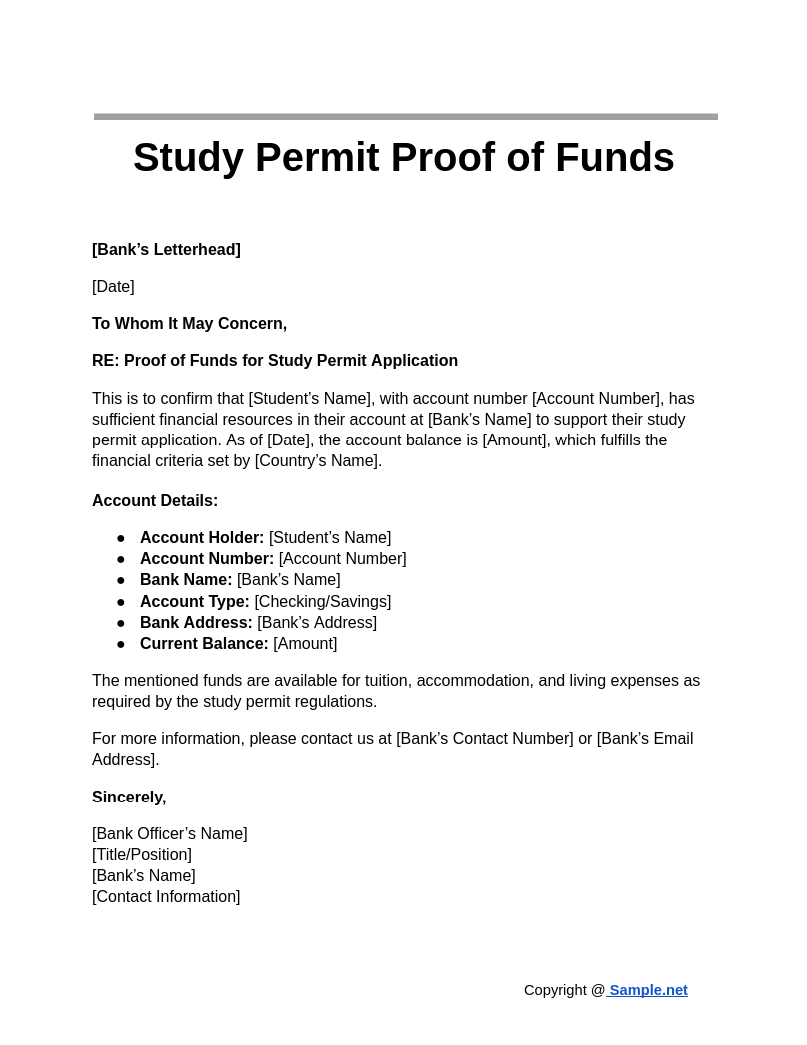

Study Permit Proof of Funds

download now -

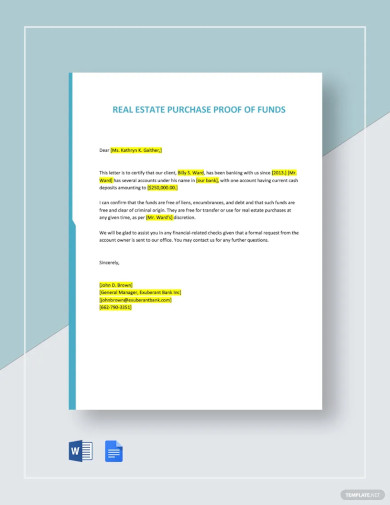

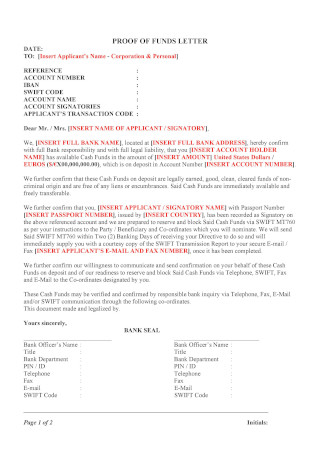

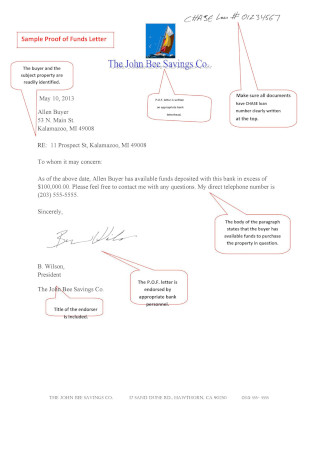

Proof Of Funds Letter Template For A Real Estate Purchase

download now -

Real Estate Proof of Funds Letter

download now -

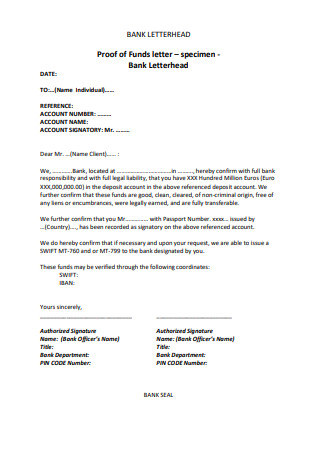

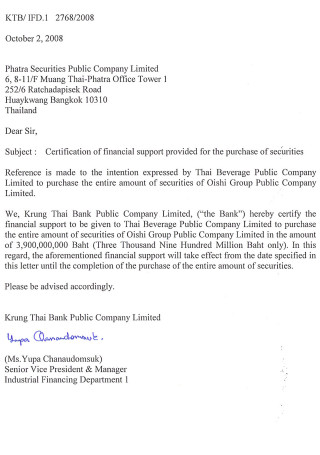

Private Lender Bank Letter

download now -

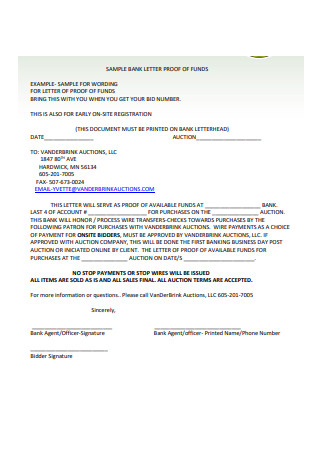

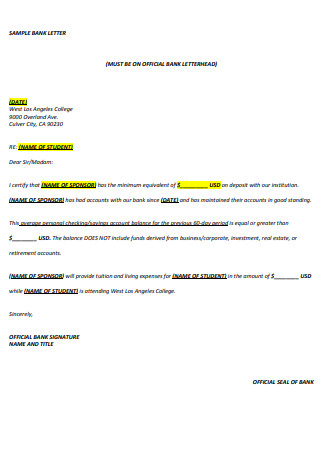

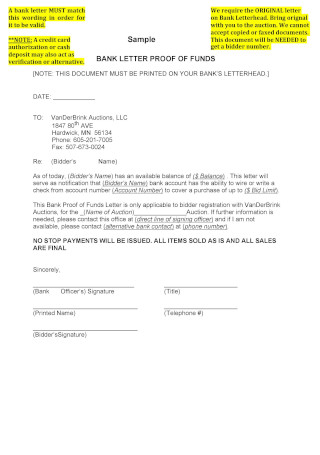

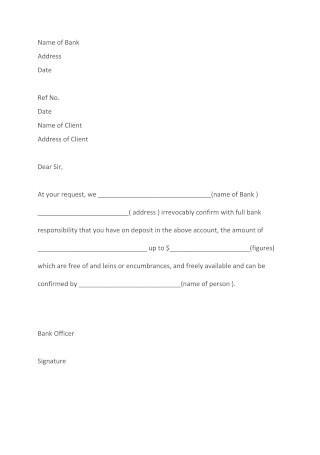

Sample Bank Letter Proof of Funds

download now -

Confirm Cash Offer Letter Cover

