3+ SAMPLE Financial Advisor Business Plan

FREE Financial Advisor Business Plan s to Download

3+ SAMPLE Financial Advisor Business Plan

What Is a Financial Advisor Business Plan?

What’s In a Financial Advisor Business Plan?

How to Create an Effective Financial Advisor Business Plan

FAQs

Is hiring a financial advisor free of any cost?

What is a financial coach?

When does someone usually need a financial advisor?

What Is a Financial Advisor Business Plan?

Before we get into the meat of things, we need to get familiarized first with what a financial advisor is and what they exactly do. A financial advisor is a skilled expert who provides financial services to their customers depending on their financial status. In their line of work, they utilize their knowledge and skills to create individualized financial plans (such as savings plans, budget plans, financial plans, and so on) with the purpose of helping clients accomplish their financial goals. Their job description encompasses a wide range of services such as investment management, tax preparation, and estate planning. Simply put, these specialists advise their customers on how to spend their money wisely.

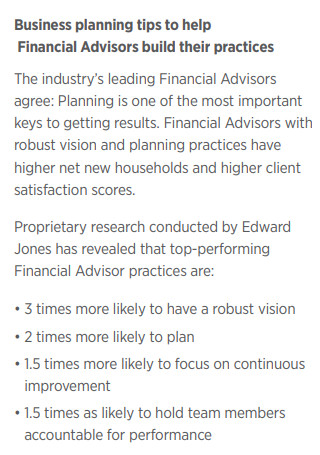

Going back earlier, there are companies that specialize in advisory services, such as financial advising. More often than not, they operate on a small scale, so a well-polished business plan is not exactly at the top of their priority list. However, it is still a big bonus if they have one. Because a financial advisor business plan is a business document that gives a picture of a financial advisory firm as it currently exists, as well as a business growth plan for the conceivable future (say, in the next five years). This document also defines the company’s business goals and the plan for achieving them. It also involves market research to back up its goals. Because this document has a significant impact on the operations of a financial advisory firm, its contents must also be flexible in order to react to changes in the industry.

What’s In a Financial Advisor Business Plan?

Since this plan is used as a tool to aid with the operations of a financial advisory firm, it needs to be effective. And in order to be effective in what it does, it needs to have the following key components in place:

How to Create an Effective Financial Advisor Business Plan

When tasked to create a business plan for a financial advisory company, here are the steps that need to be followed in order to make it effective:

1. Conduct a Company Analysis

The first step that needs to be done when creating a financial advisor business plan is to perform a company analysis. This step is essential since the type of business that the financial advisory firm focuses on and operates on will be identified here. Most commonly, there are two types, which are the consumer-centered type and the consultancy-services type. The consumer-centered financial advice sector focuses on financial planning for consumers, with financial advisers providing services such as retirement planning and investment monitoring for people. The consultancy-centered form of financial advice firm focuses on financial management consulting, with corporations and governments as common clients. Financial advisers of this sort often offer portfolio management services to their customers.

2. Perform an Industry and Customer Analysis

After conducting the company analysis and identifying what type of business the financial advisory firm will focus on, it’s time to perform an industry and customer analysis in this step. Industry analysis is used to understand the competitive dynamics of the financial advisory industry. Including this type of analysis in the business plan is significant because it teaches the individual and helps that person comprehend the market in which he or she operates. When conducting customer analysis, provide a description of the ages, genders, localities, and income levels of the clients the firm wishes to service, as well as their psychographic profiles that describe their individual wants and requirements. Conducting one is critical because the more the organization understands and addresses these demands, the better it will be at attracting and maintaining its respective consumers.

3. Conduct a Competitive Analysis

After performing the industry and customer analysis in the previous step, it’s now time to conduct a competitive analysis for the financial advisory company. In performing a competitive analysis, determine the business’s indirect and direct rivals and then concentrate on the latter section. In terms of direct competition, the business should list the other financial advising firms with whom it competes. Furthermore, in the competitive study, place attention on variables such as the sorts of clients they serve, the products and services they provide, their pricing, their strengths and weaknesses, and so on. Following that, in this stage, the company should identify the areas in which they have a competitive edge.

4. Outline the Operations Plan and Financial Plan

After conducting a competitive analysis in the previous step and determining where the financial advisory firm stands in its industry with regard to its competitors, it’s time to outline the operations and financial plan in this step. In outlining the operations plan, detail all of the daily short-term procedures required in running the financial advising firm, such as serving customers, acquiring supplies, and so on. In developing the financial plan, take note that it has three main parts, namely the income statement, the balance sheets, and the cash flow statement. The income statement is more commonly known as a profit&loss statement, the balance sheets will determine the assets and liabilities of the company, and the cash flow statement will determine how much is needed to grow the business.

5. Create the Appendix and Summarize Everything

After outlining the operations plan and the financial plan, it’s time to proceed to the final step, in which the appendix and the executive summary will be outlined. In creating the appendix section of the business plan, detail the company’s entire financial predictions, as well as any supporting papers that make the business plan more convincing. For the executive summary, detail every key point in each key component of the business plan. In other words, provide a brief summary of each component. Make sure to write it in such a way that it engages the reader. Do take note that the executive summary appears on the first page of the entire document even though it’s written last.

FAQs

Is hiring a financial advisor free of any cost?

Hiring financial advisors practically never come free of any cost. Even though the individual is not required to pay any upfront fees, a financial adviser can receive commissions on the goods sold to their clients, as well as a part of the customer’s earnings. Very high net worth individuals may be granted “free” adviser services, however, these advisors are more often than not charged with quietly directing the client into products or services that profit the institution.

What is a financial coach?

Financial coaches are a form of financial counselor that are frequently the most approachable to beginners. Financial coaches teach the fundamentals of financial literacy, such as how to manage money and cut expenses. Financial coaches can assist their customers in accumulating wealth that will be managed by an investment adviser in the future.

When does someone usually need a financial advisor?

When someone has investments but continually loses money, they may require the services of a financial advisor. Even the finest investors lose a lot of money when the market falls or when a move does not come out as planned. However, investment should significantly improve an individual’s net worth. If it isn’t, employing a financial counselor can assist an individual in determining what they’re doing incorrectly and correcting their path before it becomes too late.

Financial advisors help their respective clients, whether they are high-value individuals, governments, or corporations achieve the financial independence and security they desire. In order for them to do their job properly, one factor would be that the company they work for has a solid business plan in place, which has a massive influence on the direction that the financial advisory firm will take. In this article, you can have a look at the sample templates that exist to help you have a further understanding of this document.