22+ SAMPLE Annual Budget Plan

-

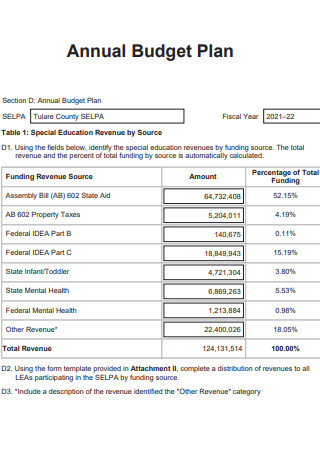

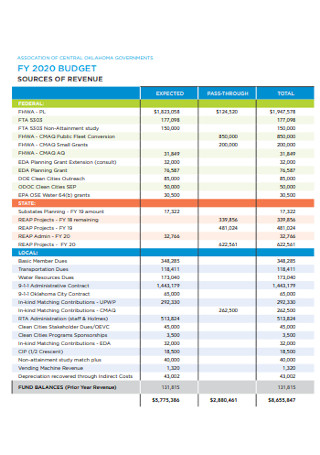

Annual Budget Plan

download now -

Annual School Budget Plan

download now -

Annual Budget Destination Marketing Plan

download now -

Annual Program Budget Plan

download now -

Annual Budget Business Plan

download now -

Annual Budget Work Plan

download now -

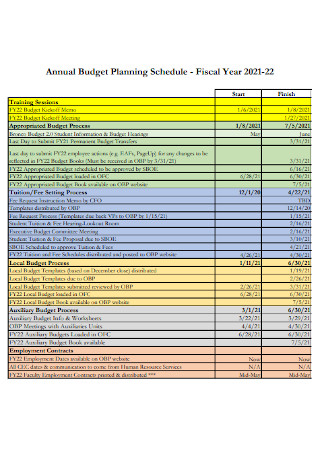

Annual Budget Schedule Plan

download now -

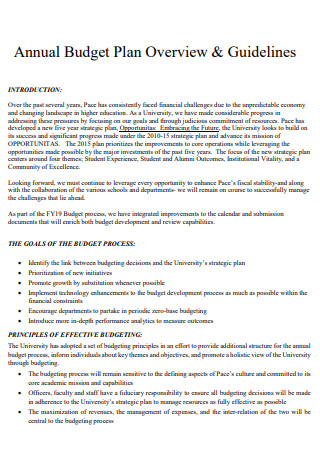

Annual Budget Plan Overview

download now -

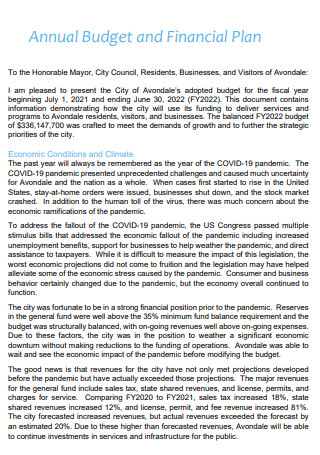

Annual Budget Financial Plan

download now -

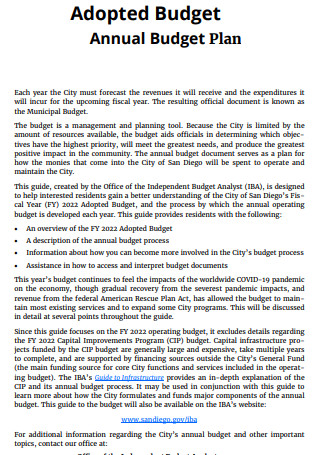

Adopted Annual Budget Plan

download now -

Annual Budget Action Plan

download now -

Annual Budget Strategic Plan

download now -

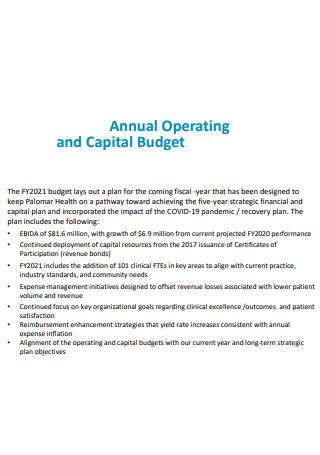

Annual Operating Budget Plan

download now -

Sample Annual Budget Plan

download now -

Instructions for Annual Budget Plan

download now -

Annual Budget Planner

download now -

Annual Performance Congressional Budget Plan

download now -

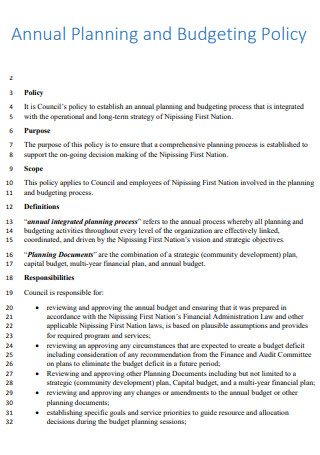

Annual Budgeting Policy Plan

download now -

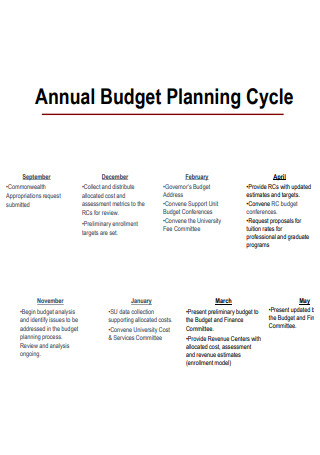

Annual Budget Planning Cycle

download now -

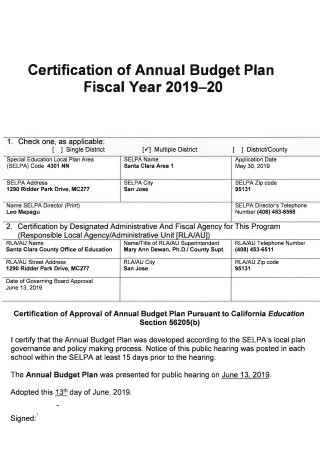

Certification of Annual Budget Plan

download now -

Annual Defense Budget Plan

download now -

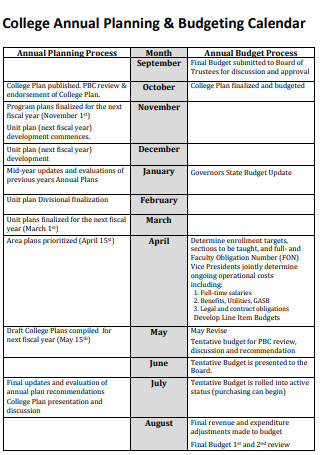

Annual Budget Calendar Plan

download now -

Annual Report Budget Plan

download now

What Is an Annual Budget?

An annual budget details a business’s anticipated revenue and expenses over 12 months. The process of developing a yearly budget includes balancing a business’s revenue streams and costs. Annual budgets are frequently expanded to include a balance sheet and cash flow statement, particularly for non-individuals. Individuals, firms, governments, and other organizations that need to keep track of financial activity employ annual budgets. Balanced annual budgets are those in which planned spending equals projected revenues. If expenditures exceed gains, it is in deficit; if revenues exceed expenses, it is in surplus. According to statistics, small firms budget in a variety of ways. Over half (54%) of small firms have a formalized budget for 2021.

Benefits of Having a Budget

Budgeting is a critical financial lesson that cannot be overstated. If you and your family want financial security, the only solution is to stick to a budget. Are you still undecided? The following are six compelling reasons everyone should establish and adhere to a budget.

