18+ Sample Financial Advisor Proposal

-

Financial Advisor Proposal Template

download now -

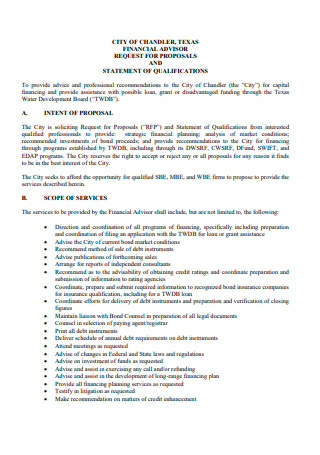

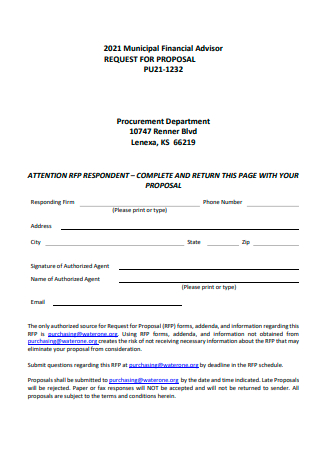

Municipal Financial Advisor Proposal

download now -

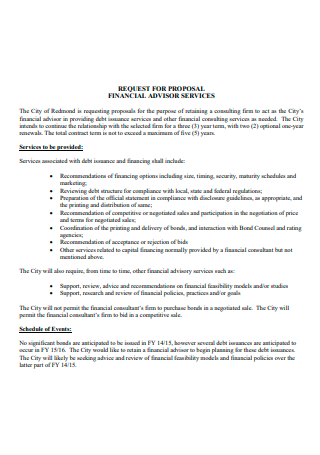

Financial Advisor Services Proposal

download now -

Financial Advisor Proposal Example

download now -

Printable Financial Advisor Proposal

download now -

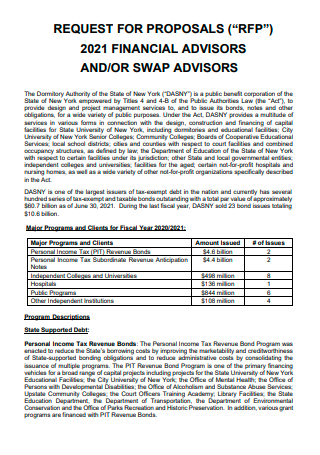

Bond Financial Advisor Proposal

download now -

Rentention of Financial Advisor Proposal

download now -

Financial Advisor Proposal in PDF

download now -

Basic Financial Advisor Proposal

download now -

School Financial Advisor Proposal

download now -

Standard Financial Advisor Proposal

download now -

Financial Advisor Notice Proposal

download now -

Formal Financial Advisor Proposal

download now -

Rail Financial Advisor Proposal

download now -

Financial Advisor Proposal to Environmental Improvement Proposal

download now -

Independent Financial Advisor Proposal

download now -

Bond Issue Financial Advisor Proposal

download now -

Financial Advisor Services For School District Proposal

download now -

Draft Financial Advisor Proposal

download now

FREE Financial Advisor Proposal s to Download

18+ Sample Financial Advisor Proposal

What Is Financial Proposal?

What Is a Financial Advisor?

What Are the Types of Financial Advisors?

How Do I Write a Financial Proposal?

What Is the Importance of Financial Advisor Proposal?

How to be a Financial Advisor?

FAQs

What Is the Difference Between Financial Advisor and Financial Consultant?

How Financial Advisor Get Paid?

How Much Does a Financial Advisor Cost?

Why Hire a Financial Advisor?

How to Pick a Good Financial Planner?

What Are the Best Financial Management Companies?

What Is Financial Proposal?

A financial proposal is written report that refers to the current and future financial state of a person or entity. Financial proposal is needed to utilize financial resources of a person or entity to fulfill its current or long-term objective. Investment plan, expense management as well as the retirement plan requires financial proposal. However, in an organization level, financial proposal is required in capital budgeting, projection or forecasting, the framing of financial policies on cash control, investing, borrowing for optimal utilization of enterprise resources, and sustainable growth of the business. Financial proposal will ensure the right balance between inflow and outflow of funds. In other words, financial proposal is a road map for your money that will help you achieve your goals.

What Is a Financial Advisor?

Financial advisors give clients a specialist advice in managing their money. They offer assistance in the management of your finances. They provide clients an advice on their investments, taxes, estate planning, college savings accounts, insurance, mortgages, and retirement. It is the role of a financial advisor to research on the marketplace and recommending the most appropriate product and services available that best suit the clients’ needs. Advisors can specialize in particular product, for instance selling employee pension schemes or offering mortgage to companies, pension or investment advice to private clients, depending on the needs of the client. Financial advisors are also known as financial planners or wealth managers.

What Are the Types of Financial Advisors?

An effective financial advisor will ask you about your goals and create a plan to help you reach them. Financial advisor will also help you invest your money, by recommending specific investments or providing you a complete invest management. Here are some of the types of financial advisor that can help you with your finances:

How Do I Write a Financial Proposal?

As financial advisor, writing a proposal is something you need to know. Writing a financial proposal requires in-depth research. The document should be brief and direct to the point. The first thing you need to start with is an overview. It should be designed as a sum up and outline the ideas in which the money is going to be spent. This will give an idea to anyone who’s reading your proposal a sense of what it is about and what are you aiming to achieve. Through this section, you should also be thinking about the solutions to the problems you have and the list of goals you have to achieve with the budget that you’ll have. You should also identify your key players. Key players mean the list of people who are going to be involved in this financial venture.

