13+ Sample Risk Assessment Plan

-

Risk Assessment Worksheet and Management Plan

download now -

Covid-19 Risk Assessment Plan

download now -

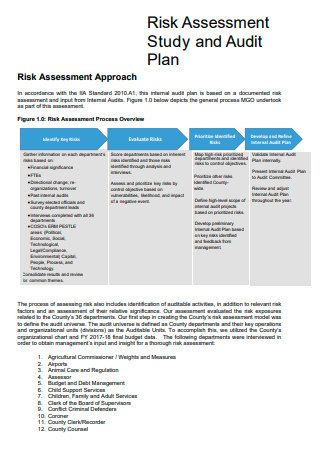

Risk Assessment Study and Audit Plan

download now -

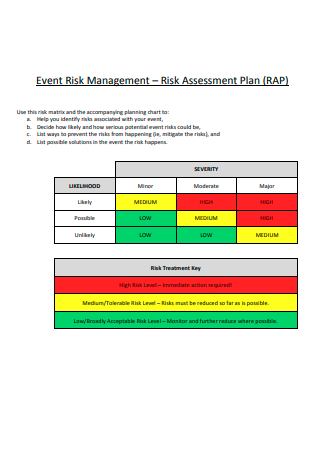

Event Risk Management Assessment Plan

download now -

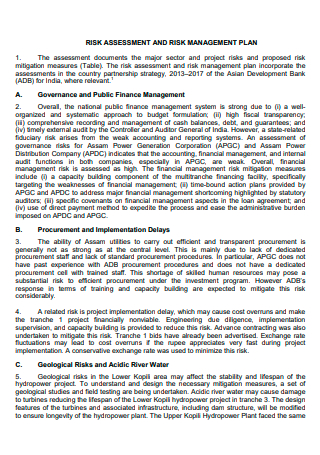

Risk Assessment and Management Plan

download now -

Risk Assessment Plan in PDF

download now -

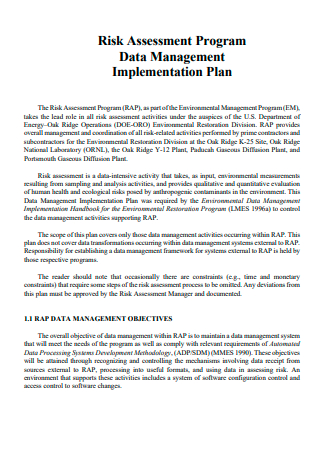

Risk Assessment Program Data Management Implementation Plan

download now -

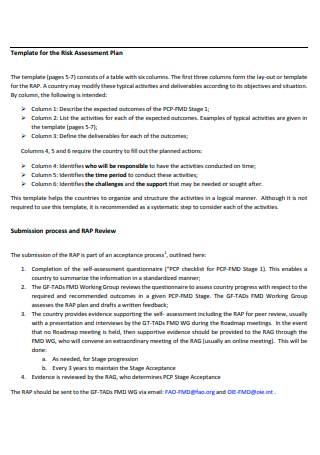

Risk Assessment Plan Template

download now -

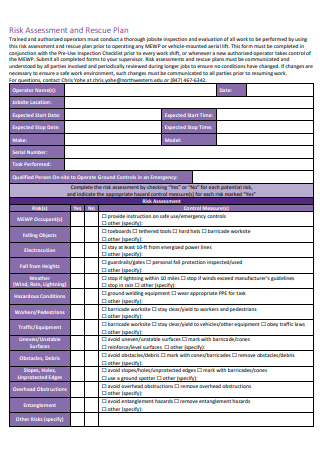

Risk Assessment and Rescue Plan

download now -

Risk Assessment and Mitigation Plan

download now -

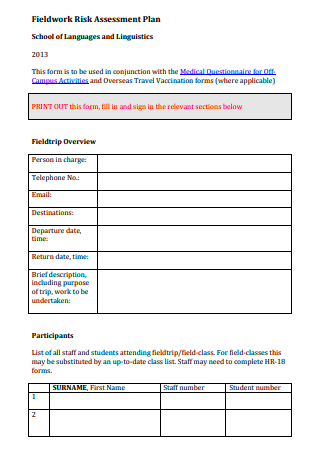

Field Work Risk Assessment Plan

download now -

Risk Assessment in Audit Planning

download now -

Quality Assurance and Risk Assessment Plan

download now -

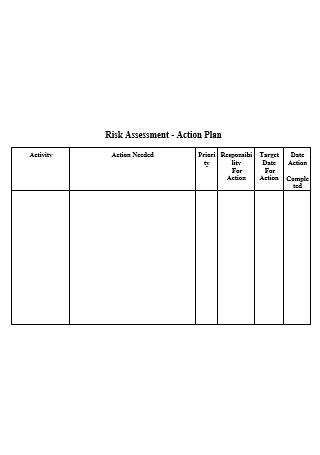

Risk Assessment Action Plan

download now

FREE Risk Assessment Plan s to Download

13+ Sample Risk Assessment Plan

a Risk Assessment?

