28+ Sample Financial Plans

-

Personal Financial Plan

download now -

Education Financial Plan Template

download now -

Building Financial Plan Template

download now -

Long Term Financial Plan

download now -

Current Financial Situation Plan

download now -

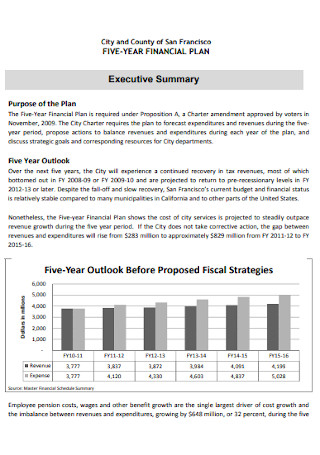

Five Years Financial Plan

download now -

Long Range Financial Plan

download now -

Financial Planning Activity Template

download now -

Sample Strategic Financial Plan

download now -

Personal Financial Plan Exam,ple

download now -

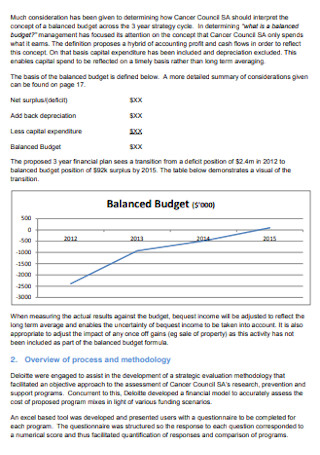

Financial Budget Plan

download now -

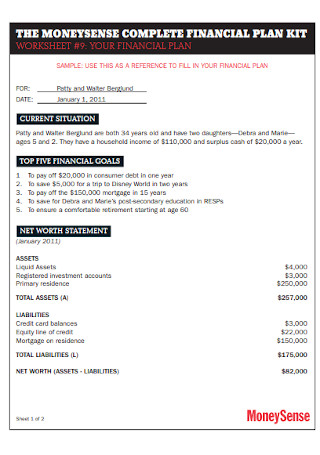

Financial Plan Worksheet

download now -

Multiyear Financial Plan

download now -

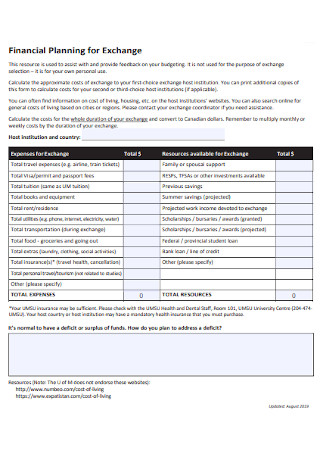

Financial Planning for Exchange

download now -

Financial Cooperative Plan

download now -

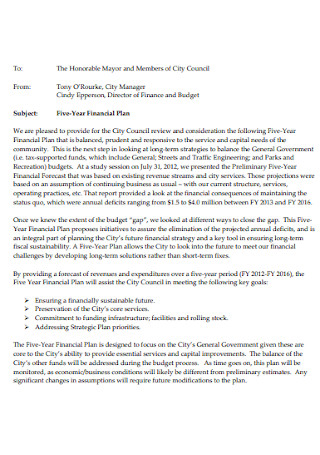

Five-Year Financial Plan

download now -

Simple Financial Plan Template

