Financial Proposal Samples

-

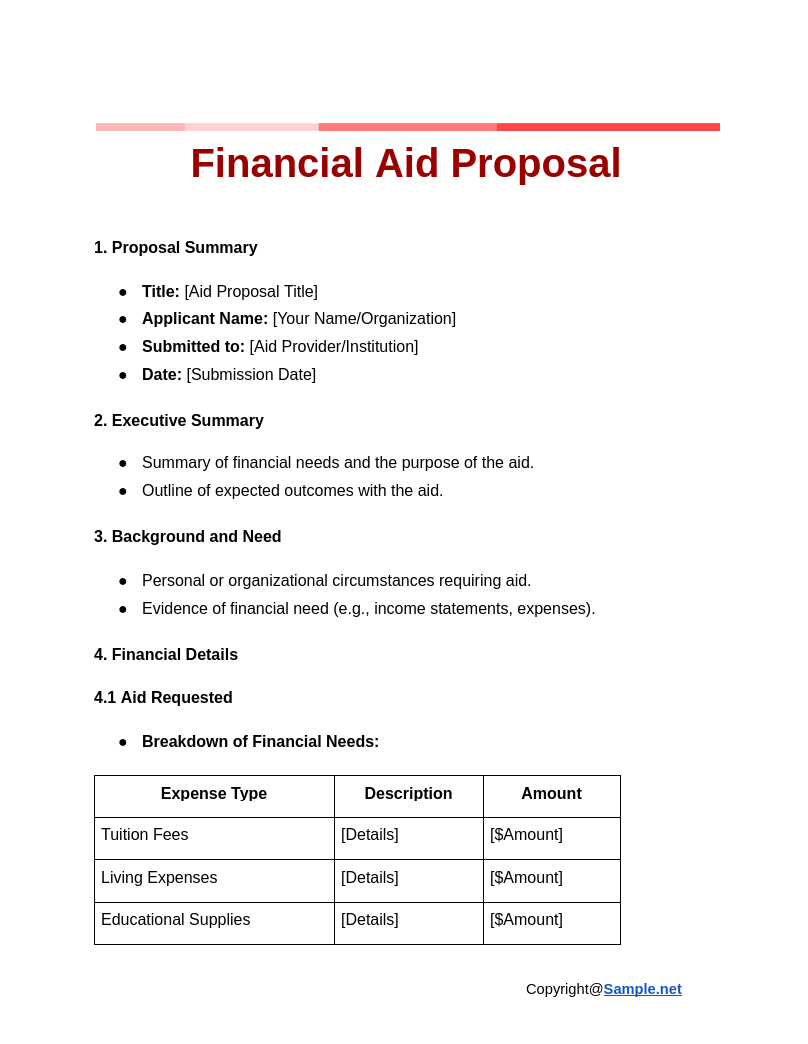

Financial Aid Proposal

download now -

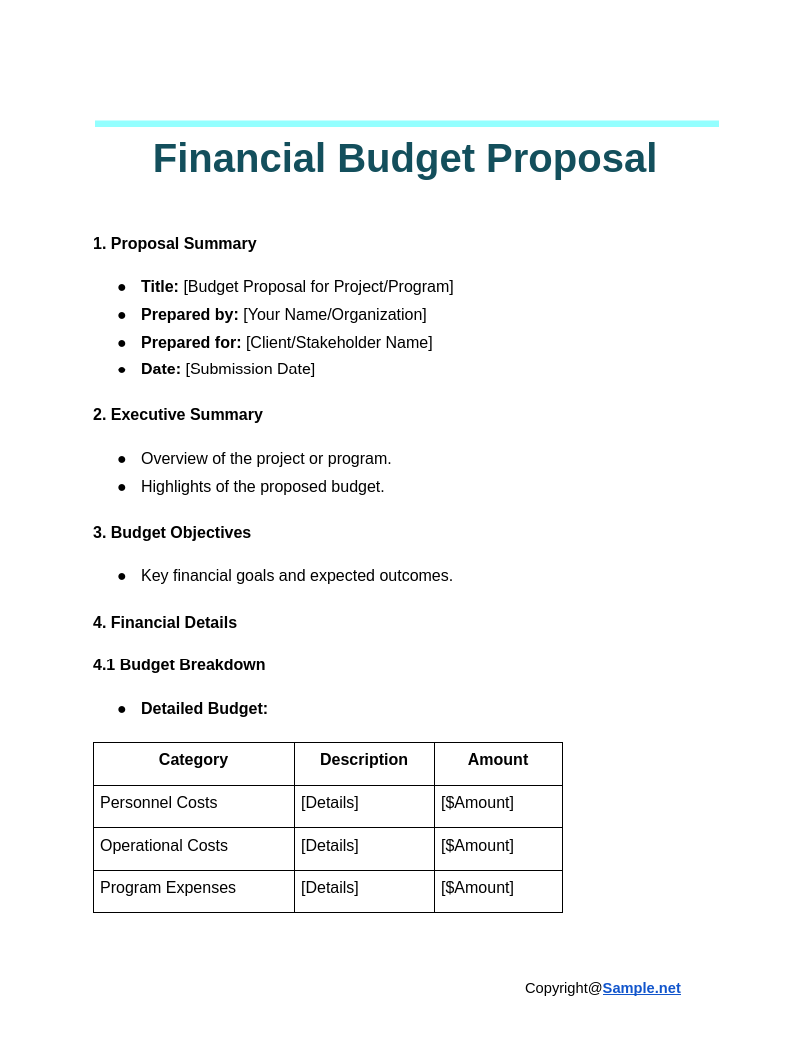

Financial Budget Proposal

download now -

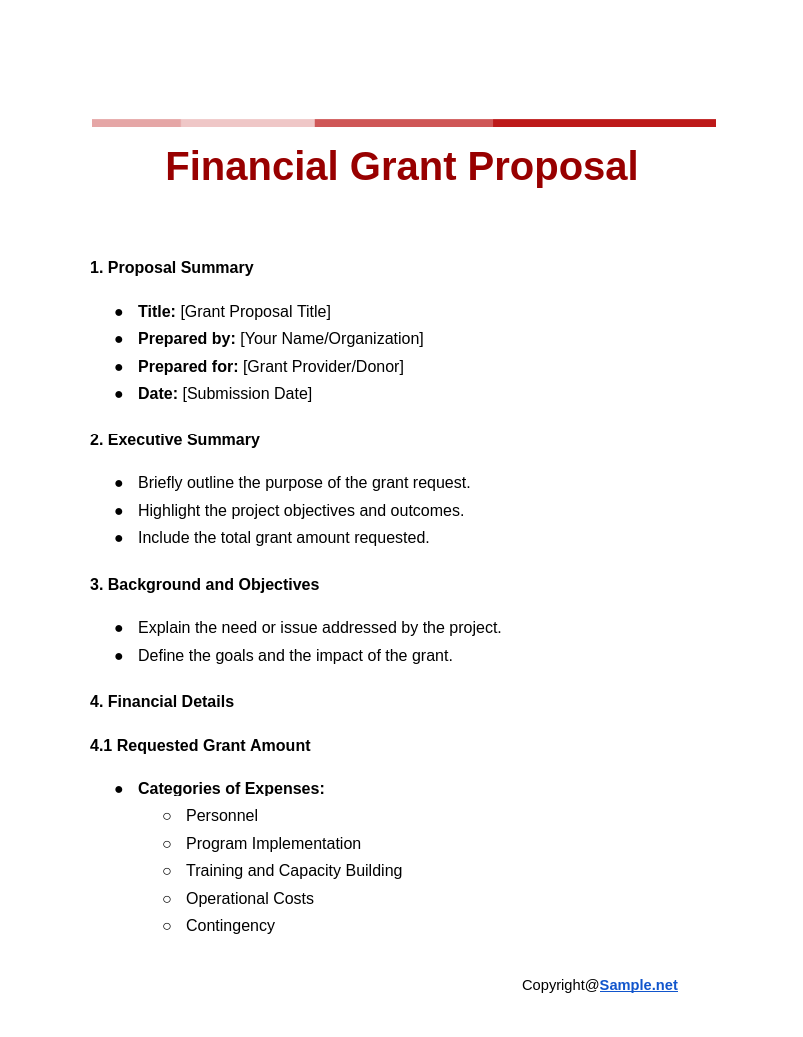

Financial Grant Proposal

download now -

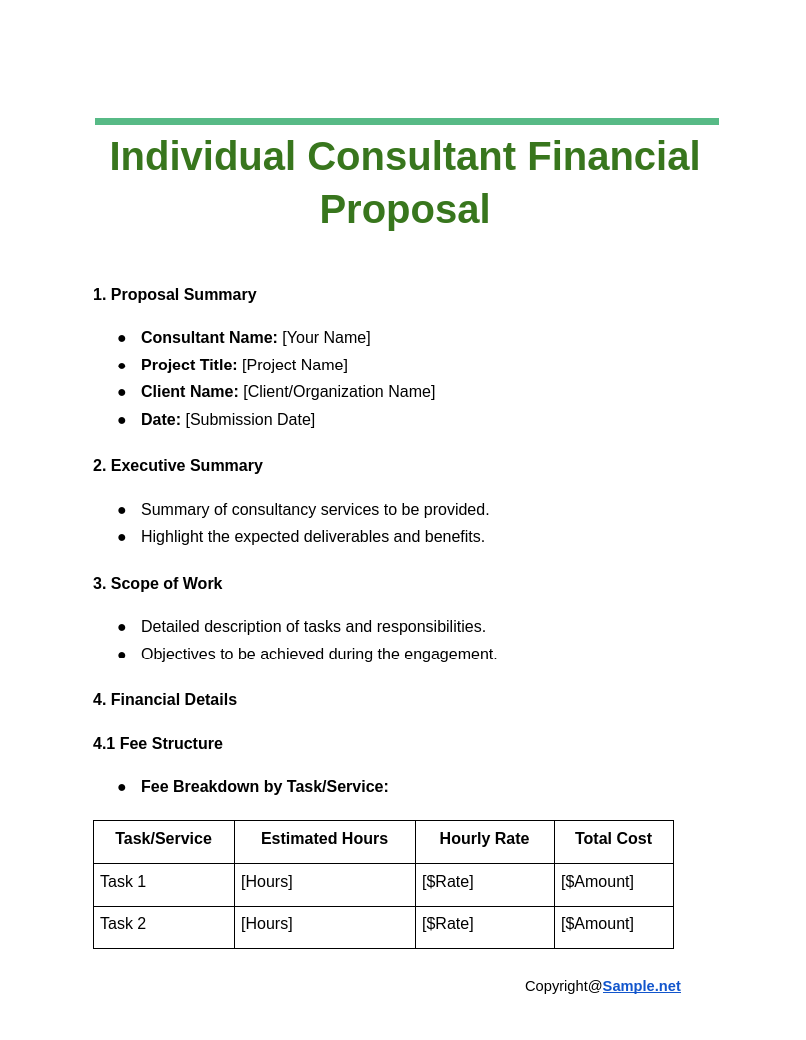

Individual Consultant Financial Proposal

download now -

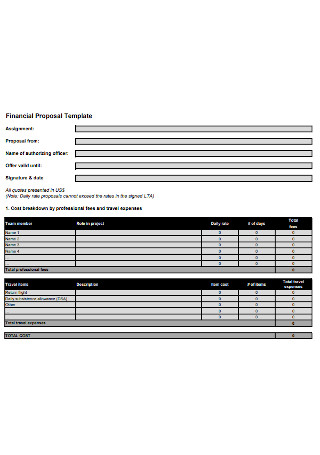

Financial Proposal Template

download now -

Financial Funding Proposal Template

download now -

Free Financial Proposal Template

download now -

Financial Consulting Proposal Template

download now -

Financial Advisor Proposal Template

download now -

Financial Investment Proposal Template

download now -

