6+ Sample Profit and Loss Projection

-

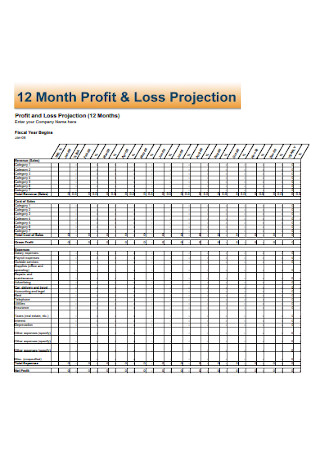

Profit and Loss Projection Template

download now -

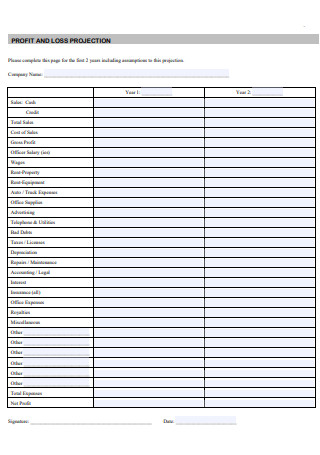

Sample Profit and Loss Projection

download now -

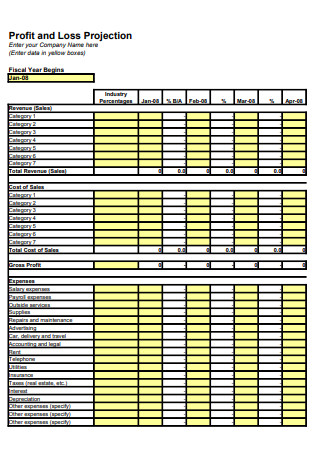

Profit and Loss Projection Example

download now -

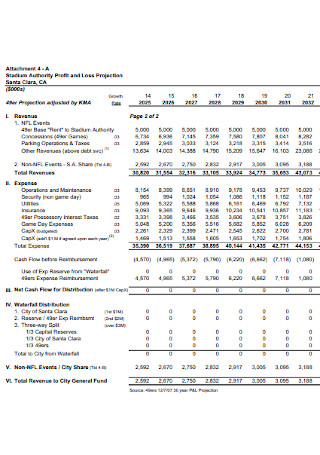

Stadium Authority Profit and Loss Projection

download now -

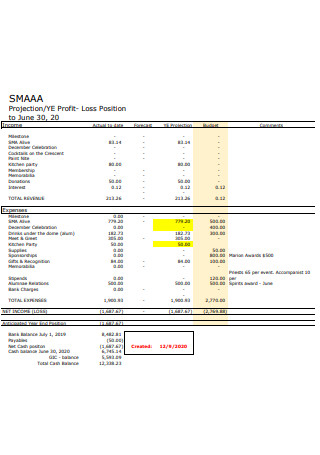

Profit and Loss Position Projection

download now -

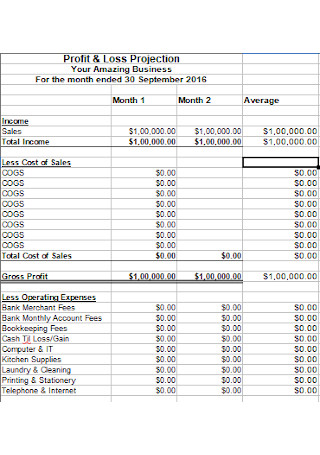

Business Profit and Loss Projection Template

download now -

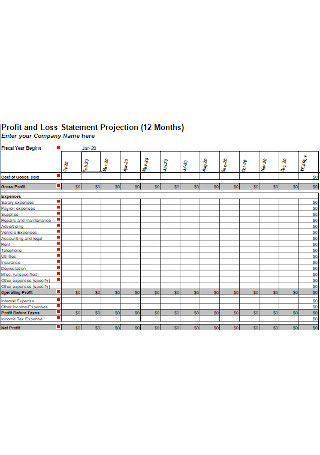

Profit and Loss Statement Projection

download now

FREE Profit and Loss Projection s to Download

6+ Sample Profit and Loss Projection

What Is a Profit and Loss Projection?

Main Elements of a Profit and Loss Projection

What Are the Types of Profit and Loss Statements?

What Are the Advantages of Making a Profit?

How to Create a Profit and Loss Projection

FAQs

What is Gross Profit?

What is the Importance of Having a Profit and Loss Statement?

What is the Cash Method of Profit and Loss Statement?

Is a Balance Sheet Different From a Profit and Loss Statement?

What Is a Profit and Loss Projection?

A profit and loss projection is a basic financial statement of a particular company that reports on its revenues and expenses in a given period, which can be either weeks, months, or years. It is also a projection of how much money is going to arrive through the sale of different items or services, as well as how much profit you will earn from these sales.

This projection statement is often utilized to guarantee that a sufficient amount of money is flowing in so that the cost of delivering the goods and services are covered, in turn, allowing you to make a profit. This is also used to determine what strategy is needed in order for the business to break even, buying the business valuable time until things start to work towards their favor again.

Main Elements of a Profit and Loss Projection

Listed and discussed below are the main components that make up an effective profit and loss projection statement:

- Revenue – this component of the profit and loss projection indicates the accounting period’s net sales or revenues. It also covers money produced from the entity’s principal business activity as well as non-operating revenue.

- Cost of Goods Sold – this component breaks down all the costs of the goods and services.

- Gross Profit – this component, also identified as a gross income or gross margin, refers to the net revenue of the business, not including the costs of sales.