download now -

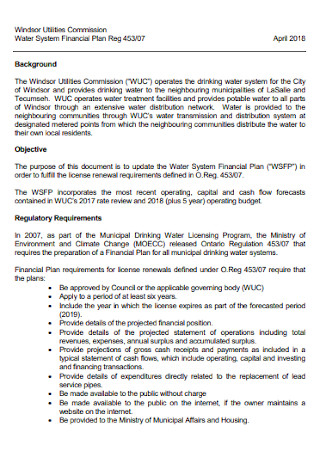

Water System Financial Plan

download now -

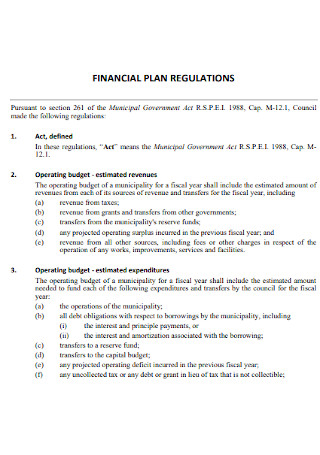

Fiinancial Regulations Plan Template

download now -

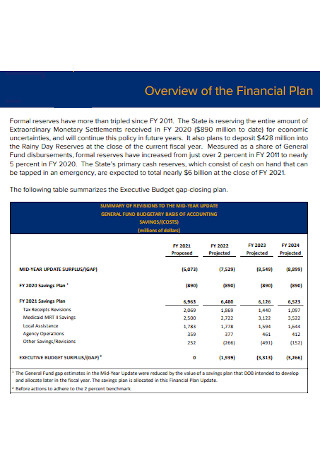

Executive Budget Financial Plan

download now -

Comprehensive Financial Plan

download now -

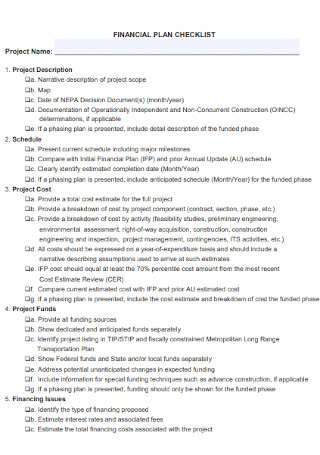

Financial Plan Checklist Template

download now -

Standard Financial Plan

download now -

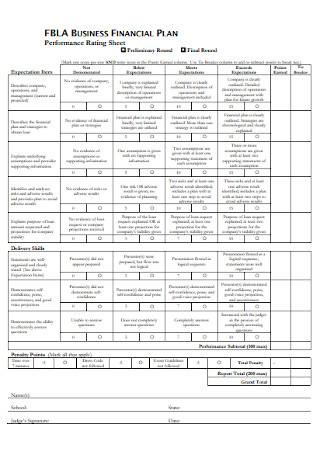

Business Financial Plan

download now -

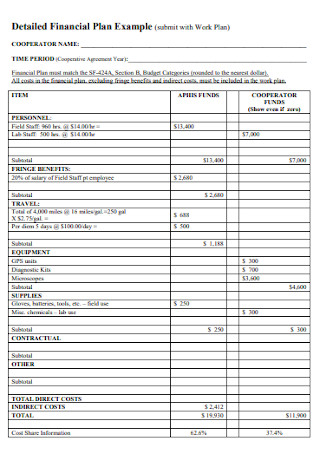

Detailed Financial Plan Example

download now -

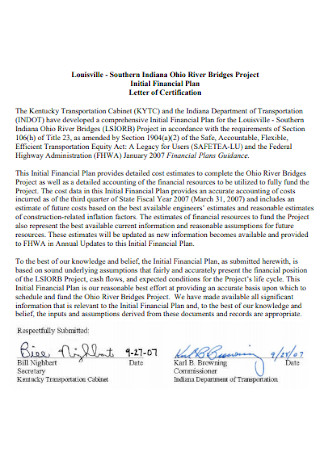

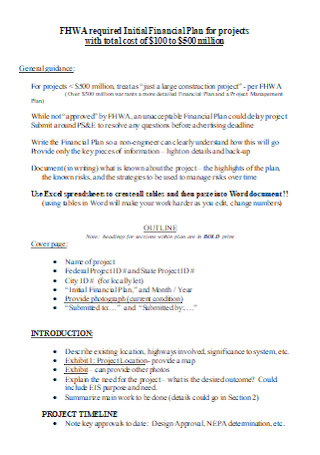

Initial Financial Plan

download now -

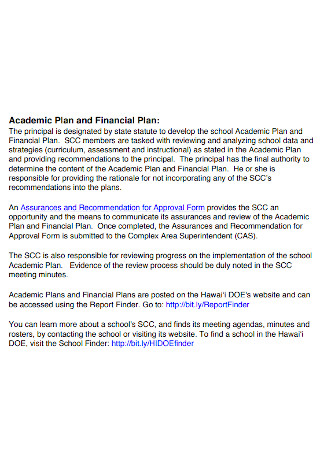

Academic Financial Plan

download now -

Formal Financial Plan Template

download now -

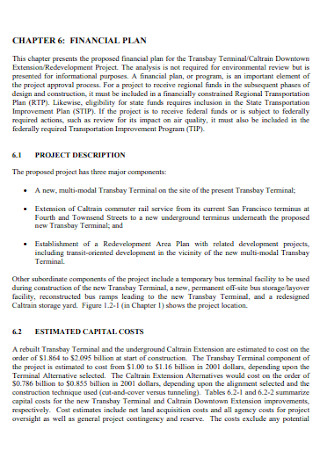

Project Financial Plan Template

download now

What Is a Financial Plan?

