50+ SAMPLE Asset Management Proposal

-

Asset Management Software Proposal

download now -

Digital Asset Management Proposal

download now -

Wastewater Asset Management Proposal

download now -

Work Order and Asset Management Proposal

download now -

Asset Management Implementation Proposal

download now -

Infrastructure Asset Management Proposal

download now -

Asset Management Plan Services Proposal

download now -

Asset Management Plan Update Proposal

download now -

Water System Asset Management Proposal

download now -

GIS-Based Asset Management Proposal

download now -

Asset Management Project Proposal

download now -

Fixed Asset Management Proposal

download now -

Asset Management Software and Implementation Proposal

download now -

Enterprise Asset Management Proposal

download now -

Enterprise Asset Management System Proposal

download now -

Development of Asset Management Proposal

download now -

Corporate Asset Management Proposal

download now -

Enterprise Asset Management Software Proposal

download now -

Asset Management Plan Proposal

download now -

Fixed Asset Management System Proposal

download now -

Asset Management Budget Proposal

download now -

Asset Management Program Audit Proposal

download now -

Computerized Asset Management Proposal

download now -

Asset Management Request Proposal

download now -

Geotechnical Asset Management for Slopes Proposal

download now -

Facility Asset Management Proposal

download now -

Mileage-Based Asset Management Proposal

download now -

Asset Management System Proposal

download now -

Media Asset Management Solution Proposal

download now -

Asset Management Grant Proposal

download now -

Asset Management Pool Proposal

download now -

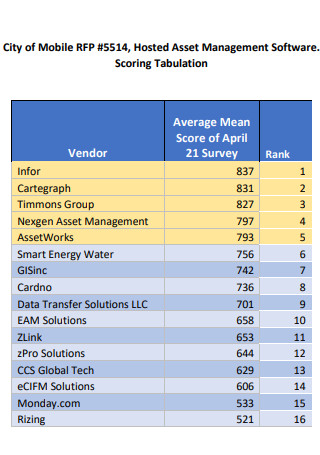

Hosted Asset Management Proposal

download now -

Asset Management Digital Tracking Proposal

download now -

Asset Management Shareholder Proposal

download now -

Assets Management Solution Proposal

download now -

Assets Maintenance Management System Proposal

download now -

Asset Management Strategy Proposal

download now -

Asset Management Consultancy Services Proposal

download now -

Simple Asset Management Proposal

download now -

IT Asset Management Proposal

download now -

Digital Asset Management System Proposal

download now -

Asset Management Lease Proposal Form

download now -

Asset Management Award of Proposal

download now -

Passive Asset Management Proposal

download now -

Market Debt Asset Management Proposal

download now -

Digital Asset Management Request Proposal

download now -

Asset Management Solution Proposal

download now -

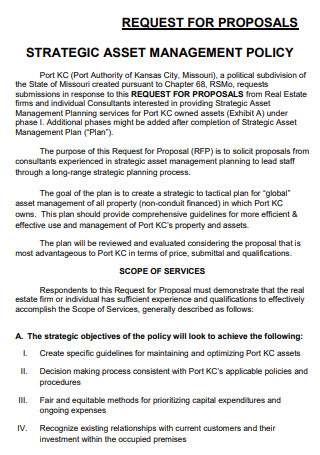

Asset Management Policy Proposal

download now -

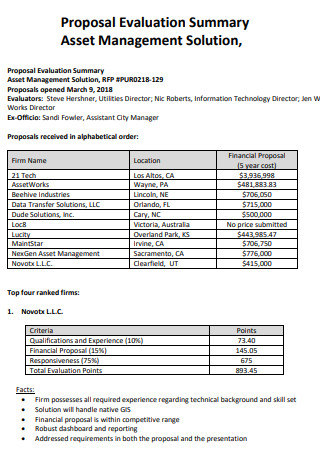

Asset Management Proposal Evaluation

download now -

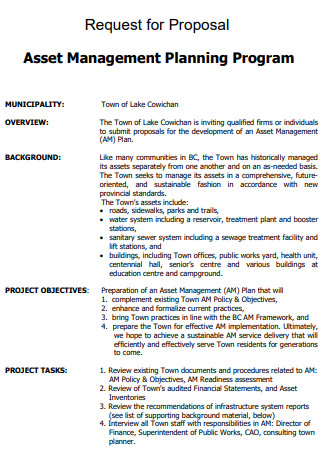

Asset Management Planning Proposal

download now -

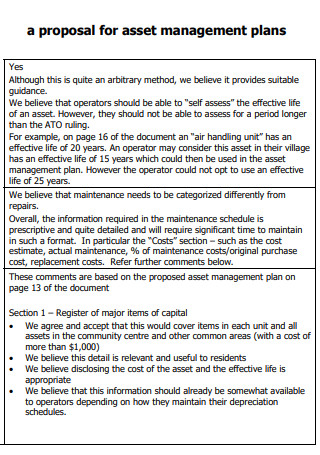

Asset Management Plan Proposal

download now

FREE Asset Management Proposal s to Download

50+ SAMPLE Asset Management Proposal

an Asset Management?

Benefits of Asset Management Tools

Tips For Wisely Managing Your Business’s Assets

How Asset Management Can Help Improve Business Efficiency

FAQs

What is asset management with example?

How long does an asset last?

What is depreciation of assets?

What Is an Asset Management?

Asset management is a systematic strategy to managing and realizing value from the objects for which a group or entity is responsible over their entire life cycles. It applies to both actual and intangible assets. According to statistics, the United States now employs over 10,595 asset managers. Women make up 35.0% of all asset managers, while men make up 60.8%.