Project Proposal Financial Plan Template

download now -

Simple Financial Proposal Template

download now -

Consultancy Financial Proposal

download now -

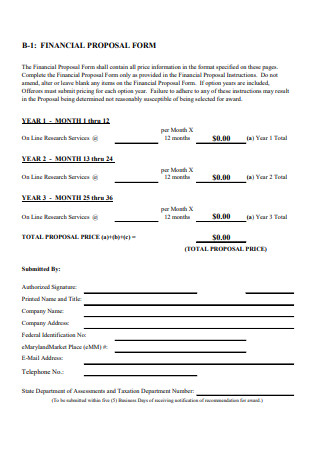

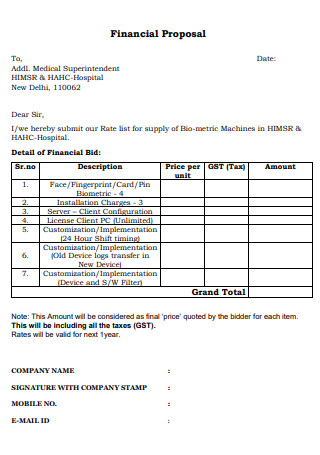

Financial Proposal Form

download now -

Basic Financial Proposal Business Plan

download now -

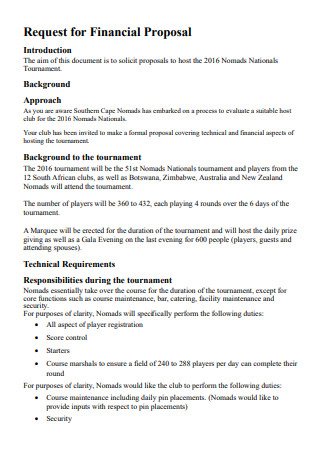

Request For Personal Financial Proposal

download now -

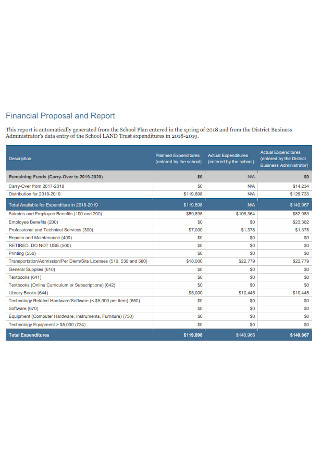

Financial Proposal and Layout Report

download now -

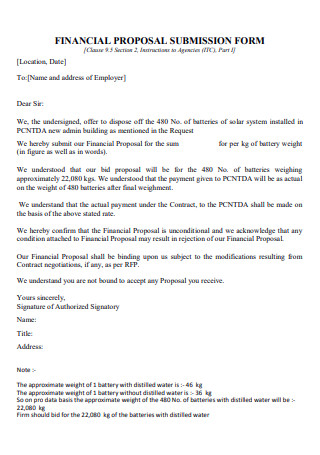

Financial Proposal Tender Submission Form

download now -

Formal Financial Proposal Job Application

download now -

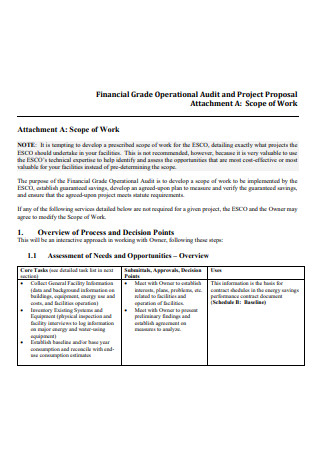

Financial Grade Operational Audit and Project Proposal

