Tips for Creating Business Log:

Creating an effective business log is crucial for maintaining organized records and facilitating smooth business operations. Here are some tips to help you create a business log:

Define the Purpose:

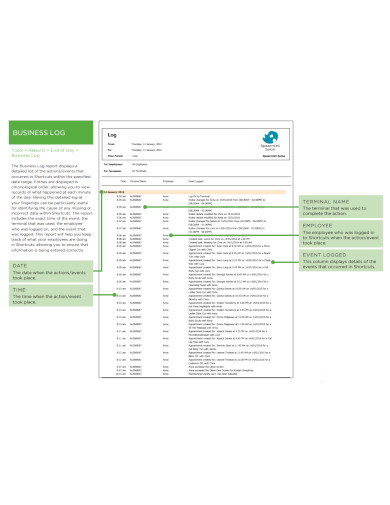

Clearly define the purpose of your business log. Whether it’s for financial transactions, project tracking, or customer interactions, understanding the purpose will guide the structure and content of the log.

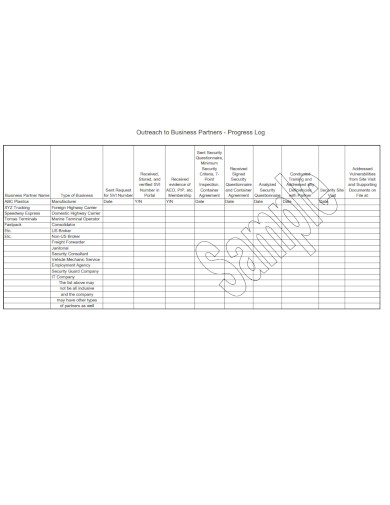

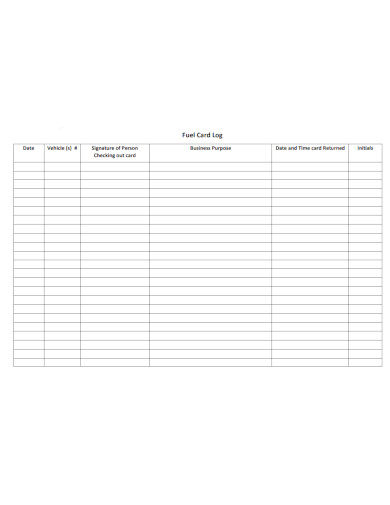

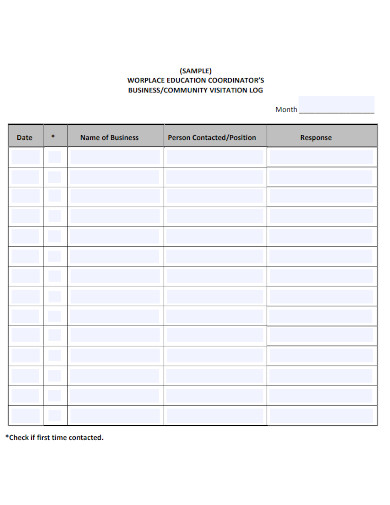

Identify Key Categories:

