Sample Retirement Announcement Letters and Emails

-

Letter to Announce an Employee Retirement

download now -

Paster Retirement Announcement Letter

download now -

Retirement Announcement Email Template

download now -

Sample Letter Announcing Resignation or Retirement

download now -

Basic Retirement Announcement Letter

download now -

Board of Directors Announcement of CEO’s Retirement Letter

download now -

Formal Retirement Announcement Letter

download now -

Staff Retirement Announcement Letter

download now -

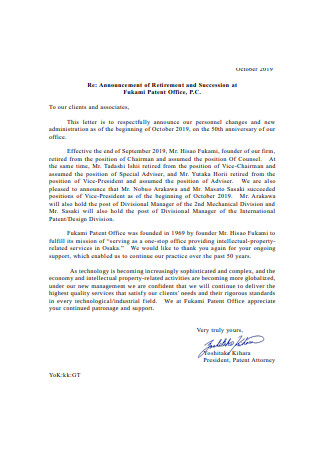

Patent Office Retirement Announcement Letter

download now -

Formal Retirement Announcement Letter Template

download now -

Employees Retirement Announcement Letter

download now -

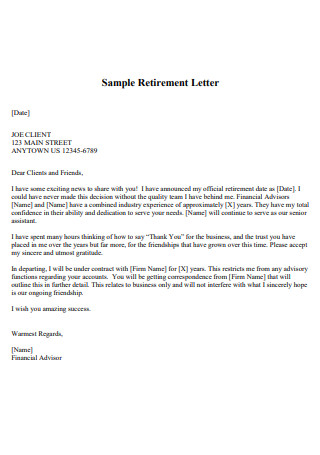

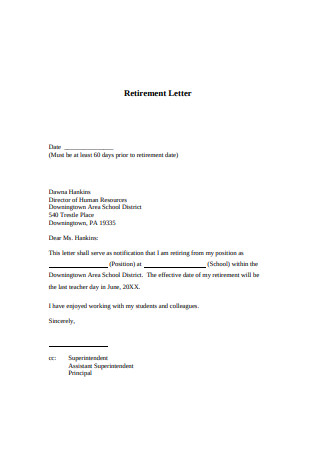

Sample Retirement Letter Template

download now -

Faculty Employee Retirement Letter

download now -

Sample Day Announcement Retirement Letter

download now -

University Email Announcement Retirement Template

download now -

Retirement Announcement School Email

download now -

Printable Retirement Letter Template

download now -

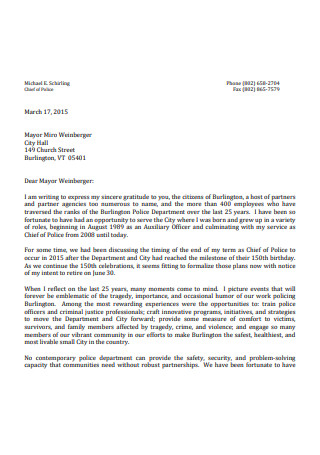

Police Retirement Announcement Letter

download now -

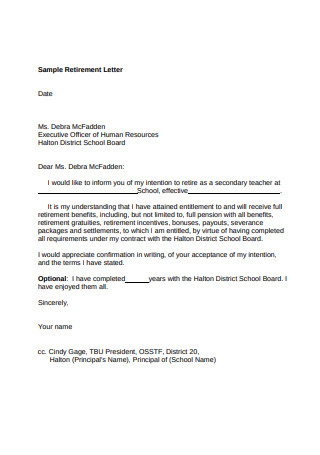

Sample Executive Officer Retirement Letter

download now -

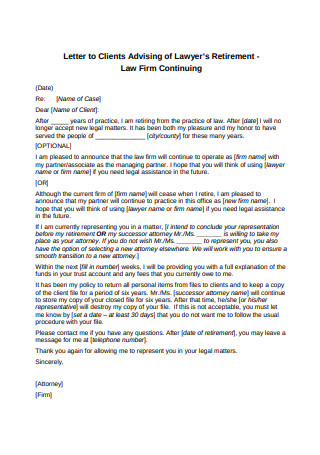

Letter to Clients Advising of Lawyer’s Retirement Template

download now -

Retirement Request Announcement Letter

download now -

Retirement Congratulation Invitation Letter

download now

FREE Retirement Announcement Letter and Emails s to Download

Sample Retirement Announcement Letters and Emails

What Is a Retirement Announcement Letter?

Benefits of Retirement Planning

Tips for Announcing Your Retirement

How to Write a Retirement Announcement Email

FAQs

What is a retirement letter summary?

Should you write a resignation letter when you retire?

How do you tell your boss you are retiring?

What Is a Retirement Announcement Letter?

An announcement of retirement resignation letter is a form of communication that many leaders send to their teams on behalf of departing employees. This typically takes the form of a professional email, especially in environments where this mode of communication is used frequently. A retirement announcement email can be used to honor the retiree’s career, provide information about their departure and outline any events or activities that will be conducted in their honor. Sending an email announcement to your team when an employee retires can contribute to a culture of positivity and generate goodwill for both the retiree and the remaining team members.