A financial plan is a structured document comprising an organization’s or individual’s financial status, objectives, and strategies for achieving those objectives. It analyzes current financial standing and a method for achieving desired goals. The financial plan may guide the individual or organization when making financial decisions to achieve long-term objectives. In addition, it serves as a direction for making financial decisions to pursue one’s goals. You may construct a financial plan for an employer or a personal plan for how you intend to pay the money you earn in your career. Learning the essential components of a financial plan and how to implement one can assist you in making more informed financial decisions.

Benefits of Financial Plans

Most readers will not be surprised that financial planning is essential to establishing a successful business. Depending on how far out you plan, your business plan dictates how you will conduct business over the next month, quarter, year, or longer. It includes an appraisal of the business environment, your objectives, the resources required to achieve them, team and help budgets, and any potential risks. Although you cannot guarantee that everything will go according to plan, this exercise prepares you for what lies ahead. You are essentially gambling on the best-case scenario without a defined financial plan. Consequently, what can you expect to gain from business financial planning? There are likely countless advantages to business planning, but nine stand out.

How to Obtain a Good Financial Plan

According to Schwab’s 2021 Modern Wealth Survey, those with a financial plan can pay their expenses on time and save money each month than those without one. So, what does an effective financial plan entail? While there are multiple ways to develop a plan — do it yourself, use a robo-advisor, work with a financial planner, or a combination of these identified four essential components that every project should contain, regardless of the method used to develop it.

1. Financial Goals

Your plan should begin with a list of your financial objectives, both large and small, regardless of whether you are creating it on your own or working with a professional. Numerous online tools can assist you in running the statistics, weighing competing priorities, and determining the optimal course of action. And if you have multiple goals to pursue a robo-advisor, or automated investing platform, can assist you in weighing the relative significance of each plan by needs, wants, and desires.

2. Budget and Cash Flow Planning

Planning-wise, your budget is where the substance meets the road. It can help you decide where your money is going and where you can create cuts to reach your financial objectives. A budget calculator can ensure you remember irregular but essential expenses, such as car repairs, out-of-pocket medical expenses, and property taxes. Separate your expense sheets into two categories as you compile your list: necessities, such as groceries and rent, and luxuries, such as dining out and gym memberships.

3. Debt Management Plan

Sometimes debt is treated as a four-letter term, but not all debt is undesirable. A mortgage, for instance, can help you develop equity and improve your credit score simultaneously. High-interest customer debt, such as credit card debt, significantly impacts your credit score. In addition, every dollar you pay in finance charges and interest is a dollar you cannot invest in other endeavors. If you have high-interest debt, you should devise a strategy to help you pay it off as soon as feasible. If you need to understand where to begin, a financial advisor can assist you in prioritizing your obligations and determining how much your monthly budget should go toward them.

4. Retirement Plan

According to an old rule of thumb, you will need roughly 80% of your current income in retirement. This, however, implies that retirement will relieve you of all work-related expenses and taxes, that your mortgage will be paid off, and that your children will be financially independent. It is also essential to recognize that Medicare does not cover everything and that Medicare-excluded healthcare expenses, such as long-term care, can rapidly add up. You may also spend more on travel, dining out, gifts, or financial assistance to a family member during retirement. Using a retirement savings calculator to input various scenarios can help you determine your retirement needs.

FAQs

What is first to prepare in financial statements?

First, the income statement, also known as the statement of earnings or the idea of operations, is prepared. It details revenues and expenditures and computes the company’s net income or loss.

What is the most important part of a financial plan?

Within the framework of a financial plan, budgeting, and savings objectives are established. Budgeting and savings are crucial in this situation. You can only accumulate wealth by controlling your expenses and knowing what you can save. Start monitoring and categorizing your monthly income statement and costs if you haven’t already.

What is the financial plan in the short term?

Short-term financial planning entails resolving immediate issues and formulating strategies to yield results, typically within a year. Short-term objectives should be realizable and adaptable to changing conditions.

There are compelling reasons to begin working on your company’s financial plan immediately. As discussed, the financials are a crucial component of your overall business strategy, without which it won’t be easy to evaluate your company’s performance. This exercise requires projection; you must rely on more than just current data. However, this is not the same as conjecture. Follow best practices and consider all potential outcomes; you will have an agile road map to future business success.