Budget Planner

-

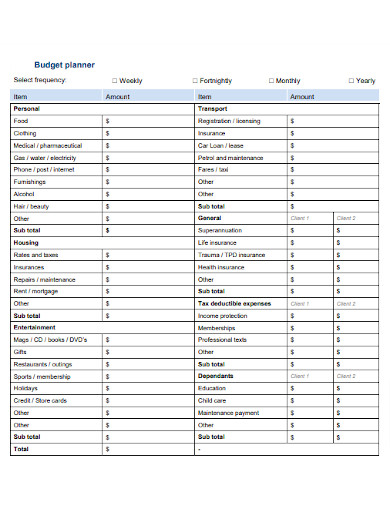

Budget Planner

download now -

Hotel Budget Planner

download now -

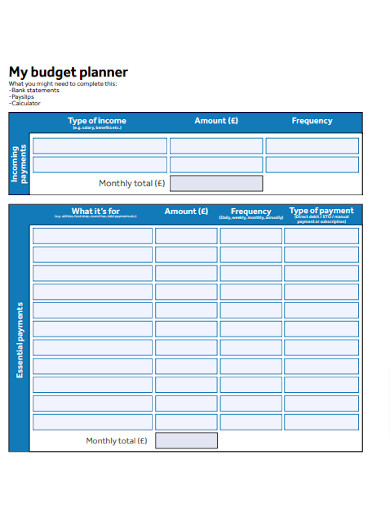

Free Blank Budget Planner

download now -

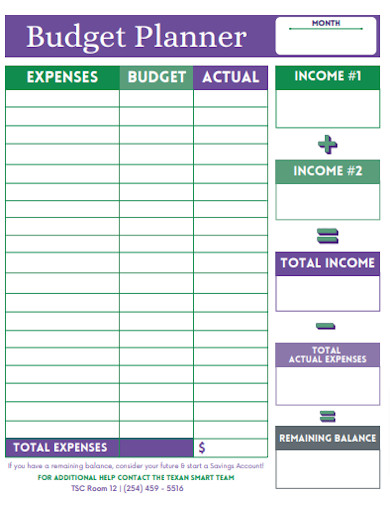

Basic Budget Planner

download now -

Custom Budget Planner

download now -

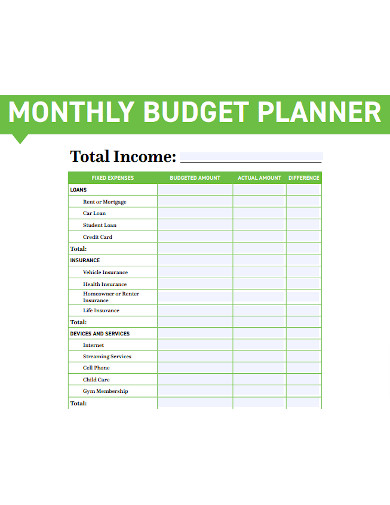

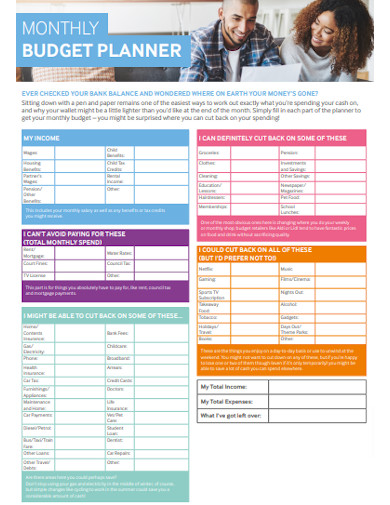

Monthly Budget Planner

download now -

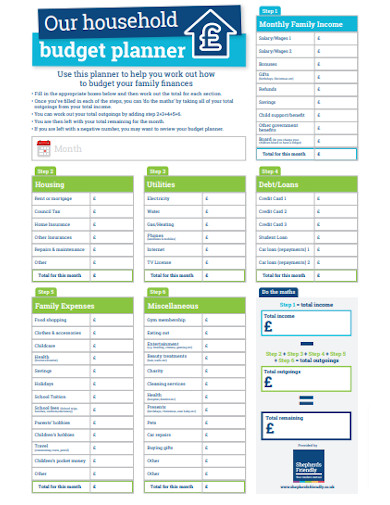

Household Budget Planner

download now -

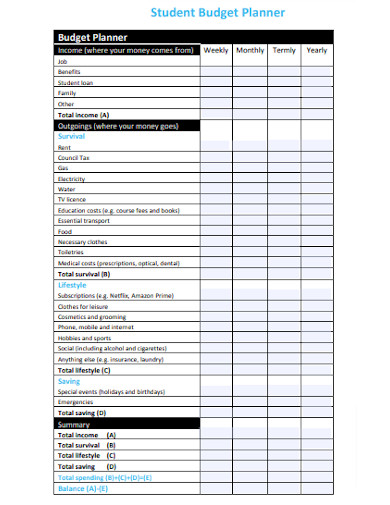

Student Budget Planner

download now -

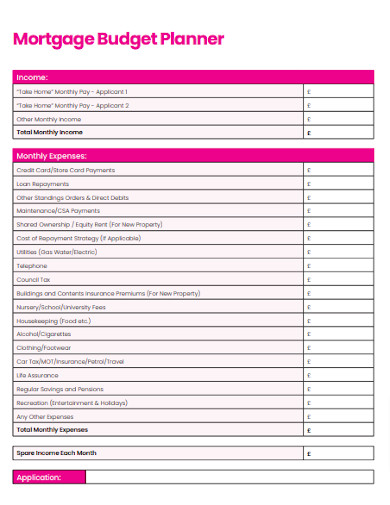

Mortgage Budget Planner

download now -

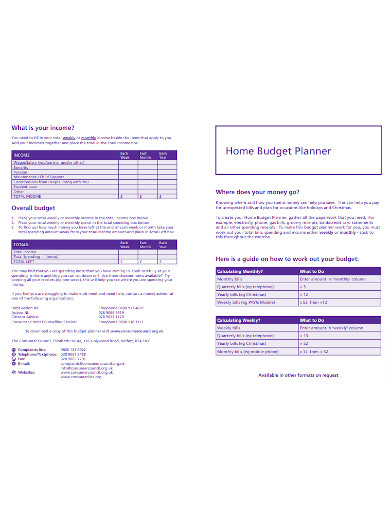

Home Budget Planner

download now -

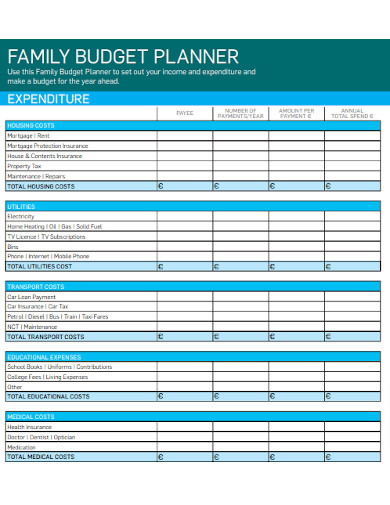

Family Budget Planner

download now -

Simple Budget Planner

download now -

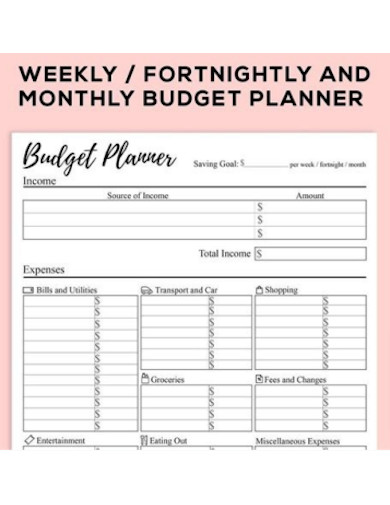

Fortnightly Budget Planner

download now -

Spreadsheet Budget Planner

download now -

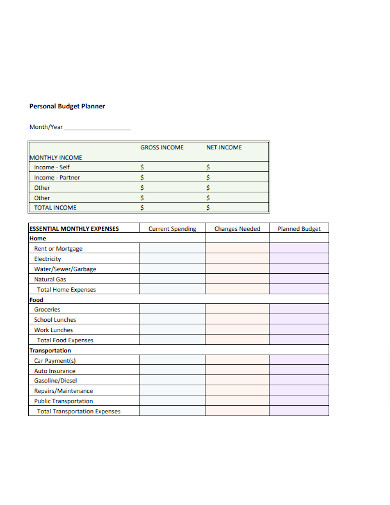

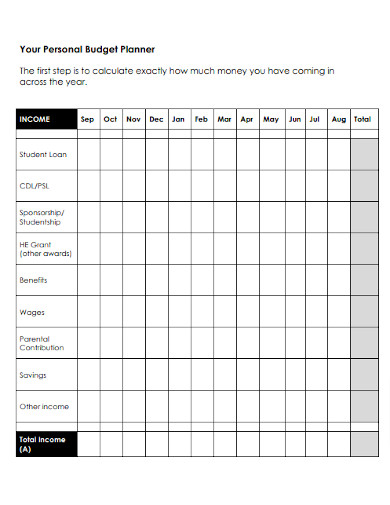

Personal Budget Planner

download now -

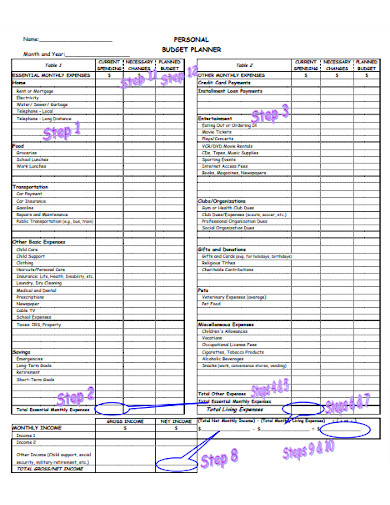