Benefits of Asset Management Tools

For organizations that rely on the output of their assets, implementing an effective asset management system is critical and can result in several significant benefits. It enables the rapid location of equipment and tools, aids in cost reduction, and expedites maintenance activities. While manual approaches such as using excel spreadsheets may suffice, asset-heavy organizations may only truly profit from asset management when utilizing a sophisticated digital platform. The advantages of digital asset management are limitless, particularly if you’re transitioning from an antiquated system or pen-and-paper asset management. However, seven critical benefits stand out above the rest.

Tips For Wisely Managing Your Business’s Assets

When you first established your firm, you may have purchased computers, office furniture, or other necessary equipment. However, you probably haven’t given these business assets much thought since. You may be unaware, but your physical assets account for a large amount of the worth of your business. Could you, for example, perform your job without a desktop computer or manufacturing equipment? Most likely not. That is why it is critical to handle assets properly.

-

1. Identify and Value Your Assets

Knowing what assets you have and their worth is critical. Once you’ve compiled a list of your assets, establish their value. This is not the price you paid for them initially, as assets degrade. To ascertain the market value of these tangible assets, search for comparable products (of around the same age) for sale in your area. This is not an actual science, but it will provide you with an estimate of their value, which can come in handy later if you wish to obtain finance.

2. Keep Track of Your Business’s Assets

Include them on your balance sheet after assigning a value to your assets. The process is typically guided by accounting software, although you can seek assistance from a professional accountant. Your balance sheet is a shot in time, as your assets (particularly cash and inventory) may fluctuate and depreciate. You’ll need to plan for periodic balance sheet updates as assets decline or undergo significant changes.

3. Protect Them

Because these assets are critical to your business’s operation, you must insure them. Business property insurance will cover replacement costs if the equipment is stolen or destroyed due to natural disasters (flood, fire, etc.). Additionally, if you operate commercial vehicles, you must have auto insurance. Yes, they are additional expenses when your budget is already stretched low, but think how you would suffer without insurance in the event of an accident. It is preferable to be safe than sorry.

4. Recognize Your Assets and Taxes

Investments in assets are considered business expenses and hence reduce taxable income. Rather than claiming the entire money you paid for a significant piece of equipment in one year, you can claim a portion of it over multiple years, depreciating the item’s worth over time. You’ll benefit from a similar tax break for years, rather than a large one followed by no benefit.

5. Determine Your Schedule of Depreciation

Thus, how can you determine the depreciation deduction available for your business assets? According to the IRS, you must deduct depreciation over the asset’s useful life. Once an investment is no longer in use, it can no longer be written off. You can depreciate assets such as equipment, automobiles, and computers for five years. You have up to seven years of office furniture and equipment. Depreciation can be wiped off over 27.5 years for residential rental properties and 39 years for commercial or non-residential properties.

How Asset Management Can Help Improve Business Efficiency

People who work for a company have a lot of different kinds of assets, and managing them isn’t always easy. You should be careful if you have a lot of things you need to sell to customers or clients. Managing your assets isn’t always easy, but it’s not impossible to make it easier and faster. As you read this article, we’ve come up with five ways to make your asset management easier so that you can make your business run more smoothly and quickly.

-

1. Determine who or what will be in charge of your assets.

You may have a lot to consider in your business. You cannot control every aspect of your organization, notably your asset management. As a result, you should identify a person you can place your faith in and rely on to be accountable for the company’s assets. If your business is tiny, one or two people are sufficient to manage your business’s assets. On the other hand, if you have a large corporation, you should have a team dedicated to managing and maintaining your company’s assets.

2. Determine the lifecycles of your assets

You must understand the life cycle of each of your assets, from acquisition through disposal. Estimate the duration of each asset’s useful life. This will assist you in determining the optimal time to do asset maintenance. By calculating the life cycle of your assets, you may also make more informed long-term acquisitions. For instance, you can choose more durable or longer-lasting computers than those currently at your business.

3. Routinely monitor your assets

Your business could lose money if you don’t track your assets regularly. You could be held responsible for unneeded taxes, insurance, purchases, and asset maintenance. Aside from that, you can end up paying taxes on items that have already depreciated, or you might pay taxes on assets that have already declined. When your assets are insufficient to match the needs of your consumers or clients, you may become overwhelmed. As a result, tracking the number of assets you have and the number of assets recorded in your books is critical.

4. Recognize how your possessions depreciate

You must understand how your company’s assets depreciate. Determine whether assets are no longer fit for use and then investigate the causes. You may be unaware that numerous items are obsolete yet are still in use by your employees, significantly slowing their work. As a result, regular depreciation tracking is critical. This activity can help determine which products should be discarded and the optimum time to purchase them.

5. Implement a solution for automated asset management

Manual asset management consumes a great deal of time, effort, and money without yielding comparable results. Consider implementing an automated asset management solution to optimize your asset management. This program automates asset management tasks such as tracking asset value and depreciation, doing preventative maintenance on assets, managing writing contracts, performing cost analysis, and generating detailed reports. By automating complicated asset management operations, you may increase your business’s efficiency, effectiveness, and production.

FAQs

What is asset management with example?

Investment managers who handle a pension fund’s assets are an example. It is also increasingly being utilized in corporate and public infrastructure to ensure a coordinated approach to cost, risk management, service/performance, and sustainability optimization.

How long does an asset last?

A life cycle of an asset refers to the sequence of stages involved in managing an asset. It begins during the planning stages when the requirement for purchase is identified and continues throughout the asset’s useful life and eventual disposition.

What is depreciation of assets?

Depreciation occurs when an asset’s value decreases over time to the point where it is worthless or negligible. Any permanent help, including office equipment, computers, machinery, and buildings, is subject to depreciation.

Making this proposal and planning all the activities to how much money will be spent might be challenging. Remember, it is essential to use all the resources you can find online, including the ones on our site, to make it more comfortable for you. Let us know how we can assist you!