33+ Sample Profit Sharing Plan

-

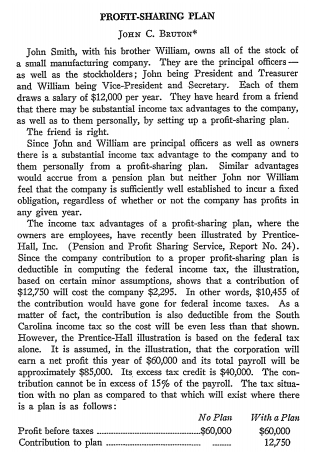

Profit-Sharing Plan Template

download now -

Basic Profit-Sharing Plan

download now -

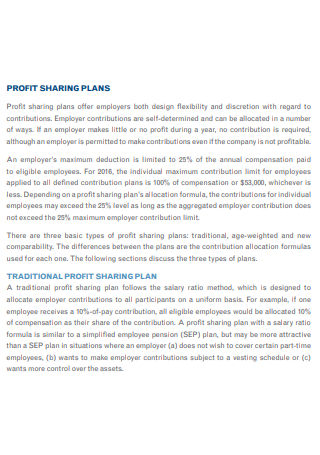

Comparability Profit-Sharing Plan

download now -

Profit-Sharing Plan in PDF

download now -

Standard Profit-Sharing Plan

download now -

Profit-Sharing Plan Example

download now -

Simple Profit-Sharing Plan

download now -

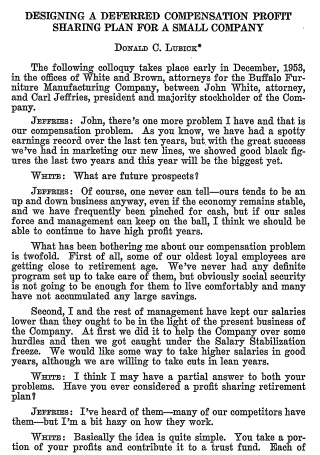

Deferred Compensation Profit-Sharing Plan

download now -

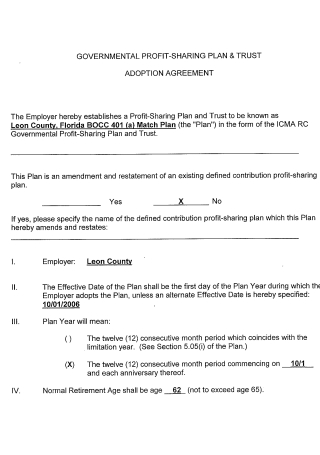

Profit-Sharing Plan and Trust Adoption Agreement

download now -

Age Weighted Profit-Sharing Plan

download now -

Printable Profit-Sharing Plan

download now -

Safe Profit-Sharing Plan

download now -

Employees Profit-Sharing Plan

download now -

Savings and Profit-Sharing Plan

download now -

Corporation Profit-Sharing Plan

download now -

Personal Profit-Sharing Plan

download now -

Profit-Sharing Plan Contribution

download now -

Owner Profit-Sharing Plan

download now -

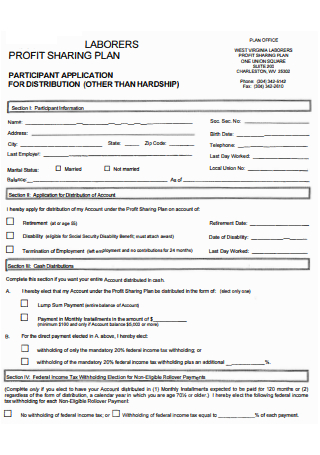

Laborers Profit-Sharing Plan

download now -

Profit-Sharing Plan Statement

download now -

Profit-Sharing Plan and Money Purchase Plan

download now -

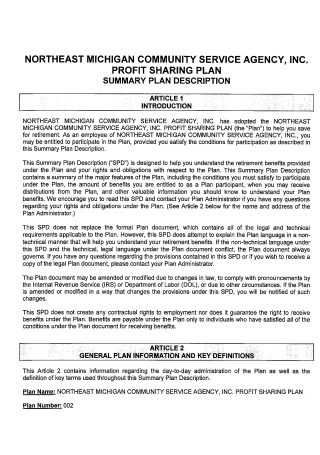

Community Service Agency Profit-Sharing Plan

download now -

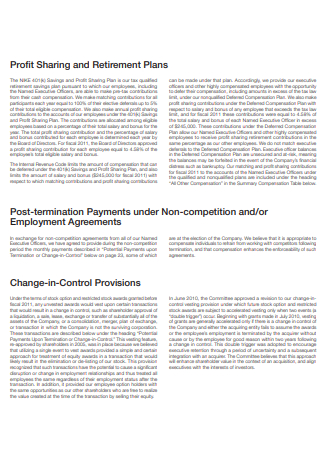

Profit-Sharing and Retirement Plan

download now -

Next Level Profit-Sharing Plan

download now -

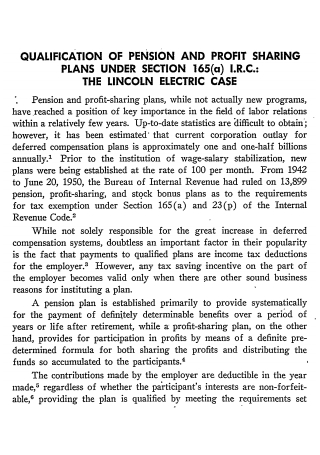

Pension and Profit-Sharing Plan

download now -

Formal Profit-Sharing Plan

download now -