download now -

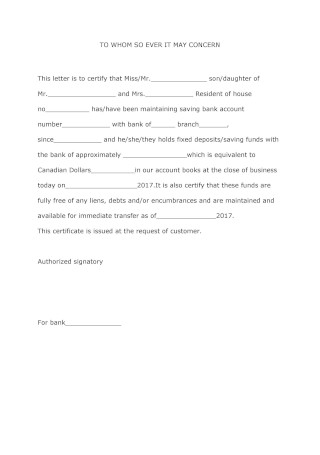

Sample Verification Proof of Funds Letter

download now -

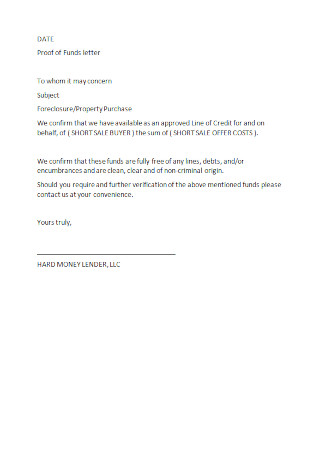

Hard Money Proof of Funds Bank Letter

download now -

Example Accountant Proof of Funds Letter

download now -

Deposit Proof of Funds Letter

download now -

Sample Attorney Proof of Funds Letter

download now -

Sample Express Entry Proof of Funds

download now -

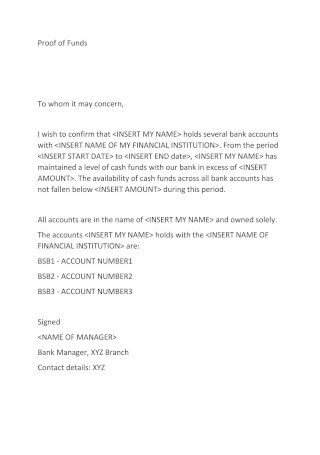

Bank Personal Proof of Funds Letter

download now -

Proof of Funds Letter Format

download now -

Sample Bank Proof of Funds Letter

download now -

Financial Lender Proof of Funds Letter

download now -

