13+ SAMPLE Project Financial Plan

-

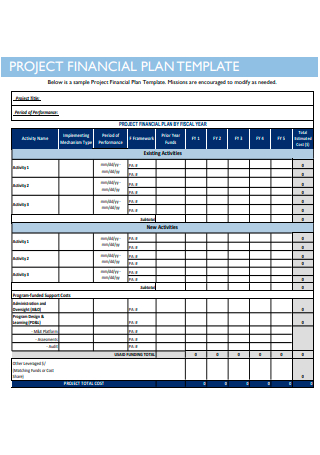

Project Financial Plan Template

download now -

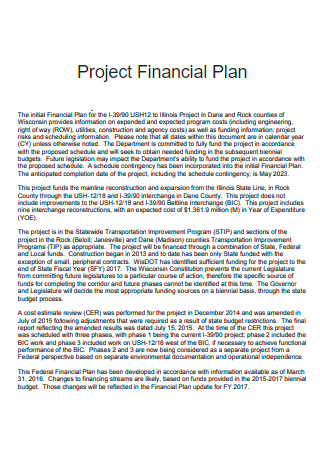

Major Project Financial Plan

download now -

Tunnel Project New Financial Plan

download now -

Project Financial Plan Update

download now -

Project Financial Plan Checklist

download now -

Project Financial Plan Annual Update

download now -

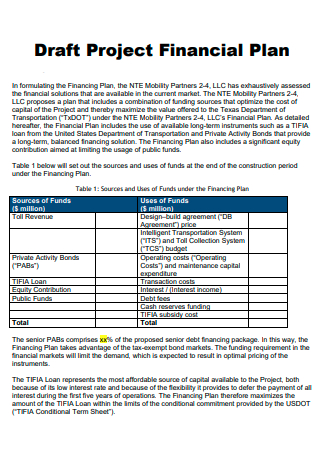

Draft Project Financial Plan

download now -

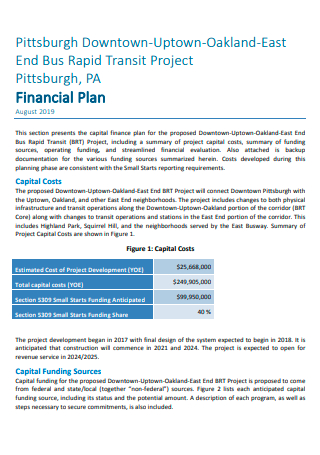

End Bus Rapid Transit Project Financial Plan

download now -

Construction Project Financial Planning

download now -

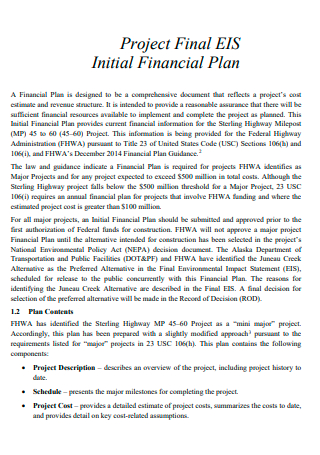

Project Initial Financial Plan

download now -

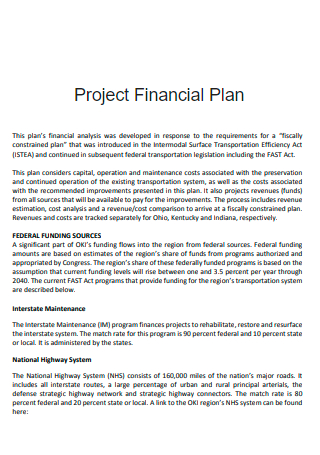

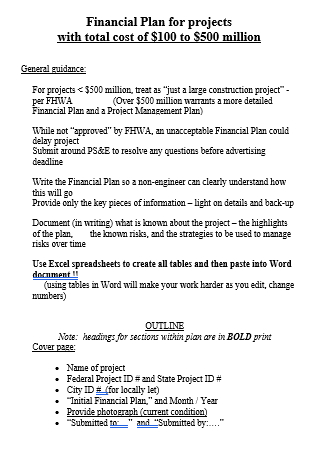

Project Financial Plan Example

download now -

Printable Project Financial Plan

download now -

Project Financial Plan in PDF

download now -

Project Financial Plan in DOC

download now

FREE Project Financial Plan s to Download

13+ SAMPLE Project Financial Plan

What Is a Project Financial Plan?

Five Components of a Financial Plan

Benefits of Financial Planning

How to Write a Project Financial Plan

FAQs

What makes a practical financial statement analysis?

Why a project budget is important?

What is the purpose of a financial plan?

What Is a Project Financial Plan?

A project financial plan defines the surrounding finances of the project, such as the resources required to fulfill specified Goals. The project financial plan describes all of the expenses that a project will spend, such as personnel, equipment, materials, and administrative costs, and an estimate of the worth of each item. Such as in a commercial project where there would be a need to consider the financial prospects. You can check out the project financial plan example prior to using the guide below in writing your own.

