Internal Audit Strategic Plan Samples

-

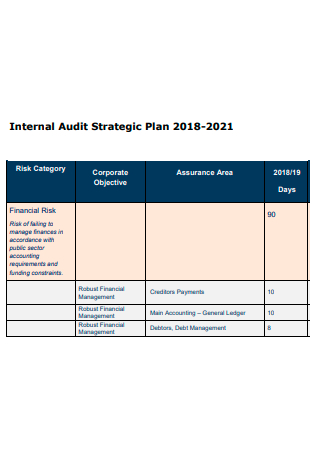

Company Internal Audit Strategic Plan

download now -

Internal Audit 5-Year Strategic Plan

download now -

Restaurant Internal Audit Strategic Plan

download now -

School Internal Audit Strategic Plan

download now -

Internal Audit Strategic Business Plan Template

download now -

Internal Audit Strategic Annual Plan

download now -

Internal Audit Strategic Plan Example

download now -

Office of the Internal Auditor Strategy and Plan

download now -

Internal Audit Strategic Planning Process

download now -

Standard Internal Audit Strategic Plan

download now -

Internal Audit Strategic Plan in PDF

download now -

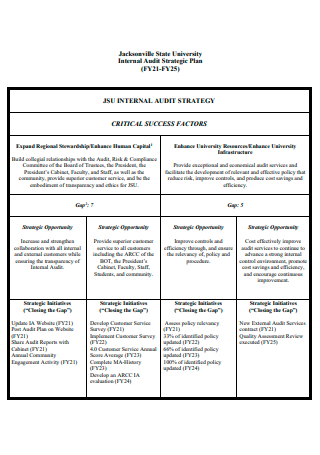

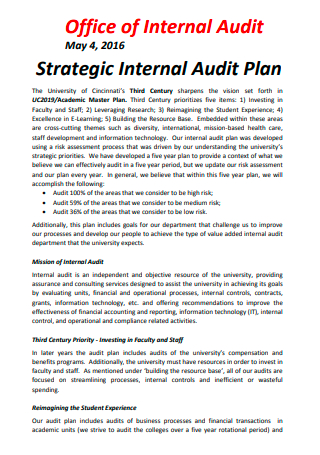

University Internal Audit Strategic Plan

download now -

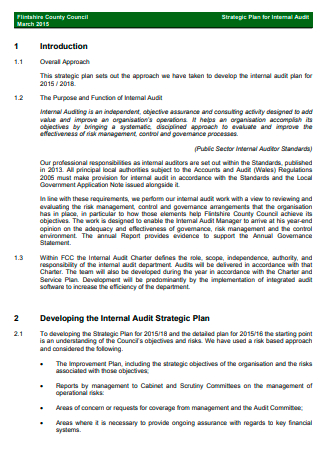

Council Internal Audit Strategic Plan

download now -

Formal Internal Audit Strategic Plan

download now -

Printable Internal Audit Strategic Plan

download now -

Office of Internal Audit Strategic Plan

download now -

Internal Audit Strategic Plan Format

download now -

Simple Internal Audit Strategic Plan

download now -

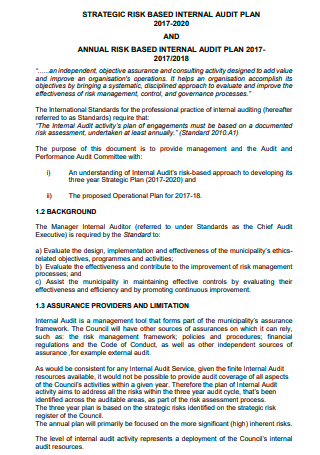

Internal Audit Risk Strategic Plan

download now -

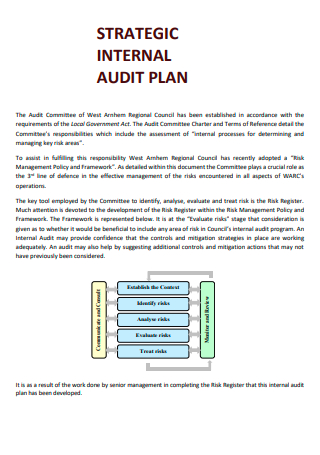

Draft Internal Audit Strategic Plan

download now -

Internal Audit Committee Strategy Plan

download now -

Sample Internal Audit Strategic Plan

download now -

Internal Audit Strategic Plan in DOC

download now

FREE Internal Audit Strategic Plan s to Download

Internal Audit Strategic Plan Format

Internal Audit Strategic Plan Samples

What is an Internal Audit Strategic Plan?

Purpose of an Internal Audit Strategic Plan

How to Create an Internal Audit Strategic Plan

FAQs

Should a strategic plan be adaptable?

What is the role of an internal auditor?

What is the difference between internal and external audits?

What role does the Internal Audit Strategic Plan play in compliance?

How does the plan align audits with organizational goals?

What are the benefits of having a flexible Internal Audit Strategic Plan?

What challenges can arise during the creation of the plan?

Download Internal Audit Strategic Plan Bundle

Internal Audit Strategic Plan Format

[Company/Organization Name]

[Year(s) Covered by the Plan]

1. Executive Summary

- A brief overview of the purpose and importance of the Internal Audit Strategic Plan.

- Summary of key strategic goals and objectives.

- Alignment with the organization’s broader goals and vision.

2. Vision and Mission of Internal Audit

- Vision Statement: A clear statement of what the internal audit function aspires to achieve.