Pnc Bank Proof of Funds Letter Guide

download now -

Blank Home Purchase Proof of Funds Letter

download now -

Proof of Funds Investment Letter Sample

download now -

Solicitor Proof of Funds Letter Example

download now -

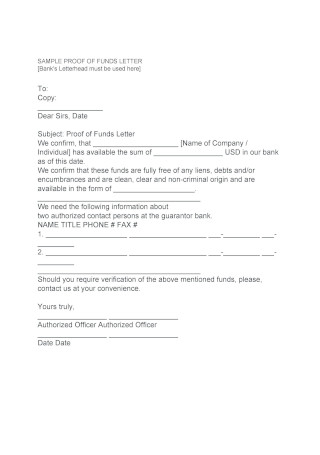

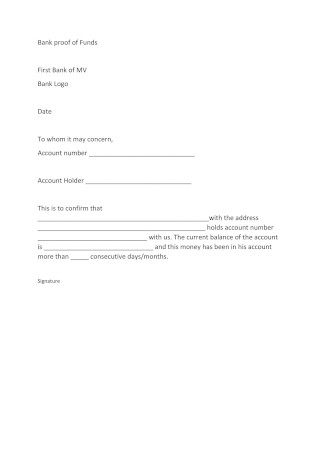

Bank Proof of Funds

download now -

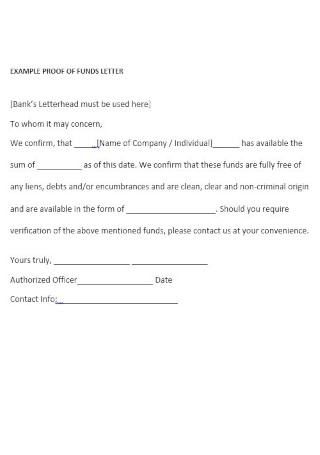

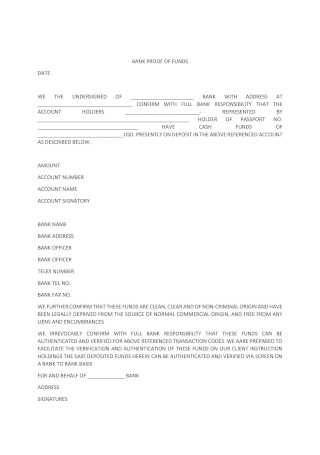

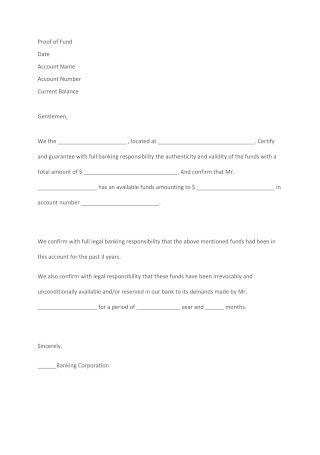

Sample Bank Proof of Funds

download now -

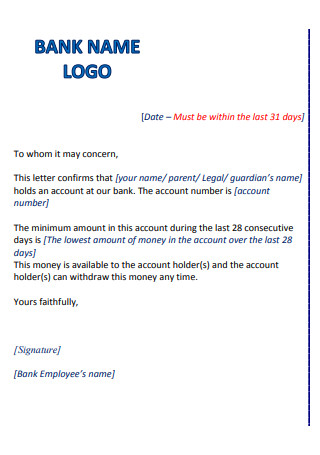

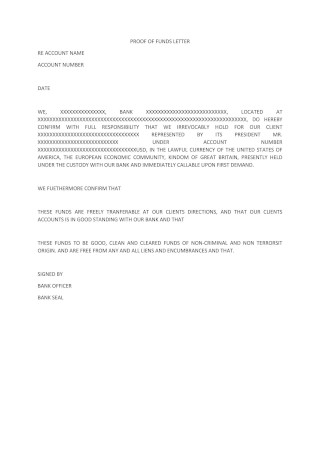

Simple Proof of Funds Letter

download now -

Proof of Funds Letter Form

download now -

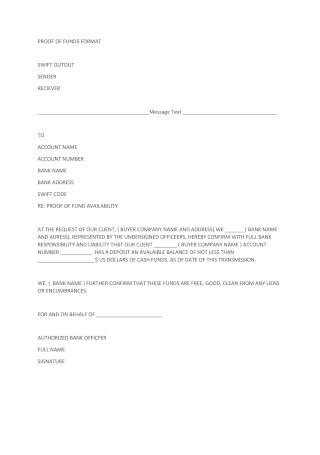