download now -

Financial Analysis Program Proposal Development

download now -

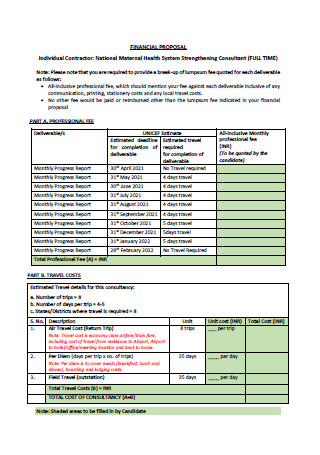

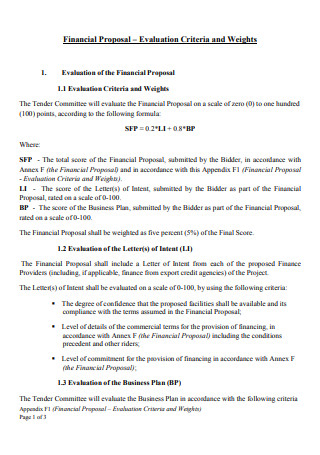

Financial Proposal Individual Consultant

download now -

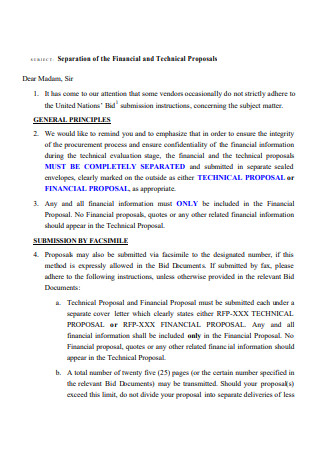

Financial and Work Technical Proposal

download now -

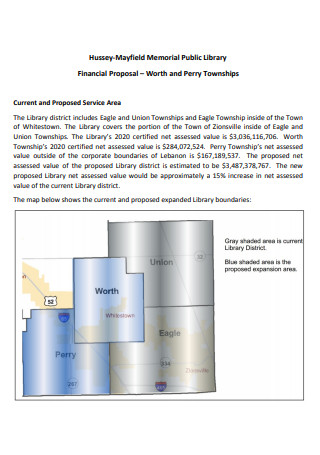

Library Partnership Financial Proposal

download now -

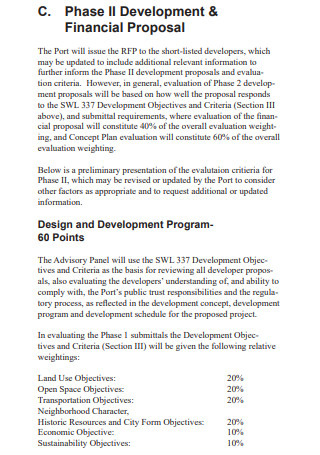

Development and Financial Informal Proposal

download now -

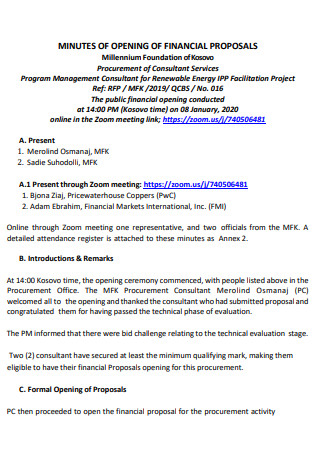

Financial Proposal Management Consulting

download now -

Sample Financial Introduction Proposal

download now -

Financial Proposal Construction Project