- Operational Expenses – this component refers to the administrative, general, and selling costs associated with running a firm for a set period of time. This covers leasing costs, wages, electricity, and any other costs associated with running a business. Non-cash expenditures such as depreciation are also included.

- Operating Income – what is operating income? well, everything you’ve earned before tax deductions, depreciation, interest, and authorization can also be referred to as your company’s operating income. In order to determine the operating income of your company, simply subtract your opening expenses from the gross profit.

- Miscellaneous Expenses and Income – this component of the profit and loss projection often comprises of income and costs that are not connected to routine activities (hence the term miscellaneous) such as any profits and losses made from selling long term assets, interest and dividend income from various investments, and other uncommon expenses and revenues.

- Net Profit – this part of the profit and loss projection refers to the entire amount earned after all expenditures have been deducted. In order to determine your company’s net profit, simply subtract your total expenses from your gross earnings.

What Are the Types of Profit and Loss Statements?

Profit and Loss Statements can be presented in different types or forms, with each type serving a different purpose. Here are those types listed below:

What Are the Advantages of Making a Profit?

Listed below are the advantages that a business can have if they continue to make profits:

How to Create a Profit and Loss Projection

Now that nearly everything about profit and loss is familiarized, it is time for you to know about the steps on creating a profit and loss projection. Some steps may be unique to different types of profit and loss projections, which is why they won’t be included here.

-

1. Get an Estimate of Your Future Revenue

This is the first thing that needs to be done when creating a profit and loss projection. In this step, you can begin by calculating how much you’ll earn each month over a certain time period, such as the next six to twelve months. Without a doubt, as the title of this step states, this is only a guess. If you currently have a business, you may extrapolate existing sales levels while accounting for major seasonal swings as well as other known variables.

-

2. Get an Estimate of Your Variable Costs

After performing the first step, which is estimating your future revenue, you may now proceed to this step which is estimating your variable costs. In this step, you’ll need to approximate the monthly charge to you of the items or services you’ll sell in order to meet your sales target. These are the costs that are subject to change. They’re termed variable, or sometimes incremental since they change based on the number of goods or services produced or sold. For example, if you run a mail-order business, the more you sell, the more you’ll have to spend on shipping fees.

-

3. Get an Estimate of Your Gross Profit

Since you’ve already acquired an estimate of your variable costs, it is now time to get an estimate of your gross profit. In order to do this, simply remove your average monthly variable expenses from your estimated average monthly sales income so that you arrive at the end result, which is your projected monthly gross profit. This figure will allow you to calculate how much of each sales revenue you will get to keep. However, you must deduct overhead charges from that amount; whatever is left over is your net profit.

-

4. Calculate Your Net Profit

After estimating what your gross profit will be, it is now time to calculate your net profit. This is a very important step because The most crucial figure to calculate is your net profit. This allows you to determine if you’ll have any money left over after paying your overhead charges, or if you’ll be able to at least break even. Make a list of your monthly fixed expenditures, such as rent, payroll, utility bills, insurance, accounting fees, and so on, to arrive at your net profit. To determine a monthly number, divide any yearly costs, such as insurance payments, by 12. Subtract your average expected monthly fixed expenses from your monthly gross earnings to calculate your monthly net profit (or loss). Then, once you’re pleased with your expense estimates for a typical month, fill in the rest for six or twelve months. Then, for each month, deduct your total fixed expenditures from your gross earnings to get your net profit.

FAQs

What is Gross Profit?

The profit that a business makes after subtracting the expenses of producing and selling its products, or the costs of delivering its services, is referred to as gross profit. A company’s gross profit will show on its income statement and may be computed by deducting the cost of items that are sold from revenue (sales). These data can be seen on the income statement of a corporation. Other terms for gross profit exist, such as sales profit or gross income.

What is the Importance of Having a Profit and Loss Statement?

The importance of having a profit and loss statement is that it demonstrates a company’s income and expenses over a specific time period, generally one fiscal year. In turn, investors and analysts can use this analysis to decide the company’s profitability, frequently combining it with information from the other two financial statements. For example, an investor may compute a company’s return on equity by measuring its net income as indicated on the profit and loss statement to its amount of shareholder equity as shown on the balance sheet.

What is the Cash Method of Profit and Loss Statement?

The cash method of profit and loss statement is only employed when cash enters and exits the company. This is a straightforward system that merely accounts for money received or paid. When cash is received, a firm records the transaction as revenue, and when cash is used to pay bills or liabilities, the transaction is recorded as a liability. This strategy is often utilized by small businesses and individuals who want to manage their own money.

Is a Balance Sheet Different From a Profit and Loss Statement?

Yes, since a balance sheet refers to a type of financial statement that shows a company’s assets, liabilities, and shareholder equity at a given point in time, while a profit and loss statement displays a business’s expenditures, income, and ability to be profitable over a period of time. Balance sheets also serve as the foundation for calculating investor rates of return and assessing a company’s capital structure and also show what the firm owns and owes, as well as the amount of money invested by shareholders. More importantly, it can also be utilized in conjunction with other essential financial accounts to perform basic analysis or calculate financial ratios.

Having a profit and loss projection readily made for your business, no matter how small or big it is will prove to be handy since it allows you as a business owner to identify if your business is profitable (and as a result, still makes it worthy to keep it going) or if your business is making a loss (which gives you the opportunity to improve the way things are run). In other words, this document helps you pinpoint the areas where your business could use a bit of help. In this article, various examples of profit and loss projections can be acquired for you to use as a reference in case you need to make one.