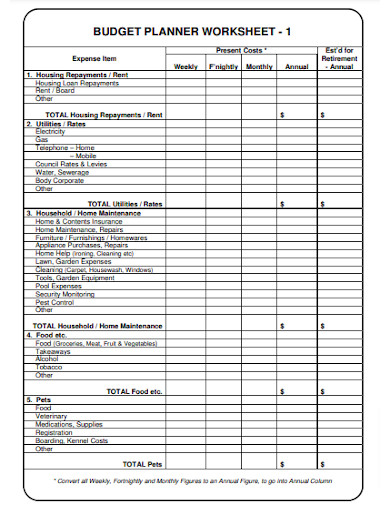

Worksheet Budget PlannerWorksheet Budget Planner

download now -

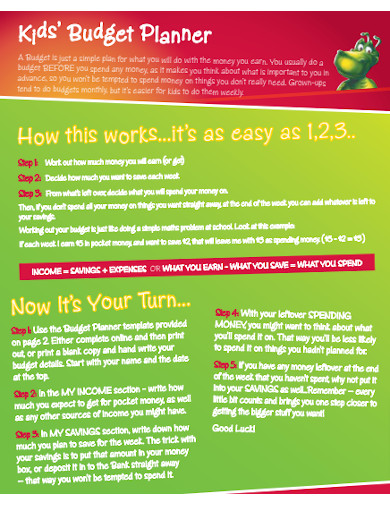

Kids Budget Planner

download now -

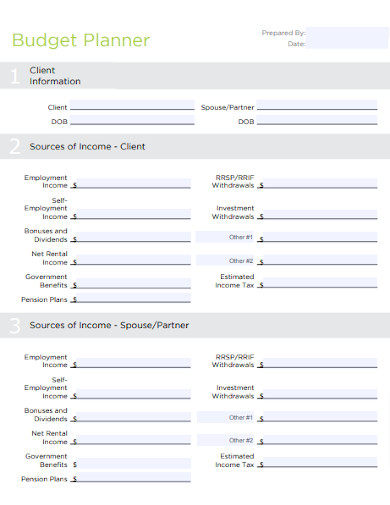

Sample Budget Planner

download now -

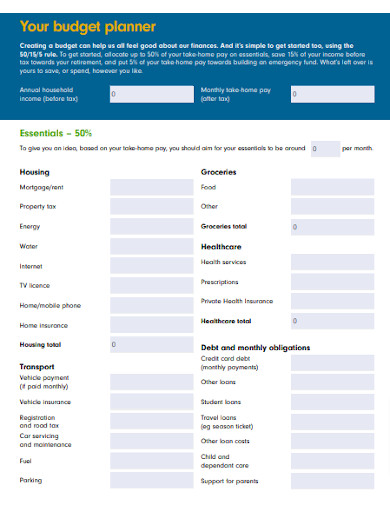

Savings Budget Planner

download now -

Editable Budget Planner

download now -

Single Person Budget Planner

download now -

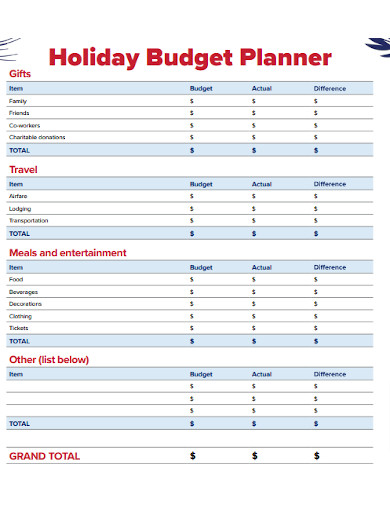

Holiday Budget Planner

download now -

Income Budget Planner

download now -

Budget Planner Outline

download now -

Apartment Budget Planner

download now -

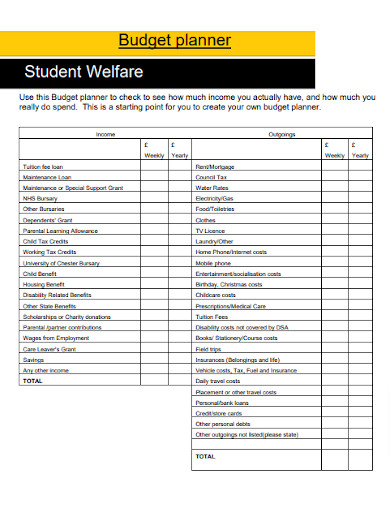

Student Welfare Budget Planner

download now -

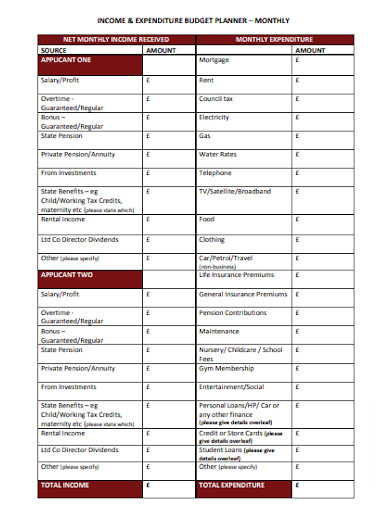

Income-Expenditure Budget Planner

download now -

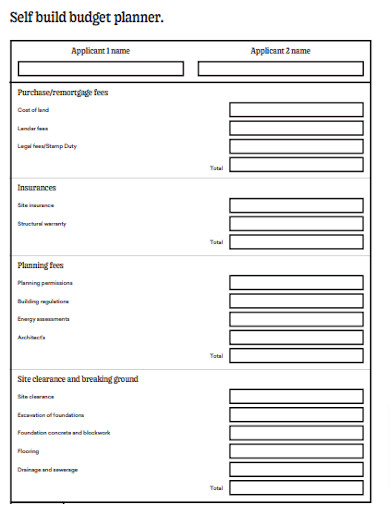

Self Build Budget Planner

download now -

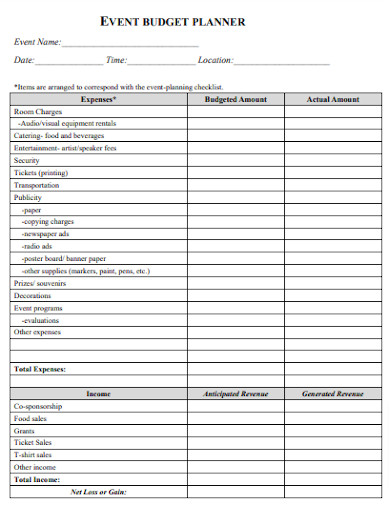

Event Budget Planner

download now

What is a Budget Planner?

A budget planner is a tool or system that can help us manage our finances. Budget planners can help us monitor our income, savings, and expenses. We can organize our financial goals through a budgeting planner. Whether