Components of a Budget

Creating your first budget may be difficult if you’re beginning a new business. Still, it’s a valuable learning experience and a fantastic method to determine what works best for your business. The best place to begin is by familiarizing yourself with your budget components. To start, you may need to make certain assumptions.

Types of Budgets

Budgeting enables you to comprehend how much money you have, how much money you have spent, and how much cash you will need in the future. A budget can be used to guide critical business decisions such as eliminating unnecessary spending, boosting employees, or purchasing new equipment. If you find yourself short of funds, the budget might help you adjust your business plan or prioritize your spending on activities. With the correct budgeting strategy in place, you can keep your firm out of debt or find methods to minimize existing debt. A thorough budget can also be utilized to secure business financing from banks and other financial institutions. Consider the many types of budgets and how they contribute to developing a company plan.

-

1. Master Budget

A master budget is the sum of lower-level budgets made by different parts of an organization. Uses financial statements, the cash forecast, and the financial plan to figure out what to do next. Use master budgets to plan what you need to do to reach your goals for the company. In larger businesses, senior management is in charge of making a lot of different versions of the master budget before it is finalized. Once it has been checked over for the last time, funds can be used for specific business activities. Smaller businesses often use spreadsheets to make their master budgets. Using budgeting software instead of spreadsheets can usually cut down on mistakes.

2. Operating Budget

A company’s predicted revenue and expenses for a given time are shown in an operating budget, and it resembles a balance sheet in many ways. Fixed and variable costs and investment, and non-operating expenses are all part of the total. Although this is a high-level summary report, each line item is accompanied by important information. This data helps determine whether or not the company is spending by its budget. It is typical for management to prepare this budget at the start of each year. There are updates to the paper monthly or quarterly, making it useful as a long-term forecast.

