6+ Sample Insurance Agency Business Plan

-

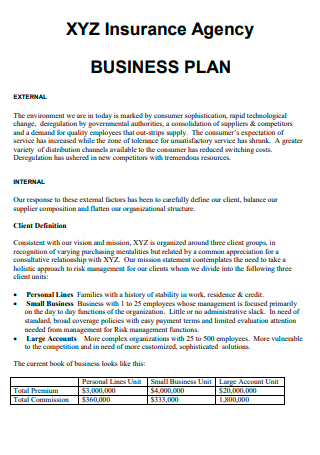

Insurance Agency Business Plan Template

download now -

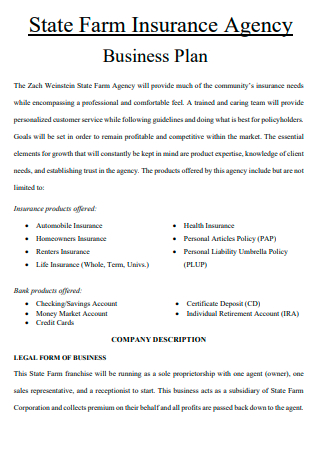

Basic Insurance Agency Business Plan

download now -

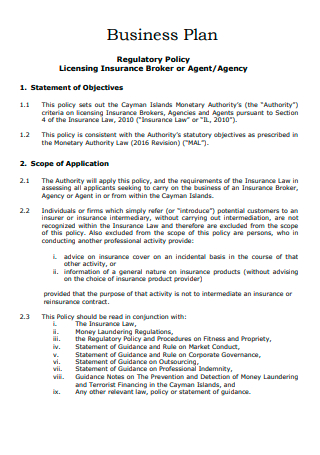

Farm Insurance Agency Business Plan

download now -

Licensing Insurance Agency Business Plan

download now -

Simple Insurance Agency Business Plan

download now -

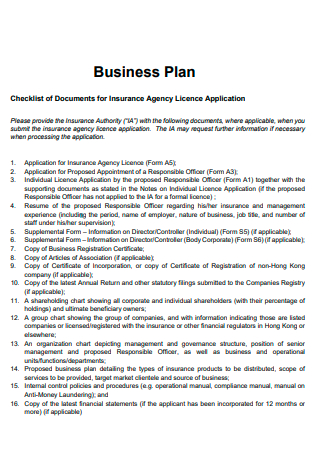

Insurance Agency Licence Application Business Plan

download now -

Insurance Agency Company Business Plan

download now

FREE Insurance Agency Business Plan s to Download

6+ Sample Insurance Agency Business Plan

What is an Insurance Agency Business Plan?

Elements of an Insurance Agency Business Plan

How to Write an Insurance Agency Business Plan

FAQs

What are the tips for an insurance agency business plan?

Is an insurance agency business profitable?

What is an Insurance Agency Business Plan?

An insurance agency business plan is a document that details the goals and objectives of an insurance agency business. It has the components that made up the business. It contains its products, detailing its market and its financial projections. The business plan is a roadmap that business owners use to run their insurance business. Whether they have state farm insurance as a product or they are in the insurance brokerage business, they need the plan so that they will have the necessary steps for their business.

Maybe your insurance business is a recruitment agency that recruits clients to have health insurance, independent insurance, or life insurance. You need a business plan that can direct you to be successful in your business. The business plan will help you to have strategies that can make your business run smoothly. You will know what to do when it comes to the marketing and sales aspect of your business. You will be able to use a great sales plan and marketing plan that you can write in the business plan. You can even have a financial plan that can help you to handle all your financials.

The insurance agency business plan can be used by any of your agents, whether they are a car insurance broker or a health insurance agent. It is necessary to have a business plan, whether it will be a general insurance agency business plan or a specific insurance agency business plan. The purpose is to ensure that you will be guided in your business. You will have an asset that you can show to clients for them to consider your products. It will also be shown to investors so that you can gather more funds for your business. There are a lot of benefits that you can get from having a business plan. It will surely make your business flourish.

To be able to create a business plan, you can refer to a sample insurance business plan or a free insurance agency business plan. You can use templates that can serve as a pattern to be used as you create your business plan. It is better that you will be guided. There can be winning business plans that you can use as a template. You can use them as you construct an insurance business plan presentation. Then you will have something to show to your clients and investors. This way, you can surely expand your business. You can be sure that your insurance business can have success because you will have a business plan that can support your business needs.

Elements of an Insurance Agency Business Plan

Are you looking for a sample insurance agency business plan? Are you doing that because you want to have a pattern to create your business plan? You must know that to create an effective business plan, you must know its elements so that it will be complete. Read the following and consider some of the elements of an insurance agency business plan:

How to Write an Insurance Agency Business Plan

Are you looking for an independent insurance agency business plan template or a health insurance business plan sample? Are you about to create an insurance agency business plan? Maybe you are looking for steps that you can follow. Well, we can provide them for you. Have the following steps in creating an insurance agency business plan:

Identify a Niche

You must first choose a market for your business. Know the target market that you will have. This will let you know how you can sell your products. It will also be useful if you will find partners who are good at selling insurance. They can help you to have a better market for your products. Be sure also that your company will pass certifications. This will give a good image to your company. Know how you can balance everything in your business. You must be able to devote some time to have a good concept for your business. To have the best that you can have, you should review markets. Make an inventory to have the best products.

Have Focus

There are many opportunities for insurance sales business. You can have a variety of products if you just know how you can handle them all. You must be able to find your ideal market. You should learn the ins and outs of the business. This can give you focus to run your company. You should know how to have additional products. Your clients should have a variety to choose from. But in doing this, you must add one product at a time. Do not add multiple products or you will have difficulty handling them.

Find Leads

Leads are important. You must find clients that can patronize your business. To do this, you can use direct leads, telemarketing, or Facebook leads. They can help you to generate clients. You should also find the best lead generation strategy. Know how you can attract clients better. When you find a good strategy, commit to it long-term. Use high-quality leads and avoid using low-quality leads.

Get Funding

Know how you can find the money for your business. You can do this by having investors that can give you funds. Investors are just around the corners. You just have to present a great business plan to them. When you get funds, start to have investments. Learn how you can expand your business. Through this, you can generate more profits.

Choose a Work Schedule

Find a work schedule that can help you to attain your goals. Have a schedule that can achieve your daily target. Be sure you can accomplish your desired sales. You should be able to make presentations that will direct you to have more clients. Make appointments to make your leads successful.

Make an Action Plan

Now, it is time to put everything into action. You must create an action plan that you can follow. Then, implement your plan. Be careful in committing the steps that you will take in your business. Do actions that can make you achieve your goals. The business plan will be nothing if it is not combined with great actions.

FAQs

What are the tips for an insurance agency business plan?

The tips for an insurance agency business plan are building a pipeline of clients, applying good marketing strategies, making a great website, using social media, having good communication, having good quotes, and maintaining a good relationship with clients.

Is an insurance agency business profitable?

Yes, it is profitable. You can use the money of clients who invested in your company to expand your business. This way, you can have a big business with a continuous flow of money.

If you are an entrepreneur, you can try the insurance business to generate good profits. All you need is an insurance agency business plan that can guide you to make your business successful. You can provide a good service to your clients and get good profits from your business at the same time. Anyway, are you needing a template for an insurance agency business plan? This post has 6+ SAMPLE Insurance Agency Business Plan in PDF. You can create your own business plan using one of these templates. Wait no more. Download now!