download now -

Standard Church Financial Proposal

download now -

Financial Training Statement Audit Services Proposal

download now -

Financial Investment Proposal Letter

download now -

Financial Feasibility One Page Proposal

download now -

Financial University Proposal

download now -

Evaluation of Financial Health Proposal

download now

FREE Financial Proposal s to Download

Financial Proposal Format

Financial Proposal Samples

What is a Financial Proposal?

Benefits of Financial Proposal

How to Create a Financial Proposal

FAQs

Is a title required for a proposal?

What constitutes a strong proposal argument?

What is the golden rule of financial planning?

What role do visual aids play in a financial proposal?

How do you address risks in a financial proposal?

How do financial proposals differ for grants and investments?

What are the key components of a financial proposal?

Download Financial Proposal Bundle

Financial Proposal Format

1. Proposal Summary

- Title: [Project Name or Purpose]

- Prepared by: [Your Name/Organization]

- Prepared for: [Client/Stakeholder Name]

- Date: [Submission Date]

2. Executive Summary

- Briefly describe the purpose of the financial proposal.

- Highlight key points of the project (scope, objectives, expected outcomes).

- Include an overview of the budget.

3. Background and Objectives

- Provide context for the proposal (e.g., market opportunity, client need).

- State the objectives and expected deliverables of the project.