(Example: “To be a trusted advisor, driving value and continuous improvement within the organization.”) - Mission Statement: The purpose of the internal audit function.

(Example: “To provide independent and objective assurance, advice, and insight to support the organization’s goals and mitigate risks.”)

3. Strategic Objectives

Define key objectives for the internal audit function. Examples include:

- Strengthening governance, risk management, and internal controls.

- Enhancing operational efficiency and effectiveness.

- Supporting compliance with laws, regulations, and policies.

- Developing an agile and data-driven audit approach.

- Building and retaining a high-performing internal audit team.

4. Risk Assessment and Prioritization

- Summary of the organization’s key risks and how the internal audit function prioritizes them.

- Focus areas for internal audits based on risk assessment (e.g., cyber risks, financial risks, operational risks).

5. Key Strategic Initiatives

Outline major initiatives to achieve the strategic objectives. For each initiative, include:

- Initiative Name: Title of the initiative.

- Description: A brief explanation of the initiative.

- Timeline: Timeframe for implementation.

- Owner: Responsible person or team.

- Metrics: How success will be measured.

6. Internal Audit Governance and Structure

- Role of internal audit within the organization.

- Reporting structure (e.g., reporting to the Audit Committee or Board of Directors).

- Description of audit independence and objectivity.

7. Resource and Capability Development

- Overview of the current internal audit team’s capabilities.

- Plan for resource development and training (e.g., upskilling in data analytics, industry-specific expertise).

- Technology and tools to be leveraged for audit efficiency.

8. Performance Measurement

- Key Performance Indicators (KPIs) for the internal audit function. Examples include:

- Percentage of the annual audit plan completed.

- Stakeholder satisfaction survey results.

- Timeliness of audit issue resolution.

- Value-added recommendations implemented.

9. Communication and Stakeholder Engagement

- Strategy for engaging with stakeholders (e.g., Audit Committee, management, and employees).

- Plan for regular reporting and updates on internal audit activities and findings.

10. Implementation Plan

- Steps and timeline for rolling out the strategic plan.

- Roles and responsibilities for implementing the plan.

- Resources required for successful execution.

11. Continuous Improvement

- Plan for regularly reviewing and updating the strategic plan to ensure alignment with organizational changes and emerging risks.

- Feedback mechanisms for enhancing audit processes.