Benefits of Retirement Planning

The advantages of retirement planning are only sometimes readily apparent. However, if you are concerned about retirement, you must understand how retirement planning can assist you. Half of Americans believe it is impossible to plan precisely for retirement expenses. Worse still, did you know that 63% of Americans dread running out of money in retirement more than death? Considering this, it is only natural to consider the advantages of retirement planning in the first place. The positive news is that many retirees are effectively using their retirement savings. Here are some of the benefits of retirement planning for those who are interested.

Tips for Announcing Your Retirement

Announcement of your retirement allows you and your employer to weigh your choices. You may not yet know what you want to do after retirement, so declaring your plan to retire can give you time to make this personal decision. It also permits your company to find a qualified replacement for the position you intend to vacate. Using the proper strategies to announce your retirement assists you and your employer in effectively handling this crucial change. Here are some tips you can check to make your retirement announcement:

1. Investigate Your Company’s Retirement Plans

The first step in an efficient retirement process is investigating your company’s retirement rules to discover if you are eligible for retirement benefits and to ensure you provide the appropriate notice. Consider scheduling a meeting memo with HR to review your retirement plan and the company’s regulations. You may be qualified to retire earlier than expected or be entitled to additional benefits based on your length of service.

2. Consult with Superiors about Alternatives

After understanding your company’s retirement policy, consider discussing your alternatives with your supervisor. During your retirement, your business may offer you the opportunity to act as a company consultant or even a part-time advisor. You can permanently deny further work, but it may be advantageous to evaluate all of your possibilities when choosing your retirement plans. Having an experienced member of a company’s team continue to work in some form can help a business thrive and uphold its principles.

3. Write an Announcement Letter or Email

The next step is to compose an official letter announcing your retirement. It is best to write your announcement so that you and your employer have a tangible record of your intentions. Consider using an internet template to compose a concise, professional letter outlining your position at the company, the aspects of your work you enjoyed, and your intention to retire. Vital information to mention in a retirement announcement is your anticipated retirement date.

4. Give at Least Six Months of Notice

Some companies demand as little as 30 days’ notice of desire to retire. However, it is generally considered professional etiquette to do so as soon as possible. This ensures that your company can fill the open job contract proposal with a suitable individual who can contribute positively to the organization. Make your retirement announcement at least six months in advance.

5. Offer Assistance throughout the Transition

Offering to assist your employer throughout your transition is a professional courtesy ensuring your organization is well-prepared for post-retirement adjustment. Helping your employer locate and train a replacement or removing your position are two methods to assist your employer. This is also an excellent method for sustaining professional relationships.

How to Write a Retirement Announcement Email

Managers, supervisors, and other leaders frequently use email to advise their staff of impending retirement and to recognize a retiree’s accomplishments. If you are a leader who would like to create an email notification for a retiring employee, consider the following steps:

1. Think of Concepts

Start by generating ideas for the information you want to include in your retirement announcement. You can get motivated by noting the prospective retiree’s positive characteristics and fond experiences you have with them. Consider working with other team members familiar with the subject throughout the brainstorming phase.

2. Structure Your Letter

Consider the sequence in which you wish to express your ideas. You could analyze your brainstorming file notes to determine if your thoughts follow a trend. You may also structure your ideas using a template like the one. Ensure that your ideas flow logically from one to the next to help your reader follow along. Consider utilizing an outline or web to arrange the layout of your email announcement of retirement.

3. Write the First Draft

Using your brainstorming and framework agreement, prepare your email announcing your retirement. Add any pertinent or fascinating details to the tales and facts about the retiree you wish to give, and eliminate any extraneous material. Include transitional phrases between paragraphs and sections to clarify the connections between ideas. To leave the most favorable impression possible on the retiree, use professional, personable, and optimistic wording in your email announcement of retirement.

4. Review and Revise

When the draft of your retirement announcement email is complete, review it. Consider whether you can make any alterations that would clarify or make your ideas more intriguing. Use this stage to guarantee that your language, use, and mechanics are error-free. Consider putting your message aside for a while and returning to it later with a new perspective to assist you in spotting potential modifications. Consider asking a colleague you trust to evaluate your email and recommend edits.

5. Send Your Email

Finally, you can send your retirement announcement email to your staff. Check your list of recipients carefully to ensure you send your message to the correct individuals. Consider any firm policies about recipient lists and BCC or CC practices. For instance, certain regulations may stipulate that only specific email formats are acceptable for inclusion on a mailing manager list. Depending on your company’s policies, you may also examine whether any former workers or associated individuals may benefit from receiving your email retirement notice.

FAQs

What is a retirement letter summary?

A retirement resignation letter is a formal document that notifies an employer of an employee’s decision to retire and begin collecting retirement benefits. Typically, this occurs alongside a meeting with a supervisor or manager, during which the employee verbally resigns and discusses a transition plan.

Should you write a resignation letter when you retire?

When you plan to retire, you should submit a retirement resignation letter to your employer. You should personally deliver your letter to your employer. Before composing your letter, you should discuss your retirement plans with your supervisor so that it does not surprise you.

How do you tell your boss you are retiring?

You should schedule a private meeting with your supervisor or immediate superior to inform them of your retirement. The session can be professional or informal, depending on your connection with your employer. Inform your boss of your retirement plans and inquire how you can assist with the transition.

Numerous individuals seek to reach the retirement stage of their professional careers. Essential to a successful retirement is informing your employer of your intention to retire, which can aid in maintaining professional relationships and ensuring a healthy work environment before your departure. Learning how to write a retirement announcement may be helpful if you intend to retire soon.