4. Financial Details

4.1 Budget Breakdown

- Categories of Expenses:

- Personnel Costs (salaries, benefits)

- Materials and Supplies

- Equipment

- Marketing/Outreach

- Administrative Costs

- Miscellaneous Expenses

- Detailed Costing Table:

| Item | Description | Quantity | Unit Cost | Total Cost |

|---|---|---|---|---|

| Item 1 | [Description] | [Qty] | [$Amount] | [$Amount] |

| Item 2 | [Description] | [Qty] | [$Amount] | [$Amount] |

| Total | [$Total] |

4.2 Payment Schedule

- Specify milestones and associated payment percentages:

- Milestone 1: [Description] – [% Payment]

- Milestone 2: [Description] – [% Payment]

- Final payment upon project completion – [% Payment]

4.3 Contingency Fund

- Allocation for unforeseen expenses (typically 5-10% of the total budget).

5. Project Timeline

- Phases: Outline major project phases with start and end dates.

- Include a Gantt chart or timeline if applicable.

6. Terms and Conditions

- Payment terms and deadlines.

- Validity period of the financial proposal.

- Provisions for changes in scope and costs.

- Confidentiality agreement and dispute resolution.

7. Conclusion

- Reinforce the value of the proposal.

- Call to action: encourage the client to approve and proceed.

8. Appendices

- Supporting documents:

- Detailed budget estimates.

- Technical specifications.

- Any relevant references or certifications.

What is a Financial Proposal?

A financial proposal is a comprehensive document designed to present a project’s financial feasibility and funding needs. It outlines the costs involved, sources of revenue, anticipated returns, and financial strategies to achieve the goals of the project. By providing stakeholders or investors with a clear picture of the financial requirements and benefits, a financial proposal serves as a blueprint for securing investments or approvals. You can also see more on Funding Proposals.

Benefits of Financial Proposal

There are many benefits to having a financial plan that you can take advantage of right away. Financial planning has a net beneficial impact on all elements of your life, from emotional and health benefits to social and economic benefits. While there are numerous advantages, some have a more significant influence than others. Wise financial planning allows you to organize your finances and choose what is proper and wrong for you or your company. Wise financial counselors teach clients how to manage their money with discipline. According to statistics, 95% of millennials save less than the required amount. 69 percent of households have an emergency fund of less than $1,000. A formal financial plan is not present in 72 percent of homes. After just one year, 83 percent of people who make financial objectives feel better about their finances. As we continue, here are some of the essential advantages of making a financial plan.