3. Cash Budget

A cash flow budget calculates how much money a business will bring in or take out over a given time. Organizations use sales forecasts and production estimates, and estimates of payables and receivables to generate cash budgets. You may use this budget to see if you have enough cash on hand to run your business, if your money is being spent wisely and if you’re on pace to make a profit.

4. Financial Budget

A company’s budget is used to determine how much money it will require to meet short-term and long-term goals. As part of a balance sheet, it considers your company’s assets, liabilities, and the equity of your stakeholders.

5. Labor Budget

A labor budget is critical for any company hoping to meet its objectives by hiring staff. It aids you in figuring out how many teams you’ll need to reach your objectives so that you can budget for their salaries. It’s a great way to budget for seasonal workers and your average employment needs.

6. Static Budget

This budget represents a projection of revenues and expenses that will not change significantly for the year. Even if sales go up or down, the budget’s line items can be utilized as benchmarks. In the case of non-profits, educational institutions, or government agencies that have been allotted fixed funds for each sector, static budgets are typically used to plan their activities.

How To Prepare an Annual Budget Plan

Preparing an annual budget plan will assist you in increasing profitability and ensuring that you have the capital to operate the business throughout the year. The following are the processes to creating an annual budget plan:

-

1. Profit and loss statements should be reviewed.

To begin generating an annual budget, examine the previous two years’ profit and loss accounts. Eliminate exceptional expenses and one-time revenue that you do not foresee in the following year. Compute the average of the two years’ profit and loss statements and adjust for increased expenses during the year. Additionally, make necessary adjustments to account for anticipated changes in gross margins, one-time investments, market circumstances, and revenue in the next year. Also, evaluate how changes in one area may affect others. For instance, if you hire additional sales professionals, your income should increase due to the increased sales. Still, you will also incur additional costs for health insurance and other related expenses.

2. Examine expenses more closely

Once you have a rough calculation of your company’s revenue and expenses for the year, you should dig deeper into costs. Several of your business’s fees are set, such as insurance, rent, leases, and other services you utilize regularly. This is an excellent opportunity to examine your current rates to determine whether you may obtain a better deal on insurance or other services. It will help consider staff remuneration, commensurate with its development and sales. Additionally, you should consider if you will need to hire, the impact that hiring will have on other areas of your budget, and the degree of expertise that individual will require to maximize operations.

3. Conduct a capital expenditure audit

Capital expenses such as new computers, machinery, and furniture are also critical to budget for. For example, if you’re hiring new staff, they’ll require laptops and other equipment to perform their duties effectively. Consider the equipment that will be necessary to hire new personnel. Consider any equipment you will need to purchase or upgrade to manufacture your product or service. Bear in mind the possible impact of the investment on output. While it may be tempting to delay huge investments, this decision can significantly influence delivery timing, product quality, and production, all of which can have a significant impact on revenue over time.

4. Determine your cash flow

When constructing your annual budget, it’s critical to account for cash flow income. For instance, you may need to purchase inventory before conducting sales and ensure that you have sufficient cash on hand to make the necessary purchases. A cash flow statement can be generated utilizing the income statement and the AR/P turnover rates in these instances.

5. Include the budget in your financial management system.

Divide your annual budget by 12 months to determine your monthly revenue and expenses. Each time you review your monthly financial statements, compare them to the budget to get a feel of how accurate your estimates were. This can assist you in controlling spending while also helping you create a more precise annual budget in the future.

FAQs

Why is budgeting critical?

Budgeting enables you to build a spending plan for your money, ensuring that you always have sufficient cash for the items you need and value. Maintaining a budget or spending plan will also help you avoid debt or overcome obligations if you are already in debt.

What is your budget’s first priority?

When it comes to budgetary priorities, retirement comes first. Additionally, it will help if you address your high-interest debt, such as credit card obligations. From there, you can concentrate on accumulating savings for emergency and scheduled maintenance.

How are budgets used in planning and control?

Budgets are vital to illuminate the financial consequences of plans, identify the resources required to carry them out and give away measuring, evaluating, and controlling the produced results about the plans.

A budget is like a map for your business. It helps you figure out how much money you’ll have coming in, where you need to improve, and how to run your business smoothly. Successful companies spend a lot of time and effort making realistic budgets because they’re an excellent way to see how well they have met their goals. If you already have a business and want to ensure your annual budget plan is done, you can look at the templates above and follow some of the steps we talked about in this article. I’m rooting for you as you make your budget plan for the year!