Proof of Funds Format

download now -

Editable Proof of Funds Letter

download now -

Blank Form of Proof of Funds Letter

download now -

Proof of Funds Form

download now -

Sample Proof of Funds Letter Format

download now -

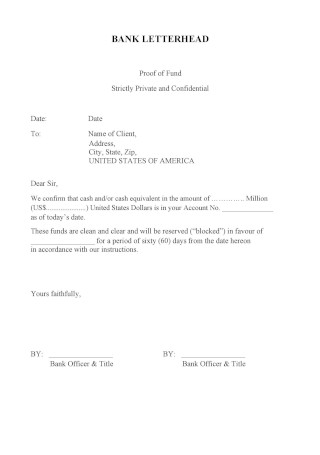

Proof of Funds Letterhead

download now -

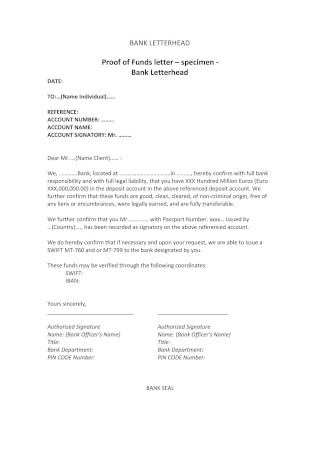

Proof of Funds Letter Specimen

download now -

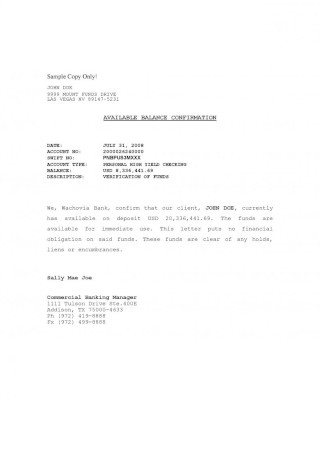

Proof of Funds Confirmation Letter

download now -

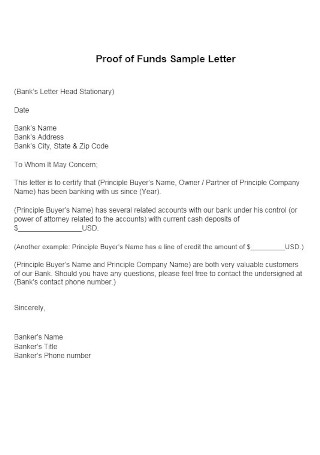

Proof of Funds Sample Letter

download now -

Cover Letter for Proof of Funding

download now -

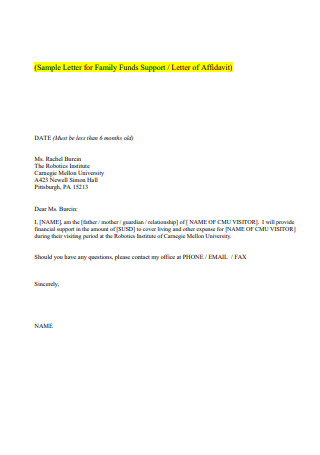