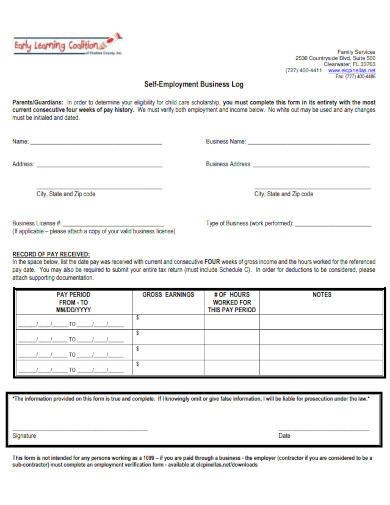

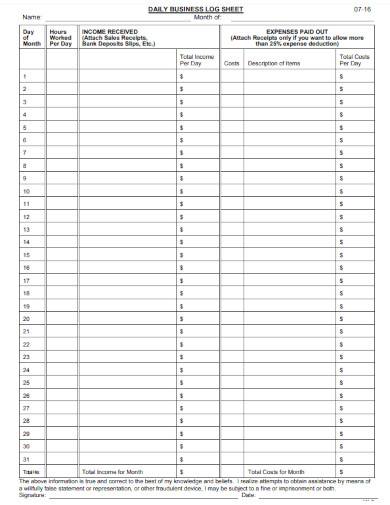

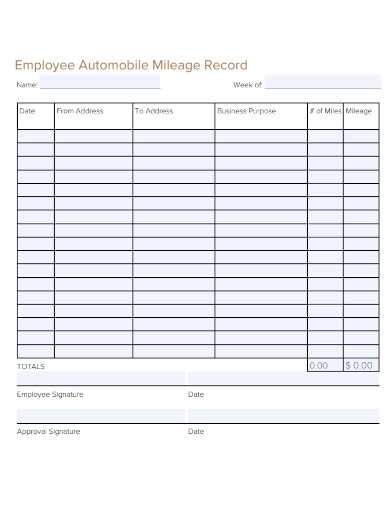

Determine the key categories or sections that your log will include. Common categories may include date, description, income, expenses, clients, projects, or any other relevant details.

Choose a Suitable Format:

Select a format that suits your needs. This could be a digital spreadsheet, accounting software, a dedicated logbook, or a combination of these. Choose a format that aligns with your business processes.

Create Clear Labels:

Use clear and concise labels for each column or section in your log. This enhances readability and ensures that information is easy to understand.

Establish a Standard Entry Format:

Define a standard format for entering data. This could include specific date formats, currency conventions, or any other consistent formatting rules. Standardization helps maintain accuracy and clarity.

Include Relevant Details:

Ensure that your log captures all relevant details for each entry. This might include dates, descriptions, amounts, and any specific information related to your business needs.

Implement a Systematic Organization:

Organize your log systematically to facilitate easy retrieval of information. This may involve sorting entries by date, category, or any other relevant criteria.

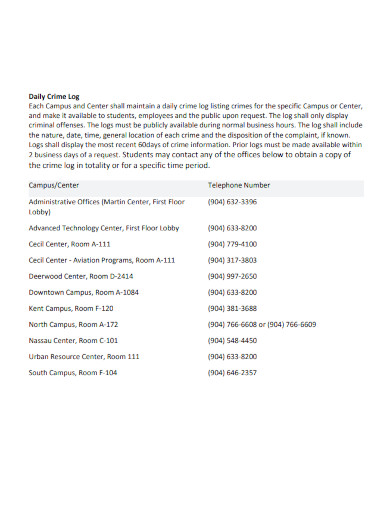

Consider Accessibility:

If multiple people will be using the log, consider how to make it accessible to those who need it. This could involve using shared digital platforms or implementing a clear physical filing system.

Plan for Growth:

Design your log with scalability in mind. As your business expands, the log should be able to accommodate increased data without becoming overly complex.

Include a Legend or Key:

If your log involves codes or abbreviations, include a legend or key to help users understand these symbols. This enhances transparency and avoids confusion.

Regularly Review and Update:

Schedule regular reviews of your business log to ensure accuracy and relevance. Update the log promptly with new information.

Backup Data Regularly:

If using digital formats, regularly backup your log data to prevent loss in case of technical issues or data corruption.

Train Relevant Personnel:

If others will be contributing to or using the business log, provide training on the log’s structure, entry procedures, and any specific guidelines.

Adhere to Legal and Regulatory Requirements:

Familiarize yourself with any legal or industry-specific regulations regarding record-keeping. Ensure your business log meets these requirements.

Seek Feedback:

Encourage feedback from users of the log to identify areas for improvement. This collaborative approach can lead to a more effective and user-friendly system.

You May Also See SAMPLE Research Log.

Why is a Business Log Important?

A Business Log is crucial for maintaining organized records, aiding in financial management, supporting decision-making, ensuring legal compliance, and enhancing overall business efficiency.

How Often Should I Update My Business Log?

Regular updates are essential. Set a schedule, whether daily, weekly, or monthly, to ensure timely and accurate recording of transactions and events

In crafting a comprehensive guide on creating a Sample Business Log, we’ve explored essential tips for effective logkeeping. From defining purpose to choosing formats and maintaining consistency, this guide empowers businesses to streamline operations. By incorporating these insights, businesses can develop an organized and efficient system, unlocking the full potential of their Sample Business Log for sustained success.