12. Appendices (Optional)

- Organizational charts for internal audit.

- Glossary of key terms.

- Detailed risk assessment matrix

What is an Internal Audit Strategic Plan?

An Internal Audit Strategic Plan is a comprehensive framework that guides the internal audit team in achieving its objectives over a specific period. It defines priorities based on risk assessment, organizational goals, and regulatory requirements. This plan ensures that internal audit activities are focused, efficient, and aligned with the organization’s vision. It also acts as a document to communicate the audit function’s value to stakeholders, fostering transparency and trust. You can also see more on Compliance Strategic Plan.

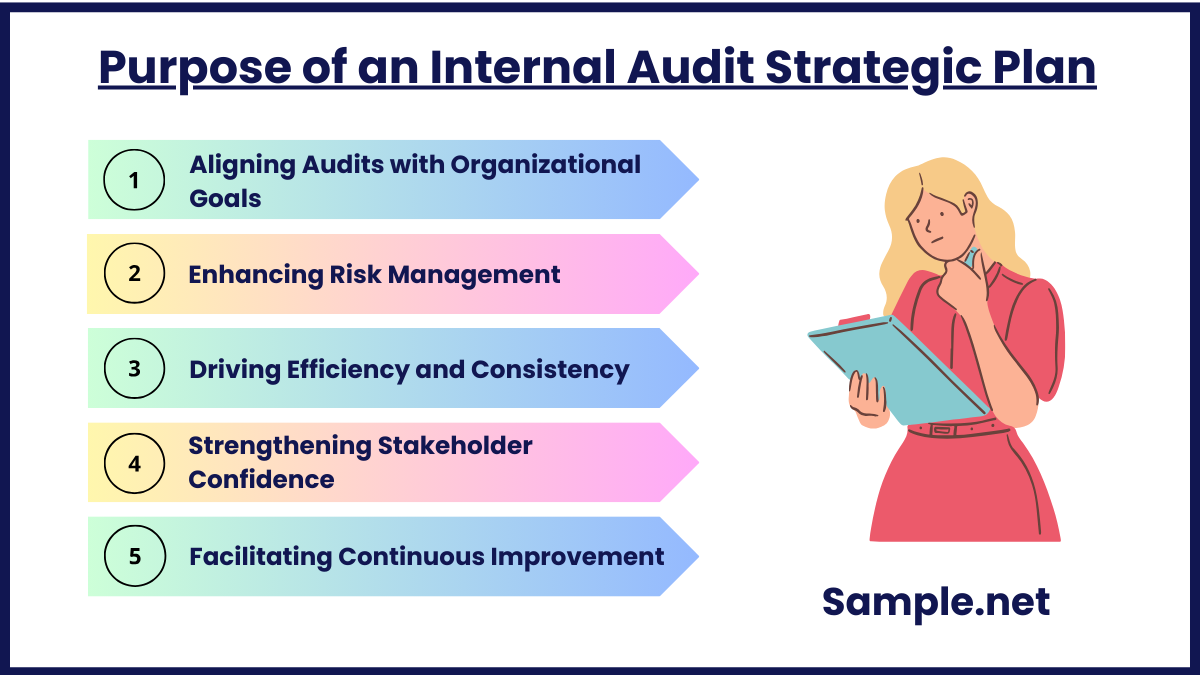

Purpose of an Internal Audit Strategic Plan

1. Aligning Audits with Organizational Goals

The plan ensures that audit activities are closely tied to the strategic objectives of the organization. By focusing on areas critical to business success, internal audits contribute directly to achieving long-term goals. This alignment enhances the relevance and impact of the audit function.

2. Enhancing Risk Management

A strategic plan identifies key risks and allocates resources to address them effectively. This proactive approach minimizes potential threats and protects the organization’s assets. By focusing on high-priority risks, the audit team adds value and safeguards organizational interests. You can also see more on Audit Corrective Action Plan.

