4+ Sample Vehicle Payment Plan

FREE Vehicle Payment Plan s to Download

4+ Sample Vehicle Payment Plan

What Is a Vehicle Payment Plan?

Types of Vehicle Payment Options

Advantages of A Vehicle Payment Plan

How To Create A Vehicle Payment Plan

FAQs

Is Paying in Installments Preferable to Paying in Full Upfront?

What Is the Longest Car Loan Term Available?

Is it Possible for Me to Get a Car Loan?

What Is a Vehicle Payment Plan?

A car payment plan can be anything from an assistance payment plan when purchasing a vehicle to a guideline for its payment when it comes to its registration and taxes. And its purpose is to assist consumers in creating or receiving help with their car installment plan. It is a written or computerized form that contains all vehicle information, customer information and contact details, as well as payment information. Because buying a car in full cash necessitates having a large sum of money on hand at all times, many people decide to look for auto pay monthly deals. Since going into installment is comparable to signing a house rental agreement in that both require monthly payments, it reduces the load on their monthly household budget.

As a result, people have the option of taking out a personal loan or entering into a vehicle financing agreement with the dealership itself. The goal of the car payment plan is to provide a guide for anyone looking to buy a new or used vehicle in terms of the amount they should pay monthly, the interest earned, the length of their payment, and the initial deposit. This should offer consumers a good idea of what they’re getting into when buying a new car. However, there are alternatives to pay off your car faster, which the Greater Texas Credit Union has enumerated. Seeing as paying off an installment faster reduces the amount of interest you pay until you can ultimately cross it off your debt payoff tracker.

Types of Vehicle Payment Options

Everyone looking to purchase a vehicle has a choice in terms of how they will pay for it. That would, however, be dependent on the existing financial situation. So, first, learn about the several types of vehicle payment alternatives available to you.

Advantages of A Vehicle Payment Plan

It’s far preferable to plan ahead of time because it allows you to prepare for any unforeseen circumstances. When it comes to payment plans, however, it will provide you with a presentation of how you will proceed and make your payments in a more customized manner. Here are some of its benefits.

How To Create A Vehicle Payment Plan

Depending on its intended use, various details may be included in your vehicle payment plan. But here are the steps to creating one.

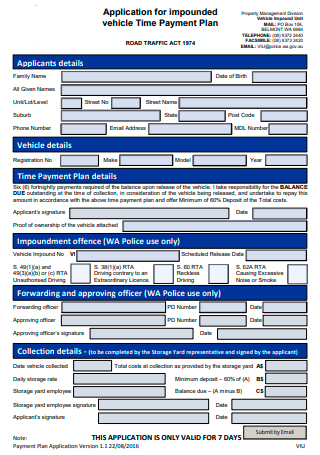

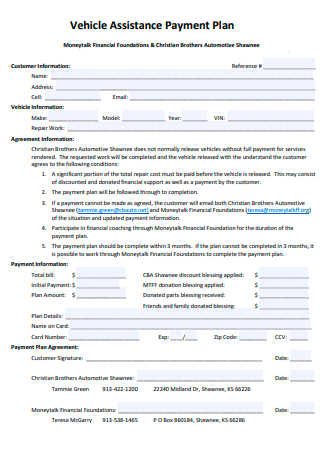

Step 1: Customer Information.

All of your customer’s information should be included in your car payment plan. It should include information such as the customer’s name, address, age, and contact details. Basic data information would easily distinguish them from the rest if there were a large number of consumers. As a result, it is critical that accurate client information is recorded. That information alone is a guarantee of any ongoing transaction, and it would identify the person who is both authorized and held accountable.

Step 2: Vehicular Details.

There are several cars that are similar. However, it is critical to record its color, specific model or brand, and registration information that makes it stand out from the rest. When it comes to impounding the vehicle or collecting it from the owner, having the data on hand makes it much easier to identify. It does not have to be recognizable, but any visible distinctive elements should still be documented. The make and model will also make it easier to repair because it will advise the technician of what precise parts they need to look over, and on the owner’s side, they will know what is included in their car parts payment plan.

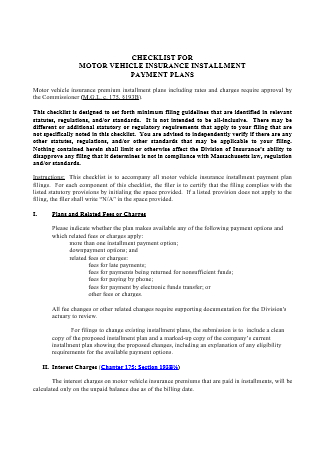

Step 3: Agreement Information

It is best to have the commitments and expectations set down in any contracts and agreements. In this scenario, what is anticipated of the buyer in terms of payments, and what are the repercussions of failing to pay in full? This could include warranties and guarantees on both sides of the table. What is contained inside the agreement material would define the rules and penalties in the event that any party failed to fulfill their role and obligations. And, in terms of repairs, what is expected in terms of prices and where it is headed? As a result, it is preferable to know that all parties agree on the decision in order to avoid future disagreements.

Step 4: Payment Information

Payment information would comprise the total bill, the initial amount paid, monthly payments, any applicable discounts, and, if paid by credit card, secured information such as the Credit Card Number and the name on the card. This information is critical in determining how the payment will be made and who will be charged for the bills. It is also possible that the individual acquiring the vehicle is not the same person who will pay for it. As a result, minor nuances like these are important.

Step 5: Payment Plan Agreement

This is where the customer’s and the vehicle dealership’s service representative’s signatures are placed. It is typically inserted at the end of the vehicle payment plan to authenticate the transaction. Both parties’ signatures and dates would be used to finalize the payment plan and the automobile purchase.

FAQs

Is Paying in Installments Preferable to Paying in Full Upfront?

This is entirely dependent on the ability of the person who will be paying for any type of purchase. Why not? If you are convinced that you can handle the consequences of withdrawing a substantial sum of money, or if it will not have a massive effect on your finances. A complete upfront payment would alleviate your concerns and provide you with immediate ownership of your product. However, because there is a danger of family emergencies and other necessities, going for installments may be preferable if making a complete cash payment would disrupt the budget for such. Because it will allow you more discretion and breathing room in managing your finances and tracking your money.

What Is the Longest Car Loan Term Available?

Two of the longest vehicle loan terms that car dealerships can provide are approximately 72 months (6 years), and the longest would most likely be 84 months (7 years). However, this is not encouraged. The longer your payment term, the more interest you pay on top of additional fees. This means that by the time you ended your loan, you may have already paid twice the amount of your vehicle’s purchase price. Although longer terms result in lower monthly payments, they also result in longer and larger payments.

Is it Possible for Me to Get a Car Loan?

First and foremost, you should speak with your bank or the dealership about your eligibility. Because asking for a loan may be more difficult if you have poor credit or an unstable source of income. Second, make sure you have all the necessary documents, such as your personal information, proof of income, home or rental billing statements, and financial statements, because your lender may prefer to know details that point to financial stability because they would like a guarantee that proves you are able to pay for what you are going to loan. However, compiling these documents does not guarantee that your application will be approved. That would still be fully dependent on the bank or creditor.

So, before you make a purchase, think about how it will benefit your life and, more importantly, how it will affect your financial situation. Consider whether what installment plans would not burden you and allow you to confidently reach the end of the road. And, on your way in, pick up these sample vehicle payment plans before you buy it!