Sample Profit-Sharing Plan

download now -

Employer Funded Retirement Profit-Sharing Plan

download now -

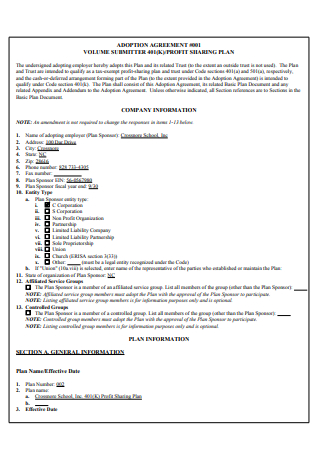

Volume Submitter Profit-Sharing Plan

download now -

Profit-Sharing Plan Design

download now -

Companies Profit-Sharing Plan

download now -

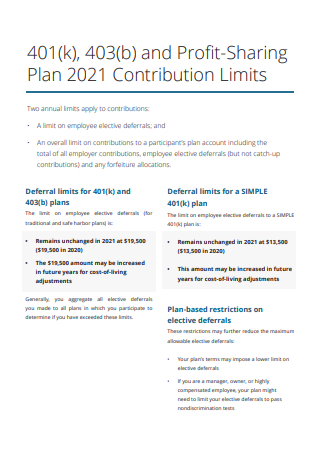

Profit-Sharing Plan Contribution Limits

download now -

Profit-Sharing Plan Format

download now -

Draft Profit-Sharing Plan

download now

FREE Profit Sharing Plan s to Download

33+ Sample Profit Sharing Plan

What Is a Profit-Sharing Plan?

Benefits of a Profit-Sharing Plan

Components of Planning

How To Set a Profit-Sharing Plan

FAQs

What impact does profit-sharing have on taxes?

What is the difference between a profit-sharing plan and a profit-sharing plan?

What is a profit-sharing bonus, and how does it work?

What is management planning?

What Is a Profit-Sharing Plan?

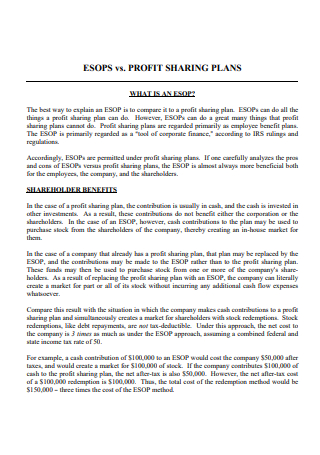

Profit-sharing plans are a type of retirement plan in which employees receive a share of the company’s profits. This type of plan is a negotiated profit-sharing plan; an employee receives a percentage of profits based on quarterly or annual earnings. This is an excellent way for a business to instill a sense of ownership in its employees, but there are typically restrictions on freely withdrawing these funds. Although there is no standard profit-sharing percentage, many experts recommend keeping it between 2.5 and 7.5 percent. Remember that there is no minimum amount that must be contributed each year, but there is a maximum amount that can be contributed that varies with inflation.