Benefits of Risk Assessment Plans

Types of Financial Risk

How To Conduct a Risk Assessment

FAQs

How can we avert danger?

Who typically takes a risk?

What constitutes a tolerable level of risk?

How critical is planning?

What Is a Risk Assessment?

A risk assessment is a joint effort of identifying and analyzing potential events that may hurt individuals, assets, and the environment, as well as making judgments “on the tolerability of the risk-based on a risk analysis” while taking influencing factors into account. According to research, only 9% of businesses claimed a comprehensive enterprise risk management (ERM) approach nine years ago. Today, a more significant proportion of companies (31%) describe their ERM procedures as complete.

Benefits of Risk Assessment Plans

Each year, millions of money are given in workplace safety disputes. Numerous cases also garner significant media attention, placing your name in the public eye during most difficult circumstances. When you take the time to conduct a risk assessment, examine the results, and address any concerns identified throughout the evaluation. However, this comprehensive review provides numerous additional benefits that are vital to any firm. The following are eight advantages of conducting a risk assessment for your business.

Types of Financial Risk

Any business enterprise involves risk, and an adequate risk assessment report is a critical component of running a successful firm. The management of a business has varying degrees of control over risk. While some risks can be controlled directly, others are primarily out of the power of firm management. A corporation can often foresee prospective risks, assess its operations’ potential impact, and be prepared to respond to adverse events. There are numerous ways to classify a business’s financial troubles. With this, here are some types of financial risks.

1. Market Risk

Market risk refers to the danger of changing conditions in the particular market where a corporation competes for business. One illustration of market risk is customers’ growing propensity to shop online. This component of market risk has posed substantial difficulties for traditional retailers. Companies that have successfully adapted to service an online buying audience have thrived and achieved significant revenue increases. In contrast, others that have been sluggish to adapt or made poor choices in response to the changing marketplace have perished. Market risk refers to the danger of changing conditions in the particular market where a corporation competes for business. One illustration of market risk is customers’ growing propensity to shop online. This component of market risk has posed substantial difficulties for traditional retailers. Companies that have successfully adapted to service an online buying audience have thrived and achieved significant revenue increases.

2. Credit Risk

Credit risk refers to the dangers that organizations face when they issue credit to clients. Also, it might refer to the business’s own credit risk with suppliers. When a firm provides financing for purchases to its consumers, it assumes a financial risk due to the likelihood of a customer defaulting on payment. A business’s credit responsibilities must be met by ensuring that it always has sufficient cash flow to pay its accounts payable invoices on time. Otherwise, suppliers may withhold credit from the company or even cease doing business with it entirely.

3. Liquidity Risk

Liquidity risk is comprised of two components: asset liquidity and operational finance liquidity. Asset liquidity refers to the ease with which a business can convert its assets to cash in the event of an unexpected, significant requirement for additional cash flow. Liquidity in operational funding is a term that refers to daily cash flow. General or seasonal revenue declines can pose a significant danger if the organization suddenly finds itself without enough cash on hand to cover basic operating needs. This is why cash flow management is crucial to corporate success—and why analysts and investors consider free cash flow when evaluating companies for equity investment.

4. Operational Risk

Operational hazards refer to the many dangers that can occur due to a business’s routine operations. Litigation, fraud, personnel issues, and business model risk all fall under the operational risk area. Business model hazard refers to the possibility that a company’s marketing and growth models are erroneous or insufficient.

5. Funding Liquidity Risk

Liquidity risk associated with funding is distinct from market liquidity risk. The risk associated with funding liquidity is that a bank will not pay its debts as they mature. In plain terms, it is the risk that the bank may be unable to meet the demand for deposit withdrawals from consumers. On the other side, market liquidity risk refers to the possibility of not selling assets on time without offering a significant discount. According to research, funding liquidity difficulties frequently result in market liquidity risk and vice versa.