Sample Letter for Family Funds Support

download now -

Proof of Funds Template

download now -

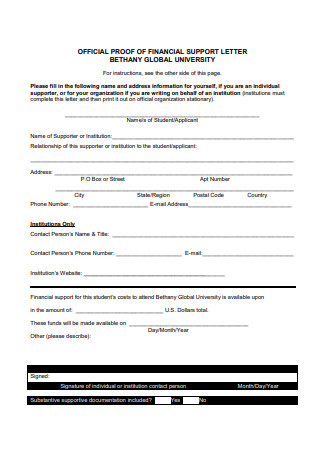

Proof of Support Letter

download now

FREE Proof of Funds s to Download

Proof of Funds Format

Proof of Funds Samples

What is a Proof of Funds?

Purposes of Proof of Funds

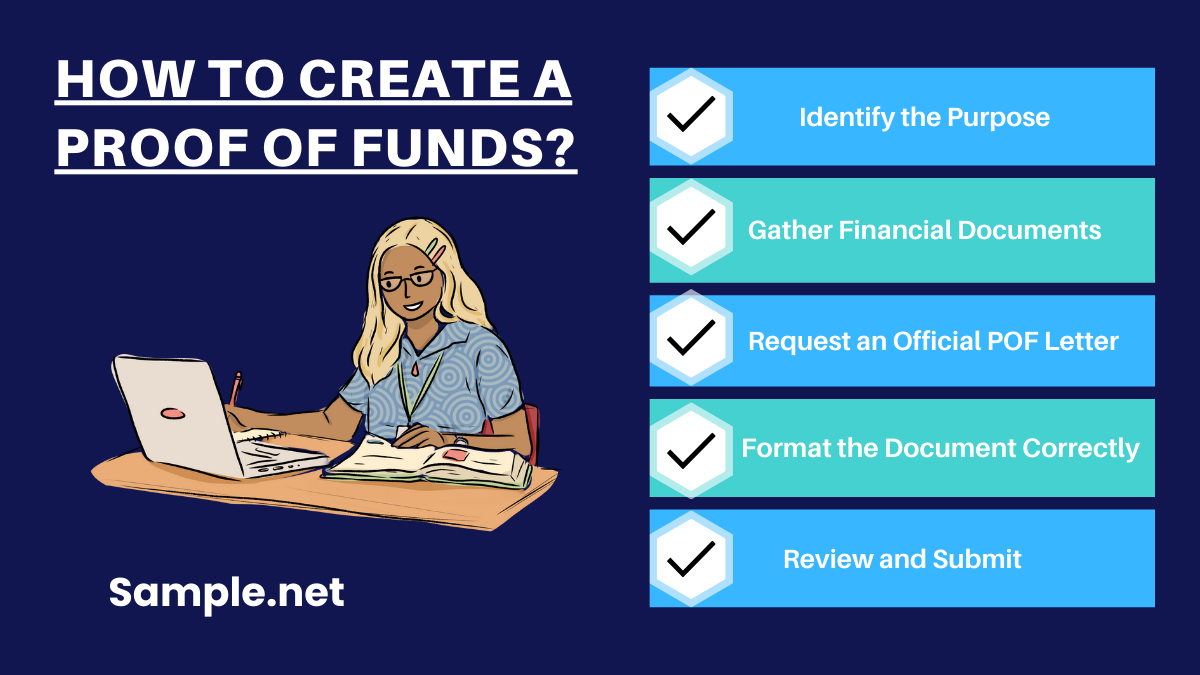

How to Create a Proof of Funds?

FAQs:

What details should be included in a Proof of Funds letter?

How does Proof of Funds affect the loan approval process?

What happens if I can’t provide Proof of Funds?

What other documents can support Proof of Funds?

What should I do if my Proof of Funds is insufficient?

How does Proof of Funds affect property bidding?