Benefits of a Profit-Sharing Plan

Most businesses recruit better employees through incentive programs like health insurance or 401(k) retirement plans. For small businesses, many incentive programs are prohibitively expensive and counter-intuitive to their rapid growth, leaving many searching for simple ways to attract new applicants and retain existing employees. Bring on the profit-sharing programs for employees! These are defined contribution plans in which an employee receives direct or indirect payments based on the profitability of the company and the employee’s salary/benefits. Such programs provide numerous benefits to small, locally owned businesses. Among the highlights are the following:

Components of Planning

Planning is a critical aspect of management. Profitability can be maximized with the right plan. When it comes to planning, several considerations must be made. These include the planning components. Each component is critical to planning.

Mission

A mission statement essentially dictates an organization’s fundamental purposes. It specifies what it wishes to accomplish. The mission statement may be explicit or implicit in the organization’s operation. A mission statement defines a business’s products and customers. It demonstrates the direction in which the firm intends to move and the objectives it wishes to accomplish. This includes the organization’s fundamental values and beliefs. The mission statement also reveals the company’s attitude toward its employees. A large number of stakeholders reference a business’s mission statement. Managers use it to assess their performance and set smart goals. Employees, on the other hand, use it to foster a sense of community and purpose. Customers and investors also use it to ascertain how the business intends to operate in the future.

Objectives

The objectives of an organization are the desired outcomes. Additionally, we can refer to them as objectives or targets. Not only planning but all aspects of business management begin with goal setting. Individualistic or collective ideals are possible. They can also be long- or short-term in duration. They can also be broad or narrow in scope. Business owners and managers should define their objectives clearly and precisely. Before setting goals, they must consider their mission and values. Additionally, they must ensure that the objectives of each activity are consistent with one another. To fulfill customer service goals, you also might set a goal of increasing your customer service employees from one to three by the end of the year or establishing a policy that guarantees consumers a return phone call by the end of the business day.

Policies

Policies are essentially declarations of intent or a course of action. They serve as the organization’s decision-making framework for all activities. As a result, they constrain the scope of decisions. For instance, a business may have a policy of continually paying a minimum dividend equal to 5% of profits. Similar to the mission statement, an organization’s policies may be expressed explicitly or implicitly. Managers establish policies for all aspects of a business, such as daily sales, production, and human resources. Policies should never be overly rigid, as this severely restricts functioning. Also, policymakers must ensure that policies are understandably communicated to employees. This will eliminate any potential ambiguities. Further, policies must evolve to address new challenges and circumstances.

Strategies

In simple terms, a strategy is a set of tiny plans of action to achieve specific goals. The achievement of the required goals is dependent on the proper implementation of the system. How an organization strategizes will be determined by its principles and missions. Numerous studies have concluded that most strategic planning efforts fail by as much as 67 percent. This is partly because the traditional approach to strategic planning is entirely backward.

Program

A program is nothing more than a sketch of a broad goal. It consists of a set of processes, procedures, and policies that the company must follow. In other words, it includes a wide range of other planning elements. A company might, for example, have a diversification strategy. As a result, budgets and policies will be created by this goal. These types of programs can be implemented at various levels by planners and managers.

Budget

Budgets are numerically expressed plans that represent expected outcomes. When a company plans to undertake anything, it can create a marketing budget to determine its goals. Budgeting is required for almost all activities, purposes, and decisions. The majority of people do not keep meticulous records of their financial transactions. While you may not recall your credit score or bank account number off the top of your head, the assumption is that you are aware of what matters most: your daily expenses. According to a 2018 study, 35% of people report missing a bill due to forgetfulness. In an age of automatic bill payment and banking apps, many people believe it is unnecessary to monitor their money until they run out — which, for many, is too late.