After finishing the first two step, you can now move onto the next section which is identifying the problems or goals that are address in designing solutions and plans of action to the client. For instance, cutting liabilities, perhaps cutting down on bank loans or working on salaries. Once you have identified and planned your intentions, you need to think about the timeframe which your company will have to achieve these goals. You should set your goals timeframe as realistically as possible. When everything is already in place and completed, go through it to assure that the proposal you made has the highest quality possible. This means no spelling mistakes, no typos and perfect grammar. Writing a financial proposal doesn’t have to be challenging and overwhelming task it may seem. As long the details that you incorporated has the best professional standard possible.

What Is the Importance of Financial Advisor Proposal?

Financial proposal gives clarity in life, provides direction and meaning to your financial decisions. Here are some reasons why financial proposal is important:

It provides a direction to your goals or dreams. Financial planning allows you understand goals better in terms of why there is a need to achieve these goals and how they impact other aspects of your life and finances.

Plan your budget in a better manner. Planning encourages you to manage inflation. This will give an insight of various things and activities.

Financial planning makes you disciplined towards money. You do not spend on unnecessary things. It will help you keep a track on your savings and spending.

By planning your finances, you plan for the future. You are able to gain visibility into your finances in the future. You would be aware of the returns your investments should earn to achieve your goals.

Importance of Financial Planning in Every Aspect of Finances:

Income. It will give you a better idea of how much you earn from salary, interest earned, dividends, etc. This will allow to understand of how much you are earning and if it is enough to earn to achieve your objectives.

Expenses. Planning finances will keep an eye on your finances. This will help determine income requirements so changes in earning capability is possible.

Savings. Planning gives you an overview of how much money you need to achieve your objectives. You make a budget and therefore can assess whether you are within budget or overspending. This will help in understanding savings rate and how much savings you need to achieve your goals.

Investment. The plan will contain an investment portfolio and asset allocation details. This will allow you to have a balanced portfolio at all times.

Taxation. Through financial plan, you can assess your tax outgo at the beginning of the financial year. You can play your finances such that you pay the least amount of tax in a legal manner.

Retirement. A proper plan will have the retirement goals listed and the income, expenses, and investment details. This will help identify steps in achieving your goals.

Estate Planning. Estate planning refers to the provisions made regarding your wealth and its distribution smoothly. The financial plan will have a clear outline of what is to be done in taking care of your finances know what steps are required to be taken to manage your estate.

How to be a Financial Advisor?

Financial advisors are very investment savvy and know a lot of stocks, bonds and more. Clearly being a financial advisor is more than just telling. If you have the desire to become a financial advisor here are some steps you need to follow:

Step 1: Select a Financial Advisor Team That You Would Like to Join

In choosing the right group to join, consider the following: the insurance company that should provide good commission rates; competent leader and successful that you can be proud of; and great support system and culture. The team develops tools and processes that will let you grow. The team provides additional benefits like giving leads and clients to their advisors.

Step 2: Contact the Team and Schedule an Orientation

These orientations usually require no commitment to join. Start reviewing for the licensure exam for financial advisors. Most exams have monthly classes for the review. Do not worry it is not hard as it looks.

Step 3: While Reviewing, Start Preparing for the Documentary Requirement for the Licensure Exam

These are the simple requirements like preparing your ID picture, proof of SSS Number and TIN. Take the examination of the Insurance Commission. Examination is just a multiple choice and it is not hard as it looks. If you pass the exam, ask your team leader on the next steps.

Step 4: Join the Trainings of the Company and the Trainings of Your Team

To fast track your growth, do online trainings while waiting for the classroom trainings. The first step to becoming a financial advisor is to know if you are fit to become a financial advisor.

FAQs

What Is the Difference Between Financial Advisor and Financial Consultant?

There is no often difference between a financial advisor and financial consultant. Many investment firms use the terms interchangeably.

How Financial Advisor Get Paid?

There are three ways financial advisors get paid. Through the client fees, commissions, and salaries.

How Much Does a Financial Advisor Cost?

Most financial advisors charge based on how much money they manage for you. The fee can range from 0.25% to 1% per year. Some financial advisors charge flat hourly or annual fee.

Why Hire a Financial Advisor?

Financial advisor will plan and connect all of the financial dots in order to provide you with overall plan to meet your financial goals. A financial advisor can also save you thousands of dollars in tax deductions and find higher-yielding investment product at little or no extra risk.

How to Pick a Good Financial Planner?

Choose a financial planner who has experience dealing with clients in similar circumstances to yours. You will also want to make sure that the financial advisor has your best interest, and that he or she is not selling you products that are not suited your need.

What Are the Best Financial Management Companies?

The key to successful financial planning is finding an honest and knowledgeable financial advisor that has your interests at heart. Any financial management company can potentially employ such an advisor. Focus on finding an excellent advisor above all else.

These professionals help in making decisions about what you should do with your money, which may include investments or other course of action. Not all financial advisors have the same level of training or will offer you the same depth of services. Be aware that in finding an advisor who is the right fit in your personality is key to developing a successful, long-term relationship. An advisor can have all the experience, credentials, and success stories in the world. Most advisors work full time, and occasionally overtime ins needed. Financial advisors spend a great deal of time marketing their services. Wherein they meet potential clients by giving seminars or through business and social networking. Financial advisors help clients plan for their short-term and long-term financial goals, including buying a home, paying for their children’s education, and retirement. They might also provide investment, tax, and insurance advice.