What is the role of Proof of Funds in mergers and acquisitions (M&A)?

Download Proof of Funds Bundle

Proof of Funds Format

[Bank’s Letterhead]

[Date]

To Whom It May Concern,

RE: Proof of Funds

This letter is to certify that [Client’s Name], holder of account number [Account Number], has maintained a balance of [Amount] in their account at [Bank’s Name] as of [Date]. The account has been in good standing, and the specified funds are currently available.

Details of the Account:

- Account Holder: [Client’s Name]

- Account Number: [Account Number]

- Account Type: [Checking/Savings/Other]

- Bank Name: [Bank’s Name]

- Bank Address: [Bank’s Address]

- Balance as of [Date]: [Amount]

Purpose of Funds:

The aforementioned funds are available for [specific purpose, e.g., purchase of property, investment, etc.], as requested by [Client’s Name].

Please note that this confirmation is based on the client’s current account balance, which is subject to change.

If further verification is required, please do not hesitate to contact us at [Bank’s Contact Number] or [Bank’s Email Address].

Thank you for your attention to this matter.

Sincerely,

[Bank Officer’s Name]

[Position/Title]

[Bank’s Name]

[Contact Information]

What is a Proof of Funds?

Proof of Funds (POF) is a document that confirms an individual’s or entity’s financial capacity to complete a transaction, showcasing sufficient available funds. You can also see more on Credit Demand Letter.

Purposes of Proof of Funds

1. Transaction Validation: It confirms that the buyer or investor has the necessary funds to meet financial obligations, enhancing transaction confidence.

2. Credibility Check: It builds trust among sellers, investors, and authorities by showcasing the buyer’s financial strength and reliability.

3. Visa Applications: It demonstrates financial stability to immigration authorities, supporting visa approvals for travel or residency. You can also see more on Visa Application Forms.

4. Loan Applications: It helps banks verify that borrowers have adequate funds, streamlining the loan approval process.

5. Business Deals: It confirms financial support in partnerships, mergers, or acquisitions, ensuring smooth business transactions.

How to Create a Proof of Funds?

1. Identify the Purpose:

Determine why you need the Proof of Funds—such as a property purchase, visa application, or business deal. Understand the specific requirements and the amount needed.

2. Gather Financial Documents:

Collect bank statements, savings account details, investment summaries, or other documents that show available funds. Ensure these documents are recent and cover the required period.

3. Request an Official POF Letter from Your Bank:

Contact your bank or financial institution to obtain an official Proof of Funds sample letter. Ensure it includes account balance, bank details, and the date of issuance.

4. Format the Document Correctly:

The POF document should be formatted properly, showing bank details, account numbers, available balance, and the signature of an authorized bank representative for credibility.

5. Review and Submit:

Double-check the details for accuracy and compliance with the recipient’s requirements before submission. Make sure it is valid for the intended transaction or application. You can also see more on Validation Letters.

FAQs:

What details should be included in a Proof of Funds letter?

A POF letter should contain the bank’s name, account holder’s name, account balance, date of issuance, and the bank representative’s signature, ensuring authenticity.

How does Proof of Funds affect the loan approval process?

Proof of Funds reassures lenders of the borrower’s financial stability, increasing the chances of loan approval by verifying the borrower’s capacity to repay or invest. You can also see more on Reference Letter.

What happens if I can’t provide Proof of Funds?

Failing to provide POF may lead to transaction delays or rejections, as it is a crucial document that assures the recipient of financial capability to complete the deal.

What other documents can support Proof of Funds?

Alongside a POF letter, documents like savings account records, fixed deposit receipts, or credit line approvals can support financial verification for a transaction.

What should I do if my Proof of Funds is insufficient?

You can increase your account balance, secure additional funds from other sources, or consider financial assistance from investors or banks to meet the transaction requirements. You can also see more on Proven Letter of Support.

How does Proof of Funds affect property bidding?

In property bidding, POF is crucial as it validates the bidder’s financial strength, making them more competitive and credible, increasing the likelihood of winning the bid.

What is the role of Proof of Funds in mergers and acquisitions (M&A)?

In M&A, Proof of Funds assures stakeholders that a buyer or investor has the financial backing needed to close the deal, reducing transaction risks and fostering trust during negotiations. You can also see more on Proof of Employment Letters.