Procedures

Procedures are among the most crucial aspects of planning. They specify the precise steps that must be taken to complete a task. They essentially serve as a guide for managers and staff as they carry out their duties. Step-by-step methods are also included in procedures. Even rules governing acts are under the purview of processes. Strategies must always be practical, according to the planning process. They should not be stiff or challenging to put into practice.

How To Set a Profit-Sharing Plan

Deciding how much to allocate to each employee is an excellent first step in setting up a profit-sharing plan for your company. When you offer a profit-sharing plan, you have the flexibility to change it as needed, even having no payments for years when you don’t make a profit. Even if you currently have retirement plans in place, you can implement such a plan regardless of the size of your company. If you’re interested, here are some instructions on how to do it.

Step 1: Decide on what you want to achieve.

One of the most complicated steps in implementing a successful profit-sharing plan is to have a clear vision statement for the initiative’s objectives. While various methods may have a specific purpose, traditional profit-sharing programs solely provide a retirement benefit. Ascertain that you have defined the purpose and scope of your profit-sharing plan. When setting goals, it’s critical to have a sense of direction. When composing your goals, ensure that you comprehend the path leading to them. After all, a goal without a straightforward way to follow is nothing more than a pipe dream. Once you’ve written down your objective, outline the steps necessary to reach it. According to research, 92% of people who make New Year’s resolutions never follow through. That leaves 8% of us in a highly elite group of goal achievers.

Step 2: Prepare the Plan

Consider a variety of options when drafting your plan to ensure its success. It could become a significant disadvantage if they are not thoroughly considered before preparing. You must include all of the company’s divisions in the discussion, as they will share in the profits. When creating it, don’t forget to tailor your profit-sharing plan to your company’s unique needs and objectives.

Step 3: Conduct Research and Communication

Before you begin developing your profit-sharing plan, you should familiarize yourself with the factors that affect your company’s overall profit. Because not everyone is familiar with the specifics of a profit-sharing plan, it is your responsibility to educate those who participate. Ensure that you inform your employees to ensure the success of your project and your project report.

Step 4: Consider Alternatives

The key to thoroughly planning the alternatives is defining the opportunity or threat and specify the criteria influencing the alternative selection process. It would help if you considered your other options when developing a profit-sharing plan with your employees. It is not limited to deferred or cash profit-sharing plans.

Step 5: Proofread

It is required to revise the final result before it is published or distributed to employees. Verify that there are no errors and correct them immediately before your hard work results in a significant loss. Also, proofreading ensures that the important document is completely error-free and professionally polished. Proofreading is critical because it can impart strength to our writing; without it, our work is more likely to contain errors.

FAQs

What impact does profit-sharing have on taxes?

Profit-sharing plan distributions are taxable income that must be declared on an individual’s tax return. The regular income tax rate applies to distributions. Employees can contribute after-tax money to several profit-sharing arrangements. A portion of the distributions would be tax-free in this situation.

What is the difference between a profit-sharing plan and a profit-sharing plan?

A profit-sharing plan is a kind of retirement plan that allows employees to partake in a company’s profits. An employee earns a percentage of a company’s profits based on quarterly or annual earnings under this type of plan, known as a deferred profit-sharing plan.

What is a profit-sharing bonus, and how does it work?

Profit-sharing is a form of incentive compensation in which employees are given a percentage of the company’s profits. The amount delivered is determined by the company’s earnings over a specific time, usually once a year. Profit-sharing, unlike employee bonuses, is only applied when the company makes a profit.

What is management planning?

Planning is the process of considering and organizing the activities necessary to accomplish a goal. Planning is also a management process that entails establishing objectives for a company’s future direction and allocating missions and resources to achieve those objectives.

A profit-sharing plan allows employees to receive a portion of the company’s profits based on the company’s earnings and ratings. We provide a quality statement to enter into a profit-sharing agreement, available in Word documents and PDF files. This summary statement includes all needed clauses for the agreement’s most significant effects. This template is simple to download and customize, and it works with all versions of the software. It gives precise outcomes to obtain the best level of performance. You might also be interested in a business operating agreement.