3. Driving Efficiency and Consistency

The plan provides a structured approach to conducting audits, ensuring consistency across all activities. It establishes standardized procedures, which improve the overall efficiency of the audit process. A well-defined plan also reduces redundancies and optimizes resource utilization.

4. Strengthening Stakeholder Confidence

Communicating the audit function’s strategic direction builds trust with stakeholders. The plan demonstrates that internal audits are not merely compliance exercises but valuable contributions to organizational success. This transparency fosters confidence among management, employees, and external parties. You can also see more on HACCP Audit Plan.

5. Facilitating Continuous Improvement

The strategic plan incorporates mechanisms for reviewing and enhancing audit processes. By regularly updating the plan to reflect changing risks and objectives, organizations ensure that internal audits remain effective and relevant. Continuous improvement is essential for adapting to evolving business environments.

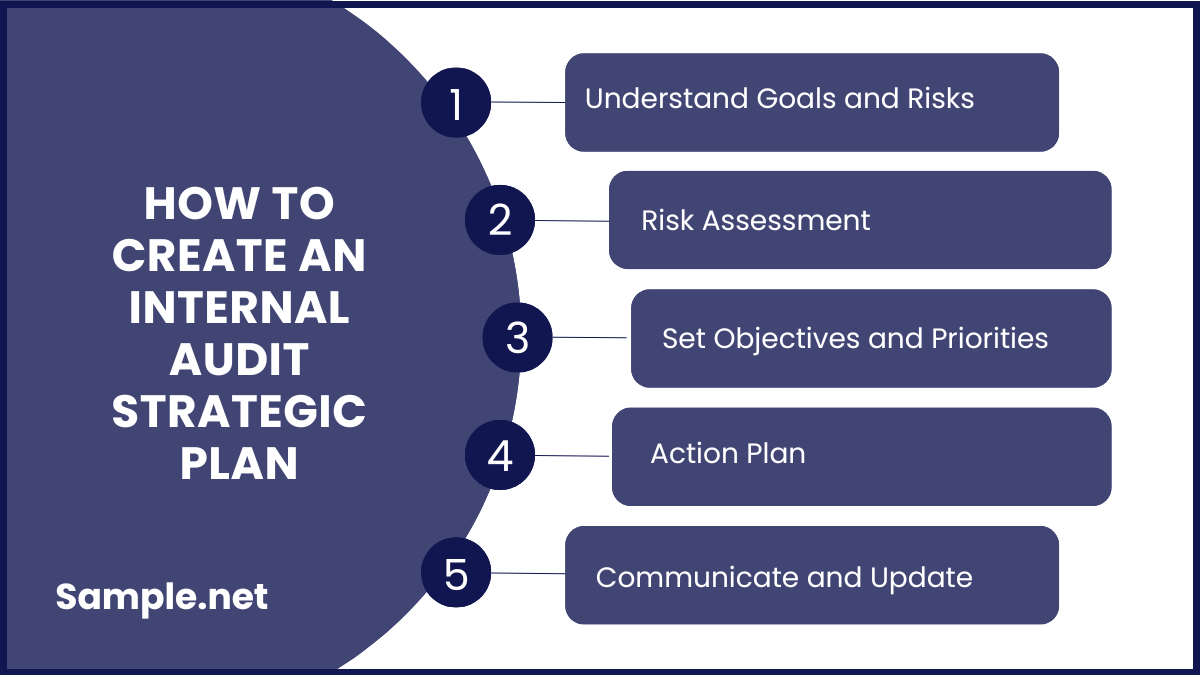

How to Create an Internal Audit Strategic Plan

1. Understand Organizational Goals and Risks

Begin by analyzing the organization’s mission, vision, and strategic objectives. Identify key risks and challenges that could impact the achievement of these goals. Engage with stakeholders to understand their expectations and align audit priorities with business needs. This foundational step ensures the plan is relevant and focused. You can also see more on Club Strategic Plan.