How To Conduct a Risk Assessment

Risk assessments are critical in any industry when it comes to establishing a safe work environment. Employers and self-employed contractors are also required by law to conduct risk assessments before undertaking work that may act as a health or safety risk. A thorough risk assessment will safeguard employees, contractors, and the general public. It should detect hazards and take actions to prevent occupational accidents and illness. The Health and Safety Executive has highlighted five procedures that contractors and organizations should follow when conducting risk assessments.

Step 1: Identify potential hazards.

The first stage in conducting a risk assessment is to identify and locate any potential dangers. Numerous hazards should be considered. Physical hazards include tripping and falling in the workplace and accidents sustained while lifting large goods or operating dangerous gear. Physical and chemical dangers such as asbestos, chemical cleaning chemicals, and infectious diseases must be considered. Also, risk assessments should consider psychosocial risks that might harm an individual’s mental health and well-being, such as stress, victimization, and excessive workload. Because each workplace is unique, the threats you discover will vary according to your industry and the exact location. By just strolling around the workplace and noting everything that could cause injury, you may be able to identify certain physical risks. However, you could review your accident and illness records to determine if patterns emerge to discover less obvious dangers. Alternatively, peruse instruction manuals for products and equipment used in the workplace can provide information on any hazards associated with working with these items.

Step 2: Determine who might suffer harm.

Once you’ve identified the dangers in your workplace, you should analyze why they’re dangerous — what types of accidents or illnesses could result? Hazards might provide a single threat, or they can be detrimental in multiple ways. Along with describing how risks may cause harm, risk assessments should determine who is at stake. This may include all employees on-site, specific groups of employees, tourists, or passers-by. Recognize who may be at risk to assist individuals and organizations in keeping people safe.

Step 3: Evaluate the risks and take preventive action.

This level focuses on establishing a safe work environment. Evaluate the likelihood and severity of risks and then implement appropriate safeguards and controls. While you are not required to eliminate risk, as this is frequently not practicable, you should take action equal to the risk level. This suggests that dangers that pose a more significant threat should be subjected to more stringent controls than low-risk hazards. This stage may include testing less dangerous equipment or goods, restricting access to hazardous places, providing adequate health and safety training, and providing protective equipment to employees and contractors.

Step 4: Make notes of your discoveries.

By documenting the results of your risk assessment, you can refer to them and examine them in the future. It is also a legal requirement for firms with five or more employees to document the results of risk assessments and the actions taken to mitigate the risk. A written risk assessment demonstrates that dangers have been identified and suitable action has been taken to reduce risk. This documentation can help shield your firm from legal liability and can also be used to educate contractors and workers about potential workplace hazards. Research indicates that consumers retain less than half of the information delivered. After a single day, people forget more than 70% of what they learned during training. After six days, 75% of the material learned during training is ignored.

Step 5: Conduct a risk assessment review.

Workplaces are constantly changing – new employees arrive and depart, equipment and products are exchanged and trialed, and new materials are introduced. And as the workplace changes, the risk assessment becomes less valuable. To ensure that risk assessments are current and include all potential dangers, they should be reviewed and revised whenever substantial changes occur in the workplace. While it is up to you to choose when a review is necessary, keep in mind that the risk assessment is a living document that should be updated as your business’s experiences evolve. As a general rule, risk assessments should be revisited annually.

FAQs

How can we avert danger?

Risk can be mitigated in two ways: loss prevention and loss control. Medical care, fire departments, night security guards, sprinkler systems, and burglar alarms are all examples of risk reduction—attempts to mitigate risk by preventing loss or reducing the likelihood of occurring.

Who typically takes a risk?

Men are more willing to accept financial risks. However, women take more social threats, such as beginning a new career in their mid-thirties or speaking their mind in a work meeting over an unpopular issue. This discrepancy appears to be because men and women perceive risk differently.

What constitutes a tolerable level of risk?

The term “reasonable risk” refers to the possibility and magnitude of harm or pain anticipated in the research being more remarkable than those encountered in ordinary life or during routine physical or psychological evaluations or testing.

How critical is planning?

It assists us in precisely defining our objectives. It forces us to think clearly and concretely about what we need to do to have the desired effect on society. It assists us in ensuring that everyone understands our objective and the steps necessary to achieve it by incorporating everyone in the planning process.

As with risk assessment phases, the particular objectives of risk assessments will very certainly differ by industry, business type, and applicable compliance regulations. The risk assessment process’s ultimate goal is to evaluate hazards and establish the inherent risk posed by those hazards. Dangers and possible impacts should be identified, and potential control methods to mitigate any negative impact on the organization’s business processes or assets should be placed.