we are going to create a project budget, small business budget, or home budget, a budget planner can help us so that we can be sure that we can allocate sufficient funds for everything. Some examples of budget planners are a monthly budget planner, a weekly budget planner, a vacation budget planner, a wedding budget planner, a family budget planner, and a home budget planner.

Making budget plans can be most effective when we are going to use a budget planner. If you want to have the best budget planner, you can search for a good online budget planner or a free budget planner. You can have a budget planner book or a budget planner worksheet. Or you can use a budget planner app. Through budget planners, you can have a comprehensive overview of your financial situation. Responsible spending will be at hand and it will be easy for you to make informed decisions when it is about money. Thus, you can meet your financial goals by using budget planners.

Benefits of a Budget Planner

Budget planners can be spreadsheets, computer software, or mobile apps. They can also be in pen and paper. Through a budget planner, you can track your money and set spending limits. It is easy for you to monitor your progress in your financial goals. This makes you prioritize expenses and identify areas where you need to cut back. It enables you to allocate funds for all your expenses. These are not the only things that a budget planner can do. They can also give you the following advantages:

How to Use a Budget Planner

Have you not used a budget planner for a long time? Is it just now that you decide to use a budget planner again after reading the benefits of a budget planner? The following steps can refresh your mind on what to do in using a budget planner:

1. Set Up Your Budget Planner

The first thing to do is to prepare a budget planner that you are going to use. Are you going to have a digital spreadsheet or are you going to use a physical planner? The choice is up to you.

2. Know Your Income

Determine your income. List all the sources of your income. Then calculate your income. Know if you need to have more income because you have too many expenses or you want to have some savings.

3. Track Your Expenses

In your budget planner, record all your expenses. Include everything, whether it is a small expense or a big expense. This is the only way to get an accurate overview of your spending habits.

4. Allocate Budget Amounts

After knowing your income and expenses, you can start allocating a budget for everything that you need. Consider your priorities and long-term goals. Be realistic in allocating the budget.

5. Monitor Your Progress

Keep track of your budget planner regularly. Update it when necessary. Always review your budget to monitor your progress. Through this, you can meet your financial goals.

FAQs

What are the tips for a budget planner?

The tips for a budget planner are setting realistic goals, creating an emergency fund, reviewing the budget planner, using technology or app, involving family members, staying motivated, and planning for irregular expenses.

When should I update the budget planner?

For best results, update your budget planner regularly. Do this weekly or monthly. Necessary adjustments are needed so updating the budget planner is a must.

All of us want to have financial stability. If we are not that rich, the only thing that we can do is to budget. And by using a budget planner, we can have discipline so that we can handle our finances well. You see, budgeting can help you so that you can meet your financial goals. Good luck with using budget planners!