Five Components of a Financial Plan

Financial planning is an essential part of everyone’s life. Management Study Guide dictates that financial planning is the process of developing objectives, rules, processes, programs, and budgets for a company’s financial activities. This guarantees that financial and investment policies are effective and appropriate. The significance may be summarized as follows: appropriate funds must be ensured, a fair balance between outflow and inflow of money must be maintained to provide stability, and suppliers of funds can readily invest in organizations that practice financial planning. Purchasing the greatest savings plan to improve your budgeting process is not the only option.

Benefits of Financial Planning

As has clearly been stated numerous times, financial planning will do any business good than not having one. But if your company is not fully convinced about the use of investing time in making one, then skip out on including it in a project plan entirely. Continue reading this curated list to be further convinced of the advantages a Financial Plan has to offer for your project.

How to Write a Project Financial Plan

As a financial planner, you may be swamped with other tasks and important responsibilities in calculating the funds necessary in bringing the project to completion. This is why it is vital for you to ensure no relevant information is left behind and in a sense, ensure that all of the project financial plan contents are accurate. This is why this guide has been designed to steer you in the right direction.

1. Profit and Loss Statement

A Profit and Loss Statement, income statement, or pro forma income statement is simply an explanation of how your company generated a profit or lost money during a specific time period. It’s a table that details all of your income sources and costs during a three-month period, as well as the overall amount of net profit or loss at the bottom. The revenue, cost of sale, and gross margin will all be included. You will also include your operational expenditures, which are the costs of running your firm but aren’t immediately related to sales.

2. Cash Flow Statement

The cash flow statement is as significant as the profit and loss statement. A cash flow statement explains how much cash your company received in, how much cash it paid out, and what its closing cash balance was, often on a monthly basis. You will struggle to manage a healthy business unless you have a clear awareness of how much funds you have, where your money is coming from, where it is going, and on what timetable. You won’t be able to raise funding unless you have a cash flow statement that clearly spells out that information for lenders and investors.

3. Balance Sheet

Your balance sheet is a picture of your company’s financial situation at a specific point in time. Your Balance Sheet should include assets, liabilities, and equity. The sum of your liabilities and total equity always equals the sum of your assets. Your entire profit or loss adds to or subtracts from your retained profits at the conclusion of the fiscal year. As a result, your retained profits represent your company’s total profit and loss from its foundation.

4. Sales Forecast

The sales prediction are your forecasts of how much you expect to sell in a specific period. Your sales forecast is a critical component of your company strategy, especially when lenders or investors are involved, and it should be updated on a regular basis. Your sales estimate should be updated on a regular basis as part of your company planning process. Create a projection that is consistent with the sales figure in your profit and loss statement. In general, you will want to divide your sales estimate into groups that will be useful for planning and marketing.

5. Personnel Plan

Consider the personnel strategy to be a justification for each team member’s importance to the business. If you decide to establish a comprehensive personnel strategy, it should contain a description of each member of your management team, as well as what they bring to the table in terms of training, skill, and product or market knowledge. Consider this a rationale for each team member’s importance to the company, as well as a reason for their pay. This is also where you would add Team members or departments for which you have budgeted but have not yet employed.

6. Business Ratios and Break-Even Analysis

If you have your income statement, cash flow statement, and balance sheet, you have all the information you need to construct the traditional business ratios. These ratios aren’t required in a company plan, particularly an internal strategy, but understanding certain essential ratios is generally a good idea. Profitability ratios that are commonly used include gross margin, return on sales, return on assets, and return on investment. Debt-to-equity, current ratio, and working capital are examples of common liquidity ratios.

FAQs

What makes a practical financial statement analysis?

It is critical for every financial expert to understand how to correctly examine a company’s financial statements. This necessitates an awareness of three main areas: the financial statement structure, the economic features of the industry in which the organization works, and the techniques the firm employs to differentiate itself from rivals. You can keep these in mind when conducting a project financial plan analysis.

Why a project budget is important?

It is a necessary step in obtaining project finance. The data will notify stakeholders of how much money is needed to finish the project and when it is needed. Additionally, a well-planned budget serves as the foundation for project cost management. The project budget has a direct impact on the financial viability of the firm. A Project Budget, when estimated reasonably and with resource limits in mind, will boost the operating margin and improve the overall successful project.

What is the purpose of a financial plan?

As a guide, a financial plan walks you through life’s path. It basically helps you take control of your income, expenditures, and assets making it easy to manage your finances and achieve your goals. As a plan should provide, you are able to follow a guide without going over the necessary budget to be spent for the project.

Now that you have read through the entirety of this article, as well as the curated lists, you are more than prepared to begin writing the project financial management plan. Don’t forget to look into the available resources provided such as the examples and templates found in this article. What are you waiting for? Make one now!