2. Conduct a Comprehensive Risk Assessment

Perform a detailed risk analysis to identify areas requiring attention. Categorize risks based on their likelihood and potential impact on the organization. Use this assessment to prioritize audit activities and allocate resources effectively. A thorough risk evaluation ensures that the plan addresses critical vulnerabilities.

3. Define Strategic Objectives and Priorities

Establish clear, measurable objectives for the internal audit function. These objectives should align with organizational goals and address high-priority risks. Outline the key priorities for the audit team over the planning period, ensuring clarity and focus. Strategic objectives provide direction and help measure the success of the plan. You can also see more on Quality Assessment Plan.

4. Develop a Detailed Action Plan

Create a roadmap that outlines specific audit activities, timelines, and resource requirements. Include details on how audits will be conducted, monitored, and evaluated. Incorporate flexibility to adapt to changing risks and priorities. A well-defined action plan ensures that the strategy is actionable and achievable.

5. Communicate, Monitor, and Update the Plan

Share the strategic plan with relevant stakeholders to gain buy-in and alignment. Regularly monitor the progress of audit activities against the plan’s objectives. Update the plan as needed to reflect changes in risks, goals, or organizational priorities. Effective communication and adaptability ensure the plan remains relevant and impactful. You can also see more on Payroll Review Audit Report.

FAQs

Should a strategic plan be adaptable?

Yes, a strategic plan of any type must be adaptable. This is because changes in company demands may occur throughout the operation of your strategic plan owing to a variety of causes such as adverse economic situations, industry developments, or consumer feedback. As a result, you must define sections throughout your strategy that may need to be updated if necessary. A project deadline or budget are two examples of having an element of adaptability in your strategic plan.

What is the role of an internal auditor?

An internal auditor is a certified professional who works for a company to give independent and impartial assessments of financial and operational business operations, especially corporate governance. An internal auditor’s primary responsibility is to detect and repair problems before they are identified during an external audit by another business or regulatory agency. Internal auditors often conduct a variety of activities, such as analyzing financial accounts, expenditure reports, inventories, financial data, budgeting and accounting methods, and developing risk assessments for each department. You can also see more on Preventive Action Plan.

What is the difference between internal and external audits?

Internal auditing is intended to assist firms in meeting strategic objectives, detecting fraud, and improving operations. The internal audit may be done by a company’s internal audit department or it can be outsourced, depending on the size of the business. The management directs the scope of their work, but they preserve independence and impartiality by submitting to the audit committee or the management. External audit, on the other hand, seeks to assure investors, lenders, and other stakeholders that a company’s released financial statements depict the organization’s performance in a substantially true and fair manner. External auditors must be unbiased of the firms they audit since their primary obligation is to external stakeholders.

What role does the Internal Audit Strategic Plan play in compliance?

The plan ensures that audits focus on evaluating adherence to legal and regulatory requirements. It helps organizations maintain compliance by identifying gaps, implementing corrective measures, and avoiding potential penalties. Compliance-focused audits strengthen trust and reputation. You can also see more on Data Strategy Plan.

How does the plan align audits with organizational goals?

The plan integrates the organization’s strategic objectives into audit priorities, ensuring that resources are allocated to areas that impact success. This alignment enhances the relevance of audits and ensures they contribute to achieving business goals effectively.

What are the benefits of having a flexible Internal Audit Strategic Plan?

A flexible plan allows organizations to adapt to changing risks, regulations, and priorities. It ensures that the internal audit function remains responsive and relevant in dynamic environments. Flexibility enhances the value and effectiveness of the plan over time.

What challenges can arise during the creation of the plan?

Common challenges include inadequate stakeholder engagement, insufficient resources, unclear objectives, and resistance to change. Addressing these issues through effective communication, planning, and leadership ensures the successful development and implementation of the plan. You can also see more on Risk Assessment Plan.