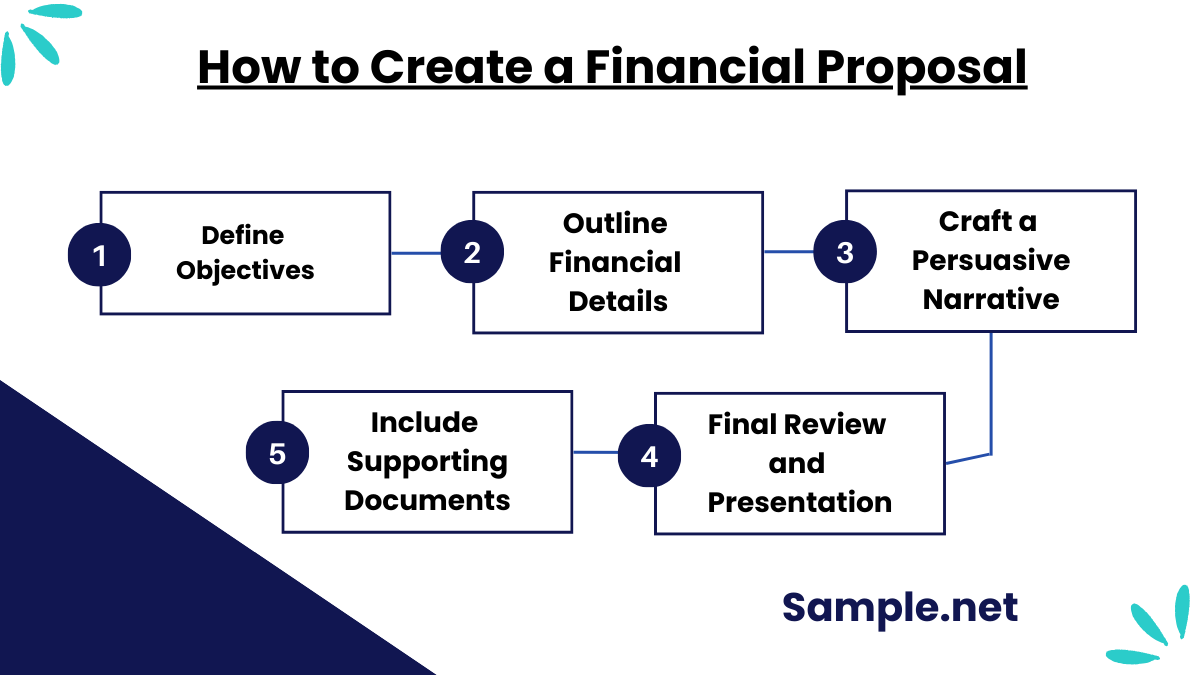

How to Create a Financial Proposal

Step 1: Define Objectives

Start by identifying the purpose of your financial proposal. Are you seeking funding, approval, or a partnership? Clearly articulate the goals, and ensure they align with the stakeholders’ interests. Provide supporting data or research that emphasizes the relevance and need for the proposal.

Step 2: Outline Financial Details

Include detailed budgets, cost breakdowns, and funding requirements. Highlight income sources and potential revenue streams. Use realistic estimates to prevent credibility issues. At this stage, ensure the financial figures are aligned with industry standards and comparable projects. You can also see more on Investment Request For Proposal.

Step 3: Craft a Persuasive Narrative

Explain how the financial plan will achieve the outlined goals. Discuss expected returns, timelines, and risks. Provide a rationale for your assumptions and forecasts. Incorporating visual aids like charts and graphs can make your narrative compelling and clear.

Step 4: Include Supporting Documents

Attach essential documents like balance sheets, profit and loss statements, and cash flow projections. A well-documented proposal instills confidence in the accuracy of your financial strategy. Tailor these attachments to the specific requirements of your audience. You can also see more on Agency Funding Proposal.

Step 5: Final Review and Presentation

Review the proposal for errors, inconsistencies, and gaps. A professionally formatted document can significantly impact its reception. Practice delivering the proposal confidently if an in-person presentation is required. Gather feedback and revise as necessary before submission.

A financial proposal is essential for outlining the funding needs and projected returns of a project. It conveys the financial viability and potential benefits to stakeholders, fostering trust and collaboration. A clear, concise, and transparent proposal ensures alignment with business goals and increases the likelihood of securing necessary investments. You can also see more on Construction Investment Proposal.

FAQs

Is a title required for a proposal?

A proposal’s title is just as crucial as the proposal itself, if not more so, because it will offer donors their initial impression when they begin reading it. You’ll need to think about and create a short, snappy, and appealing title that gets right to the core of what the proposal is about.

What constitutes a strong proposal argument?

A proposal argument is an argument form that focuses on proposing a basic proposal to solve a problem, explain the proposal’s features, and provide compelling reasons to endorse the submission.

What is the golden rule of financial planning?

The “Golden Rule” of government expenditure is a fiscal guideline that states that government borrowing should only be increased to fund initiatives that will pay off in the future. According to the Rule, existing obligations and expenditures are financed through taxation rather than issuing additional sovereign debt. You can also see more on Budget Proposal.

What role do visual aids play in a financial proposal?

Visual aids like charts, graphs, and tables make financial data easier to understand, improving clarity and engagement for stakeholders.

How do you address risks in a financial proposal?

Identify potential risks, provide mitigation strategies, and discuss contingency plans. Transparency about risks builds stakeholder trust. You can also see more on Fee Proposal.

How do financial proposals differ for grants and investments?

Grant proposals focus on non-repayable funding, emphasizing social or community impact, while investment proposals highlight profitability and returns for investors.

What are the key components of a financial proposal?

They include objectives, budgets, financial forecasts, funding requirements, and supporting documents like balance sheets or cash flow statements.